Abstract

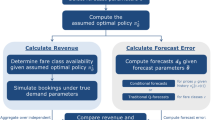

In their competitive environment, airlines are always searching for ways to maximize revenues. This article uses the sophisticated Passenger Origin-Destination Simulator (PODS) simulator to examine the revenue impact of four implementations of hybrid forecasting (HF) and fare adjustment (FA) in combination with three different methods of unconstraining – Expectation Maximization (EM), Projection Detruncation (PD) and Booking Curve (BC). Owing to the competitive nature of PODS (four airlines competing for customers) and its allowance for customer choice, we are able to assess all the implications of these HF and FA implementations in combination with unconstraining, including the impact of spill, upgrades and recapture. We find that in the fully/semi-restricted fare environment, under either EM or PD, the optimal combination is HF only, independent of demand level and that under BC unconstraining, the optimal combination is HF with FA equal to 0.5 (medium demand) or HF only (high demand) if using leg optimization. Under network optimization, it is best to use HF with FA equal to 0.5 for EM/PD unconstraining and HF only if using BC unconstraining, independent of demand level. When using realistic booking data from major global airlines to calibrate the largest PODS global network (U1), we show that becoming more aggressive with HF and FA can lead to revenue gains of 0.3–2.3 per cent.

Similar content being viewed by others

References

Belobaba, P.P. and Hopperstad, C.A. (2004) Algorithms for revenue management in unrestricted fare markets. INFORMS Section on Revenue Management, Cambridge, MA.

Belobaba, P. and Wilson, J. (1997) Impacts of yield management in competitive airline markets. Journal of Air Transport Management 3 (1): 3–10.

Boyd, E.A. and Kallesen, R. (2004) The science of revenue management when passengers purchase the lowest available fare. Journal of Revenue and Pricing Management 3 (2): 171–177.

Cooper, W.L., Homem-de-Mello, T. and Kleywegt, A.J. (2006) Models of the spiral-down effect in revenue management. Operations Research 54 (5): 968–987.

Fiig, T., Isler, K., Hopperstad, C. and Belobaba, P. (2010) Optimization of mixed fare structures: Theory and applications. Journal of Revenue and Pricing Management 9 (1/2): 152–170.

Fiig, T., Isler, K., Hopperstad, C. and Olsen, S.S. (2012) Forecasting and optimization of fare families. Journal of Revenue and Pricing Management 11 (3): 322–342.

Hopperstad, C.A., Belobaba, P.P. and Skwarek, D.K. (1996) Passenger O/D simulator update. Proceedings of AGIFORS Reservations and Yield Management Study Group. Zurich, Switzerland, May.

Little, R.J. and Rubin, D.B. (1987) Statistical Analysis with Missing Data. New York: John Wiley and Sons.

McLachlan, G.J. and Krishnan, T. (1997) The EM Algorithm and Extensions. New York: John Wiley and Sons.

Skwarek, D.K. (1996) Revenue and traffic impacts of alternative detruncation methods. Proceedings of AGIFORS Reservations and Yield Management Study Group. Zurich, Switzerland, May.

Walczak, D., Mardan, S. and Kallesen, R. (2010) Customer choice, fare adjustments and the marginal expected revenue data transformation: A note on using old yield management techniques in the brave new world of pricing. Journal of Revenue and Pricing Management 9 (1/2): 94–109.

Weatherford, L.R. (2013a) Improved revenues from various unconstraining methods in a passenger origin-destination simulator (PODS) environment with semi-restricted fares. Journal of Revenue and Pricing Management 12 (1): 60–82.

Weatherford, L.R. (2013b) Sophisticated unconstrainer revenue performance in a large airline network when applied to all closed observations or multiple estimates. Journal of Revenue and Pricing Management 12 (6): 489–508.

Weatherford, L.R. (2013c) Searching to maximize revenue in unrestricted and less-restricted competitive fare environments: combining hybrid forecasting and fare adjustment with various unconstraining methods. Journal of Revenue and Pricing Management 12 (6): 524–550.

Weatherford, L.R. and Kimes, S.E. (2003) A comparison of forecasting methods for hotel revenue management. International Journal of Forecasting 19 (3): 401–415.

Weatherford, L.R. and Pölt, S. (2002) Better unconstraining of airline demand data in revenue management systems for improved forecast accuracy and greater revenues. Journal of Revenue and Pricing Management 1 (3): 234–254.

Zeni, R.H. (2001) Improved forecast accuracy in revenue management by unconstraining demand estimates from censored data. PhD thesis, Rutgers University, Newark, New Jersey.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Weatherford, L. Combining hybrid forecasting and fare adjustment with various unconstraining methods to maximize revenue in a global network with four airlines. J Revenue Pricing Manag 13, 388–401 (2014). https://doi.org/10.1057/rpm.2014.18

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/rpm.2014.18