Abstract

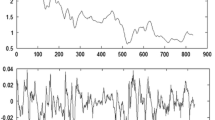

Previous studies on freight rate dynamics have explored the behavior of freight rates and their characteristics, including unit root, among other factors. However, there are few articles related to the stochastic process characterizing their dynamics. Moreover, to the best of the authors’ knowledge, there are no articles that incorporate seasonality in the freight rate dynamics. In the present article, we propose a factor model for the stochastic behavior of TCE (Time Charter Equivalent) and WS (World Scale) prices where one factor is a seasonal factor. In addition, based on this type of modeling, we study the seasonal behavior of freight rates and find that models allowing for stochastic seasonality outperform models with deterministic seasonality. Therefore, ship owners and charterers can accommodate their business strategies to the facts that (i) freight rates are higher in winter and spring than in the summer and autumn and that (ii) these differences are not deterministic but stochastic. These facts have also important implications in derivatives valuation and hedging.

Similar content being viewed by others

Notes

For the sake of brevity we have just presented one route results and we have used the current month forward, FCM, prices. However the rest of the routes and forward prices results are more or less the same and are available upon readers’ requests.

Each seasonal factor is modeled through a complex trigonometric component, whichcan be expressed by means of two real SDE. The SDE for the complex trigonometric component is: da t =−i2πφa t dt+Q α dW at , where a t is a complex factor (a t =α t +iα∗ t ). Equaling real and imaginary components in the previous equation yields the two real SDEs for α t and α∗ t .

Here we assume homoskedasticity in the error terms. Liu and Tang (2011) show evidence of heteroskedasticity in the convenience yield series for WTI and copper, using daily data. However, we have confined ourselves to the constant volatility case for several reasons. First, the residuals of the model show little evidence of heteroskedasticity with weekly data. Second, a stochastic volatility model is probably more realistic, but also more complex so much the Kalman-filter formulae cannot be computed explicitly in an exact way and it is necessary the use of approximations, whereas all the formulae in this article are exact.

As seen by Garcia et al (2012), ραα*=0 and σ α =σα*.

As seasonal factors are not stochastic, they do not need a risk premium.

Detailed accounts of Kalman filtering are given in Harvey (1989).

References

Adland, R.O. (2000) A Non-Parametric Model of the Time Charter-Equivalent Spot Freight Rate in the Very Large Crude Oil Carrier Market. Foundation for Research in Economics and Business Administration.

Adland, R. and Cullinane, M. (2005) A time-varying risk premium in the term structure of bulk shipping freight rate. Journal of Transport Economics and Policy 39 (2): 191–208.

Adland, R. and Cullinane, M. (2006) The non-linear dynamics of spot freight rates in tanker markets. Transportation Research Part E 42 (3): 211–224.

Adland, R. and Koekebakker, S. (2004) Modelling forward freight rate dynamics – Empirical evidence from time charter rates. Maritime Policy & Management 31 (4): 319–335.

Adland, R. and Koekebakker, S. (2007) Ship valuation using cross-sectional sales data: A multivariate non-parametric approach. Maritime Economics & Logistics 9 (2): 105–118.

Adland, R., Koekebakker, S. and Sødal, S. (2006) Are spot freight rates stationary? Journal of Transport Economics and Policy 40 (3): 449–472.

Adland, R. and Strandenes, S. (2006) Market efficiency in the bulk freight market revisited. Maritime Policy & Management 33 (2): 107–117.

Adland, R. and Strandenes, S. (2007) A discrete-time stochastic partial equilibrium model of the spot freight market. Journal of Transport Economics and Policy 41 (2): 189–218.

Alizadeh, A. and Kavussanos, N. (2001) Seasonality patterns in dry bulk shipping spot and time charter freight rates. Transportation Research Part E: Logistics and Transportation Review 37 (6): 443–467.

Alizadeh, A. and Kavussanos, N. (2002) Seasonality patterns in tanker spot freight markets. Economic Modelling 19 (5): 747–782.

Alizadeh, A. and Nomikos, N. (2004) Cost of carry, causality and arbitrage between oil futures and tanker freight markets. Transportation Research Part E: Logistics and Transportation Review 40 (4): 297–316.

Chen, Y. and Wang, S. (2004) The empirical evidence of the leverage effect on volatility in international bulk shipping market. Maritime Policy & Management 31 (2): 109–124.

Cortazar, G. and Naranjo, L. (2006) An n-factor gaussian model of oil futures prices. The Journal of Futures Markets 26 (3): 209–313.

Cortazar, G. and Schwartz, E. (2003) Implementing a stochastic model for oil futures prices. Energy Economics 25 (3): 215–218.

Cullinane, M. and Khanna, K. (1999) Economies of scale in large container ships. Journal of Transport Economics and Policy 33 (2): 185–207.

Dai, Q. and Singleton, K. (2000) Specification analysis of affine term structure models. The Journal of Finance 55 (5): 1943–1978.

Dikos, G. (2004) New building prices: Demand inelastic or perfectly competitive? Maritime Economics & Logistics 6 (4): 312–321.

Dikos, G. and Marcus, H. (2003) The term structure of second-hand prices: A structural partial equilibrium model. Maritime Economics & Logistics 5 (3): 251–267.

Franses, P. and Veenstra, A. (1997) A co-integration approach to forecasting freight rates in the dry bulk shipping sector. Transportation Research 31 (6): 447–58.

Garcia, A., Población, J. and Serna, G. (2012) The stochastic seasonal behavior of natural gas prices. European Financial Management 18 (3): 410–443.

Garcia, A., Población, J. and Serna, G. (2013) The stochastic seasonal behavior of energy commodity convenience yields. Energy Economics 40: 155–166.

Glen, D., Owen, M. and Van der Meer, R. (1981) Spot and time charter rates for tankers, 1970–1977. Journal of Transport Economics and Policy 15 (1): 45–58.

Hale, C. and Vanags, A. (1989) Spot and period rates in the dry bulk market: Some tests for the period 1980–1986. Journal of Transport Economics and Policy 23 (3): 281–291.

Harvey, A. (1989) Forecasting Structural Time Series Models and the Kalman Filter. Cambridge: Cambridge University Press.

Huang, S., Liu, Z., Wang, H. and Zheng, L. (2013) Optimal tanker chartering decisions with spot freight rate dynamics considerations. Transportation Research Part E: Logistics and Transportation Review 51: 109–116.

Liu, P. and Tang, K. (2011) The stochastic behavior of commodity prices with heteroskedasticity in the convenience yield. Journal of Empirical Finance 18 (2): 211–224.

Rygaard, J. (2009) Valuation of time charter contracts for ships. Maritime Economics & Logistics 36 (6): 525–544.

Schwartz, E. (1997) The stochastic behavior of commodity prices: Implication for valuation and hedging. The Journal of Finance 52 (3): 923–973.

Schwartz, E. and Smith, J. (2000) Short-term variations and long-term dynamics in commodity prices. Management Science 46 (7): 893–911.

Sorensen, C. (2002) Modeling seasonality in agricultural commodity futures. The Journal of Futures Markets 22 (5): 393–426.

Stopford, M. (1997) Maritime Economics. London: Unwin Hyman.

Tvedt, J. (2003) A new perspective on price dynamics of the dry bulk market. Maritime Policy & Management 30 (3): 221–230.

Wei, W. (2005) Time Series Analysis: Univariate and Multivariate Methods, 2nd edn. Massachusetts: Addison Wesley.

Author information

Authors and Affiliations

Additional information

This article is the sole responsibility of its author. The views represented here do not necessarily reflect those of the Banco de España.

Rights and permissions

About this article

Cite this article

Poblacion, J. The stochastic seasonal behavior of freight rate dynamics. Marit Econ Logist 17, 142–162 (2015). https://doi.org/10.1057/mel.2014.37

Published:

Issue Date:

DOI: https://doi.org/10.1057/mel.2014.37