Abstract

Drawing on transaction cost theories and the resource-based view of a firm, we posit that the value of corporate social responsibility (CSR) initiatives is greater in countries where an absence of market-supporting institutions increases transaction costs and limits access to resources. Using a large sample of 11,672 firm-year observations representing 2445 unique firms from 53 countries during 2003–2010 and controlling for firm-level unobservable heterogeneity, we find supportive evidence that CSR is more positively related to firm value in countries with weaker market institutions. We also provide evidence on the channels through which CSR initiatives reduce transaction costs. We find that CSR is associated with improved access to financing in countries with weaker equity and credit markets, greater investment and lower default risk in countries with more limited business freedom, and longer trade credit period and higher future sales growth in countries with weaker legal institutions. Our findings provide new insights on non-market mechanisms such as CSR through which firms can compensate for institutional voids.

Abstract

Prenant appui sur les théories des coûts de transaction et l'approche par les ressources d'une entreprise, nous postulons que la valeur des initiatives en matière de responsabilité sociale des entreprises (RSE) est plus élevée dans les pays où l'absence d'institutions de soutien au niveau du marché augmente les coûts de transaction et limite l'accès aux ressources. Utilisant un large échantillon de 11.672 observations entreprise-année représentant 2.445 entreprises uniques de 53 pays au cours de la période 2003-2010 et contrôlant l’hétérogénéité inobservable au niveau de la firme, nous trouvons des preuves que la RSE est plus positivement liée à la valeur des entreprises dans les pays à faibles institutions de marché. Nous fournissons également des données sur les canaux par lesquels les initiatives en matière de RSE réduisent les coûts de transaction. Nous constatons que la RSE est associée à un meilleur accès au financement dans les pays à faibles marchés d’actions et de crédit, à des investissements plus importants et à un risque de défaut plus faible dans les pays où la liberté d'entreprise est plus limitée, et à une période de crédit commercial plus longue et à une croissance des ventes futures plus élevée dans les pays avec des institutions juridiques plus faibles. Nos résultats fournissent de nouveaux éclairages sur les mécanismes non marchands, tels que la RSE, à travers lesquels les entreprises peuvent compenser les vides institutionnels.

Abstract

Partiendo de las teorías de costos de transacción y la teoría basada en recursos de la empresa, nosotros postulamos que el valor de las iniciativas de responsabilidad social empresarial (RSE) es mayor en países en donde la ausencia de instituciones de apoyo al mercado aumenta los costos de transacción y limita el acceso a recursos. Usando una amplia muestra de 11.672 observaciones empresa-año representando a 2445 empresas únicas de 53 países en el período 2003-2010 y controlando por heterogeneidad no observable a nivel de la empresa, encontramos evidencia para apoyar que la RSE está más relacionada positivamente al valor empresarial en países con instituciones de mercado más débiles. También damos evidencia sobre los canales mediante los cuales las iniciativas de RSE reducen los costos de transacción. Encontramos que la RSE está asociada con un mejor acceso a financiación en países con mercados de valores y de crédito más débiles, mayor inversión y un menor riesgo de incumplimiento en países con libertad empresarial más limitad, y el periodo de crédito comercial más extenso, y más crecimiento de ventas futuras en países con instituciones legales más débiles. Nuestros hallazgos dan nuevos entendimientos de los mecanismos de no mercado, como la RSE a través del cual las empresas pueden compensar los vacíos institucionales.

Abstract

Baseando-se em teorias de custos de transação e na visão baseada em recursos da firma, postulamos que o valor das iniciativas de responsabilidade social corporativa (CSR) é maior em países onde a ausência de instituições de apoio ao mercado aumenta os custos de transação e limita o acesso aos recursos. Usando uma grande amostra de 11.672 observações empresa-ano, representando 2445 empresas distintas de 53 países durante 2003-2010 e controlando a heterogeneidade não observável no âmbito da empresa, encontramos evidências confirmatórias que a CSR é mais positivamente relacionada com o valor da empresa em países com instituições de mercado mais fracas. Nós também fornecemos evidências sobre os canais através dos quais as iniciativas de CSR reduzem custos de transação. Nós concluímos que a CSR está associada com um melhor acesso a financiamento em países com mercados de ações e de crédito mais fracos, maior investimento e menor risco de solvência em países com liberdade comercial mais limitada, e período de crédito comercial mais longo e crescimento de vendas futuras superior em países com instituições legais mais fracas. Nossos resultados fornecem novas perspectivas sobre mecanismos não-mercadológicos tais como a CSR, através da qual as empresas podem compensar vazios institucionais.

Abstract

借鉴公司的交易成本理论和资源基础观, 我们假定企业社会责任 (CSR) 活动的价值在市场支持制度缺乏致使交易成本增加和资源使用受限的国家更大。使用2003-2010年期间来自53个国家代表2445家独特公司的11,672个公司年观察数据大样本, 并控制公司层面不可观察的异质性, 我们发现了在较弱市场制度的国家中CSR与公司价值观之间更加正相关的支持性证据。我们还提供了CSR活动减少交易成本渠道的证据。我们发现CSR与改善的融资渠道在股票和信贷市场较弱的国家相关: 在商务自由更有限的国家, 投资越大, 违约风险越低; 在法律机制更弱的国家, 贸易信贷期越长, 未来销售额增长越高。我们的发现对像CSR这样的非市场机制提供了新的见解, 通过它公司可以弥补制度孔隙。

Similar content being viewed by others

Notes

While prior literature tends to associate institutional voids with emerging markets, the quality of developed markets’ institutions also varies (e.g., Khanna & Palepu, 2010).

Our theoretical framework is consistent with Khanna, Palepu, and Bullock (2010), who argue that “a prospective emerging giant can build confidence and social capital in consumer, supplier and investor circles, contributing to its competitive advantage.” The authors offer a few examples of firms that have employed CSR to fill institutional voids. For instance, Zain – a telecom provider – introduced One Network in sub-Saharan Africa, which effectively eliminated roaming charges in this market. This strategy was specifically designed to make telecommunications accessible to poor customers. Zain also invested heavily in Africa, creating direct and indirect employment and quickly becoming the largest taxpayer in many countries in which it operated. The positive image of “partner in progress” smoothed Zain’s government relations and helped it become the world’s fastest growing telecom provider by 2008.

We thank an anonymous reviewer for suggesting this theoretical framework.

Jones and Hill (1988) suggest bounded rationality, opportunism, uncertainty and complexity, a low number of trading relationships, information asymmetry, and asset specificity as six main factors leading to transaction difficulties.

Other studies report no relation (McWilliams & Siegel, 2000) or a negative relation (Wright & Ferris, 1997). Recent meta-analyses (e.g., Margolis, Elfenbein, & Walsh, 2007; Orlitzky, Schmidt, & Rynes, 2003) note that this line of research generally finds a positive relation between CSR and corporate financial performance, particularly in recent years. However, the direction of causality remains largely unresolved.

Corporations engage in socially responsible activities for a variety of reasons; some are strategic and others are altruistic (Baron, 2001; Hillman & Keim, 2001). Young and Makhija (2014) provide a thorough discussion and integration of CSR theories. While firms may invest in CSR for altruistic reasons in countries with strong institutions, the strategic value of CSR in reducing transaction costs in emerging economies suggests that the strategic value of CSR is greater in countries with weaker market-supporting institutions than in countries with stronger institutions.

In the international business context, Strike, Gao, and Bansal (2006) examine whether international diversification is related to CSR. Husted and Allen (2006) assess the relation between multinational enterprises’ global or country-specific CSR and their international organizational strategy. Luo (2006) examines the relation between CSR and the political strategy of multinational enterprises. Christmann and Taylor (2006) find that a firm shapes its CSR strategy in response to customer preference, monitoring, and expected sanctions, and Waldman, Siegel, and Javidan (2006) show that country-specific cultural factors and CEO leadership characteristics are associated with the values that top management team members attach to CSR.

We obtain qualitatively similar results when we use CSR ratings from Governance Metrics International as an alternative proxy for CSR.

To ensure our results are not driven by a few countries, we re-run our regressions after excluding countries with fewer than 10 observations (15 countries) and fewer than 100 observations (35 countries). We further estimate weighted regressions where weights are given by the inverse of the number of observations per country. Untabulated results are consistent with those reported, suggesting that our results are not driven by heterogeneity in the number of observations across countries.

All of our inferences are qualitatively similar when we examine the environmental performance and social performance scores separately.

For example, Khanna, Palepu, and Sinha (2005) examine institutional voids in terms of political and social systems, openness to foreign investment, and quality of product, labor, and capital markets. Meyer et al. (2009) and Gubbi, Aulakh, Ray, Sarkar, and Chittoor (2010) focus on the areas of business freedom, trade freedom, property rights, investment freedom, and financial freedom. Chakrabarty (2009) captures institutional voids along two dimensions: financial credit availability and agency contracting.

These databases have the advantage of consistently providing a time series of relevant institutional variables for a large number of countries.

With respect to legal institutions, Gwartney, Hall, and Lawson (2014: 5) argue that “perhaps more than any other area, this area is essential for the efficient allocation of resources. Countries with major deficiencies in this area are unlikely to prosper regardless of their policies in the other four areas.”

We also check potential reverse causality between CSR and firm value through the Granger causality test. Specifically, we regress TOBQ and CSR_P on lagged TOBQ, lagged CSR_P, the vector of other controls (SIZE, ROA, LEV, R&D/S, SGR, and LOG_GDP), as well as year and firm fixed effects. In an alternative specification, we add an additional lag of TOBQ and CSR_P. Untabulated results show that TOBQ does not Granger-cause CSR_P, suggesting that reverse causality is not a significant concern in our study.

Servaes and Tamayo (2013) argue that mixed findings in the literature on the link between CSR and firm value are due in part to model misspecification arising from the omission of controls for time-invariant unobservable firm characteristics. A Hausman test rejects firm random effects in favor of firm fixed effects. The fixed effects design is a generalization of the difference-in-differences approach (Imai & Kim, 2014).

If firm CSR policies are sticky, that is, change little over time, the relation between CSR and firm value is driven by cross-sectional rather than time series variation in CSR. Zhou (2001) shows that in such a case, firm fixed effects may absorb the effect of CSR on firm value, leaving CSR with no significant explanatory power in firm value regressions. In other words, we might fail to detect a relation between CSR and firm value even if one truly exists. To explore this issue, we calculate between (cross-sectional) and within (time-series) variation in CSR. For the between variation, we calculate the standard deviation of CSR by year across firms. The average of these standard deviations is 0.28. For the within variation, we calculate standard deviation of CSR by firm across years. The average of these standard deviations is 0.11. Although between variation in CSR is larger than within variation, there is still relatively enough within variation in CSR to detect the effect of CSR on firm value in the presence of firm fixed effects.

We also estimate the model in equation (1) using an overall measure of the strength of market-supporting institutions, calculated by aggregating the stock market efficiency, credit market efficiency, the extent of business freedom, and legal system efficiency indices. The untabulated results are consistent with those in Table 3. That is, the coefficient on CSR is positive and statistically significant at the 1% level, and the coefficient on the interaction between CSR and the overall strength of market-supporting institutions is negative and statistically significant at the 1% level.

We match with replacement. That is, a firm in the control group could be used as a match more than once.

We also implement instrumental variables estimation using the industry-year average CSR score excluding the focal firm (El Ghoul et al., 2011; Kim, Li, & Li, 2014). The results, which are available in the online appendix, are qualitatively the same as those in Table 3.

Our results are consistent with the economics-based profit-maximization view of CSR, coined as profit-maximizing ethics (Windsor, 2001) or strategic CSR (Baron, 2001) in the literature. That is, socially responsible actions can have a positive impact on a firm’s cash flows, which is in line with the instrumental stakeholder theory in Jones (1995).

References

Adler, P. S., & Kwon, S. W. 2002. Social capital: Prospects for a new concept. Academy of Management Review, 27(1): 17–40.

Akerlof, K. 1970. The market for “lemons”: Qualitative uncertainty and the market mechanism. Quarterly Journal of Economics, 84(3): 448–500.

Angrist, J., & Pischke, J. 2008. Mostly harmless econometrics: An empiricist’s companion. Princeton, NJ: Princeton University Press.

Barney, J. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17(1): 99–120.

Baron, D. P. 2001. Private politics, corporate social responsibility and integrated strategy. Journal of Economics and Management Strategy, 10(1): 7–45.

Belkaoui, A. 1976. The impact of the disclosure of the environmental effects of organizational behavior on the market. Financial Management, 7(2): 26–31.

Bénabou, R., & Tirole, J. 2010. Individual and corporate social responsibility. Economica, 77(305): 1–19.

Bragdon Jr., J. H., & Marlin, J. A. 1972. Is pollution profitable? Risk Management, 19(4): 9–18.

Brammer, S. J., & Pavelin, S. 2006. Corporate reputation and social performance: The importance of fit. Journal of Management Studies, 43(3): 435–455.

Chakrabarty, S. 2009. The influence of national culture and institutional voids on family ownership of large firms: A country level empirical study. Journal of International Management, 15(1): 32–45.

Chang, S. J., & Hong, J. 2000. Economic performance of group affiliated companies in Korea: Intragroup resource sharing and internal business transactions. Academy of Management Journal, 43(3): 429–448.

Cheng, B., Ioannou, I., & Serafeim, G. 2014. Corporate social responsibility and access to finance. Strategic Management Journal, 35(1): 1–23.

Christmann, P., & Taylor, G. 2006. Firm self-regulation through international certifiable standards of symbolic versus substantive implementation. Journal of International Business Studies, 37(6): 863–878.

Claessens, S., Djankov, S., Fan, J., & Lang, L. 2002. Disentangling the incentive and entrenchment effects of large shareholdings. Journal of Finance, 57(6): 2741–2771.

Clarkson, M. E. 1995. A stakeholder framework for analyzing and evaluating corporate social performance. Academy of Management Review, 20(1): 92–117.

Cleary, S. 1999. The relationship between firm investment and financial status. Journal of Finance, 54(2): 673–692.

Coase, R. H. 1937. The nature of the firm. Econometrica, 4(16): 386–405.

Coase, R. H. 1960. The problem of social cost. Journal of Law and Economics, 3(1): 1–44.

Demirgüç-Kunt, A., & Maksimovic, V. 2002. Funding growth in bank-based and market-based financial systems: Evidence from firm-level data. Journal of Financial Economics, 65(3): 337–363.

Dhaliwal, D. S., Li, O. Z., Tsang, A., & Yang, Y. G. 2011. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. The Accounting Review, 86(1): 59–100.

Doh, J. P., Lawton, T. C., & Rajwani, T. 2012. Advancing nonmarket strategy research: Institutional perspectives in a changing world. Academy of Management Perspectives, 26(3): 22–39.

Du, S., Bhattacharya, C. B., & Sen, S. 2011. Corporate social responsibility and competitive advantage: Overcoming the trust barrier. Management Science, 57(9): 1528–1545.

Durnev, A., & Kim, E. H. 2005. To steal or not to steal: Firm attributes, legal environment, and valuation. Journal of Finance, 60(3): 1461–1493.

El Ghoul, S., Guedhami, O., Kwok, C. C., & Mishra, D. R. 2011. Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance, 35(9): 2388–2406.

Fama, E. F., & French, K. R. 1997. Industry costs of equity. Journal of Financial Economics, 43(2): 153–194.

Fisman, R., & Khanna, T. 2004. Facilitating development: The role of business groups. World Development, 32(4): 609–628.

Flammer, C. 2015. Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Management Science, 61(11): 2549–2568.

Foss, K., & Foss, N. J. 2005. Resources and transaction costs: How property rights economics furthers the resource-based view. Strategic Management Journal, 26(6): 541–553.

Freedman, M., & Stagliano, A. J. 1991. Differences in social-cost disclosures: A market test of investor reactions. Accounting, Auditing & Accountability Journal, 4(1): 68–83.

Friedman, M. 1962. Capitalism and freedom. Chicago, IL: University of Chicago Press.

Friedman, M. 1970. The social responsibility of business is to increase its profits. New York Times, 13 September: 122–126.

Gelb, D. S., & Strawser, J. A. 2001. Corporate social responsibility and financial disclosures: An alternative explanation for increased disclosure. Journal of Business Ethics, 33(1): 1–13.

Godfrey, P. C. 2005. The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Academy of Management Review, 30(4): 777–798.

Griffin, D., Guedhami, O., Kwok, C. C. Y., Li, K., & Shao, L. 2015. National culture, corporate governance practices, and firm performance. Working Paper, University of South Carolina.

Gubbi, S. R., Aulakh, P. S., Ray, S., Sarkar, M. B., & Chittoor, R. 2010. Do international acquisitions by emerging-economy firms create shareholder value? The case of Indian firms. Journal of International Business Studies, 41(3): 397–418.

Gwartney, J. D., Hall, J. C., & Lawson, R. 2014. Economic freedom of the world: 2014 annual report. Vancouver, BC: Fraser Institute.

Hart, S. L. 1995. A natural-resource-based view of the firm. Academy of Management Review, 20(4): 986–1014.

Hill, C. W., & Jones, G. R. 1989. Strategic management: An integrated approach. Boston, MA: Houghton Mifflin.

Hillegeist, S. A., Keating, E. K., Cram, D. P., & Lundstedt, K. G. 2004. Assessing the probability of bankruptcy. Review of Accounting Studies, 9(1): 5–34.

Hillman, A., & Keim, G. 2001. Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strategic Management Journal, 22(2): 125–139.

Husted, B. W., & Allen, D. B. 2006. Corporate social responsibility in the multinational enterprises: Strategic and institutional approaches. Journal of International Business Studies, 37(6): 838–849.

Imai, K., & Kim, I. S. 2014. On the use of linear fixed effects regression estimators for causal inference. Working Paper, Princeton University.

Ioannou, I., & Serafeim, G. 2012. What drives corporate social performance? The role of nation-level institutions. Journal of International Business Studies, 43(9): 834–864.

Jayachandran, S., Kalaignanam, K., & Eilert, M. 2013. Product and environmental social performance: Varying effect on firm performance. Strategic Management Journal, 34(10): 1255–1264.

Jensen, M. C., & Meckling, W. H. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(3): 305–360.

Jones, G. R., & Hill, C. W. L. 1988. Transaction cost analysis of strategy-structure choice. Strategic Management Journal, 9(2): 159–172.

Jones, T. M. 1995. Instrumental stakeholder theory: A synthesis of ethics and economics. Academy of Management Review, 20(2): 404–437.

Karna, A., Täube, F., & Sonderegger, P. 2013. Evolution of innovation networks across geographical and organizational boundaries: A study of R&D subsidiaries in the Bangalore IT cluster. European Management Review, 10(4): 211–226.

Khanna, T., & Palepu, K. G. 1997. Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4): 41–51.

Khanna, T., & Palepu, K. G. 2000a. The future of business groups in emerging markets: Long-run evidence from Chile. Academy of Management Journal, 43(3): 268–285.

Khanna, T., & Palepu, K. 2000b. Emerging market business groups, foreign investors and corporate governance. In R. Morck (Ed), Concentrated ownership 265–294. Chicago: University of Chicago Press.

Khanna, T., & Palepu, K. G. 2000c. Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups. Journal of Finance, 55(2): 867–891.

Khanna, T., & Palepu, K. G. 2010. Winning in emerging markets: A road map for strategy and execution. Boston: Harvard Business Press.

Khanna, T., & Palepu, K. G. 2011. Winning in emerging markets: Spotting and responding to institutional voids. World Financial Review, May–June: 18–20.

Khanna, T., Palepu, K. G., & Bullock, R. 2010. Winning in emerging markets: A road map for strategy and execution. Boston: Harvard Business Press.

Khanna, T., Palepu, K. G., & Sinha, J. 2005. Strategies that fit emerging markets. Harvard Business Review, 83(6): 4–19.

Kim, Y., Li, H., & Li, S. 2014. Corporate social responsibility and stock price crash risk. Journal of Banking & Finance, 43(1): 1–13.

Kim, Y., Park, M. S., & Wier, B. 2012. Is earnings quality associated with corporate social responsibility? The Accounting Review, 87(3): 761–796.

Klapper, L. F., & Love, I. 2004. Corporate governance, investor protection, and performance in emerging markets. Journal of Corporate Finance, 10(5): 703–728.

Klein, B., Crawford, R. G., & Alchian, A. A. 1978. Vertical integration, appropriable rents, and the competitive contracting process. Journal of Law and Economics, 21(2): 297–326.

Kuppuswamy, V., Serafeim, G., & Villalonga, B. 2014. The effect of institutional factors on the value of corporate diversification. In B. Villalonga (Ed), Finance and strategy:, Advances in Strategic Management (Vol 31): 37–68. Bingley, UK: Emerald Group Publishing Limited.

La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. 1999. Corporate ownership around the world. Journal of Finance, 54(2): 471–517.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. 1998. Law and finance. Journal of Political Economy, 106(6): 1113–1155.

Larcker, D. F., & Rusticus, T. O. 2010. On the use of instrumental variables in accounting research. Journal of Accounting and Economics, 49(3): 186–205.

Leff, N. 1978. Industrial organization and entrepreneurship in the developing countries: The economic groups. Economic Development and Cultural Change, 26(4): 661–675.

Lev, B., Petrovits, C., & Radhakrishnan, S. 2010. Is doing good good for you? How corporate charitable contributions enhance revenue growth. Strategic Management Journal, 31(2): 182–200.

Luo, X., Wang, H., Raithel, S., & Zheng, Q. 2015. Corporate social performance, analyst stock recommendations, and firm future returns. Strategic Management Journal, 36(1): 123–136.

Luo, Y. 2006. Political behavior, social responsibility, and perceived corruption: A structuration perspective. Journal of International Business Studies, 37(6): 747–766.

Luo, Y., & Tung, R. L. 2007. International expansion of emerging market enterprises: A springboard perspective. Journal of International Business Studies, 38(4): 481–498.

Margolis, J. D., Elfenbein, H. A., & Walsh, J. P. 2007. Does it pay to be good? A meta-analysis and redirection of research on the relationship between corporate social and financial performance. Working Paper, Harvard Business School.

McLean, R. D., Zhang, T., & Zhao, M. 2012. Why does the law matter? Investor protection and its effects on investment, finance, and growth. Journal of Finance, 67(1): 313–350.

McWilliams, A., & Siegel, D. 2000. Corporate social responsibility and financial performance: Correlation or misspecification. Strategic Management Journal, 21(5): 603–609.

McWilliams, A., & Siegel, D. 2001. Corporate social responsibility: A theory of the firm perspective. Academy of Management Review, 26(1): 117–127.

Meyer, J. W., & Rowan, B. 1977. Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83(2): 340–363.

Meyer, K. E., Estrin, S., Bhaumik, S. K., & Peng, M. W. 2009. Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30(1): 61–80.

Miller, D., Lee, J., Chang, S., & Le Breton-Miller, I. 2009. Filling the institutional void: The social behavior and performance of family vs non-family technology firms in emerging markets. Journal of International Business Studies, 40(5): 802–817.

Morck, R., Shleifer, A., & Vishny, R. W. 1988. Management ownership and market valuation: An empirical analysis. Journal of Financial Economics, 20(1–2): 293–315.

Myers, S. C. 1977. Determinants of corporate borrowing. Journal of Financial Economics, 5(2): 147–175.

Nahapiet, J., & Ghoshal, S. 1998. Social capital, intellectual capital, and the organizational advantage. Academy of Management Review, 23(2): 242–266.

Oliver, C. 1991. Strategic responses to institutional processes. Academy of Management Review, 16(1): 145–179.

Orlitzky, M., Schmidt, F., & Rynes, S. 2003. Corporate social and financial performance: A meta-analysis. Organization Studies, 24(3): 403–441.

Pava, M. L., & Krausz, J. 1996. The association between corporate social responsibility and financial performance: The paradox of social cost. Journal of Business Ethics, 15(3): 321–357.

Peng, M. W., Lee, S. H., & Wang, D. 2005. What determines the scope of the firm over time? A focus on institutional relatedness. Academy of Management Review, 30(3): 622–633.

Penrose, E. T. 1995 [1959]. The theory of the growth of the firm. Oxford: Oxford University Press.

Porter, M. E. 1991. Towards a dynamic theory of strategy. Strategic Management Journal, 12(S2): 95–117.

Porter, M. E., & Kramer, M. R. 2002. The competitive advantage of corporate philanthropy. Harvard Business Review, 80(12): 56–68.

Porter, M. E., & Kramer, M. R. 2006. The link between competitive advantage and corporate social responsibility. Harvard Business Review, 84(12): 78–92.

Porter, M. E., & Kramer, M. R. 2011. Creating shared value. Harvard Business Review, 89(1/2): 62–77.

Reeb, D., Sakakibara, M., & Mahmood, I. P. 2012. From the editors: Endogeneity in international business research. Journal of International Business Studies, 43(3): 211–218.

Reeve, T. 1990. The firm as a nexus of internal and external contracts. In M. Aoki, B. Gustafson, & O. E. Williamson (Eds), The firm as a nexus of treaties 133–161. London: Sage.

Ricart, J. E., Enright, M. J., Ghemawat, P., Hart, S. L., & Khanna, T. 2004. New frontiers in international strategy. Journal of International Business Studies, 35(3): 175–200.

Robins, J. A. 1992. Organizational considerations in the evaluation of capital assets: Toward a resource-based view of strategic investment by firms. Organization Science, 3(4): 522–536.

Rodriguez, P., Siegel, D. S., Hillman, A., & Eden, L. 2006. Three lenses on the multinational enterprise: Politics, corruption, and corporate social responsibility. Journal of International Business Studies, 37(6): 733–746.

Rosenbaum, P., & Rubin, D. 1983. The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1): 41–55.

Russo, M. V., & Fouts, P. A. 1997. A resource-based perspective on corporate environmental performance and profitability. Academy of Management Journal, 40(3): 534–559.

Saxton, T. 1997. The effects of partner and relationship characteristics on alliance outcomes. Academy of Management Journal, 40(2): 443–461.

Servaes, H., & Tamayo, A. 2013. The impact of corporate social responsibility on firm value: The role of customer awareness. Management Science, 59(5): 1045–1061.

Shane, P. B., & Spicer, B. H. 1983. Market response to environmental information produced outside the firm. The Accounting Review, 58(3): 521–538.

Siegel, J. 2009. Is there a better commitment mechanism than cross-listings for emerging economy firms? Evidence from Mexico. Journal of International Business Studies, 40(7): 1171–1191.

Spicer, B. H. 1978. Investors, corporate social performance and information disclosure: An empirical study. The Accounting Review, 53(1): 94–111.

Strike, V. M., Gao, J., & Bansal, P. 2006. Being good while being bad: Social responsibility and the international diversification of US firms. Journal of International Business Studies, 37(6): 850–862.

Surroca, J., Tribo, J. A., & Waddock, S. 2010. Corporate responsibility and financial performance: The role of intangible resources. Strategic Management Journal, 31(6): 463–490.

Teece, D. J. 1982. Towards an economic theory of the multiproduct firm. Journal of Economic Behavior & Organization, 3(1): 39–63.

Waddock, S., & Graves, S. 1997. The corporate social performance financial performance link. Strategic Management Journal, 18(4): 303–319.

Waldman, D. A., Siegel, D., & Javidan, M. 2006. Components of transformational leadership and corporate social responsibility. Journal of Management Studies, 43(8): 1703–1725.

Wang, T., & Bansal, P. 2012. Social responsibility in new ventures: Profiting from a long-term orientation. Strategic Management Journal, 33(10): 1135–1153.

Wernerfelt, B. 1984. A resource-based view of the firm. Strategic Management Journal, 5(2): 171–180.

Williamson, O. 1975. Markets and hierarchies. New York: Free Press.

Williamson, O. E. 1985. The economic institutions of capitalism. New York: Free Press.

Williamson, O. E. 1991. Comparative economic organization: The analysis of discrete structural alternatives. Administrative Science Quarterly, 36(2): 269–296.

Windsor, D. 2001. “Corporate social responsibility: A theory of the firm perspective”: Some comments. Academy of Management Review, 26(4): 502–504.

Wood, D. J. 1991. Corporate social performance revisited. Academy of Management Review, 16(4): 691–718.

Wright, P., & Ferris, S. 1997. Agency conflict and corporate strategy: The effect of divestment on corporate value. Strategic Management Journal, 18(1): 77–83.

Yao, D. A. 1988. Beyond the reach of the invisible hand: Impediments to economic activity, market failures, and profitability. Strategic Management Journal, 9(S1): 59–70.

Young, S. L., & Makhija, M. V. 2014. Firms’ corporate social responsibility behavior: An integration of institutional and profit maximization approaches. Journal of International Business Studies, 46(7): 670–698.

Zhang, M., Ma, L., Su, J., & Zhang, W. 2014. Do suppliers applaud corporate social responsibility? Journal of Business Ethics, 121(4): 543–557.

Zhou, X. 2001. Understanding the determinants of managerial ownership and the link between ownership and performance: Comment. Journal of Financial Economics, 62(3): 559–571.

Acknowledgements

The authors thank two anonymous reviewers, Jonathan Doh (Editor), Nargess Kayhani, Tammy Madsen, Niki den Nieuwenboer, Carrie Pan, Sanjay Patnaik, and participants at the 2015 Harvard Business School (HBS)/Journal of International Business Studies workshop on “International Business Responses to Institutional Voids”, 2015 SSFII Social and Sustainable Finance and Impact Investing conference at the Said Business School, University of Oxford, 2015 FMA European Conference, and at the 2014 Academy of International Business Meeting for constructive comments. The authors appreciate the generous financial support of the Social Sciences and Humanities Research Council of Canada.

Author information

Authors and Affiliations

Corresponding author

Additional information

Accepted by Jonathan Doh, Guest Editor, 23 December 2015. This article has been with the authors for three revisions.

Supplementary information accompanies this article on the Journal of International Business Studies website (www.palgrave-journals.com/jibs)

Electronic supplementary material

Appendices

APPENDIX A

APPENDIX B

APPENDIX C

APPENDIX C Economic Significance of Market-Supporting Institutions by Country

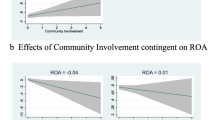

We clarify how we obtain the economic significance of the impact of CSR on firm value in Table 3. Recall that our regression is as follows:

To evaluate the marginal impact of CSR_P on TOBQ, we calculate the derivative of TOBQ with respect to CSR_P, which is given by:

We evaluate this derivative at the first quartile of Institution: α 1 +α 3 × Q1(Institution) and the third quartile of Institution: α 1 +α 3 × Q3(Institution)

Then we obtain the effect of one-standard-deviation increase in CSR_P (0.29) on TOBQ evaluated at the first quartile of Institution: [α 1 +α 3 × Q1(Institution)] × 0.29 and the third quartile of Institution: [α 1 +α 3 × Q3(Institution)] × 0.29

Finally, the difference: ([α 1 +α 3 × Q1(Institution)]-[α 1 +α 3 × Q3(Institution)]) × 0.29 measures our economic significance of a one-standard-deviation increase in CSR_P (0.29) on TOBQ after an institutional change from the first to the third quartile.

Our calculations are summarized in the table below.

Rights and permissions

About this article

Cite this article

Ghoul, S., Guedhami, O. & Kim, Y. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J Int Bus Stud 48, 360–385 (2017). https://doi.org/10.1057/jibs.2016.4

Published:

Issue Date:

DOI: https://doi.org/10.1057/jibs.2016.4