Abstract

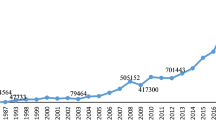

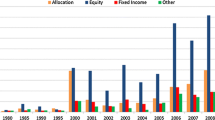

The risk and return characteristics of a highly diversified investment portfolio are examined in an effort to best assess its potential by means that incorporate both conventional risk estimation and performance evaluation. Estimation of performance variability and downside risk often assumes a constant, stable, average covariance matrix of asset returns and only provides an indirect gauge of capacity for the downside compensation interplay between assets. Performance measurement allows for final conclusions to be drawn, but does not capture the structural characteristics leading to results, nor does it make a distinction between chance occurrence and structural bias. The Mahalanobis distance is employed in order to quantify both aspects simultaneously and document a contemporary shift in advanced pension trust management. The asset liability structures of pension trusts allow for unusually long time horizons and managing agencies typically possess the resources necessary to select and maintain opaquely priced investments in a controlled fashion. A particular pension fund history, involving a period of transition from a conventional, strictly US-based mix of stocks, bonds, real estate and cash, to a more diversified set of eight additional asset classes, allows for discussion of first results and assessment of the trend toward diversification.

Similar content being viewed by others

References

Andersen, T.G. and Bollerslev, T. (1997) Answering the Critics: Yes, ARCH Models Do Provide Good Volatility Forecasts, NBER Working Paper No. 6023, April.

Andersen, T.G., Bollerslev, T., Christoffersen, P.F. and Diebold, F.X. (2006) Volatility and correlation forecasting. In: G. Elliott, C.W.J. Granger and A. Timmermann (eds.) Handbook of Economic Forecasting. Vol. 1, Amsterdam, the Netherlands: Elsevier, pp. 779–792.

Bollerslev, T., Chou, R.Y and Kroner, K.F. (1992) ARCH modeling in finance: A review of the theory and empirical evidence. Journal of Econometrics 52 (1–2): 5–59.

Bollerslev, T., Engle, R.F and Nelson, D.B. (1994) ARCH Models. In: R.F. Engle and D. McFadden (eds.) Handbook of Econometrics. Vol. IV, Amsterdam: North Holland.

Chow, G., Jacquier, E., Lowrey, K. and Kritzman, M. (1999) Optimal portfolios in good times and bad. Financial Analysts Journal 55 (3)(May/June) 65–73.

Elton, E.J. and Gruber, M.J. (1977) Risk reduction and portfolio size: An analytical solution. Journal of Business 50 (4) October: 415–437.

Epps, T. (1979) Comovements in stock prices in the very short run. Journal of the American Statistical Association 74 (366): 291–298.

Fama, E. (1965) The behavior of stock market prices. Journal of Business 38 (1): 34–105.

Kritzman, M. and Li, Y. (2010) Skulls, financial turbulence, and risk management. Financial Analysts Journal 66 (5): 30–41.

Lieberman, M. and Lundin, M. (2014) From sow’s ear to silk purse: The Transformation of the Arizona Public Safety Personnel Retirement System, Benefits Magazine, June 2014, pp. 2–7.

Lintner, J. (1965) The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics 47 (1): 13–37.

Lundin, M., Dacorogna, M.M. and Muller, U. (1998) Correlation of high frequency financial time series. In: P. Lequeux (ed.) The Financial Markets Tick by Tick, London: Wiley, pp. 91–126.

Mahalanobis, P.C. (1927) Analysis of race-mixture in Bengal. Journal of the Asiatic Society of Bengal 23: 301–333.

Mandelbrot, B.B (1963) Volatility Estimation Using Extreme Values of Asset Prices, Manuscript, Olin School of Business, Washington University.

Markowitz, H. (1952) Portfolio selection. Journal of Finance 7 (1) March: 77–91.

Markowitz, H. (1959) Portfolio Selection: Efficient Diversification of Investments, New York: John Wiley & Sons, p. 111.

Mossin, J. (1966) Equilibrium in a capital asset market. Econometrica 34 (4): 768–783.

New England Pension Consultants, LLC (2014) Private Communication, New England Pension Consultants, LLC.

Sharpe, W. F. (1964) Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance 19 (3): 425–442.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Anderson, M., Chen, S., Hacking, J. et al. Modern pension fund diversification. J Asset Manag 15, 205–217 (2014). https://doi.org/10.1057/jam.2014.23

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jam.2014.23