Abstract

We extend the Rothschild-Stiglitz (RS) insurance market model with adverse selection by allowing insurers to offer either non-participating or participating policies, that is, insurance contracts with policy dividends or supplementary calls for premium. It is shown that an equilibrium always exists in such a setting. Participating policies act as an implicit threat that dissuades deviant insurers who aim to attract low-risk individuals only. The model predicts that the mutual corporate form should be prevalent in insurance markets where second-best Pareto efficiency requires cross-subsidisation between risk types.

Similar content being viewed by others

Notes

According to the International Cooperative and Mutual Insurance Federation (ICMIF), the cooperative and mutual market share is over 40 per cent in, for example, Japan, Germany and France, and it is also high in the U.S.A., where mutuals' market share was 34.7 per cent in 2011.

Mutuals usually charge their members a premium, known as an advance call, at the start of each policy period. Advance premium mutuals set premium rates at a level that is expected to be sufficient to pay expected losses and expenses and that provide a margin for contingencies, and policyholders usually receive dividends. In contrast, assessment mutuals collect an initial premium that is just sufficient to pay typical losses and expenses and levy supplementary premiums whenever unusual losses occur. State Farm Mutual Automobile Insurance Company, the largest automobile insurer in the United States and the world's largest mutual property and casualty insurer, is a typical example of an advance premium mutual that distributes dividends to its policyholders almost every year. In maritime insurance, P&I clubs (which stands for protection and indemnity mutuals) are assessment mutuals: they pass back good underwriting years to shipowners through returned premiums or by asking them to pay supplementary premiums when the financial year is less favourable. The mutual insurance industry also includes reciprocals, fraternal societies, risk retention groups and group captives. See Williams et al. (1998) for information on the different types of mutuals.

This mapping between the nature of contracts and the corporate form reflects the fact that mutuals are deprived of the shock absorber provided by stocks. However, from a descriptive standpoint, this is obviously an oversimplification of the insurance market. Firstly, insurers may offer participating and non-participating contracts simultaneously. In particular, most life insurance contracts include profit participation clauses, even in the case of stock insurers. However, more often than not, life insurance contracts play also the role of a saving instrument, and their return is strongly affected by macroeconomic factors, which takes us away from the setting considered in this paper. More importantly, whatever the corporate structure, the participation of policyholders in profit may take other forms than policy dividends: in particular, it may go through discounts when contracts are renewed, which is a strategy available to stock insurers and mutuals. We should also keep in mind that, in practice, the superiority of a corporate form over the other may also reflect other factors, including agency costs and governance problems.

This feature of participating contracts and its relevance to the analysis of market equilibrium were already pointed out by Rothschild and Stiglitz (1976) in the following insightful remark: “The peculiar provision of many insurance contracts, that the effective premium is not determined until the end of the period (when the individual obtains what is called a dividend) is perhaps a reflection of the uncertainty associated with who will purchase the policy, which in turn is associated with the uncertainty about what contracts other insurance firms will offer”.

Other authors have highlighted the effect of such an externality in markets with adverse selection. See in the introduction and in the concluding section.

Indeed, small deviations at the contract offer stage may lead all individuals of a given type to switch to another insurer and hence a jump in insurers’ expected profits.

Mimra and Wambach (2011) assume that insurers can withdraw individual contracts, with multiple withdrawal stages that terminate endogenously. Netzer and Scheuer (2014) consider a setting where insurers can decide either to remain active or to withdraw from the market. In both papers, the Miyazaki-Wilson-Spence (MWS) allocation is sustained as a subgame-perfect Nash equilibrium. Mimra and Wambach (2011) establish that latent contracts (not chosen on the equilibrium path) may annihilate profitable deviations, and that the MWS allocation is the unique equilibrium allocation if there is free entry during the withdrawal stages. Netzer and Scheuer (2014) show that the possibility of withdrawing from the market generates equilibrium multiplicity that vanishes under arbitrarily small withdrawal costs. Diasakos and Koufopoulos (2011) show that the MWS allocation is the unique equilibrium allocation that satisfies a stability condition when insurers can offer pre-approved application that allow them to commit not to withdraw contracts.

As conjectured by Riley (2001) and established by Mimra and Wambach (2011), the MWS allocation and the RS allocation can be sustained as equilibrium allocations if contracts can be withdrawn and added at the intermediary stage. Other timings are possible. For instance, Dosis (2013) models a competitive insurance market with adverse selection as an informed principal game, where individuals offer sets of contracts to insurers who may subsequently add contracts to the offers of the buyers.

The word “accident” is taken in its generic meaning: it refers to any kind of insurable loss, such as health-care expenditures or fire damages.

Indeed, if an insurer could increase its residual expected profit (i.e. the expected corporate earnings after policy dividends have been distributed) by offering other insurance policies, then it could contract with risk-neutral investors and secure higher fixed fees. Note that the residual profit of a mutual is nil if profits are distributed as policy dividends or losses are absorbed through supplementary premiums. In that case, if the mutual insurer could make a positive residual profit, then he would benefit from becoming a stock insurer.

Formally a supplementary call is equivalent to D<0. Note that γ∈(0, 1) is observed in life insurance markets when stock insurers distribute a part of profit as policy dividend.

Of course, in practice, policyholders behave as shareholders do: they trust the profit announcement released by mutual insurers. To be viable, participating policies and shareholding require truthful financial accounting and efficient corporate control mechanisms.

Rothschild and Stiglitz (1976) observe that the condition for an equilibrium to exist is more restrictive when insurers offer menus than when they offer contracts.

Rothschild and Stiglitz (1976) define a competitive equilibrium as a set of contracts that is robust to entry. This definition may be reformulated in the case where insurers offer menus of contracts by defining an RS equilibrium as a set of menus that break even on average, such that there is no menu outside the equilibrium set that, if offered in addition, would lead to strictly positive expected profits. This definition leads to the same characterization of the RS equilibrium contracts as in the formal game theory approach that we follow in this paper.

When no ambiguity occurs, we use the same notation for insurance contracts (k, x) and their images in the (WN, WA) plane.

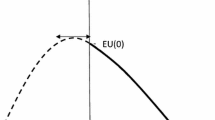

This equivalence between the existence of the RS equilibrium and the second-best Pareto optimality of (C* H , C* L ) holds if insurers can offer menus of contracts, as postulated in this paper. If the insurers’strategy was restricted to offering one contract, then there would exist a range of λ-values such that the RS equilibrium exists but is Pareto-dominated by a pair of contracts with cross-subsidisation.

This is valid for any subgame played in stage 2, including when an individual contemplates the possibility of choosing a contract offered by an insurer j that does not attract anyone on the equilibrium path. In such a case, we assume that such an individual considers herself as part of a deviating group with arbitrarily small positive measure and she has beliefs about the composition of this group. This allows us to postulate that the law of large numbers still applies in such deviations. We may also observe that, if individuals do not choose insurer j's contracts for some consistent expected policy dividends, then a fortiori they will also not choose these contracts for the worst expectations, that is, when insurer j only attracts type H individuals that are concentrated on the less profitable contracts. In that case, we would have D e j=γjmin{(1−π H )k H j−π H x H j,(1−π H )k L j−π H x L j}. Hence, without loss of generality, we can also assume that individuals have pessimistic expectations of policy dividends paid by insurers that do not attract any customers. An alternative assumption would consist in postulating that the individual considers herself as the unique customer of insurer j. If γ j =1, this would mean that insurer j would not offer any coverage to its unique policyholder, which would lead to the same conclusion, that is, no individuals with such beliefs would deviate to insurer j.

Assuming that there is a continuum of individuals for each type plays a crucial role in our model, for otherwise individuals would face a lottery when buying a participating contract (i.e. the law of large number would not apply). Relatedly, contrary to the RS model (and to game-theoretic formulations of the MWS equilibrium), it is not possible to present the extended RS model as an m+1 player Bayesian game, with m firms and one insurance purchaser whose type is private information. Here, the continuum of players is an essential ingredient of the model.

We relate an equilibrium allocation to a symmetric equilibrium of the market game for reasons of simplicity in the proofs (see the Appendix). A more general definition would consist in saying that an equilibrium allocation is sustained by a (possibly asymmetric) equilibrium of the market game, with unchanged conclusion about the existence of such an equilibrium allocation.

When λ⩾λ* the allocation (C* H , C** L ) can also be sustained by an equilibrium of the market game in which insurers offer participating contracts. Participating contracts play a specific role when λ<λ*: in this case insurers cannot offer non-participating contracts at equilibrium.

The comments that follow focus on this case for presentation simplicity. One may check that this occurs when individuals have DARA preferences. Similar comments coud be made if type H individuals move to

after the deviation.

after the deviation.This approach can be used to reproduce the behaviour of the so-called advance premium mutuals, as these mutuals are not allowed to charge additional premiums.

Lamm-Tennant and Starks (1993) show that stock insurers bear higher undiversifiable risk than mutuals, when risk is measured by the intertemporal variance of the loss ratios (loss incurred/premium earned). They argue that this result supports the agency and risk screening approaches to the insurance company structure. The present analysis brings us to another empirical verification strategy: it suggests that we should relate the insurance corporate form to the cross-section variance of their loss ratios among contracts for a given line of business (e.g. conditioning the loss ratio on deductible levels or coinsurance rates). Greater cross-subsidisation corresponds to larger cross-section variance of the loss ratio, which paves the way for possible empirical tests of the theory developed in this paper. However, at this stage, the only conclusion we can draw is of a theoretical nature: mutuals are robust to competitive attacks in insurance markets characterized by adverse selection, which may not be the case for stock insurance companies.

This classification of regimes depending on whether λ is above or under the threshold λ* may be recovered as follows. Consider the maximization of the type L expected utility subject to constraints (A.1)–(A.4), and let Φ(λ) be the value function of this problem. Let u** L ≡U L (k** L , x** L , 0) be the type L expected utility at the RS equilibrium. There are two possible regimes depending on whether (A.4) is binding or not at the optimal solution. When (A.4) is binding, the RS allocation is an optimal solution and we have Φ(λ)=u** L . When (A.4) is not binding, we have Φ(λ)>u** L and the Envelope Theorem gives Φ′(λ)<0 in that case. We deduce the characterization of Crocker and Snow (1985) with λ*=sup{λ|Φ(λ)>u** L }.

Some non-deviant insurers may not attract any individual, but all active non-deviant insurers attract the same proportions of both types because the larger the proportion of types L, the larger the policy dividend.

For instance, when everybody believes that the deviant insurer may only attract type H individuals, which makes C′ less attractive than C″.

References

Bisin, A. and Gottardi, P. (2006) ‘Efficient competitive equilibria with adverse selection’, Journal of Political Economy 114 (3): 485–516.

Boyd, J.H., Prescott, C. and Smith, B.D. (1988) ‘Organizations in economic analysis’, Canadian Journal of Economics 21 (3): 477–491.

Crocker, K.J. and Snow, A. (1985) ‘The efficiency of competitive equilibria in insurance markets with asymmetric information’, Journal of Public Economics 26 (2): 207–220.

Dasgupta, P. and Maskin, E. (1986a) ‘The existence of equilibrium in discontinuous economic games, I: Theory’, Review of Economic Studies 53 (1): 1–26.

Dasgupta, P. and Maskin, E. (1986b) ‘The existence of equilibrium in discontinuous economic games, II: Applications’, Review of Economic Studies 53 (1): 27–41.

Diasakos, T.M. and Koufopoulos, K. (2011) ‘Efficient Nash equilibrium under adverse selection’, mimeo, Collegio Carlo Alberto and University of Warwick.

Dionne, G. and Fombaron, N. (1996) ‘Non-convexities and the efficiency of equilibria in insurance markets with asymmetric information’, Economics Letters 52 (1): 31–40.

Doherty, N.A. and Dionne, G. (1993) ‘Insurance with undiversifiable risk: Contract structure and organizational forms of insurance firms’, Journal of Risk and Uncertainty 6 (2): 187–203.

Dosis, A. (2013) ‘Strategic foundations for efficient competitive markets with adverse selection’, mimeo, ESSEC Business School.

Dubey, P. and Geanakoplos, J. (2002) ‘Competitive pooling: Rothschild and Stiglitz reconsidered’, Quarterly Journal of Economics 117 (4): 1529–1570.

Engers, M. and Fernandez, L. (1987) ‘Market equilibrium with hidden knowledge and self selection’, Econometrica 55 (2): 425–439.

Faynzilberg, P.S. (2006) ‘Credible forward commitments and risk-sharing equilibrium’, mimeo.

Guerrieri, E., Shimer, R. and Wright, R. (2010) ‘Adverse selection in competitive search equilibrium’, Econometrica 78 (6): 1823–1862.

Hellwig, M. (1987) ‘Some recent developments in the theory of competition in markets with adverse selection’, European Economic Review 31 (1–2): 319–325.

Inderst, R. and Wambach, A. (2001) ‘Competitive insurance markets under adverse selection and capacity constraints’, European Economic Review 45 (10): 1981–1992.

Kosfeld, M. and von Siemens, F. (2011) ‘Team production in competitive labor markets with adverse selection’, mimeo, University of Amsterdam.

Lamm-Tennant, J. and Starks, L.T. (1993) ‘Stock versus mutual ownership structures: The risk implications’, Journal of Business 66 (1): 29–46.

Laux, A. and Muermann, A. (2010) ‘Financing risk transfer under governance problems: Mutuals versus stock insurers’, Journal of Financial Intermediation 19 (3): 333–354.

Ligon, J.A. and Thistle, P.D. (2005) ‘The formation of mutual insurers in markets with adverse selection’, Journal of Business 78 (2): 529–555.

Mayers, D. and Smith, C. (1988) ‘Ownership structure accross lines of property-casualty insurance’, Journal of Law and Economics 31: 351–378.

Mimra, W. and Wambach, A. (2010) ‘Endogenous capital in the Rothschild-Stiglitz model’, mimeo, University of Cologne.

Mimra, W. and Wambach, A. (2011) A game-theoretic foundation for the Wilson equilibrium in competitive insurance markets with adverse selection, CESifo working paper no 3412.

Miyazaki, H. (1977) ‘The rat race and internal labor markets’, Bell Journal of Economics 8 (2): 394–418.

Netzer, N. and Scheuer, F. (2014) ‘A game theoretic foundation of competitive equilibria with adverse selection’, International Economic Review 55 (2): 399–422.

Picard, P. (2010) Participating insurance contracts and the Rothschild-Stiglitz equilibrium puzzle, Ecole Polytechnique, Department of Economics, Cahier de Recherche n°2009-30.

Prescott, E.C. and Townsend, R.M. (1984) ‘Pareto optima and competitive equilibria with adverse selection and moral hazard’, Econometrica 52 (1): 21–45.

Riley, J. (1979) ‘Informational equilibrium’, Econometrica 47 (2): 331–359.

Riley, J. (2001) ‘Silver signals: Twenty-five years of screening and signaling’, Journal of Economic Literature 39 (2): 432–478.

Rosenthal, R.W. and Weiss, A. (1984) ‘Mixed-strategy equilibrium in a market with asymmetric information’, Review of Economic Studies 51 (2): 333–342.

Rothschild, M. and Stiglitz, J.E. (1976) ‘Equilibrium in competitive insurance markets: An essay on the economics of imperfect information’, Quarterly Journal of Economics 90: 630–649.

Smith, B.D. and Stutzer, M.J. (1990) ‘Adverse selection, aggregate uncertainty and the role for mutual insurance contracts’, Journal of Business 63 (4): 493–510.

Smith, B.D. and Stutzer, M.J. (1995) ‘A theory of mutual formation and moral hazard with evidence from the history of the insurance industry’, Review of Financial Studies 8 (2): 545–577.

Spence, M. (1978) ‘Product differentiation and performance in insurance markets’, Journal of Public Economics 10 (3): 427–447.

Williams, Jr. C.A., Smith, M.L. and Young, P.C. (1998) Risk Management and Insurance, 8th edn. Boston: Irwin McGraw-Hill.

Wilson, C. (1977) ‘A model of insurance markets with incomplete information’, Journal of Economic Theory 16 (2): 167–207.

Acknowledgements

This research has benefited from the support of the AXA Research Fund (Chair on Large Risk in Insurance). I would like to thank Casey Rothschild and two referees for their very constructive comments and suggestions. I am also particularly grateful to Richard Arnott, Jean-Marc Bourgeon, Renaud Bourlès, Georges Dionne, Rida Laraki, Patrick Rey, Bernard Salanié, François Salanié, Art Snow, Achim Wambach and to the participants in seminars at Columbia University, Ecole Polytechnique, EGRIE, National Chengchi University, Paris School of Economics, Risk Theory Society, Toulouse School of Economics, University of Barcelona, University of Paris 1 and University of Rennes for their comments on previous versions of this article.

Author information

Authors and Affiliations

Appendix

Appendix

Proof of Proposition 1

-

Let (W H , W L ) be an equilibrium allocation, with W t =(W t N, W t A) the lottery of type t individuals for t=H, L. It is sustained by a symmetric subgame-perfect Nash equilibrium of the market game. We have W t N=W−k t +γP and W t A=W−A+x t +γP, where C t =(k t , x t ) is the contract taken out by type t individuals, γ∈[0, 1] is the policy dividend coefficient and P is the equilibrium profit per policyholder. At such an equilibrium, the menu of contracts offered by insurers should not make negative residual profit for otherwise insurers would deviate to a “zero contract” without indemnity and premium. Furthermore, the type H expected utility should not be lower than u H *≡u(W−π H A), for otherwise it would be possible to make profit by offering a contract to type H individuals (and that contract would remain profitable even if it were also chosen by types L). Hence an equilibrium allocation necessarily satisfies the following conditions

where (A.1) is the non-negative residual profit constraint, (A.2) and (A.3) are incentive compatibility constraints respectively for types H and L and (A.4) expresses that the type H expected utility is larger or equal to u H *. The MWS allocation

maximises (1−π

L

)u(W

L

N)+π

L

u(W

L

A) with respect to W

H

N,W

H

A,W

L

N,W

L

A⩾0 subject to (A.1)–(A.4). It corresponds to the menu of non-participating contracts

maximises (1−π

L

)u(W

L

N)+π

L

u(W

L

A) with respect to W

H

N,W

H

A,W

L

N,W

L

A⩾0 subject to (A.1)–(A.4). It corresponds to the menu of non-participating contracts  with

with  We know from Crocker and Snow41 that the optimal solution to this maximisation is as follows: (A.2) is always binding, (A.3) is never binding and there exists λ*∈(0, 1) such that if λ⩾λ*, then

We know from Crocker and Snow41 that the optimal solution to this maximisation is as follows: (A.2) is always binding, (A.3) is never binding and there exists λ*∈(0, 1) such that if λ⩾λ*, then  (C*

H

, C**

L

) and (A.4) is binding and if λ<λ* then

(C*

H

, C**

L

) and (A.4) is binding and if λ<λ* then  and (A.4) is not binding.Footnote 55

and (A.4) is not binding.Footnote 55Assume that all insurers offer

with γ=0 if λ⩾λ* and γ=1 if λ<λ* and consider a deviation C′=(C′

H

, C′

L

, γ′) by some insurer at the contract offer stage, with γ′∈[0, 1].

with γ=0 if λ⩾λ* and γ=1 if λ<λ* and consider a deviation C′=(C′

H

, C′

L

, γ′) by some insurer at the contract offer stage, with γ′∈[0, 1].When λ⩾λ*, all insurers offer (C* H , C** L , 0) and we know from the RS model that profitable deviations with γ′=0 do not exist in that case. Profitable deviations with γ′∈(0, 1) do not exist either. Indeed, let C′ i =(k′ i , x′ i ) for i=H or L. Let P be the profit per policyholder of the deviant insurer—and (1−γ′)P is its residual profit—at a continuation equilibrium that follows its move to C′ and assume P>0. Consider the non-participating menu C″=(C″ H , C″ L , 0) where C″ i =(k′ i −γ′P, x′ i +γ′P). Thus, (1−γ′)P is equal to the profit made after the deviation to C″ when each individual substitutes C″ i to C′ i , and we know that this profit cannot be positive because C″ is non-participating. Hence, we have P⩽0.

When λ<λ*, all insurers offer

To start with, consider deviations such that γ′=0. Observe that C′ must necessarily attract some type L individuals to be profitable and that all non-deviant insurers necessarily attract type H and L individuals with identical proportions.Footnote 56 Assume first that there exists a continuation equilibrium where the deviant insurer makes positive profit, type H individuals keep choosing a contract from non-deviant insurers and either all type L individuals choose a contract in C′, say C′

L

(Case 1.1) or they randomise between C′

L

and

To start with, consider deviations such that γ′=0. Observe that C′ must necessarily attract some type L individuals to be profitable and that all non-deviant insurers necessarily attract type H and L individuals with identical proportions.Footnote 56 Assume first that there exists a continuation equilibrium where the deviant insurer makes positive profit, type H individuals keep choosing a contract from non-deviant insurers and either all type L individuals choose a contract in C′, say C′

L

(Case 1.1) or they randomise between C′

L

and  (Case 1.2). In Case 1.1, since γj=1 for all non-deviant insurers, we deduce that type H’s expected utility is lower or equal to u*

H

in the continuation equilibrium. As the deviant insurer makes positive profit and types H’s expected utility is (weakly) lower than u

H

*, using λ<λ* shows that type L expected utility at C′

L

is (weakly) lower than at C**

L

and thus (again from λ<λ*) it is lower than at

(Case 1.2). In Case 1.1, since γj=1 for all non-deviant insurers, we deduce that type H’s expected utility is lower or equal to u*

H

in the continuation equilibrium. As the deviant insurer makes positive profit and types H’s expected utility is (weakly) lower than u

H

*, using λ<λ* shows that type L expected utility at C′

L

is (weakly) lower than at C**

L

and thus (again from λ<λ*) it is lower than at  In Case 1.2, non-deviant insurers also pay negative policy dividends, which implies that type L individuals reach a lower expected utility than at

In Case 1.2, non-deviant insurers also pay negative policy dividends, which implies that type L individuals reach a lower expected utility than at  Thus, in Cases 1.1 and 1.2 there exists another continuation equilibrium following deviation C′, where types H choose

Thus, in Cases 1.1 and 1.2 there exists another continuation equilibrium following deviation C′, where types H choose  types L choose

types L choose  and the deviant insurer makes zero profit.

and the deviant insurer makes zero profit.Assume now that there exists a continuation equilibrium where the deviant insurer makes positive profit and attracts individuals from both types, with proportion λ′∈(0, 1) for type H. Consider two cases according to whether all type L individuals choose a contract in C′, say C′ L (Case 2.1) or type L individuals randomise between C′ L and

(Case 2.2). In Case 2.1, if type H individuals choose non-deviant insurers with positive probability, then we are back to the situation described in Case 1.1, with unchanged conclusion and if all type H individuals choose a contract in C′, say C′

H

, then type L expected utility is lower than at

(Case 2.2). In Case 2.1, if type H individuals choose non-deviant insurers with positive probability, then we are back to the situation described in Case 1.1, with unchanged conclusion and if all type H individuals choose a contract in C′, say C′

H

, then type L expected utility is lower than at  because the allocation corresponding to (C′

H

, C′

L

) would satisfy (A.1)–(A.4) with positive profit. In Case 2.2, let λ″ be the proportion of types H among individuals who purchase insurance from a non-deviant insurer. If λ″>λ, non-deviant insurers pay a negative policy dividend, which implies that the expected utility of type L individuals is lower than at

because the allocation corresponding to (C′

H

, C′

L

) would satisfy (A.1)–(A.4) with positive profit. In Case 2.2, let λ″ be the proportion of types H among individuals who purchase insurance from a non-deviant insurer. If λ″>λ, non-deviant insurers pay a negative policy dividend, which implies that the expected utility of type L individuals is lower than at  If λ″⩽λ, we have λ′⩾λ. The allocation corresponding to (C′

H

, C′

L

) would satisfy (A.1)–( A.4) with positive profit and a proportion of type H larger or equal to λ. The expected utility reached by type L individuals at C′

L

is thus necessarily lower than at

If λ″⩽λ, we have λ′⩾λ. The allocation corresponding to (C′

H

, C′

L

) would satisfy (A.1)–( A.4) with positive profit and a proportion of type H larger or equal to λ. The expected utility reached by type L individuals at C′

L

is thus necessarily lower than at  Thus, in Cases 2.1 and 2.2 as well there exists another continuation equilibrium following deviation C′, where type H individuals choose

Thus, in Cases 2.1 and 2.2 as well there exists another continuation equilibrium following deviation C′, where type H individuals choose  type L individuals choose

type L individuals choose  and the deviant insurer makes zero profit.

and the deviant insurer makes zero profit.Consider now deviations such that γ′∈(0, 1). Let P be the residual profit per policyholder of the deviant insurer at a continuation equilibrium. Assume P>0 and, once again, let C″=(C″ H , C″ L , 0) where C″ i =(k′ i −γ′P, x′ i +γ′P). Deviating to C″ is profitable when individuals make the same choices as in the continuation equilibrium that follows the deviation to C′. Since C″ is a non-participating menu of contracts, the previous development shows that there exists a continuation equilibrium following the deviation to C″ where type H individuals choose

type L individuals choose

type L individuals choose  and the deviant insurer makes zero profit. This is also true when the deviant chooses C′ instead of C″, for some expectations on policy dividends paid by the deviant insurer.Footnote 57

and the deviant insurer makes zero profit. This is also true when the deviant chooses C′ instead of C″, for some expectations on policy dividends paid by the deviant insurer.Footnote 57Thus, for any deviation at stage 1, there exists a continuation equilibrium where the deviant insurer makes zero residual profit, which completes the proof. □

Proof of Proposition 2

-

Let

be the type t expected utility at the MWS allocation, that is

be the type t expected utility at the MWS allocation, that is  where

where  for t=H and L. Consider another equilibrium allocation

for t=H and L. Consider another equilibrium allocation  with

with  with

with  the type t expected utility, that is,

the type t expected utility, that is,  Since any equilibrium allocation satisfies conditions (1)–(4), we have

Since any equilibrium allocation satisfies conditions (1)–(4), we have  Suppose

Suppose

Let C′=(C′ H , C′ L , 0) be a deviation from the equilibrium menu of contracts such that (C′ H , C′ L ) is incentive compatible. It can be chosen arbitrarily close to

with positive profit when type H individuals choose C′

H

and type L individuals choose C′

L

. There is at least one continuation equilibrium after this deviation where all type L individuals choose C′

L

and the deviant insurer makes positive profit. Consider a continuation equilibrium where non-deviant insurers still attract some individuals.

with positive profit when type H individuals choose C′

H

and type L individuals choose C′

L

. There is at least one continuation equilibrium after this deviation where all type L individuals choose C′

L

and the deviant insurer makes positive profit. Consider a continuation equilibrium where non-deviant insurers still attract some individuals.If the profit per policyholder of non-deviant insurers is larger than on the equilibrium path, then all type H individuals purchase insurance from non-deviant insurers, since by doing so they get an expected utility that is weakly larger than

and thus, for (C′

H

, C′

L

) close enough to

and thus, for (C′

H

, C′

L

) close enough to  larger than what they would get from the deviant insurer. This is incompatible with an increase in the profit of these insurers. If the profit per policyholder of non-deviant insurers is weakly lower than on the equilibrium path (thus providing a weakly lower expected utility to policyholders), then for C′

L

close enough to

larger than what they would get from the deviant insurer. This is incompatible with an increase in the profit of these insurers. If the profit per policyholder of non-deviant insurers is weakly lower than on the equilibrium path (thus providing a weakly lower expected utility to policyholders), then for C′

L

close enough to  all type L individuals purchase insurance from the deviant insurer.

all type L individuals purchase insurance from the deviant insurer.Thus, at any continuation equilibrium after the deviation, all type L individuals purchase insurance from the deviant insurer, and the deviation is profitable whatever the choice of type H individuals, hence a contradiction with the definition of an equilibrium. We deduce that

and

and  at any equilibrium allocation that differs from the MWS allocation. □

at any equilibrium allocation that differs from the MWS allocation. □

Rights and permissions

About this article

Cite this article

Picard, P. Participating Insurance Contracts and the Rothschild-Stiglitz Equilibrium Puzzle. Geneva Risk Insur Rev 39, 153–175 (2014). https://doi.org/10.1057/grir.2014.9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/grir.2014.9

after the deviation.

after the deviation.

maximises (1−π

L

)u(W

L

N)+π

L

u(W

L

A) with respect to W

H

N,W

H

A,W

L

N,W

L

A⩾0 subject to (A.1)–(A.4). It corresponds to the menu of non-participating contracts

maximises (1−π

L

)u(W

L

N)+π

L

u(W

L

A) with respect to W

H

N,W

H

A,W

L

N,W

L

A⩾0 subject to (A.1)–(A.4). It corresponds to the menu of non-participating contracts  with

with  We know from Crocker and Snow

We know from Crocker and Snow (C*

H

, C**

L

) and (A.4) is binding and if λ<λ* then

(C*

H

, C**

L

) and (A.4) is binding and if λ<λ* then  and (A.4) is not binding.

and (A.4) is not binding. with γ=0 if λ⩾λ* and γ=1 if λ<λ* and consider a deviation C′=(C′

H

, C′

L

, γ′) by some insurer at the contract offer stage, with γ′∈[0, 1].

with γ=0 if λ⩾λ* and γ=1 if λ<λ* and consider a deviation C′=(C′

H

, C′

L

, γ′) by some insurer at the contract offer stage, with γ′∈[0, 1]. To start with, consider deviations such that γ′=0. Observe that C′ must necessarily attract some type L individuals to be profitable and that all non-deviant insurers necessarily attract type H and L individuals with identical proportions.

To start with, consider deviations such that γ′=0. Observe that C′ must necessarily attract some type L individuals to be profitable and that all non-deviant insurers necessarily attract type H and L individuals with identical proportions. (Case 1.2). In Case 1.1, since γj=1 for all non-deviant insurers, we deduce that type H’s expected utility is lower or equal to u*

H

in the continuation equilibrium. As the deviant insurer makes positive profit and types H’s expected utility is (weakly) lower than u

H

*, using λ<λ* shows that type L expected utility at C′

L

is (weakly) lower than at C**

L

and thus (again from λ<λ*) it is lower than at

(Case 1.2). In Case 1.1, since γj=1 for all non-deviant insurers, we deduce that type H’s expected utility is lower or equal to u*

H

in the continuation equilibrium. As the deviant insurer makes positive profit and types H’s expected utility is (weakly) lower than u

H

*, using λ<λ* shows that type L expected utility at C′

L

is (weakly) lower than at C**

L

and thus (again from λ<λ*) it is lower than at  In Case 1.2, non-deviant insurers also pay negative policy dividends, which implies that type L individuals reach a lower expected utility than at

In Case 1.2, non-deviant insurers also pay negative policy dividends, which implies that type L individuals reach a lower expected utility than at  Thus, in Cases 1.1 and 1.2 there exists another continuation equilibrium following deviation C′, where types H choose

Thus, in Cases 1.1 and 1.2 there exists another continuation equilibrium following deviation C′, where types H choose  types L choose

types L choose  and the deviant insurer makes zero profit.

and the deviant insurer makes zero profit. (Case 2.2). In Case 2.1, if type H individuals choose non-deviant insurers with positive probability, then we are back to the situation described in Case 1.1, with unchanged conclusion and if all type H individuals choose a contract in C′, say C′

H

, then type L expected utility is lower than at

(Case 2.2). In Case 2.1, if type H individuals choose non-deviant insurers with positive probability, then we are back to the situation described in Case 1.1, with unchanged conclusion and if all type H individuals choose a contract in C′, say C′

H

, then type L expected utility is lower than at  because the allocation corresponding to (C′

H

, C′

L

) would satisfy (A.1)–(A.4) with positive profit. In Case 2.2, let λ″ be the proportion of types H among individuals who purchase insurance from a non-deviant insurer. If λ″>λ, non-deviant insurers pay a negative policy dividend, which implies that the expected utility of type L individuals is lower than at

because the allocation corresponding to (C′

H

, C′

L

) would satisfy (A.1)–(A.4) with positive profit. In Case 2.2, let λ″ be the proportion of types H among individuals who purchase insurance from a non-deviant insurer. If λ″>λ, non-deviant insurers pay a negative policy dividend, which implies that the expected utility of type L individuals is lower than at  If λ″⩽λ, we have λ′⩾λ. The allocation corresponding to (C′

H

, C′

L

) would satisfy (A.1)–( A.4) with positive profit and a proportion of type H larger or equal to λ. The expected utility reached by type L individuals at C′

L

is thus necessarily lower than at

If λ″⩽λ, we have λ′⩾λ. The allocation corresponding to (C′

H

, C′

L

) would satisfy (A.1)–( A.4) with positive profit and a proportion of type H larger or equal to λ. The expected utility reached by type L individuals at C′

L

is thus necessarily lower than at  Thus, in Cases 2.1 and 2.2 as well there exists another continuation equilibrium following deviation C′, where type H individuals choose

Thus, in Cases 2.1 and 2.2 as well there exists another continuation equilibrium following deviation C′, where type H individuals choose  type L individuals choose

type L individuals choose  and the deviant insurer makes zero profit.

and the deviant insurer makes zero profit. type L individuals choose

type L individuals choose  and the deviant insurer makes zero profit. This is also true when the deviant chooses C′ instead of C″, for some expectations on policy dividends paid by the deviant insurer.

and the deviant insurer makes zero profit. This is also true when the deviant chooses C′ instead of C″, for some expectations on policy dividends paid by the deviant insurer. be the type t expected utility at the MWS allocation, that is

be the type t expected utility at the MWS allocation, that is  where

where  for t=H and L. Consider another equilibrium allocation

for t=H and L. Consider another equilibrium allocation  with

with  with

with  the type t expected utility, that is,

the type t expected utility, that is,  Since any equilibrium allocation satisfies conditions (1)–(4), we have

Since any equilibrium allocation satisfies conditions (1)–(4), we have  Suppose

Suppose

with positive profit when type H individuals choose C′

H

and type L individuals choose C′

L

. There is at least one continuation equilibrium after this deviation where all type L individuals choose C′

L

and the deviant insurer makes positive profit. Consider a continuation equilibrium where non-deviant insurers still attract some individuals.

with positive profit when type H individuals choose C′

H

and type L individuals choose C′

L

. There is at least one continuation equilibrium after this deviation where all type L individuals choose C′

L

and the deviant insurer makes positive profit. Consider a continuation equilibrium where non-deviant insurers still attract some individuals. and thus, for (C′

H

, C′

L

) close enough to

and thus, for (C′

H

, C′

L

) close enough to  larger than what they would get from the deviant insurer. This is incompatible with an increase in the profit of these insurers. If the profit per policyholder of non-deviant insurers is weakly lower than on the equilibrium path (thus providing a weakly lower expected utility to policyholders), then for C′

L

close enough to

larger than what they would get from the deviant insurer. This is incompatible with an increase in the profit of these insurers. If the profit per policyholder of non-deviant insurers is weakly lower than on the equilibrium path (thus providing a weakly lower expected utility to policyholders), then for C′

L

close enough to  all type L individuals purchase insurance from the deviant insurer.

all type L individuals purchase insurance from the deviant insurer. and

and  at any equilibrium allocation that differs from the MWS allocation. □

at any equilibrium allocation that differs from the MWS allocation. □