Abstract

This paper investigates the impact of stock markets and banks on economic growth in the Middle East and North African (MENA) countries. The sample comprises a panel data from 13 MENA countries over the period 1988–2009. This paper uses recent GMM techniques developed for dynamic panels. The findings suggest that stock markets and banks positively influence economic growth in the MENA countries only during periods of stability. Our results are robust to several specifications and potential biases induced by simultaneity, omitted variables and unobserved country specific effects.

Similar content being viewed by others

Notes

The countries are Egypt, Iran, Jordan, Lebanon, Morocco, Tunisia, Bahrain, Kuwait, Saudi Arabia, United Arab Emirates, Qatar, Turkey and Oman.

This paper uses the Beck et al. (2010) financial database. As real GDP is a flow variable defined relative to a period while bank credit to private sector, liquid liabilities and market capitalization are stock variables measured at the end of period, Beck et al. (2010) deflate the end of year of these variables by end of year consumer price index (CPI) and deflate the GDP by the average annual CPI. Then, they take the average of these variables in period t and period t−1 and relate it to the real flow variable for period t.

As we could not find data on average schooling for many MENA countries, we used the adult literacy rate as a proxy for human capital.

Our instability periods match those identified by the stability indexes published by the World Governance Indicators and the IFO World Economic Survey.

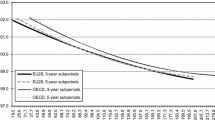

Results from a 3-year moving average were less significant than those obtained using a 5-year moving average and considering a higher order moving average leads to loss in the number of observations.

We only consider a break in the mean of the variables as the variables do not exhibit jointly any deterministic trend.

References

Abdellatif, M . 2001: Economic crises and democratisation in Morocco. The Journal of North African Studies 6 (3): 70–82.

Abedifar, P, Molyneux, P and Tarazi, A . 2013: Risk in Islamic banking. Review of Finance 17 (6): 2035–2096.

Ahmed, AD . 2010: Financial liberalization, financial development and growth linkages in Sub-Saharan African countries: An empirical investigation. Studies in Economics and Finance 27 (4): 314–339.

Al-Malkawi, H-AN and Abdullah, N . 2011: Finance-growth nexus: Evidence from a panel of MENA countries. International Research Journal of Finance and Economics 63: 129–139.

Alonso-Borrego, C and Arellano, M . 1999: Symmetrically normalized instrumental-variable estimation using panel data. Journal of Business and Economics Statistics 17 (1): 36–49.

Arellano, M and Bond, S . 1991: Some tests of specifications for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies 58 (2): 77–297.

Arellano, M and Bover, O . 1995: Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68 (1): 29–51.

Arestis, P, Demetriades, PO and Luintel, KB . 2001: Financial development and economic growth: The role of stock markets. Journal of Money Credit and Banking 33 (1): 16–41.

Baltagi, B . 2005: Econometric analysis of panel data, 3rd Edition. Wiley: New York.

Barajas, A, Chami, R and Yousefi, S . 2011: The impact of financial development on growth in the Middle East and North Africa. In: Middle East and Central Asia Regional Economic Outlook. Chapter 3.3 IMF: Washington DC.

Beck, T, Demirguc-Kunt, A and Levine, R . 2010: Financial institutions and markets across countries and over time: The updated financial development and structure database. World Bank Economic Review 24 (1): 77–92.

Beck, T and Levine, R . 2004: Stock markets, banks, and growth: Panel evidence. Journal of Banking and Finance 28 (3): 423–442.

Beck, T, Levine, R and Loayza, N . 2000: Finance and the sources of growth. Journal of Financial Economics 58 (1–2): 261–300.

Ben Naceur, S and Ghazouani, S . 2007a: Stock markets, banks, and economic growth: Empirical evidence from the MENA region. Research in International Business and Finance 21 (2): 297–315.

Ben Naceur, S and Ghazouani, S . 2007b: The determinants of stock market development in the Middle-Eastern and North African region. Managerial Finance 33 (7): 477–489.

Ben Naceur, S, Ghazouani, S and Omran, M . 2008: Does liberalization spur financial and economic development in the MENA region? Journal of Comparative Economics 36 (4): 673–698.

Bencivenga, VR and Smith, BD . 1991: Financial intermediation and endogenous growth. Review of Economic Studies 58 (2): 195–209.

Bencivenga, VR, Smith, BD and Starr, RM . 1995: Transactions costs, technological choice, and endogenous growth. Journal of Economic Theory 67 (1): 153–177.

Blundell, R and Bond, S . 1998: Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87 (1): 115–143.

Blundell, R, Bond, S and Windmeijer, F . 2000: Estimation in dynamic panel models: Improving on the performance of the standard GMM estimators. In: Baltagi, BH, Thomas, B, Fomby, R and Carter, H (eds). Nonstationary Panels, Panel Cointegration and Dynamic Panels. (Advances in Econometrics, Vol. 15), Emerald: UK, pp. 53–91.

Breitung, J . 2000: The local power of some unit root tests for panel data. In: Baltagi, BH, Thomas, B, Fomby, R and Carter, H. (eds). Nonstationary Panels, Panel Cointegration and Dynamic Panels. (Advances in Econometrics, Vol. 15) Emerald: pp. 161–177.

Cavalcanti, T V de V, Mohaddes, K and Raissi, M . 2011: Growth, developmentand natural resource: New evidence using heterogeneous panel analysis. The Quarterly Review of Economics and Finance 51 (4): 305–318.

Chong, BS and Liu, Ming-Hua . 2009: Islamic banking: Interest free or interest-based? Pacific-Basin Finance Journal 17 (1): 125–144.

Greenwood, J and Smith, BD . 1997: Financial markets in development, and the development of financial markets. Journal of Economic Dynamics and Control 21 (1): 145–181.

Hondroyiannis, G, Lolos, S and Papapetrou, E . 2005: Financial markets and economic growth in Greece, 1986–1999. Journal of International Financial Markets, Institutions and Money 15 (2): 173–188.

Im, K-S, Lee, J and Tieslau, M . 2005: Panel LM unit-root tests with level shifts. Oxford Bulletin of Economics and Statistics 67 (3): 393–419.

Im, KS, Pesaran, MH and Shin, Y . 2003: Testing for unit roots in heterogeneous panels. Journal of Econometrics 115 (1): 53–74.

Inoubli, C and Khallouli, W . 2011: Does financial development impact on growth? Empirical evidence with threshold effect. Paper presented at the 17th Annual Conference: Politics and Economic Development, Turkey.

International Monetary Fund (IMF). 2008: World economic and financial surveys. Global financial stability report, Washington DC, October, http://www.imf.org/external/pubs/ft/gfsr/2008/02/pdf/text.pdf.

King, RG and Levine, R . 1993a: Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics 108 (3): 717–737.

King, RG and Levine, R . 1993b: Finance, entrepreneurship and growth: Theory and evidence. Journal of Monetary Economics 32 (3): 513–542.

Levin, A, Lin, CF and James Chu, CS . 2002: Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics 108 (1): 1–24.

Levine, R . 1991: Stock markets, growth and tax policy. Journal of Finance 46 (4): 1445–1465.

Levine, R . 1998: The legal environment, banks, and long-run economic growth. Journal of Money, Credit and Banking 30 (3): 596–613.

Levine, R . 1999: Law, finance, and economic growth. Journal of Financial Intermediation 8 (1–2): 8–35.

Levine, R, Loayza, N and Beck, T . 2000: Financial intermediation and growth: Causality and causes. Journal of Monetary Economics 46 (1): 31–77.

Levine, R and Zervos, S . 1998: Stock markets, banks, and economic growth. American Economic Review 88 (3): 537–558.

Maddala, GS and Wu, S . 1999: A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics 61 (S1): 631–652.

Masoud, N and Hardaker, G . 2012: The impact of financial development on economic growth: Empirical analysis of emerging market countries. Studies in Economics and Finance 29 (3): 148–173.

McKinnon, RI . 1973: Money and capital in economic development. Brookings Institution Press: Washington DC.

Mishkin, FS . 2010: The economics of money, banking and financial markets. Prentice Hall: USA.

Nieuwerburgh, SV, Buelens, F and Cuyvers, L . 2006: Stock market development and economic growth in Belgium. Explorations in Economic History 43 (1): 13–38.

Nili, M and Rastad, M . 2007: Addressing the growth failure of the oil economies: The role of financial development. The Quarterly Review of Economics and Finance 46 (5): 726–740.

Obstfeld, M . 1994: Risk-taking, global diversification, and growth. American Economic Review 84 (5): 1310–1329.

Petrucci, S . 1997: Morocco’s potential still unrealized, Independent Evaluation Group (IEG), the World Bank Group, http://lnweb90.worldbank.org/oed/oeddoclib.nsf/DocUNIDViewForJavaSearch/33297C600E792CD0852567F5005D8FBE, accessed 20 May 2013.

Rajan, RG and Zingales, L . 1995: What do we know about capital structure? Some evidence from international data. Journal of Finance 50 (5): 1421–1460.

Roodman, D . 2009: A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics 71 (1): 135–158.

Rousseau, PL and Wachtel, P . 2000: Equity markets and growth: Cross-country evidence on timing and outcomes, 1980–1995. Journal of Banking and Finance 24 (12): 1933–1957.

Sachs, J and Warner, M . 1995: Natural resource abundance and economic growth. National Bureau of Economic Research Working paper 5398, USA.

Shaw, E . 1973: Financial deepening in economic development. Oxford University Press: New York.

The World Bank (WB). 2013: World Bank Indicator, http://data.worldbank.org/data-catalog/world-development-indicators, accessed 15 September 2013.

Windmeijer, F . 2005: A finite sample correction for the variance of linear two-step GMM estimators. Journal of Econometrics 126 (1): 25–51.

Acknowledgements

This paper has greatly benefitted from very useful comments received from two anonymous reviewers and the editor of Comparative Economic Studies. The authors are responsible for all remaining errors and imperfections.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Hamadi, H., Bassil, C. Financial Development and Economic Growth in the MENA Region. Comp Econ Stud 57, 598–622 (2015). https://doi.org/10.1057/ces.2015.21

Published:

Issue Date:

DOI: https://doi.org/10.1057/ces.2015.21