Abstract

Globalization, income growth and changing cultural trends are believed to prompt consumers in low-income countries to adopt the more affluent diet of high-income countries. This study investigates the convergence of food expenditure patterns worldwide, focusing on total food expenditure, raw food categories and ultra-processed foods and beverages across more than 90 countries over the past decades. Contrary to prior belief, we find that food expenditure patterns of lower-income countries do not universally align with those of higher-income nations. This trend is evident across most raw food categories and ultra-processed foods and beverages, as the income level of a country continues to play a crucial role in determining its food expenditure patterns. Importantly, expenditure patterns offer estimates rather than a precise idea of dietary intake, reflecting consumer choices shaped by economic constraints rather than exact dietary consumption.

Similar content being viewed by others

Main

Progressing towards healthier and more sustainable diets stands as one of the paramount global challenges, given the need to feed an expanding global population amid the effects of climate change1,2,3. Historically, high-income countries have set many expenditure patterns, profoundly influencing agricultural and food production practices across the globe4,5. These evolving patterns, coupled with a notable transition in recent decades towards energy-intensive and animal-based foods, not only determine the trajectory of food production but also reshape international trade dynamics by prioritizing certain commodities6,7,8. The combined influence of these trends has substantial environmental consequences, affecting land use, water conservation and greenhouse gas emissions9,10,11,12. Furthermore, this shift in consumption has been linked to increasing instances of obesity and non-communicable diseases13,14,15,16.

With large populations in low-income countries advancing economically, there is an increasing curiosity about whether their food demand patterns will echo those of their more affluent counterparts2,3,17,18,19. By exploring the convergence in food demand between low- and high-income countries, this research seeks to offer insights into potential shifts in global food systems and the ensuing implications for agriculture, trade and policy. Recognizing these patterns is vital for planning, investment and policy-making in both agriculture and public health sectors.

Several studies15,20,21,22,23 indicate that globalization, income growth and changing cultural trends are prompting consumers in lower-income countries to adopt a more affluent dietary pattern, commonly referred to as the ‘Western diet’, which prioritizes meats, dairy products, refined grains and pre-packaged foods and beverages. However, existing research primarily focuses on intake information24,25,26,27, overlooking the aspect of how consumers allocate their budget among different food categories. Understanding budget allocation is essential as it reflects consumer priorities, preferences and economic accessibility. Therefore, our study’s focus on expenditure patterns complements these dietary intake studies by providing an alternative lens through which to view food consumption trends. Furthermore, the dynamic nature of consumption patterns, influenced by socio-economic factors and health awareness, is often overlooked in current literature, despite ongoing shifts in dietary preferences driven by increased access to nutritional knowledge20,22,23. These dynamics may lead to divergent consumption trajectories between lower- and higher-income countries.

This study investigates the convergence of budget shares for total food, stimulants and 12 raw food categories across 94 countries from 1990 to 2019 and the convergence trends for ultra-processed foods (UPFs) and ultra-processed beverages (UPBs) across 92 countries from 2009 to 2019. We apply the neoclassical economic concept of “convergence’ to describe the dynamics of food expenditure patterns in high- and lower-income countries. This implies that over time, countries tend to adopt a similar food expenditure pattern, irrespective of their initial differences. It is crucial to note, however, that these expenditure patterns serve as proxies, offering an approximation rather than a direct measure of dietary intake, reflecting consumer choices within economic constraints rather than exact dietary consumption.

This research offers three contributions to existing literature. First, it covers an extensive range of regions and the most updated data available for the analysis of global food expenditure trajectories. Second, from a technical perspective, by employing the ‘log t-test’ convergence method introduced by Philips and Sul28,29, we have enhanced the empirical model to address the issue of spurious convergence commonly encountered in research on similar topics2,17. Such studies typically rely on beta-convergence methodology, which has faced criticism for its low power in distinguishing convergence and divergence30,31. In addition, instead of generalizing food demand trends for all countries, we highlight the ‘club convergence’ concept, suggesting countries within a club exhibit similar food expenditure behaviour. This nuanced approach allows us to discern distinct trends among specific country groups28. Lastly, we employ the Multinomial Logistic Regression (MNL) to explain the formation of distinct convergence clubs, taking into account both economic and non-economic determinants. These advancements provide insights into global food expenditure trajectories, informing the formulation of robust national and regional policies.

Results

Food budget share across different income-level countries

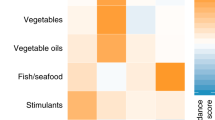

Figure 1 presents food expenditure patterns across four different income-level countries. The figure reveals an inverse relationship between income levels and the proportion of the budget spent on food (Fig. 1a). It shows that lower-income countries show a stronger preference for plant-based foods, whereas higher- and upper-middle-income countries tend to allocate more of their budget to animal-sourced foods. Additionally, as income increases, so does spending on stimulants such as alcoholic drinks and tobacco. Interestingly, the expenditure on ultra-processed foods and beverages remains relatively stable across all income levels, around 5% for ultra-processed foods and 2% for ultra-processed beverages (Fig. 1b).

Budget shares are recorded at the per capita level. The income-group classification of countries is based on ‘World Bank Income Classifications Fiscal Year 2024’54. a, Aggregated budget shares for food and non-alcoholic beverages and for stimulants, across different income-group countries in 2019. b, Average budget shares for detailed categories across different income-group countries in 2019.

Global convergence test for food expenditure pattern

Before the convergence analysis, we conducted an Augmented Dickey–Fuller test in the R programme (version 4.1.2, available at https://www.r-project.org; tseries package, available at https://cran.r-project.org/web/packages/tseries/index.html) to identify if food budget shares follow deterministic or stochastic trends, essential for choosing the correct testing method. Following Desli and Gkoulgkoutsika32, deterministic trends suggest using the beta-convergence test33, whereas stochastic trends require a stochastic approach like the unit root approach or the pair-wise34 approach. For mixed trends, the log t-test28 is suitable. In conducting Augmented Dickey–Fuller tests, we incorporate both a constant term and a linear trend into our analysis following the recommendations outlined by Stadnytska35. Additionally, the optimal lag length for each test was determined using the Akaike Information Criteria. The results, presented in Supplementary Table 1, revealed both trend types across the cross-sectional average expenditure share on each category and 30 cases (15 categories, two countries each), with three deterministic and the rest stochastic. Thus, we apply the log t-test for our analysis, considering its ability to handle mixed trends. We also apply the unit root approach for a robustness check.

Using the log t-test and the unit root approach, we assessed disposable income’s share on food in various-income countries, comparing it to high-income countries. Columns (1) to (3) in Table 1 present the results of the log t-test in different model settings. Results across three model settings indicated negative point estimates \((\hat{b})\) and t statistics below −1.65, rejecting the hypothesis of global food consumption pattern convergence at the 5% significance level, indicating divergent growth trends in food budget shares among different income countries. The findings from the unit root approach, displayed in column (4), largely support the outcomes of the log t-test, with exception of the category ‘Coffee, tea and cocoa’, which displays evidence of convergence.

Club convergence test for food expenditure pattern

Given the lack of worldwide convergence in all food categories, we employ the club convergence tests proposed by Philips and Sul28,29 to distinguish partial convergence clusters of food budget shares. Additionally, we applied an MNL approach to explore the influencing factors contributing to the formation of various convergence clusters. The results displayed in Tables 2 and 3 show that total food and almost all food categories have certain countries forming clusters that follow the same trend except the category ‘Oils and fats’. The results of club convergence analysis for ‘Oils and fats’ show that although two groups formed and their corresponding t value is higher than −1.65, their coefficient for log(t) is lower than 0 (‘Oils and fats’ in Table 2). Consequently, the allocation of budget shares towards ‘Oils and fats’ will continually drift apart among all countries.

Tables 2 and 3 and Figs. 2 and 3 all show the results of the club convergence. Tables 2 and 3 show the number of countries included in the identified converging club or diverging group for each food category, along with the estimated \(\hat{b}\) coefficient and corresponding t values. The magnitude of \(\hat{b}\) represents double the speed of convergence, which is denoted as \(\alpha\), and indicates the types of convergence. If \(\hat{b}\ge 2\), that is, \(\alpha \ge 1\), then it implies countries/regions with the club converge to the common steady-state level of food budget share (absolute convergence). Meanwhile, if \(0\le \hat{b} < 2\), it means the growth rate of budget share across countries will converge, which is also called conditional convergence. We also categorized specific countries into the same diverging group category, where they exhibited similar expenditure behaviours, but these groups as collective entities are diverging from one another (\(\hat{b} < 0\)). This means that whereas individuals within each group are alike, the overall direction or trends of these groups are moving in different, often opposite, directions. Drawing from the identified clubs/groups, we generate two figures to depict the characteristics of each club/group. Figure 2 showcases the evolution of the average food budget share within each club/group from 1990 to 2019, whereas Fig. 3 illustrates the geographical distribution of each club/group where the shaded area represents countries in diverging groups. Supplementary Tables 3–15 present the results of the MNL analysis for each category.

a–o, Clubs and groups for each food category are generated based on the log t-test. Budget shares are recorded at the per capita level. Average budget share on total food and stimulants (a), bread and cereals (b), meat (c), fish and seafood (d), milk, cheese and eggs (e), oils and fats (f), fruit (g), vegetables (h), sugar and confectionery (i), coffee, tea and cocoa (j), mineral waters and soft drinks (k), alcoholic drinks (l), tobacco (m), ultra-processed foods (n) and ultra-processed beverages (o) in each club or group over the years.

a–o, Clubs and groups for each food category are generated based on the log t-test. Geographical distribution of clubs or groups in total food and stimulants (a), bread and cereals (b), meat (c), fish and seafood (d), milk, cheese and eggs (e), oils and fats (f), fruit (g), vegetables (h), sugar and confectionery (i), coffee, tea and cocoa (j), mineral waters and soft drinks (k), alcoholic drinks (l), tobacco (m), ultra-processed foods (n) and ultra-processed beverages (o).

Club convergence test results

Total food and stimulants budget share

‘Total food and stimulants’ in Table 2 reveals that three distinct clubs exhibit positive coefficients and t values above −1.65, suggesting similar food consumption patterns among their member countries, although with slow convergence rates. Club 1, with 43 countries, shows a convergence rate of 0.033% per year at a growth rate of 0.066. Club 2 includes 24 countries with a slightly slower rate of 0.03% per year and a coefficient of 0.059, indicating conditional convergence. Club 3, the smallest with eight countries, boasts the fastest rate of 0.086% per year, highlighted by a coefficient of 0.172. Group 4, in contrast, demonstrates a diverging trend. The average total food budget share trends downward across all clubs/groups, as shown in Fig. 2a, but gaps remain, particularly among countries in Africa, Eastern Europe, Central Asia and Southeastern Asia, which mainly fall into Club 1 and Group 4. Supplementary Table 3 identifies income level and Gross Domestic Product (GDP) per capita growth rate as the main factors influencing club affiliation, suggesting diverging convergence targets between lower- and higher-income countries.

Bread and cereals budget share

Club 1 emerges as the sole convergence club in the ‘Bread and Cereals’ category, consisting of nine countries with a uniform growth trajectory and a 0.142% annual convergence speed, as detailed in ‘Bread and cereals’ in Table 2. Two additional groups are recognized, both showing a tendency towards divergence with negative coefficients. Club 1 is characterized by the lowest average budget share for bread and cereals, as depicted in Fig. 2b. MNL analysis in Supplementary Table 4 further suggests that countries with higher GDP per capita growth rates have a greater likelihood of being in Club 1, contrasting with the other two groups.

Meat budget share

The club convergence test for the category ‘Meat’ shows that only three countries (Egypt, Georgia and Kazakhstan) follow the same growth trend named Club 1. Other countries are divided into two diverging groups, which may have similar budget shares on meat in recent years but will diverge in the future. Figure 2c indicates that Club 1 has the highest average budget share on meat and has an increasing trend after 2010, whereas other groups have relatively low budget share and downward trends.

Fish and seafood budget share

‘Fish and seafood’ in Table 2 reveals a single convergence club (Club 1 with 13 countries) for ‘fish and seafood’ budget shares, converging at 0.007% per year, and two diverging groups. Club 1 consistently allocates the highest budget share to fish and seafood, over 4% annually, as shown in Fig. 2d. In contrast, the other groups spend less. MNL analysis indicates that income level and culture, especially Spanish culture, significantly influence club affiliation, with higher income and Spanish cultural backgrounds correlating with lower expenditure on fish and seafood.

Milk, cheese and eggs budget share

Five clubs/groups are identified, with two converging (Clubs 1 and 2) and three diverging. Clubs 1 and 2, containing four and ten countries, respectively, are moving towards uniform growth rates at 0.272% and 0.126% annually, as shown in ‘Milk, cheese and eggs’ in Table 2. The remaining groups display diverging trends with negative coefficients. Notably, Club 2 experiences the lowest and declining budget share for this food category. MNL analysis indicates that higher trade openness, food-import rates and Spanish culture reduce membership likelihood in Club 2, whereas increases in food production, GDP growth and dependency ratios have the opposite effect.

Fruit budget share

Club 1, with 34 countries converging at 0.129% annually towards a common growth path, exhibits a high and slightly increasing fruit budget share, as detailed in Table 2 (‘Fruit’) and Fig. 2g. In contrast, other countries form Group 1, showing a diverging trend and lower fruit expenditure with a decreasing trend. MNL analysis suggests that high-income and English-cultured countries are less likely to join Club 1, which mainly includes regions such as North Africa, Middle and South Asia and South America.

Vegetables budget share

The club convergence analysis reveals four groups, with Clubs 1 and 2 showing convergence for 9 and 44 countries, respectively, and the rest diverging. Group 3, as depicted in Fig. 2h, has the highest and increasing vegetable budget share post-2000, whereas Club 2 records the lowest with a slight decline. Geographically, Club 2’s members are predominantly from North America, Europe and Eastern Asia. MNL results highlight that Club 2 countries are typically wealthier, aligning with observations that lower-income nations spend more on vegetables, as shown in earlier figures.

Sugar and confectionery budget share

The convergence test reveals two converging clubs, Club 1 and Club 2, both with decreasing budget shares, and one diverging group, Group 3, with a higher budget share. Club 2’s budget share decreases faster than Club 1’s. Countries in Club 1 are spread across Europe, West Asia, Africa and Austria, whereas Club 2 includes North America and East Asia. MNL analysis shows that high food-import rates and specific cultural influences affect expenditure on sugar and confectionery, with high-income countries, particularly those in Club 2, spending less in this category.

Coffee, tea and cocoa budget share

Expenditure on ‘Coffee, tea, and cocoa’ is categorized into four groups, with Club 1 comprising 16 countries and converging at 0.35% annually (‘Coffee, tea and cocoa’ in Table 3). The remaining countries form three diverging groups (Groups 2, 3 and 4), with Club 1 spending the least on these items and showing a decreasing trend from 1990 to 2019. MNL analysis indicates that countries with higher food production growth rates and those with English culture are more associated with Club 2.

Mineral waters and soft drinks budget share

The spending divides into four patterns, with Group 4 leading in budget share and showing consistent growth, whereas Clubs 1, 2 and 3 each have lower shares and slight declines. These clubs converge at rates of 0.568%, 0.069% and 0.301% per year, respectively (‘Mineral waters and soft drinks’ in Table 3). MNL analysis reveals that countries with high food-import rates tend to fall into Club 1, whereas high-income countries and those with rising dependency ratios are more common in Club 2. Spanish cultural affiliation decreases the likelihood of belonging to Clubs 1 and 2.

Alcoholic drinks budget share

The test identifies three converging clusters and one diverging group, with Club 1 having the highest and Club 3 the lowest budget shares for alcohol (‘Alcoholic drinks’ in Table 3). All groups saw declining expenditure from 1990 to 2019. Factors influencing cluster formation, as per Supplementary Table 12, include lower likelihoods for high-food-production-growth countries to be in Club 1 and a higher chance in Club 3. Arabic cultural ties correlate with lower presence in Clubs 1 and 2, reflecting minimal alcohol spending. Geographically, Club 3, with the least spending, consists mainly of nations affected by religious norms, especially Islamic regions.

Tobacco budget share

Tobacco expenditure analysis reveals five clubs/groups with varying budget shares and trends. Group 3 stands out with the highest share and positive growth, whereas Clubs 1 and 2, along with Groups 4 and 5, have lower shares and declining trends (‘Tobacco’ in Table 3). Supplementary Table 13 indicates trade growth and income levels as key factors for Club 1 membership, with higher-income countries more inclined towards Club 1.

UPFs share

Per capita UPF budget allocation reveals five patterns: two converging clubs and three diverging groups (‘Ultra-processed foods’ in Table 3), with Group 3 allocating the highest to UPFs (9%) and Club 2 the least (about 2%). Most countries in Group 4 consistently spend around 4%. MNL analysis shows cultural influences, particularly English and Arabic, significantly affect club/group membership, with English cultural influence favouring Club 2 affiliation.

UPBs share

Similar to UPFs, the club convergence analysis on UPBs reveals two converging groups and three diverging groups (‘Ultra-processed beverages’ in Table 3). Notably, Group 3 stands out with the highest budget share on UPBs, hovering around 2.5%, albeit showing a slight downward trend. Predominantly, nations align with Club 1, characterized by a steady budget share on UPBs at approximately 1.75% over time. Further analysis using the MNL model (Supplementary Table 15) indicates that high-income countries exhibit a lower likelihood of membership in Club 1, whereas countries with an English culture are less inclined to belong to Club 2.

Discussion

We analysed per capita budget shares for total food and 12 raw food categories across 94 countries from 1990 to 2019 and UPFs and UPBs in 92 countries from 2009 to 2019 to test food expenditure pattern convergence from lower- to higher-income countries and examine factors influencing these patterns.

Our findings suggest that the food expenditure lacks a global converge pattern, which indicates the food demand in lower-income countries do not necessarily follow those in higher-income countries36,37,38. Countries’ budget allocations for food categories vary based on factors such as income level, food import and production growth rates, GDP per capita and culture. Whereas overall spending on food and stimulants is declining globally, the disparity in expenditure rates between high- and lower-income countries suggests that equalization is unlikely. Certain categories such as ‘Fruit’, ‘Sugar and confectionery’, ‘Mineral waters and soft drinks’ and ‘Tobacco’ show widening gaps in budget shares, with some countries experiencing increasing trends while others face decreases. Our study extensively examines global food expenditure patterns but may not fully address regional and subnational nuances. Future research could enhance this aspect by exploring regional patterns, as seen in Reardon’s39 work on sub-Saharan Africa and Pingali’s6 research on Asia. The implications of these findings extend to policy considerations, as they offer indicators of expenditure patterns and the pace of convergence, both of which can serve as valuable predictors of future food demand12,40. These insights carry importance not only for the food industry but also for guiding governmental policy decisions7,11,16,41. Furthermore, they may contribute to the ongoing dissemination of nutrition knowledge worldwide42.

This study has two major limitations worth noting. First, it centres on food expenditure rather than direct dietary intake, meaning conclusions about dietary habits should be approached with caution. Secondly, our study encounters challenges in accurately categorizing foods as processed, unprocessed or ultra-processed—with the last category often heavily modified with additives and associated with health risks. Whereas we utilize Baker et al.’s43 approach to differentiate among these food types, this may lack precision, especially because the dataset does not report on the specific food consumed away from home. Consequently, any conclusions drawn about the levels of food processing must be treated with caution.

Methods

Data

Utilizing data from Euromonitor on per capita food budget shares, this study examines the potential convergence of food expenditure patterns between lower-income and high-income countries. Per capita food budget shares are derived by dividing per capita food expenditure by per capita disposable income across various countries, as documented by Euromonitor. In addition to analysing total food budget shares, this study disaggregates the data into 12 sub-categories encompassing food, drink and tobacco, which collectively represent the majority of commonly consumed food products. The analysis covers the period from 1990 to 2019 and includes a sample of 94 countries categorized by the World Bank into 42 high-income countries, 25 upper-middle-income countries, 25 lower-middle-income countries and two low-income countries. The expenditure and disposable income data for these countries have been consistently documented, ensuring the robustness of our analysis.

Furthermore, beyond raw food categories, this study investigates the demand for ‘ultra-processed foods (UPFs)’ and ‘ultra-processed beverages (UPBs)’ to address concerns about the increasing proportion of UPFs and UPBs in modern diets. Thus, we collected the per capita budget shares on UPFs and UPBs from 2009 to 2019 across 92 countries, classified by the World Bank into 41 high-income countries, 25 upper-middle-income countries, 24 lower-middle-income countries and two low-income countries. All expenditure data on UPFs and UPDs are real data, without Euromonitor modelled data included. Figure 1 presents the budget share of the total food, 12 raw food categories, UPFs and UPBs across different income groups in 2019.

The notable advantage of the Euromonitor food expenditure dataset lies in its documentation of individuals’ and households’ food consumption via expenditure rather than mere intake quantities. This approach enables meaningful comparisons across different consumption categories. Additionally, it facilitates a more comprehensive understanding of how people allocate their expenses across diverse food categories, especially in the context of global price fluctuations. However, it is important to note that these data do not capture the total food available to households or individuals for three main reasons, especially for most low- and middle-income countries. First, Euromonitor’s data tend to be biased towards food expenditures made at grocery stores, potentially underrepresenting purchases from restaurants, hotels and fast food chains44. Second, in many developing regions, households may rely on their own agricultural production for consumption, which does not involve monetary expenditure. Particularly in rural areas, a large portion of household consumption may come from farm-produced goods. Third, Euromonitor focuses on purchases made through modern retailing sectors, potentially underestimating food expenditures by neglecting purchases made at small shops or from independent vendors. The data also face limitations due to the absence of a distinct classification for starchy staples within our dataset, which restricts our ability to thoroughly investigate regional consumption patterns of these essential food items. Furthermore, the challenge in accurately quantifying UPFs and UPBs from the data may limit the depth of our analysis on their consumption trends, possibly affecting the robustness of our conclusions on food expenditure convergence. Despite its limitations, Euromonitor data offer a more robust foundation for comparing household food purchases globally. Moreover, its usage has surged in recent years for numerous consumption and market-based studies, as evidenced by the works of Regmi et al.17, Popkin et al.19,45 and Baker et al.46.

Food consumption convergence test

For the total food and and each of the food categories, the current research applies the ‘log t-test’ proposed by Phillips and Sul28,29 to analyse whether the per capita food budget share for the corresponding category in different countries converges to the same steady state. The ‘log t-test’ provides a comprehensive process for testing the global convergence, divergence or potential partial / club convergence in case global convergence does not exist. Moreover, the convergence rate can be estimated at the same time if there is global or club convergence. The brief outline of the ‘log t-test’ model and the econometric testing procedure are as follows:

For a group of countries \(i=(1,\,2,\ldots ,\,N\;)\) within a period of T, the log per capita food budget share for food category k of country i at time t, \(\log {y}_{{it}}\), can be viewed as the product of a time-varying idiosyncratic factor loading \({\delta }_{{it}}\), which also absorbs the error terms \({\varepsilon }_{{it}}\), and a common factor \({\mu }_{t}\), according to the relation:

where \({\delta }_{{it}}\) acts as a unit-specific measure of the share of or distance to the common growth path \({\mu }_{t}\). Because \({\mu }_{t}\) is a common factor, it can be removed by constructing the relative transition coefficient \({h}_{{it}}\) to avoid the need to determine a specific form of \({\mu }_{t}\) in subsequent hypothesis testing. Specifically, the transition coefficient \({h}_{{it}}\) is given by the proportion of log per capita food budget share of country i to the panel average of all countries at time t:

where \({h}_{{it}}\) is time dependent, describing how this proportion evolves over time, thereby providing a measure of food budget share transition. Convergence in a panel exists if all individual units approach the sample average over time, which means \({\delta }_{{it}}\) converges to \(\delta\) or \({h}_{{it}}\) converges to 1. These requirements equal to the cross-sectional variance of \({h}_{{it}}\) converges to zero, as follows:

By constructing the cross-sectional variance, equation (3) summarizes the difference between individual units into a single index, such that the following analysis is effectively converted from a panel set-up to a time series set-up. The conditions of convergence are quite straightforward. However, it is difficult to distinguish whether \({H}_{t}\) converges to zero with limited time series in empirical studies. Thus, to formulate a testable null hypothesis of the convergence, Phillips and Sul28,29 propose the following semiparametric specification of \({\delta }_{{it}}\):

where \({\delta }_{i}\) is the time-invariant part of the country-specific factor loading \({\delta }_{{it}}\), L(t) is a slowly varying increasing function (with \(L(t)\to {\infty \;\mathrm{as}}\,t\to {\infty }\), common choice for L(t) can be \(\log t\) or \(\log (t+1)\)), \(\alpha\) is the speed of convergence, \({\sigma }_{i}\) is the idiosyncratic scale parameter satisfied \({\sigma }_{i} > 0\) for all i, and \({\xi }_{{it}}\) is a weakly autocorrelated random error variable (\({\xi }_{{it}}\) is \({iid}(0,1)\)). Therefore, the null hypothesis of convergence becomes: \({\delta }_{{it}}={\delta }_{i}\) and \(\alpha \ge 0\), whereas the alternative is \({\delta }_{{it}}\ne {\delta }_{i}\) or \(\alpha < 0\). Under the null hypothesis, we have the cross-sectional variance in the following format:

where \({{\rm{\psi }}}_{{it}}={\sigma }_{i}{\xi }_{{it}}\), \({{\rm{\psi }}}_{t}=\frac{1}{N}\mathop{\sum }\limits_{i=1}^{N}\left({{\rm{\sigma }}}_{i}{{\rm{\xi }}}_{{it}}\right)\), \({{\rm{\sigma }}}_{{\psi }_{t}}^{2}=\frac{1}{N}\mathop{\sum }\limits_{i=1}^{N}{\left({\psi }_{{it}}-{\psi }_{t}\right)}^{2}=\frac{1}{N}\mathop{\sum }\limits_{i=1}^{N}{\left({\psi }_{{it}}\right)}^{2}-{\psi }_{\;t}^{2}\). The logarithmic form of \({H}_{t}\) will be:

with

where \({{{\eta }}}_{{Nt}}=\frac{1}{\sqrt{N}}\mathop{\sum }\limits_{i=1}^{N}{\sigma }_{i}^{2}\left({{\rm{\xi }}}_{{it}}^{2}-1\right)\) and \({v}_{{\rm{\psi }}N}^{2}=\frac{1}{N}\left(1-\frac{1}{N}\right)\mathop{\sum }\limits_{i=1}^{N}{\sigma }_{i}^{2}\). The \({v}_{{\rm{\psi }}N}^{2}\) approaches to \({v}_{{\rm{\psi }}}^{2}\) as N approaches infinity. Using \(\log {H}_{1}\) minus \(\log {H}_{t}\), we can get:

Moving \(2\log L\left(t\right)\) to the left-hand side, we can have a simple regression equation, which uses \(\log t\) as its independent variable:

where the intercept \(a=\log {H}_{1}-\log \frac{{v}_{\psi N}^{2}}{{\delta }^{2}}\) does not depend on \(\alpha\), the coefficient \(b=2\alpha\), and \({u}_{t}=-{{{\epsilon }}}_{t}\). Thus, the null hypothesis of \(\alpha \ge 0\) can be examined using a simple linear regression and a one-sided t-test to the coefficient \(b\). Moreover, the regression also provides an empirical estimate of convergence speed, which equals \(b/2\).

On the basis of these preliminary considerations, the hypothesis testing procedure involves the following three steps:

-

1.

Calculation of the cross-sectional variance ratio \({H}_{1}/{H}_{t}\), where the \({H}_{1}\) and \({H}_{t}\) refer to the cross-sectional variance of \({h}_{{it}}\) at the initial year and the tth year of the dataset, respectively.

-

2.

Estimation of the following OLS regression:

where \(r\) is a truncation parameter ranging from 0 to 1. The purpose of excluding a fraction \(r\) from the time series is to focus attention in the test on what happens as the sample size gets larger. On the basis of the Monte Carlo experiments, Phillips and Sul28 and Du47 suggest setting \(r\in [0.2,\,0.3]\) for optimal performance in situations where the small or moderate \(T\left(\le 50\right)\).

3. One-sided t-test for \(\alpha \ge 0\) using \({\hat{b}}\,({\hat{b}}=2\hat{\alpha })\) and a heteroskedasticity and autocorrelation-consistent standard error, the null hypothesis of convergence is rejected at the 5% level if \({t}_{\hat{b}} < -1.65\). The magnitude of \(\hat{b}\), therefore, measures the speed of consumption convergence. If \(\hat{b}\ge 2\), that is, \({\rm{\alpha }}\ge 1\), then it implies the convergence in the expenditure (absolute convergence). Meanwhile, if \(0\le \hat{b} < 2\), it implies the growth rate of expenditure within countries will converge, which is also called conditional convergence.

The club convergence tests are conducted in the case the global convergence does not exist. For each food, drink and tobacco category, the investigation of possible convergence clusters involves the four following steps:

-

1.

Order countries decreasingly based on the per capita food budget share of the category in the last period.

-

2.

Form a core group \({G}_{k}\) by selecting \(k\) countries with the highest per capita food budget share, where the \(k\) is decided by maximizing the value of the subgroup convergence t statistics. In case of the t statistics for all k are less than the critical value −1.65, drop the highest observation and repeat this step for the rest of observations. There is no club convergence in this panel if no core group can form.

-

3.

Adding the rest countries to the core group \({G}_{k}\) one by one and running the log t-test separately. Including the country in the convergence club if the t statistics is bigger than the critical value. After testing all remaining countries, conducting a log t-test for the core group and all countries passed the initial log t-test together to make sure the t statistics for the whole group is bigger than −1.65. If so, the first subgroup formed. If not, increase the critical value and repeat this step until the first club is formed.

-

4.

For countries not included in the first club, repeat step (1) to step (3) until no club can be formed.

Specifically, the log t-test is performed in Stata (version 15.1; http://www.stata.com) using the PSECTA package (https://github.com/kerrydu1986/PSECTA).

Food consumption convergence test

Besides the log t-test, we conducted robustness checks using a unit root approach21,48. This approach examines whether the differences in the food budget share between two countries remain stable over time. Typically, two countries are converging if the budget share difference is stationary, whereas the presence of a unit root indicates a lack of convergence. A common method in testing panel unit root when the time dimension is small is the Harris–Tsavalis test (HT). The model specification for the HT test is as follows:

where \({w}_{i,\;j,t}\) denotes the log difference in the budget share allocated to category k between country i and country \(j\) (or the benchmark) at year \(t\). \(\Delta\) denotes the first-difference operator. \({{\boldsymbol{z}}}_{i,\;j,t}^{{{{\prime} }}}{\gamma }_{i,\;j}\) represents the panel-specific means and trends terms. However, we remove the drift and trend terms when testing for convergence, as suggested by Busetti et al.48. Following Michail21, we choose cross-country sample average budget share allocated to category k in each year as the benchmark to test whether all countries are converging to the same expenditure pattern. The null hypothesis of the HT test (\(\beta =0\)) suggests the presence of a unit root, signifying a lack of convergence in the panel. The unit root approach used to test food consumption convergence is performed in the Stata programme (version 15.1; http://www.stata.com) using the xtunitroot command.

Multinomial logistic model

In the initial stage, where the potential emergence of convergence clusters is elucidated, we proceed to investigate the underlying elements that influence the development of distinct clusters. The transformation of culinary preferences and dietary habits across various nations can be attributed to shared factors49, including enhancements in food provisioning, global trade dynamics, the globalization of food production, household income trends, escalating urbanization and evolving family structures. Simultaneously, the dietary consumption tendencies within a specific region are also moulded by intrinsic elements50 such as cultural heritage and environmental circumstances. In light of the categorical dependent variable, characterizing the established clusters from the first stage, featuring two or more classifications, we employ an MNL model51,52,53. The subsequent section delineates the interrelation between the identified clusters and the potential influencing factors for each category encompassing food, beverages and tobacco, expressed as follows:

where \({p}_{i,{\;j}}\) is the probability that country i belongs to club \(j\). \({Z}_{i,\;j}\) is a vector of variables that would affect the probability of the country being in club \(j\). It encompasses both socio-economic factors—such as the average growth rate of trade as a percentage of GDP, the average growth rate of urban population as a percentage of the total population, the average growth rate of food imports as a percentage of merchandise imports and the average growth rate of the food production index—and cultural factors, as indicated by the official language2,7. \({\beta }_{j}\) represents the specific constant term of club j. The parameter of our primary interest is \({\gamma }_{j}\), which measures the average marginal effect of the determinants of being a member in club j. The descriptive statistics of all the covariates are presented in Supplementary Table 2. The MNL analysis is performed in the Stata programme (version 15.1; http://www.stata.com) using the logit command.

Reporting summary

Further information on research design is available in the Nature Portfolio Reporting Summary linked to this article.

Data availability

All food expenditure data and other socio-economic factors used in this study are available on Euromonitor (https://www.euromonitor.com/usa) by subscription. Source data are provided with this paper.

Code availability

The code is available upon reasonable request.

References

Springmann, M. et al. Options for keeping the food system within environmental limits. Nature 562, 519–525 (2018).

Azzam, A. Is the world converging to a ‘Western diet’? Public Health Nutr. 24, 309–317 (2021).

Chepeliev, M. Spillover effects of dietary transitions. Nat. Food 4, 458–459 (2023).

Vasileska, A. & Rechkoska, G. Global and regional food consumption patterns and trends. Procedia Social Behav. Sci. 44, 363–369 (2012).

Yi, J. et al. Post-farmgate food value chains make up most of consumer food expenditures globally. Nat. Food 2, 417–425 (2021).

Pingali, P. Westernization of Asian diets and the transformation of food systems: implications for research and policy. Food Policy 32, 281–298 (2007).

Bentham, J. et al. Multidimensional characterization of global food supply from 1961 to 2013. Nat. Food 1, 70–75 (2020).

Fukase, E. & Martin, W. Economic growth, convergence, and world food demand and supply. World Dev. 132, 104954 (2020).

Chatzimpiros, P. & Harchaoui, S. Sevenfold variation in global feeding capacity depends on diets, land use and nitrogen management. Nat. Food 4, 372–383 (2023).

Tilman, D. & Clark, M. Global diets link environmental sustainability and human health. Nature 515, 518–522 (2014).

Vaidyanathan, G. What humanity should eat to stay healthy and save the planet. Nature 600, 22–25 (2021).

Hasegawa, T., Havlík, P., Frank, S., Palazzo, A. & Valin, H. Tackling food consumption inequality to fight hunger without pressuring the environment. Nat. Sustain. 2, 826–833 (2019).

Swinburn, B. A. et al. The global obesity pandemic: shaped by global drivers and local environments. Lancet 378, 804–814 (2011).

Popkin, B. M. & Reardon, T. Obesity and the food system transformation in Latin America. Obesity Rev. 19, 1028–1064 (2018).

Yuan, S. et al. Trends in dietary patterns over the last decade and their association with long-term mortality in general US populations with undiagnosed and diagnosed diabetes. Nutr. Diabetes 13, 5 (2023).

O’Hearn, M. et al. Incident type 2 diabetes attributable to suboptimal diet in 184 countries. Nat. Med. 29, 982–995 (2023).

Regmi, A., Takeshima, H. & Unnevehr, L. J. Convergence in food demand and delivery: do middle-income countries follow high-income trends? J. Food Distrib. Res. 39, 116–122 (2008).

Popkin, B. M., Adair, L. S. & Ng, S. W. Global nutrition transition and the pandemic of obesity in developing countries. Nutr. Rev. 70, 3–21 (2012).

Popkin, B. M. & Hawkes, C. Sweetening of the global diet, particularly beverages: patterns, trends, and policy responses. Lancet Diabetes Endocrinol. 4, 174–186 (2016).

Gatto, A., Kuiper, M. & van Meijl, H. Economic, social and environmental spillovers decrease the benefits of a global dietary shift. Nat. Food 4, 496–507 (2023).

Michail, N. A. Convergence of consumption patterns in the European Union. Empirical Econ. 58, 979–994 (2020).

Garnett, T., Mathewson, S., Angelides, P. & Borthwick, F. Policies and actions to shift eating patterns: what works. Foresight 515, 518–522 (2015).

Gilbert, P. A. & Khokhar, S. Changing dietary habits of ethnic groups in Europe and implications for health. Nutr. Rev. 66, 203–215 (2008).

Singh, G. M. et al. Estimated global, regional, and national disease burdens related to sugar-sweetened beverage consumption in 2010. Circulation 132, 639–666 (2015).

Anand, S. S. et al. Food consumption and its impact on cardiovascular disease: importance of solutions focused on the globalized food system: a report from the workshop convened by the World Heart Federation. J. Am. Coll. Cardiol. 66, 1590–1614 (2015).

Sun, H. et al. Global disease burden attributed to high sugar-sweetened beverages in 204 countries and territories from 1990 to 2019. Preventive Med. 175, 107690 (2023).

Micha, R. et al. Global, regional, and national consumption levels of dietary fats and oils in 1990 and 2010: a systematic analysis including 266 country-specific nutrition surveys. Brit. Med. J. 348, g2272 (2014).

Phillips, P. C. & Sul, D. Transition modeling and econometric convergence tests. Econometrica 75, 1771–1855 (2007).

Phillips, P. C. & Sul, D. Economic transition and growth. J. Appl. Econom. 24, 1153–1185 (2009).

De Long, J. B. Productivity growth, convergence, and welfare: comment. Am. Econ. Rev. 78, 1138–1154 (1988).

Quah, D. Galton’s fallacy and tests of the convergence hypothesis. Scand. J. Econ. 95, 427–443 (1993).

Desli, E. & Gkoulgkoutsika, A. World economic convergence: does the estimation methodology matter? Econ. Modell. 91, 138–147 (2020).

Barro, R. J. & Sala-i-Martin, X. Convergence. J. Polit. Econ. 100, 223–251 (1992).

Pesaran, M. H. A pair-wise approach to testing for output and growth convergence. J. Econom. 138, 312–355 (2007).

Stadnytska, T. Deterministic or stochastic trend: decision on the basis of the augmented Dickey–Fuller test. Methodology 6, 83–92 (2010).

Von Lyncker, K. & Thoennessen, R. Regional club convergence in the EU: evidence from a panel data analysis. Empirical Econ. 52, 525–553 (2017).

Bartkowska, M. & Riedl, A. Regional convergence clubs in Europe: identification and conditioning factors. Econ. Modell. 29, 22–31 (2012).

Lyons, S., Mayor, K. & Tol, R. S. Convergence of consumption patterns during macroeconomic transition: a model of demand in Ireland and the OECD. Econ. Modell. 26, 702–714 (2009).

Reardon, T. et al. The processed food revolution in African food systems and the double burden of malnutrition. Glob. Food Secur. 28, 100466 (2021).

Xia, L. et al. Global food insecurity and famine from reduced crop, marine fishery and livestock production due to climate disruption from nuclear war soot injection. Nat. Food 3, 586–596 (2022).

Lucas, E., Guo, M. & Guillén-Gosálbez, G. Low-carbon diets can reduce global ecological and health costs. Nat. Food 4, 394–406 (2023).

Spronk, I., Kullen, C., Burdon, C. & O’Connor, H. Relationship between nutrition knowledge and dietary intake. Br. J. Nutr. 111, 1713–1726 (2014).

Baker, P. et al. Ultra‐processed foods and the nutrition transition: global, regional and national trends, food systems transformations and political economy drivers. Obesity Rev. 21, e13126 (2020).

Frazão, E., Meade, B. G. S. & Regmi, A. Converging patterns in global food consumption and food delivery systems. Amber Waves 6, 22–29 (2008).

Popkin, B. M. & Ng, S. W. The nutrition transition to a stage of high obesity and noncommunicable disease prevalence dominated by ultra‐processed foods is not inevitable. Obesity Rev. 23, e13366 (2022).

Baker, P. et al. First‐food systems transformations and the ultra‐processing of infant and young child diets: the determinants, dynamics and consequences of the global rise in commercial milk formula consumption. Maternal Child Nutr. 17, e13097 (2021).

Du, K. Econometric convergence test and club clustering using Stata. Stata J. 17, 882–900 (2017).

Busetti, F., Fabiani, S. & Harvey, A. Convergence of prices and rates of inflation. Oxford Bull. Econ. Stat. 68, 863–877 (2006).

Kearney, J. Food consumption trends and drivers. Philos. Trans. R. Soc. B 365, 2793–2807 (2010).

Djekic, I. et al. Cultural dimensions associated with food choice: a survey based multi-country study. Int. J. Gastron. Food Sci. 26, 100414 (2021).

Wang, J., Yuan, W. & Rogers, C. L. Economic development program spending in the US: is there club convergence? Appl. Econ. 55, 5097–5114 (2023).

McFadden, D. in Frontiers in Econometrics (ed. Zarembka, P.) 105–139 (Academic Press, 1973).

Morales-Lage, R., Bengochea-Morancho, A., Camarero, M. & Martínez-Zarzoso, I. Club convergence of sectoral CO2 emissions in the European Union. Energy Policy 135, 111019 (2019).

World Bank Country and Lending Groups (World Bank, 2024); https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups

Acknowledgements

This study was supported by the project founded by the US Department of Agriculture, Foreign Agricultural Service (USDA-FX22TA-10960R022, W. Li).

Author information

Authors and Affiliations

Contributions

W. Li conceptualized and supervised the project. W. Liang analysed the data. W. Liang and P.S. collected the data and drafted the paper. Y.H. created the figures. All authors contributed to revising and editing the manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Food thanks Nektarios Michail and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary Tables 1–15.

Source data

Source Data Fig. 1

Statistical source data for the pie and bar plots.

Source Data Fig. 2

Statistical source data for the line plots.

Source Data Fig. 3

Statistical source data for the maps.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Liang, W., Sivashankar, P., Hua, Y. et al. Global food expenditure patterns diverge between low-income and high-income countries. Nat Food 5, 592–602 (2024). https://doi.org/10.1038/s43016-024-01012-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s43016-024-01012-y

- Springer Nature Limited