Abstract

The escalating threat of natural disasters to public safety worldwide underlines the crucial role of effective environmental risk management tools, such as insurance. This is particularly evident in the case of earthquakes that occurred in Oklahoma between 2011 and 2020, which were linked to wastewater injection, underscoring the need for earthquake insurance. In this regard, from a survey of 812 respondents in Oklahoma, USA, we used supervised machine learning techniques (i.e., logit, ridge, least absolute shrinkage and selection operator (LASSO), decision tree, and random forest classifiers) to identify the factors that influence earthquake insurance uptake and to predict individuals who would acquire earthquake insurance. Our findings reveal that influential factors that affect earthquake insurance uptake include demographic factors such as older age, male gender, race, and ethnicity. These were found to significantly influence the decision to purchase earthquake insurance. Additionally, individuals residing in rental properties were less likely to purchase earthquake insurance, while longer residency in Oklahoma had a positive influence. Past experience of earthquakes was also found to positively influence the decision to purchase earthquake insurance. Both decision trees and random forests demonstrated good predictive capabilities for identifying earthquake insurance uptake. Notably, random forests exhibited higher precision and robustness, emerging as an encouraging choice for earthquake insurance modeling and other classification problems. Empirically, we highlight the importance of insurance as an environmental risk management tool and emphasize the need for awareness and education on earthquake insurance as well as the use of supervised machine learning algorithms for classification problems.

Similar content being viewed by others

Introduction

The current surge in the occurrence, intensity, and severity of natural disasters (e.g., hurricanes/cyclones, earthquakes, floods, and others) around the world has called for the need for various insurance packages as a risk management tool to guarantee the safety of nations and their citizenry1,2,3. However, the extent to which people see and understand the consequences of natural disasters as well as the degree to which the disaster threatens their safety are rarely considered in earthquake insurance design. Survey research has suggested that the ability to comprehend the consequences of natural hazards in any location is linked to several demographic variables of respondents (including age, gender, and race) as well as a variety of local contextual factors (e.g., length of residence in the state, risk perception, government aid, and others)4,5,6.

We conjecture that these factors have played a significant role in numerous global contexts where earthquakes or other natural disasters have occurred. According to Pynn and Ljung 7, the primary motivation for purchasing disaster insurance among North Dakotans is their perception of risk. Furthermore, Botzen and Bergh8 conducted a contingent valuation survey in the Netherlands to elicit individual risk beliefs and flood insurance, and found that individuals are willing to pay for disaster insurance based on their perception of flood risk. In the Oklahoma context in particular, Li et al.9 found that perception on the efficacy of protective action (e.g., expected outcome of insurance) has a significant role in risk mitigation action for tornados and earthquakes.

A study by Seifert et al.10 that compared flood insurance in Germany and the Netherlands found that people are inclined to insure for natural disasters such as floods based on their risk experience, risk perception, and the charity hazard. Niyibizi et al.11 found that, on average, Oklahomans prefer lower earthquake risks and support regulations on activities linked to human-induced earthquakes in their state to reduce seismic activity. In addition, Abbas et al.12 found that in Pakistan, factors such as age, non-agricultural income, and preconceptions about the effectiveness of insurance can influence an individual’s willingness to pay for flood insurance, while Oral et al.13 discovered that in Turkey, earthquake preparedness is influenced not only by an individual's experience with earthquakes but also by cultural factors. Moreover, Greer et al.14 and Choi et al.15 argue that in the U.S., political ideology could significantly affect decision-makers’ perceptions of hazards, but its effects vary by the type of hazard.

Taking the foregoing expositions together, insurance uptake is important because natural disasters can cause significant economic, environmental, and financial losses, impacting not only individuals but also entire communities, regions, and countries. The costs associated with natural disasters can vary greatly depending on their scale and severity, but they can include a wide range of expenses such as damage to infrastructure, homes, and businesses; environmental degradation; loss of income; loss of life and reduced economic growth16,17. An example is Hurricane Katrina, one of the most catastrophic hurricanes in recorded history, which caused damages exceeding US$100 billion2,18, of which only $62 billion worth of the damaged property was insured19.

Another example is the devastating earthquake that struck Sichuan Province in China on May 12, 2008, causing over 88,670 deaths, over 374,000 injuries, and the destruction of an estimated 5.5 million structures20. Wang et al.21 observed that in response to the repeated earthquakes, the Chinese government launched the Catastrophe Insurance Pilot Program in Chuxiong in 2014. This program aimed to transfer the individual risk of injury and property loss to the insurance market, thus reducing the burden on the government and cutting down on expenditures20. Indirect costs, such as disruptions to supply chains and transportation networks, lost productivity, and increased insurance premiums, can also be significant. In some cases, the economic costs of natural disasters and earthquakes can be so substantial that they can destabilize national economies, particularly in developing countries with limited resources and infrastructure to cope with such events22. Consequently, it is crucial to develop strategies and policies for managing and mitigating the immediate and long-term effects of natural disasters and earthquakes.

Moreover, despite the potentially enormous cost of the hazards, each individual has a different attitude toward risk preparedness action and hazard control policy depending on their perspective on hazards. For instance, Choi and Wehde23 and Murphy et al.24 explain that individuals’ perception on hazard and corresponding policy significantly affect not only their risk preparedness action but also their level of compliance toward hazard control policy. Moreover, Wehde and Choi25 argue that individual’s perception and trust in hazard control policy may vary depending on the type of hazard. Therefore, without accounting for potential behavioral factors on risk preparedness decision for a given disaster (e.g., purchasing insurance for earthquake), it would be difficult to design an effective policy. Against the foregoing, this study has two objectives. The first is to analyze the factors that influence the decision to purchase earthquake damage insurance. The second objective is to predict which individuals are more likely to obtain earthquake insurance in Oklahoma, given the state's increased vulnerability to earthquakes from 2010 to 202026,27. To realize these twin objectives, we use a variety of supervised machine learning techniques, encompassing logistic regression, ridge regression, and LASSO, to identify the influential factors of earthquake insurance uptake. In addition, decision trees and random forest algorithms are utilized for predictive modeling. The primary goal of the research is to provide insights on how to design policies aimed at encouraging more individuals and businesses to obtain earthquake damage insurance, and minimizing the risk of severe damage and financial loss in the event of an earthquake. The results of this study will provide policymakers with insights on how to design and evaluate feasible methods of implementing earthquake insurance as a compensation mechanism. The findings may also help insurance companies develop more effective marketing strategies to encourage more individuals and businesses to purchase earthquake insurance. Individuals and businesses can also use the study's findings to inform their decision-making process regarding earthquake insurance purchase, potentially resulting in lower financial losses in the event of an earthquake. According to Franco28, insurance can be a powerful ‘ex-ante’ strategy in an earthquake mitigation framework when combined with other approaches, because it can help achieve other important goals such as safe building construction and land development regulations.

The state of Oklahoma is a compelling case study for this research due to the significant increase in earthquakes associated with fracking between 2010 and 202011,26,27,29,30,31. While the state experienced less than two M3.0 earthquakes per year on average from 1978 to 2008, the Oklahoma Geological Survey32 reported a sharp increase in earthquakes from 41 to 903 between 2010 and 2015, all which exceed M3.0 on the Richter scale. Although scientific research has provided strong evidence linking fracking to an increase in the number of earthquakes in Oklahoma, the state's risk management and protective action options against induced earthquakes have raised concerns among all individuals and businesses. The legal system's insufficient compensation for earthquake victims, as reported by Konschnick33 and Ng'ombe and Boyer34, adds to the uncertainty. Furthermore, even though most earthquakes recorded in Oklahoma between 2011 and 2016 were relatively small, some caused significant damage to homes and businesses33. For instance, the 5.7 magnitude earthquake that occurred in Prague, Oklahoma in 2011 caused injury to two people and destroyed 14 homes and is believed to be linked to wastewater injection34,35. These events underscore the importance of studying the determinants of earthquake damage insurance uptake in Oklahoma to mitigate the financial and physical damages caused by future earthquakes.

The paper makes the following contributions to existing literature. First, by identifying the factors that influence earthquake insurance uptake, this study provides empirical evidence that helps explain the decision-making process of individuals and businesses regarding earthquake insurance uptake. In doing so, the supervised machine learning algorithms used, which include logit, ridge regression, and least absolute shrinkage selection operator (LASSO), are useful in that such models, ridge regression and LASSO in particular, can identify influential factors through variable selection. When applied in this context, ridge regression and LASSO help in selecting a subset of covariates (predictor variables) that have the most influence on earthquake insurance uptake. The LASSO can act as a feature selection method, keeping only the most relevant factors influencing the decision to acquire earthquake insurance while shrinking the coefficients of less importance to zero36,37. Our study's findings also shed light on why some individuals and businesses are hesitant to purchase earthquake insurance, despite the increased risk of earthquakes in some regions. This is important because potential earthquake risks in Oklahoma are expected to remain for some time38, and this may not be particular to Oklahoma, but many other world regions are susceptible to earthquakes.

Second, we contribute to the earthquake prediction policy problem by identifying attributes that predict individuals who can purchase earthquake insurance based on covariates, by using robust supervised machine learning models that include decision trees and random forests. Earthquake insurance uptake may involve non-linear relationships and complex interactions among factors. Machine learning algorithms like decision trees and random forests are particularly adept at capturing such complexities, which can be critical for understanding the nuanced influences on insurance uptake39,40. When compared to traditional econometric approaches, machine learning models are more suitable for prediction problems because they can improve the accuracy and efficiency of uncovering the determinants of earthquake insurance uptake36,37. Using decision tree and random forest algorithms for prediction allows us to uncover potential complex relationships between the features and the target variable in addition to important variables that predict earthquake insurance uptake.

Methods and materials

Data sources

Our data was collected from a 2017 earthquake survey that was conducted online in Oklahoma using Qualtrics. The data is part of the research by Ng’ombe and Boyer34 which established how much of the earthquake damage the oil and gas industry should be liable for, in terms of what earthquake victims endure. This study focuses on the factors associated with the decision by Oklahoma residents to purchase home/property insurance against earthquakes in the state. The data were collected from the U.S. state of Oklahoma and its counties that experienced a rise in earthquakes linked to fracking. To administer the survey, it was first approved by the Oklahoma State Institutional Review Board (IRB), and then conducted through Survey Sampling International (SSI), a reputable organization that employs numerous methods to recruit respondents. The survey was conducted with 1,153 individuals through SSI, of which 813 of them successfully completed the survey. According to Ng’ombe and Boyer34, SSI has panels of potential respondents that respond to online surveys for a given fee. A series of questions on people’s attitudes toward earthquakes in the state and their demographic, and socio-economic characteristics were asked in the survey. The variables used in this study are described in Table 1. Columns 1 and 2 respectively include variable names and their definitions. The response variable is earthquake insurance. It represents people who responded Yes or No to a question that asked them whether they insured their residence or property against earthquake-related damage.

Independent variables are classified into two sets. The first set of independent variables comprises socio-demographics such as age, gender, and race of the survey respondents. The second set comprises a range of variables relating to respondents’ attitudes toward earthquakes in Oklahoma. Table 2 shows descriptive statistics for these variables based on to the entire sample, with and without earthquake insurance. The t-test statistics for the mean differences of the variables between the two groups of respondents are presented in the last column of Table 2. The total sample size is 812 with 14.4% (114 respondents) reporting that their property/residence was insured against earthquake damage. In terms of the mean differences of variables by insurance uptake status, we can see that the sample was not purely homogenous in their responses as most of the variable means were statistically different from zero between the two groups. For example, the mean age difference between people with and without insurance was 1.01 years, which is statistically different from zero – those with insurance were older. A similar observation can be made for the numerous variables considered.

Independent variables

The variables included in all our models are shown in Table 1. They are based on a review of literature on people’s attitudes toward earthquakes [e.g., 11, 25, 34, 36, 42–52]. We included socio-demographic variables because they are expected to influence people’s decision to have earthquake insurance as well as to help predict which individuals would acquire earthquake insurance. in accordance with existing literature, we anticipate that female respondents are more likely than males to own earthquake insurance because females are warier of environmental threats and calamities11,41. Regarding demographic factors such as race, ethnicity, education, and income, we anticipate a heterogeneous relationship with the likelihood of having earthquake insurance. For example, Ansolabehere and Konisky42 found that minority groups are more skeptical and concerned about coal and natural gas plants located near their homes, which we believe would motivate them to purchase earthquake damage insurance. In a separate study, Boudet et al.43 observed that politically conformist respondents had at least an undergraduate degree, and older respondents were more likely to support hydraulic fracturing in the United States. Also, Ng’ombe and Boyer34 found varying levels of earthquake-related liability levels that respondents would assign to fracking firms in Oklahoma for any damage, which suggests that similar varying outcomes could be expected regarding their decision to purchase earthquake insurance.

Moreover, we expect respondents who have lived in Oklahoma for a longer period to more likely own earthquake insurance because they would have more previous experience with earthquakes, especially since 2009, when the state started to experience numerous earthquakes10. As in Ng’ombe and Boyer34, we anticipate that renters will be less likely to have earthquake damage insurance than property owners. By political affiliation, we anticipate that Democrats (Republicans) are more (less) likely to have earthquake insurance because they have shown greater (lesser) willingness to accept fracking related benefits for regulation11. Boudet et al.43 and Davis and Fisk44 observed that Democrats are more committed to controlling wastewater injection in order to prevent potential earthquakes than Republicans.

Following Ng’ombe and Boyer34, we included the extent of earthquake damage respondents’ residence or property incurred in the past when assessing respondents’ attitudes toward earthquakes in Oklahoma. These include minor damage, moderate damage, major damage, and other damage as defined in Table 1. There have been many lawsuits in Oklahoma by residents whose property incurred damage from earthquakes, but success stories related to compensation are few45,46. However, we expect that people whose property or house incurred any earthquake-related damage will prefer to have their property insured against earthquakes, especially since most insurers have stated that they would be able to insure against both natural and man-made earthquakes in Oklahoma47.

Other earthquake-related factors that we expect to influence the decision to have earthquake insurance include people’s concerns about earthquake damage, the state’s obligation to regulate wastewater injection, earthquake experience, beliefs, and knowledge of the importance of oil and gas companies to Oklahoma. For example, we hypothesize that those who want wastewater injection to be abruptly stopped or who prefer to have earthquake insurance are warier of the risks of earthquakes to their property and therefore more likely to purchase earthquake insurance.

Supervised machine learning algorithms

To achieve its objectives, this study uses the following supervised machine learning (ML) algorithms: logit model, ridge regression, LASSO, decision trees, and random forest. We chose supervised ML over alternative methods because it served our research as a classification problem. With supervised ML, the algorithm is trained to learn the mapping between the input data (predictor variables) and the output data (dependent variable), so that it can select the influential variables of the output data and depending on the model used, also make predictions on new, previously unseen data.

Supervised machine learning is the method of choice for applications like ours, where a specific target variable must be both explained by influential input factors and predicted. In our case, we employ supervised ML to unravel the variables that shape individuals' decisions regarding earthquake insurance acquisition while also predicting which respondents are likely to make a purchase. To clarify, supervised ML effectively categorizes variables into two crucial categories: output (e.g., the decision to purchase insurance or not) and input (e.g., respondent characteristics like risk perception). This categorization assumes a significant correlation and, potentially, a causal relationship between the labeled input and output variables, offering a robust framework for our analytical endeavors40. On the other hand, in unsupervised ML, the algorithm is given a dataset with no pre-existing labels or outputs (i.e., no correlation/causation assumptions between variables). The algorithm then attempts to find patterns or structure in the data on its own, without any guidance or supervision. Unsupervised learning is used in applications where the researcher is interested in discovering hidden patterns or groupings in the data, such as clustering similar customers together for targeted marketing39,48.

Logit, ridge regression, and LASSO

Let the dependent variable \({y}_{i}\) follow a Bernoulli distribution. In this context, \({y}_{i}\) represents whether an individual has their residence or property insured against damage from earthquakes. The probability of detecting whether an individual has their residence or property insured against damage from earthquakes and \(P({y}_{i}=1)\) denotes the probability of detecting insurance coverage based on the available predictors in the data. This way, we have a binary classification model that explains the probability of classes \({y}_{i}=1\) or \({y}_{i}=0\) using the predictors described in Sect. 'Methods and materials'. Following James et al.40, the logit classifier is

where observations in the database are represented by i, whereby i = 1, …, N, and \(\beta\) corresponds to unknown parameters to be estimated, \({x}_{i}\) is a vector of explanatory variables. Maximum likelihood estimation of the following log-likelihood function allows us to estimate the parameter estimates

In high-dimensional settings, where the number of predictors is large, collinearity between the predictors can lead to unstable estimates and unreliable predictions. In such cases, penalized regression models are commonly employed to improve the accuracy and interpretability of the model. Penalized regression techniques, such as ridge regression and LASSO, add a constraint to the equation to regularize the model39, resulting in reduced coefficients. This, in turn, shrinks the coefficients of less influential variables towards zero, improving the general performance of the model40. In this study, we applied the ridge classifier and LASSO, which impose a penalty on the logit model to avoid overfitting and identify influential variables in the decision to acquire earthquake insurance.

The ridge classifier adds a fine-tuning parameter \(\lambda \ge 0\) to Eq. (2). Estimation of the coefficients using the ridge classifier is achieved by maximizing the following modified version of Eq. (2)

where k is the total number of penalized coefficients. However, the ridge classifier includes all the coefficients in the final model by adding a squared magnitude of the coefficient \(\beta\) as a penalty term. Therefore, if \(\lambda \to \infty\), there would be overfitting37,48. Increasing \(\lambda\) reduces the variance but raises the bias resulting in the model being less accurate and more precise. We therefore used cross-validation when selecting the optimal value of \(\lambda\) to minimize the validation error.

The LASSO offers an alternative regularization procedure in which a number of inputs is potentially eliminated from the model, thereby bypassing limitations of a ridge classifier. Introduced by Hastie et al.48, the LASSO’s log-likelihood to be maximized is

The LASSO algorithm adds a penalized term to the traditional logit model which sets the coefficients of less influential variables to zero. It therefore selects only those inputs that are most relevant among the potentially many variables in the databases. Cross-validation was also used to select the \(\lambda .\)

Decision trees

Decision trees are a powerful and widely used tool for solving classification problems in machine learning. A decision tree is a tree-like model that uses a set of input features to make predictions about the target variable39,49. The use of a decision tree in this study is appealing because it provides sufficient visual information to predict which individuals are likely to insure against earthquake damage or not. The decision tree model consists of nodes and branches, where each node represents a feature, and each branch represents a possible outcome for that feature. The tree is constructed by recursively splitting the data into subsets based on the values of the input features until the subsets become homogeneous with respect to the target variable48.

Regarding training the model, the process involves searching for the best features to split the data and creating a hierarchy of nodes and branches that best separates the data into different classes. In our case, this produces a tree structure that can be used to predict earthquake damage insurance uptake for the new and previously unseen data. One of the most important benefits of decision trees is their interpretability. Unlike other machine learning algorithms that can be difficult to interpret, such as random forest (next section), decision trees are simple to understand and can provide valuable insights into the decision-making process. Decision trees can also handle non-linear relationships between the input features and the target variable, making them a valuable tool in many real-world applications39. While decision trees maybe easier to interpret, they can suffer from overfitting, where the model becomes too complex and captures noise in the data. To address this issue, several techniques have been developed, including pruning and ensemble methods like random forests40.

Random forests

Another ML technique we use to achieve our second objective is a random forest classifier. A random forest classifier has a wide range of applications, including image classification, natural language processing, and fraud detection50. First introduced by Breiman51, random forest classifiers are an ensemble learning method that combines the outputs of multiple decision trees to make a final prediction. During the training phase, the algorithm constructs several decision trees on different subsets of the training data. At each split in a decision tree, a random subset of the input features is selected as candidates for the split. This process helps to reduce overfitting and improve the generalization ability of the model. The final prediction is made by aggregating the predictions of all individual decision trees40. The use of random forests has become increasingly popular due to their ability to handle high-dimensional data and capture complex nonlinear relationships in the data, making them an effective tool for many real-world applications.

Random forests have several advantages over other classification algorithms. According to Kassambara39 and James et al.40, random forests are robust to overfitting, can handle large datasets with high dimensionality, can capture complex nonlinear relationships between input features and output labels, and are relatively easy to use and require minimal parameter tuning. In the present study, let x be a vector of inputs described in Table 1. The inputs in Table 1 will help us to predict y, that reveals whether an individual has his/her property insured against earthquake damage. By so doing, the training procedure for random forests applies bootstrap aggregation or bagging to tree learners (see James et al.40 and Breiman51 for more details). Thus, for a training set \(x={x}_{1}, \dots ,{x}_{n}\) with responses \(y={y}_{1}, \dots ,{y}_{n}\), bootstrap aggregation continually selects a random sample (K times) with replacement of the training data sets to fit trees to the following samples.

For b = 1, …, B:

-

Sample \(n\) training samples with replacement from \(x, y\), and let these be called \({x}_{b},{y}_{b}.\)

-

Train a classification tree \({k}_{b}\) on \({x}_{b},{y}_{b}.\)

-

Upon completion of the training, make predictions for unseen samples \({x}{\prime}\) by taking the majority vote in the case of classification trees or by averaging the predictions made from all the individual regression trees on \({x}{\prime}\) in the case of non-classification trees as follows

$$\hat{k} = \frac{1}{B}\mathop \sum \limits_{b = 1}^{B} k_{b} (x{\prime} ),$$(5)

Such a bootstrapping algorithm is considered to improve model performance because it decreases model variance without increasing the bias. Therefore, an estimate of the uncertainty of prediction is the standard deviation of the prediction from all individual regression trees x’40.

The optimal number of trees, B, can be determined through two methods: cross-validation or the out-of-bag error (OOBE), as described in James et al.40. The OOBE measures the average prediction error for each training sample \({x}_{i}\) using the trees that did not include \({x}_{i}\)37. In general, the testing and training errors tend to level off after a certain number of trees have been fitted. As noted by Silveira et al. 37, this is the basic bagging technique for trees. However, random forests differ from this pattern in one keyway: they use a modified learning algorithm that selects a random subset of features at each candidate split during the learning process. Silveira et al.37 contend that the selection of highly predictive features can lead to correlated results in the B trees, which can affect the accuracy of the model for earthquake damage insurance. However, using a subset of features in each split, typically the square root of the total number of features, can help to prevent correlation and improve accuracy40,49.

Performance measures

The performance of logistic regression, ridge regression, and LASSO models was assessed by examining the magnitude and signs of the coefficients. Ridge regression and LASSO, being regularization techniques, tend to push coefficients towards zero. Consequently, variables retaining non-zero coefficients in LASSO or having relatively larger coefficients in ridge regression are considered more influential39. This evaluation provided insights into the extent to which these models effectively identify the most influential factors affecting earthquake insurance uptake.

As previously mentioned, in the case of decision trees and random forests, individuals were classified as having a high likelihood of having earthquake damage insurance if their predicted probability exceeded 0.5. Therefore, to evaluate the performance of the decision tree and random forest models for predictive modeling, various performance measures were employed, including accuracy, sensitivity, specificity, and precision which are computed as:

where TN are true negatives, FN are false negatives, TP are true positives, and FP are false positives. True negatives refer to when the model identifies a data point as part of the negative class, and this identification is correct (e.g., the model identifies an individual A as non-buyer of insurance through learning, and it does match with an actual decision of A in the data). In the same context, FN, TP, and FP happen by false negative (e.g., identify A as a non-buyer but does not match with actual decision), true positive (e.g., identify A as a buyer and does match with actual decision), and false positive (e.g., identify A as a buyer but does not match with actual decision), respectively. These metrics collectively provided insights into the decision trees and random forest models' effectiveness in correctly identifying those likely to purchase earthquake insurance.

Moreover, each performance measure falls within the range of 0 to 1, with higher values indicating better model performance for each metric. For instance, if FN and FP are unlikely to happen (i.e., the model accurately identifies individuals’ positive/negative decisions through learning), the denominator of Accuracy measure will be closer to the numerator. Therefore, the measure will be closer to 1. Accuracy depicts a fraction of cases correctly classified out of the total cases. Precision, also known as positive predicted value, measures the proportion of correctly predicted positive cases out of the total number of positive cases in the dataset39. Sensitivity – or recall or the true positive rate, calculates the proportion of positive cases that are correctly classified out of the total number of real positive cases in the dataset40. Finally, Specificity measures the proportion of negative cases that are correctly identified out of the total number of negative cases in the dataset. These performance measures are typically derived from a confusion matrix, which is a 2 × 2 table that summarizes the results of a machine learning algorithm by classifying observations as TP, TN, FP, and FN.

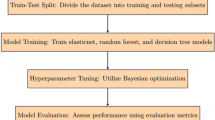

Estimation strategies

In this study, we utilized a range of R software packages including glmnet, caret, rpart, and rattle to estimate all our models52,53,54,55,56. To obtain reliable estimates, we divided our data into separate training and testing sets40. The training set comprised 70% of the total observations and was used to estimate model parameters, while the remaining 30% were used for out-of-sample estimation and prediction in the testing set. We used the glmnet package to implement ridge and LASSO classifiers and determine the optimal λ values that minimized cross-validation prediction error. Specifically, we performed cross-validation to identify the optimal values of \(\lambda\) that gave the best models and found that \(\lambda\) = 0.0066 and \(\lambda\) = 0.0003 were optimal for ridge regression and LASSO, respectively40. We generated plots of the cross-validation error as a function of log (\(\lambda\)) for the ridge and LASSO classifiers (Fig. 1 and 2, respectively). Note that increasing the value of \(\lambda\) for the ridge regression (LASSO) tends to shrink coefficients of factors that affect earthquake insurance toward zero (or exactly zero).

As for predictive models, particularly the decision tree classifier, due to the large number of variables used to predict individuals who insure their property against earthquake, the decision tree generated was too large, necessitating pruning. Pruning involves simplifying the model by removing branches or nodes that do not contribute to its predictive power and prevents overfitting. We pruned the decision tree using recursive partitioning and selected the complexity parameter using tenfold cross-validation55. As mentioned before, to further improve on the performance of the decision tree model, we also employed random forests. Random forests can reduce the model's variance and improve its accuracy40.

Results

Factors affecting earthquake insurance uptake

Table 3 presents results from logit, ridge regression, and LASSO. We find that the LASSO model did not eliminate any coefficients, probably due to the small value of the shrinkage parameter chosen by cross-validation. Therefore, we present the results of all three classifiers collectively in Table 3. Moreover, regularization approaches such as ridge and LASSO tend to shrink the coefficients towards zero, which can lead to biased estimates of the standard errors. Consequently, the glmnet package used to estimate these models does not provide standard errors for the coefficients39,52. While the absence of standard errors limits the interpretability of the coefficients, we note that the magnitudes and signs of the coefficients are consistent across the three models. This also confirms that the results in Table 3 are robust. Given this consistency and the significance of the coefficients in the logit model, we focus our analysis on the significant coefficients of the results identified by this model.

The findings in Table 3 reveal that several socio-demographic factors have a significant impact on earthquake insurance uptake. These factors include age, gender, ethnicity, race, and political affiliation. Interestingly, Democrats were found to be less likely to have earthquake insurance compared to Independents. Moreover, the length of time a person has lived in Oklahoma was also found to influence their likelihood to insure against earthquakes. Other factors that were found to affect the likelihood of earthquake insurance uptake include the type of housing (renting vs. owning), level of education, and annual income.

In addition to these factors, respondents' attitudes toward earthquakes were also found to be significant factors that influence earthquake insurance uptake. Specifically, individuals who had experienced moderate earthquake damage or expressed concerns about earthquake safety, as well as those who believed that the state should regulate environmental quality, were more likely to insure against earthquakes. Finally, working in the oil and gas industry, receiving oil and gas revenue leases, and having multiple oil and gas companies on their property were also found to significantly influence the decision to acquire earthquake insurance.

Predictive modeling results of earthquake insurance uptake

Before we present prediction results of which individuals were likely to acquire earthquake, we first report performance measures of the two tree-based ML algorithms. The performance measures indicate that a decision tree model had an accuracy rate of 89.55%, while the random forest classifier achieved a perfect classification rate of 100%. These findings imply that a decision tree was able to correctly predict about 90% of the time those that would insure against earthquakes as well as those that did not insure against earthquakes while the random forest did so by 100%. When it comes to precision, we found that a decision tree classifier achieved a precision score of 83.58% implying that out of the total of those that have earthquake insurance, the decision tree classifier was able to correctly predict 83.58% of them to have earthquake insurance. Interestingly, the random forest classifier correctly predicted all positive cases, achieving a perfect precision score of 100%.

In terms of sensitivity, the decision tree and random forest classifiers achieved sensitivity scores of 28.33% and 100%, respectively. In terms of specificity, which represents the proportion of observations without earthquake insurance that are correctly identified out of the total number of uninsured observations, the decision tree classifier exhibited a specificity score of 99%, while the random forest classifier achieved a perfect score of 100%. Overall, our findings suggest that a random forest classifier performed better than a decision tree on these predictions, a result that parallels Geetha et al. 57. This could be because random forests create an ensemble of decision trees and average their predictions which helps reduce variance and cancel out individual decision tree errors40.

With regard to predicting which individuals are likely to acquire earthquake insurance, a decision tree was generated and depicted in Fig. 3. This decision tree consists of a root node, nine levels, 20 leaf nodes, and 38 decision nodes. The importance of the predictors in the decision tree is based on the information gained from each variable58. In our decision tree, the internal/decision nodes represent the variables that contribute the most to predicting which individuals would take earthquake insurance. On the other hand, the leaf nodes represent the outcome variable, which indicates whether a respondent takes earthquake insurance or not. Notably, our decision tree shows that whether a resident rents their property or not is the most important predictor of earthquake insurance uptake, as shown in the primary branch of the tree.

Our decision tree results unveil intricate patterns that shed light on which individuals based on the covariates would acquire earthquake insurance. For individuals who rent their property and have fewer than four oil and gas companies operating on their premises, the estimated probability of insuring their property against earthquakes is a mere 7%. This result may be due to renters possibly assuming that the property owner's insurance covers earthquake damage, leading to a lower likelihood of seeking additional coverage. However, a stark contrast emerges when individuals contend with at least four oil and gas companies on their property, where the likelihood of insuring their property against earthquakes surges to a staggering 100%. One plausible explanation could be that the presence of numerous companies reflects higher risk perception, motivating individuals to secure earthquake insurance. This aligns with the idea that proximity to oil and gas activities may raise concerns about induced seismicity and, consequently, the need for coverage11.

Conversely, a different narrative emerges for individuals who do not rent a property, are not of Asian ethnicity, have lived in Oklahoma for less than 9.5 years, and receive gas leases from oil and gas companies, yet do not believe that wastewater injection should be stopped abruptly. In this scenario, such individual’s predicted probability of insuring their property against earthquakes plummets to 0%. The absence of insurance interest within this group might relate to a perception of low earthquake risk, potentially influenced by their shorter duration of residence and trust in wastewater injection practices. Conversely, a distinct subgroup of individuals, characterized by non-renters who are not of Asian ethnicity, have lived in Oklahoma for less than 9.5 years, receive gas leases from oil and gas companies, advocate for the cessation of wastewater injection, do not have an annual income between $75,000 and $99,999, and are older than 19 years, emerge as the most likely to secure earthquake insurance, with an elevated 88% probability. The high likelihood among this subgroup could be attributed to their greater awareness of earthquake risks due to their opposition to wastewater injection and possibly lower income levels, which could make them more risk-averse. Intriguingly, this subgroup constitutes merely 1% of the observations within the training dataset. We find many results from the decision tree and to conserve space, the remaining pathways and individuals’ associated predicted probabilities of earthquake insurance uptake are outlined in Table 4.

In Fig. 4, the order of importance of variables in forecasting which individuals are inclined to obtain earthquake insurance, in accordance with the random forest classifier, is presented. In Fig. 4, we present the order of importance of variables in predicting earthquake insurance uptake. Our analysis reveals that the length of an individual's residence in Oklahoma is the single most influential predictor of who has earthquake insurance. Following this, property rental status emerges as the next vital factor. Moreover, individual age and the presence of oil and gas companies operating on one's property also exhibit significant contributions to the likelihood of securing earthquake insurance. In summary, the duration of residency in Oklahoma, property rental status, age, and the extent of oil and gas company activities on their property are all prominent, contributing by at least 50% towards the prediction of earthquake insurance acquisition. Additionally, numerous other variables play a substantial role in forecasting who is likely to obtain earthquake insurance. Conversely, the variable related to respondents identifying as Black or African American is found to make the smallest contribution to the prediction of earthquake insurance uptake, indicating its limited relevance in this context.

Discussion

The recent surge in natural disasters worldwide, including the increasing occurrence, intensity, and severity of earthquakes, highlights the need for effective risk management tools, such as insurance packages, to ensure the safety of nations and their citizens1,3. The widespread impact of these catastrophic events, affecting many people simultaneously47, emphasizes the importance of understanding people's preparedness for earthquakes and their decisions to opt for earthquake damage insurance. Our study employs a multifaceted approach, integrating logit, ridge regression, and Least Absolute Shrinkage and Selection Operator (LASSO) classifiers to identify influential factors of earthquake insurance uptake. Additionally, we took advantage of the predictive power of decision tree and random forest classifiers to identify individuals likely to invest in earthquake insurance based on relevant covariates. Our analyses yield valuable insights for policymakers, facilitating the development of more robust insurance strategies aimed at safeguarding individuals and communities from the profound repercussions of seismic events.

The logit, ridge regression, and LASSO demonstrated their ability to provide consistent results on the influential factors that affect earthquake insurance uptake. This was evidenced by the LASSO not shrinking away any factor coefficients with coefficient signs and magnitudes being close to those from the logit and ridge classifiers. On the other hand, decision trees and random forest classifiers generated robust findings by accurately predicting which individuals are likely to acquire earthquake insurance based on the relationships within the data59. The random forest classifier had a 100% score across accuracy, precision, sensitivity, and specificity with the decision tree coming close with regard to accuracy and specificity.

Our findings on influential factors of earthquake insurance uptake suggest that age is a significant factor in earthquake insurance uptake, with younger residents being less likely to insure against earthquake damage initially but becoming increasingly more likely to do so as they age. This trend may be due to older individuals becoming more aware of the need for insurance as they experience changes in lifestyle and gain a greater understanding of the potential danger posed by earthquakes. The influence of lifestyle on insurance adoption is an important consideration, as it can affect the perceived value of insurance among individuals. For instance, Sidi et al.60 have noted that the demand and supply of insurance services related to flooding are affected by various factors, including age, economic circumstances, family status, and lifestyle. Similarly, the findings about the Hurricane Katrina disaster suggest that age is an important factor in the decision to purchase flood insurance, with older residents being more likely to insure their properties against floods compared to younger residents61. Thus, policymakers should consider these age-related factors when developing strategies to promote earthquake insurance uptake, particularly targeting younger residents who may be less likely to prioritize insurance.

Surprisingly, the results of our study indicate that male respondents are more likely to have earthquake insurance than female respondents. We had initially hypothesized that women would be more cautious of environmental risks and therefore more likely to have earthquake insurance11,41. However, it is possible that insurance policies are often registered in the name of the male household head, which could explain this finding. In terms of ethnicity and race, our results align with our expectations: respondents of Hispanic origin are more likely to have earthquake insurance, while Asian respondents and those of two or more races are also more likely to insure against earthquakes than White respondents. This finding is consistent with Ansolabehere and Konisky42, who found that minority groups are more skeptical and concerned about such environmental disasters. It is possible that earthquakes linked to wastewater injection motivate them to have earthquake damage insurance in case of an unexpected seismicity.

Our results indicate that Democrats are less likely to own earthquake insurance than Independents, contrary to what was expected. This finding is surprising given that previous studies have shown that Democrats generally support wastewater injection regulation, which has been linked to increased seismic activity in Oklahoma11. Wines62 noted that Democratic state lawmaker, Cory Williams, advocated for more robust action on the quakes and criticized the state's response to the surge in earthquakes. Furthermore, the study found that respondents who have lived in Oklahoma for a longer period are more likely to have earthquake damage insurance. This result is reasonable because those who have lived in Oklahoma longer would have experienced more earthquakes, making them more likely to have their property and residence insured.

Our study also found that renters are less likely than homeowners to have earthquake damage insurance. This is expected since renters may be less interested in seeking earthquake insurance as they can easily move away. In terms of respondents' education levels, those with higher education levels (e.g., associate, undergraduate, or graduate degrees) are more likely to have earthquake damage insurance than those with lower education levels. This could be because people with higher education levels are more aware of the benefits of insurance and the risks associated with earthquake damage.

Respondents with higher incomes (at least $25,000 annual gross income) are more likely to have earthquake insurance than those with lower incomes. This finding is consistent with Browne et al.'s61 observation of a strong association between wealth and insurance demand, as well as a preference for insuring against high likelihood, low level consequence risks. People with relatively higher incomes may have more assets and property to protect, making them more likely to invest in earthquake insurance to recover from potential losses.

We found that respondents whose property or residence experienced moderate earthquake damage or other earthquake damage are more likely to have earthquake damage insurance compared to those whose property did not suffer any damage from earthquakes. This result is consistent with Choi et al.’s 63. findings on risk preparedness for tornadoes: individuals who have experienced the devastating effects of natural disasters would be more likely to seek protection through disaster insurance. A study conducted by Ivčević et al.64 in Italy found that locals were willing to invest in mitigating climate change-related threats, which supports the idea that individuals are willing to take measures to protect themselves from natural disasters. In a similar vein, Osberghaus65 and Hong66 suggested that individuals tend to take preventive measures against flood damage when they have experienced historical damage and anticipate future damage. Furthermore, respondents who were concerned about earthquakes are more likely to insure against earthquake damage than those who were not. This finding is consistent with the observations of Pothon et al.67 that individuals are more likely to insure their homes or property against earthquakes if they believe that a devastating earthquake is imminent and are concerned about potential damage. Overall, these findings suggest that personal experiences and attitudes towards natural disasters play a crucial role in the adoption of disaster insurance.

Moreover, we found that respondents who believe the state has a responsibility to regulate the quality of the environment and the actions of fracking companies are significantly more likely to have earthquake insurance. However, we found that financial assistance provided by the government after natural disasters may be perceived as premium-free and influence demand for natural disaster insurance, which is in line with the work of Browne and Hoyt68 on aid hazards. Browne and Hoyt68 found that individuals at risk may not purchase insurance due to their expectation of receiving aid from various sources.

Furthermore, we found that an increase in the number of oil and gas drilling companies at respondents' residences and respondents working in the oil and gas industry is positively associated with higher odds of having earthquake insurance. This finding suggests that individuals who have experience with oil and gas companies may have a greater awareness of the potential risks associated with fracking and may be motivated to mitigate the risk of earthquake damage by purchasing insurance. In contrast to flood insurance, where proximity to flood-prone areas may not affect an individual's decision to purchase insurance69, the presence of oil and gas companies on a property exposes it to induced earthquakes related to wastewater injection, potentially increasing the likelihood of individuals purchasing earthquake insurance.

Our findings on the effect of individuals’ location, experience, and risk perception on insurance uptake are consistent with previous studies. For example, Antwi-Boasiako's29 study in Ghana found that homeowners with internal locus control of location are more likely to insure against natural disasters. Similarly, Osberghaus65 observed in Germany that homeowners’ likelihood of insuring against flood damage increases with historical damage and the prospect of future damage. Yu et al.70 found that factors such as households' risk perception, education level, and profession significantly affect the intention to adapt to earthquake risks in rural China.

In addition, risk tolerance is a crucial factor that influences the uptake of disaster insurance among homeowners. Landry and Turner71 on the Georgia Coast found that risk tolerance, attitude towards community risk management initiatives, wealth exposure, and perceived damages all determine the adoption of disaster insurance. Athavale and Avila44 suggest that the demand for earthquake insurance increases with the level of risk, indicating that homeowners take earthquake insurance due to the potential risks associated with earthquakes.

With regards to predicting which individuals are more likely to acquire earthquake insurance, most results from the decision tree are consistent with factors identified by a random forest classifier that produced perfect predictions and ranked variables by their importance in influencing earthquake insurance uptake. Our decision tree results showed that individuals who rent property and have a limited number of oil and gas companies operating on their premises demonstrate a relatively low likelihood (7%) of insuring their property. However, this subgroup constitutes a significant portion of the dataset, accounting for 50% of the observations. In contrast, individuals with the same renting status but with a higher number of oil and gas companies on their property exhibit a much higher probability (100%) of obtaining earthquake insurance, despite comprising a smaller percentage of the dataset (0%). This implies that the presence of these companies significantly influences insurance decisions, a variable that the random forest classifier also indicated to be important in predicting who acquires earthquake insurance.

Moreover, individuals who do not stay on rented property, have resided in Oklahoma for less than 9.5 years, and do not receive gas leases from oil and gas companies have a 12% probability of insuring their property, with a considerable representation of 21% in the dataset. Age plays a crucial role within this subgroup. Those under 48 years old display a 7% probability, while those older than 52 years old are much less likely (0%) to insure their property. Interestingly, individuals between 48 and 52 years old in this group are highly inclined to obtain earthquake insurance (100%). Another significant factor that influences insurance decisions is the perception of wastewater injection practices. For individuals with characteristics similar to the aforementioned group but who do not believe wastewater injection should be abruptly halted and have an annual income between $75,000 and $99,999, the probability of insuring their property is 0%. In contrast, individuals with the same characteristics but who are older than 19 years old are much more likely (88%) to acquire earthquake insurance.

The findings continue to underscore the complexity of insurance decision-making. Variables such as education level and duration of Oklahoma residency also come into play. Notably, individuals who have lived in Oklahoma for over 9.5 years, hold an associate degree, and do not anticipate working for oil and gas companies have a 12% probability of insuring their property, while those with similar characteristics but with job expectations in the oil and gas industry have a 100% probability.

These findings are consistent with prior research in behavioral economics and insurance decision-making. Studies such as Doherty and Schlesinger72 and Outreville73 emphasized the role of risk perceptions and external factors in insurance choices. Moreover, in the context of environmental risk perceptions, Slovic74 highlighted the impact of public attitudes and beliefs on risk-related decisions. The results from this study further underscore the significance of individual beliefs, experiences, and contextual factors in earthquake insurance uptake.

Overall, the findings presented in this study could inform future policy decisions aimed at mitigating the impact of natural and induced hazards in Oklahoma and other regions facing similar risks. Collectively, our study and others (e.g. 64,65,) highlight the importance of understanding individuals' risk perception, knowledge, and experience with natural disasters when examining their decision to purchase disaster insurance.

Conclusion

The present study sought to contribute to the design and evaluation of effective earthquake insurance compensation mechanisms by providing valuable insights to policymakers, insurance companies, and individuals. We used supervised machine learning techniques to identify influential factors of earthquake insurance uptake as well as predict individuals that would take earthquake insurance. Our data were collected from residents from Oklahoma, USA.

Based on our study's findings, we draw the following conclusions and policy implications. First, the survey results showed that only 14.4% of the total sample had earthquake damage insurance in Oklahoma, which is cause for concern given the increased likelihood of earthquakes and seismic activity in the state38. This low percentage of insurance coverage highlights the need for increased awareness and education campaigns aimed at encouraging residents in Oklahoma and other earthquake-prone regions around the world with little or no earthquake insurance75, to encourage purchase of earthquake damage insurance. This will help to ensure that residents can protect their property and livelihoods in the event of catastrophic losses from earthquakes. According to the Organization for Economic Co-operation and Development (OECD)3, raising awareness about the importance of financial preparedness may include communicating about the expected allocation of disaster costs, particularly who is responsible for those costs, as well as providing information about the availability and key characteristics of disaster risk financing tools. It is therefore recommended that policymakers and stakeholders take proactive measures to increase awareness of the importance of earthquake damage insurance and work to create policies that encourage more residents to obtain insurance coverage.

Second, the empirical findings derived from logit, ridge regression, and LASSO, focusing on the determinants of earthquake insurance adoption, are consistent with the results obtained from decision tree and random forest classifiers. However, it's worth noting that the decision tree analysis goes a step further by delving into intricate nonlinear relationships, a dimension that logit, ridge, and LASSO are inherently limited to exploring. Essentially, we found that many socio-demographic factors affect people's decisions to insure against earthquakes. Women and younger respondents were less likely to have earthquake insurance, underscoring the need for targeted awareness campaigns aimed at these groups. Additionally, respondents of Hispanic or Asian descent and those identifying as multiracial were more likely to have earthquake insurance than White respondents. it is therefore important to encourage earthquake-prone residents of all races and ethnicities to insure against earthquakes, not just targeting awareness programs to minority racial ethnic groups.

Third, our study emphasized the role of education, as respondents with higher levels of formal education were more likely to have earthquake insurance showing the potential importance of knowledge and decision analysis skills in making life choices such as earthquake insurance uptake76. We note that higher-income groups are more likely to insure against earthquakes due to the value of their assets.

Fourth, there are several variables related to respondents’ attitudes toward earthquakes that significantly explain people’s decision to have earthquake insurance. Respondents who have experienced moderate property damage or consider earthquakes a safety issue consider earthquake insurance and the regulation of wastewater injection as important measures that could mitigate earthquake risks and minimize mental concerns going forward. Additionally, the finding that respondents connected to the fracking industry are still interested in purchasing earthquake insurance highlights the importance of an efficient insurance system that compensates earthquake victims. Therefore, our results suggest that state regulation of activities linked to earthquakes and overseeing an effective insurance system should be a priority for policymakers to address the risks of earthquakes in Oklahoma and elsewhere.

Moreover, our analysis demonstrates that both decision trees and random forests offer robust predictive capabilities for identifying individuals who would and would not acquire earthquake insurance. The decision tree achieved an accuracy rate of approximately 90% in correctly classifying these groups, while the random forest excelled with an impressive accuracy rate of 100%. Delving into precision, the decision tree classifier exhibited a commendable score of 83.58%, signifying its ability to accurately predict 83.58% of those with earthquake insurance. Intriguingly, the random forest classifier achieved a remarkable perfect precision score of 100%. While both methods are effective, the random forest's exceptional precision and robustness make it an encouraging choice for modeling earthquake insurance uptake and other classification problems, offering heightened confidence in its predictions.

Data availability

The datasets generated during and/or analyzed during the current study are not publicly available due to privacy/ethical reasons but are available from the corresponding author on reasonable request.

References

Adigüzel, F., Kleijnen, M., Erkan, B. B. B. & Yozgatligil, C. T. Identifying non-adopter consumer segments: an empirical study on earthquake insurance adoption in Turkey. J. Consum. Aff. 53, 662–685 (2019).

Schuh, F. & Jaeckle, T. Impact of hurricanes on US insurance stocks. Risk Manag. Insur. Rev. 26, 5–34 (2023).

The Organisation for Economic Co-operation and Development OECD. Disaster Risk Financing: A global survey of practices and challenges, OECD Publishing. Paris. https://doi.org/10.1787/9789264234246-en (2015).

Zhang, C. M. & Qian, Z. W. Minority community willingness to pay for earthquake insurance. Disast. Prevent. Manag. Int. J. 27, 556 (2018).

Paudel, J. Deadly tornadoes and racial disparities in energy consumption: Implications for energy poverty. Energy Econ. 114, 106316 (2022).

Han, C. Seismic activity and development of mood disorders: Findings from the 2016 Kyungju earthquake. Sci. Total Environ. 187, 161328 (2023).

Pynn, R. & Ljung, G. M. Flood insurance: a survey of Grand Forks, North Dakota, homeowners. Appl. Behav. Sci. Rev. 7, 171–171 (1999).

Botzen, W. W. & van den Bergh, J. C. Risk attitudes to low-probability climate change risks: WTP for flood insurance. J. Econ. Behav. Organ. 82, 151–166 (2012).

Li, Y., Greer, A. & Wu, H. C. Applying the extended parallel process model to understand households’ responses to tornado and earthquake risks in Oklahoma. Risk Anal. https://doi.org/10.1111/risa.14176 (2023).

Seifert, I., Botzen, W. W., Kreibich, H. & Aerts, J. C. Influence of flood risk characteristics on flood insurance demand: a comparison between Germany and the Netherlands. Nat. Hazard. 13, 1691–1705 (2013).

Niyibizi, B., Ng’ombe, J. N. & Boyer, T. A. Regulating earthquake risk: Preferences for trade-offs between economic benefits and regulation of produced wastewater injection from hydraulic fracturing. J. Environ. Plann. Manag. 63, 981–1000 (2020).

Abbas, A., Amjath-Babu, T. S., Kächele, H. & Müller, K. Non-structural flood risk mitigation under developing country conditions: an analysis on the determinants of willingness to pay for flood insurance in rural Pakistan. Nat. Hazards 75, 2119–2135 (2015).

Oral, M., Yenel, A., Oral, E., Aydin, N. & Tuncay, T. Earthquake experience and preparedness in Turkey. Disast. Prev. Manag. 24, 21–37 (2015).

Greer, A., Wu, H. C. & Murphy, H. Does etiology matter? Exploring attitudes towards tornado and earthquake hazards. Int. J. Disast. Risk Reduct. 76, 103005 (2022).

Choi, J., Wehde, W. & Maulik, R. Politics of problem definition: Comparing public support of climate change mitigation policies using machine learning. Rev. Policy Res. https://doi.org/10.1111/ropr.12523 (2022).

Cremen, G., Galasso, C. & McCloskey, J. Modelling and quantifying tomorrow’s risks from natural hazards. Sci. Total Environ. 817, 152552 (2022).

Joseph, I. L. The effect of natural disaster on economic growth: Evidence from a major earthquake in Haiti. World Dev. 159, 106053 (2022).

Howerton, A., & Bacon, F. W. Hurricane katrina's effect on property and casualty insurance companies'stock prices. In Allied Academies International Conf.. Academy of Accounting and Financial Studies. Proc. (Vol. 22, No. 1, pp. 12–16). (Jordan Whitney Enterprises, Inc., 2017).

Munich Re Hurricanes, typhoons and cyclones. Accessed March 26, 2023 from https://www.munichre.com/en/risks/natural-disasters-losses-are-trending-upwards/hurricanes-typhoons-cyclones.html#-15513545(2021).

Tian, L., Yao, P. & Jiang, S. J. Perception of earthquake risk: a study of the earthquake insurance pilot area in China. Nat. Hazards 74, 1595–1611 (2014).

Wang, X., Zhou, M. & Shao, J. A risk-sharing mechanism for multi-region catastrophe insurance with government subsidies. Int. J. Disast. Risk Reduct. 86, 103558 (2023).

Qamer, F. M. et al. A framework for multi-sensor satellite data to evaluate crop production losses: the case study of 2022 Pakistan floods. Sci. Rep. 13, 4240 (2023).

Choi, J. & Wehde, W. Venue preference and earthquake mitigation policy: Expanding the micro-model of policy choice. Rev. Policy Res. 36, 683–701 (2019).

Murphy, H., Greer, A. & Wu, H. C. Trusting government to mitigate a new hazard: The case of Oklahoma earthquakes. Risk Haz. Cris. Public Policy 9, 357–380 (2018).

Wehde, W. & Choi, J. Public preferences for disaster federalism: comparing public risk management preferences across levels of government and hazards. Public Adm. Rev. 82, 733–746 (2022).

Chen, X. et al. The Pawnee earthquake as a result of the interplay among injection, faults and foreshocks. Sci. Rep. 7, 1–18 (2017).

Qin, Y., Chen, T., Ma, X. & Chen, X. Forecasting induced seismicity in Oklahoma using machine learning methods. Sci. Rep. 12, 9319 (2022).

Franco, G., Beer, M., Kougioumtzoglou, I. & Patelli, E. Earthquake mitigation strategies through insurance. Encycl. Earthq. Eng. 5, 1–18 (2014).

Antwi-Boasiako, B. A. It’s beyond my control: The effect of locus of control orientation on disaster insurance adoption. Int. J. Disast. Risk Reduct. 22, 297–303 (2017).

Kaown, D. et al. Earthquakes and very deep groundwater perturbation mutually induced. Sci. Rep. 11, 13632 (2021).

Johann, L., Shapiro, S. A. & Dinske, G. The surge of earthquakes in Central Oklahoma has features of reservoir-induced seismicity. Sci. Rep. 8, 11505 (2018).

Oklahoma Geological Survey. Preliminary Earthquake Information. Oklahoma. Accessed from http://wichita.ogs.ou.edu on June 2, 2021 (2017).

Konschnik, K. Regulating stability: State compensation funds for induced seismicity. Geo. Envtl. L. Rev. 29, 227 (2016).

Ng’ombe, J. N. & Boyer, T. A. Determinants of earthquake damage liability assignment in Oklahoma: A Bayesian Tobit censored approach. Energy Policy 131, 422–433 (2019).

Jackson, R. B. et al. The environmental costs and benefits of fracking. Pet. Abstr. 56(7), 101 (2016).

Athey, S. & Imbens, G. W. Machine learning methods that economists should know about. Ann. Rev. Econ. 11, 685–725 (2019).

Silveira, D., Vasconcelos, S., Resende, M. & Cajueiro, D. O. Won’t get fooled again: A supervised machine learning approach for screening gasoline cartels. Energy Econ. 105, 105711 (2022).

Ogwari, P. O., DeShon, H. R. & Hornbach, M. J. The Dallas-Fort Worth airport earthquake sequence: Seismicity beyond injection period. J. Geophys. Res. Solid Earth 123, 553–563 (2018).

Kassambara, A. Machine Learning Essentials: Practical Guide in R. Sthda (2018).

James, G., Witten, D., Hastie, T. & Tibshirani, R. An introduction to statistical learning 18 (Springer, 2013).

Gutteling, J. M. & Wiegman, O. Gender-specific reactions to environmental hazards in the Netherlands. Sex Roles 28, 433–447 (1993).

Ansolabehere, S. & Konisky, D. M. Public attitudes toward construction of new power plants. Pub. Opin. Quart. 73, 566–577 (2009).

Boudet, H. et al. “Fracking” controversy and communication: Using national survey data to understand public perceptions of hydraulic fracturing. Energy Policy 65, 57–67 (2014).

Athavale, M. & Avila, S. M. An analysis of the demand for earthquake insurance. Risk Manag. Insur. Rev. 14, 233–246 (2011).

Wertz, J. Oil companies ask judge to toss federal earthquake lawsuit. StateImpact Oklahoma, June 3. (2016) https://stateimpact.npr.org/oklahoma/2016/06/03/oil-companies-askjudge-to-toss-federal-earthquake-lawsuit/

Mix, T. L. & Raynes, D. K. Denial, disinformation, and delay: recreancy and induced seismicity in Oklahoma’s shale plays. In Fractured Communities: Risks, Impacts, and Protest Against Hydraulic Fracking in us Shale Regions (ed. Mix, T. L.) 173–197 (Rutgers University Press New Brunswick, 2018).

Browne, M. J., Hofmann, A. & Lin, X. J. Race Discrimination in the Adjudication of Claims: Evidence from Earthquake Insurance (Springer, Singapore, 2020).

Hastie, T., Tibshirani, R., Friedman, J. H. & Friedman, J. H. The Elements of Statistical Learning: Data Mining, Inference, and Prediction (Springer, 2009).

Efron, B. & Hastie, T. Computer Age Statistical Inference, Student Edition: Algorithms, Evidence, and Data Science (Cambridge University Press, 2021).

Uddin, S., Khan, A., Hossain, M. E. & Moni, M. A. Comparing different supervised machine learning algorithms for disease prediction. BMC Med. Inform. Decision Mak. 19, 1–16 (2019).

Breiman, L. Random forests. Mach. Learn. 45, 5–32 (2001).

Friedman, J., Hastie, T. & Tibshirani, R. Regularization paths for generalized linear models via coordinate descent. J. Stat. Softw. 33, 1 (2010).

Kuhn, M. Building predictive models in R using the caret package. J. Stat. Softw. 28, 1–26 (2008).

Williams, G. J. Data mining with rattle and R: The art of excavating data for knowledge discovery, series Use R! Springer. Singapore https://doi.org/10.1007/978-1-4419-9890-3 (2011).

Therneau, T., Atkinson, B. & Ripley, B. rpart: Recursive partitioning and regression trees. R Packag. Ver. 4, 1–10 (2015).

R Core Team. R: A language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. URL https://www.R-project.org/.(2023)

Geetha, V., Punitha, A., Abarna, M., Akshaya, M., Illakiya, S., & Janani, A. P. An effective crop prediction using random forest algorithm. In 2020 International Conf. on System, Computation, Automation and Networking (ICSCAN) (pp. 1–5). IEEE (2020).

AlKaabi, L. A., Ahmed, L. S., Al Attiyah, M. F. & Abdel-Rahman, M. E. Predicting hypertension using machine learning: Findings from Qatar Biobank Study. Plos one 15, e0240370 (2020).

Huang, S. et al. Evaluating the risk of hypertension using an artificial neural network method in rural residents over the age of 35 years in a Chinese area. Hypertens. Res. 33, 722–726 (2010).

Sidi, P., Sukono, M. & Supian, S. Supply and Demand Analysis for Flood Insurance by Using Logistic Regression Model: Case Study at Citarum Watershed in South Bandung, West Java (IOP Publishing, 2017).

Cannon, C., Gotham, K. F., Lauve-Moon, K. & Powers, B. The climate change double whammy: Flood damage and the determinants of flood insurance coverage, the case of post-Katrina New Orleans. Clim. Risk Manag. 27, 100210 (2020).

Wines, M. Oklahoma recognizes role of drilling in quakes. New York Times, April 21. https://www.nytimes.com/2015/04/22/us/oklahoma-acknowledges-astewater-from-oiland-gas-wells-asmajor-cause-of-quakes.html?_r=0 Accessed on April 23, (2015).

Choi, J., Robinson, S., Maulik, R. & Wehde, W. What matters the most? Understanding individual tornado preparedness using machine learning. Nat. Hazards 103, 1183–1200 (2023).

Ivčević, A., Statzu, V., Satta, A. & Bertoldo, R. The future protection from the climate change-related hazards and the willingness to pay for home insurance in the coastal wetlands of West Sardinia, Italy. Int. J. Disast. Risk Reduct. 52, 101956 (2021).

Osberghaus, D. The determinants of private flood mitigation measures in Germany—Evidence from a nationwide survey. Ecol. Econ. 110, 36–50 (2015).

Hong, J., Jo, H., Seo, D. & You, S. Impact of induced seismicity on the housing market: Evidence from Pohang. Buildings 12(3), 286 (2022).

Pothon, A., Gueguen, P., Buisine, S. & Bard, P. Y. California earthquake insurance unpopularity: the issue is the price, not the risk perception. Nat. Hazards Earth Syst. Sci. 19, 1909–1924 (2019).

Browne, M. J. & Hoyt, R. E. The demand for flood insurance: Empirical evidence. J. Risk Uncertain. 20, 291–306 (2000).

Brody, S. D., Highfield, W. E., Wilson, M., Lindell, M. K. & Blessing, R. Understanding the motivations of coastal residents to voluntarily purchase federal flood insurance. J. Risk Res. 20, 760–775 (2017).

Yu, J. et al. Household adaptation intentions to earthquake risks in rural China. Int. J. Disast. Risk Reduct. 40, 101253 (2019).

Landry, C. & Turner, D. Risk perceptions and flood insurance: Insights from homeowners on the georgia coast. Sustainability 12, 10372 (2020).

Doherty, N. A. & Schlesinger, H. Optimal insurance in incomplete markets. J. Polit. Econ. 91, 1045–1054 (1983).

Outreville, J. F. The relationship between relative risk aversion and the level of education: A survey and implications for the demand for life insurance. J. Econ. Surveys 29, 97–111 (2015).

Slovic, P. Perception of risk. Science 236, 280–285 (1987).

Kusuma, A., Nguyen, C. & Noy, I. Insurance for catastrophes: why are natural hazards underinsured, and does it matter?. Adv. Spat. Econ. Model. Disast. Impacts 52, 43–70 (2019).

Nguyen, C. N. & Noy, I. Measuring the impact of insurance on urban earthquake recovery using nightlights. J. Econ. Geogr. 20, 857–877 (2020).

Author information

Authors and Affiliations

Contributions

J.N.N. conceptualized the ideas and then performed data curation, formal analysis, investigation, validation, software, writing—original draft preparation, writing, reviewing, and editing, as well as funding acquisition. K.N.A., A.Z., J.H., and O.T contributed to the investigation of the problem, validating the results, writing the second draft of the manuscript, reviewing, and editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ng’ombe, J.N., Addai, K.N., Mzyece, A. et al. Uncovering the factors that affect earthquake insurance uptake using supervised machine learning. Sci Rep 13, 21314 (2023). https://doi.org/10.1038/s41598-023-48568-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-023-48568-6

- Springer Nature Limited