Abstract

Based on a panel fixed effect model, our paper explores the impact of digital transformation on the operation efficiency of Chinese A-share listed enterprises during 2009–2020. It conducts related robustness tests, mechanism analysis, and heterogeneity analysis to provide a comprehensive understanding of the intrinsic relationship between digitalization and firm performance. The empirical findings demonstrate that digital transformation has a significantly positive effect on firm performance. More specifically, rising digital transformation of enterprises leads to an improvement in their operation efficiency. The research further reveals that digital transformation mainly promotes the efficiency of capital-labor allocation, which in turn enhances firm performance. Overall, our study adds to the existing literature by offering empirical evidence on the relationship between digital transformation and enterprise operation efficiency, providing valuable insights for practitioners and policymakers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As technology continues to advance as digital transformation of enterprises has emerged as a critical area that has had and will continue to have a profound effect on how business may operate and the way how people may behave. The G20 Digital Economy Development and Cooperation Initiative document, released at the G20 Hangzhou Summit in 2016, identifies three phases of the digital economy: digitalization of information, digital transformation, and digitalization of business. Among these, digital transformation involves utilizing digital technologies to aggregate, analyze, utilize, and exchange data, in order to make informed decisions and develop innovative business models that drive value creation and enhance business performance (Verhoef et al. 2021). This phenomenon is described by Yao (2023) as the fourth industrial revolution, featuring with digital technologies and big data, which has had a profound impact on business operation (Lasi et al. 2014). Previous research has shown that digital transformation is a key factor in boosting firm performance (Bakhshi et al. 2014), reducing production costs (Loebbecke and Picot 2015), enhancing innovation capabilities (Yoo et al. 2012), and optimizing organizational management structures (Einav and Levin 2014) to drive high-quality and efficient corporate development. In a rapidly changing global competitive landscape and a volatile economic environment, companies must actively embrace change and proactively promote digital transformation to stay ahead. Therefore, examining the impact of digital transformation on the operation efficiency of companies, from the perspective of their digital transformation, is essential for companies to better adapt to the new market and future challenges.

When examining the factors that exert influence upon firm performance, the predominant focus within the realm of enterprise industry literature resides in the analysis of commercial banks' performance (Berger et al. 2009; Fungáčová et al. 2013). Concurrently, these influential determinants can be categorized into external and internal factors. Some scholars have diligently scrutinized the ramifications of external factors on firm performance, encompassing aspects such as strategic investment allure (Berger et al. 2009), regional corruption dynamics (Hanousek et al. 2019), the pervasive impact of the COVID-19 pandemic (Khatib and Nour 2021), and various other contributory elements. Furthermore, certain academics have engaged in discourse surrounding the consequences posed by internal control factors on firm performance. For instance, the purview extends to encompass intracompany risk management protocols (Gordon Lawrence et al. 2009), interrelations amidst internal executive counterparts (Michiels et al. 2013), and the defining characteristics of governing boards (Pucheta-Martínez and Gallego-Álvarez 2020).

Of particular note, the extent of digital transformation undertaken by enterprises, as an intrinsic factor exerting influence upon firm performance, has engendered a corpus of pertinent literature. Bloom et al. (2012) and Bessen and Righi (2019), leveraging data gleaned from an expansive cohort comprising over 4,000 companies across Europe and Asia, alongside 4,262 entities cataloged within the Compustat database in the United States, during the chronological span from 1990 to 2012, respectively, have empirically established that the evolution of digital technology has propelled improvements in firm performance. Nevertheless, Kim et al. (2011) posited the view that the impact of digital technology on firm performance lacks a statistically significant positive impetus. Certain scholars, exemplified by Hajli et al. (2015), postulate that the dividends reaped from digital transformation may be selectively garnered by particular enterprises or industries. Therefore, a note of circumspection is warranted as Ferreira and Fernandes (2017) underscored the inconclusiveness characterizing the polarity of the influence wielded by digital transformation upon corporate performance. In light of this, prudence dictates refraining from prematurely drawing definitive conclusions.

Through a comprehensive review of the existing research literature, it becomes apparent that there exists a lack of consensus among academic perspectives regarding the influence of Digital Transformation on enterprise operational efficiency. Consequently, a more profound exploration of the intricate interplay between these two phenomena becomes imperative. Furthermore, the mechanisms through which Digital Transformation exerts its impact on business efficiency have received limited scholarly attention. In light of these gaps, the present study aims to delve into the intricate relationship between corporate Digital Transformation and corporate operating efficiency, utilizing a sample of Chinese listed companies spanning the years 2009 to 2020. This exploration is grounded in the application of a panel fixed-effect model, supplemented by a comprehensive analysis of the associated mechanisms and potential sources of heterogeneity. To this end, we incorporate the interaction of capital allocation efficiency, labor allocation efficiency, and technological progress bias in our investigation.

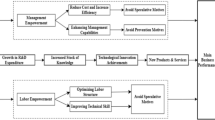

Our findings unveil a significant and affirmative role played by enterprise Digital Transformation in bolstering operating efficiency. This enhancement is chiefly facilitated by the concurrent optimization of capital and labor allocation efficiencies. Notably, our inquiry uncovers a pronounced inclination for firms to direct their technological advancements towards labor-centric avenues when pursuing digital transformation for the purpose of augmenting firm performance. These discernments bear profound implications for comprehending the intricate mechanisms that underlie the relationship between Digital Transformation and business efficiency. By contributing to the augmentation of the existing body of relevant literature, our findings furnish valuable insights and serve as a foundational underpinning for the formulation and execution of informed policy decisions.

A distinguishing facet of our study lies in its innovative conceptualization of digital intelligent transformation as an overarching technological augmentation of both capital and labor elements. This novel approach posits that Digital Transformation intrinsically influences the efficiency of both capital and labor, thereby necessitating a comprehensive examination of their intertwined dynamics. Additionally, we break new ground by devising a quantitative measure to gauge the extent of enterprise digital transformation, employing Python-based web crawling techniques and text analysis methodologies. This pioneering methodology presents researchers with a potent and precise instrument for assessing and appraising the extent of Digital Transformation within enterprises, thereby offering a valuable reference point for subsequent research endeavors and practical applications.

2 Research hypothesis

Internal and external information asymmetry commonly plague companies. The former refers to the inadequate exchange of information among various departments, impeding the smooth flow of information and consequently affecting the overall performance of the enterprise. The latter denotes the unequal distribution of information between firms and external stakeholders, thereby increasing uncertainty and risk in transaction processes. Digital transformation, on the one hand, enhances internal management efficiency (Loonam et al. 2018), and on the other hand, helps firms become more flexible and responsive to external market changes (Mikalef and Pateli 2017), facilitating rational planning of growth strategies to adapt to consumer demand fluctuations (Kaur and Sood 2015). In general, digital transformation has the potential to improve communication efficiency within and between firms, reduce information asymmetry, increase information delivery transparency and efficiency, thereby lowering operational costs (Lindstedt and Nauri 2010; Mikalef et al. 2018), search costs and transaction costs (Goldfarb and Tucker 2019). Moreover, Bessen and Righi (2019) and other scholars have noted that digital transformation can increase firms' productivity. They suggest that through digital transformation, firms can manage their costs effectively and generate higher returns, which can ultimately improve their operation efficiency. Based on these findings, we propose hypothesis 1.

-

Hypothesis 1: Digital transformation significantly improves firm performance.

Firm performance can be enhanced through two mechanisms of in their digital transformation progress. In accordance with the Enterprise Innovation Driver Theory, digital transformation inherently embodies innovation. This paradigm ushers in novel technologies, tools, and methodologies, thereby ushering in a transformative shift in the operational landscape and business model of enterprises. Innovation, as a catalyst, empowers enterprises to unearth novel resource allocation strategies and labor organization approaches that seamlessly align with evolving market demand dynamics. This innovative stance stands poised to effectively catalyze the efficiency of enterprise resource allocation and labor deployment, a notion that is substantiated within the existing body of literature. Loebbecke and Picot (2015) contend that the use of operational digital technology enables firms to make better investment choices at a lower cost, thereby directing resources towards efficient projects and improving the efficiency of capital allocation. Secondly, according to Goldfarb and Tucker (2019), digital technology development leads to increased market transparency, thereby reducing search costs and tracking costs for firms, which in turn improves resource allocation efficiency. Additionally, the digital transformation of enterprises can facilitate the replacement of simple labor with automated systems (Babina et al. 2021), reduce the demand for low-end labor, and remove temporal and spatial constraints and barriers to labor factor mobility (Acemoglu and Restrepo 2018), ultimately leading to improved labor allocation efficiency. Yang et al. (2023) suggests that digital transformation not only enhances firm productivity but also reduces the income gap between the high- and low-skilled workers. Chen et al. (2023) posits that digital technologies are conducive to form performance of the banking industry in China. However, few studies have deliberately focused on digital transformation and its impact on firm operation efficiency of the Chinese listed firms during 2009–20 when many enterprises had undergone prodigious digital transformation, providing an unique opportunity for us to testify whether digital transformation can have a significant influence on firm performance in the Chinese context. In particular, we aim to testify another hypothesis on how and why digital transformation affects firm performance as put forward by hypothesis 2 below.

-

Hypothesis 2: Digital transformation can improve the resource and labor allocation efficiency of firms, thereby increasing operational efficiency.

3 Research design

3.1 Data source

The financial data of the listed companies examined in our study were sourced from two databases: the China Research Data Service Platform (CNRDS) and the WIND database. Digital transformation measurement data are collected from the annual reports of companies listed on the Shanghai and Shenzhen Stock Exchanges. Our study uses a sample of Chinese A-share listed companies during 2009–20, which comprises 12,276 firm-year observations in 12 consecutive years after eliminating missing, duplicated, and invalid samples. To ensure the robustness of the data, a 1% upper and lower tailing process is employed to filter out extreme values that could skew the results.

3.2 Model construction

To examine the impact of digital transformation on firm performance, our study constructs a model that includes several variables. The dependent variable is total factor productivity (\(tfp\)), which is commonly used to measure firm performance. The degree of digital transformation is represented by the standardized digital transformation word frequency (\(ai\)). A set of control variables (\(controls\)) is included in the model. The subscript \({\text{it}}\) represents the data of the i-th variable in year t. Individual fixed effects or industry fixed effects are denoted by \({u}_{i}\), time fixed effects are represented by \({\mu }_{t}\), and the random error term is \({\varepsilon }_{it}\). The hypothesis that digital transformation of enterprises can improve operational efficiency is tested by assessing the significance of \({\gamma }_{1}\), the coefficient on \(ai\). A significantly positive value of \({\gamma }_{1}\) indicates that hypothesis 1 is supported.

Additionally, the present study aims to investigate the underlying mechanisms through which digital transformation affects firm performance. To this end, we introduce the interaction terms (\(ai_{it} *mechanism_{it}\)) in Model 1 to examine the mediating roles of capital allocation efficiency, labor allocation efficiency, and technological progress bias. Specifically, we denote the capital allocation efficiency as \(mpk\), labor allocation efficiency as \(mpl\), and technological progress bias as \(d\). For ease of interpretation, we de-mean the interaction terms of \(mpk\), \(mpl\), and \(d\).

3.3 Variable settings

3.3.1 Explained variables (\({\varvec{tfp}}\))

In our study, we utilize the lp method to gauge the total factor productivity of enterprises. Semi parametric methods such as lp estimation can effectively solve endogeneity and sample selection problems. To achieve this, we formulate a model as follows: \({Y}_{it}\) represents the main business income, \({K}_{it}\) the net investment in fixed assets, \({L}_{it}\) the number of employees, \({M}_{it}\) intermediate inputs, which is replaced by the data of cash and labor purchased by the enterprise, and \({\varepsilon }_{it}\) is a random error term. The application of the lp method necessitates the utilization of intermediate inputs as proxies. The coefficients are derived through the regression of Eq. 3. These coefficients are subsequently integrated into Eq. 3 to compute the projected values. By subsequently juxtaposing these projected values with the actual output values, residual values are calculated, effectively yielding the measure of total factor productivity. In relation to the quantification of total factor productivity, we have employed the "prodest" command within Stata to facilitate this calculation. Given the twelve-year duration of the data, we apply the price index deflator to the main business income, net investment in fixed assets, and intermediate inputs prior to calculating total factor productivity. A higher \(tfp\) value is indicative of better firm performance.

Figure 1 illustrates the annual average trend of total factor productivity for enterprises. Taking an overall perspective, the average annual TFP of enterprises ranges between 3.80 and 3.95, with a maximum value of 3.95 and a minimum value of 3.82. There is little variation in the average TFP across different years. However, upon closer examination of Fig. 1, several noteworthy points emerge.

Following the financial crisis in 2008, the Chinese government implemented a massive expansionary fiscal policy stimulus program to bolster effective market demand and stabilize the economy. Increased market demand enabled firms to generate revenue from product sales and invest in business expansion to leverage economies of scale, thereby improving their performance. Notably, enterprise performance peaked in 2011, followed by a subsequent decline that reached its lowest point in 2015 at 3.82. The year 2015 witnessed significant volatility in China's capital markets, with the Shanghai Stock Exchange Index experiencing a sharp decline and multiple stocks being subject to trading suspensions and circuit breakers. Despite the government's efforts to stabilize the market, these events inevitably impacted enterprise operations. However, post-2015, enterprise performance gradually rebounded and reached a recent peak of 3.93 in 2018. In 2019, the outbreak of the novel coronavirus (COVID-19) further disrupted enterprise operations. External factors, such as reduced market demand and logistical challenges, coupled with internal difficulties related to resuming work and production, contributed to a decline in business efficiency and, subsequently, enterprise performance. Figure 1 also indicates a notable decrease in the average annual TFP of enterprises in 2020, falling to 3.56. This decline can be attributed to the far-reaching effects of the COVID-19 pandemic, which continued to exert its influence on the global economy, including the enterprise sector in China.

Although the average value of total factor productivity does not show significant variation between years, a closer look reveals the impact of external shocks on firm performance. the financial crisis of 2008 stimulated government intervention, leading to improved firm performance. However, fluctuations in subsequent years were influenced by stock market events and the devastating impact of the COVID-19 pandemic in 2019. These findings contribute to a better understanding of the dynamics of firm performance and its broader implications for the Chinese economy.

3.3.2 Core explanatory variables (\({\varvec{ai}}\))

Considering the limitations of traditional financial indicators to represent the level of digital transformation, and the advancements in text mining technology, our study employs text analysis to measure the digital level of enterprises. Firstly, the annual reports of all listed enterprises in the sample period from the two Chinese Stock Exchanges are crawled using the Python software crawler technology. English annual reports are eliminated. Secondly, the obtained annual reports are matched with existing filtered enterprise samples, and unsuccessful matches are eliminated. Then, 236 keywords related to the digital transformation of enterprises are identified through an extensive review of literature and policy reports, and consultations with experts. These keywords, such as "face recognition, big data, digital intelligence, financial technology," are used to build a thesaurus in the Python software "jieba" package. Finally, machine learning text analysis function is utilized to mine and analyze the matched enterprise annual reports, and the standardized word frequencies of the keywords are used as indicators of the digitalization level of enterprises. The higher the value of the indicators, the higher the digitalization level. Standardized word frequency refers to dividing the keyword word frequency counted by each enterprise by the total number of keywords (236). This method provides researchers with an effective tool to more comprehensively and accurately measure and evaluate the degree of Digital transformation of enterprises. As depicted in Fig. 2, there is an observable upward trend in the level of digital transformation across enterprises.

Based on Fig. 2, it is evident that the degree of digital transformation in enterprises has generally been increasing since 2009, reaching its peak in 2020, with a range of 0.041 to 0.161. Looking more closely, there is a steady rise in the degree of digital transformation from 2009 to 2013, with a value of 0.050 in 2013. Subsequently, the pace of digital transformation accelerated, reaching 0.058 in 2014 and further increasing to 0.062 in 2015. From 2015 onwards, there was explosive growth in the degree of digital transformation. To assess the year-on-year growth rates, we can calculate the growth rates for various periods. The growth rate of digital transformation from 2014 to 2015 was 0.07, from 2015 to 2016 it was 0.37, from 2016 to 2017 it was 0.24, from 2017 to 2018 it was 0.21, from 2018 to 2019 it was 0.15, and from 2019 to 2020 it was 0.08. Notably, the period of 2015–2016 witnessed the fastest growth in the degree of digital transformation, followed by 2016–2017.These findings from Fig. 2 provide valuable insights into the increasing trend of digital transformation in enterprises over time. The period from 2015 to 2016 stands out as a period of significant growth, reflecting the increasing importance of digital transformation for enterprises. The subsequent years also demonstrate notable growth rates, highlighting the ongoing adoption and integration of digital technologies in firm performance.

3.3.3 Control variables (\({\varvec{controls}}\))

Our study employs several control variables, including the total asset turnover ratio (\(turnover\)), which is derived from the net sales revenue divided by total assets. The growth rate of revenue (\(salesr\)) is also considered to evaluate the company's growth ability, which is calculated as the difference between current revenue and previous revenue divided by previous revenue. The stability of the company's asset structure is assessed by \(fixratio\), which is calculated as the ratio of fixed assets to total assets. The return on total assets (\(roa\)), indicating a company's profitability, is computed as the ratio of net income to total assets. The shareholding ratio of the largest shareholder (\(own\)), expressed as a percentage, is used as a proxy for the concentration of equity in the company. Additionally, the age of the enterprise (\(age\)) is also taken into account, which is computed as ln(year of observation—year of establishment + 1).

3.3.4 Mechanism Variables (\({\varvec{mechanism}}\))

Our study focuses on three primary mechanism variables, namely, capital allocation efficiency (\(mpk\)), labor allocation efficiency (\(mpl\)), and technological progress bias (\(d\)). To measure these variables, a stochastic frontier model in the form of trans-log production function is utilized. The model is constructed as follows: \({Y}_{it}\) represents the output of the enterprise, which is measured by the main business income of the enterprise. \({K}_{it}\) denotes the capital input of the enterprise, which is measured by the net investment in fixed assets of the enterprise, while \({L}_{it}\) denotes the labor input of the enterprise, which is measured by the number of active employees of the enterprise. \({T}_{it}\) represents technical progress, which is the annual time minus the initial time of the sample span. \({\varepsilon }_{it}\) denotes the stochastic error term that reflects the inefficiency of the stochastic system, and \({\mu }_{it}\) represents the technical inefficiency error term.

By utilizing the estimation outcomes from Model 4, the relevant capital allocation efficiency, labor allocation efficiency, and technological progress bias index (Diamond 1965) of the firm can be derived as follows: \({\varepsilon }_{{K}_{it}}\) refers to the capital output elasticity, while \({\varepsilon }_{{L}_{it}}\) represents the labor output elasticity. If capital allocation efficiency is high, it signifies the effective utilization of resources in production, resulting in a higher output-to-input ratio. Similarly, elevated labor allocation efficiency implies optimal utilization of the workforce, leading to comparatively higher output levels. The technological progress bias index, denoted by d, implies that \(d>0\) suggests a biased technological progress towards capital, while \(d<0\) implies that technological progress is biased towards labor. In contrast, \(d=0\) indicates a neutral technical progress bias.

3.3.5 Descriptive statistics

Table 1 presents the descriptive statistics for the variables analyzed in our study. The total factor productivity values range from a minimum of 1.8329 to a maximum of 5.7426, with a mean of 3.8905 and a standard deviation of 0.7158. These results indicate that the total factor productivity of each enterprise differs only slightly. The digital transformation of enterprises ranges from 0.9000 to 0.0000, with a smaller standard deviation due to the data being standardized. Meanwhile, in addition to the explanatory variable of total factor productivity and the explanatory variable of the degree of digital transformation in enterprises, Table 1 provides descriptive statistics for the control variables, which offer an intuitive and comprehensive understanding of Chinese listed enterprises.

Examining the total asset turnover ratio, we observe values ranging from 0.0384 to 3.0980, with a standard deviation of 0.5443. This indicates that the total asset turnover ratio of enterprises exhibits relatively low variability, with a mean value of 0.6873. Notably, the control variables that exhibit significant differences across enterprises are the operating income growth rate and the return on total assets. The maximum value of the operating income growth rate is 178.0089, the minimum value is -64.4708, and the standard deviation is 33.3621. These figures suggest substantial variation in the operating income growth rate among enterprises, with some even experiencing negative growth. Similarly, the return on total assets shows considerable diversity, with a maximum value of 19.7300, a minimum value of -27.9500, and a standard deviation of 6.2275. The maximum value of the fixed assets ratio is 0.9393, while the minimum value is 0.0003. Since the fixed assets ratio is obtained by dividing fixed assets by total assets, its values range between 0 and 1. The standard deviation of the fixed assets ratio is 0.1854, with a mean value of 0.2420, indicating a relatively lower proportion of fixed assets in the sample. Moving on to the enterprise age variable, we observe a maximum value of 4.0073, a minimum value of 1.7918, and a mean value of 3.0054, suggesting that the sample consists of relatively older enterprises. Analyzing the shareholding ratio of the first largest shareholder, we find a maximum value of 0.7496, a minimum value of 0.0821, a standard deviation of 0.1513, and a mean value of 0.3487. Furthermore, considering the mechanism variable of enterprise capital allocation efficiency, we note a maximum value of 2.0029, a minimum value of 0.0221, a standard deviation of 0.3521, and a mean value of 0.4465. Similarly, for the enterprise labor allocation efficiency, the maximum value is 4.4321. Comparing the capital allocation efficiency and labor allocation efficiency of enterprises, it is evident that labor allocation efficiency exhibits greater fluctuations than capital allocation efficiency, with the mean value of labor allocation efficiency slightly higher than that of capital allocation efficiency. Lastly, regarding the technical progress bias index, we observe a maximum value of -0.0465, a minimum value of -0.0718, a standard deviation of 0.0057, and a mean value of -0.0568. These findings suggest that the technical progress of the sample enterprises tends to be biased towards labor.

4 Empirical results and analysis

4.1 Benchmark return

We conduct a Hausman test and obtained a p-value of less than 0.01, which leads to the rejection of the original hypothesis. Subsequently, we adopt a fixed-effects model. Table 2 displays the results of the baseline regression, where the first column presents the outcomes of the regression with only the core explanatory variables based on individual and time fixed effects. The results of the first column reveal a positive correlation between digital transformation and the operational efficiency of enterprises, but the relationship is statistically insignificant. On the other hand, the second column presents the outcomes after the addition of control variables to the first column. The findings show a significant and positive correlation between the degree of digital transformation and the business efficiency of the firm. In economic terms, a 10% increase in the degree of digital transformation results in a 1.881% increase in the business efficiency of the firm, while controlling for individual and time fixed effects and other control variables. Additionally, the results of the second column demonstrate a significant and positive correlation between the total asset turnover ratio and the growth rate of operating income of the enterprise with the operating efficiency of the enterprise. This association arises from the fact that the higher these variables are, the quicker the total asset turnover, and the better the operating condition of the enterprise, reflecting a stronger operating capacity and growth ability. The coefficient of fixed assets ratio also shows a significantly positive association at the 1% level, where a higher fixed assets ratio alleviates financing constraints and enhances total factor productivity, as well as providing operational flexibility to improve operational efficiency. Moreover, the return on total assets of an enterprise exhibits a significantly positive correlation with the operating efficiency of the enterprise. The profitability of the enterprise is reflected in the return on total assets, and the better the profitability, the higher the operating efficiency of the enterprise. However, firm age and firm equity concentration are positively but not significantly related to firm operation efficiency. Apart from individual and time fixed effects, industry and time fixed effect regressions are also conducted, and the results are presented in the third and fourth columns of Table 2. The coefficient of digital transformation is 0.5759 at 1% level of significance without the inclusion of control variables for industry and time fixed effects, and 0.3684 at 1% level of significance with the inclusion of control variables, which also confirms that digital transformation is conducive to improving business efficiency, thus proving hypothesis 1.

4.2 Robustness tests

4.2.1 Endogeneity test

To address the potential endogeneity issue, our study employs the two-stage least squares (2SLS) method with instrumental variables for testing endogeneity. Specifically, the first-order and second-order lags of digital transformation are selected as instruments for the digital transformation of firms. The left side of the first column shows the results of the first stage regression, and the right side shows the results of the second stage regression. The weak instrument problem is first examined by testing the Wald F statistic, which yields a value of 3017.095 for each instrument, well exceeding the critical value of 10, thereby indicating that weak instruments are not a concern. Additionally, the Hansen J test is performed to test the validity of the instrument selection. The resulting p-value of 0.1962, greater than the conventional significance level of 0.05, confirms that the instruments are valid. Finally, the LM statistic is computed to test the overidentification restriction, with a value of 71.922 and a p-value of 0.0000, which indicates that the original hypothesis of insufficient instrumental variable identification is rejected. Overall, these tests provide strong evidence that the instrumental variables employed in our study are a valid substitute for the original core explanatory variables. The results in the first column of Table 3 demonstrate that digital transformation has a significant positive impact on firms' operational efficiency.

4.2.2 Lagged variable regression

In order to further verify the robustness of our findings, we replace the dependent variable with a first-order lag of total factor productivity in the second column of Table 3, and controlled for individual and time fixed effects using 2sls. The results of the regression analysis reveal that the coefficient of digital transformation is positive at the 10% level, thus supporting our initial findings.

4.2.3 Substitution of core explanatory variables

In our study, the primary explanatory variable is the standardized word frequency. To ensure the robustness of the results, the logarithm of the total word frequency of keywords is employed as a substitute. The regression results of the third column in Table 3 demonstrate that the coefficient of digital transformation is significant at the 1% level. Specifically, the coefficient of digital transformation is estimated to be 0.0226, indicating that digital transformation of enterprises has a positive and significant impact on their operation efficiency.

4.2.4 Subsample regression

The present study employs empirical data spanning 2009–2020, a period that includes the emergence of the COVID-19 pandemic in 2019, which has the potential to affect the study's empirical outcomes. To address this potential issue, a subsample covering the years 2009–2018 is selected for the regression analysis. As shown in the fourth column of Table 3, the regression results indicate that the coefficient of digital transformation remains significantly positive at the 1% level, which reaffirms the robustness of the study's findings.

4.2.5 Mechanism test

To ensure the robustness of the results, our mechanism testing and heterogeneity analysis are both empirically tested based on two-stage least squares regression. The first column in Table 4 adds the interaction term between digital transformation and firms' capital allocation efficiency to the 2sls regression. After adding the interaction term, the coefficient of digital transformation is still significantly positive at the 1% level, and the coefficient of the interaction term is 0.4452, which is also significantly positive at the 10% level. On the one hand, it can be shown that the degree of digital transformation of a firm can significantly improve the operation efficiency when the capital allocation efficiency is average, and the higher the capital allocation efficiency, the greater the effect of digital transformation on firm performance. In other words, capital allocation efficiency reinforces the effect of digital transformation on firm performance. On the other hand, since the coefficient of the interaction term is also significantly positive, it also indicates that digital transformation improves capital allocation efficiency, and hence firm performance. The second column of Table 4 shows that the coefficient of digital transformation is still significantly positive after the inclusion of the interaction term, and the coefficient of the interaction term is also significantly positive at 0.2357. It can be shown that when labor allocation efficiency is average, a 10% rise in digital transformation will raise total factor productivity by 1.967%. It can also be shown that enterprises improve their labor allocation efficiency by increasing the degree of digitization, and thus improve their performance. The higher the degree of digitalization, the higher the labor allocation efficiency, and therefore the better firm performance. The third column in Table 4 adds the interaction term between digital transformation and the technological progress bias index. It can be seen that the coefficient of Digital transformation is also positive at the significance level of 1%, and the coefficient of interaction item is -15.8174 at the significance level of 10%. From the above, we can see that the mean value of technological progress bias is negative, so this indicates that Digital transformation can improve firm performance when technological progress is labor oriented and less than or equal to its mean value. Looking at it from another angle, when technological advancements are biased towards capital, digital transformation can have an adverse impact on firm performance.

4.3 Heterogeneity analysis

4.3.1 Region-based heterogeneity analysis

Given the pronounced variations in economic development levels across different regions within China, our study employs a meticulous heterogeneity analysis. This analysis stratifies the nation's provinces into two distinct categories: the eastern region and the central-western region. The primary objective of this segmentation is to ascertain whether the mechanisms previously identified operate differentially across these disparate locales. Prior to the inclusion of mechanism variables, we embark on a sub-sample Two-Stage Least Squares (2SLS) regression. The initial column of Table 5 presents the outcomes derived from this sub-sample 2SLS regression for each delineated region. The outcomes, as showcased in Table 5, underscore several noteworthy findings. Within the second column of the regression outcomes for the eastern region, the coefficient corresponding to digital transformation stands at 0.2719, manifesting statistical significance at the 1% level. Nevertheless, the coefficient pertaining to its interaction term, amounting to 0.3586, fails to attain statistical significance. This suggests an absence of the capital allocation efficiency mechanism within the context of the eastern region. Shifting focus to the third column of the regression results for the eastern region, the coefficient affiliated with the interaction term between digital transformation and labor allocation efficiency emerges as 0.1767, achieving statistical significance at the 10% level. This observation postulates that digital transformation bears the capacity to propel labor allocation efficiency, consequently fostering an enhancement in enterprise performance. In the realm of the central-western region, the 2SLS regression outcomes initially indicate an insignificance associated with the coefficient linked to digital transformation. However, upon the inclusion of the interaction term, a distinctive pattern becomes evident. Specifically, the coefficient associated with the interaction between digital transformation and capital allocation efficiency registers at a statistically significant value of 1.3323, signifying the 1% level of significance. Correspondingly, the coefficient associated with the interaction between digital transformation and labor allocation efficiency stands at 0.8934, also attaining statistical significance at the 1% level. This juxtaposition of outcomes underscores a pivotal inference: the digital transformation of enterprises does not exert a direct promotion of enterprise performance. Instead, its impact is channeled through the elevation of both labor and capital allocation efficiencies, subsequently bestowing a salient enhancement upon firm performance. A discerning comparison of the regression results between the eastern and central-western regions unveils a notable pattern. Specifically, the coefficients pertaining to interaction terms, as observed within the first two columns, exhibit comparatively higher values within the central-western regions. This disparity indicates an intensified role played by digital transformation in the promotion of capital and labor allocation efficiencies, thereby engendering a more profound amelioration in business efficiency within the central-western regions. This notable alignment with the findings of Yang et al. (2023) study concerning digital transformation's implications for worker wages among divergent regions underscores the cogency of our observations. This pronounced difference can be attributed to the central-western regions' relatively lower economic development level, coupled with the prevailing inadequate emphasis on digital transformation. This, in conjunction with the comparatively suboptimal capital and labor allocation efficiency of enterprises in the central-western regions vis-à-vis their eastern counterparts, contributes to this phenomenon. Hence, a compelling imperative emerges: an elevation of the digital transformation quotient within the central-western regions holds the potential to mitigate information asymmetry among enterprises. This strategic augmentation can stimulate the optimization of resource allocation, thereby catalyzing an efficacious enhancement in capital and labor allocation efficiencies. This collective augmentation, in turn, confers a heightened impact upon operational efficiency within firms, thus substantiating the pronounced significance of digital transformation in the realm of enterprise dynamics.

4.3.2 Industry-based heterogeneity analysis

Our study categorizes firms into manufacturing and non-manufacturing industries. The coefficients of the first column of the sub-sample benchmark regression results of digital transformation in Table 6 are still significantly positive. Based on the regression results of the second and third columns of Table 6 for the manufacturing industry, both interaction terms are significant. Specifically, the interaction term coefficient between digital transformation and capital allocation efficiency is 1.3642 at the 1% significance level, and the interaction term coefficient between digital transformation and labor allocation efficiency is 0.4974 at the 5% significance level. These results suggest that manufacturing firms can enhance product quality and maintain market competitiveness by reducing costs through digital transformation, thus promoting capital and labor allocation efficiency, and ultimately improving business efficiency. In addition, the interaction coefficient between digital transformation and enterprise technological progress bias is -25.6366 at a significance level of 5%, indicating that when technological progress is biased towards labor, it is beneficial for digital transformation to promote enterprise performance. On the other hand, only the third column of the regression results is significant for non-manufacturing firms, where the interaction term coefficient between digital transformation and labor allocation efficiency is 0.1887 at the 10% significance level.

The result indicates that the mechanism of capital allocation efficiency is not significant for non-manufacturing firms, and digital transformation improves business efficiency by promoting labor allocation efficiency. By comparing the results of the two industries, we find that the coefficient of the 2sls regression for the non-manufacturing industry is larger than that for the manufacturing industry. This indicates that the non-manufacturing industry has a greater potential to improve firm performance through digital transformation. The mechanism test reveals the existence of both capital allocation efficiency and labor allocation efficiency mechanisms for manufacturing firms. However, only the labor allocation efficiency mechanism exists for non-manufacturing firms. In the non-manufacturing sector, firms are primarily engaged in service industries, such as finance, retail, hospitality, and consulting. Unlike manufacturing enterprises, non-manufacturing enterprises rely more on human resources and information technology to provide services. Therefore, digital transformation plays a crucial role in enabling non-manufacturing enterprises to achieve long-distance transmission and globalization of services. Through the application of digital technology, enterprises can offer online services, engage in remote collaboration, and facilitate virtual communication, thereby delivering high-quality services that promote business development and enhance performance. Moreover, by implementing advanced digital technologies and automation systems, companies can enhance the efficiency and accuracy of their production and service processes. This, in turn, helps them reduce costs and increase production capacity, leading to improved performance. These are conducive to the digital transformation of non-manufacturing companies to promote labor allocation and thus improve firm performance.

4.3.3 The nature of corporate equity-based heterogeneity analysis

Our study concludes by conducting regressions based on the ownership nature of the firms. From Table 7, the first column of regression results indicates that digital transformation can promote the operational efficiency of state-owned enterprises (SOEs), with interaction coefficients of 0.5439 and 0.1539 for columns 2 and 3, respectively, that are not significant, indicating the absence of corresponding mechanisms in SOEs. The coefficient of digital transformation and technological progress bias is -28.8068 at the 10% level, indicating that but when the technological progress bias of SOE firms is labor, digital transformation is able to boost firm performance. The 2sls regression result of digital transformation coefficient for non-SOEs is 0.0771, but it is not significant. After adding interaction coefficients, it can be observed that the interaction coefficient of digital transformation and labor allocation efficiency is 0.2324 at a 5% level of significance. This indicates that digital transformation cannot directly impact non-SOE enterprises, and they need to promote labor allocation efficiency through digital transformation to improve firm performance.

On the one hand, due to the large scale and complex organizational structures of state-owned enterprises (SOEs), the process of adapting and implementing digital transformation may take longer. Additionally, the resource allocation of SOEs can be influenced by political factors and stakeholders, which may result in capital and labor allocation not being fully based on efficiency principles. On the other hand, during the digital transformation process, SOEs may prioritize improving operational efficiency and optimizing business processes rather than solely focusing on the efficiency of capital and labor allocation. Therefore, although the efficiency of capital and labor allocation in SOEs may not show significant changes, digital transformation can still lead to improvements in operational efficiency. In contrast, non-SOE enterprises are characterized by their small size and high staff turnover, which results in reduced operational efficiency and increased operating costs. In comparison to large enterprises, small businesses often face limitations in resources and lack economies of scale. Their smaller production scale makes it challenging to achieve procurement and production cost advantages similar to those of larger counterparts. Moreover, high staff turnover poses another challenge for non-SOE enterprises. Intense competition and rapidly evolving industries contribute to employees frequently changing jobs, resulting in the loss of skills and experience and impacting the operational efficiency and business continuity of these companies. The constant turnover necessitates additional investments in recruitment, training, and integrating new employees, thereby increasing labor costs. However, digital transformation presents non-SOE enterprises with an opportunity to address these challenges and enhance their business efficiency. Specially, through digital transformation, non-SOE enterprises have the opportunity to revamp their organizational structures to maximize efficiency, improve capital allocation efficiency, labor allocation efficiency, and reduce costs. This transformative process can ultimately enhance firm performance.

4.3.4 Size-based heterogeneity analysis

Furthermore, our analysis extends to the examination of heterogeneity based on firm size, the outcomes of which are presented below. To delineate, we gauge enterprise size relative to the mean size of the sampled companies: those surpassing the mean are classified as large enterprises, while those falling short constitute small enterprises. The outcomes for large enterprises manifest that digital transformation does not directly engender enhanced business performance. Evidently portrayed in the third column of the table, the interaction coefficient between digital transformation and labor allocation efficiency for large enterprises is 0.2366, significant at the 5% threshold. This observation suggests that substantial enterprises can enhance labor allocation efficiency through digital transformation, thereby fostering enterprise performance. Contrastingly, digital transformation wields a more potent influence on small enterprises, with mechanisms involving capital allocation efficiency and labor allocation efficiency coming to the fore. This suggests that digital transformation can augment the resource allocation and labor efficiency of smaller enterprises, ultimately ameliorating their performance. This discrepancy may be attributed to the smaller scale of these entities and the heightened personnel turnover, culminating in inefficiencies and elevated operational costs. However, through digital transformation, smaller enterprises can reimagine their corporate organizational framework, optimizing efficiency, curtailing costs, and elevating operational efficacy. Importantly, this analysis mirrors our exploration of both SOEs and non-SOEs, thus substantiating the dependability of our findings (Table 8).

5 Conclusions and policy implications

In the rapidly evolving technological landscape of the world, with continuous changes in the global competitive scenario and increasing uncertainty in the economic environment, it is imperative for enterprises to actively embrace change and proactively push forward digital transformation to better adapt to new markets and future challenges. Our study examines the impact of enterprise digital transformation on operational efficiency based on panel data in 2009–2020 for Chinese A-share listed companies over a continuous 12-year period, using a panel fixed-effects model, and conducts relevant robustness tests, mechanism analysis, and heterogeneity analysis. Empirical results show that enterprise digital transformation has a significantly positive impact on firm performance measured by total factor productivity. In other words, rising digital transformation is conducive to improving firm performance the China’s listed firms. The Mechanism analysis reveals that enterprise digital transformation mainly promotes capital and labor allocation efficiency to improve their performance. In addition, we find that firms' technological advances are biased toward labor when it comes to favoring digital transformation for firm performance.

From a regional perspective, the sub-regional benchmark regressions indicate that firms in both the Eastern and Midwestern regions are capable of enhancing their performance through digital transformation. There is a mechanism role of labor allocation efficiency in the eastern region, while there is a mechanism role of resource allocation efficiency and labor allocation efficiency in the central and western regions, i.e., the enterprises in the central and western regions are able to promote the enterprise resource allocation efficiency and labor allocation efficiency through digital transformation, which in turn promotes the performance of the enterprises. However, a comparison between the two regions reveals that digital transformation plays a more substantial role in promoting capital allocation efficiency and labor allocation efficiency, leading to improved firm performance, in the Midwest compared to the East. From an industry perspective, the coefficient of digital transformation is significantly positive for both manufacturing and non-manufacturing firms, as demonstrated by the industry 2sls regression. This implies that both types of firms can enhance their performance through digital transformation. Regarding the mechanism involved, there is a corresponding mechanism role for manufacturing firms. Through digital transformation, manufacturing firms are able to improve their labor allocation efficiency and capital allocation efficiency, consequently promoting their overall performance. At the same time, the technological progress of manufacturing companies is biased towards labor, which is conducive to digital transformation for firm performance. Conversely, the mechanism of capital allocation efficiency for non-manufacturing enterprises is not significant. Digital transformation, in this case, primarily enhances the operating efficiency of enterprises by promoting labor allocation efficiency. From the perspective of the nature of equity, the benchmark regression coefficient of digital transformation for state-owned enterprises is significantly positive. However, there is no mechanism effect observed for capital allocation efficiency and labor allocation efficiency. The technological progress of SOE firms is biased towards labor, which facilitates digital transformation for business performance. In contrast, the coefficient of the 2sls regression for digital transformation in non-state-owned enterprises is positive but statistically insignificant. Nevertheless, a mechanism role is present for non-state-owned enterprises, suggesting that digital transformation does not directly affect them. Instead, it needs to promote the efficiency of capital and labor allocation through digital transformation to improve firm performance. Heterogeneity analysis based on firm size reveals that digital transformation exerts a more pronounced influence on small-scale firms. It facilitates the enhancement of their resource allocation efficiency and labor allocation efficiency, consequently leading to performance improvement. Conversely, for large-scale enterprises, the role of digital transformation is primarily centered around resource allocation efficiency.

The limitations inherent in our paper stem from the potential presence of a minor reverse causality between digital transformation and total factor productivity, notwithstanding our meticulous incorporation of pertinent control variables. Moreover, it's important to note that our current research predominantly centers on elucidating the affirmative influence of digital transformation on firm performance. While we have briefly discussed the adverse impact of digital transformation on businesses in the Mechanisms Test, we have not extensively explored this aspect. However, to pave the way for future explorations, it would be judicious to consider avenues that delve into the realms pertaining to the potential adverse implications of digital transformation on firm performance. This would offer a more comprehensive and well-rounded perspective on the multifaceted interplay between digital transformation and corporate dynamics.

Our study delves deeply into the ramifications of digital transformation on both resource allocation efficiency and labor allocation efficiency within enterprises. By uncovering the intricate interplay among these distinct components, our research offers invaluable insights that shed light on real-world business operations and the formulation of strategic initiatives. The findings of our study suggest that the government should not only encourage companies to enhance their digital transformation efforts, but also promote the widespread adoption of digital technologies to provide the necessary technical support and resources for successful implementation. It is essential to support companies in strengthening their talent development and management capabilities to ensure the success of digital transformation initiatives. Specifically, the government needs to prioritize the digital transformation of enterprises in the central and western regions. The government should enhance the digital infrastructure in these areas, including network coverage and data center construction. This will provide stable and high-speed digital environments, fostering the application and innovation of digital technologies. Furthermore, implementing corresponding policies and regulations to create a more flexible and favorable business environment for enterprises in the central and western regions is crucial. For instance, simplifying administrative approval procedures and reducing related tax burdens can foster a conducive operating environment. The government should also intensify efforts in intellectual property protection to enhance innovation incentives and competitiveness among enterprises in these regions. Additionally, the government can facilitate collaboration and cooperative innovation between non-manufacturing enterprises and universities, research institutions, and technology parks. This joint effort will foster technology exchange and cooperation, promoting digital transformation projects. All of these contribute to improving the performance of the company.

Additionally, companies need to comprehensively consider their current situation and future development, formulate scientifically reasonable digital transformation plans and strategies, strengthen research and application of digital technologies, and establish a digital talent pool. Firstly, enterprises need to comprehensively consider their current situation and future development, including assessing internal resources and capabilities, researching market demand and competitive environment, as well as evaluating the prospects of digital technology applications. It is also important to objectively assess the efficiency of resource allocation and labor allocation within the organization. This ensures that the digital transformation plan aligns with the actual situation of the enterprise, making it feasible and sustainable. Secondly, enterprises need to establish clear and specific digital transformation goals and indicators to measure the effectiveness and outcomes of the transformation. These goals should be specific, quantifiable, and aligned with the core business and strategic objectives of the enterprise. When formulating digital transformation plans and strategies, enterprises should consider digital technologies and tools that are suitable for their own operations and integrate them closely with their core business. Strengthening research and application of digital technologies may involve areas such as artificial intelligence, big data analytics, and the Internet of Things. Collaboration with research institutions and technology vendors can facilitate active technological research and development to meet business needs and maintain competitive advantages. Lastly, enterprises need to establish a digital talent pool to drive the effective implementation of digital transformation. This includes recruiting and developing talents with digital skills and knowledge, fostering digital awareness and capabilities among internal employees, and establishing effective mechanisms for team collaboration and knowledge sharing. These efforts will facilitate the successful implementation of digital transformation, leading to improved firm performance and sustainable development.

References

Abdul Razak Abdul Hadi, Hafezali Iqbal Hussain, et al. 2018. Bank’s performance and its determinants–evidence from Middle East, Indian Sub-continent and African Banks. Polish Journal of Management Studies 17 (07): 17–26.

Acemoglu, D., and P. Restrepo. 2018. The race between man and machine: implications of technology for growth, factor shares, and employment. American Economic Review 108 (6): 1488–1542.

Allen N. Berger, Iftekhar Hasan, Mingming Zhou. 2009. Bank ownership and efficiency in China: What will happen in the world’s largest nation?. Journal of Banking and Finance 33 (1): 113-130.

Babina T., Fedyk A., He A. X., and Hodson J. 2021. Artificial intelligence, firm growth,and industry concentration [R]. Working Paper.

Bakhshi H., Bravo-Biosca A., and Mateos-Garcia J. 2014. The analytical firm: estimating the effect of data and online analytics on firm performance. Nesta Working Paper. 1–3.

Bessen J., and Righi C. 2019. Shocking technology: what happens when firms make large IT investments [R]. SSRN Working Paper.

Bloom, N., S. Raffaella, and V.R. John. 2012. Americans do it better: US multinationals and the productivity miracle. American Economic Review 102 (1): 167–201.

Chen S., Li S., Liu Q., Wang C. 2023. Fertilizing the soil: FinTech development and corporate digital transformation. Digital Economy and Sustainable Development 1: article 1.

Diamond, P.A. 1965. Disembodied technical change in a two-sector model. The Review of Economic Studies 32 (2): 161–168.

Einav L., and Levin, J. 2014. Economics in the age of big data. Science 346(6210):1243089.

Ferreira, J., and C. Fernandes. 2017. Resources and capabilities effects on firm performance: What are they? Journal of Knowledge Management 21 (5): 1202–1217.

Fungáčová Zuzan, Pierre Pessarossi, Laurent Weill. 2013. Is bank competition detrimental to efficiency? Evidence from China. China Economic Review 27: 121-134.

Goldfarb, A., and C. Tucker. 2019. Digital economics. Journal of Economic Literature 57 (1): 3–43.

Gordon Lawrence A, Loeb Martin P, Tseng Chih-Yang. 2009. Enterprise risk management and firm performance: a contingency perspective. Journal of Accounting and Public Policy 28 (4): 301–327.

Hajli, M., J.M. Sims, and V. Ibragimov. 2015. Information Technology Productivity Paradox in the 21St Century. International Journal of Productivity and Performance Management 64 (4): 457–478.

Hanousek, J., A. Shamshur, and J. Tresl. 2019. Firm efficiency, Foreign Ownership and CEO Gender in Corrupt Environments. Journal of Corporate Finance. 59: 344–360.

Kaur J., and Sood L. 2015. Comparison between various types of adder topologies.

Khatib, S., and A.I. Nour. 2021. The impact of corporate governance on firm performance during The COVID-19 pandemic: Evidence from malaysia. Journal of Asian Finance Economics and Business. 8 (2): 0943–0952.

Kim, J., Y.H. Li, and L.D. Zhang. 2011. Corporate tax avoidance and stock price crash risk: Firm-level analysis. Journal of Financial Economics. 100 (3): 639–662.

Lasi H., Fettke P., Kemper H. G., Feld T., and Hoffmann M. 2014. Industry 4.0. Business and Information Systems Engineering 6: 239–242.

Levinsohn, James, and Amil Petrin. 2003. Estimating production functions using inputs to control for unobservables. The Review of Economic Studies 70 (02): 317–341.

Lindstedt, C., and D. Naurin. 2010. Transparency is not enough: making transparency effective in reducing corruption. International Political Science Review 31 (3): 301–311.

Loebbecke, C., and A. Picot. 2015. Reflections on societal and business model transformation arising from digitization and big data analytics: a research agenda. Journal of Strategic Information Systems 24 (3): 149–157.

Loonam, J., S. Eaves, V. Kumar, and G. Parry. 2018. Towards digital transformation: Lessons learned from traditional organizations. Strategic Change 27 (2): 101–109.

Michiels Anneleen, Wim Voordeckers, Nadine Lybaert, Tensie Steijvers. 2013. CEO Compensation in private family firms:Pay-for-performance and the moderating role of ownership and management. Family Business Review 26 (2): 140-160.

Mikalef, P., and A. Pateli. 2017. information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and FSQCA. Journal of Business Research. 1: 1–16.

Mikalef, P., I.O. Pappas, J. Krogstie, and M.N. Giannakos. 2018. Big data analytics capabilities: A systematic literature review and research agenda. Information Systems and e-Business Management 16: 547–578.

Pucheta-Martínez, M.C., Gallego-Álvarez, I. 2020. Do board characteristics drive firm performance? An international perspective. Review of Managerial Science, 14(6):1251–1297.

Verhoef, P.C., T. Broekhuizen, Y. Bart, et al. 2021. Digital transformation: a multidisciplinary reflection and research agenda. Journal of Business Research. 122 (1): 889–901.

Yang P, Riepe J, Moser K, et al. 2019. Women directors, firm performance, and firm risk: a causal perspective. The Leadership Quarterly 30 (5): 101297.

Yang, G., Yao, S., Dong, X. 2023. Digital economy and wage gap between high- and low-skilled workers. Digital Economy and Sustainable Development 1: article (7).

Yao, S. 2023. Editorial introduction, digital economy and sustainable development. 1: article (2).

Yoo, Y., J.B. Richard, and Jr., Kalle L., and Ann M.,. 2012. Organizing for innovation in the digitized world. Organization Science 23 (5): 1398–1408.

Funding

This paper is financially supported by the National Natural Science Foundation of China (72071094).

Chen Chuanglian is grateful for the funding support provided by the National Natural Science Foundation of China (72071094).

Author information

Authors and Affiliations

Contributions

All authors jointly completed this research study, and there is no confict of interest between the authors. The authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

All authors of this article have no objections to the ranking of the authors and there are no conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chen, C., Zhang, Y. & Wang, S. Digital transformation and firm performance: a case study on China’s listed companies in 2009–2020. DESD 1, 18 (2023). https://doi.org/10.1007/s44265-023-00018-x

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s44265-023-00018-x