Abstract

Blockchain-based cryptocurrencies have garnered significant attention from academic and industry. However, systematic studies on cryptocurrency usage patterns and adoption across contexts are limited. Identifying factors and developing predictive models for cryptocurrency adoption remains challenging. This article conducts a systematic review with qualitative and quantitative (mixed) syntheses on the adoption of blockchain-based cryptocurrencies, adhering to PRISMA guidelines. From 579 initial articles, 124 were selected and classified into review-based, exploratory-based, and empirical-based categories. Exploratory articles examined global awareness and ownership of cryptocurrencies. Empirical articles were categorized into general, payment method, investment tool, transfer medium, and other contexts. The review reveals higher awareness and ownership of cryptocurrencies among young, educated males with proficient computer skills in both developed and developing nations. The Technology Acceptance Model (TAM) and its variants are the most frequently used in the surveyed articles. Key factors like Perceived Ease of Use (PEoU), Perceived Usefulness (PU), and Perceived Trust were extensively studied. Studies on payment methods mainly focused on the customer perspective, with limited attention to the service provider perspective. As an investment tool, factors like social influence, PU, financial literacy, facilitating conditions, and perceived risk were significant. For cryptocurrencies as a transfer medium, security and risk perceptions, performance and effort expectancy, and social influence were crucial. In other contexts, trialability, transparency, and cost efficiency drove adoption, with trust and usability being vital for cryptocurrency wallet usage. Additionally, the article proposes an integrative model combining TAM with technical, economic, personal, and environmental factors. The findings from this systematic review will guide future research in developing more comprehensive models for predicting the adopting of cryptocurrencies across various contexts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Blockchain-based cryptocurrencies have revolutionized digital finance by introducing secure, decentralized methods for handling transactions and investments. This technology transcends mere technical advancement, transforming industries ranging from finance to healthcare. Originating from the integration of several concepts [1,2,3], it concluded in the creation of Bitcoin by Satoshi Nakamoto, as described in his paper “Bitcoin: A Peer-to-Peer Electronic Cash System” [4, 5]. Since Bitcoin’s inception, cryptocurrencies have attracted substantial interest from both academia and industry. However, despite this attention, the adoption of cryptocurrencies remains limited across different domains and demographics, presenting significant difficulties and challenges [6]. Addressing these challenges requires an understanding of the factors driving cryptocurrency adoption across various contexts and comprehensive grasp of the current state of blockchain-based cryptocurrency frameworks and their diverse applications [7].

Although there is a considerable body of articles on blockchain-based applications, there remains a gap in the literature related to cryptocurrency, especially in providing a comprehensive overview of its applications and frameworks in various contexts and domains [8]. Open questions remain about the general awareness and ownership of blockchain-based cryptocurrency in developed and developing countries [9]. Furthermore, there is a lack of categorization of external factors deployed by academics to predict the adoption of the technology in various contexts such as personal, technical, economic, and environmental factors [10]. This systematic review addresses this gap by synthesizing existing literature and offering an overview of current research trends. Additionally, it sheds a light on understanding the impact of factors related to the above-mentioned categories, as this is essential for developing a general view of how cryptocurrencies are adopted and implemented across different domains.

Based on the gap in knowledge discussed above, we articulate an overall research question: What is the current awareness, ownership, and factors that influence adoption of blockchain-based cryptocurrency technologies in various domains? This question is explored in detail in Sect. 3, Research Methodology. To answer this question, this systematic review aims to investigate the general awareness and ownership of cryptocurrency across distinct parts of the world. It also explores the themes and contexts in which cryptocurrency has been studied. Additionally, the article examines and categorizes the external factors (technical, Economic, Personal, Environmental) employed to predict the adoption of blockchain-based cryptocurrency. The primary objectives of this survey article are as follows:

-

To explore the awareness and ownership of cryptocurrency across developed and developing countries.

-

To provide a detailed analysis of the adoption of blockchain-based cryptocurrencies in different contexts, namely: general context, payment method, investment tool, transfer medium, and other areas.

-

To categorize the external factors influencing the adoption of cryptocurrency in various contexts into personal, technical, economic and environment groups.

-

To formulate a model to predict the adopting of cryptocurrency in various context.

By achieving these objectives, this article seeks to provide a comprehensive understanding of the current state and future potential of blockchain-based cryptocurrencies across different domains.

The significance of this article lies in its ability to offer a comprehensive outline of the current state of blockchain-based cryptocurrency frameworks and their diverse applications. This review serves as a valuable source for policymakers, industry experts, and academics scholars, aiding them in understanding the complex nature of cryptocurrency applications across various sectors. It includes qualitative analyses of five active research contexts within cryptocurrency adopting. These contexts based on the area of the study and the specific sectors where cryptocurrency adoption has been implemented: general use, utilization as a payment method, use as an investment tool, function as a transfer medium, and other applications. Furthermore, the article categorizes external factors from these empirical articles into four main groups: technical, economic, personal, and environmental. Each category is thoroughly examined to explain its influence on the adoption of cryptocurrency frameworks. However, the data gathered for this paper truncates at the end of 2022 but nonetheless indicates a trajectory of increasing integration of cryptocurrencies within various contexts.

The structure of this survey article is organized in the following sections. Section two offers a critical exploration of related work in cryptocurrency adoptions. Section three details the research methodology that was utilized in this systematic review. Section four presents the research results and answers our research questions. Section five conducts an in-depth discussion about the findings in this review. Section six conclude the article and explain future work.

2 Related work

Blockchain-based cryptocurrencies represent a significant shift in managing digital transactions. Satoshi Nakamoto launched this shift by establishing first blockchain-based cryptocurrency, Bitcoin, in October 2008 [4]. Since then, blockchain-based cryptocurrency has evolved to include smart contracts executed within a distributed network under specified conditions and expanding cryptocurrency applications beyond financial transactions. In 2014, Ethereum emerged as a platform for developing decentralized applications and enhanced the technology's flexibility [11]. The advancements in cryptocurrencies have enabled their usage in various domains, challenging traditional financial systems [8]. Moreover, cryptocurrencies have been adopted as investment tools, simulating stocks markets [12]. Additionally, trading in cryptocurrencies has emerged as a popular domain, enabling traders to exchange various digital currencies [13]. Furthermore, cryptocurrencies have been adapted as a transfer medium, offering a decentralized alternative to money transfer services. Cryptocurrencies are also deployed in supply chain management, and land ownership registration [14].

In the existing literature of cryptocurrency adoption, a few review articles summarized the research. The first relevant article, by Alzahrani S. & Daim T. [9], categorized enabling factors into technical, economic, social, and personal perspectives. From a technical perspective, key factors including control, anonymity, fast transaction, blockchain technology, security, and supporting community. From economic standpoint, most critical factors include investment opportunities, low fees, alternative to banks, limited supply, increase demand, business adoption, and use as a payment method. For social perspective, the most crucial factors include subjective norms, global attention, and influencers involvements. Personal factors include technological curiosity, control over money, and privacy. Furthermore, Al-Amri R et al. identifies the gaps in the existing literature on cryptocurrency adoption, emphasizing the dominance of positivist approaches [10]. Notable gaps include the lack of research on factors such as user resistance to change, monetary uncertainty, value formation, and authority support. Additionally, there is insufficient research on using cryptocurrencies for payments and on adoption from both customer and merchant perspectives.

Thantrige R. H. has categorized factors from the literature based on their impact on individuals [15]. He identified key positive factors such as effort and performance expectancy, perceived benefits, perceived trust, alternative banking, investment system, fast transaction, low transaction fee, anonymity, and the ability of controlling assets. Conversely, frequently mentioned negative factors include perceived risks, security, personal, social, and technical factors, along with distrust in government regulations and financial institutions. In a similar direction, Bhuvana R., and Aithal P. S. ranked factors from the literature [16]. They ranked them from most to least repetitive factor: PEoU, social affect, convenience, perceived trust, price instability, personal believes, privacy, and perceived risk. Sousa, A. et al. further explored the advantages and disadvantages of customer eagerness and trust in cryptocurrency [17]. The article identified several gaps in financial research, geographical focus, theoretical model testing, and attention beyond Bitcoin, as well as a lack of quantitative, business-based, and sustainability studies.

A summary of the above-mentioned reviews is detailed in Table 1. These articles make significant contributions to the literature, yet several limitations have been identified. Initially, there is an insufficient number of systematic review articles addressing the adoption of cryptocurrency. Except for the article by Sousa, A. et al., the other reviewed articles have not been published in recognized and prominent venues. Furthermore, most of these articles do not cover enough articles in term of the volume, an exception is the work by Alzhrani S. and Daim T., which covered 56 articles. Finally, these articles are outdated, highlighting the need for a new article that summarize the most recent advancements. Therefore, conducting a systematic review of the related literature would enhance our overall understanding. This would help in identifying the characteristics of the related literature on the adoption of cryptocurrency using various models and identifying general gaps in literature.

3 Research methodology

A Systematic Literature Review (SLR) is a methodical type of literature review that helps researchers in locating, categorizing, and examining the existing body of literature related to a specific research question. The primary aim of an SLR is to evaluate the current literature in relation to the research question, thereby identifying gaps within it.

3.1 Methodology design

We followed the systematic review guidelines established by the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) [18]. The search strategy, formulated by the authors, was executed in September 2022. The primary aim of this article is to provide a broad evaluation of the current literature on the adoption of cryptocurrency across various domains. To enhance our understanding, we are examining global awareness and ownership of cryptocurrency. Additionally, we categorize factors from existing literature into technical, economic, personal, and environmental factors. By fulfilling these aims, we can develop a model to investigate the adoption of blockchain-based cryptocurrency. Thus, the primary set of questions guiding this review are as follows:

-

Research Question One: What are the general awareness and ownership trends of blockchain-based cryptocurrencies in different countries?

-

I.

How do the pattern of awareness and ownership of blockchain-based cryptocurrencies differ between developed and developing countries?

-

Research Question Two: How is the adoption of blockchain-based cryptocurrencies manifested in various contexts?

-

I.

How do various theoretical models and user behavior articles enhance our understanding of blockchain-based cryptocurrencies adoption in general context?

-

II.

What are the varying perceptions and insights of customers and service providers regarding the use of blockchain-based cryptocurrencies as a payment method?

-

III.

How do various factors impact the decision-making process of individuals considering blockchain-based cryptocurrencies as an investment tool?

-

IV.

What are the key user expectations and barriers identified in the literature regarding the adoption of blockchain-based cryptocurrencies for cross-border asset transfers?

-

V.

How do other adopting area contexts highlight the diverse applications and acceptance factors of blockchain-based cryptocurrencies ?

-

Research Question Three: How can the factors influencing the adopting of blockchain-based cryptocurrencies be categorized into distinct groups?

-

I.

What are the technical, economic, personal, and environmental factors affecting the adopting of blockchain-based cryptocurrency?

-

Research Question Four: How can insights from the surveyed literature be used to develop a model for investigating blockchain-based cryptocurrencies adopting?

3.2 Search strategy and data sources

To identify relevant articles, a series of carefully selected keywords were utilized as search terms. These keywords included “Cryptocurrency Adoption,” “Cryptocurrency Acceptance,” “Cryptocurrency Adoption Models,” “Cryptocurrency Acceptance Model,” “Blockchain-based Cryptocurrency Models,” “Cryptocurrency Adoption Frameworks,” “Cryptocurrency Conceptual Model,” and “Cryptocurrency Acceptance Framework.” The systematic review incorporated articles sourced from a range of reputable online databases such as IEEE, Scopus, ScienceDirect, Web of Science, and Google Scholar.

3.3 Inclusion and exclusion parameters

We limited the search to the articles that fit our inclusion parameters which is listed in Table 2. Our first screening was based on checking the title, abstracts, conclusions, and keywords. Then, we evaluated the body of the paper to find the most suitable paper that satisfies our criteria.

3.4 Data selection

Using the guidelines and search keywords mentioned, the initial database search retrieved (n = 512) articles. Additional articles were identified from other sources (n = 67). After removing duplicate, remained articles reached (n = 518). Then, screening and removing irrelevant articles result (n = 342). Accordingly, 124 articles met our criteria and were divided into the following sections: 5 Review-based articles, 28 Exploratory-based articles, and 91 Empirical Adoption-based articles. The Empirical Adoption-based articles were further classified into five distinct categories based on the domain of cryptocurrency adoption they analyzed, which encompassed general area context, payment method context, investment tool context, transfer medium context and other areas context. Articles falling under the "other areas" category were included due to their focus on domains not previously listed, total. The data section process is depicted in Fig. 1.

3.5 Data synthesis

The diverse range of objectives, methodologies, standards, and contexts in the selected articles lacked sufficient uniformity and consistency for some quantitative analysis methods. Consequently, the article employed various qualitative analysis methods, including thematic analysis, narrative synthesis, and content analysis. Additionally, the article incorporated elements of quantitative synthesis through descriptive statistics.

4 Research results

This section presents the results regarding the collected surveyed papers. The following subsections describe the characteristics of articles, cryptocurrency awareness and ownership, cryptocurrency adopting in different contexts, and categorization of factors.

4.1 Characteristics of articles

This section represents general distribution about the collected papers in this survey articles. We visualized the characteristics analyses, so we can identify trends, domain patterns, and influential factors. The following subsections describe the frequency of keywords, article types, article publishers, methodological approaches, articles domains, articles countries, utilized theories and models, external factors, and their categories.

4.1.1 Occurrence of keywords

Figure 2 depicts the frequency map of keywords occurrences mentioned by the authors of the articles. The bigger square represents the most frequent keywords, while smaller square signifies less frequent keywords. Furthermore, each color represents a cluster where keywords at the center have more frequency than the outer keywords. Thus, cryptocurrency, bitcoin, blockchain were the most used keywords. Then, it followed by the frequency of TAM model, trust, adoption, and financial literacy.

4.1.2 Distribution of article’s types and publishers

Most of the examined articles were published as journal articles with a frequency of 87 articles. Additionally, there were 23 papers published in various conferences around the globe. The distribution of the articles included a wide range of article types involving 10 theses for master and PhD students. Regarding publishers, The leading the venue of publication with around 15% of articles were published in Elsevier, then it followed by publication from various university databases due to the fact many of the articles were based on thesis work from leading universities around the globe, as depicted in Fig. 3.

4.1.3 Distribution of methodological approach

Most researchers preferred to conduct their articles using quantitative research methodology, which constitutes 80.3% (94 articles) of the total, as shown in Fig. 4. Qualitative research is represented to a lesser extent, accounting for 12.0% (14 articles) of the articles. A relatively small number of articles (9 articles) employ a mixed-methods approach, integrating both qualitative and quantitative techniques.

4.1.4 Distribution of investigated perspectives

Figure 5 illustrates the distribution of articles according to the perspective they investigate. Customer’s perspective is the most investigated, comprising around 65% of the articles, compared to other perspectives. This is followed by the “investor perspective” and “service provider perspective” each accounting for 12% of the articles. Only 6.8% of the total examine both the service provider and customer perspectives simultaneously. The least represented are articles from other perspectives, which make up just 4.3% of the total.

4.1.5 Distribution of article countries

Figure 6 depicts the distribution of articles to the country where the experiments were conducted. It reveals that a considerable number of articles (16 articles) focusing on international perspectives. Malaysia leads the count for country specific research with 13 articles, followed by the United States with 12 articles. China and Spain show notable numbers, with 10 and 8 articles, respectively. Furthermore, Germany is represented by 6 articles, while Indonesia has 5 articles. Subsequently, the chart displays a wide range of countries around the world.

4.1.6 Distribution of theories and models in cryptocurrency adopting

Figure 7 illustrates the distribution of the empirical research on TAM, UTAUT, DOI, TPB, TRA and other models on blockchain-based cryptocurrency over the years. It can be observed that the first article dates from 2014, following which is an increasing interest for these experiments in blockchain-based cryptocurrency field. This suggests that it is a matter of concern to the business, scientific and academic communities. The figure demonstrates the type of base-model that has been deployed to conduct these experiments. In this regard, it can be observed that most of the articles use TAM model and its variants as a base conceptual model with over 35% of the articles, yet those that deployed UTAUT model, and its variants consist of slightly over 17% of the articles. Then, it followed by the percentages of articles utilizing the TPB and DOI theories as base model for their work.

4.2 Cryptocurrency awareness and ownership

In this section, we investigate the first research question regarding the general awareness and ownership of blockchain-based cryptocurrencies in various countries. Exploratory based articles provide a comprehensive overview the adoption, awareness, usages, and ownership of cryptocurrencies. These articles shed a light on how the awareness and ownership patterns of the technology differ between developed and developing countries. Notably, these articles do not relay on theoretical or conceptual models. Instead, they include experimental research conducted across diverse cultures, religions, and economic background worldwide. The summary of exploratory-based articles is provided in Table 4 (see Appendix A). Several important findings emerge from these exploratory articles. First, young male individuals with high level of education and with a good grasp of computers have more tendency to be aware of cryptocurrencies than their counterparts [19,20,21]. This pattern of awareness has been discovered in both developed and developing countries, such as Germany, Austria, and Pakistan. This suggests that this group is more concerned about cryptocurrency than others. Second, participants commonly own cryptocurrency as an investment tool rather than for other means [6, 11, 19, 22]. Third, owning cryptocurrency out of curiosity is a repeated theme in different articles [19, 23, 24].

As predicted, our analysis shows that there is generally higher awareness and adoption of cryptocurrencies in developed countries, particularly in the USA, UK, Germany, and Japan, mainly due to access to information and education [20, 23, 25]. Moreover, the main motivations for owning cryptocurrencies in these regions include profit expectations, technological curiosity, low transaction fees, and the desire for freedom and avoid third parties. However, adoption is hindered by regulatory uncertainty, price volatility, security concerns, and complexity [26]. The demographics of cryptocurrency users in developed countries are primarily younger, male, highly educated, and financially literate individuals. In contrast, developing countries show mixed levels of awareness and adoption. Some countries, like Zimbabwe and Morocco, have lower understanding and adoption rates due to strict regulatory and educational barriers [27, 28]. The motivations for adopting cryptocurrencies in developing countries are like those in developed nations, including future potential, wealth empowerment, and technological value, but they are also influenced by local economic instability [11]. Barriers in these regions include misunderstandings, regulatory restrictions, security concerns, and price volatility [29]. Demographic trends are comparable with developed countries, with a focus on younger, educated males, with a technical knowledge [29].

4.3 Cryptocurrency adoption in different contexts

In this section, we investigate the second research question regarding the adoption of cryptocurrencies in various contexts. The section below highlights the most significant contexts that researchers have focused on while examining the technology. First is the general context, which includes broad experimental based articles on cryptocurrency adoption. The second context is payment method context, encompassing empirical research that integrates cryptocurrencies as a payment solution. The third context involves articles adapted cryptocurrency as investment tools, analyzing articles that consider cryptocurrencies. Then, the transfer medium context discusses empirical articles where cryptocurrencies have been used for cross-border asset transfers. Finally, other contexts cover articles that specialize in more specific areas of interest, such as online trading, land registration, and other means.

Regarding the distribution of these contexts in our systematic review, the payment method context represents the largest segment, accounting for approximately 39.6% (36 articles) of the total, as depicted in Fig. 8. This is followed by the general context, which constitutes a substantial 33.0% (30 articles). The investment tool context is represented by 12.1% (11 articles), while the transfer medium context accounts for a smaller share of 5.5% (5 articles). Additionally, 9 articles examined the adoption of technology in other areas context.

4.3.1 Cryptocurrency adoption in general context

In this subsection, we address the first research question from the second set, focusing on the contributions of various theoretical models and user behavior studies to our understanding of cryptocurrency adoption in general context. The topic of cryptocurrency adopting in general context has generated considerable number of articles. We will examine these articles according to different themes covered in literature. The details of the models adopted, the context of each article, the methodologies employed, the factors considered, and the sample sizes are summarized in Table 5 (see Appendix A).

The methodologies approaches vary significantly across these empirical articles in cryptocurrency adoption. Wiguna U et al., Kumpajaya and Dhewanto, Wood J, et al., and Saif A. employed the TAM model or its variations, focusing on factors like social influence, user interface, and TAM’s main constructs [30,31,32,33]. McMorrow J. and Esfahani M., Silinskyte J., Heidari H. et al., Fergyanto E. et al., and Mohomed N. utilized UTAUT or its variations, emphasizing performance expectancy and effort expectancy [34,35,36,37,38]. Schaupp L. and Festa M., Mazambani L. and Mutambara E., and Walton A. and Johnston K adopted the TPB, focusing on attitude, subjective norms, and perceived behavioral control [39,40,41]. The TRA was the base model for articles by Alaklabi S. and Kang K., and Hasan S. Z. et al., focusing more on the impact of diverse types of risks [42, 43]. These empirical articles highlighting the diversity of models used to investigate cryptocurrency adoption.

A Few articles have utilized a qualitative methodology to explore the adoption of cryptocurrency in a general context. Kumpajaya and Dhewanto, Silinskyte J., and Walsh C. each adopted qualitative methods in their research. Kumpajaya and Dhewanto conducted exploratory interviews with Indonesian users, Silinskyte J. focused on examining the perception of Lithuanian customers, and Walsh C. explored the adaption among Irish male millennials [31, 35, 44]. While Kumpajaya and Dhewanto suggested that the perceived compatibility and knowledge have a substantial influence on Bitcoin’s approval, Silinskyte J. indicated that the perceived performance and effort expectancy as well as facilitating conditions are major factors in deciding user adoption of Bitcoin [31, 35]. These qualitative articles enhance our understanding of the nature of cryptocurrency adoption and shape users’ perspectives.

The influence of TAM main factors was a prevalent theme in the literature of cryptocurrency adoption. Wood J, et al. highlighted that the intention to adopt and use Bitcoin/cryptocurrency is considerably motivated by PEoU [32]. Furthermore, Kumpajaya and Dhewanto claimed that PEoU positively impacts PU and intended use [31]. Additionally, Wiguna U et al. highlighted that while the PU of the cryptocurrency wallet is intensely affected by social influence, the PEoU is strongly impacted by the user interface [30]. Also, Saif A. underlined that the PEoU, and PU are major factors influencing the intention to accept and use of cryptocurrencies [33]. Furthermore, the article revealed that the PU and PEoU mediate the relations between the intention to accept cryptocurrency and awareness. However, Walton A. and Johnston K. claimed that the intention to adopt Bitcoin is not directly impacted by PU, and PEoU [41]. These outcomes emphasize the importance of TAM’s constructs in understanding cryptocurrency adoption.

The impact of social influence on cryptocurrency adoption has been discussed in several articles. Saif A. underlined that the social influence is a major variable that determines the intention to accept and use of blockchain-based cryptocurrency [33]. Furthermore, Mohomed N., and Walton A. and Johnston K. highlighted that social influence is a key factor that positively motivates users’ behavioral intention to accept Bitcoin [38, 41]. Also, Walsh C. confirmed that due to social influence people become more aware of cryptocurrency [44]. In contrast, Silinskyte J. suggested that social influence does not affect behavioral intention [35]. Additionally, Fergyanto E. et al. indicated that social influence has less profound impact on behavioral intention [37]. Given the contradictory views presented, it is evident that social influence plays a critical role in shaping attitudes towards. However, its role can vary substantially across distinct perspective and population.

The role of subjective norms in cryptocurrency adoption has been extensively explored in various articles. Kim M. indicated that only three monetary factors (Retention-time, Distrust, and Anxiety) are impacted by subjective norm [45]. Alaklabi S. and Kang K. indicated that the subjective standards are major factor that significantly influences the user intention to adopt blockchain-based cryptocurrency [42]. Furthermore, Schaupp L. and Festa M. highlighted that users’ acceptance and intention of adoption are positively influenced by subjective norms [39]. In contrast, Mazambani L. and Mutambara E. emphasized that the intention to accept cryptocurrency is not associated with subjective norm [40]. These findings suggests that while subjective norms play a critical role in influencing cryptocurrency adoption, their impact can vary significantly across different contexts and populations.

Several articles have explored the impact of perceived trust in cryptocurrencies adoption. Saif A. underlined that perceived trust is fundamental factor affecting the intention to accept cryptocurrency [33]. Similarly, Miraz M. H. et al. indicated that the adoption is affected by trust among other factors [46]. Mohomed N. claimed that perceived trust has a direct impact on users’ behavioral intention [38]. Additionally, Wiguna U et al. suggested that users’ trust increases with government guidelines and security features [30]. Interestingly, Heidari H. et al. identified that personal propensity is a major factor impacting initial trust, which in turns influences the intention [36]. Roppelt, J. C. suggested that cryptocurrency owners have more trust and viewed it as less risky platform [47]. Koroma J, et al. stressed that trust is positively impacted by the technology attachment and transparency. Trust also mediates between transparency and citizens’ behavior [48]. These perspectives underscore trust as a key element in cryptocurrency adoption.

The effect of performance expectancy in the adoption and acceptance of cryptocurrency has been investigated in several articles. McMorrow J. and Esfahani M. indicated that the intention to accept and adopt cryptocurrencies is mostly affected by performance expectancy and effort expectancy, respectively [34]. Furthermore, Heidari H. et al. indicated that performance expectation has an encouraging effect on users’ behavioral intentions [36]. Similarly, Fergyanto E. et al. suggested that performance expectancy was identified as a major factor influencing users in adopting Bitcoin [37]. Conversely, Miraz M. H. et al. claimed that performance expectancy has a negative effect on the adoption of cryptocurrency [46]. Given the contrasting insights on performance expectancy, it is evident that its influence on cryptocurrency adoption is complex. Thus, further investigations are required to explain performance expectancy impact on user behavior and technology acceptance.

The impact of perceived benefits on cryptocurrency adoption has been a focus in several articles. Walton A. and Johnston K. suggested that perceived benefits are among the major enablers impacting Bitcoin adoption intentions [41]. However, these benefits do not directly influence the decision to adopt [41]. Similarly, Alaklabi S. and Kang K. identified perceived benefits and perceived enjoyment as significant influencers of user intention towards blockchain-based cryptocurrencies [42]. Additionally, Hasan S. Z. et al. revealed that perceived benefits and perceived value directly impact the behavioral intention to accept cryptocurrency, with perceived value also playing a critical role in shaping attitudes [43]. Thus, the emphasis on perceived benefits within these articles highlight their critical role in the decision process for cryptocurrency adoption.

The role of price volatility in cryptocurrency adoption in general context has been widely discussed topic across numerous articles. Miraz M. H. et al. indicated that the adoption of cryptocurrency is influenced by price volatility among other factors [46]. Furthermore, Walsh C. highlighted that price volatility is found to be one of the significant factors that impact the intention of Irish male millennials towards cryptocurrency [44]. Additionally, Walton A. and Johnston K. noted that price volatility and the technology’s complexity as major obstacles to investing in and accepting Bitcoin in South Africa [41]. This consensus on the critical impact of price volatility across different demographics and regions emphasize its importance in shaping users’ perception on digital cryptocurrency adoption.

The impact of various risks on cryptocurrency adoption has been discussed in the existing literature. Abramova S. et al. indicated that perceived risk varies depending on users’ experience with cryptocurrency [49]. Roppelt, J. C. indicated that security risks, particularly those cause by external third parties, significantly influence cryptocurrency usage [47]. Walsh C. suggested that financial risk is a key obstacle in adopting the technology [44]. Additionally, Hasan S. Z. et al. confirmed that perceived risk acts as a barrier to the intention of adopting cryptocurrency [43]. M. K. et al. claimed that the risk of Bitcoin acts as a mediator in the correlation involving the intentions and actual behavior [50]. In contrast, Alaklabi S. and Kang K. underlined that personal innovation, privacy risk, and financial risk were not relevant factors impacting users’ intention [42]. These varied outcomes underscore the complexity of risk in cryptocurrency adoption, highlighting the need for more articles to clarify the role of these risks.

The impact of relative advantages and facilitating conditions on cryptocurrency adoption has been considerably discussed in the literature. Wood J, et al. signaled that the intention to use Bitcoin is considerably driven by its relative advantages, visibility, and compatibility [32]. Similarly, Walsh C. confirmed the importance of relative advantage in cryptocurrency adoption in general context [44]. On the aspect of facilitating conditions, Miraz M. H. et al. indicated that the adoption of cryptocurrency is influenced by transaction transparency and facilitating conditions [46]. Furthermore, Fergyanto E. et al. suggested that facilitating conditions as critical factors influencing Bitcoin Adoption [37]. In reflecting on these findings, it is evident that both relative advantages and facilitating conditions play a pivotal role in the adoption of digital currencies.

The impact of knowledge and social media on the adoption of technology was explored in a few articles. McMorrow J. and Esfahani M. suggested that while the technological knowledge has a stronger influence than financial knowledge on the intention to adopt the technology, both factors show weak correlations with attitude and intention towards using cryptocurrencies [34]. In terms of social media, M. K. et al. suggested that social media usage positively affects the intention of adopting Bitcoin. Furthermore, they identified that the intentions of users are consequently related to their genuine behavior toward Bitcoin acceptance in general context [50]. The insights from these articles demonstrate the need for further articles to fully understand the influence of distinct types of knowledge on cryptocurrency adoption.

The adoption of the technology from an Islamic perspective has been explored in several articles. Saleh A. et al. incorporated the TAM, TRA, and the De-individuation Theory to examine cryptocurrency-based transactions from an Islamic perspective [51]. Their research suggests that Shariah compliance, PEoU, PU, emotionality, and financial concern directly impact the behavioral intention to adopt the technology from an Islamic Perspective. Moreover, the article highlights the role emotionality, as a mediator factor in relation to Islamic faith, is affected by financial concern and Shariah compliance [51]. In another article, Al-Amri R. et al. applied the UTAUT model to examine the Islamic Perspective on cryptocurrency adoption [86]. They claimed that behavioral intention is greatly impacted by performance and effort expectancy, social Influence, and shariah compliance. These findings collectively underscore the critical importance of shariah compliance in the adoption of modern technologies within Islamic communities.

Several articles have compared Partial Least Squares Structural Equation Modeling (PLS-SEM) and Artificial Neural Network (ANN) for data analysis. A notable article by Abbasi G. et al. examined the role of individual innovation in mediating the link between performance expectancy and price value [52]. Their findings highlight the significance of trust, performance and effort expectancy, price value, and the individual innovation have an encouraging effect on consumers’ intention to use cryptocurrency. Personal innovativeness and price value were identified as having significant positive effects. Another article by Hussain W. et al., designed a model by integrating TAM with TRA [53]. Both PLS-SEM and ANN analyses revealed that PU is influenced by PEoU, which in turn is affected by optimism. The intention to use cryptocurrency is influenced more by PU than PEoU. Similarly, Alharbi A. and Sohaib O. evaluated the impact of readiness dimensions on cryptocurrency adoption [54]. They found that innovativeness and optimism positively affect adoption, with differences in factor ranking.

A comparative analysis between the PLS-SEM and the fuzzy set Qualitative Comparative Analysis (fsQCA) was conducted by Arias-Oliva et al. [55]. They examined the influence of external factors from financial literature on cryptocurrency acceptance. Their research suggested that performance expectancy, and facilitating conditions are significant determinants of users’ acceptance of cryptocurrency. However, it stressed that the perceived risk, financial literacy, and social influence were not significant in influencing customer intentions. In a subsequent article using fsQCA, the authors found results aligned with their previous work [56]. The Found perceived expectancy is the most influential enabler, then followed by the impact of the effort expectancy and facilitating conditions. However, fsQCA analysis revealed that the perceived risk, financial literacy, and social influence were major factors influencing the intention when combined with other factors. The article emphasized that social influence plays a role as an encouraging factor and suggested that financial literacy affects users’ intention.

Several articles have investigated users’ perspectives on cryptocurrency adoption without using conceptual models. Arli, D. et al. revealed a direct link between users’ knowledge, trust, and cryptocurrency usage [57]. They found that consumers trust their governments and would support cryptocurrency if endorsed by them yet remain anxious about investing and trading. Gafar A. et al. examined factors affecting users’ perception of Bitcoin, finding that its value and expanding network impact perception across generations, while security has insignificant impact [58]. Sobhanifard Y. and Sadatfarizani, S. identified technological skills as the most influential factor in adoption, followed by technological ambiguity and advantages, highlighting motivations like low fees and user control [59]. Wu H. and Chang Y. analyzed loyalty intention to use bitcoin from a customer’s perspective [60]. The results showed that experiential satisfaction was greatly influenced by experiential motivation, experiential strength, and experiential co-creation. These investigations highlight that insights into cryptocurrency adoption can be gained without established models.

4.3.2 Cryptocurrency adoption as a payment method

In this subsection, we address the second research question from the second set, focusing on the varying perceptions and experiences of customers and service providers regarding the use of cryptocurrencies as a payment method. Numerous empirical articles have explored the adoption of cryptocurrencies for payment purposes. These empirical articles have investigated the topic from different perspectives namely customer perspective, service provider perspective, and a combination of both. The details of adopted models, the context of article, the methodologies employed, the factors considered, and the sample sizes are summarized in Table 6 (see Appendix A).

4.3.2.1 Articles covering both customer and service provider perspectives

There are several articles that investigate the adoption of cryptocurrency for payment means from both customer and service provider perspectives. We will analyze these empirical articles according to different themes and topics covered.

The methodologies and stakeholder perspective vary significantly across these empirical articles. In term of deployed methodology, Baur A. W. et al. and Hoeven M. rely more on conceptual and theoretical models, whereas Daryaei M. et al., Leherbauer P., and Temizkan V. et al. utilize expert opinions and qualitative research, respectively [61,62,63,64,65]. In term of stakeholder perspectives, Baur A. W. et al. deployed a unified conceptual model and focused on a broad range of stakeholders, including customers and retailers [61]. Moreover, Hoeven M. utilized two models and differentiates between customers and retailers [62]. Additionally, Daryaei M. et al. center on experts in the tourism sector [63]. Leherbauer P. and Temizkan V. et al. targeted both merchants and customers using a similar approach [64, 65]. This varied focus results in different insights regarding who accepts cryptocurrency and why.

Perceived usefulness (PU) is a recurring theme across several articles. These empirical articles indicate the importance of this factor in adapting the technology. The articles by Baur A. W. et al. and Hoeven M. underscore the significance of PU in accepting the technology as payment method [61, 62]. While both articles indicate the correlation between the PU and the intention to adapt the technology, yet the weight of this factor varies between customer and merchant groups. Furthermore, Daryaei M. et al. supported the same view in their qualitative article with experts in the field [63]. Thus, PU appear to create an encouraging condition for the adoption of cryptocurrencies for payment means.

Technological complexity is among the discussed topics in several articles. The articles by Daryaei M. et al., and Leherbauer P. both identified technological complexity as a barrier to adapt the technology from both customers and services providers [63, 64]. Furthermore, Temizkan V. et al. suggested that some customers who may not appreciate cryptocurrency as a payment method, either due to their limited technological background or they do not have trust in the technology [65]. In contrast, Baur A. W. et al. highlighted that even though both customers and service providers see blockchain technology as a complex platform, they yet come to an agreement that cryptocurrency has a future possibility to be a payment method [61]. This finding indicates the importance of further investigation on the impact of the complexity of underlined technology of cryptocurrency on the intention to use it for payment means.

Some articles investigated the role of risk in shaping the intention to adopt the technology for payment means. Daryaei M. et al. indicated that risk concerns related to loss of wallet secret keys and being a targeted by theft are the main factors that have negative influence in the adoption of the technology [63]. In contrast, Baur A. W. et al. suggested that perceived risk was not mentioned as a major concern during their interviews with participants [61]. This disagreement could be attributed a limitation in Baur A. W. et al. article due to a limited number of participants. However, further investigating is required to confirm the role of risk concerns in both customer and service provider intentions.

The most influencing factors impacting the intention to adapt the technology was an area of discussion across these empirical articles. While Baur A. W. et al. and Hoeven M. emphasize on the major impact of factors like usability and subjective norms, Daryaei M. et al. suggest that government regulation and awareness are the most influencing facts [61,62,63]. Furthermore, Leherbauer P. highlights individual characteristics, readiness, and customization from a customer’s perspective and marketing efforts, image, and transaction speed from service provider viewpoint [64]. Furthermore, Temizkan V. et al. underlined that customers and service providers prefer to buy using cryptocurrency due to speed, secure and low international payment transaction fees [65]. These findings suggest varying focus of articles and varying perceptions of the most influencing factors across different demographic and regional contexts.

4.3.2.2 Articles covering customer perspective

Recent articles have extensively explored customer perspectives on the adoption of cryptocurrencies as a payment method. Employing a variety of methodologies, these investigations have uncovered a wide range of factors that influence the intention to accept the technology in this context. In our analysis, we will analyze these empirical articles, examining the diverse themes and topics they cover.

The methodologies approach varies significantly across these empirical articles. Mendoza J. et al., Albayati et al., Abramova S. and Böhme R., Almarashdeh I., Mendoza-Tello J. C. et al., and Alqaryouti O. et al. all focused on quantitative approaches based on the TAM model but differed in focus of external factors [66,67,68,69,70,71]. While Mendoza J. et al. included perceived security and perceived trust, Albayati et al. focused more on the usability factors [66, 67]. Furthermore, Mendoza-Tello J. C. et al. focused on social commerce effect on Trust [70]. Additionally, Alqaryouti O. et al. article focused more on the perceived benefits influence on the intention of users [71]. This diversity in research highlights the flexibility of the TAM model in exploring various dimensions of technology acceptance.

Two articles adopted a qualitative methodology in their investigation of customer perspective. Alqaryouti O. et al., and Treiblmaier H. et al. utilized qualitative methods, with Alqaryouti O. et al. concentrated on the effect of users’ perceived usefulness and knowledge, while Treiblmaier H. et al. focused on the tourism industry [72, 73]. Both articles included factors from the TAM model, Treiblmaier H. et al. included other factors from the UTAUT, and the Contingency Theory [72, 73]. While Treiblmaier H. et al. examined the travel and tourism industry in Asia Pacific region, whereas Alqaryouti O. et al. investigated payment systems in the United Arab Emirates [72, 73]. Treiblmaier H. et al. highlighted that blockchain and cryptocurrency are complex platforms and poorly understood by the general people due to bad effect from media [73]. These qualitative inquiries shed light on the diverse aspects influencing customer perspectives on technology adoption.

The influence of the TAM main constructs was extensively investigated across several articles on the adoption of the technology. In term of PEoU, Alqaryouti O. et al., Almajali D, et al., Conde N. et al., Nadeem M. et al., Schaupp L. C. et al., and Hamm P. emphasized on the substantial impact of PEoU among other factors on the intention to adapt the technology [72, 74,75,76,77,78]. Conversely, Mendoza J. et al., and Abramova S. and Böhme R. indicated that PEoU is not a major enabler and has weak influence on the intention to adapt the technology [66, 68]. Regarding PU, Mendoza J. et al., Conde N. et al., Nadeem M. et al., Schaupp L. C. et al., and Almajali D., et al. all underlined that PU is an important variable that determines the intention to use the technology [66, 74, 76,77,78]. These findings underscore the importance of TAM core constructs across different contexts and articles.

The impact of trust is a recurring theme in deploying cryptocurrency as a payment method context. Mendoza J. et al. perceived trust does not considerably predict the intention to utilize cryptocurrencies [66]. In contrast, Albayati et al., Ooi, S. K. et al., Schaupp L. C. et al., and Almarashdeh I. suggested that perceived trust is a key factor that significantly impacts consumers decision to the technology [67, 69, 77, 79]. Furthermore, Almajali D., et al. highlighted trust has moderate influence on the intention to adapt the technology [74]. Articles like Mendoza-Tello J. C. et al. highlighted that trust has a major influence on PU, so it has indirect effect on the intention to adapt the technology [70]. These findings together highlight the role of trust in the cryptocurrency adoption, showing its varying degrees of influence across different research perspectives.

The significance impact of diverse types of risks on cryptocurrency adoption is a theme recurrently explored across various articles. Surprisingly, Mendoza J. et al. argued that perceived risk is not a major enabler that predicts the intention to accept digital currencies [66]. In contrast, Abramova S. and Böhme R. suggested that Bitcoin’s potential is undermined by its attachment with diverse types of risks related to financial losses and security breaches [68]. Furthermore, Almajali D., et al., Schaupp L. C. et al. and Conde N. et al. all emphasized that the intention to use cryptocurrency is impacted by perceived risk among other factors [74, 77, 78]. Moreover, Ögel S. and Ögel İ. confirmed that the psychological risks have negative influence on the attitudes to use Bitcoin, though these attitudes are not impacted by performance risk, or privacy risks [80]. These articles show the complex nature of risk perceptions in the context of cryptocurrency adoption.

The influence of perceived trust on cryptocurrency adoption from a customer perspective has been discussed. Ooi, S. K. et al. highlight that users’ intention to use Bitcoin is influenced by perceived trust, which serves as a mediator between Bitcoin use and perceived security [79]. Furthermore, Cordero E. et al. identified trust as the most significant factor on consumer behavioral intention to deploy cryptocurrency as financial tool [81]. Furthermore, Almajali D., et al. and Conde N. et al. suggested that the intention to use cryptocurrency in electronic payments is influenced by perceived trust among other factors [74, 78]. Additionally, Mendoza-Tello J. C. et al. emphasized that the use of social commerce improves user trust which positively reflects on the intention to use cryptocurrency as an electronic payment method [118]. Thus, perceived trust appears to offer an encouraging environment for the adoption of cryptocurrencies for payment means from customer perspective.

The influence of security and control has been a subject of debate in articles investigating cryptocurrency as a payment method. Almarashdeh I. emphasized that security and control is negatively associated with the behavioral intention to use bitcoin as payment method [69]. Furthermore, Ooi, S. K. et al. highlights that customers’ intention to use Bitcoin is considerably influenced by perceived security [79]. Also, Alqaryouti O. et al. convinced that the main enablers of cryptocurrency are perceived security among other factors [72]. In contrast, Nadeem M. et al. highlights that the intention to use Bitcoin is not substantially influenced by the security and control factor [76]. This disagreement of viewpoints could be attributed to regional and cultural differences in investing in cryptocurrency adoption.

The influence of regulatory support on cryptocurrency adoption has been discussed in the literature. Albayati et al. highlighted that regulatory support significantly influence trust level, and consumers feel secured if local governments regulate blockchain and cryptocurrency [67]. Furthermore, Abramova S. and Böhme R. indicate customers concerns about the potential of governmental restrictions on Bitcoin [68]. Additionally, Schaupp L. C. et al. examined the factors impacting intention to adopt cryptocurrency regarding governmental regulations [77]. The article indicated that governmental support would allow more protections and encouraging people to get adopt the technology [77]. In contrast, Yeong Y. et al. found that the government support is not a critical factor in impacting users’ intention in Malaysia [82]. These findings on regulatory support’s influence vary across regions and cultures, suggesting the need for more empirical articles to explore the complex nature of government regulations and cryptocurrency acceptance.

The influence of subjective norms and social influence on the technology adoption has been a crucial point in numerous articles. Alzahrani S. and Daim T. confirmed that experts consider subjective norms as the one of most influential factors that affects users’ decisions to adopt the technology [83]. Furthermore, Almajali D. et al. suggested that the intention to use cryptocurrency is impacted by subjected norms [74]. Additionally, Chen x. et al. highlighted that social influence, along with other factors, significantly affects the adoption through the mediation of customer satisfaction [84]. Similarly, Yeong Y. et al. suggested that social influence has an encouraging impact on consumers’ behavioral intention to adopt cryptocurrency [82]. Furthermore, Schaupp L. C. et al. confirmed that costumers’ intentions are significantly affected by subjective norms [77]. These outcomes underscore the critical importance of social factors in shaping consumer attitudes and intentions toward cryptocurrency adoption.

Several articles have highlighted the role of diverse factors on the adoption of cryptocurrency. Albayati et al. highlighted that after a certain degree of experience, customers feel confident and adopt blockchain-based technologies [67]. While Cordero E. et al. suggested performance expectancy is a major factor affecting user behavioral intention, whereas Hamm P. suggested cost-effectiveness, data confidentiality, fast processing, and large number of accepting service providers are key factors in influencing users’ adoption of cryptocurrency for payment means [75, 81]. Alqaryouti O. et al. highlighted that anonymity, and minimal transaction fees are main enablers [72]. Additionally, Conde N. et al. suggested that the intention to accept Bitcoin in electronic payment is influenced by self-efficacy, and appropriateness of resources [74]. Furthermore, Schaupp L. C. et al. indicated that attitudes are influenced by a range of factors including personal innovativeness, and compatibility [77].

4.3.2.3 Articles covering service provider perspective

Recent articles have explored service provider perspectives on the adoption of cryptocurrencies as a payment method. Employing a variety of methodologies, these investigations have uncovered a wide range of factors that influence the intention to accept the technology in this context. In our analysis, we will analyze these empirical articles, examining the diverse themes and topics they cover.

The methodological approaches across empirical articles on cryptocurrency adoption present considerable diversity. Roos C. and Palos-Sanchez et al. both utilized quantitative methodologies, yet they focused on distinct factors influencing adoption [85, 86]. Roos C. concentrated on business executives' perspectives with more emphasis on effort and performance expectancy, while Palos-Sanchez et al. investigated the same perspective but emphasized on the role of privacy and trust [85, 86]. Additionally, Roussou I. et al., Nuryyev et al., and Guych N. et al. conducted quantitative approaches based the TAM model in their research [87,88,89]. Roussou et al. combined TAM with the Innovation Decision Process Model and focus on perceived security, while Nuryyev et al. emphasized social influence and strategic orientation in the context of SMEs in tourism and hospitality [87, 88]. This diversity in critical points offers varied insights into the factors driving cryptocurrency acceptance.

Two articles adopted a qualitative methodology in their investigation from the service provider perspective. Mehilli L., and Chen S. and Tham A. utilized qualitative methods, with Mehilli L. conducting exploratory interviews with companies’ executives, and Chen and Tham exploring merchants' perspectives [90, 91]. Both articles highlighted the practical advantages of cryptocurrency adoption, such as additional services and uniqueness effects, yet they differed in their emphasis on barriers and obstacles to adopting the technology [90, 91]. While Mehilli L. focuses on Italian perspective, Chen S. and Tham A. explore Australian viewpoint [90, 91]. These regional differences highlight different market dynamics and regulatory environments, which offer various insights in investigating cryptocurrency adoption.

Social influence is significantly discussed factor across numerous articles focusing on the adoption of cryptocurrencies as payment methods from service provider’s perspective. The article conducted by Roos C., Guych N. et al., and Nuryyev et al. all emphasized the role of social influence in this context [85, 88, 89]. However, these articles differ in how strong the influence of this factor. Roos C., and Guych N. et al. suggested the factor has a week and fair influence, whereas Nuryyev et al. suggested a strong influence [85, 88, 89]. This suggests varying perceptions of social influence across different demographic and regional contexts. Therefore, further investigation is necessary to examine to which extend service providers are influenced by the perception and actions of their peers in the industry.

The role of TAM main factors was a common theme across several articles in the literature. In term of PU, Roussou I. et al., Guych N. et al., and Wu R. et al. identified it as significantly impacting technology adoption [87, 92]. Roussou et al. and Guych et al. both found PU to be a major factor affecting user acceptance intentions directly, while Wu et al. highlighted its role in determining e-retailers’ technostress [87, 92]. Regarding PEoU, Roussou I. et al. indicates that the variable has no effect on the acceptance of cryptocurrencies [87]. In contrast, Guych N. et al. underlines that the factor has profound influence on the adoption of the technology [89]. The varied findings on the impacts of PU and PEoU, pointing to the need for a deeper understanding of their roles in different contexts and sectors.

The impact of trust in the context of cryptocurrency adoption as payment method has been a recurring theme in literature. Roos C. indicated that trust hold a fair and direct influence on the intention to use Bitcoin as a means of payment [85]. In contrast, Guych N. et al. suggested that trust in cryptocurrency has a strong positive impact on the perceived usefulness which impact the influence on the intention [89]. Furthermore, Palos-Sanchez et al. states that trust has a significant role on influencing privacy and PEoU. Consequently, the article asserted that trust impacts the intention to use cryptocurrency from an executive manager perspective [86]. While these findings highlight the critical role of trust in shaping service providers perspectives, yet further investigation is required to understand the influence across different contexts and regions.

The influence of distinct types of risks from service provider perspective has been a prevalent theme. Guych N. et al. suggested that financial risk and social risk have no impact on the PU, do not impact of the intention to adopt digital currencies [89]. Furthermore, Wu R. et al. indicated that risks, such as price instability and uncertainty, do not impact cryptocurrency efficacy, which they identified as the most substantial factor in their article [92]. In addition, Bolstler M. examined the influence of accepting Bitcoin as a payment method on enterprise risk management [93]. The results highlighted that many companies have either not addressed or only partially addressed the risks attached with the technology adoption. Notably, there is considerable evidence that risks lack of knowledge in dealing with such modern technology [93]. These findings underscore the complexity of managing and mitigating these risks in a rapidly evolving cryptocurrency adoption.

The most influential factors have been a subject of debate in articles investigating cryptocurrencies as a payment method. While Roos C. suggested that performance expectancy is the most influential factor on the intention, Wu R. et al. suggested that compatibility and convenience are the leading factors that significantly determine e-retailers’ intentions [85, 92]. Furthermore, Chen S. and Tham A. underlined that merchants primarily utilize cryptocurrency payment due to the perceived uniqueness effects that fascinate tourists [91]. In Addition, Jonker N. underline the retailer’s acceptance is greatly influenced by costumer adoption, retailers’ economic gain, and retailer’s accessibility factors [94]. Finally, Nuryyev et al. indicated that social influence, strategic orientation, and owner/manager personal characteristics are the most influential factors [88]. These results imply varying focus of articles and varying perceptions of the most influencing factors across different demographic and regional contexts.

4.3.3 Cryptocurrency adoption as an investment tool

In this subsection, we address the third research question from the second set, focusing on how several factors impact the decision-making process of individuals considering cryptocurrencies as an investment tool. We will analyze empirical articles within the investment tool context according to their themes and topics. The models adopted, context of each article, methodologies employed, factors considered, and sample sizes in the investment tool context are summarized in Table 7 (see Appendix A).

Social influence and subjective norms are recurring themes on cryptocurrency investment intentions. Gupta, S. et al. and Soomro, B. A. et al. both identified social influence as a key variable impacting the intention to invest in cryptocurrency [95, 96]. Similarly, Liaquat S., and Siddiqui A. indicated that the behavioral intentions of users are greatly impacted by social influence among other factors [97]. The same view is supported by the findings from Shin D.’s article [98]. These findings highlight the influence of peers and the surrounding community in cryptocurrency investment decisions. However, the article by Ayedh A. et al. indicates an opposite view, suggesting that the adaption intention among Muslim investors is not significantly impacted by subjective norms [99]. This disagreement could be attributed to religion and cultural differences in investing in cryptocurrency.

Perceived usefulness and financial literacy are among the most discussed topics in numerous articles on cryptocurrency investment. Jariyapan P. et al., and Bharadwaj S. and Deka S. analyzed the impact of these factors, highlighting their substantial effect on the intention to invest in cryptocurrency [100, 101]. Similarly, Liaquat S. et al., Zhao H. and Zhang L., and Gupta, S. et al. supported the same view and confirmed that the intention is greatly influenced by financial literacy among other factors [95, 97, 102]. Contrarily, Pham, Q. T. presented a different view, suggesting the intention of investors to use cryptocurrency is not associated with financial literacy and socio-demographic factors [103]. These findings indicate the importance of further investigation on the effect of financial literacy on the intention to invest in cryptocurrency.

Facilitating conditions and compatibility are key factors in the context of investing in cryptocurrency. Liaquat S., and Siddiqui A., and Ayedh A., et al. underscored the effect of facilitating conditions and compatibility on the intention to adopt the technology [97, 99]. Similarly, Gupta, S. et al. highlighted on the role of facilitating conditions as one of major factors that impact the intention to adapt cryptocurrency as an investment tool [95]. Furthermore, Bharadwaj S., and Deka S. confirmed the influence of compatibility on the intention of young Indian to investing in cryptocurrency [101]. Thus, facilitating conditions and compatibility appear to create an encouraging environment for the adoption of cryptocurrencies as an investment tool.

The impact of perceived risk is a recurring theme in cryptocurrency investment context. Articles including those by Liaquat S. et al., and Pham Q. confirm the effect of perceived risk on the intention to adopt cryptocurrency as an investment tool [97, 103]. Furthermore, Zhao H. and Zhang L. highlighted that the intention to invest in digital currencies has an inverse relationship with perceived risk [102]. In addition, Sukumaran S. et al. highlighted that investors’ intention towards cryptocurrency is considerably influenced by perceived risk [104]. However, Jariyapan P. et al. suggested that perceived risk does not negatively impact the intention to adopt cryptocurrency [100]. These articles underscore varying perceptions of perceived risk across different demographic and regional contexts. The findings highlight the complexity of perceived risk on the intention to accept cryptocurrency as an investment tool.

The role of effort expectancy in the adoption of cryptocurrency as an investment tool has been examined in a limited number of articles. Gupta S. et al. found that effort expectancy minimally affects the intention to invest in cryptocurrency [95]. Furthermore, Liaquat S. and Siddiqui A. suggested that cryptocurrency users do not focus on factors such as effort and performance expectancy [97]. According to these articles the factor appears to be neglected and has minimal impact on users’ intention to invest in cryptocurrency. However, since there are only two articles investigating this factor, further investigations are required on the influence of effort expectancy on the intention to invest in cryptocurrency.

The influence of demographic and profit factors has been a subject of debate in articles investigating cryptocurrency as an investment tool. Articles such as those conducted by Sukumaran S. et al. emphasized the significance of demographic factors such as age and gender. Conversely, research by Pham Q. T. suggested a weak association between socio-demographic factors and the intention to accept cryptocurrency [103, 104]. The article by Mattke J. et al. introduced a fascinating perspective where some investors are motivated by the philosophy behind cryptocurrency rather than profit anticipation. This contrasts with other articles that users primarily focus on financial and profit aspects of investment [12]. These variations suggest that cryptocurrency investment decisions are impacted by a mix of psychological, social, and economic factors that vary across distinct groups, regions, and contexts.

4.3.4 Cryptocurrency adoption as a transfer medium

In this subsection, we address the fourth research question from the second set, focusing on the key user expectations and barriers identified in the literature regarding the adoption of cryptocurrencies for cross-border asset transfers. The adoption of cryptocurrency as a transfer medium has received limited articles in the academic community. We will analyze these articles according to various themes and topics. The models adopted, the context of each article, methodologies employed, factors considered, and sample sizes in the context of transfer mediums are summarized in Table 8 (see Appendix A).

The security and risk perceptions were one of recurring themes in the literature on cryptocurrency adoption as a transfer medium. Hwang Y. and Moon Y. identified these perceptions as major barriers to the adoption of cryptocurrency as transfer medium [105]. Similarly, Jegerson D. et al. identified risk perceptions is a key obstacle to adopted cryptocurrency for remittances in the UAE [106]. Conversely, the article by Ter Ji-Xi J et al. indicated an opposite view, suggesting that perceive risk does not significantly affect the behavioral intention to adapt cryptocurrencies as transfer medium in Malaysia [107]. This disagreement could be attributed to regional differences in trust and familiarity in the underline technology blockchain.

User expectations and perceptions have been critical themes in deploying cryptocurrency as a transfer medium. Articles by Ter Ji-Xi J et al. and Siew Chin w. et al. highlighted the importance of performance expectancy, effort expectancy, and facilitating conditions in shaping user intentions [107, 108]. Furthermore, Siew Chin w. et al. indicated user intentions is significantly impacted by output quality and results demonstrability. All these factors suggest a strong user focus on the efficiency of cryptocurrencies as a transfer medium. Moreover, Shahzad et al. users PU impacts the correlation between PEoU and intention to use in adapting the technology as a transfer medium [109]. These articles highlight the critical role of user expectations regarding the functionality and efficiency of cryptocurrencies as transfer medium.

The articles under review have illustrated numerous mediating factors that play critical roles in the adoption of cryptocurrency as a transfer medium. Jegerson D. et al. identified the significant role of consumer innovation on the intention to adopt the technology [106]. Ter Ji-Xi J et al. indicated the importance of social influence on the intention to accept the digital currencies [107]. Shahzad et al. highlighted the role of perceived usefulness in impacting the intentions of customers [109]. These factors collectively influence the correlation between other factors and the intention to adopt the technology as a transfer medium. Thus, these mediators provide an important insight in understanding how users’ intentions are impacted and influenced when adopting the technology.

Demographic factors and awareness were a topic of discussion in various articles in utilizing the technology as a transfer medium. The article by Ter Ji-Xi J et al. indicates that age plays a significant role in mediating the correlation between social influence and behavioral intentions in Malaysia [107]. This finding implies the importance of age and its impact on the adoption of the technology as transfer medium. Shahzad et al. emphasis on awareness and perceived trustworthiness as significant factors in the acceptance of cryptocurrency as transfer medium in China [109]. A notable observation is these articles are diverse in term of regional cover with focused research in countries like Malaysia, China, and the UAE.

4.3.5 Cryptocurrency adoption in other adoption areas

In this subsection, we address the fifth research question from the second set, focusing on how other adopting area contexts highlight the diverse applications and acceptance factors of blockchain-based cryptocurrencies. Recent empirical articles have explored the adoption of cryptocurrency across different domains. We will analyze each article in terms of context and findings. The models adopted, context of each article, methodologies employed, factors considered, and sample sizes in various adoption contexts are summarized in Table 9 (see Appendix A).

Agustina D. analyzed the context of online cryptocurrency trading, confirming that the PEOU greatly influences PU and attitude towards cryptocurrency [13]. Interestingly, PU did not substantially influence attitude; instead, attitude towards use significantly affects behavioral intention, which impacts actual use. Trialability considerably affects behavioral intention and PEOU, while complexity affects PEOU but not PU. In another article, Hoxha V., and Sadiku S. examined the acceptance of blockchain-based technologies for real estate transaction registration in Kosovo [14]. Their empirical findings highlighted that users have positive perception towards implementing the technology in real estate in Kosovo due to its transparency, security, and cost efficiency Transparency was the most influential variable for adoption intention, followed by cost reduction and security. These articles demonstrate diverse applications in the literature, from online trading to real estate transactions.

The perspectives of cryptocurrency developers and users were analyzed by Folkinshteyn and Lennon through the integration of TAM model and perceived risk factors in their analysis [110]. Their research differentiated between Bitcoin as a digital currency and blockchain as a financial technology, identifying unique risk factors for each. For Bitcoin, the perceived risk includes risks of business failure, security risk and code/crypto error risk, viability of Bitcoin, third party failure, and regulatory risk. For Blockchain technology, the perceived risk includes risk of business bankruptcy, lesser regulatory issues, and fewer security concerns. The article outcome highlighted that Bitcoin as a currency benefit from being an open-source platform, gives users full control, and transactional efficiency. However, it suffers some drawbacks related to error intolerance, and security issues. Conversely, Blockchain technology is regarded as a valuable addition to financial and record-keeping systems, though it is not deemed as a replacement for all users. This article provides a valuable insight into the developers mindset and their deep understanding of the technology.

Bitcoin services were investigated by Yoo K. et al. through the integration of four user-oriented theories: IDT, the Benefit-Risk Concept, TPB, and the Transaction Cost Theory [111]. The article underscored the significance of perceived benefits and services compatibility in impacting customers’ intentions. However, the article emphasized that the perceived risk, cost, and complexity are not significant factors in affecting consumers’ intentions. In a separate article, cryptocurrency wallet services and user experience were investigated by Albayati H. et al. through utilizing the User Experience Questionnaire (UEQ) alongside usability assessments [112]. The article indicates that the use of cryptocurrency wallets is significantly impacted by trust and usability. Furthermore, the article states that trust is influenced by usability via attractiveness. Furthermore, it confirms that users are attracted by the wallet’s usability features. These articles show the diverse investigations in the literature from Bitcoin services to wallet services and user experience.

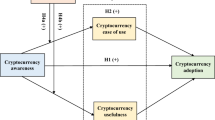

The intention to repurchase Bitcoin was explored by Nadeem M. A. et al. by the Expectation Confirmation Theory (ECT) with TAM model [113]. They found that PEoU and perceived enjoyment are positively affected by users’ expectations. Moreover, the intention to repurchase is considerably affected by PEoU, perceived enjoyment, and satisfaction. Furthermore, satisfaction is influenced by PEoU, perceived enjoyment, and expectation. In a distinct investigation, the intention of keeping Bitcoin under speculation was explored by Huang W. [114]. The article revealed that most participants have limited understanding of Bitcoin’s risk, value, and the technology. The more transactions and perceived speculation risks by investors, the less they perceive the need for governmental regulation. Individuals tend to hold onto their assets regardless of regulations. However, they prefer governmental regulations when they perceive higher Bitcoin prices. These articles investigated the complexity of users’ intentions when it comes to repurchase or hold Bitcoin under speculations.