Abstract

The recognition of climate change as real and unprecedented has been acknowledged by global communities. Furthermore, fossil fuel energy consumption and territorial emissions are identified as major drivers of climate change. Data collected from the World Bank for BRICS (Brazil, Russia, India, China, and South Africa) group of countries for the period from 1990 to 2018, and analyzed using Panel FGLS and Panel GEE models, revealed an inverted U-shaped relationship between GDP per capita and its square with fossil fuel energy consumption in BRICS countries. However, this relationship was not observed with territorial emissions. It is indicated that the BRICS group of countries is making efforts to reduce fossil fuel energy consumption, but investment in green technology is insufficient to reduce territorial emissions. Therefore, it is recommended that climate policies need to be more aggressively implemented to support investment in clean and green energy technology.

Similar content being viewed by others

1 Introduction

Environmental quality raises worry due to global warming and climate change, emerging primarily from greenhouse gases (GHGs) emissions. Some of the major agents behind GHG emission are fossil fuel consumptions, industrialization, urbanization and development, which are the most profound factors of economic growth. Empirical findings [1,2,3,4] verified people’s beliefs in most countries that climate change is anthropogenic and real, which is expected to be more costly in the coming future. Currently, heating, lighting, cooling, and transportation are all heavily dependent on fossil fuel-derived energy [5] and its continuation will linger with the negative impact of climate change [6]. Climate change-induced migration has recently been observed in [7], which shows that South Asia, sub-Saharan Africa, and Latin America will experience over 143 million outward migration [8]. At a global level, countries are coming up with innovative policies, efficient allocation of resources, emission reduction targets, energy-efficient techniques, etc. in order to tackle the problem arising out of climate change. A global consensus, through a continuous effort to understand, adapt, and mitigate climate change, has emerged despite barriers created by climate denials and the withdrawal of the USA from the Paris agreement during Donald Trump period. However, to meet the targets set in the Paris Agreement, fossil fuel energy consumption needs to be checked, regulated, and reduced by most of the countries [9]. Reduction of GHG emission concentration in the atmosphere and reaching net-zero emission require energy and climate policies to comply with the Paris Agreement [10, 11]. It is of the utmost importance to identify energy sources that consistently align with renewable energy consumption trends when analysing policies related to energy transitions and decarbonization [12, 13]. Despite this, subsidy on fossil fuel price is on rise [14] indicating a gross inconsistency in climate policy implementation [15]. Direct subsidy to fossil fuel industry is still on in all most all countries except a few- the United Arab Emirates, China, Morocco, Ukraine, and Egypt- leading to policy ineffectiveness despite UNEP’s effort to create a consensus regarding its negative impact on the global environment [16,17,18].

As most of the developed countries are the main contributors to rising temperature and global warming, they must support, cooperate and take initiatives in terms of technology transfer and finance to mitigate climate change. Several agreements, policies, laws and regulations have been undertaken from time to time to effectively address the climate change issues. However, these initiatives fail to account for the long-term effects of human-caused changes to the global carbon cycle and fail to provide a comprehensive, systemic view that is directed by planetary boundaries, which is concerning from an earth system law standpoint [19].

Multilateral, bilateral, regional and national banks are all well-recognized financing agencies particularly for infrastructure projects, and thus, they can act as regulators in funding only those projects having the potential of low carbon emission [8]. In the case of all infrastructure projects, profitability should not be the priority, rather the focus should be on producing public goods and avoidance of harmful externalities. Such kinds of investments are environmentally friendly and socially desirable [20]. Even though investments in green energy projects are not providing high return, like alternative energy projects, and are not free from risk, yet to achieve the target set in SDGs and Paris Agreements, investment in such projects need to be prioritized with incentives from public authorities [21]. Onshore wind and solar technology projects have already proved to be of low-risk and have drawn the attention of investors largely to invest in such projects [22].

The rationale behind this study is based on the notion that climate change is a real phenomenon and that its negative effects have been felt by the majority of people in the majority of countries throughout the world in the form of extreme weather events such as cyclones, droughts, heatwaves, cloudbursts, and other similar phenomena around the world. Consequently, the nations of the world are now taking this matter seriously. In order to achieve the goal that was established in the Paris Agreement, every nation must reduce the amount of energy that they consume that comes from fossil fuels. Additionally, they must implement policies that encourage investments in green energy while simultaneously moving in the direction of a low-carbon economy or transition. Therefore, this study is an attempt to investigate the drivers of fossil fuel energy consumption and territorial emission in the BRICS countries, the fast-emerging economies, to ascertain whether these countries have started reducing their fossil fuel energy consumption and territorial emission or not.

The study initially estimates fossil fuel energy consumption and territorial emission using its determinants in these countries. In order to know the influence of clean technology funds on fossil fuel energy consumption, we have also introduced a clean technology fund (CTF) dummy in models. The remaining part of the study is as follows. In Sect. 2, we presented an exhaustive literature survey relevant to the study. Theory and practice of fossil fuel energy consumption and territorial emission are discussed in Sect. 3. Methodology and data are explained in Sect. 4, followed by descriptive data analysis in Sect. 5. Section 6 presents the results of panel unit root tests, estimation of fossil fuel consumption and estimation of territorial emission. We discussed the results in Sect. 7, with concluding the study with policy suggestions in Sect. 8.

2 Review of literature

Energy is important for economic growth and therefore, a large number of studies are available in the existing literature about how energy has influenced economic growth worldwide. However, investing rapidly in new energy infrastructure, more efficient use of fuels and electricity, and cleaner power sources is necessary to reduce pollution responsible for global warming as the globe confronts a worsening climate problem in the twenty-first century [23]. To achieve socioeconomic development and energy security within the growth limits set by the global economy's SDG 7 on climate change mitigation, the energy sector must be adequate, which means transitioning to sustainable energy sources [24].

However, a positive and causal relationship was found between fossil fuel energy consumption and economic growth and fossil fuel consumption and CO2 emission in a study conducted for 22 African countries in the long and short terms [25]. Large-scale use of fossil fuels led to a widespread increase in CO2 emission during the nineteenth and twentieth centuries [26] and it, in turn, led to the increase in temperature and crop failure (O’ Leary et al. 2011). Each country is trying to strike a balance between economic growth and measures to mitigate climate changes [27]. Several nations have already begun the process of transitioning to low-carbon energy sources, which is typically driven by economic or health concerns, but climate policies have also played a role in facilitating and driving this transition [28, 29].

Shifting to low carbon energy and renewable energy is also fraught with risk in terms of lowering economic growth, especially for the developing countries, which have to meet the aspirational demands of many people. A causal positive relationship between fossil fuels and real GDP growth was found in all groups of countries (including developing or developed, energy exporters or importers) both in short- and long- terms irrespective of the stage of economic development [30]. This study advised against the direct fossil fuel energy consumption reduction, which might be harmful to economic growth; and suggested encouraging energy efficiency and development of non-fossil fuels energy through direct policy interventions like subsidies, tax credits, etc. [30]. Even the low-carbon energy uses, like nuclear energy and solar power, do not decrease the use of fossil fuels. A study conducted in the US found that under current mining technology, electricity generation skill and government policy, low carbon energy could not replace fossil fuels, which is one of the reasons as to why the US opted out of the Kyoto agreement [31].

However, some studies have found that the use of renewable energy has a favourable impact on total factor productivity (TFP). There is evidence found in the study in 36 countries that the use of renewable energy increases TFP and the use of fossil fuels has a negative impact on TFP [32]. The fossil fuel divestment movement is gaining traction ever since Bill McKibben promoted it in a study in Rolling Stone magazine in 2012. As per fossil fuel network estimates, until 2017, the movement had secured the commitments of approximately US$5.53 trillion. A study investigated the impact of fossil divestment on GHGs emissions and found that the direct impact of divestment is insignificant. However, it argued that the indirect impact of it is substantial in creating social awareness and social acceptance of effective climate policy [33]. Most European countries still depend heavily on fossil fuels, which exceeds more than 60 percent. Some countries, such as UK and Germany, have a higher value than 80 percent [34].

The elimination of fossil fuel consumption subsidies can be an effective tool to reduce the demand for fossil fuels and meeting the targets of the Paris agreement given in Nationally Determined Contributions (NDCs). One study, which focused on 25 countries with high fossil- fuels consumption subsidies, found that reforms in consumption subsidies would help them in meeting the target commitments of the Paris agreement in high global price scenario and low price scenario [35]. Another study in the same domain confirms the short-term benefits of the removal of fossil fuel consumption subsidies; however, it casts doubts about its efficacy in the long- term in the absence of stringent climate policies. It also points out the substitution effect of phasing out the fossil fuel subsidies. As coal receives fewer subsidies, it might make the coal an alternate fuel in place of petroleum products or gas. In addition, coal might even be favorable fuel to renewable energy in price terms [36]. The carbon tax or environmental tax is also regarded as one of the effective tools for addressing the problem of climate change. However, its acceptance is problematic. Its acceptance varies across countries depending upon the awareness of citizens of the country concerned about the climatic problem and people’s trust in its political system. One such study, carried out on 23 countries of the EU in 2016, found that there is a constant interaction between the level of awareness of the climate problem and the political trust of citizens. It found that countries with a population having high awareness about the problem and having trust in their political system have high support for such taxes [37].

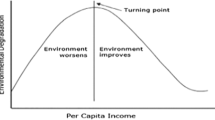

Though the above literature discussed some aspects of fossil fuel energy consumption and carbon emission, it is silent about what drives both especially in the BRICS group of countries. The importance of renewable energy consumption and economic growth as instruments to reduce fossil fuel consumption has recently been realized when signatories of the Paris agreement submitted their Intended Nationally Determined Contributions (INDCs) to reduce carbon emission. Though we cannot ignore the inverted U-shaped Kuznets curve relationship between pollution and income, the same relationship between fossil fuel energy consumption and GDP per capita has given new insight in the study, which will definitely guide policymakers and public authorities of the BRICS group of countries to use GDP per capita as an instrument to reduce fossil fuel consumption and territorial emission.

3 Theory and practice of fossil fuel energy consumption and territorial emission

3.1 Theoretical underpinning

Economic development is related to the environment via energy uses, which has been mapped in the famous inverted U -shaped Kuznets’ curve [38]. It has been found in many developed countries that the pollution level first increases along with economic development and after attaining a certain per capita income, it starts declining. It means the quality of the environment is a luxury good, which has no/ negative value/ demand at a lower level of income, and whose value/demand increases at the higher level of income. After a threshold level of income, the more the level of income, the flatter is the demand curve for quality of the environment, signifying a more income-elastic curve of environment [9].

The developed countries in general have gone through these phases of the Kuznets’ curve [39]. Globalization also plays an important role in environmental quality through many channels. First, it is through the Kuznets’ curve discussed above: the globalization leads to more economic development through more specialization, economies of scale, and innovations based on absolute/comparative advantages leading to more uses of energy (especially fossils fuels), which, in turn, results into the same journey along with inverted U- shaped Kuznets’ curve [9].

Other channels also play roles through globalization, especially in the case of global pollution. As per the race to a bottom hypothesis, the developing countries, in pursuit of getting a competitive edge and for the lack of finance, compromise on environmental norms. The developed countries also get tempted to follow suits to neutralize their advantage, which they claim unfair. The net impact is an increased level of greenhouse gases (especially CO2) leading to global warming. Another channel might be through the pollution heaven hypothesis. It works through the relocation of polluting industries from developed countries to poor / developing countries owing to the lax—environmental rules there. These countries specialize in polluting industries. However, this channel contributes no or less net pollution as a result of the relocation of polluting industries from developed countries to poor countries with weak environmental norms. Globalization does not only contributes negatively to the environment, rather it contributes positively as well through foreign direct investment. It is also through the import of better environment-friendly technologies and adhering to better standards/ norms by industries in general through pressure from the international community (Frankel 2008).

3.2 Policy practice of BRICS countries for effective energy transitions

Most of the BRICS countries have proactively undertaken various initiatives for transitioning towards a low carbon economy [40]. The green practice of Brazil for large use of hydropower, incentivizing green financing with low-interest rate, electric power auctions with fair prices and significant growth of wind power industry make it one of the world's cleanest energy matrix countries. Distributed generation of solar energy in Brazil largely supported its green initiatives, even though there are challenges of regulatory barriers in the free market for these new energy sources. The wide use of ethanol as fuel in flex-fuel cars, policies of biodiesel blending, and natural gas are expected to replace fossil fuel by 2050 in Brazil [41].

Russia’s positions in 2018 as an exporter of natural gas, crude oil and coal was first, second and third respectively. Russia is one of the biggest producers and exporters in the global non-renewable energy market. Green practice, global transitioning towards renewable energy and decarbonisation of energy system are considered as a threat to Russia’s revenue earning from production and export of fossil fuels [42].

India is consistently putting its effort into decarbonizing the energy systems [43]. India promised to have renewable energy- installed capacity of 175 GW by 2022, and substantial portion of it is already achieved due to the promotion of solar and wind energy [44]. In order to promote the manufacturing and adoption of electric vehicles, various initiatives are being undertaken by the Indian Government. The recent energy policy initiatives towards electric mobility facilitated by capital subsidy and income tax exemption in India is one of the best examples of green practice [45].

The massive industrialization and manufacturing activities since the 1980s made China a high-growth economy. However, most of the industries being growth driver, pollute the air, water and soil, contributing largely to climate change [46]. As a result, China included all the relevant policy measures in its agenda to reduce fossil fuel energy consumption to meet the target set in Paris agreement in order to mitigate climate change. As such, China has a policy prescription of discouraging the promotion of coal-based power plants and focusing on green energy integration. China’s policy prescription also includes the promotion of electric cars, Emission Trading System development and reforms in the power sector [47]. As a green practice, China’s coal-fired power plants have been dismantled. China is putting lots of efforts to reduce emission levels along with reducing the number of smog days and lower particulate matter [46, 48]. Due to the recent Coronavirus outbreak from Wuhan city of China and China’s aggression towards its neighbour, the Indo-Pacific partner countries have started supporting each other and their economic exposure to China has been restricted largely in order to isolate China globally. This shows how China is deviating from its commitment to the Paris agreement for sustainable development goals while focusing mostly on aggressive behaviour towards its neighbours [38].

Sustainable/ green energy has been integrated with most of the South African cities during the past two decades. Some of the cities of South Africa contributed immensely in the achievement towards green energy transition with being the world’s leading green cities, while others showed a little progress [49]. In spite of this, around 100 GW of wind energy is needed to meet the energy target of South Africa by 2050. This may not be possible unless the country corrects its ongoing policy uncertainties. Except for the Russian Federation, most of the BRICS countries have already on the way to transitioning towards a low carbon economy.

4 Methodology and data

Key drivers of global economic growth and development are the BRICS countries, which together make up a substantial share of the world's population, landmass, and GDP. Greenhouse gas emissions, water and air pollution, deforestation, and biodiversity loss are some of the major environmental problems they confront. The BRICS countries' commitment to renewable energy sources has the potential to improve environmental sustainability on a global scale. A more rapid shift to a green economy may be possible as a result of the BRICS nations' heavy investment in green technology, innovation, and renewable energy. The BRICS framework provides an opportunity for international collaboration on environmental challenges through joint projects and partnerships. Therefore, BRICS countries are selected for this study.

First, we discussed the estimation strategy followed by sources of data and stationarity of the series as given below.

4.1 Estimation strategy

The step wise methodology used in this study is presented in Fig. 1, which shows why did we select Generalized Estimating Equations (GEE) for this study. In the case of macro-panel, there may be a positive correlation among the residuals over time, and because of excluding some common factors in the model; the cross-sectional dependence may prevail along with the problem of heteroscedasticity [50].

First, we started our estimation using a fixed effect model. However, in the present case, the BRICS group of countries are taken along with the time period between 1990 and 2018. Therefore, fixed is not appropriate because the time period (T) is greater than the number of countries (n) i.e. T > n [51]. The panel data had repetitive observations over time leading to cross-sectional dependence. Panel data often show non-spherical errors because of contemporaneous correlation across the countries and country-level heteroscedasticity. Therefore, we have conducted a test of cross-sectional dependence, heteroscedasticity, and serial correlation. In order to avoid heteroscedasticity and serial correlation issues in panel data, a non-spherical error structure is used to improve inference and estimation by estimating the model using feasible generalized least squares (FGLS) estimator [52]. Just to start with, the estimation process, we may write the Ordinary Least Square (OLS) as

The estimation process of FGLS states to estimate the heteroscedasticity structure from the above OLS as follows. Now, the general case of heteroscedasticity is:

Then,

Hence, in the case of FGLS, \(\widehat{\Omega }\) can be estimated first from OLS, which will be used instead of \(\Omega\). Thus, the beta coefficient in the case of FGLS can be estimated in Eq. 1 as:

However, the confidence interval generated by this estimator was too small, and non-spherical errors were ignored because of less gain efficiency. Therefore, we then estimated the model by Generalized Estimating Equations (GEE). Even in the case of a misspecified correlation structure, GEE provides an unbiased and consistent estimation of standard errors of parameters [53]. Prior to this, Liang and Zeger had recommended that even in case of misspecified “working” correlation structure, the \(\widehat{\beta }\) would be asymptotically consistent if estimated using GEE [54]. In GEE we assume that the outcomes are independent across country/ clusters. However, they are correlated within each country/ cluster. Assuming a relationship between the jth mean of outcome vector \({Y}_{ij}\) and the covariates we can write link function in Eq. 2 as:

\({\text{where}},\) \(\beta\) is the \(p\times 1\) vector of beta coefficient of the GEE and \(l\left(.\right)\) is a link function, which is known and \({X}_{ij}\) is covariates. Liang and Zeger further suggested that the solution of Eq. 3 given below would provide the estimate of the beta coefficient [54].

In Eq. 3, \({\mu }_{i}={({\mu }_{i1}, {\mu }_{i2}, \dots {\mu }_{{1n}_{i}})}^{\prime}\) is the mean vector of the outcome vector, \({Y}_{i}={({Y}_{i1}, {Y}_{i2}, \dots {Y}_{{1n}_{i}})}^{\prime}\). Accordingly, the jth mean of response vector \({Y}_{ij}\) is \({\mu }_{ij}\) where, the cluster/ country is \(i={1,2}, \dots , K\) with jth response as \(j={1,2}, \dots , {n}_{i} .\)

The following Fossil Fuel Energy Consumption (FC) function and Territorial Emissions (TE) function are estimated in this study using panel FGLS and panel GEE models.

where, FC indicates Fossil fuel energy consumption (% of total); TFT indicates Total Fuel Trade (% of merchandise trade); RE indicates Renewable energy consumption (% of total final energy consumption); PGDP indicates GDP per capita, PPP (constant 2011 international $) (PGDP); PGDP2 indicates PGDP square; FDI indicates Foreign direct investment, net inflows (% of GDP); FDI2 indicates FDI square (FDI2); OR indicates Oil rents (% of GDP); CTF indicates Climate Technology Fund; and TE indicates Territorial emissions in MtCO2.

4.2 Data source

Data for this study were collected from World Development Indicators (WDI) of the World Bank for the period from 1990 to 2018 except for the Clean Technology Fund, which was collected from [55]. The linear prediction method was used to fill the gap of missing observations. All the variables in their natural log are used in this study.

4.3 Panel unit root test

Before proceeding to estimation, first, the series of panel data will be tested for stationarity. The available panel unit root test followed in this study is adapted from Levin and Lin [56]. Then we applied the Augmented Dicky-Fuller Test as given in Eq. 6:

where, the null hypothesis is \({\rho }_{i}=0\) as against the alternative hypothesis is \({\rho }_{i}<0\). That means all the series in the panel are non-stationary under the null hypothesis as against fraction of the series in the panel are stationary under the alternative hypothesis.

5 Descriptive data analysis

5.1 Fossil fuel energy consumption

The non-renewable energy resources, which take millions of years to form, are known as fossil fuel and they are depleted much faster than they are formed. These non-renewable energies, known as fossil fuel, comprised oil, petroleum, coal, and natural gas products. The fossil fuel energy consumption in this study is the percentage of total energy consumption.

Figure 2 shows that Brazil’s fossil fuel energy consumption was 51.23% of total energy consumption during 1990. Since then, Brazil observed an increasing fossil fuel energy consumption growth rate until 1996, when it reached to 56.27% of total energy consumption, 3.04% more than its previous year. After 1996, however, the country observed a negative growth rate of 0.09%, when the fossil fuel energy consumption as a percentage of total energy consumption declined from 57.34% in 1998 to 57.29% in 1999. Brazil, however, experienced a minimum and negative growth rate of 4.40% when fossil fuel energy consumption as a percentage of total energy consumption declined to 54.64% in 2003 from 57.15% in 2002. The maximum growth rate of energy consumption of Brazil as a percentage of total energy consumption stood at 4.23% when it increased from 51.32% in 2009 to 53.49% in 2010.

The fossil fuel energy consumption of China always remained above Brazil during our study period. Starting from fossil fuel energy consumption of 75.71% of total energy consumption in 1990, China reached a record level of the maximum amount to 89.11% of total energy consumption in year 2018. In spite of adopting various initiatives, China failed to reduce its rising fossil fuel energy consumption trend as observed from Fig. 2. The annual average growth of fossil fuel energy consumption for China varies between growth rates of − 1.16% to 2.50% during this period. It is observed from Fig. 2 that the fossil fuel energy consumption of China remained historically large.

Russian Federation is one of the major consumers of fossil fuels. During our study period, the Russian federation met around 89.51% to 93.40% of total energy consumption from fossil fuel energy. The annual growth rate of fossil fuel energy consumption of the Russian federation remained more or less stagnant between − 1.49% and 2.94% during the same period.

Just like China, Fossil fuel energy consumption of India has been rising continuously since 1990. The country observed the highest growth rate of annual average fossil fuel energy consumption of 3.40% in 1995. This is because of the sudden jump in fossil fuel energy consumption as a percentage of total energy consumption from 58.01% in 1994 to 59.99% in 1995. Starting with 53.76% of total energy consumption in 1990, the fossil fuel energy consumption of India reached its maximum at 76.52% in 2018. India’s rising fossil fuel energy consumption may be attributed to its rising population leading to rising energy demand, inadequate investment in renewable energy leading to less access to clean energy, and insufficient funding for research and development to harvest renewable and clean energy.

South Africa is one of the leading consumers of fossil fuel energy. Fossil fuel energy consumption of South Africa varies between 84.24% and 88.15% of total energy consumption with annual average growth rates varying between − 1.5% and 1.76% during our study period. South Africa has not yet focused on harvesting renewable energy adequately and the country is largely dependent on fossil fuel energy to meet its rising energy demand.

5.2 Total fuel trade

Total Fuel Trade consists of Fuel exports and Fuel imports in the BRICS group of countries. Fuel is consisting of (i) petroleum, petroleum products, and related materials- petroleum oils, oils from bitumen materials, crude; (ii) petroleum oils or bituminous minerals > 70% oil; (iii) residual petroleum products, n.e.s., related mater; (iv) gas, natural and manufactured; (v) liquefied propane and butane; (vi) natural gas, whether or not liquefied; (vii) petroleum gases, other gaseous hydrocarbons, n.e.s. (viii) coal gas, water gas & similar gases (excluding hydrocarbon.) and (iv) electric current. Here, fuel exports and imports are considered as the percentage of total merchandise trade (aggregate of total merchandise imports and exports).

Figure 3 and Table 1 show that Brazil observed a considerable variation of total fuel trade from 10.02% to 29.30% of total merchandise trade with growth rates varying between − 25.48% and 35.76%. Starting from total fuel trade as 29.12% of total merchandise trade in 1990, Brazil experienced a highly fluctuated trend until 2018, when it realized total fuel trade as 27.59% of merchandise trade. However, during this period, on an average, total fuel trade declined till 1998, when it reached to 10.02% of total merchandise trade with an annual average growth rate of − 18.44%. Thereafter, it started rising on an average until 2018.

Like any other country of BRICS group, the growth rates in total fuel trade of China as a percentage of total merchandise trade remained highly volatile –ranging between the annual growth rates of-31.80 percent and 62.16%. At the same time, the total fuel trade of China highly fluctuated between 6.88% and 19.94% of its total merchandise trade. The trend of total fuel trade of India as a percentage of total merchandise trade saw, on an average, a rising trend with annual average growth rate fluctuation between − 31.90% and 49.47%. Russian Federation also has experienced a similar growth pattern of total fuel trade as India. The total fuel trade of the Russian Federation fluctuated between 42.66% and 72.58% of total merchandise trade from 1990 to 2018. Therefore, its annual average growth rates of total fuel trade fluctuated between − 25.72% and 25.14% during the same period. However, South Africa has realized a relatively rising trend of total fuel trade as a percentage of total merchandise trade during the study period except during 1995 when its total fuel trade increased suddenly to 17.32% of merchandise trade, a growth by 197.89% as compared to its previous year. If this outlier is ignored, the annual average growth rates of total fuel of South Africa fluctuated between − 24.23% and 23.65%. A sudden jump of the total fuel trade growth of South Africa by 197.89% in 1995 is due to the fact that both fuel export and fuel import jumped suddenly to 8.95% of total merchandise export and 8.37% of total merchandise import, a 64.49% and 2138.29% more annual average growth than its previous year respectively.

5.3 Renewable energy consumption

Here renewable energy consumption is considered as the share of renewable energy in total final energy consumption. The emphasis on renewable energy is increasing continuously in all the BRICS countries in general. It might be because of their commitments to reducing GHGs under the Kyoto Protocol and the Paris Agreement. However, as a percentage of the total energy consumption, its share is fluctuating in the given sample period. Figure 4 shows that Brazil and India have had the highest share among the BRICS countries, whereas Russia had the lowest share of its total energy consumption. Brazil had a 49.8 percent share of renewable energy in total energy consumption in the year 1990, which has come down steadily to 40.5 percent in the year 2018, with negative and positive growth rates during the period. The minimum and maximum growth rates of its share in total energy consumption were 4.58 in the year 1995 and 5.3 percent in 2003 respectively.

China started its journey in the given sample period with a 34.08 percent share of renewable energy of its total energy consumption in the year 1990 and ended with 11.97 percent in the year 2018. It is the country which had negative growth rates in the share of renewable energy to total energy consumption in most of the years of the sample periods. Its maximum share of 34.08% was in 1990 (the starting year in the sample) and the minimum share (9%) was at the last year of the sample periods (2018). It had a minimum growth rate (− 17.74%) in the year 2016 and a maximum growth rate of 3.61 was in the year 1996.

India had the maximum share (58.65%) of renewable energy vis-a-vis total energy consumption in the year 1990, which gradually declined to 31.88 percent in the year 2018, though total absolute energy consumption from renewable sources has seen continuously increasing during this period. Its maximum share was in the year 1990 and the minimum share was at the end of sample periods (2018). India had the minimum (− 6.55 percent) and maximum (0.54%) growth rates of renewable energy consumption to total energy consumption in the years 2009 and 2003 respectively.

The Russian Federation has had the minimum share (among BRICS countries) of renewable energy consumption to its total energy consumption during the sample periods- 3.75 percent in 1990 and 3.32% in 2018. It might be because Russia is one of the largest producers and exporters of fossil fuels. It had a minimum share (3.22%) of renewable energy in the year 2011 and a maximum (4.03%) in 2013. The minimum and maximum growth rates of − 9.8 percent and 11.64 percent were recorded in the years 2008 and 2013 respectively.

South Africa had a 16.62% share of renewable energy in its total energy consumption in the year 1990 and had a 16.18 percent share at the end of sample periods with small fluctuation in the share throughout its sample periods. Its minimum share (15.5%) was in the year 2009, while it recorded the maximum share (19.12%) in the year 2001. It recorded the maximum growth in the share of renewable energy consumption to total energy consumption in the year 2010, which is 9.69 percent. The minimum growth of − 5.04% was recorded in the year 2016.

5.4 GDP per capita

GDP Per Capita as per Purchasing Power Parity Method is an important indicator signifying the average living standard of the citizens of the country. BRICS are the fast emerging countries, which is testified by their fast increasing per capita income. Now the world business cycle is more synchronized because of the increased level of globalization. However, the BRICS countries weathered the downturn phases in the wake of the 1997–98 South East Asian Crisis and 2008 subprime crisis well and continued their northward journey. It shows the resilience power of their economies.

Figure 5 and Table 1 show that Brazil started in the sample period with US$ 10,342 per capital in 1990 and ended with US$ 14,283 in 2018. It had a maximum growth rate of 6.5 percent in 2010 and a minimum growth rate of − 4.35 percent in the year 2015. It had small dips of almost 1 percent in per capita income growth in the years 1998 and 1999, just after the 1997 currency crisis, and in 2009 in the wake of the subprime crisis.

China has recorded miraculous growth in the per capita income in the sample period. It started with a modest per capita income of US$ 1521 in 1990, which was even lower than India’s per capita income, and ended with the US $16,187. It accounted for the highest growth rate of 13.6% in per capita income in the year 2007 and a minimum growth rate of 6.1% in the year 2018. It recorded the growth rates in all years of the sample period, which showed their successful implementation of counter-cyclical policies in the wake of the currency crisis and the subprime crisis.

India also started with a modest per capita income of US$ 1906 in the year 1990 and ended with a per capita income of US$ 6899 in the year 2018. It also managed the two financial crises well during the sample period and recorded growth rates in per capita income during all years (except 1991). However, India has lagged much behind China in spite of its initiating the structural reform program in the year 1991. It might be the result of multiple reasons, including better labor laws and world-class infrastructure in the Special Economic Zones on the eastern coast of China. India had the highest growth rate of 7.4% in the year 2010 and the lowest growth rate of -0.98 percent in the year 1991.

Russia had a history of development after the dissolution of the Soviet Union, which is also reflected in the growth rate of its per capita income. It started with reasonably high per capita income (US$ 20,639) in the year 1990, which nosedived to US$ 11,918 in the year 1998 in the wake of the currency crisis. It was also the nadir point for Russia in the sample period. Thereafter, it is increasing continuously except for a few years, when oil prices fell to record low levels. In the year 2018, it had a per capita income of US$ 26,253, the highest in the BRICS countries. It had the highest growth rate (10.46%) in per capita income in the year 2010 and the lowest growth rate (− 14.6%) in the year 1992.

South Africa had US$ 9900 per capita income in the year 1990 and US$ 12,144.7 in the year 2018. It also felt the brunt of two crises experienced by the world during the sample period, recording negative growth rates of 1.09 and 2.8 percent in the years 1998 and 2009 respectively. It had a maximum growth rate (4.27%) in the year 2006, just before the Subprime crisis, and a minimum growth rate (− 4.5%) in the year 1992.

5.5 Foreign direct investment, net inflows

We considered Foreign Direct Investment net inflows as one of the major factors to estimate fossil fuel energy consumption. The BRICS countries are fast emerging countries. The FDI has played an important role in this regard. The BRICS countries are trying hard to invite FDI in all sectors (except a few sensitive areas) by creating a conducive business environment (Fig. 6).

Brazil’s net inflow of FDI was 0.21 percent of GDP in the year 1990, which increased to 4.72 percent of GDP in the year 2018. It was maximum (5.03 percent of GDP) in the year 2000 and minimum (0.18 percent of GDP) in the year 1991.

China has been opening its economy to FDI right from the beginning. China’s FDI net inflow as a percentage of GDP was 0.966% in the year 1990, which increased to 1.5 percent of GDP in the year 2018. Its FDI share was maximum (6.13% of GDP) in the year 1993 and minimum (0.96 percent of GDP) in the year 1990. China has emerged as a world factory where almost all big companies have opened their operations owing to the conducive business environment there.

India has also progressively opened its economy to FDI from the year 1991 onwards after launching the massive reform program in the wake of the balance of payment crisis. Its net inflow of FDI as a percentage of GDP was 0.073 percent in the year 1990, which increased to 1.54% of GDP in the year 2018. India recorded the maximum FDI inflow as a percentage of GDP (3.6%) in the year 2006 and the minimum (0.027%) in the year 1991.

After the dissolution of the Soviet Union in the year 1991, Russia also opened its economy to the world. Its FDI net inflow share as a percentage of GDP was to the tune of 0.25 percent in the year 1992, which increased to 0.52 percent of GDP in the year 2018. It recorded the maximum FDI net inflow as a percentage of GDP (4.5%) in the year 2008 and the minimum (0.17%) in the year 1994.

South Africa had a negative net FDI inflow as a percentage of GDP (− 0.065%) in the year 1990, which increased to positive 1.48% of GDP in the year 2018. It recorded the maximum share (5.8%) of net FDI inflow as a percentage of GDP in the year 2001. The minimum share as a percentage of GDP was recorded in the year 1990 when it was negative net inflow as a percentage of GDP (− 0.065%).

5.6 Oil rents

The estimates of natural resource rents are calculated as the difference between the price of a commodity and the average cost of producing it. This is done by estimating the world price of units of specific commodities and subtracting estimates of average unit costs of extraction or harvesting costs (including a normal return on capital). These unit rents are then multiplied by the physical quantities countries extract or harvest to determine the rents for each commodity as a share of gross domestic product (GDP). Oil rents are the difference between the value of crude oil production at world prices and total costs of production.

Figure 7 and Table 1 revealed that except for the Russian Federation, which is at the top, and South Africa, which is at the bottom, the rest of the BRICS group countries followed a similar growth pattern of oil rent. Both Table 1 and Fig. 7 show that Russian Federation witnessed an outlier in its oil rent trend during 1999 when the annual average growth rate of it reached 375.27% from − 62.73% recorded during the previous year. Ignoring this outlier, the growth rates of oil rent in the Russian Federation varied between − 62.73% and 84.69%, whereas the oil rent fluctuated between 1.650% and 14.48% of GDP. However, the oil rent in South Africa remained at a very subsistent level that fluctuated between 0% and 0.21% of GDP during our study period. Except for these two extreme countries, the rest of the countries of the group follow a similar growth pattern in oil rents—Brazil’s trend of oil rent varies between 0.25% and 2.50% of GDP, and China’s trend of oil rent varies between 0.20% and 5.20% of GDP without any significant amount of outlier in both cases. Similarly, the oil rent trend of India fluctuated between 0.24% and 1.78% of GDP with its annual average growth rate varying between − 61.73% and 67.85%.

5.7 Climate technology fund

The Clean Technology Fund (CTF) provides scaled-up financing to contribute to the demonstration, deployment and transfer of low carbon technologies with a significant potential for long-term reduction of greenhouse gas emissions (GHG). It provides concessional financing, channelled through six partner multilateral development banks (MDB), to large-scale, country-led projects and programs in renewable energy, energy efficiency and transport. The CTF supports countries and regions through strategic investment plans of their own design, and Dedicated Private Sector Programs (DPSP), which includes projects in additional countries. Countries covered under CTF are Chile, Colombia, Egypt, Honduras, India, Indonesia, Kazakhstan, Mexico, Morocco, Nicaragua, Nigeria, Philippines, South Africa, Thailand, Turkey, Ukraine, and Vietnam. Thus, India and South Africa are the only two countries from the BRICS group of countries covered under CTF.

5.8 Territorial emissions

On the basis of production, countries usually measure their carbon dioxide emissions. Countries used this accounting method to measure carbon dioxide emission while reporting the same and setting the target at domestic and international level. The emission measured by the countries through a production-based accounting method is known as territorial emission [57].

International trade plays an important role as a dividing line between consumption and production-based emission. Countries have been measuring and reporting their territorial production-based emission to each international agreement starting from the Kyoto Protocol to the Paris Agreement. Figure 8 envisaged that the average growth rate of territorial emission of Brazil during the last 29 years stood at 2.98%, while the maximum growth rate reached 14.20% in 2010. India and China have a similar growth pattern of territorial emission. The average growth rate of territorial emission of India and China during the last 29 years stood at 5.40% and 5.34%, while they reached a maximum growth rate of 11.35% in 2008 and 17.71% in 2003 respectively. While the average growth rate of territorial emission estimated at − 1.25% for Russia, the same is estimated at 1.58% for South Africa during the last 29 years. The maximum territorial emission of Russia stood at 5.51%, whereas of South Africa, 13.42%. As seen above, BRICS group countries are now leading the dynamics of global emission as their living standard is shifting from low to medium and medium to high level. They are now following the growth and consumption path of developed countries, which need to be checked through reforms in climate policy. Their territorial emission is rising fast, though they are also contributing largely to consumption-based emission due to their dependence on imports [58].

6 Results

The data set used here is panel data. Therefore, first, we conducted panel unit tests and then estimated fossil fuel energy consumption using Fixed Effect, FGLS, and GEE, as given below.

6.1 Panel unit root test result

We have used Levin-Lin-Chu; Im-Pesaran-Shin; Fisher Chi-square; and Harris-Tzavalis panel unit root tests to understand the nature of the series. Under the null hypothesis, we assumed that all the series in the panel are non-stationary as against under the alternative hypothesis that a fraction of the series in the panel is stationary. The majority of the unit root tests shown in Table 2 rejected the null hypothesis in the case of the Total Fuel Trade (TFT) and Foreign Direct Investment (FDI) series in the panel, while in the case of the remaining series in the panel they do not reject. This indicates that none of the series in the panel, except TFT and FDI, is stationary at level. However, the majority of the panel unit root tests shown in Table 2 reject the null hypothesis in the case of all series in the panel in their first difference indicating that they all are stationary at first difference. Therefore, we considered first difference of all the variables in all the models (Table 2).

6.2 Estimation result of fossil fuel consumption

Results in Table 3 show the estimation of fossil fuel energy consumption using the Fixed Effect Model, FGLS, and GEE. Because of the limitations explained in the methodology section, we did not consider Fixed Effect model for analysis purposes.

Besides, diagnostic test results in Table 3 revealed that there are cross-sectional dependence, heteroscedasticity, and autocorrelation issues in the data set suggested by Breusch-Pagan LM Test for Cross-Sectional Independence, Modified Wald test for group-wise heteroscedasticity, and Wooldridge Test for autocorrelation respectively. Therefore, we have estimated fossil fuel consumption using a feasible generalized least square (FGLS) model as shown in Table 3. In FGLS, we found that RE, FDI, PGDP, and PGDP2 are statistically significant predictors of fossil fuel energy consumption.

6.3 Estimation results of territorial emissions

Results in Table 4 show the estimation of Territorial Emissions (TE) using the Fixed Effect Model, FGLS, and GEE. In the Fixed Effect model, only three variables are statistically and significantly influencing TE. However, due to the limitations of the use of the Fixed Effect model in the case of the BRICS group of countries, we have discarded it for analysis purposes.

Our diagnostic test results of Breusch-Pagan LM Test for Cross-Sectional Independence, Modified Wald test for group-wise heteroscedasticity, and Wooldridge Test for autocorrelation suggested cross-sectional dependence, heteroscedasticity and autocorrelation issues in the data respectively (please see Table 4). Therefore, we have estimated TE using a feasible generalized least square (FGLS) model as shown in Table 4. In FGLS, we found that while FC, TFT, RE, and FDI2 predicted TE significantly, our interest variable PGDP and PGDP Square remained insignificant in predicting it.

Again, in order to check the robustness of the FC and TE model, we estimated them using GEE. We now found that our results are robust because there is no much change in sign and magnitude of the beta coefficients even after changing the models in the case of both FC and TE (please see Tables 3 and 4).

7 Discussion

FGLS estimation results shown in Tables 3 and 4 revealed that renewable energy consumption played a statistically significant role in predicting both fossil fuel energy consumption and territorial emission significantly, keeping all other factors constant. Thus, a 1% increase in renewable energy consumption leads to declining fossil fuel energy consumption by 0.112% and territorial emission by 0.1% statistically at 1% and 10% level of significance respectively in BRICS group countries, other things remaining constant. This is because most of the countries in BRICS have increased their renewable energy installed capacity substantially. They all are now trying to increase their share of renewable energy to the total energy consumption significantly in order to meet their respective Intended Nationally Determined Contributions (INDCs) as a part of the Paris agreement. Among others, India and China are aggressively investing in renewable energy projects including Solar, Wind, and large hydropower projects. Therefore, investment in renewable energy will significantly reduce fossil fuel energy consumption and territorial emission.

While FDI, as shown in Table 3, influenced fossil fuel energy consumption statistically and positively at a 5% level of significance, FDI square remained insignificant in predicting it. This shows that as of now BRICS group countries have not successfully regulated and diverted FDI for clean energy production, consumption, and import. Most of the FDI has directly or indirectly promoted increasing consumption of fossil fuel energy, as the result shows that a 1% increase in FDI inflow increases fossil fuel consumption by 0.0028%, statistically at a 5% level of significance. Two major over-populated countries of the world -China and India- are there in BRICS group countries demanding more energy to consume. Therefore, FDI in the BRICS countries should be directed to green production and green economic activities in order to ensure less fossil fuel energy consumption. However, the result shown in Table 4 revealed that while FDI failed to predict territorial emission, FDI square influenced it negatively at a 10% level of significance. In long run, FDI inflow may be one of the instruments in reducing territorial emission because the result shows that territorial emission is reduced by 0.002% with every 1% increase in FDI inflow, controlling all other factors.

Quite interestingly, while GDP per capita influenced fossil fuel consumption statistically and positively at a 5% level of significance, GDP Per Capita square influenced it negatively at the same 5% level of significance, keeping other factors constant. This throws some important insights regarding the GDP Per Capita and fossil fuel energy consumption relationship. This is equivalent to the environmental Kuznets curve relationship, which states that during the early stages of development, when GDP Per Capita increases, fossil fuel energy consumption also increases, but after reaching a threshold point, fossil fuel energy consumption declines as GDP Per Capita continues to increase, keeping all other factors constant. This happened beyond a certain point of per capita income because due to rising income, the BRICS group of countries started using clean and renewable fuels with the objective of lowering pollution. However, territorial emission has not yet been influenced by GDP per capita and GDP per capita square as both predictors remain insignificant in predicting the same while keeping all other factors constant. It is a matter of serious concern that when fossil fuel energy consumption can be reduced beyond a certain point because of rising income, the same is not happening in the case of territorial emission. Therefore, though investment in renewables and energy-efficient technology have already been initiated, it is not adequate to impact the reduction of territorial emission.

In the FGLS model, we also introduced a CTF dummy to know the influence of it on fossil fuel energy consumption and territorial emission. Again, other things remaining constant, CTF failed to predict both fossil fuel energy consumption and territorial emission statistically and significantly, suggesting that fund transfer under CTF remained inadequate as of now in the BRICS group of countries. Therefore, an adequate amount of investment in clean energy technology, facilitated by CTF, is required to reduce fossil fuel consumption and territorial emission significantly. Total fuel trade and fossil fuel energy consumption both influenced territorial emission positively at a 1% level of significance each, controlling other factors. This is obvious that both total fuel trade and fossil fuel energy consumption contribute largely to territorial emission in BRICS group countries, which must be curtailed down in order to meet the target set in the Paris agreement.

8 Conclusion and policy implication

This research examines the impact of renewable energy consumption on reducing fossil fuel energy consumption and territorial emissions through the use of Fixed Effect, FGLS, and GEE models. All estimated models have yielded consistent results, with beta coefficients maintaining the same sign, indicating the robustness of our findings.

The findings indicate that increased use of renewable energy led to a decrease in fossil fuel energy consumption and territorial emissions in the BRICS countries. The BRICS countries, particularly India and China, have expanded their capacity for solar, wind, and substantial hydropower, leading to a shift from fossil fuels to renewable energy sources in an effort to transition to a low-carbon economy. In addition to this, foreign direct investment remained a positive and significant predictor of fossil fuel energy consumption. Therefore, BRICS group countries should regulate and divert FDI for clean energy than dirty energy. Rising energy demand, in the case of both China and India, should be met from renewable energy sources. FDI should be allocated using some policy reforms, to play a major role in its generation, distribution, and consumption. Adequate investment in clean energy technology needs to be promoted in all BRICS group of countries, while the focus should be on renewable than relatively clean fuel in the fossil fuel category. As of now, India and South Africa are the only two countries among the BRICS group of countries receiving clean technology funds, which are also not adequate. The results indicate that fossil fuel consumption initially increased as income levels rose, but eventually started to decline after reaching a certain threshold. This suggests a relationship similar to the Kuznets' inverted U-shaped curve between GDP per capita and fossil fuel consumption. Fossil fuels are primarily responsible for both local and global pollutants, including greenhouse gases. The BRICS countries have begun to recognize the negative effects of fossil fuel consumption and are investing a portion of their increasing affluence in expanding renewable energy capability. Renewable energy consumption has risen while fossil fuel energy consumption has decreased in most BRICS countries. However, territorial emissions have not been affected by increasing income or economic progress. Policymakers should utilize income as a tool to decrease fossil fuel energy consumption and territorial emissions, facilitating the shift towards a low carbon economy. It should be politically acceptable at this point because the electorate would also approve of it. One important aspect of this study is about clean technology fund. Only India and South Africa received clean technology funds, which are also not adequate in predicting fossil fuel consumption and territorial emission significantly. Therefore, while climate change is a global problem, clean technology funds should not be restricted to a few countries. The remaining countries of the BRICS group should also get an adequate amount of clean technology funds, which will help in reducing fossil fuel energy consumption leading them to make transition to low carbon economies. Thus, there is a need to reform the existing policies and introduce new climate policies, which will promote investment in clean technology and reduce fossil fuel dependence to curtail down territorial emission in order to achieve a low carbon economy effectively.

This study may be extended further if policy initiatives to reduce emissions and to increase the renewable and clean energy consumption data in each country of BRICS group are available. The major limitation of this study is that it has used data up to 2018 because beyond 2018 all the relevant variables are not available. BRICS group of countries are relatively doing well in order to mitigate climate change; however, aggressive climate change mitigation policy implementation is a must not only in the BRICS group of countries but also for the rest of the world in order to achieve what all countries have committed in Paris agreement.

Data availability

The datasets generated by the survey research during and/or analyzed during the current study are available in the Dataverse repository: https://databank.worldbank.org/source/world-development-indicators#.

References

Mildenberger M, Tingley D. Beliefs about climate beliefs: the importance of second-order opinions for climate politics. Br J Polit Sci. 2019;49:1279–307. https://doi.org/10.1017/S0007123417000321.

PRC (Pew Research Center). Pew Global Attitudes & Trends. 2017. http://www.pewglobal.org/question-search/?qid=2863&cntIDs=&stdIDs.

Running K. World citizenship and concern for global warming: building the case for a strong international civil society. Soc Forces. 2013;92:377–99. https://doi.org/10.1093/sf/sot077.

Tranter B, Booth K. Scepticism in a changing climate: a cross-national study. Glob Environ Change. 2015;33:154–64.

Simcock N, Mullen C. Energy demand for everyday mobility and domestic life: exploring the justice implications. Energy Res Soc Sci. 2016;18:1–6.

Adger WN. Scales of governance and environmental justice for adaptation and mitigation of climate change. J Int Dev. 2001;13(7):921–31.

Rigaud K, et al. Groundswell: preparing for internal climate migration, World Bank, Washington, DC. 2018. http://hdl.handle.net/10986/29461. http://hdl.handle.net/10986/29461.

OECD (Organisation for Economic Co-operation and Development); The World Bank; UN Environment. Financing Climate Futures: Rethinking Infrastructure, OECD Publishing, Paris. 2018. https://doi.org/10.1787/9789264308114-en.

Gupta A, Dalei NN. Energy, environment and globalization: an interface. In Energy, Environment and Globalization Springer, Singapore, 2020. pp. 1–14.

Gupta A, Dalei NN. (Eds.). Energy, environment and globalization: recent trends, opportunities and challenges in India. Springer Nature, ISBN 978-981-13-9310-5. 2019. https://www.springer.com/gp/book/9789811393099.

IPCC. Fifth Assessment Report (AR5). Contribution of working group II to the fourth assessment report of the Intergovernmental Panel on Climate Change. 2014.

Estevão J, Lopes JD. SDG7 and renewable energy consumption: the influence of energy sources. Technol Forecast Soc Chang. 2024;198: 123004.

Ulpiani G, Vetters N, Maduta C. Towards (net) zero emissions in the stationary energy sector: a city perspective. Sustain Cities Soc. 2023;97:104750.

Bast E, Makhijani S, Pickard S, Whitley S. The fossil fuel bailout: G20 subsidies for oil, gas and coal exploration. ODI-Oil Change. 2015. https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/9234.pdf.

Gerasimchuk I, Bassi A, Ordonez C, Doukas A, Merrill L, Whitley S. Zombie energy: climate benefits of ending subsidies to fossil fuel production. International Institute for Sustainable Development, Geneva. 2017.

IEA (International Energy Agency). Tracking fossil fuel subsidies in APEC economies. International Energy Agency Insight Series 2017. 2017. http://www.iea.org/publications/insights/insightpublications/TrackingFossilFuelSubsidiesinAPECEconomies.pdf.

OECD (Organisation for Economic Co-operation and Development). Inventory of energy subsidies in the EU’s Eastern Partnership countries: Ukraine. 2016. https://www.iisd.org/gsi/sites/default/files/ffs_ukraine_draftinventory_en.pdf.

Sovacool BK. Reviewing, reforming, and rethinking global energy subsidies: towards a political economy research agenda. Ecol Econ. 2017;135:150–63. https://doi.org/10.1016/j.ecolecon.2016.12.009.

Van Asselt H. Governing fossil fuel production in the age of climate disruption: towards an international law of ‘leaving it in the ground.’ Earth Syst Governance. 2021;9: 100118.

Rode J, Pinzon A, Stabile MC, Pirker J, Bauch S, Iribarrem A, Sammon P, Llerena CA, Alves LM, Orihuela CE, Wittmer H. Why ‘blended finance’ could help transitions to sustainable landscapes: lessons from the Unlocking Forest Finance project. Ecosyst Serv. 2019;37: 100917.

Taghizadeh-Hesary F, Yoshino N. The way to induce private participation in green finance and investment. Financ Res Lett. 2019;31:98–103.

FS-UNEP. Global Trends in Renewable Energy Investment. 2016. p. 2016.

Smol M. Is the green deal a global strategy? Revision of the green deal definitions, strategies and importance in post-COVID recovery plans in various regions of the world. Energy Policy. 2022;169: 113152.

Hajiyev N, Guliyev V, Abdullayeva S, Abdullayeva E. Energy intensity of the economy in the context of rethinking growth within a limited planet. Energ Strat Rev. 2023;50: 101246.

Mensah IA, Sun M, Gao C, Omari-Sasu AY, Zhu D, Ampimah BC, Quarcoo A. Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. J Clean Prod. 2019;228:161–74.

Kuckelberg KM. Climate Change and its Impact on the Livelihood of Farmers and Agricultural Workers in Ghana. Friedrich Ebert Stiftung and General Agricultural Worker’s Union of GTUC. Retrieved on October 2019. 2012.

Dalei NN. Determinants of energy consumption in open economies. Contemporary Issues in Trade, Environment and Policy, Ane Books. 2016. 89–104.

Kashour M. A step towards a just transition in the EU: conclusions of a regression-based energy inequality decomposition. Energy Policy. 2023;183: 113816.

Romano E, Mutschler R, Hollmuller P, Sulzer M, Orehounig K, Rüdisüli M. Spatial carbon and price spillovers among EU countries on their pathway toward net-zero electricity supply. Energy Econ. 2024;131:107349.

Asafu-Adjaye J, Byrne D, Alvarez M. Economic growth, fossil fuel and non-fossil consumption: a Pooled Mean Group analysis using proxies for capital. Energy Econ. 2016;60:345–56.

Tsai BH, Chang CJ, Chang CH. Elucidating the consumption and CO2 emissions of fossil fuels and low-carbon energy in the United States using Lotka-Volterra models. Energy. 2016;100:416–24.

Rath BN, Akram V, Bal DP, Mahalik MK. Do fossil fuel and renewable energy consumption affect total factor productivity growth? Evidence from cross-country data with policy insights. Energy Policy. 2019;127:186–99.

Braungardt S, van den Bergh J, Dunlop T. Fossil fuel divestment and climate change: reviewing contested arguments. Energy Res Soc Sci. 2019;50:191–200.

Martins F, Felgueiras C, Smitková M. Fossil fuel energy consumption in European countries. Energy Procedia. 2018;153:107–11.

Chepeliev M, van der Mensbrugghe D. Global fossil-fuel subsidy reform and Paris Agreement. Energy Econ. 2020;85: 104598. https://doi.org/10.1016/j.eneco.2019.104598.

Schwanitz VJ, Piontek F, Bertram C, Luderer G. Long-term climate policy implications of phasing out fossil fuel subsidies. Energy Policy. 2014;67:882–94. https://doi.org/10.1016/j.enpol.2013.12.015.

Fairbrother M, Sevä IJ, Kulin J. Political trust and the relationship between climate change beliefs and support for fossil fuel taxes: evidence from a survey of 23 European countries. Glob Environ Chang. 2019;59: 102003. https://doi.org/10.1016/j.gloenvcha.2019.102003.

Frankel J. Environmental effects of international trade. Expert Report Number 31 to Sweden’s Globalization Council, 2008. p. 7.

Pugel TA. International economics. Tata McGraw Hill; 2008.

Dalei NN, Roy H. The empirical relationship between carbon emission and energy use of BRICS nations. J Public Affairs. 2021;2021(21): e2154. https://doi.org/10.1002/pa.2154.

Wills W, Westin FF. Climate transparency policy paper: energy transition in Brazil. Climate Transparency. https://www.climate-transparency.org/wp-content/uploads/2019/02/Brazil-Policy-Paper-Energy-Transition-FINAL.pdf. Retrieved September 2020.

Rasoulinezhad E, Taghizadeh-Hesary F, Sung J, Panthamit N. Geopolitical risk and energy transition in Russia: evidence from ARDL bounds testing method. Sustainability. 2020;12(7):2689.

Dalei NN, Roy H, Gupta A. Crude oil import of India from its major oil trade partner countries: an empirical evidence using panel data analysis. Int J Adv Res Dev. 2017;2(6):726–35.

De A. Energy transition: renewables in India’s electric future. Energy World. The Economic Times. 2020. https://energy.economictimes.indiatimes.com/energy-speak/energy-transition-renewables-in-india-s-electric-future/3964. Retrieved September, 2020.

Lata C. Busting the Myth—Electric Vehicle Policy. Energy World. The Economic Times. 2020. https://energy.economictimes.indiatimes.com/news/power/opinion-busting-the-myth-electric-vehicle-policy/77455023. Retrieved September, 2020.

Song S. Here’s how China is going green. Environment and Natural Resource Security. World Economic Forum. 2018. https://www.weforum.org/agenda/2018/04/china-is-going-green-here-s-how/. Retrieved September 2020.

Zhongying W, Sandholt K. Thoughts on China’s energy transition outlook. Energy Transit. 2019;3:59–72. https://doi.org/10.1007/s41825-019-00014-w.

Azevedo VG, Sartori S, Campos LM. CO2 emissions: a quantitative analysis among the BRICS nations. Renew Sustain Energy Rev. 2018;81(107–115):2021. https://doi.org/10.1016/j.rser.2017.07.027.

Euston-Brown M, Borchers M. Sustainable energy transitions in South African Cities: reflections on enablers of change over the past two decades. In Urban Energy Transition (pp. 553–578). Elsevier. 2018.

Hoechle D. Robust standard errors for panel regressions with cross-sectional dependence. Stand Genomic Sci. 2007;7(3):281–312.

Reed WR, Ye H. Which panel data estimator should I use? Appl Econ. 2011;43(8):985–1000. https://doi.org/10.1080/00036840802600087.

Parks R. Efficient estimation of a system of regression equations when disturbances are both serially and contemporaneously correlated. J Am Stat Assoc. 1967;62:500–9.

Ghisletta P, Spini D. An introduction to generalized estimating equations and an application to assess selectivity effects in a longitudinal study on very old individuals. J Educ Behav Stat. 2004;29(4):421–37.

Liang KY, Zeger SL. A comparison of two bias-corrected covariance estimators for generalized estimating equations. Biometrika. 1986;73:13–22.

CIF (Climate Investment Fund). CTF/TFC.20/4/Rev.1. Meeting of the CTF Trust Fund Committee. Washington DC. 2017.

Levin A, Lin CF. Unit root test in panel data: asymptotic and finite sample properties, University of California at San Diego, Discussion Paper No. 92-93. 1992.

Victor DG, Zhou D, Ahmed EHM, Dadhich PK, Olivier JGJ, Rogner H-H, Sheikho K, Yamaguchi M. Introductory Chapter. In: Edenhofer O, Pichs-Madruga R, Sokona Y, Farahani E, Kadner S, Seyboth K, Adler A, Baum I, Brunner S, Eickemeier P, Kriemann B, Savolainen J, Schlömer S, von Stechow C, Zwickel T, Minx JC, editors. Climate Change 2014: Mitigation of Climate Change Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge and New York: Cambridge University Press; 2014.

Makarov I. BRICS: Toward a New Climate Agenda. 2020. https://valdaiclub.com/a/highlights/brics-toward-a-new-climate-agenda/ (Retrieved October 2020).

Funding

The authors did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Contributions

The first author made significant contributions to several aspects of the research paper, including the abstract, introduction, policy practices of BRICS nations for efficient energy transitions, methodology, data and estimating approach, results, discussion, conclusion, and policy implications. The theoretical framework, literature review, descriptive data analysis, and final proofreading of the manuscript were all done by the second author.

Corresponding author

Ethics declarations

Competing interests

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Dalei, N.N., Gupta, A. Adoption of renewable energy to phase down fossil fuel energy consumption and mitigate territorial emissions: evidence from BRICS group countries using panel FGLS and panel GEE models. Discov Sustain 5, 52 (2024). https://doi.org/10.1007/s43621-024-00237-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43621-024-00237-y