Abstract

This paper analyses the stochastic properties of UK nominal and real wages over the period 1750–2015 using fractional integration techniques. Both the original series and logged ones are analysed. The results generally suggest that nominal wages exhibit a higher degree of persistence, which reflects relatively long lags between inflation and wage adjustments. Endogenous break tests are also carried out and various structural breaks are identified in both series. On the whole, the corresponding subsample estimates imply an increase over time in the degree of persistence of both series.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

This paper provides new evidence on the stochastic properties (more specifically, mean reversion and persistence) of both nominal and real wages in the UK over a long time span, i.e. from 1715 to 2015, using fractional integration techniques. In a previous study based on a much longer sample (more precisely, from 1260 to 1994) Gil-Alana (2005) had focused exclusively on the long run and only in the case of real wages and found evidence of a unit root; Caporale and Gil-Alana (2006) had instead analysed the same data applying a procedure due to Robinson (1994) which tests for the presence of unit (and fractional) roots at both the zero and the cyclical frequencies. They concluded that the former play a more significant role, even when allowing for a break in 1875, which coincides with the beginning of the Second Industrial Revolution and the move to “New” unionism representing workers in a wider set of industries and resulting in a mass labour movement.

The present study makes a twofold contribution compared to the two mentioned above. Specifically, it uses a shorter sample starting a few decades before the period over which the Industrial Revolution (i.e. the transition to new manufacturing processes) took place (approximately from 1760 to around 1820 or 1840) to examine the behaviour of both nominal and real wages over a relatively more homogeneous period, and it allows for multiple breaks rather than a single one.Footnote 1 The first extension is essential because the degree of nominal and real wage inertia or persistence can be very different: in the former case it depends on the extent to which changes in current prices or inflation feed through to nominal wages in the same period (with a stronger response normally occurring when prices increase rather than decrease), whilst in the latter case it is determined by possible labour market frictions, a slow and/or only partial adjustment taking place when real wages or the mark-up of prices over marginal costs are not very responsive to demand pressures. In other words, the speed at which nominal or real wages adjust in response to exogenous shocks is mainly caused by labour market rigidities rather than the nature of the shocks themselves.

Concerning the second extension of the analysis, i.e. the tests for multiple endogenous breaks, this type of investigation is very important because a number of different wage determination regimes (e.g., before and after the creation of trade unions, or different periods in the unionisation movement) have been in place during the period examined, which should be taken into account empirically. Their existence also implies that different theoretical models might be appropriate for explaining wage behaviour in different sub-samples; for instance, in the more recent decades a competing-claims model of unionised economy with imperfect competition, with wages being determined through collective bargaining and prices being set by imperfectly competitive firms, has been found to describe well the UK experience (see Layard et al. 1991, 1994). Similarly, different policies might be required in different time periods, the general consensus being that supply-side policies, such as wage bargaining reforms, are most effective in reducing unemployment (see Layard et al. 1994), whilst demand management policies do not have permanent effects (see Barrell et al. 1994).

There are very few other studies on wage persistence, and these do not analyse long runs of data using fractional integration techniques. Specifically, Hospido (2015), estimated an error-components model for wages that incorporates individual fixed effects, job-specific effects, and a persistent shock with autoregressive structures, and showed that in the US wage persistence is lower when worker and firm heterogeneity is taken into account, whilst Bonhomme et al. (2019) estimated both a static model allowing for nonlinear interactions between workers and firms and a dynamic one also including Markovian earnings dynamics and endogenous mobility using Swedish data.

To sum up, the present study fills an important research gap by using for the first time long-memory methods (i) to compare the degree of persistence of nominal and real wages, and (ii) to assess whether this has changed over time, both issues not having been analysed previously in the literature. The layout of the paper is as follows. "Methodology" outlines the econometric methodology. "Data description and empirical results" describes the data and presents the empirical results. "Conclusions" offers some concluding remarks.

Methodology

For our purposes, we use fractional integration methods that have the advantage of being more general and flexible than standard ones based on the unit root versus stationarity dichotomy that only allows for integer degrees of differentiation.

The chosen specification, which also includes deterministic terms (namely a constant and a linear time trend), is the following:

where y(t) is the observed time series; α an β are unknown coefficients on the constant and the linear time trend, respectively; L is the lag operator, i.e. Lkx(t) = x(t − k), and x(t) is assumed to be integrated of order d, or I(d), where d is another parameter to be estimated from the data. Finally, u(t) is a I(0) or short-memory process which is assumed in turn to be a white noise and to exhibit (weak) autocorrelation.

The estimation is carried out using a Whittle function in the frequency domain as in the fractional integration tests of Robinson (1994), which are widely applied in the empirical literature. In addition, Bai and Perron’s (2003) tests re used to detect any possible structural breaks.

Data description and empirical results

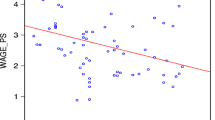

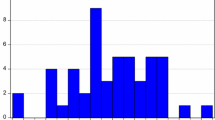

The data examined are nominal and real wages in the UK at an annual frequency over the period from 1715 to 2015. They have been constructed by the Bank of England and are available from https://ourworldindata.org/grapher/nominal-wages-consumer-prices-and-real-wages-in-the-uk-since-1750?tab=chart&country=~GBR.Footnote 2 Both series, whether in their raw or logged form, exhibit an increasing trend (see Figs. 1, 2).

Table 1 reports the estimates obtained when using the original data. It can be seen that in the case of nominal wages neither the intercept nor the time trend are statistically significant regardless of the assumption made about the disturbances; by contrast, the intercept is significant in the case of real wages. The estimates of d are higher than 1 in all cases (namely for both nominal and real wages and with both white noise and autocorrelated residuals), the I(1) hypothesis always being rejected in favour of d > 1.

Table 2 reports the results for the log-transformed data. The estimates of d are now smaller compared to those based on the original data. More precisely, in the case of white noise disturbances (panel i) they are equal to 1.50 for nominal wages and 0.99 for real wages, and the I(1) hypothesis is rejected in favour of higher values of d for nominal wages but not for real ones. In addition, a significant positive time trend coefficient is found for the logged real wages. When allowing for autocorrelation (panel ii), the estimates of d are smaller (1.34 for nominal wages and 0.80 for real wages) and, as in the white noise case, the I(1) hypothesis is rejected for nominal wages but not for real ones. The time trend coefficient is now significant for both series and nominal wages have a higher slope coefficient.

On the whole, our findings suggest that nominal wages exhibit a higher degree of persistence than real ones, i.e. they are characterised by higher (lower) rigidity (flexibility) compared to the latter; this is a similar result to what is normally found for the US, where real wage flexibility and nominal wage rigidity are thought to reflect relatively long lags between inflation and wage adjustments (see, e.g., Branson and Rotenberg 1980; Sachs 1979); by contrast, in the case of most other European countries the opposite normally holds in the presence of inflationary shocks, which is a consequence of a relatively high degree of indexation of wages to prices (and a relatively low degree of inertia in the determination of nominal wages—see, e.g., Coe 1985; Arpaia and Pickelmann 2007).

Next, we focus on the log-transformed data and also test for structural breaks in this case;Footnote 3 in particular, using the Bai and Perron (2003) approach we detect five breaks in the case of nominal wages (in 1792, 1835, 1879, 1924 and 1969), and four in that of real ones (in 1858, 1888, 1935 and 1975—see Table 3). These broadly correspond to well-known historical events or policy measure, more specifically: (i) in the case of nominal wages approximately to the start of the war between Britain and revolutionary France, the Poor Law amendment that tightened relief, the start of the Anglo-Zulu war, the first Labour government (headed by Ramsay MacDonald), and the White Paper “In Place of Strife” issued by the Labour Goverment to reform the Trades Union movement; (ii) in the case of real wages approximately to the Indian Mutiny, the Convention of Constantinople guaranteeeing free maritime passage through the Suez canal in war and peace, the first “two-day weekend” giving workers extra time off instead of making redundancies, and the coming into force of the Equal Pay Act and Sex Discrimination Act.

Table 4 reports the estimates of d for each of the corresponding subsamples, six for nominal wages and five for real ones. In the former case, the time trend coefficient is found to be positive and significant in the first subsample (1750–1792) as well as the last two, namely 1925–1969 and 1970–2015, in the latter its value being much higher. The estimates of d show a mononotic increase over the first four subsamples (until 1924), decrease slightly during the fifth one, and increase again during the last one. It is noteworthy that all of them are significantly above 1, which implies a rejection of the I(1) hypothesis, the only exception being the first subsample for which the estimate of d is below 1 and thus mean reversion is found.

As for logged real wages, the trend is now found to be positive for the third (1889–1935) and the fourth (1936–1975) subsamples; in addition, the I(1) hypothesis cannot be rejected for the first four subsamples whilst it is rejected in favour of I(d, d > 1) for the last one.

However, these results should be taken with caution given the relatively small number of observations for each subsample and the very wide confidence bands for the values of d. Thus, in what follows, we restrict the number of breaks in the series to two, specifically in 1835 and 1924 for logged nominal wages, and in 1738 and 1967 for logged real ones (Table 5).

Table 6 displays the corresponding subsample estimates for d. It can be seen that in the case of logged nominal wages, the time trend is no longer significant in any subsample, whilst the estimates of d are 1.07 (for 1750–1835), 1.79 (for 1836–1924) and 1.54 (for 1925–2015), and the unit root null hypothesis cannot be rejected for the first subsample, whilst it is in favour of d > 1 for the remaining two. As for logged real wages, the time trend is significant in the last two subsamples (1874–1967) and (1968–2015), its coefficient being much higher in the latter. The estimates of d increase monotonically, from 0.84 in the first subsample to 0.95 in the second one and 1.36 in the last one, the null hypothesis of I(1) not being rejected in the first two cases.

Conclusions

This paper has analysed the stochastic properties of UK nominal and real wages over the period 1750–2015 using fractional integration techniques that are more general than standard approaches restricting the differencing parameter to be an integer. Endogenous break tests have also been carried out since different wage determination regimes have been in place over the time period considered. Nominal and real wage developments matter because they have implications for price stability and competitiveness at the country level. The results generally suggest that nominal wages exhibit a higher degree of persistence, and thus adjust with relatively long lags to inflation shocks. In addition, on the whole the subsample estimates imply an increase over time in the degree of persistence of both series.

The fact that nominal wages exhibit a higher degree of persistence than real ones indicates that the UK labour market is more similar to the US one than those of the other European countries. In the latter set of economies real wage rigidity versus nominal wage flexibility is frequently found as a result of a relatively high degree of indexation of wages to prices. Persistence in real wages affects international competitiveness negatively since it implies that labour (and thus production) costs do not adjust quickly in response to shocks; in such cases appropriate labour market policies should be designed to increase flexibility and restore competitiveness. It would appear that the UK has generally had a competitive advantage given the higher degree of flexibility of its labour market.

These findings have important implications for policymakers in the UK. In particular, they suggest that their focus should be on the pass-through from prices to nominal wages rather than on frictions in the labour market which affect real wages directly; this means more specifically ensuring that wage bargaining is mindful of the possible wage-inflation spiral resulting from a full indexation of nominal wages, and persuading unions to accept possibly lower real salaries in the short run to achieve a quicker reduction in inflation and a faster and sustained growth in real income over the medium and long term, thereby increasing welfare.

A limitation of this study is the linearity assumption. Future work could allow for nonlinearities by using, for example, the orthogonal polynomials in the time of Hamming (1973) and Bierens (1997) in the context of fractional integration as in Cuestas and Gil-Alana (2016), or the Fourier functions in time as in Gil-Alana and Yaya (2021), or neural networks as in Yaya et al. (2021).

Data availability

Data are available from the authors upon request.

Code availability

The codes are in Fortran and are available from the authors upon request.

Notes

Another interesting issue is how wage persistence can be explained by permanent worker, employer, and match heterogeneity. Carneiro et al. (2022) analyse it in the case of Portugal in the context of a dynamic panel model by applying a bias correction to deal with the incidental parameter problem. They report that the uncorrected estimates understate wage persistence and overstate the importance of permanent unobserved heterogeneity in driving it. The present study focuses instead on a comparison between persistence in real and nominal wages, respectively, using long runs of data to examine long-memory properties in the case of the UK.

Please note that the Bank of England series are not available beyond 2015, and thus extending the sample would require using data from other sources, which would make the series inconsistent and vitiate the results. For this reason, the analysis has been carried out only until 2015.

The test results were essentially the same when using the original series; they are not reported for brevity’s sake but are available from the authors upon request.

References

Arpaia A, Pichelmann K (2007) Nominal and real wage flexibility in EMU. Int Econ Econ Policy 4:299–328. https://doi.org/10.1007/s10368-007-0092-6

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econometr 18(1):1–22. https://doi.org/10.1002/jae.65

Barrell R, Caporale GM, Sefton J (1994) Prospects for European unemployment. In: Michie J, Grieve Smith J (eds) Unemployment in Europe. Academic Press, Cambridge, pp 32–44

Bierens HJ (1997) Testing the unit root with drift hypothesis against nonlinear trend stationarity with an application to the US price level and interest rate. J Econometr 81:29–64. https://doi.org/10.1016/S0304-4076(97)00033-XGet

Bonhomme S, Lamadon T, Manresa E (2019) A distributional framework for matched employer-employee data. Econometrica 87(3):699–739. https://doi.org/10.3982/ECTA15722

Branson WH, Rotenberg JJ (1980) International adjustment with wage rigidity. Eur Econ Rev 13(3):309–332

Caporale GM, Gil-Alana LA (2006) Long memory at the long run and at the cyclical frequencies: modelling real wages in England, 1260–1994. Empir Econ 31(1):83–93. https://doi.org/10.1007/s00181-005-0017-6

Carneiro A, Portugal P, Raposo P, Rodrigues PMM (2022) The persistence of wages. J Econometr. https://doi.org/10.1016/j.jeconom.2021.11.014

Coe DT (1985) Nominal wages. The NAIRU and wage flexibility. OECD Econ Stud. 5 (Autumn). https://mpra.ub.uni-muenchen.de/114295

Cuestas JC, Gil-Alana LA (2016) Testing for long memory in the presence of non-linear deterministic trends with Chebyshev polynomials. Stud Nonlinear Dyn E 20(1):37–56. https://doi.org/10.1515/snde-2014-0005

Gil-Alana LA (2005) A re-examination of historical real daily wages in England. J Pol Mod 27(7):829–838. https://doi.org/10.1016/j.jpolmod.2005.05.008

Gil-Alana LA, Yaya OS (2021) Testing fractional unit roots with non-linear smooth break approximations using Fourier functions. J Appl Stat 48(13–15):2542–2559. https://doi.org/10.1080/02664763.2020.1757047

Hamming RW (1973) Numerical methods for scientists and engineers. Dover, Mineola

Hospido L (2015) Wage dynamics in the presence of unobserved individual and job heterogeneity. Labour Econ 33:81–93. https://doi.org/10.1016/j.labeco.2015.03.012

Layard R, Nickell SJ, Jackman R (1991) Unemployment. Oxford University Press, Macroeconomic performance and the labour market. https://doi.org/10.1093/acprof:oso/9780199279166.001.0001

Layard R, Nickell S, Jackman R (1994) The unemployment crisis. Oxford University Press, Oxford

Robinson PM (1994) Efficient tests of nonstationary hypotheses. J Am Stat Assoc 89:1420–1437. https://doi.org/10.2307/2291004

Sachs J (1979) Wages, profits and macroeconomic adjustment: a comparative study. Brook Paper Econ Act 2:269–333

Yaya OS, Ogbonna AE, Furuoka F, Gil-Alana LA (2021) A new unit root test for unemployment hysteresis based on the autoregressive neural network. Oxford Buln Econ Stat 83(4):960–981. https://doi.org/10.1111/obes.12422

Acknowledgements

Luis A. Gil-Alana gratefully acknowledges financial support from the Grant PID2020-113691RB-I00 funded by MCIN/AEI/https://doi.org/10.13039/501100011033.

Funding

Luis A. Gil-Alana gratefully acknowledges financial support from the Grant PID2020-113691RB-I00 funded by MCIN/AEI/https://doi.org/10.13039/501100011033.

Author information

Authors and Affiliations

Contributions

Prof. Guglielmo Maria Caporale wrote the introduction, literature review, interpretation of the results and conclusions. Prof. Luis Alberiko Gil-Alana computed the empirical results, and took part in the interpretation of the results, conclusions and final supervision of the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Caporale, G.M., Gil-Alana, L.A. Nominal and real wages in the UK, 1750–2015: mean reversion, persistence and structural breaks. SN Bus Econ 3, 135 (2023). https://doi.org/10.1007/s43546-023-00516-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-023-00516-2