Abstract

This paper examines the influence of the six World Governance Indicators (WGIs), as defined by the World Bank, on the real GDP growth of five emerging markets, the BRICS (Brazil, Russia, India, China, and South Africa) countries, and three advanced economies, the United States, Germany and Japan. The analysis is based on a panel data set containing the six WGIs along with further macroeconomic variables (government debt, external debt, current account balance, trade balance, budget balance, foreign exchange rate and short-term interest rate), with annual data from 1996 to 2018. We find that regulatory quality has a positive impact on economic growth, an effect that remains stable across all robustness tests. This indicates that a sound regulatory environment stimulates economic growth. We also find a negative impact of rule of law on economic growth, but this effect is not robust. The literature, however, documents a negative effect from income to rule of law, expressing that higher income does not necessarily lead to a demand for better institutions. A principal component analysis on the WGIs shows that governance is diverse across countries, while stable over time. The first two PCs capture more than 95% of the WGIs variance and are able to cluster emerging and developed markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Economists increasingly agree that a country’s governance and the quality of its institutions have a significantly positive influence on growth performance (Acemoglu et al. 2001; Kaufmann and Kraay 2002; Han et al. 2014; Mira and Hammadache 2017; Samarasinghe 2018). Strong institutions serve as a backdrop against which governments enable stable economic conditions (Samarasinghe 2018). In a 1992 report of the World Bank, the need for good governance was emphasized and identified as the existence of transparent processes, including a bureaucracy performed with professional ethos, a government that takes responsibility for its actions, and a strong civil society engaged in public affairs acting under the rule of law (World Bank 1994, p. 7). In this report, the World Bank defined governance as “the manner in which power is exercised in the management of a country’s economic and social resources for development”.

However, the picture of the relationship between governance and growth still remains ambiguous and has yet to be fully understood. For examples, outcomes may differ across regions. As Acemoglu et al. (2005) put it, “[..], while we have good reason to believe that economic institutions matter for economic growth, we lack the crucial comparative static results which will allow us to explain why [the] equilibrium [of] economic institutions differ [..]” (p. 2).

We seek to provide answers to the following question: What governance indicators help emerging market (EM) nations achieve a sustainable level of real economic growth in comparison with developed economies (DM)? The paper contributes to the literature by examining if governance factors affect GDP differently for EMs and DMs. We investigate which World Governance Indicators (WGIs) influence—and to what extent—the real GDP growth of EM economies, with a focus on BRICS countries (Brazil, Russia, India, China, South Africa), but excluding China, and comparing these to DM economies, namely, the United States, Germany and Japan. All of the economics considered have in common that they are highly indebted, although this plays a minor role for the analysis itself. A panel data model including macroeconomic indicators between the years 1996 and 2018 is analyzed. The goal is to shed further light on the relationship between governance and economic development while comparing EM and DM economies.

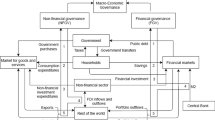

To this end, we conduct an extensive empirical study on a panel data set covering the time period 1996–2018 and involving WGIs and a set of control variables. Kaufmann et al. (1999) constructed the WGIs as six aggregate indicators corresponding to six basic governance concepts, which, according to their study, show a strong causal relationship between good governance and improved development outcomes: Voice and Accountability (VA), Political Stability and Absence of Violence (PSAV), Government Effectiveness (GE), Regulatory Quality (RQ), Rule of Law (RL), and Control of Corruption (CC). The control variables, identified as the main drivers of GDP growth in the related literature (Sánchez and Röhn 2016; Prasad et al. 2019) comprise government debt, external debt, budget balance, trade balance, current account balance, short-term interest rates and foreign exchange rates. Fixed effects and time fixed effects act as proxies for further controls.

Because the six WGIs are highly correlated, we build an aggregate governance index using principal component analysis (PCA). We find that the aggregate index—the first principal component—separates the EM economies and DM economies into two separate clusters. While the first PC varies strongly across countries, it is “sticky” within each country. As such, the general level of governance does not explain the variation in GDP that is observed within each country. We do, however, find relationships between GDP growth and higher PCs across countries. These higher PCs turn out to be highly related to specific WGIs expressing in particular RQ and RL, as well as GE to some lesser extent. Other PCs create clusters of specific countries, so we can conclude that the WGIs differentiate between governance setups of various countries. Our findings are robust across variations of fixed effects and random effects models.

Our results are summarised as follows: The first main finding is that RQ has a stable statistically significant positive relationship with real GDP growth across all model variations and robustness tests. This indicates that a higher RQ—comprising perceptions of sound policies and regulations, which in turn enable business development and foreign trade—results in a positive impact on economic growth. The trend towards more globalisation in the time period considered and the related opportunities for economic development support the finding. The second finding is that the positive relationship between RQ and GDP is stronger for EM economies than for DM economies. This result is statistically significant when EM economies are aggregated as well as for each economy individually. As a consequence, EM economies benefit disproportionately from improving RQ and are harmed disproportionately from a decline in RQ. The third finding indicates that RL has a statistically significant negative relationship with economic growth. However, this finding is not stable across all robustness tests, mainly due to low within-country variation in RL. As a consequence, the resulting coefficients may be biased and the effect may be smaller than suggested by the panel data models. Economically, a possible explanation for the negative effect could be the negative economic impact of shorter election cycles associated with more democratic countries as opposed to more stable economic policies of less democratic countries. A similar finding in Kaufmann and Kraay (2002) is attributed to established elites reaping private benefits from low quality institutions with little reason to expect that higher income will lead to demands for better institutions.

Our study is also motivated by the renewed interest to better comprehend the principal drivers behind economic growth since The Great Recession of 2008. Recent studies focus not only on quantitative factors, such as labor and capital, to try and explain economic development, but also on qualitative channels, such as institutional quality. Economists have begun to rear away from the concept that policies have no role in shaping long-term economic development (Sánchez and Röhn 2016, p. 5).

In 2016, the OECD reported that “countries with better quality of institutions experience less severe negative growth shocks” (Sánchez and Röhn 2016, p. 6). This can be explained as follows: More often than not, institutionally weak societies suffer from a false redistribution of wealth by their government—often in favor of the people in power. To remain in power, politicians may pursue unsustainable policies that appeal to a majority of the population. In the long-run, however, this gives way to growing social and economic unrest. Unsustainable policies hinder the development of certain economic relationships and cause flight of capital, making a country more unstable and susceptible to shocks (Acemoglu et al. 2005, pp. 2–3). In addition, there seems to be a higher degree of infighting amongst power groups, ultimately leading to further political turbulence and a lack of cooperation in the face of a crisis (Sánchez and Röhn 2016, p. 20).

As illustrated by World Bank (2020), institutional quality and economic complexity are between the top five components of a growth-friendly environment, behind education, urbanization and investments (p. 220). For this reason, “[c]oncerns about prospects for productivity growth in EMDEs [emerging market and developing economics] call for a renewed emphasis on structural policies that can unlock productivity gains [..]” (World Bank 2020, p. 222). Gains in productivity can be derived from contained political risk, simplified and transparent legal processes, fair competition, contract enforcement, and through greater trust in institutions. Good governance helps bring safer business environments and trade reforms forward that in turn promote growth (World Bank 2020, p. 229).

The remainder of this paper is organized as follows: “Related empirical studies” examines the related literature. In “Governance and GDP growth in EM and DM economies” we introduce the conceptual background and methodology. “Results” presents the empirical results and in “Conclusion” we conclude.

Related empirical studies

Many papers are concerned with the role of institutions for a country’s economic growth. Amongst these, the ones that are most relevant and closely related to this study, are Acemoglu et al. (2001), Kaufmann and Kraay (2002), Han et al. (2014), Emara and Chiu (2016), Samarasinghe (2018), Mira and Hammadache (2017), Han et al. (2014) and Sánchez and Röhn (2016).

A positive relationship between the quality of institutions and economic growth is well-established, e.g., Kaufmann and Kraay (2002). A positive correlation, however, does not yet establish a causal effect. There are essentially three situations: a causal effect may be present in either direction or an additional, possibly unobservable, variable may cause both the relationship between the quality of institutions and economic growth.

Amongst the first papers to expose the causal effect of the role of institutions on economic growth, Acemoglu et al. (2001) employ an instrumental variable (IV) approach. As an instrument, they use mortality rates of European settlers in various colonies in the 18th and 19th centuries, arguing that the incentive to establish good institutions was weak if settlers were unlikely to settle permanently. Likewise, Kaufmann and Kraay (2002) establish a causal effect from governance to economic growth on a cross section of 175 countries for the time period 2000/2001.

More recently, the work of Emara and Chiu (2016) evaluates the impact of governance on economic growth between the years 2009–2013, using a panel of 188 countries with a special focus on Middle Eastern and North African (MENA) nations. The authors summarize the existing WGIs into a “composite governance index” (CGI) using the principal components analysis (PCA) method, to then apply it to a simple regression model for the analysis. They find that an increase in CGI by one unit increases GDP per capita by about 2% (Emara and Chiu 2016, p. 2). A draw-back of this study is that, given the composite governance index, the influence of the individual factors on growth cannot be revealed.

On the other hand, Samarasinghe (2018) studies the individual influence of the World Governance Indicators on growth. The author finds that control of corruption plays a principal role in the development of an economy. He argues that a one unit rise in control of corruption contributes to a 6.9% increase in economic growth. The research uses data of 145 countries between the years 2002–2014, and includes variables, such as corruption, political stability, absence of violence/terrorism, voice and accountability, FDI, trade openness and government consumption. The paper applies three econometric models (pooled OLS, fixed effects and random effects methods) having the log of real GDP based on purchasing power parity (PPP) as the dependent variable (Samarasinghe 2018, pp. 23, 20). The use of dummy variables to capture not only regional effects, but also the influence of income levels on the governance and growth prospects of the countries in question, is also worth noting.

Mira and Hammadache (2017) study the relationship between the implementation capacity of governance principles, as defined by the World Bank, and the economic performance of 45 developing countries. They use several regression model estimations—similar to Samarasinghe (2018)—on the dependent variables GDP growth rate and GDP per capita, along with explanatory variables such as commodity prices, risk perception indexes and economic growth rates of dominant developed countries. Their findings indicate that given the broad concept of good governance, it is rather difficult to assume a positive correlation between governance and growth, let alone generalize such findings when it comes to EM economies—a valid point made by the authors. Be that as it may, Mira and Hammadache (2017) find that four of the six variables have a positive correlation with GDP growth; however, only two of these variables are significant: government effectiveness and political stability and reduction of violence (p. 11)—with the latter being the most influential indicator in all regressed models of merely all regions (excluding Asia) (p. 16).

The Asian Development Bank (ADB) examines the question whether countries with above-average governance grow faster than countries with below-average governance. The study includes all six WGIs between the time span of 1998 and 2011 (Han et al. 2014). The ADB also finds that four out of six governance indicators show a positive impact on GDP per capita and GDP growth, namely, government effectiveness, political stability, control of corruption and regulatory quality (Han et al. 2014). Developing Asian countries with a surplus in at least three out of the four listed government indicators have grown up to 2% annually, while MENA countries grew 2.5% faster than deficit countries (Han et al. 2014, p. 10)—results comparable to that of (Emara and Chiu 2016). The study applies a generalized method of moments (GMM) model (Han et al. 2014, p. 2).

Sánchez and Röhn (2016) explore various types of policy frameworks that strengthen economic and financial systems and help alleviate the probability and depth of deep economic downturns, such as the GFC in 2008. They employ a quantile regression model using Value at Risk (VaR) to examine how policy settings relate to extreme fluctuations in GDP tail risks (5th percentile) of mainly OECD countries. Macroprudential policies, banking supervision, labor market policies, quality of institutions as well as country characteristics such as size, stage of development and openness to trade are some of the factors taken into account. Their results suggest that “[..] increasing the government effectiveness indicator by one standard deviation increases quarterly growth by around 0.2 percentage points [..], a modest but economically significant effect” (Sánchez and Röhn 2016, p. 20). Voice and Accountability also proved to be statistically significant in the 5th percentile—otherwise known as Growth-at-Risk (GaR)—at the 1% level (Sánchez and Röhn 2016, p. 31).

The initial inspiration for this paper was Prasad et al. (2019), which examines Growth-at-Risk (GaR) in IMF countries. In the original paper on GaR, Adrian et al. (2022) analyze a total of 22 countries (11 advanced and 11 emerging market economies), between the years 1973 and 2016. The main goal of the GaR framework is to link current macro-financial conditions to the distribution of future growth (Prasad et al. 2019, p. 2). However, governance indicators are not taken into consideration. Simply put, the model monitors the evolution of risk to economic activity over time, making it a suitable instrument to assess the likelihood of future risk scenarios (Prasad et al. 2019, p. 4). The authors use a five step Excel-based GaR tool, including country specific financial condition indexes (FCIs), to estimate tailored partitions of macro-financial variables, which are ranked according to their informational content and estimated using quantile regression coefficients to generate a fitted future growth distribution model. Based on these steps, a scenario analysis is conducted. Overall, the GaR framework attempts to assess the potential impact of systemic risk on the real economy (Prasad et al. 2019, p. 32). It turns out that “GaR is higher in the short-run; but lower in the medium run, when initial financial conditions are loose relative to typical levels” (Adrian et al. 2022).

A related stream of literature deals with the relationship between democracy, governance and economic growth, e.g., Acemoglu et al. (2019), Tarverdi et al. (2019) and Rivera-Batiz (2002). The literature argues that democracies can be linked to both greater and lower governance. Democracies allow to remove inefficient and corrupt government administrations, increasing the quality of governance in the long run. On the other hand, major decisions necessary for long-run growth may be harder to push through in democracies. A notable example is Singapore (see Section 2 of Rivera-Batiz 2002). Since our focus in this paper is the link and comparison of governance and growth in EM and DM economies, we defer this fascinating extension of adding democracy as an additional dimension to further research.

Governance and GDP growth in EM and DM economies

In the following, we first outline the variables involved in the study. We then briefly summarize the principal component method, which is applied to the WGIs, and introduce the panel data model linking GDP growth with the WGIs.

Variables

The variables are described in detail below. An overview of the variables used in the analysis is given in Table 1.

GDP growth

Our main interest lies in determining the relationship between governance and the economic prosperity and welfare of a country, with a particular focus on classifying countries as either emerging market (EM) or developed market (DM) countries. To measure economic welfare, we choose year-on-year real GDP growth expressed as a percentage of GDP. Real GDP growth serves as a common proxy for economic growth—in-line with the World Economic Outlook (WEO) standards of the IMF. The main reason for using annual data is that the key independent variables, the World Governance Indicators, along with a large share of the control variables, are only available annually. It is also arguable that yearly data is a more appropriate data frequency for the estimation at hand, since “policymakers may be more concerned about 1 year of very low growth compared to just one bad quarter” (Sánchez and Röhn 2016, p. 13).

World Governance Indicators

The key independent variables of this study are the six World Governance Indicators developed by World Bank economists in the late 1990s (Kaufmann et al. 1999). Kaufmann et al. (2009) updated these indicators in 2009 and defined them as follows:

-

1.

Voice and Accountability (VA)—capturing perceptions of the extent to which a country’s citizens are able to participate in selecting their government, as well as freedom of expression, freedom of association, and a free media;

-

2.

Political Stability and Absence of Violence (PSAV)—capturing perceptions of the likelihood that the government will be destabilized or overthrown by unconstitutional or violent means, including politically-motivated violence and terrorism;

-

3.

Government Effectiveness (GE)—capturing perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies;

-

4.

Regulatory Quality (RQ)—capturing perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development;

-

5.

Rule of Law (RL)—capturing perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence;

-

6.

Control of Corruption (CC)—capturing perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests.

The above listed dimensions of governance summarize “the process by which governments are selected, monitored and replaced; the capacity of the government to effectively formulate and implement sound policies; and the respect of citizens and the state for the institutions that govern economic and social interactions among them” (Kaufmann et al. 2009, p. 5). There are two ways in which the six WGIs are measured: “(1) in standard normal units, ranging from \(-2.5\) to 2.5, and (2) in percentile rank terms, from 0 to 100, with higher values corresponding to better outcomes”.Footnote 1 As is common in most of the literature, we use the first specification.

Moreover, to deal with the high correlation and possible multicollinearity between the governance indicators, the factors are also aggregated into principal components (see “Principal component analysis” below for details). The resulting principal components are primarily used as the main explanatory variables to examine the contribution of governance on economic development.

Control variables

There are numerous factors likely to affect the real GDP growth of a country. Following the works of Sánchez and Röhn (2016) and Prasad et al. (2019), the control variables constitute fiscal and monetary policy indicators that are likely to affect near-term economic growth and influence the response to economic shocks. To that end, government debt, external debt and budget balance as a share of GDP are included in the baseline model as a proxy to capture the fiscal policy framework of a country. To monitor for monetary policy stance, short-term interest rates are included. To account for trade openness, the variable trade balance is added to the regression model, measured as exports plus imports of goods and services, and current account balance as a percentage of GDP. Because trade is highly dependent on fluctuations in the value of a currency, foreign exchange rate returns (with the underlying FX rate is expressed in USD) are inserted.

Government debt, current account and budget balance proved to be highly significant to the real GDP growth of all selected countries, with a negative relationship of government debt and current account on real economic development. The Inter-American Development Bank revealed the negative and robust effect of government debt on growth, based on 136 countries between the years 1970–2010 (Calderón and Fuentes 2013, p. 3). As the paper at hand also proves, strong institutions and a high quality of domestic policy environment help mitigate this effect (Calderón and Fuentes 2013, pp. 33–34).

Bivens and Irons (2010) note that there is a specific threshold in the debt-to-GDP ratio of a country that when exceeded can pose dangers to the health of an economy. They claim that at moderate debt levels there is no association between debt and growth, but that according to their estimation, exceeding a threshold of a 90% debt-to-GDP ratio hinders economic development(Bivens and Irons 2010). Another study by the European Central Bank suggests that this negative effect may already start at government debt levels beyond 70–80% of GDP (Checherita-Westphal and Rother 2012, p. 4).

In any case, “[t]he theory underlying why federal borrowing can be bad for economic growth primarily concerns deficits, not debt” (Bivens and Irons 2010). An increase in a state’s budget deficit implies that the government has raised its demand for loanable funds, borrowing money not only from foreign investors and the private sector, but also from its own citizens. The increased demand for a fixed supply of savings by the state drives up interest rates, reducing private sector investments and national capital stock along with it, which subsequently causes a down-turn in economic growth (Bivens and Irons 2010).

The original data set considered contained further variables, such as long-term interest rates, inflation and credit-to-GDP gap. However, due to collinearity not only with short-term interest rates but also between the variables themselves, only short-term interest rates were kept to control for interest rate differentials and lending practices between countries. It is also worth mentioning that the most frequently traded instruments in EM economies are of a short-term nature (OECD 2020, p. 38).

We also considered adding global variables, such as the MSCI world index as a global measure of equity markets. However, global time series are effectively subsumed by time fixed effects.

Sánchez and Röhn (2016) state that, “monetary policy decisions are likely to take the structural policy settings into account when reacting to a shock and monetary policy transmission mechanisms may depend on structural policy settings” (p. 14). For example, when real GDP growth is at the lower percentile, policy makers may be more likely to implement growth-friendly reforms, possibly improving their governance scores. This may imply a negative correlation between growth and governance. Against this backdrop, a reverse causality effect that could significantly affect findings must not be ignored (Sánchez and Röhn 2016, p. 14).

Principal component analysis

Principal component analysis (PCA) is most commonly used to reduce the dimensionality of high-dimensional data sets. If the different dimensions of the data are correlated, then PCA allows to capture a high proportion of the variability of the data with few dimensions only.

Conceptually, PCA refers to a linear factor model, where the factors are unobservable (latent) and determined from within the multivariate data. The principal idea is to rotate the coordinates expressing the data points in such a way that the factors are orthogonal, with the first factor capturing the maximum variance of the data, the second factor capturing the highest remaining variance, and so on. If the data are sufficiently correlated, then one can reduce the dimension while retaining a high proportion of data’s variance. Mathematically, the principal components of a covariance, resp. correlation matrix correspond to the eigenvectors. The eigenvalues express the amount of variance explained by each of the eigenvectors. We refer to, e.g., Chapter 23 of Simon and Blume (1994) for a mathematical treatment of PCA.

This exposition follows Section 10.2 of James et al. (2013). Let \({\varvec{X}} =(X_1,\ldots , X_p)^{{T}}\) be a random vector with expectation zero (i.e., demeaned). The first principal component (PC) of \({\varvec{X}}\) is the linear combination

that has the largest variance and normalised, such that \(\sum _{j=1}^p \phi _{j1}^2 =\Vert {\boldsymbol{\phi }}_1\Vert _2=1\). The elements \(\phi _{11}, \ldots , \phi _{1p}\) are the loadings of the first principal component. The second principal component \(Z_2\) is the linear combination of \(X_1, \ldots X_p\) (demeaned) that has maximal variance out of all linear combinations that are uncorrelated with \(Z_1\). Higher principal components are defined likewise.

With data, the PCs are determined as follows. Assume given an \(n\times p\) data set \({\textbf{X}}\), demeaned to have mean zero, consisting of n observations of p variables. If applying PCA with the correlation matrix in mind, then \({\textbf{X}}\) would be standardised. Calculating the first principal component refers to finding

that has the largest sample variance, subject to the constraint \(\sum _{j=1}^p \phi _{j1}^2=1\). In other words, the first principal component loading vector solves the optimisation problem

Because the variables are demeaned, this maximises the sample variance of \(z_{11}, \ldots , z_{n1}\). The \(z_{11}, \ldots , z_{n1}\) are referred to as the scores of the first principal component. The loadings and scores of the second PC are determined by maximising the variance out of all linear combinations uncorrelated with \(z_{11}, \ldots , z_{n1}\). The process is repeated for higher PCs.

In practice, principal components are found via the eigendecomposition of the covariance or correlation matrix of \(X_1, \ldots , X_p\). The eigenvectors correspond to the factor loadings, with the eigenvalues denoting to the proportion of variance captured by each principal component. The scores are determined from (1).

Obviously, from maximizing the (remaining) variance for each PC, and because the PCs, resp. scores, are uncorrelated, one can reduce the dimension of the original data by discarding the last PCs, while retaining as much data variability as possible.

Panel data model

Our main interest lies in determining the relationship between WGIs, resp. their PCs, and GDP growth, both across countries and over time. We, therefore, consider a variety of regression models including the above-mentioned control variables to determine which of the WGIs, resp. PCs are statistically significant.

For panel data, the pooled ordinary least squares (OLS), the fixed effects and the random effects models are the most commonly used regression models. This also applies in the context of our analysis, see, e.g., Samarasinghe (2018). Without specifying cross-sectional dummy variables, pooled OLS ignores individual cross-sectional effects, while the fixed effects and random effects specifications allow for individual cross-sectional effects. When the cross sections are countries, as in our case, then these effects capture time-invariant characteristics, such as culture, race, religion that may have affect explanatory variables (e.g., governance forms). Specifying cross-sectional fixed effects, therefore, allows to capture not only observable, but also unobservable time-invariant effects. Provided the individual effects are time-invariant, this allows to establish causal effects between the independent and dependent variables. Allowing in addition for time fixed effects captures the time variation affecting all countries, such as the global business cycle.

In the following, we denote the dependent variable (real GDP growth) by Y and the vector of independent variables by \({\textbf{X}}\), which consists of both the explanatory variables (WGIs or their PCs) and control variables. All variables are indexed by the cross sections (countries) \(i=1,\ldots , n\) and by time \(t=1, \ldots , T\). Dummy variables are denoted by \(D_j\), \(j=1,\ldots , n\), resp. \(D_s\), \(s=1,\ldots , T\). Specifically, \(D_{ij}=1\), if \(j=i\), and 0 otherwise; likewise, \(D_{ts}=1\), if \(s=t\), and 0 otherwise. The error terms are denoted by \(\varepsilon _{it}\). We generally assume that \({\mathbb {E}}\varepsilon _{it}=0\) and \({\mathbb {E}}[X_{it} \varepsilon _{it}]=0\).

The following panel data models are considered in our analysis:

-

The Least Squares Dummy Variable Model (LSDV) corresponds to a pooled OLS model with cross-sectional dummy variables:

$$\begin{aligned} Y_{it} = \sum _{j=1}^n \alpha _j D_{ij} + {\boldsymbol{\beta }}^{{T}} \,{\textbf{X}}_{it} + \varepsilon _{it}. \end{aligned}$$(2)The cross-sectional fixed effects \(\alpha _1, \ldots , \alpha _n\) are also called individual effects.

-

The within transformation eliminates the individual effects \(\alpha _1, \ldots , \alpha _n\) by demeaning all variables:

$$\begin{aligned} Y_{it} - {\overline{Y}}_i ={\boldsymbol{\beta }}^T ({\textbf{X}}_{it} - {\overline{\textbf{X}}}_{\textbf{i}}) + (\varepsilon _{it}-\overline{\varepsilon }). \end{aligned}$$(3) -

Time-fixed effects are included by adding dummy variables:

$$\begin{aligned} Y_{it} - {\overline{Y}}_i = \sum _{s=1}^{{T}} \gamma _s D_{ts} + {\boldsymbol{\beta }}^T ({\textbf{X}}_{it} - {\overline{\textbf{X}}}_{\textbf{i}}) + (\varepsilon _{it}-{{\overline{\varepsilon }}}). \end{aligned}$$(4) -

The random effects model assumes that the individual effects \(\alpha _1, \ldots , \alpha _n\) are not constant, but random variables, independently and identically distributed across individuals:

$$\begin{aligned} Y_{it} = \beta _0 + {\boldsymbol{\beta }}^T\, {\textbf{X}}_{it} + \alpha _i + \varepsilon _{it}. \end{aligned}$$(5)Here \(\alpha _i + \varepsilon _{it}\) can be thought of as the error term. Consistency requires that all \(\alpha _i\), \(\varepsilon _{it}\) and \({\textbf{X}}_{it}\) are mutually independent.

For a detailed exposition and a concise treatment of all consistency conditions, we refer the reader to, e.g., Verbeek (2012) or Wooldridge (2015).

Aside from using dummy variables for each country, we also sometimes cluster the countries into two groups by including an EM versus DM dummy variable. As another variant, we also interact cross-sectional dummy variables with individual PCs to measure effects from the PCs that vary across countries.

The main difference between the fixed effects model (3) and the random effects model (5) can be expressed by the estimates of each model, see, e.g., Section 10.2.4 of Verbeek (2012). The fixed effects model estimates

which is the expectation of real GDP growth given the explanatory and control variables as well as the individual effect. On the other hand, the random effects model estimates

i.e., the individual effect \(\alpha _i\) is “integrated out”. The Hausman test may be used to decide between applying a FE model or a RE model. Essentially, this is a test for the null hypothesis that \(x_{it}\) and \(\alpha _i\) in (5) are uncorrelated, which is required for consistency of the RE estimator. In this case, the RE estimator is efficient, which means that it should be preferred if the null hypothesis is not rejected. On the other hand, an FE estimator may be preferred if the individuals in the sample are “one of a kind”, such as countries or industries.

Results

Data

The paper analyses the BRICS (Brazil, Russia, India, China and South Africa) as representatives for EM economies across the globe. With the exception of China, EM countries have less total debt per GDP than advanced economies. China’s total debt grew sevenfold since the GFC, accounting for more than half of all outstanding debt by EM economies (Authers and Leatherby 2019). Data availability for these countries is mostly guaranteed. Advanced economies such as the United States, Germany and Japan are included in the analysis as a comparative measure. The time frame of this study is 22 years, from 1996 to 2018, given that the World Governance Indicators are only available since 1996.

The required data was collected from the online World Bank Open Data source, OECD Data, International Monetary Fund, Bank of International Settlements, Trading Economics, The Global Economy and Quandl. For some countries data fore the 2000s was unavailable, causing the data set to be partly unbalanced. In addition, certain variables of certain countries had to be gathered from alternative sources. The sample has a total of 137 observations. An overview of the variables involved is given in Table 1.

Descriptive statistics

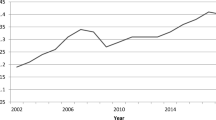

We give a brief statistical description of the variables involved. Figures 1 and 2 show the time series and box whisker plots of the real annual year-on-year GDP figures for the eight countries considered. With the exception of China and India, all countries are strongly affected by the GFC in 2009.

Table 2 lists the main statistical measures of real GDP as well as all the governance factors and the control variables. Here, the data are aggregated across EM and DM countries. We see that GDP of EM countries is more volatile compared to DM countries. The governance factors of DM countries are in general significantly higher and less volatile than for EM countries. Figure 3 shows box-whisker plots of the WGI distributions.

Figure 4 shows biplots of real GDP against each of the governance factors. The biplots show that none of the governance factors taken by itself provides a (linear) explanation of real GDP growth. However, they reveal that RL (rule of law) and CC (control of corruption) yield two clusters of EM and DM countries. A couple of interesting observations regarding the WGIs can be made from the plots: First, WGIs of DM economies are generally higher than of EM countries (the main exception being PSAV). Second, China and Russia have exceptionally low levels in VA, where the remaining EM countries are on par with the DM countries. Third, the WGIs tend to be “sticky”, i.e., they show some, but little variation around each country’s mean/median.

Principal component analysis of governance factors

As outlined in “Principal component analysis”, PCA performs best if the multivariate data considered features a high degree of linear dependence, expressed as correlation. Figure 5 exhibits several plots related to the PCA of the WGIs. The plot at the top left show the correlations of the WGIs, showing that the WGIs GE, RQ, RL and CC have pairwise correlations greater than 0.9. The smallest correlation observed is 0.63, which can still be considered a strong linear relationship. It can, therefore, be expected that a PCA on the six WGIs will produce a small set of governance factors aggregating the different aspects of the WGIs.

The plot at the bottom left shows the eigenvectors, corresponding to the factor loadings, i.e., the first column corresponds to the factor loadings \(\phi _{11}, \ldots , \phi _{p1}\) in Eq. (1), etc. These can be interpreted as weights associated with each variable. This shows that the first PC (PC1) is a general factor aggregating all WGIs with similar weights. The plot at the bottom right shows the proportion of the WGIs variance captured by each PC. These are determined from the eigenvalues, which capture the variance of the PC scores, i.e., \(z_{11}, \ldots , z_{n1}\) from Eq. (1) for PC1, etc.

Because of the WGIs high correlation, PC1 captures 88.7% of the variance of the WGIs. PC2 through PC6 capture additional aspects of 1–2 WGIs each. However, the amount of variance captured drops sharply.

The plot at the top right shows the correlations between the WGIs and the PCs. To be precise, these are the correlation between the WGIs and the PC scores, i.e., \(z_{11}, \ldots , z_{n1}\) from Eq. (1) for PC1, etc. Just as the factor loadings, these correlation induce a correspondence between each PC and 1–2 WGIs.

Since the first PC captures \(88.7\%\) of the variance of the WGIs, it can be considered a proxy for overall governance. The top plot of Fig. 6 shows a plot of the time series, which indicates that governance differs across countries, but remains fairly constant across time. The lower plot shows a biplot of GDP growth against the first PC. This shows how governance, expressed as PC1, separates EM and DM countries.

Figure 7 shows biplots of PC2 against PC1. The countries are colour-coded in the left plot, showing that PC1 separates the DM countries from the EM countries. PC1 and PC2 together separate China and Russia from the other EM countries. The right plot shows the output of an agglomerative clustering algorithm with \(k=2\) clusters (see, e.g., James et al. 2013). With two clusters, the algorithm clearly separates EM and DM countries. With three clusters, China is separated, and with four clusters in addition Russia is assigned its own cluster.

Regression results

Table 3 shows the output of different pooled OLS, fixed effects (FE) and random effects (RE) models with the WGIs as the explanatory variables. All estimates were produced by GNU gretl.Footnote 2 All errors are robust (HAC for OLS models, Arellano for FE models and Nerlove for RE models). A comparison of the pooled OLS model without dummies, model (1), with the other models indicates that individual fixed or random effects cannot be ignored. The constant specified in the FE and RE models follow the convention in Stata,Footnote 3 which is also adopted by gretl. It is chosen, such that, without any information about the independent variables, the model predicts the average of the dependent variable, real GDP growth in our case. The coefficients of the pooled OLS models with country dummies, model (2), are equal to the FE model with country factors, model (3).

A Hausman test on the “base models” (3) and (4) rejects the null hypothesis that the RE model produces consistent estimates (p-value approx. zero). We, therefore, continue the main analysis with FE models, but cross-checks indicate similar effects with the RE model across all model variations. However, our main interest lies in assessing differences in effects of WGIs on DM and EM markets as well as assessing to what extent effects on individual countries are streamlined or comparable. Models (6)–(11) consist of the base FE model (3) with an additional interacting variable for each WGI with the EM dummy. PSAV and GE are no longer statistically significant when clustering DM and EM markets (models (7) and (8)). To further break down the analysis of the WGIs, we consider FE models, where each WGI—one-by-one—is replaced by country-specific interacting WGIs. The output of the WGIs’ coefficients is shown in Table 4. It turns out that RQ and RL are the only WGIs, where (i) statistical significance is obtained for nearly all countries, and where (ii) the effects point in the same direction. This is an indication that these effects hold in general and are not country-specific. We find a positive impact of RQ and a negative impact of RL on real GDP growth. Further robustness tests in Tables 5, 6 and 7 confirm these findings. However, the negative impact of RL has to be taken with some caution: the within-variation of RL is very low for most countries (see Fig. 3); likewise, when ranking the within-country standard deviations of WGIs, this is lowest or second-lowest for RL for each country. A further indication for too little within-variation is the sharp drop in the constant whenever RL is dropped from the model (Tables 5 and 6). It is well-known that too little within-variation can lead to numerically unstable coefficient estimates (e.g., Wooldridge 2015). Hence, the results of RL should be considered with caution.

Table 3 with the main results indicates that for each additional 0.1 standard deviation units in RQ, on average real GDP growth increases by approx. 0.5–0.6 percentage points ceteris paribus. The results also suggest that as a result of a 0.1-standard-deviation appreciation in RL, real GDP growth drops by approx. 0.7 percentage points on average. The findings are similar when employing a dynamic panel model including a lag of real GDP growth.

To understand the results from an economic point of view requires taking a closer look at the attributes captured by RQ and RL. Following Kaufmann and Kraay (2002), RQ includes “perceptions of measures imposed by excessive regulation in areas such as foreign trade and business development.” One would, therefore, expect to see a positive impact of RQ on real GDP growth, especially when taking into account the advancement of globalisation in the time period under consideration. This last point is also supported by the positive incremental effect of RQ on EM countries (model (9)), reflecting that a more stable business environment opens up business opportunities not only on a national level, but also globally.

The negative relationship associated with RL may appear less plausible and, on grounds of the issues outlined above, should be interpreted with care. However, in-line with our finding of a negative effect between GDP and RL, Kaufmann and Kraay (2002) find a negative effect from income (measured by GDP) to RL. Their result is robust in the sense that a positive effect could only be obtained by an implausibly high measurement error, which is equivalent to saying that RL would be virtually uninformative. One implication of measuring a negative feedback from income on RL is that “improvements in institutional quality or governance are unlikely to occur merely as a consequence of economic development” (Kaufmann and Kraay 2002). In fact, they plausibly explain that the opposite may occur: as established elites reap private benefits from low quality institutions, there is little reason to expect that higher income will lead to demands for better institutions. This is exemplified on economies in East Asia and Latin America.

Table 8 shows the same models as Table 3, but with the WGIs replaced by the PC scores. Without interaction terms, PC4 is statistically significant at the 1% level, and PC3 is statistically significant at the 10% level. The factor loadings in Fig. 5 (lower left) indicate that PC4 captures variability mainly in RQ and RL not captured by any of the other PCs. The statistical significance of the PC4/EM interaction term confirms that the finding that RQ is a driver of GDP growth. The statistical significance of the PC5/EM interaction term is consistent with the findings that GE, RQ and RL are statistically significant in the regressions with the WGIs and that the loadings on PC5 of these variables are high.

Surprisingly, PC1, which accounts for 88.7% of the variance of the WGIs and which can, therefore, be considered a proxy for governance as a whole, is not statistically significant. The biplot of real GDP growth against PC1, see the corresponding plot in Fig. 6, shows that PC1 separates EM from DM countries. Furthermore, we see different country-specific effects. Together with the observation that the scores of PC1 are “sticky”, i.e., show little variation within countries (see Fig. 6), indicates that PC1 may be replaced by the constant and the country fixed effects. The regression models in Table 9 investigate this further. Model (1) shows the pooled OLS model without a constant and without country fixed effects. These are replaced by interaction terms of PC1 with each country. Aside from the high statistical significance for all countries, except for Brazil and South Africa, we find different signs of the coefficients, indicating that the overall relationship of governance and GDP growth differs across countries. In fact, the U.S. and Japan are the only countries with a statistically significant positive relationship between governance and GDP growth. Model (2) contains a PC1/EM interacting term. While the effect of PC1 for DM countries is positive, the interacting term has a statistically significant negative coefficient large enough to conclude that the relationship is negative for EM countries. This confirms the relationship between the lower WGIs and generally higher GDP growth of EM markets.

Conclusion

We explore the role of governance on GDP growth by investigating the relationship between governance and annual real GDP growth in a panel of the five BRICS countries and three DM countries (Japan, Germany, U.S.) in the time period 1996–2018. Governance is represented by six world governance indicators (WGIs) defined by the World Bank: voice and accountability (VA), political stability and absence of violence (PSAV), government effectiveness (GE), rule of law (RL), regulatory quality (RQ) and control of corruption (CC).

Due to the high correlation amongst the WGIs, a principal component analysis (PCA) allows to aggregate the WGIs into governance factors capturing the joint variation of all WGIs. The first PC, which captures 88.7% of the WGIs variance, shows significant differences across countries, but shows little variation within countries over time. As such, governance tends to be more “sticky” than GDP growth. It also clearly separates EM from DM countries, with EM countries having a lower governance than DM countries. Applying a clustering algorithm to the first two PCs clearly separates the countries into the following clusters: EM/DM countries for two clusters, EM-ex-China/China/DM for three clusters and EM-ex-China-Russia/China/Russia/DM for four clusters. Throughout, the EM countries Brazil, India and South Africa remain within one cluster.

A diverse set of panel regression models, including fixed effects and random effects models on the WGIs as explanatory variables and involving a set of control variables reveals that two WGIs have statistically significant effects on GDP growth: regulatory quality (RQ) and rule of law (RL). The results are robust when employing dynamic panel models, where a lag of the dependent variable is included (however, the results are not shown here, as they add no new information).

RQ has a significant positive influence on economic growth, which also persists at more granular levels: First, when differentiating EM and DM countries it turns out that the effect is significantly stronger for EM countries than for DM countries. Second, when differentiating at the country level, the effect is positive for all but one country (the exception being Japan).

Regulatory quality not only helps prevent corruption and the occurrence of monopolies, but regulations also are an essential part of enabling sustainable economic growth, market openness, social welfare, sound financial systems, environmental protection (Mujtaba et al. 2018, p. 7) as well as foreign trade and business development (Kaufmann and Kraay 2002). Such achievements are made by putting rules in place that ensure public money is well spent and allocated towards the most pressing issues and by creating an environment that embraces private investment and business development. The positive effect observed may be emphasised by the trend towards a more globalised world during the time period under consideration, which would boost business activities and, therefore, economic growth in those markets that create a reliable regulatory framework. It is, therefore, reasonable that improvements on RQ in EM economies—countries in most need of structural reforms—, have a positive impact on growth.

RL has a statistically significant negative effect on economic growth. The robustness tests, however, indicate that this observation must be taken with care, especially in the magnitude observed. For most countries, within-variation in RL is very low, whence estimated coefficients associated with RL may, at least in part, be compensated by fixed effects, similar to a multicollinearity issue. One possible economic argument for the negative effect of RL on economic growth is as follows: The countries that mostly adhere to the rule of law are (developed) countries with a democratic regime and a 4-year election cycle. This means that every 4 years more focus is put on short-term political campaigns and political agendas may change, so de facto long-term economic programmes may suffer some breaks or even be reversed along the way. This does not happen in countries with a dictatorial or totalitarian regime, where leaders are in power over many years “without being questioned”, meaning certain programmes that may boost economic growth (with no regards to the rule of law) are able to prevail over time and not only in a marathon-like 4 year period. Similarly, Kaufmann and Kraay (2002) find that income has a negative impact on governance, expressed through RL. They argue that “higher incomes do not necessarily lead to demands for better institutional quality”. In fact, one can easily conceive situations, where elites in a country benefit from a status quo of misgovernance and hinder demands for better governance even as incomes rise.

When replacing the WGIs by the PCs in the panel data analysis, the above results are confirmed. The fourth PC, which is statistically significant across all models and robustness tests, essentially captures RQ and RL. At first surprisingly, the first PC, which captures 88.7% of the WGIs variance, is not statistically significant. As noted above, this may be due to the “stickiness” or little within-variation of the first PC over time. At a more granular level, however, we find that the first PC separates emerging market countries (EM) from developed market (DM) countries. This reflects that DM countries have an overall higher governance. However, only a weak significant relationship is revealed with respect to real GDP growth. When building interaction terms of the first PC with the countries, however, we find that for most countries a statistically significant relationship between the first PC and GDP growth exists, with only Japan and the U.S. having a statistically significant positive relationship.

Data availability statement

On demand by email to the corresponding author.

Code availability

Mathematica and gretl code available on demand.

Notes

Gould, W. (2013) “Interpreting the intercept in the fixed-effects model”. URL http://www.stata.com/support/faqs/statistics/intercept-in-fixed-effects-model/.

References

Acemoglu D, Johnson S, Robinson JA (2001) The colonial origins of comparative development: an empirical investigation. Am Econ Rev 91(5):1369–1401. https://doi.org/10.1257/aer.91.5.1369

Acemoglu D, Johnson S, Robinson JA (2005) Institutions as a fundamental cause of long-run growth. In: Aghion P, Durlauf SN (eds): Handbook of economic growth, vol 1. Elsevier, Amsterdam, pp 385–472

Acemoglu D, Naidu S, Restrepo P et al (2019) Democracy does cause growth. J Polit Econ 127(1):47–100. https://doi.org/10.1086/700936

Adrian T, Grinberg F, Liang N et al (2022) The term structure of growth-at-risk. Am Econ J: Macroecon 14(3):283–323. https://doi.org/10.1257/mac.20180428

Authers J, Leatherby L (2019) As china’s debt balloons, other emerging markets fail to take off. https://www.bloomberg.com/graphics/2019-emerging-markets-debt/. Accessed 8 Apr 2020

Bivens J, Irons J (2010) Government debt and economic growth. EPI Briefing Paper No. 271, Economic Policy Institute. https://www.epi.org/publication/bp271/

Calderón C, Fuentes JR (2013) Government Debt and Economic Growth. IDB Working Paper Series No. IDB-WP-424, Inter-American Development Bank (IDB), Washington, DC.

Checherita-Westphal C, Rother P (2012) The impact of high government debt on economic growth and its channels: an empirical investigation for the Euro area. Eur Econ Rev 56(7):1392–1405. https://doi.org/10.1016/j.euroecorev.2012.06.007

Emara N, Chiu I (2016) The impact of governance environment on economic growth: the case of Middle Eastern and North African countries. J Econ Libr 3(1):24–37

Han X, Khan H, Zhuang J (2014) Do governance indicators explain development performance? A cross-country analysis. Working Paper, Asian Development Bank. https://doi.org/10.2139/ssrn.2558894

James G, Witten D, Hastie T et al (2013) An introduction to statistical learning, vol 112. Springer, Berlin

Kaufmann D, Kraay A (2002) Growth without governance. Policy Research Working Paper, The World Bank. https://doi.org/10.1596/1813-9450-2928

Kaufmann D, Kraay A, Zoido-Lobatón P (1999) Governance matters. Policy Research Working Paper, The World Bank. https://doi.org/10.1596/1813-9450-2196

Kaufmann D, Kraay A, Mastruzzi M (2009) Governance matters VIII: aggregate and individual governance indicators 1996–2008. Policy Research Working Paper, The World Bank. https://doi.org/10.1596/1813-9450-4978

Mira R, Hammadache A (2017) Relationship between good governance and economic growth: a contribution to the institutional debate about state failure in developing countries. Working Paper, Centre d’économie de l’Université Paris Nord. https://doi.org/10.2139/ssrn.3464367

Mujtaba B, McClelland R, Williamson P et al (2018) An analysis of the relationship between regulatory control and corruption based on product and market regulation and corruption perceptions indices. Bus Ethics Leadersh 2(3):6. https://doi.org/10.21272/bel.2(3).6-20.2018

OECD (2020) OECD Sovereign Borrowing Outlook 2020. OECD Publishing, Paris

Prasad A, Elekdag S, Jeasakul P et al (2019) Growth at risk: concept and application in IMF country surveillance. IMF Working Papers, No. 2019/036, International Monetary Fund. https://doi.org/10.5089/9781484397015.001

Rivera-Batiz FL (2002) Democracy, governance, and economic growth: theory and evidence. Rev Dev Econ 6(2):225–247. https://doi.org/10.1111/1467-9361.00151

Samarasinghe T (2018) Impact of governance on economic growth. Working Paper, Munich Personal RePEc Archive, No. 89834

Sánchez AC, Röhn O (2016) How do policies influence GDP tail risks? OECD Economics Department Working Papers No. 1339

Simon CP, Blume L (1994) Mathematics for Economists. Norton, New York

Tarverdi Y, Saha S, Campbell N (2019) Governance, democracy and development. Econ Anal Policy 63:220–233. https://doi.org/10.1016/j.eap.2019.06.005

Verbeek M (2012) A guide to modern econometrics, 4th edn. Wiley, Hoboken

Wooldridge JM (2015) Introductory econometrics: a modern approach. Cengage Learning, Boston

World Bank (1994) Governance: the World Bank’s experience. The World Bank. https://doi.org/10.1596/0-8213-2804-2

World Bank (2020) Global economic prospects, slow growth, policy challenges. Report

Funding

Open Access funding enabled and organized by Projekt DEAL. No funds, grants or other support were received.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Data collection and analysis were performed primarily by LEML, and amended by NP. The first draft of the manuscript was written by LEML and NP and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare not competing interests.

Financial interests

The authors have no relevant financial or non-financial interests to disclose.

Ethical approval and Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Misi Lopes, L.E., Packham, N. & Walther, U. The effect of governance quality on future economic growth: an analysis and comparison of emerging market and developed economies. SN Bus Econ 3, 108 (2023). https://doi.org/10.1007/s43546-023-00488-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-023-00488-3