Abstract

FDI has become a desired form of incoming investment for capital-poor nations like Bangladesh. Therefore, a critical analysis of macroeconomic constituent’s influences that determine the inflow of this “Investment-Blood” is undoubtedly rational. The study is conducted to shed empirical light on the relationship between FDI and other macroeconomic variables in Bangladesh, which is believed to assist modifications at the policy level. Resorting on annual time-series data and harnessing ARDL bounds testing and Error Correction Model, this study detects a long-run relationship between inward FDI and a set of regressors. The study finds no impact of interest rate and foreign reserve on FDI. Export is inversely related to FDI. This study reveals a substitutionary effect of export on FDI, which suggests applying the Heckscher-Ohlin model to reduce redundant exports by producing goods only in which the nation has a comparative advantage to create more room for FDI. In other words, to attract more FDI, Bangladesh has to make a trade-off in export. This paper recommends adopting FDI-led development as an intermediary solution until export can surpass the total import. The effects of import, current account balance (CAB), and per capita GDP are all positive. The findings further disclose that the CAB gap due to reduced export can be mitigated with more FDI. Electricity production has an inverse effect on FDI for high energy production costs. Thus, to attract more FDI in Bangladesh, this paper's robust findings suggest increasing the interest rate, decreasing unnecessary export, and relying more on renewable energy sources.

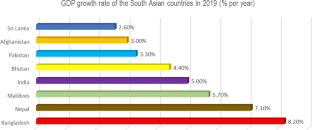

Author’s compilation by exploiting data from Asian Development Bank,

The output of CUSUM was retrieved from STATA statistical software

Similar content being viewed by others

Data availability

The data that support the findings of this study are available on the World Development Indicators (WDI) website of the [World Bank] at the following URL: https://datacatalog.worldbank.org/dataset/world-development-indicators.

Code availability

Not applicable for the present study.

Notes

1 USD = BDT 85.

References

Ahmad F, Draz MU, Yang SC (2018) Causality nexus of exports, FDI and economic growth of the ASEAN5 economies: evidence from panel data analysis. J Int Trade Econ Dev 27(6):685–700. https://doi.org/10.1080/09638199.2018.1426035

Akaike H (1974) A new look at the statistical model identification. IEEE Trans Autom Control 19(6):716–723. https://doi.org/10.1109/TAC.1974.1100705

Ali U, Wang JJ (2018) Does outbound foreign direct investment crowd out domestic investment in China? Evidence from time series analysis. Global Econ Rev 47(4):419–433. https://doi.org/10.1080/1226508X.2018.1492431

Ali W, Abdullah A, Azam M (2017) Re-visiting the environmental Kuznets curve hypothesis for Malaysia: fresh evidence from ARDL bounds testing approach. Renew Sust Energ Rev 77:990–1000. https://doi.org/10.1016/j.rser.2016.11.236

Ali M, Ahmad TI, Sadiq R (2019) Empirical investigation of foreign direct investment and current account balance in East Asian economies. Pak J Commer Soc Sci (PJCSS) 13(3):779–795

Amighini A, Sanfilippo M (2014) Impact of South-South FDI and trade on the export upgrading of African economies. World Dev 64:1–17. https://doi.org/10.1016/j.worlddev.2014.05.021

Anuchitworawong C, Thampanishvong K (2015) Determinants of foreign direct investment in Thailand: Does natural disaster matter? Int J Disast Risk Re 14:312–321. https://doi.org/10.1016/j.ijdrr.2014.09.001

Asiamah M, Ofori D, Afful J (2019) Analysis of the determinants of foreign direct investment in Ghana. J Asian Bus Econ Stud 26(1):56–75. https://doi.org/10.1108/JABES-08-2018-0057

Asian Development Bank (2020) Economic indicators for Bangladesh. Available via https://www.adb.org/countries/bangladesh/economy/ Accessed 29 March 2020

Bangladesh Bank (2017) Foreign Direct Investment (FDI) in Bangladesh: Survey Report January-June, 2017. Available via https://www.bb.org.bd/pub/halfyearly/fdisurvey/fdisurveyjanjun2017.pdf/ Accessed 29 March 2020

Bangladesh Bank (2018) Foreign Direct Investment in Bangladesh. Available via https://www.bb.org.bd/pub/halfyearly/fdisurvey/fdisurveyjuldec2018.pdf/ Accessed 5 April 2020.

Bangladesh Bank (2020) Annual reports on economic indicators. Available via https://www.bb.org.bd/openpdf.php/ Accessed 5 April 2020

Behera H, Yadav I (2019) Explaining India’s current account deficit: a time series perspective. J Asian Bus Econ Stud 26(1):117–138. https://doi.org/10.1108/JABES-11-2018-0089

Bera AK, Jarque CM (1981) Efficient tests for normality, homoscedasticity and serial independence of regression residuals: Monte Carlo evidence. Econ Lett 7(4):313–318. https://doi.org/10.1016/0165-1765(81)90035-5

Bermejo Carbonell J, Werner RA (2018) Does foreign direct investment generate economic growth? A new empirical approach applied to Spain. Econ Geogr 94(4):425–456. https://doi.org/10.1080/00130095.2017.1393312

Bevan AA, Estrin S (2000) The Determinants of Foreign Direct Investment in Transition Economies (December 2000). CEPR Discussion Paper No. 2638. Available at SSRN: https://ssrn.com/abstract=258070

Bhasin N, Gupta A (2017) Macroeconomic impact of FDI inflows: an ARDL approach for the case of India. Trans Corp Rev 9(3):150–168. https://doi.org/10.1080/19186444.2017.1362860

Bhujabal P, Sethi N (2020) Foreign direct investment, information and communication technology, trade, and economic growth in the South Asian Association for Regional Cooperation countries: an empirical insight. J Public Aff 20(1):e2010. https://doi.org/10.1002/pa.2010

Blanton RG, Blanton SL (2015) Is foreign direct investment “Gender Blind”? Women’s rights as a determinant of US FDI. Fem Econ 21(4):61–88. https://doi.org/10.1080/13545701.2015.1006651

Boateng A, Hua X, Nisar S, Wu J (2015) Examining the determinants of inward FDI: evidence from Norway. Econ Model 47:118–127. https://doi.org/10.1016/j.econmod.2015.02.018

Breusch TS (1978) Testing for autocorrelation in dynamic linear models. Austr Econo Papers 17:334–355. https://doi.org/10.1111/j.1467-8454.1978.tb00635.x

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc B 37(2):149–163. https://doi.org/10.1111/j.2517-6161.1975.tb01532.x

Cavallari L, d’Addona S (2013) Nominal and real volatility as determinants of FDI. Appl Econ 45(18):2603–2610. https://doi.org/10.1080/00036846.2012.674206

Chanegrih M, Stewart C, Tsoukis C (2017) Identifying the robust economic, geographical and political determinants of FDI: an extreme bounds analysis. Empir Econ 52(2):759–776. https://doi.org/10.1007/s00181-016-1097-1

Dhaka Tribune (2019) Bangladesh's export earnings decline further. Available via https://www.dhakatribune.com/business/commerce/2019/12/05/bangladesh-s-export-earnings-decline-further/ Accessed 7 April 2020

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431. https://doi.org/10.1080/01621459.1979.10482531

Doraisami AG (2007) Financial crisis in Malaysia: did FDI flows contribute to vulnerability? J Int Dev J Dev Stud Assoc 19(7):949–962. https://doi.org/10.1002/jid.1358

Dreger C, Schüler-Zhou Y, Schüller M (2017) Determinants of Chinese direct investments in the European Union. Appl Econ 49(42):4231–4240. https://doi.org/10.1080/00036846.2017.1279269

Durbin J, Watson GS (1950) Testing for serial correlation in least squares regression: I. Biometrika 37(3/4):409–428. https://doi.org/10.2307/2332391

Eita JH, Manuel V, Naimhwaka E (2018) Macroeconomic variables and current account balance in Namibia. https://mpra.ub.uni-muenchen.de/id/eprint/88818

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica J Econ Soc 64(4):813–836. https://doi.org/10.2307/2171846

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica J Econ Soc. https://doi.org/10.2307/1913236

Financial Express (2018) Bangladesh attracts nearly $3.0b FDI in 2017–18 fiscal year. Available via Bangladesh attracts nearly $3.0b FDI in 2017–18 fiscal year (thefinancialexpress.com.bd) Accessed 26 November 2020

Financial Express (2019a) BD’s economic growth hits record 8.15pc in FY19. Available via https://thefinancialexpress.com.bd/economy/bds-economic-growth-hits-record-815pc-in-fy191575976234/ Accessed 5 April 2020.

Financial Express (2019b) Bangladesh's FDI rises over 5pc from July to October. Available via https://thefinancialexpress.com.bd/economy/bangladeshs-fdi-rises-over-5pc-from-july-to-october-1577257337/ Accessed 7 April 2020.

Financial Express (2019c) Power generation cut to one-third of capacity. Available vai https://thefinancialexpress.com.bd/trade/power-generation-cut-to-one-third-of-capacity-1576988993/ Accessed 6 April 2020.

Financial Express (2020a) Time to switch over to brand apparel exports. Available via https://thefinancialexpress.com.bd/views/views/time-to-switch-over-to-brand-apparel-exports1582903085/ Accessed 6 April 2020.

Financial Express (2020b) Interest rates of 6%-9%: At whose interest? Available via https://thefinancialexpress.com.bd/views/reviews/interest-rates-of-6-9-at-whose-interest-1583598314/ Accessed 5 April 2020.

Godfrey LG (1978) Testing against general autoregressive and moving average error models when the regressors include lagged dependent variables. Econometrica 46:1293–1301. https://doi.org/10.2307/1913829

Goh SK, Tham SY (2013) Trade linkages of inward and outward FDI: evidence from Malaysia. Econ Model 35:224–230. https://doi.org/10.1016/j.econmod.2013.06.035

Goswami C, Saikia KK (2012) FDI and its relation with exports in India, status and prospect in north east region. Procedia-Soc Behav Sci 37:123–132. https://doi.org/10.1016/j.sbspro.2012.03.280

Gupta P, Aggarwal V, Champaneri K, Narayan K (2020) Impact of foreign direct investment on GDP growth rate in india: analysis of the new millennium. In: Rajagopal BR (ed) Innovation, technology, and market ecosystems. Palgrave Macmillan, Cham

Heckscher E (1919) The effect of foreign trade on the distribution of income. Ekonomisk Tidskrift 11:497–512

Hossain MR (2020) Can small-scale biogas projects mitigate the energy crisis of rural Bangladesh? A study with economic analysis. Int J Sustain Energy. https://doi.org/10.1080/14786451.2020.1749056

Jaffri AA, Asghar N, Ali MM, Asjed R (2012) Foreign direct investment and current account balance of Pakistan. Pak Econ Soc Rev 50:207–222

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12(2–3):231–254. https://doi.org/10.1016/0165-1889(88)90041-3

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxford B Econ Stat 52(2):169–210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Jude C (2016) Technology spillovers from FDI. Evidence on the intensity of different spillover channels. World Econ 39(12):1947–1973. https://doi.org/10.1111/twec.12335

Jude C (2019) Does FDI crowd out domestic investment in transition countries? Econ Trans Instit Change 27(1):163–200. https://doi.org/10.1111/ecot.1218

Khalid AM, Marasco A (2019) Do channels of financial integration matter for FDI’s impact on growth? Empirical evidence using a panel. Appl Econ 51(37):4025–4045. https://doi.org/10.1080/00036846.2019.1588945

Kueh JSH, Puah CH, Lau E, Abu Mansor S (2007) FDI-trade nexus: empirical analysis on ASEAN-5. https://mpra.ub.uni-muenchen.de/id/eprint/5220

Kumari R, Sharma A (2017) Determinants of foreign direct investment in developing countries: a panel data study. Int J Emerg Mark 12(4):658–682. https://doi.org/10.1108/IJoEM-10-2014-0169

Kurtović S, Maxhuni N, Halili B, Talović S (2020) The determinants of FDI location choice in the Western Balkan countries. Post-Communist Econ. https://doi.org/10.1080/14631377.2020.1722584

Liang FH (2017) Does foreign direct investment improve the productivity of domestic firms? Technology spillovers, industry linkages, and firm capabilities. Res Policy 46(1):138–159. https://doi.org/10.1016/j.respol.2016.08.007

Mahmoodi M, Mahmoodi E (2016) Foreign direct investment, exports and economic growth: evidence from two panels of developing countries. Econ Res-Ekon Istraz 29(1):938–949. https://doi.org/10.1080/1331677X.2016.1164922

Mamuti A, Ganic M (2019) Impact of FDI on GDP and unemployment in macedonia compared to albania and bosnia and herzegovina. In: Mateev M, Poutziouris P (eds) Creative business and social innovations for a sustainable future advances in science, technology & innovation (IEREK interdisciplinary series for sustainable development). Springer, Cham

Mengistu AA, Adhikary BK (2011) Does good governance matter for FDI inflows? Evidence from Asian economies. Asia Pac Bus Rev 17(3):281–299. https://doi.org/10.1080/13602381003755765

Milner HV (2014) Introduction: the global economy, FDI, and the regime for investment. World Polit 66(1):1–11. https://doi.org/10.1017/S0043887113000300

Mina W (2020) Do GCC market-oriented labor policies encourage inward FDI flows? Res Int Bus Finance 51:101092. https://doi.org/10.1016/j.ribaf.2019.101092

Mishra B, Jena P (2019) Bilateral FDI flows in four major Asian economies: a gravity model analysis. J Econ Stud 46(1):71–89. https://doi.org/10.1108/JES-07-2017-0169

Mukherjee J, Chakraborty D, Sinha T (2014) The Causal Linkage Between FDI and Current Account Balance in India: An Econometric Study in the Presence of Endogenous Structural Breaks. In: Ghosh A, Karmakar A (eds) Analytical Issues in Trade, Development and Finance. India Studies in Business and Economics. Springer, New Delhi

Nelson CR, Plosser CR (1982) Trends and random walks in macroeconmic time series: some evidence and implications. J Monetary Econ 10(2):139–162. https://doi.org/10.1016/0304-3932(82)90012-5

Newey WK, West KD (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica The Econom Soc 55(3):703–708. https://doi.org/10.2307/1913610

Odhiambo NM (2009) Energy consumption and economic growth nexus in Tanzania: An ARDL bounds testing approach. Energ Policy 37(2):617–622. https://doi.org/10.1016/j.enpol.2008.09.077

Ohlin B (1924) The theory of trade. In: Flam H, Flanders J (eds) Heckscher-Ohlin trade theory. The MIT Press, Cambridge, pp 73–214

Okafor G, Piesse J, Webster A (2017) FDI determinants in least recipient regions: the case of sub-Saharan Africa and MENA. Afr Dev Rev 29(4):589–600. https://doi.org/10.1111/1467-8268.12298

Opoku EEO, Ibrahim M, Sare YA (2019) Foreign direct investment, sectoral effects and economic growth in africa. Int Econ J 33(3):473–492. https://doi.org/10.1080/10168737.2019.1613440

Owusu-Manu D, Edwards D, Mohammed A, Thwala W, Birch T (2019) Short run causal relationship between foreign direct investment (FDI) and infrastructure development. J Eng Design Technol 17(6):1202–1221. https://doi.org/10.1108/JEDT-04-2019-0100

Pacheco-López P (2005) Foreign direct investment, exports and imports in Mexico. World Econ 28(8):1157–1172. https://doi.org/10.1111/j.1467-9701.2005.00724.x

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica J Econ Soc. https://doi.org/10.2307/1913712

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326. https://doi.org/10.1002/jae.616

Pfaffermayr M (1994) Foreign direct investment and exports: a time series approach. Appl Econ 26(4):337–351. https://doi.org/10.1080/00036849400000080

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346. https://doi.org/10.1093/biomet/75.2.335

Rodríguez-Pose A, Cols G (2017) The determinants of foreign direct investment in sub-Saharan Africa: What role for governance? Reg Sci Policy Pract 9(2):63–81. https://doi.org/10.1111/rsp3.12093

Sabir S, Rafique A, Abbas K (2019) Institutions and FDI: evidence from developed and developing countries. Financial Innov 5(1):8. https://doi.org/10.1186/s40854-019-0123-7

Saini N, Singhania M (2018) Determinants of FDI in developed and developing countries: a quantitative analysis using GMM. J Econ Stud 45(2):348–382. https://doi.org/10.1108/JES-07-2016-0138

Salem M, Baum A (2016) Determinants of foreign direct real estate investment in selected MENA countries. J Prop Invest Finance 34(2):116–142. https://doi.org/10.1108/JPIF-06-2015-0042

Salike N (2016) Role of human capital on regional distribution of FDI in China: new evidences. China Econ Rev 37:66–84. https://doi.org/10.1016/j.chieco.2015.11.013

Schwarz G (1978) Estimating the dimension of a model. Ann Stat 6(2):461–464. https://doi.org/10.1214/aos/1176344136

Seker F, Ertugrul HM, Cetin M (2015) The impact of foreign direct investment on environmental quality: a bounds testing and causality analysis for Turkey. Renew Sust Energ Rev 52:347–356. https://doi.org/10.1016/j.rser.2015.07.118

Shah MH, Khan F (2019) Telecommunication Infrastructure Development and FDI into Asian Developing Nations. Journal of Business and Tourism 5(1): 91–102. https://ssrn.com/abstract=3455150

Stock JH, Watson MW (1993) A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica J Econ Soc. https://doi.org/10.2307/2951763

Sunde T (2017) Foreign direct investment, exports and economic growth: ADRL and causality analysis for South Africa. Res Int Bus Finance 41:434–444. https://doi.org/10.1016/j.ribaf.2017.04.035

The Business Standard (2019) Bangladesh’s foreign debt rises 122pc in 10 years. Available via https://tbsnews.net/economy/bangladeshs-foreign-debt-rises-122pc-10-years/ Accessed 10 April 2020.

The Daily Star (2015) The importance of FDI: Constraints and potential. Available via https://www.thedailystar.net/supplements/24th-anniversary-the-daily-star-part-2/the-importance-fdi-constraints-and-potential/ Accessed 6 April 2020.

The Daily Star (2018) Economy to stay strong. Available via Bangladesh GDP Growth Rate in 2017–18: Economy to stay strong (thedailystar.net) Accessed 26 November 2020

Uddin M, Chowdhury A, Zafar S, Shafique S, Liu J (2019) Institutional determinants of inward FDI: evidence from Pakistan. Int Bus Rev 28(2):344–358. https://doi.org/10.1016/j.ibusrev.2018.10.006

UNCTAD (2006) World Investment Report (WIR). Available via http://unctad.org/en/pages/PublicationArchive.aspx?publicationid=709/ Accessed 7 April 2020

UNCTAD (2019) World Investment Report. Special Economic Zones. Available via https://unctad.org/en/PublicationsLibrary/wir2019_en.pdf/ Accessed 6 April 2020

Wang CC, Wu A (2016) Geographical FDI knowledge spillover and innovation of indigenous firms in China. Int Bus Rev 25(4):895–906. https://doi.org/10.1016/j.ibusrev.2015.12.004

White H (1980) A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica J Econ Soc 48:817–838. https://doi.org/10.2307/1912934

World Bank (2018) World development indicators 2018. World Bank, Washington, DC. https://datacatalog.worldbank.org/dataset/world-development-indicators.

World Bank (2020) Doing Business 2020. Available via http://documents.worldbank.org/curated/en/688761571934946384/pdf/Doing-Business-2020-Comparing-Business-Regulation-in-190-Economies.pdf/ Accessed 6 April 2020.

Yakubu I (2020) Institutional quality and foreign direct investment in Ghana: a bounds-testing cointegration approach. Rev Int Bus Strat 30(1):109–122. https://doi.org/10.1108/RIBS-08-2019-0107

Yimer A (2017) Macroeconomic, political, and institutional determinants of FDI inflows to ethiopia: an ARDL approach. In: Heshmati A (ed) Studies on economic development and growth in selected African countries. Frontiers in African business research. Springer, Singapore. https://doi.org/10.1007/978-981-10-4451-9_7

Zheng J, Ismail MN (2019) Determinants of Chinese overseas FDI in ASEAN countries. In: Idris A, Kamaruddin N (eds) ASEAN Post-50. Palgrave Macmillan, Singapore

Acknowledgement

I am genuinely grateful to my research supervisor Dr. Kausik Chaudhuri for his valuable time and suggestions during this manuscript's preparation. Besides, I would like to express my gratitude to the Commonwealth Scholarship Commission (CSC) and the University of Leeds for funding my research work.

Funding

This research was supported and funded by the Commonwealth Scholarship Commission (CSC), United Kingdom and Leeds University Business School, University of Leeds, UK.

Author information

Authors and Affiliations

Contributions

The corresponding author is liable for every aspect from designing to writing of the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The author declares of having no competing interests.

Rights and permissions

About this article

Cite this article

Hossain, M.R. Inward foreign direct investment in Bangladesh: Do we need to rethink about some of the macro-level quantitative determinants?. SN Bus Econ 1, 48 (2021). https://doi.org/10.1007/s43546-021-00050-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-021-00050-z

Keywords

- Inward FDI

- Import

- Current account balance

- Export reduction

- ARDL cointegration

- Bangladesh’s FDI-led development