Abstract

Due to the vast number of countries that have been affected, the coronavirus (COVID-19) pandemic has brought about a devastating global financial crisis. This commentary considers the ongoing COVID-19 recession, its global economic impact, the responses from governments, future projections, business and governance lessons learned so far, as well as future research prospects. In doing so, two key questions are considered: what can we draw from this unprecedented ongoing crisis so as not to experience the same scale of pandemic and recession in the future? What did we do wrong and what can be changed for good to reshape our businesses and economies? The author aims to provide key takeaways for resilient and sustainable organizations, corporate governance, and compensation systems.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

During H1N1 (swine flu), SARS, Ebola, HIV, Zika, malaria, dengue fever, etc., scientists, such as Bell et al. (2004), Boston et al. (2004), Lovelock (2009), and Watts et al. (2018), have warned us about the expanding virulence and elevated rate of infectious diseases on account of the mistreatment of habitat and wildlife. Regarding COVID-19, some scientists and epidemiologists believe that COVID-19 is a sign of overexploitation of wildlife, which facilitates the appearance of new dangerous sicknesses (Bennett 2020; Gatti 2020; Woodward 2020). Similarly, Poon and Peiris (2020) quoted that “it is not a coincidence that the likely origin of this COVID-19 is in the human-animal relations that occurred in China”. On the other hand, climate scientists and ecologists argue that the COVID-19 pandemic is owing to climate denial tactics, deforestation, and climate change (Kaplan 2020). Manzanedo and Manning (2020) illustrated that there are many parallels between the COVID-19 crisis and global climate crises, and they have listed the five COVID-19 lessons learned for climate change. They also debated if we reflect on the challenge of today’s crisis, it may help us better prepare for the future. Otherwise, it is logical to believe that COVID-19 may not be the last crisis or epidemic in the world.

Scientists, epidemiologists, or ecologists may not achieve a consensus on the real cause of COVID-19, but we all agree that COVID-19 is unlike any prior epidemics and crises. It has reached all corners of the world, and it is the worst-hit and has the worst devastating and brutal impact on the global economy and health systems (Hassan et al. 2020; Noy et al. 2020). Unfortunately, it is not over yet.

We should not be deaf to the screams coming from our habitat and environment. Before it is getting too late, businesses and governments should seriously take the environment into account as one of the stakeholders. Thus, we should shift our perspectives to holistic, inclusive, fairer, sustainable, and resilient approaches, such as sustainability and ‘stakeholderism’. For instance, after the first wave of the COVID-19 outbreak, the British Academy Roundtable has urged businesses to take a holistic approach by leaving the narrow shareholder approach and, instead, by taking a multi-stakeholder approach (Gore and Blood 2020; Ozili and Arun 2020). In other words, COVID-19 has stressed that we cannot neglect the concept of sustainability anymore.

As a result, although COVID-19 and its devastating impact on our businesses and economies are not over yet, this commentary article aims to find answers to the following research questions: what can we draw from this unprecedented ongoing crisis so as not to experience the same scale of pandemic and recession in the future? What did we do wrong and what can be changed for good to reshape our businesses and economies? As the format of ‘agenda-setting’ and ‘perspective offering calls for action’ commentary article, the author shares her opinion with the readers after the detailed analyses of the scientific articles, news, and literature in business, economics, and corporate governance area. Moreover, the second purpose of this commentary is to provide research questions and develop a future research framework, which will result in advancing knowledge in the field and outlining avenues for future studies. Thus, the results of this paper contribute to the literature and practice as follows: (1) key takeaways are provided for practitioners to establish sustainable and resilient businesses and governance systems; (2) the future research framework matrix is developed for scholars to aid them to conduct interdisciplinary research on COVID-19.

The rest of this paper is structured as follows: “The World during and post COVID-19 outbreak” discusses COVID-19 and its consequences and the governments’ responses to the crisis. “Businesses and corporate governance lessons learned” sheds light on the business and corporate governance lessons learned from the uncharted recession. “Conclusion, limitation and future research” presents the conclusion and limitations of the commentary article and future research agenda.

The world during and post-COVID-19 outbreak

COVID-19 has not been over while the article has been written. Thus, post COVID-19 indicates the time when the curfews, lockdowns, or stay-home-orders ended and when the ‘new normal’ started, approximately after May 2020.

COVID-19 and its consequences

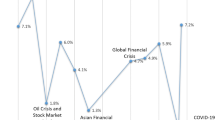

The world has changed dramatically due to COVID-19. The pandemic has forced a change in people’s daily life and business activities around the world. During the outbreak, countries/states/cities shut down, governments imposed stay-at-home-orders or lockdowns, employees worked at home, meetings were held virtually, businesses were digitalized, and education moved to online platforms to prevent the widespread of viral infection and to maintain the health care benefits (O'Malley 2020). From the financial and economic aspects, it created a sudden, exogenous, and far-reaching economic downturn only in a couple of months in 2020. For example, the Dow Jones and the FTSE 100 saw their biggest quarterly drops in the first 3 months of the year since 1987. Since the first outbreak started in January to July 2020, FTSE 100 (the UK), Dow Jones (the USA), and Nikkei (Japan) stock exchange indexes have lost almost 19.3%, 13.3%, and 5.2% of their values, respectively (Jones et al. 2020).

The World Bank has predicted that the global economy will shrink by 5.2% in 2020 and more than 60 million will be pushed into extreme poverty owing to the COVID-19 (Reinhart and Reinhart 2020). The COVID-19 has delivered a brutal hit to every economy in the world, but the period, speed, and magnitude of the shock and governments’ responses to the COVID-19 have varied across the globe. For instance, GDP dropped by 4.8% in the first quarter of 2020 and 9.1% in the second quarter in the USA, which is the sharpest contraction since the global financial crisis of 2007–2009 (Hutt 2020). On the other hand, the Japanese stock exchange and the Japanese economy were the least affected in the G7 Economies (Horowitz 2020) and the success of the Japanese approach is explained in the following section.

Many companies, unfortunately, laid off their employees, forced their staff to take a furlough, and/or cut the employees’ salaries and executive compensations. In the UK, the unemployment rate increased to 10% during the COVID-19 recession (Rushe 2020). The overall number of people claiming benefits due to unemployment has risen above 2.1 million in the UK for the first time since 1996 (Partington 2020). Similarly, the unemployment rate in the United States has reached the 1930s Great Depression levels. The unemployment rate has shot up from 4.4 to 14.7% (Rushe 2020). 45.7 million have filed for unemployment during the pandemic as of June 13, 2020, in the USA, which is greater than the combined population of 23 states (Lambert 2020).

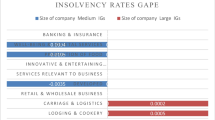

Not all companies have been equally impacted by the COVID-19 crisis. Some sectors surged their gains, but some lost millions of dollars in a couple of months. Oil and gas, travel, transportation, restaurants, airlines, hotels, entertainment, automobile, real estate, construction, sports, retail sectors were hit the hardest by the outbreak (Podstupka 2020). On the other hand, grocery stores, cleaning products, pharmaceutical, health care, cybersecurity, e-commerce, technology, and communication industries were the winners of the COVID-19 recession (Ogg and Lange 2020).

By the end of May 2020, lockdowns and stay-home-orders ended in most of the countries/states/cities around the world, and economies and businesses reopened to ‘new working normal’. Our priorities have changed in the new working normal. While the world is changing, the re-framing of the business and corporate governance and executive compensation structures is also inevitable and prominent in the ‘new working normal’. Therefore, companies should develop sustainable businesses and sustainable compensation and corporate governance structures based on stakeholder theory.

For the compensation, based on the shareholder theory, the CEOs working in these thriving sectors will be awarded due to the financial success, and the CEO working in the other sectors negatively impacted by the outbreak will be punished. Is it a fair, sustainable, and resilient approach to punish the executives for the circumstances beyond their control?

Responses by governments

The governments and regulatory bodies have not stayed silent to the change and recession. The European Union (EU), the World Bank (WB), the International Monetary Fund (IMF), the USA, the UK, China, Hong Kong, South Korea, Japan, India, Australia, Canada, Russia, Switzerland, Turkey, etc., have announced recovery plans and aid packages to help their society and businesses to cope with the effects of COVID-19 crisis (Alpert 2020).

Between March and April 2020, the American government passed three main relief packages. Recently the US government passed a stimulus bill (CARES Act). The Coronavirus Aid, Relief, and Economic Security Act (the CARES Act) is an aid package of approximately $2.3 trillion for many different efforts, e.g., one-time direct cash payment for a person, aid for the unemployed, grants for businesses, hospitals, health care providers, state and local governments, school, and universities (Alpert 2020). The businesses that receive financial assistance under Title IV of the CARES Act should impose certain limits on executive compensation (Persaud and Andrade 2020). CARES Acts brings compensation and severance limits: “Employees or officers who received between $425,000 and $3 million in total compensation in 2019 cannot receive more than what they made in 2019 during any 12 months” (Patterson 2020).

Another example of a government bailout for COVID-19 is from Switzerland. The Swiss federal council passed a stimulus bill and approved a package of CHF 60 million between March and April 2020 (KPMG 2020). The UK government announced a $37 billion fiscal stimulus and aid packages to individuals, small businesses, self-employed, and the unemployed, and $379 billion loan and loan guarantees to the businesses (Gov.UK 2020; Partington and Mason 2020). The final example is from the EU. The European Commission (EC) has introduced €1.85 trillion recovery plans, called ‘Next Generation EU’. This European Recovery Plan (Next Generation EU) does not only offer a financial bailout but also proposes incentives and regulations for a more sustainable, resilient, and fairer Europe for the next generations. For instance, the European Green Deal includes sustainable corporate governance initiative, mandatory compliance with sustainability principles, sustainable finance and investment strategies, and it invests in a more circular economy, clean technologies, and value chains, etc. The EC promised to put forward a sustainable corporate governance initiative in 2021 (EU 2020; Nagarajan 2020).

In simpler terms, if we conclude on these rescue packages, grants, and responses by governments, we can state that COVID-19 has emphasized the importance of nationwide collective actionFootnote 2 in contrast to the ‘winner takes all/most’ capitalism approach. Even the western capitalist countries, having individualism as a doctrine of rights (individuation) (Turner 1988), have taken nationwide collective action and have approved the billion dollars of aid packages to support the local businesses and their society. As shortly discussed in the prior section, Japan is one of the least affected countries within the Group of Seven (G7) economies due to its collectivist norms. The success of the Japanese approach during the COVID-19 is explained by Tashiro and Shaw (2020) and Vries (2020) as follows: “Tokyo did not become the next New York, the Japanese health system did not collapse, and their economic activity has never fallen beneath the level to which they aspire”. In other words, the Japanese form of sustainable and collective (stakeholder-oriented) capitalism works. As a result, it brings up the following question: is shareholder-based capitalism (individuation) slowly moving to stakeholder-based capitalism (collectivism)?

The purpose here is not to prove the superiority or inferiority of any country; it rather emphasizes the over-arching aim of ‘leave no one behind’ and the importance of achieving the globally agreed standards of the United Nation (UN)’s agenda-sustainable development goals (SDG) (Arora and Mishra 2020; Ashford et al. 2020; Barneveld et al. 2020). As Barneveld et al. (2020) stated, COVID-19 might be a portal to a greener, ecological, sustainable, and collective version of global capitalism, which will help to build a harmonious society, have a holistic stakeholder approach, and remove the pay inequalities or, at least, narrow the pay gap (Eklund and Stern 2020).

Businesses and corporate governance lessons learned

If the scenario analysis technique is used to project the long-term impacts and consequences of COVID-19, then there could be two paths: an optimistic scenario and a pessimistic scenario. According to the pessimistic scenario, COVID-19 is not the end, just the beginning of the dangerous and global contagious sicknesses unless any preventive measures are taken to stop the overexploitation of habitats that have a huge impact on wildlife and global warming, in turn, the expanding virulence (Bennett 2020; Eaton and Kalichman 2020; Gatti 2020).

Based on the optimistic scenario, the politicians, managers, and the general public will heed the warning of the habitats, wildlife, and environment, ensure accountability for the sustainability crises, and work together to build a sustainable, resilient, fair, holistic, and harmonious society, governments, and businesses. Thus, the following paragraphs are providing the readers with some general advice and key considerations to reach the goal of sustainable and resilient businesses although there are no universal and one-size-fits-all solutions to cope with the ongoing COVID-19 crisis.

The most immediate concern for the board of directors (BOD) should be the health and well-being of the employees and they should realize that employees are the human capital, not an expense. That is, the employees are the intellectual asset of the company. To create trust, executives should demonstrate leadership, fairness, transparency, and open, honest, and timely communication to all stakeholders.

The second prudent course of action for the executives and directors is not to lose long-term perspective while managing short term challenges, such as liquidity and solvency issues. As Nestle chairperson, Bulcke says “during a crisis, the chair feels like a motorcycle driver who needs to look ahead of the curve. If you keep looking at only what is just in front of you, your wheels don’t come out of the curve well, and you lose your balance” (Schmitt et al. 2020).

Third, BOD should see this crisis as an opportunity to acknowledge the vulnerabilities of their organization and take action for a change. Post-COVID-19, we are in a moment of change to more resilient, sustainable, and fairer companies. To do so, BOD should take a holistic approach and change their focus from ‘shareholderism’ to ‘stakeholderism’, develop sustainable value chains and partnerships, re-structure their corporate governance mechanism for sustainability, reshape CEO pay structures into fairer and sustainable ones, narrow the pay gap between employees and CEOs, learn to manage new upcoming risk and opportunities, have a succession plan for the critical employees, such as CEO and directors, and develop circular and sustainable strategies. Moreover, by addressing the broader stakeholders' concerns, shareholder interests can also be met. 77% of European practitioners surveyed by EY believe that sustainable corporate governance practices will play an important role in helping businesses to emerge from this COVID-19 crisis (EY 2020). Charlebois et al. (2020) also agree to align executive pay with stakeholder experience. It means that stakeholders’ expectations should be reflected in compensation decisions. Besides, the senior director of research at the National Association of Corporate Directors (NACD) emphasized that it is the right time for the BOD to assess their CEO compensation schemes and seek more sustainable solutions and frameworks, such as pay for sustainability or Environmental, Social and Governance (ESG) performance (Oord 2020). The American former vice president (Mr. Gore) stated that for a resilient, sustainable, and fair economy and businesses, the BOD should put ESG factors at the heart of their decision-making (Gore and Blood 2020). The investors in the USA have also asked for the disclosure of the ESG performance of the listed companies because they have stated that ESG information is essential for their decision-making. The investors’ demand for ESG disclosure has been made earlier, but it has noticeably increased during the COVID-19 crisis. As a result, the Securities Exchange Commission (SEC) has been urged to develop standardized principle-based rules for ESG disclosure (Azizuddin 2020; Harvey et al. 2020; Lee 2020).

Last but not least, the pandemic has re-emphasized the value of board diversity, digitalization, cybersecurity, flattening (non-hierarchical) corporate structures, and shorter decision-making lines to take agile decisions during uncharted times. It has accelerated the digital change in the organization and on the board. Now BOD should question whether they are prepared for destructive technologies, e.g., artificial intelligence, machine learning, etc., and whether they can maintain their effectiveness in the virtual environment (Hilb 2020). For instance, artificial intelligence and machine learning can help them in agile decision-making to cope with an unprecedented crisis, complexity and rapid change of environment, and the mass of information. For diversity, board composition is also important. Board members should be diverse to navigate these challenges. Diversity includes age, race, gender, geographical location, background (practitioner or scientist) and, skills (hard skills, soft skills, digital skills), etc. (EY 2020).

To sum up, we can argue that these key takeaways may not include brand-new concepts, theories, or suggestions, and we are aware of the significance of these concepts even before COVID-19. However, have we successfully carried out our duties to the environment, society, and governance? or have we failed in or neglect our duties? The COVID-19 has re-emphasized that sustainability is not a topic of ‘comply or explain’ anymore. It is a requirement that all businesses, governments, and people around the globe have to comply with.

Conclusion, limitation, and future research

Scientists, epidemiologists, and ecologists have debated that viruses have been expanded and the rate of infectious diseases has been elevated because we have not heeded the warnings of the habitats, wildlife, and environment (Bennett 2020; Gatti 2020). They have listed COVID-19 lessons learned for global warming and the habitat. Similarly, this paper has concluded with the COVID-19 lessons learned for countries, businesses, and corporate governance and it has also answered the question of what the future prospects are in the COVID-19-related research in the domain of social sciences, business, economics, and computer science.

We have reached a point that we cannot walk away from the COVID-19 crisis without taking lessons. The two key takeaways would be: (1) we should start moving to the sustainable and resilient management and governance systems if we have not yet, and (2) we should consider changing our perspectives from ‘shareholderism’ (individuation) to ‘stakeholderism’ (collectivism). In other words, we should shift our focus from the shareholder to the stakeholder approach for the sake of the interest of a broader group.

One of the results of the article is the lessons learned from the COVID-19 for our businesses and economies. For instance, the wide important themes are the nationwide collectivism, circular economy, sustainability, digitalization, cybersecurity, sustainable corporate governance, ESG based performance, ESG executive compensation, sustainable supply chain, board composition, and board diversity, long-term perspective, succession planning, and flat organizations. Furthermore, this paper outlines some future research avenues on COVID-19. The multi-disciplinary future research framework matrix on COVID-19 (Fig. 1) is developed by the author to inform the scholars of the emerging topics.

As illustrated in more detail in Fig. 1, some of the following topics may be the areas of concern for the scholars who want to conduct quantitative or qualitative research on the COVID-19 and its impacts:

-

o

the government stimulus package and its impact on the resilience of the businesses;

-

o

the CARES Act’s restrictions on the executive pay, and its effect on the executive compensation structure/level in the USA in the long run;

-

o

the impact of the EC Green Bill on the disclosure requirements, corporate governance structures, or the circular economy;

-

o

the COVID-19 disclosure and its impact on firms’ sustainable (ESG) performance or financial performance;

-

o

the sustainable (ESG) firms versus unsustainable (non-ESG) firms, and their financial performance during COVID-19;

-

o

the permanent change in CEO compensation structures post-COVID-19;

-

o

the change in the corporate governance structures of the listed firms in the highly affected sectors post-COVID-19;

-

o

the boards and disruptive technologies (cybersecurity, artificial intelligence, machine learning) for their decision-making.

As a limitation of the commentary article, there is no universal solution or single right or wrong to respond to this crisis. One-size-fits-all approaches are always very risky and harmful. Therefore, the opinion in this manuscript can be only used as a tool to find the reader’s best way to navigate through the challenges during the crisis and to develop sustainable and resilient businesses and governance structures.

Notes

The term of ‘collectivism’ in this manuscript is used to describe the interest of a broader group, in contrast to the individualism or individuation. Thus, stakeholderism, collectivism, stakeholder approach, and stakeholder theory are used interchangeably. Moreover, the collective action in this article means ‘nationwide collective’ action, not worldwide action.

References

Alpert G (2020) COVID-19 Government Stimulus and Financial Relief Guide. https://www.investopedia.com/government-stimulus-efforts-to-fight-the-covid-19-crisis-4799723

Arora NK, Mishra J (2020) COVID-19 and importance of environmental sustainability. Environ Sustain 3:117–119. https://doi.org/10.1007/s42398-020-00107-z

Ashford NA, Hall RP, Arango-Quiroga J, Metaxas KA, Showalter AL (2020) Addressing inequality: the first step beyond COVID-19 and Towards Sustainability. Sustainability. https://doi.org/10.3390/su12135404

Azizuddin K (2020) SEC Committee Pushes for ESG Disclosure Rules. https://www.responsible-investor.com/articles/sec-committee-pushes-for-esg-disclosure-rules

Bell D, Roberton S, Hunter P (2004) Animal origins of sars coronavirus: possible links with the international trade in small carnivores philosophical transactions. Biol Sci 359:1107–1114

Bennett J (2020) Reorienting the post-coronavirus economy for ecological sustainability. J Aust Political Econ 85:212–218

Boston PJ, Margulis L, Lovelock J, Torres PR (2004) Scientists debate gaia: the next century. MIT Press, Cambridge

Charlebois S, Pennell P, Ki R (2020) COVID-19 and Executive Pay: Initial Reactions and Responses. https://corpgov.law.harvard.edu/2020/05/09/covid-19-and-executive-pay-initial-reactions-and-responses/

EU (2020) Europe’s moment: Repair and Prepare for the Next Generation. https://ec.europa.eu/info/sites/info/files/communication-europe-moment-repair-prepare-next-generation.pdf

EY (2020) The Role of Corporate Governance in Shaping Europe Recovery Post COVID-19. Paper presented at the 25th European Corporate Governance Conference, Zagreb, Croatia, https://www.youtube.com/watch?v=-eRT_LVFlAc&feature=youtu.be,

Eaton LA, Kalichman SC (2020) Social and behavioral health responses to COVID-19: lessons learned from four decades of an HIV pandemic. J Behav Med 43:341–345

Eklund M, Stern H (2020) COVID-19 Reshapes Businesses and Executive Compensation. Working Paper

Gatti RC (2020) Coronavirus outbreak is a symptom of Gaia’s sickness. Ecol Model 426:1–3

Gore A, Blood D (2020) Capitalism After the Coronavirus The Wall Street Journal June 29

Gov.UK (2020) Chancellor Announces Additional Support to Protect Businesses. https://www.gov.uk/government/news/chancellor-announces-additional-support-to-protect-businesses

Harvey SM, Zarghamee RS, Ocker JM (2020) What Board Members Need to Know about the “E” in ESG. https://corpgov.law.harvard.edu/2020/07/09/what-board-members-need-to-know-about-the-e-in-esg/

Hassan TA, Hollander S, Lent Lv, Tahoun A (2020) Firm Level Exposure to Epidemic Diseases: Covid-19, SARS, and H1N1. Paper presented at the European Accounting Association (EAA), Virtual

Hilb M (2020) Toward artificial governance? The role of artificial intelligence in shaping the future of corporate governance. J Manag Gov. https://doi.org/10.1007/s10997-020-09519-9

Horowitz J (2020) Covid-19 Dealt a Shock to the World's Top Economies CNN:https://edition.cnn.com/2020/2008/2028/economy/global-recession-g2027-countries/index.html

Hutt R (2020) The Economic Effects of COVID-19 around the World World Economic Forum (WEF) February 17:https://www.weforum.org/agenda/2020/2002/coronavirus-economic-effects-global-economy-trade-travel/

Jones L, Palumbo D, Brown D (2020) Coronavirus: A Visual Guide to the Economic Impact BBC News June 30:https://www.bbc.com/news/business-51706225

KPMG (2020) Switzerland: Government and Institution Measures in Response to COVID-19. https://home.kpmg/xx/en/home/insights/2020/04/switzerland-government-and-institution-measures-in-response-to-covid.html

Kaplan S (2020) What the Coronavirus can Teach us About Fighting Climate Change The Washington Post, https://www.washingtonpostcom/climate-solutions/2020/08/21/questions-about-cimate-change-virus/

Kv B et al (2020) The COVID-19 pandemic: lessons on building more equal and sustainable societies. Econ Labour Relat Rev 31:1022

Lambert L (2020) 45.7 Million Have Filed for Unemployment During the Pandemic. https://fortune.com/2020/06/18/45-7-million-have-filed-unemployment-during-the-pandemic-greater-than-the-combined-population-of-23-states/

Lee AH (2020) Modernizing” Regulation S-K: Ignoring the Elephant in the Room. SEC, https://www.sec.gov/news/public-statement/lee-mda-2020-01-30

Lovelock J (2009) The vanishing face of gaia: a final warning. Perseus Book Group, New York

Manzanedo RD, Manning P (2020) COVID-19: Lessons for the climate change emergency. Sci Total Environ 742:140563

Nagarajan S (2020) The European Union's $826 Billion Stimulus Plan. https://www.businessinsider.com/what-eu-826-billion-covid-19-stimulus-package-means-2020-5?r=US&IR=T

Noy I, Ferrarini B, Park D (2020) COVID-19 and SARS: An Epidemiological and Economic Comparison. Development Asia: https://development.asia/explainer/covid-19-and-sars-epidemiological-and-economic-comparison

O'Malley M (2020) Leadership Lessons from the COVID-19 Crisis, https://www.pearlmeyer.com/blog/leadership-lessons-from-the-covid-19-crisis.

Ogg JC, Lange C (2020) Here are 40 Solid Stocks of Companies Thriving through the Coronavirus Recession. https://www.usatoday.com/story/money/2020/05/15/40-solid-stocks-of-companies-thriving-through-the-covid-19-recession/111701046/

Oord Fvd (2020) Lessons Learned from the Corona Crisis -An International Board Perspective. Paper presented at the Lessons Learned from Corona Crisis: An International Board Perspective, International Center for Corporate Governance (ICfCG), Switzerland, https://zoom.us/rec/share/2M9NPp77-jJJXYHX1GbPQ6gHG8fgaaa82yRI_PpeyEgCuZX5F01GtDR2f92EZoSS?startTime=1586430033000,

Ozili P, Arun T (2020) Spillover of COVID-19: impact on the global economy. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3562570

Partington R (2020) UK Jobless Claims Soar by Nearly 70% in April. https://www.theguardian.com/business/2020/may/19/uk-jobless-april-coronavirus-crisis-unemployment-benefits

Partington R, Mason R (2020) Key Points from Budget 2020 – at a Glance. https://www.theguardian.com/uk-news/2020/mar/11/key-points-from-budget-2020-at-a-glance

Patterson S (2020) Pandemic: Remuneration Committees Take Action, https://www.pearlmeyer.com/knowledge-share/presentation/pandemic-remuneration-committees-take-action.

Persaud NJ, Andrade A (2020) Who CARES about Executive Compensation after COVID-19? https://www.winston.com/en/benefits-blast/who-cares-about-executive-compensation-after-covid-19.html

Podstupka S (2020) Real-Time Oil & Gas Industry Executive Pay Actions At-A-Glance, https://www.pearlmeyer.com/blog/real-time-oil-and-gas-industry-executive-pay-actions-at-a-glance.

Poon LL, Peiris M (2020) Emergence of a novel human coronavirus threatening human health. Nat Med 26:317–319

Reinhart C, Reinhart V (2020) The Pandemic Depression. Foreign Aff 99:83–95

Rushe D (2020) US Job Losses have reached Great Depression levels. Did it have to be that way? https://www.theguardian.com/world/2020/may/09/coronavirus-jobs-unemployment-kurzarbeit-us-europe

Schmitt A, Probst G, Tushman M (2020) The Role of the Board Chair During a Crisis MITSloan Management Review https://sloanreview.mit.edu/article/the-role-of-the-board-chair-during-a-crisis/

Tashiro A, Shaw R (2020) COVID-19 pandemic response in Japan: What is behind the initial flattening of the curve? Sustainability. https://doi.org/10.3390/su12135250

Turner BS (1988) Individualism, capitalism and the dominant culture: a note on the debate the Australian and New Zealand. J Sociol 24:47–64

Vries Pd (2020) COVID-19 versus Japan's Culture of Collectivism. https://www.japantimes.co.jp/opinion/2020/05/22/commentary/japan-commentary/covid-19-versus-japans-culture-collectivism/#.Xv_7PihKiUk

Watts N, Amann M, Ayeb-Karlsson S, Watts N, Amann M, Ayeb-Karlsson S (2018) The lancet countdown on health and climate change: from 25 years of inaction to a global transformation for public health. Lancet 391:581

Woodward A (2020) Both the new coronavirus and SARS outbreaks likely started in chinese wet markets business insider February 26:https://www.businessinsider.com/wuhan-coronavirus-chinese-wet-market-photos-2020-2021?r=US&IR=T

Funding

The University of Wisconsin-La Crosse (UWL) has provided the author with summer research support to compensate for her research time dedicated to this project.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that they have no conflict of interest.

Ethical approval

The author declares that this study complies with ethical standards.

Informed consent

The author declares that this research does not involve humans and/or animals.

Rights and permissions

About this article

Cite this article

Eklund, M.A. The COVID-19 lessons learned for business and governance. SN Bus Econ 1, 25 (2021). https://doi.org/10.1007/s43546-020-00029-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-020-00029-2