Abstract

Using microdata from the Retail Price Survey (the basic statistics for the Consumer Price Index), we document facts regarding price stickiness in Japan. The main results are as follows: (1) The average frequency of price changes approximates \(20\%\) on a monthly basis. (2) The frequency of price changes is more heterogeneous than that in the US (3) Whereas no clear relationship exists between the frequency and size of price changes, a positive correlation emerges between the size of price changes and price dispersion across stores. (4) Large cities tend to have a higher frequency of price changes and smaller price dispersion than small cities. (5) A positive relationship exists between price changes and jobs-to-applicants ratio for some services. (6) Behind the 2022–2023 price increase, the frequency of price changes exhibits a notable increase for certain goods and services such as eating out, while no distinct change is observed for the size of price changes or price dispersion.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Price stickiness stands as a pivotal determinant influencing the effectiveness of monetary policy. Despite an accretion of empirical studies on the extent of price stickiness, including in Japan, the accuracy of measuring price stickiness is impeded by constraints in data accessibility. Prevailing data are normally based on prices aggregated at the regional level, and although scanner data are frequently used nowadays, they are restricted exclusively to goods with services being frequently omitted. This problem is particularly serious in Japan.

The first objective of this study is to present facts on price stickiness in Japan by employing the rich micro-level Retail Price Survey (RPS) data, which is the basic statistics of the consumer price index (CPI). Specifically, the frequency of price changes is our focus, because it serves as the basis of macroeconomic models that assume price stickiness such as New Keynesian models, and thus, offering comprehensive tables at both the item and category levels is vital for calibrating model parameters in future research.Footnote 1

The second objective is to analyze the relationships among various variables related to price stickiness, such as the frequency and size of price changes and cross-sectional dispersion in prices. This investigation holds significance in shaping a comprehensive model of price stickiness beyond the analysis of Japanese data. It will guide us in assessing the validity of sticky price models—such as menu cost and Calvo-type models—and in answering questions regarding whether aggregate or idiosyncratic shocks influence economic fluctuations and what causes heterogeneity in price stickiness. We leverage disparities across regions to empirically analyze whether these price stickiness variables are related to regional economic conditions, particularly, the effective jobs-to-applicants ratio. This estimation mirrors that of the Phillips curve with region, item, and month dummies in the fixed effects, while controlling for macroeconomic factors such as changes in inflation expectations and monetary policy.

It should be noted that our analysis is confined to Japan with no guarantee that the evidence of price stickiness is seamlessly extrapolated to other nations. Notably, Japan’s prolonged period of comparatively subdued inflation rates may imply significant dissimilarities with other countries in the attributes of price stickiness. To probe inter-country differences, this study compares the frequency of price changes for items ubiquitously featured in the CPI in both Japan and the US.

The main results obtained from the analysis are as follows: First, the average frequency of price changes (weighted average based on CPI weight) is \(22\%\) on a monthly basis. This metric varies widely across items with a standard deviation of \(28\%\). The unweighted average and median are \(25\%\) and \(16\%,\) respectively, with values varying considerably depending on the aggregation method. The frequency of price changes tends to be lower for services than goods, and a polarization exists between items with highly flexible prices (especially fresh food) and items with prices rarely revised (especially services). The average size of price changes is \(15\%,\) and the cross-sectional price dispersion across stores is \(26\%\) and \(32\%\) in terms of standard deviation and the difference between the 75th and 25th percentiles, respectively.

Second, the frequency and size of price changes depend on the measurement method. Changes in field agents and specification (attributes of the surveyed goods) increase the measured frequency of price changes for particular services, including eating out and those related to domestic duties (e.g., automotive maintenance, barber services, and external wall coating). Conversely, the impact on goods is smaller. As services have a lower frequency of price changes than goods, the frequency of changes in field agents and specification cannot be neglected. Furthermore, the impact of regional aggregation is large. When the frequency of price changes is measured based on the prices aggregated at the municipal level to be the same as the published RPS, the frequency of price changes becomes considerably larger.

Third, a comparison of the frequency of price changes between Japan and the US reveals that the variation in the frequency of price changes by item is greater in Japan than in the US The frequency of price changes in Japan is higher than in the US for items for which the frequency of price changes is commonly high in the two countries (especially fresh food), whereas the frequency of price changes in Japan is lower than in the US for items for which the frequency of price changes is commonly low (especially services). In other words, the frequency of price changes is more heterogeneous in Japan. The macroeconomic implication of this fact is that because the sector with sticky prices has a persistently larger effect on aggregate price rigidity than that with flexible prices, when other conditions are equal, the effect of monetary policy on the real side of the economy is greater in Japan than in the US (see (Carvalho, 2006)).

Fourth, in examining the relationship among several variables related to price stickiness, we observe no clear relationship between the frequency and size of price changes, while a positive correlation is observed between the size of price changes and price dispersion across stores. At the item level, price dispersion tends to increase for items with larger price changes. Furthermore, the regression of the size of price changes on price dispersion as well as the fixed effects for each prefecture, item, and month reveals a significant positive relationship between the size of price changes and price dispersion. These results suggest that idiosyncratic shocks are more important than aggregate shocks in firms’ price setting.

Fifth, an examination of heterogeneity by region suggests that the law of one price is not generally established for either goods or services. Specifically, price levels tend to be higher in larger cities for the categories of foods, services related to domestic duties, and services related to communication, culture, and recreation. However, there are some goods and services, such as other industrial products and eating out, for which there is no significant difference between large and small cities. Additionally, we find that larger cities tend to have a higher frequency of price changes. Finally, price dispersion from the national average for goods tends to be smaller in large cities than small cities. Large cities have higher population densities and shorter shopping distances between competing stores, which may result in smaller price differences.

Sixth, we examine the relationship between several price stickiness variables and employment conditions at the local level and find significant relationships for some services. We run the regression of the Phillips curve using price stickiness variables by prefecture, item, and month as the dependent variable, while the explanatory variables comprise the effective jobs-to-applicants ratio by prefecture and month and the fixed effects of prefecture, item, and month. When the log price difference (i.e., inflation rate) is used as the dependent variable, the coefficient on the effective jobs-to-applicants ratio is not significant for goods but is significant for some services (particularly, domestic duties and medical care and welfare). This result is consistent with the prediction by Hazell et al. (2022) that prices of tradable goods do not respond to region-specific factors, whereas those of non-tradable goods (i.e., services) do. Furthermore, the decomposition of price changes shows that the size of price changes is positively associated with the effective jobs-to-applicants ratio for services in the period before the COVID-19 pandemic, while the frequency of price changes is not.

Seventh, we assess the frequency and size of price changes and price dispersion during the 2022–2023 price-increase phase. We find no clear change in the size of price changes or price dispersion, but an increase in the frequency of price changes. Specifically, the frequency of price changes increases considerably for fresh food from 0.42 to 0.65. Even services, typically characterized by sticky prices, exhibit a notable increase in the frequency of price changes from 0.049 to 0.067 for private services (e.g., eating out and domestic duties) and from 0.009 to 0.021 for public services (e.g., school lunch). This suggests that a state-dependent sticky price model fits the data better than a time-dependent sticky price model. Furthermore, regarding the regression of the Phillips curve for services, we find that the coefficient on the effective jobs-to-applicants ratio becomes insignificant in the period after the pandemic. This result suggests that the increase in the inflation rate in the service sector may not have been driven by labor market tightening but potentially by other factors such as the escalation in global commodity prices.

Numerous studies measure price stickiness both overseas and in Japan.Footnote 2 Of these, Higo and Saita’s (2007) study is most relevant to our study. The most notable difference is that Higo and Saita (2007), as well as Ikeda and Nishioka (2007) and Kaihatsu et al. (2023), use published aggregated data from the RPS. As these studies’ authors acknowledge, the frequency of price changes is overestimated because a price change in any store among several stores in a region is considered a price change when we use the aggregated RPS data. Abe and Tonogi (2010) and Sudo et al. (2014) use supermarket scanner data to analyze price stickiness. Unlike the RPS and CPI, which cover only representative items, the scanner data cover all goods provided they are sold in supermarkets. However, the scanner data do not include items that are not sold in supermarkets—notably, services such as eating out and cutting hair. The contribution of this study to the existing body of research on the US and Europe is constrained, primarily owing to the long-standing availability of similar data in these regions. Nonetheless, our study adds value by shedding light on price dispersion, which has received comparatively less attention in prior research, and delving into a more detailed examination of regional heterogeneity.

In recent years, there has been a notable surge in the body of research focused on price dynamics while considering regional heterogeneity [e.g., Nishizaki and Watanabe (2000), Fitzgerald and Nicolini (2014), McLeay and Tenreyro (2019), Hazell et al. (2022), and Kishaba and Okuda (2023)]. One challenge in analyzing the determinants of price setting, especially the effect of economic activity, is that aggregate shocks, such as monetary policy and technology shocks, affect not only economic activity but also inflation expectations. This issue becomes particularly pronounced during periods of declining inflation expectations, as witnessed during the Great Moderation, which may make the estimation of the slope of the Phillips curve seriously biased unless inflation expectations are appropriately controlled. To address this challenge, regional data can be used to analyze the effects of region-specific economic activity on price dynamics in a particular region, while controlling aggregate factors. Hazell et al. (2022) construct a sticky price model comprising tradable and non-tradable goods (equivalent to services) and two regions and demonstrate that the slope of the Phillips curve for an entire country can be estimated from the Phillips curve for non-tradable goods using panel data and the time fixed effects. Kishaba and Okuda (2023) apply the framework by Hazell et al. (2022) to the Japanese data. A distinguishing feature of our analysis—compared with that of Hazell et al. (2022) and Kishaba and Okuda (2023)—is our breakdown of prices, considering both the frequency and size of price changes. However, in contrast to Kishaba and Okuda (2023), our study is constrained by limitations in accessing microdata, resulting in a shorter data period restricted to the period after 2012. This timeframe corresponds to a period characterized by low inflation and nearly zero nominal interest rates, commonly associated with a flat Phillips curve.

The structure of this paper is organized as follows. Section “2” provides an overview of the RPS data and variable definitions. Section “3” presents the results of price stickiness, such as the frequency and size of price changes and price dispersion. Section 4 presents the results for the relationship between the variables related to sticky prices. Section 5 presents the results for regional heterogeneity. Section 6 presents the results for the estimation of the Phillips curve. Section 7 examines time-series changes in the frequency and size of price changes and price dispersion. Section 8 concludes.

2 Overview of the RPS data and definition of variables

2.1 Retail price survey

The RPS is one of the fundamental statistics based on the Statistics Act in Japan, which forms an integral component of the CPI. The RPS involves a survey conducted by field agents who gather price data from as many as 576 retail stores spanning the entire nation. See Online Appendix A for the descriptive statistics such as surveyed items, weights in terms of expenditure (CPI weights), and the number of surveyed shops.

For this study, we obtain microdata on the RPS, which include prices by stores on a monthly basis. This allows us to analyze price stickiness in detail, particularly ensuring accurate calculation of the frequency and size of price changes and price dispersion.

Several items are excluded from our analysis. Some items are not surveyed in the RPS because (1) they do not have a defined survey area (e.g., gasoline and waterworks), (2) they have uniform prices nationwide or regionally (e.g., electricity, communication charges, and railroad fares), or (3) prices are collected using web scraping or POS data (e.g., personal computers, airfare, and accommodation). In addition, (4) rent is excluded from our analysis because it requires separate handling, and (5) items that are surveyed in the RPS but not in the CPI are also excluded. Some items are surveyed three times in a month because of their extreme price volatility (e.g., cabbage), which we do not analyze in some cases.

Our analysis covers 511 items, and the expenditure weight of these items (CPI weight, 2020 base) compared with the overall CPI items (582 items, 2020 base) is approximately \(60\%\). Notably, rent constitutes a significant portion of the excluded items, contributing to about \(20\%\) of the overall CPI weight. It is worth highlighting that rent, particularly imputed rent, is widely recognized for its remarkable price rigidity. Conversely, the excluded items like personal computers and airfare, which rely on web scraping and POS data, exhibits a tendency towards frequent price changes.

The data period begins in September 2012, owing to limitations in the availability of micro RPS data. Data on prefectural survey items (so-called D items, e.g., water and sewerage charges, college and university fees) are available only from October 2016. The data period ends in April 2023.

2.2 Definition of variables

We focus primarily on the following variables.Footnote 3 The first variable is the price level. We calculate the unweighted average price of \(p_{ism}\) across store s by item i and month m, where we ignore the records that are not surveyed—denoted by NAs (not available). We index the price level by standardizing September 2012 to one.

The second is the frequency of price changes, which is defined as

for item i and month m, where I(x) represents a price-change indicator, which takes the value of 1 if x is true. More specifically, we calculate it in the following steps. First, we record whether a price is changed from the previous month for each item, month, and store. The conditions for determining price changes are that prices are surveyed both in the previous and current months; the price difference is at least two yen; no change occurs in field agents or item specification (attributes of surveyed goods); and the month is not April 2014 or October 2019, months observing the rise in the consumption tax rate. Data for NAs are ignored, though assuming that the price exhibits no change from the previous month is possible. Second, for each item and month, we calculate the fraction of stores wherein prices are revised and define this as the frequency of price changes. For the items that are surveyed three times in a month (early/mid/late period), we calculate the frequency of price changes from the previous period (i.e., around 10 days before), but not from the previous month. Denoting this as f, we calculate the monthly frequency of price changes as \(1-(1-f)^{3}\).

The third is the size of price changes. It is calculated as

for each item and month. We record the absolute size of price changes when a price change is determined, dividing it by the previous month’s price, and then taking the simple average.

The fourth is price dispersion across stores. After obtaining the logarithmic values for the price, \(log(p_{ism}),\) for each item, store, and month, we calculate price dispersion across stores as the standard deviation or difference between 75th and 25th percentiles.

Price dispersion—despite receiving less attention in existing studies than the frequency and size of price changes—is closely related to welfare losses in the New Keynesian model based on Calvo-type price stickiness. Price dispersion signals that labor is not efficiently supplied to sectors, and deviations from the law of one price can lower consumer surpluses (see Nakamura et al. (2018)).

Our methodology encompasses the calculation of several key metrics for each item and month, including the price level, frequency of price changes, size of price changes, and price dispersion. In general, items in the RPS directly correspond to items in the CPI. However, in some cases, a more diverse set of items are surveyed in the RPS (especially the D items) than in the CPI.Footnote 4 In such cases, we calculate simple averages for the multiple items surveyed in the RPS that pertain to a specific CPI item.

These variables calculated for each item are aggregated based on the CPI weights. We use two tiers of categories for aggregation following the CPI and Higo and Saita (2007). The first is a large category, consisting of the following five classifications: fresh food, goods (excluding fresh food), goods (public), services, and services (public). The other is a medium category, consisting of 19 classifications such as textiles and eating out. The categories not labeled public are those in the private sector. When averaging over time, we take simple averages.

3 Frequency and size of price changes and price dispersion

3.1 Main results

Table 1 summarizes the frequency and size of price changes and price dispersion for the items in RPS. The CPI-weighted mean of the frequency of price changes is \(22\%\) on a monthly basis. The unweighted mean and median are \(25\%\) and \(16\%,\) respectively. The standard deviation of the frequency of price changes is \(28\%,\) indicating high heterogeneity. Figure 1 depicts the histogram of the frequency of price changes by item, indicating that the frequency of price changes is broadly divided into the following two modes: highly flexible items with the frequency close to one and rigid items with the frequency close to zero. Items with a high weight tend to have a low frequency of price changes, making weighted mean smaller than unweighted mean.

The frequency of price changes is nearly the same as that in Higo and Saita (2007), which is \(21\%\). Two points should be noted. First, Higo and Saita (2007) use the published RPS, wherein prices are aggregated. Using aggregated price data generates an upward bias in calculating the frequency of price changes. Second, the analysis period is different. The data cover the period from 2012 to 2023, whereas (Higo & Saita, 2007) use data from 1999 to 2003. During the secular stagnation, the slope of the Phillips curve has reportedly flattened, and thus, the frequency of price changes in the data period may be lower than that in the period analyzed by Higo and Saita (2007). Conversely, the frequency of price changes may be higher because the data include the period of high inflation after the COVID-19 pandemic. To illustrate this, we divide our data period into “Before COVID-19” and “After COVID-19,” denoting the periods from September 2012 to December 2019 and January 2020 to April 2023, respectively. As depicted in Table 1, the frequency of price changes registers a lower value before the COVID-19 at \(17\%\), compared to \(24\%\) after the COVID-19 pandemic.

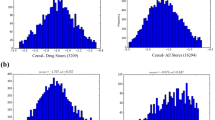

The weighted mean of the size of price changes is \(15\%\). The left-hand panel of Fig. 2 illustrates a histogram of the size of price changes by item, which exhibits a single-mode distribution peaking around \(15\%\) and no clear differences by category. Comparing the size of price changes before and after the COVID-19 pandemic, Table 1 reveals an increase from \(14\) to \(16\%\).

Price dispersion is substantial. It is \(26\%\) and \(32\%\) in standard deviation and the difference between the 75th and 25th percentiles, respectively. As the RPS examines the prices of certain pre-specified items, this result suggests that the law of one price does not hold, with variations of approximately 30% from one store to another. The figure on the right-hand side of Fig. 2 presents a histogram of price dispersion based on standard deviation by item, which does not exhibit bimodal patterns or any discernible dependence on item characteristics, unlike the pattern observed in the frequency of price changes. Price dispersion did not increase after the COVID-19 pandemic.

Tables 2 and 3 summarize the frequency and size of price changes at the large and medium category levels, respectively. A comparison of the CPI weights of the items surveyed in the RPS and CPI indicates that, while the RPS covers almost all CPI items for fresh food, there are large omissions in services. Among services, zero or extremely low coverage is observed in rent; those related to communication, culture, and recreation; those related to domestic duties (public); and those related to culture and recreation (public).

Fresh food and petroleum products stand out with a remarkably high frequency of price changes, surpassing \(50\%\) on a monthly basis. In contrast, several categories, primarily within the service sectors, such as eating out and services related to domestic duties, exhibit a notably low frequency of around \(1\%\) or even less.

When the period is divided into segments before and after the onset of the COVID-19 pandemic, Table 2 shows that the frequency of price changes increases considerably for fresh food from 0.42 to 0.65. Even services, typically characterized by sticky prices, exhibit a notable increase in the frequency of price changes from 0.049 to 0.067 for private services and from 0.009 to 0.021 for public services. Regarding the size of price changes, the direction of change is diverse: it increases from 0.163 to 0.382 for public services, whereas it decreases from 0.154 to 0.144 for private services. For goods excluding fresh food, the size of price changes remains almost unchanged at 0.135.

In Tables 2 and 3 in Online Appendix C, we report results at the medium category levels before and after the onset of the COVID-19 pandemic. The frequency of price changes increases for the majority of medium categories, particularly exhibiting a substantial increase in for the following three categories: food products, eating out, and services related to domestic duties. Regarding the size of price changes, no clear change is observed for the medium categories of goods excluding fresh food. Private services such as eating out and domestic duties exhibit a decrease, whereas public services such as domestic duties and medical care/welfare exhibit a substantial increase.

3.2 Dependence on measurement methods

We assess the extent to which measured price stickiness varies depending on the calculation method (Tables 4 and 5). In the CPI and RPS, surveyed items (item specifications) are reviewed every month, in addition to major revisions every five years. Furthermore, field agents occasionally change. In the benchmark study, the frequency of price changes is calculated by excluding the month in which surveyed items or field agents are changed.

Item specifications were reviewed 824 times from September 2012 to April 2023. Considering that the number of items and months are approximately 600 and 128, this suggests that the frequency of item specifications is around \(1\%\) on a monthly basis, which is excluded from our calculation of the frequency of price changes. However, excluding all the item specification changes might be excessive because some of the changes reflect simple changes in item quantity, such as the number of items or volume, in which case we may be able to calculate a quantity-adjusted price. To assess this impact, we examine the contents of 217 item specification changes from September 2012 to December 2014. We find 29 cases of quantity changes out of 217, in which quantity increases and decreases are 12 and 17 cases, respectively. Thus, quantity changes account for only \(11.7\%\) of item specification changes. Furthermore, calculating a quantity-adjusted price is not straightforward because quantity is often specified with a range (e.g., spaghetti of \(260{-}301\; \text{g}\) to \(260{-}330\;\text{g}\)).

Nevertheless, it would be important to calculate the upper bound of the frequency of price changes by assuming that all changes in item specifications and field agents are price changes. Calculating the frequency of price changes by including (i.e., ignoring) these changes, we summarize in Table 4 the effects of changes in item specifications and field agents on the measurement of the frequency and size of the price changes. The overall effects are modest. However, the frequency of price changes undergoes considerable changes for certain services— particularly, eating out and services related to domestic duties. When the frequency of price changes is calculated but changes in field agents are neglected, the value for eating out and services related to domestic duties increases from \(2.2\) to \(3.2\%\) and from \(1.1\) to \(1.5\%,\) respectively. This suggests the possibility that, for items with a low frequency of price changes, changes in field agents occur more frequently than actual price changes, resulting in an upward bias in the measurement of price changes if we ignore this effect. Another possibility is that item specifications for services are inherently more ambiguous compared to those for goods, which lead to a greater degree of discretion exercised by field agents when collecting price data. Furthermore, the table indicates that for services related to domestic duties, the effect of changes in item specifications on the measurement of the size of price changes is substantial. When we ignore this, the size of price changes increases from \(15\) to \(45\%\).

Next, we examine the effects of regional aggregation on the measurement of the frequency of price changes. The RPS appears to publish prices as a simple average of prices in multiple stores within a municipality, rounding to the first decimal place. For this reason, in previous studies (Higo and Saita 2007; Ikeda and Nishioka 2007; Kaihatsu et al. 2023) that examine price stickiness using published RPS data, the frequency of price changes is measured as if it were one, even when only one store in a municipality revises its price while other stores maintain their prices unchanged (i.e., an upward bias in the frequency of price changes). Moreover, the RPS does not publish prices for all cities (e.g., in Hokkaido prefecture, the published RPS comprises three regions, while the micro RPS data include six regions).

To validate this potential upward bias, we calculate the frequency of price changes after aggregating prices within the same region (city, town, village level, or prefecture level) for the eating-out category. Table 5 clearly demonstrates that, as anticipated, the greater the degree of aggregation (baseline \(\rightarrow \) city, town, village \(\rightarrow \) prefecture), the higher the reported frequency of price changes. For example, for udon (Japanese noodle), the original frequency of price changes stands at \(2.6\%,\) but this increases considerably to \(6.4\%\) when aggregated by city, town, or village, and further escalates to \(14.9\%\) when aggregated by prefecture. These findings underscore the substantial impact of aggregation on the measurement of the frequency of price changes and emphasize the importance of utilizing micro RPS data for more precise analysis.Footnote 5

3.3 Comparison between Japan and the US

We compare the frequency of price changes between Japan and the U.S, utilizing data from the table provided in the appendix by Bils and Klenow (2004) and focusing on items that are commonly surveyed in both countries. However, it is important to note that there are significant differences in the composition of items within certain categories between the two countries. For example, in Japan, the eating-out category comprises a wide variety of food items such as udon, Chinese noodles, spaghetti, and hamburgers, while in the US, it is classified more broadly as lunch or dinner. Similarly, in the category of fresh food, Japan offers a diverse range of seafood items such as tuna, sardines, and salmon, while the US offers only fish excluding canned. By contrast, the US has a broader array of repair supplies and infant clothing items. For details, see the table in Online Appendix A. The fraction of items common in both countries is \(61\%\) and \(47\%\) in Japan and the US, respectively (calculated as the number of common items divided by the number of items for Japan or the US). Based on the CPI weight, the fraction of common items is \(68\%\) in Japan and \(46\%\) in the US. Another important note is that price changes owing to temporary sales are included in the US. Bils and Klenow (2004) document that temporary sales make up approximately \(20\%\) of price changes, whereas (Nakamura & Steinsson, 2008) argue that the effect of temporary sales is larger, accounting for about \(50\%\) of price changes.

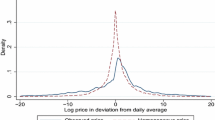

Figure 3 depicts a scatter plot of the frequency of price changes for common items with Japan on the horizontal axis and the US. on the vertical axis. The following observations are made: First, items with a high frequency of price changes in Japan tend to have a high frequency of price changes in the US as well (i.e., positive correlation). Second, for items for which the frequency of price changes is high in both Japan and the US (especially fresh food), the frequency of price changes is even higher in Japan than in the US. Third, contrary to the second result, for items for which the frequency of price changes is low in the two countries (especially services), the frequency of price changes is lower in Japan than in the US. The second and third results suggest a flatter slope of the regression line, with the estimated slope being 0.42 (significant at the \(5\%\) level). Furthermore, the data reveals that the standard deviation in the frequency of price changes across items is about twice as large for Japan at 0.32 (or \(32\%\)) compared to 0.17 for the U.S, whereas the average frequency of price changes is comparable (0.28 for Japan and 0.27 for the US). Although the inclusion of temporary sales increases the frequency of price changes for the US, this is predominantly exclusive for goods, and the result that the frequency of price changes in the US is higher than that in Japan remains valid for the category of services.

This result suggests that overall price stickiness as a determinant of the real effect of monetary policy is more pronounced in Japan than in the US. Carvalho (2006) shows that when price stickiness is heterogeneous, overall price stickiness is greater than when it is homogeneous, and the real effect of monetary policy is larger. This is because when monetary policy shocks occur, the share of sectors with rigid prices becomes relatively prominent among firms that did not adjust their prices, which Carvalho (2006) calls the frequency composition effect. Furthermore, Aoki (2001) suggests that an optimal monetary policy should refer to price changes in sectors with rigid prices, and in this respect, placing greater emphasis on service sectors is desirable in Japan than in the US, as these sectors tend to exhibit lower frequency of price changes and greater price stickiness.

4 Relationship between price stickiness indicators

This section presents an examination of the relationship between the three main indicators of price stickiness: the frequency of price changes, the size of price changes, and price dispersion.

4.1 Theoretical possibility

Before presenting the empirical results, we consider the theoretical relationship between the frequency and size of price changes. When heterogeneity in the frequency of price changes is more pronounced heterogeneity caused by idiosyncratic shocks (as opposed to aggregate shocks), we might expect a negative correlation between the frequency and size of price changes. For example, in the Calvo-type sticky price model, where firms have a fixed and heterogenous probability of adjusting their prices each period, the size of price changes will be smaller the higher the frequency of price changes. Similarly, in a state-dependent sticky price model, where menu costs vary across items, smaller menu costs lead to a higher frequency of price changes and smaller price adjustments.

On the contrary, a plausible scenario exists where the frequency of price changes is positively correlated with the size of price changes. In particular, when menu costs are uniform across items and idiosyncratic shocks have a predominant influence, both the frequency and size of price changes will be larger for items with greater idiosyncratic shocks.

When menu costs are heterogeneous and idiosyncratic shocks are considerable, the frequency of price changes is likely to be uncorrelated with the size of price changes. The idiosyncratic nature of shocks and the variability in menu costs across firms can result in diverse responses to price adjustments. A similar expectation holds in the Calvo-type model. Specifically, when idiosyncratic shocks dominate over aggregate shocks, the frequency of price changes is expected to be uncorrelated with the size of price changes.

4.2 Empirical investigation

Figure 4 depicts scatter plots of the frequency and size of price changes for each item or medium category, which shows an insignificant correlation. Columns (1) and (2) of Table 6 confirm this result: the estimation result shows no significant relationship between the two variables, suggesting the dominance of idiosyncratic shocks over aggregate shocks.

While the above analysis is based on time and regional average of the frequency and size of price changes, it is possible to break down the variables by prefecture and month. We conduct a regression of the panel data, wherein the dependent variable is the size of price changes and the explanatory variables are the frequency of price changes and the fixed effects for prefectures, items, and months.

Table 7 presents the estimation results, indicating a significant positive relationship between the frequency and size of price changes for the service category. This can be explained by the predominance of idiosyncratic shocks and the minimal variation in the frequency of price changes (e.g., menu costs) across items. A barely significant positive relationship at the \(10\%\) level is observed for goods excluding fresh food, whereas no significant relationship is observed for fresh food and services (public). Dividing the data period before and after the COVID-19 pandemic hardly impacts the estimation results (see Table 5 in Online Appendix C). A significant positive relationship between the frequency and size of price changes is found both before and after the COVID-19 pandemic for the service category. For goods excluding fresh food, the relationship is significantly positive at the \(5\%\) level after the pandemic, whereas it is insignificant before the pandemic. The last result may be attributed to a difference in the size of shocks, as we explained in the above theoretical framework. After the onset of the pandemics, cost shocks became dominant, which induces increases in both the frequency and size of price changes, thereby leading to a positive association between the frequency and size of price changes. By contrast, before the pandemic, the absence of notable shocks meant that the positive association between the frequency and size of price changes was offset by the heterogeneity in menu costs, which generated a negative association.

Next, we focus on price dispersion among stores and analyze its relationship with the frequency and size of price changes. Figure 5 is a scatter plot of the size of price changes and price dispersion based on standard deviation for each item or medium category. Unlike Fig. 4, a significant positive correlation is observed between the two variables. By contrast, although not presented in the figure, no clear relationship is observed between the frequency of price changes and price dispersion.

Columns (3) to (8) in Table 6 present estimates with price dispersion as the dependent variable and the frequency and size of price changes as the explanatory variables. The coefficient on the size of price changes is almost consistently positive and significant. In the right-hand side panel of Fig. 5, the point on the lower right is services related to medical care and welfare (public), where prices are, to a large extent, determined by the government. With this exclusion, the correlation coefficient is significant (Columns (6) and (7)). By contrast, the coefficient on the frequency of price changes is significantly positive in Columns (3) and (4), but not significant in Columns (5) to (8), implying no robust relationship between the frequency of price changes and price dispersion. In Table 4 in Online Appendix C, we conduct the estimation by dividing periods into segments before and after the onset of the COVID-19 pandemic. The positive association between price dispersion and size of price changes is robust in both before and after the pandemic, when the data are at the item level (Columns (3) to (5)).Footnote 6

Like the analysis in Table 7, we run a regression with price dispersion as the dependent variable and the frequency and size of price changes as the explanatory variables, with the fixed effects for prefectures, items, and months included. Table 8 indicates a significant positive relationship between the size of price changes and price dispersion for all large categories. In other words, price dispersion tends to increase for items for which the size of price changes increases. By contrast, the coefficient on the frequency of price changes is significantly negative in the three large categories except for fresh food (only at the \(10\%\) level for services). In other words, price dispersion tends to decrease for items with the increased frequency of price changes. We decompose the frequency of price changes into the upward and downward frequency of price changes, and the estimation results show that the absolute value of the coefficient is larger for the upward frequency of price changes than for the downward frequency of price changes. Thus, price dispersion is more responsive to the upward frequency of price changes than to the downward frequency of price changes. These estimation results are robust both before and after the COVID-19 pandemic (see Online Appendix C).

In summary, we find an insignificant or positive relationship between the frequency and size of price changes as well as a positive relationship between the size of price changes and price dispersion. Can these results be explained by the dominance of idiosyncratic shocks? The answer is probably yes. For items with large idiosyncratic shocks, the Ss band (the price inaction range) widens based on the menu cost model, resulting in large price dispersion. Large idiosyncratic shocks also increase the size of price changes, which generates a positive relationship between the size of price changes and price dispersion. However, explaining the negative relationship between the frequency of price changes and price dispersion, as observed in Table 8, may pose challenges.

5 Regional heterogeneity

In this and subsequent sections, we analyze price stickiness by utilizing detailed information regarding regions provided in the RPS.Footnote 7 In this section, we analyze the relationship between price stickiness and the size of economic activity in cities. We address the following questions: Do large cities have a greater frequency of price changes and earlier timing of price changes? We run the following regressions:

where i, s, r represent an item, shop, and municipality in which shop s is located. The dependent variable \(y_{is}\) is several indicators of price stickiness, whereas the explanatory variable \(\text {city weight}_{r}\) is the size of economic activity of municipality r given by the CPI weights in the base year 2015.Footnote 8

The estimation results are presented in Tables 9, 10, 11, 12, in which the dependent variables are the logarithm of prices, frequency of price changes, size of price changes, and price dispersion. The logarithm of prices is used to examine whether the law of one price holds across cities. Price dispersion is defined as the absolute difference between the logarithm of the price in the shop and the unweighted mean of prices across Japan. It should be noted, even if we use an unweighted mean, it suffers from the phenomenon that large cities would influence the mean more than small cities if prices are surveyed from more stores in large cities.

Table 9 shows that for price levels, the higher the price, the larger the city for several product categories (fresh food, food products, services related to domestic duties, and services related to communication, culture, and recreation). This suggests that the law of one price does not hold for not only services (non-tradable) but also several goods (relatively more tradable). However, no significant price difference is observed for other product categories (textiles, other industrial products, eating out, and services related to education).

Table 10 reveals that when the dependent variable is the frequency of price changes, the coefficients are significantly positive for almost all product categories. This suggests that the larger the city size, the higher the frequency of price changes. According to Table 11, the signs of the coefficients are mixed for the size of price changes. The coefficients are significantly positive for fresh food, textiles, eating out, and services related to forwarding and communication (public), while they are negative for food products. Table 12 shows that for the goods in textiles and other industrial products, the coefficients are significantly negative, indicating that the larger the city size, the smaller price dispersion. One plausible explanation of this result is that as city size grows, it typically corresponds to higher population density and a reduction in the size of the shopping or competitive marketplace. This brings the pricing environment closer to adhering to the principles of the law of one price.

The subsequent question is whether price changes occur earlier in large cities such as Tokyo compared to small cities, with prices spilling over from Tokyo to rural areas. To address this question, first, we calculate the fraction of price changes by month, item, and region. Regions are categorized into large and small cities, with a specific focus on a small city referred to as “small city A” based on the RPS. Furthermore, we select the metropolitan area of Tokyo consisting of the 23 Tokyo wards and the three major large cities surrounding Tokyo (Saitama, Yokohama, and Chiba). Second, for each item, we calculate correlation coefficients for pairs of large and small cities or for pairs of Tokyo wards and cities surrounding Tokyo. To capture potential lead-lag relationship, we calculate correlation coefficients with a one-month shift applied to each pair.

Lead-lag correlation between cities. To draw the figures, first, we calculate the frequency of price changes per month, item, and region. For regions, we select a large city and a small city A based on the RPS classification in the left-hand side panel and Tokyo wards and major large cities in the surrounding prefectures (Saitama City, Yokohama City, and Chiba City) in the right-hand side panel. Second, for each item, we calculate correlation coefficients for pairs of a large city and a small city A (left-panel) and for pairs of a Tokyo ward and a major metropolitan area in the surrounding prefectures (right-panel). Correlation coefficients are not calculated simultaneously, but are shifted by one month from each other. Each dot represents an item and the solid lines represent the 45-degree lines

Figure 6 depicts the scatter plot. Each point represents the correlation coefficient for each item, for pairs of large and small cities on the left and for pairs of Tokyo wards and cities surrounding Tokyo on the right. The horizontal axis represents the correlation coefficient when large cities or Tokyo are one month ahead, while the vertical axis represents that large cities or Tokyo are one month behind. If price changes occur earlier in large cities and Tokyo than in small cities and cities surrounding Tokyo, there should be more points to the lower right of the 45-degree line. The figure shows that despite a positive correlation, neither a clear leading nor lagging effect is observed between the regions. The absence of a clear leading or lagging effect implies that the timing of price changes does not exhibit a consistent and systematic pattern where large cities influence smaller cities or regions with a predictable time delay.

6 Estimating the Phillips curve

Following the previous section, we analyze the relationship between economic activity and prices using regional variations. Specifically, we focus on the cyclical aspects of inflation dynamics to estimate the Phillips curve, that is, the relationship between real and nominal variables. Following (Hazell et al., 2022) for the US and Kishaba and Okuda (2023) for Japan, we run the following regression:

where \(y_{ipm}\) represents the price variable for item i, prefecture p, and month m, and \(\text {job}_{pm}\) represents the effective jobs-to-applicants ratio obtained from Ministry of Health, Labour and Welfare.Footnote 9 Coefficient b represents the slope of the Phillips curve, indicating the extent to which changes in real economic activity impact the inflation rate. While endogeneity is generally a challenge in estimating the Phillips curve, the advantage of this estimation is that by utilizing regional and time variations and including their fixed effects, we can control for the channel, wherein aggregate shocks affect prices through inflation expectations.

The contribution of this analysis, compared to that of Hazell et al. (2022) and Kishaba and Okuda (2023), is that we analyze not only price change (inflation rate) but also the component of that change using the RPS microdata. Specifically, the frequency and size of price changes and price dispersion can be used as the dependent variable. As previously mentioned, in the US CPI, prices are surveyed every other month in many cities except for food and energy, making this type of analysis particularly difficult for services.

According to the model developed by Hazell et al. (2022), the coefficient obtained by estimating the price change of services is the same as the slope of the Phillips curve for an entire economy. The coefficient for goods, which are predominantly tradable, is predicted to be insignificant because of the law of one price.

Table 13 presents the estimation results when the dependent variable is price change (i.e., log month-to-month difference in price times 100). The coefficient on the effective jobs-to-applicants ratio is positive at 0.08 for the large category of services though it is not significant at the \(5\%\) level (but significant at the \(10\%\) level). The size of the coefficient indicates that a one-unit increase in the effective jobs-to-applicants ratio increases the inflation rate for services by \(0.08\%,\) which is similar to Kishaba and Okuda’s (2023) result—that is, approximately 0.1. When we divide the period into before and after the COVID-19 pandemic, the estimation result reveals that the coefficient on the effective jobs-to-applicants ratio for the large category of services is significantly positive at 0.19 before the pandemic. However, it is noteworthy that the coefficient becomes insignificant after the pandemic. This may suggest that the increase in the inflation rate in the service sector was not driven by labor market tightening but by other factors such as the rise in global commodity prices. While our data end in April 2023, wages have increased strongly since then (which was a primary reason for the Bank of Japan ending its quantitative easing policy in March 2024). Therefore, estimation using extended data may render the coefficient significant even after the pandemic.Footnote 10

Table 14 summarizes the coefficient on the effective jobs-to-applicants ratio for each medium category. Among private services, the coefficient is significantly positive for services related to domestic duties and services related to medical care and welfare, while it is insignificant for eating out, services related to education, and services related to communication, culture, and recreation.

Next, we run the regression using detailed price variables, the frequency and size of price changes and price dispersion, as the dependent variable. Table 15 shows that the coefficient on the effective jobs-to-applicants ratio for the large category of services is significantly positive when the dependent variable is the size of price changes and the period is before the COVID-19 pandemic, although it is insignificant for the full observation period or when the dependent variable is the frequency of price changes or price dispersion. Thus, when the jobs-to-applicants ratio increases, the size of price changes tends to increase, but the frequency of price changes does not increase. This result supports time-dependent pricing models such as Calvo or Taylor rather than state-dependent pricing models such as a menu cost model.Footnote 11

7 Inflation in 2022–2023

Prices have been increasing worldwide around 2022–2023, a period marked by the end of the COVID-19 pandemic as well as Russia’s invasion of Ukraine. To investigate price developments in detail, we use the RPS data. Figures 7, 8, 9, 10, 11 illustrate the time series changes in the frequency and size of price changes and price dispersion for each category. The solid line indicates the 50th percentile by item in each category, while the dark red and light pink ranges show the 25th-75th and 10th-90th percentile.

Specifically, Figs. 7 to ?? depict the frequency of price changes in the large and medium categories. They indicate a notable increase in the frequency of price changes starting from 2022 for some but not all categories. Particularly, categories such as food products, eating out, and services related to domestic duties represent a marked increase. However, fresh food products do not display a discernible increase from 2022, suggesting that their frequency of price changes was already relatively high. Additionally, for certain other categories like textiles, petroleum products, and other industrial goods, there has been minimal change in the frequency of price changes since 2022.

Figures 8 and 9 show that the size of price changes exhibits no notable change. Figure 11 shows that price dispersion has hardly changed since 2022. In the long run, price dispersion in food products and textiles appears to be on a downward trend, whereas eating out and services related to domestic duties are on an increasing trend.

In summary, the price surge observed around 2022–2023 is accompanied by a notable increase in the frequency of price changes, rather than the size of price changes. This outcome suggests that state-dependent sticky price models, such as the menu cost model, may offer a more robust framework for explaining the underlying factors driving recent price increases, as opposed to time-dependent sticky price models like the Calvo model.

8 Concluding remarks

In this study, we have presented a diverse array of evidence on price stickiness using RPS microdata. An essential avenue for future research lies in the construction of a macroeconomic model that aligns with the empirical findings obtained from this study. Specifically, it is necessary to consider to the extent to which these facts can be explained within the simple menu cost or Calvo model, and what additional elements or complexities must be incorporated to provide a more comprehensive explanation.

Data availability

This study is based on my own analysis using information from the Retail Price Survey, administered by the Statistics Bureau of the Ministry of Internal Affairs and Communications. All remaining errors are my own.

Notes

A csv file and tables are provided on the author’s website and in Online Appendix A.

An important variable related to price stickiness that is not dealt with in this paper is the hazard probability (conditional probability of a price change after consecutive price unchanges), which is presented in Online Appendix B.

For example, consider the CPI item of college and university fees (national). In the RPS, various prices are surveyed, such as (1) national college and university tuition fees for the courses of law, literature, and economics, (2) national college and university tuition fees for the courses of science and technology, (3) national college and university entrance fees for the courses of law, literature, and economics, and (4) national college and university entrance fees for the courses of science and technology.

Out of the 24 items, 18 have the same value when the aggregation of regions is changed from city to prefecture. This is because these items are surveyed only in one city per prefecture.

However, when the data are at the category level, this positive association is not consistently significant, showing significance only after the pandemic (Columns (6) to (8)). The small number of observations, around 20, or minimal changes in price levels before the pandemic likely contribute to the insignificant association between price dispersion and the size of price changes.

In the US, CPI prices are surveyed monthly only in Chicago, Los Angeles, and New York. In other regions, prices are surveyed every two months, except those for food and energy, which limits the regional variations in the analysis of price stickiness (see (Nakamura & Steinsson, 2008)).

In the CPI, weights are calculated from the product of the amount spent per household and the number of non-agricultural, forestry, and fishing households. We do not consider the area of municipalities. See https://www.stat.go.jp/data/cpi/2015/kaisetsu/pdf/0.pdf.

As in Kishaba and Okuda (2023), we use the jobs-to-applicants ratio rather than the unemployment rate because the former captures business cycles more effectively in Japan, where employment protection is strong. Furthermore, the regional data on the unemployment rate are not as disaggregated as those on the jobs-to-applicants ratio.

The table also shows that the coefficient on the effective jobs-to-applicants ratio is significantly negative for goods excluding fresh food before the pandemic. This is puzzling because, based on Hazell et al. (2022), the coefficient should be zero or, if anything, positive if the law of one price does not hold for goods.

Similar to Table 13, the table also presents puzzling results for goods excluding fresh food. When the dependent variable is the frequency of price changes, the coefficient on the effective jobs-to-applicants ratio is significantly negative, rather than zero or positive, for the entire observation period. Moreover, for the size of price changes as the dependent variable, the coefficient is insignificant for the entire observation period; however, it exhibits a significant positive association before the pandemic and a significant negative association after the pandemic.

References

Abe, N., & Tonogi, A. (2010). Micro and macro price dynamics in daily data. Journal of Monetary Economics, 57(6), 716–28.

Aoki, K. (2001). Optimal monetary policy responses to relative-price changes. Journal of Monetary Economics, 48(1), 55–80.

Bils, M., & Klenow, P. J. (2004). Some evidence on the importance of sticky prices. Journal of Political Economy, 112(5), 947–85.

Carvalho, C. (2006). Heterogeneity in price stickiness and the real effects of monetary shocks. Frontiers in Macroeconomics, 2(1), 1.

Dhyne, E., et al. (2006). Price changes in the euro area and the United States: Some facts from individual consumer price data. Journal of Economic Perspectives, 20(2), 171–92.

Fitzgerald, T. J., & Nicolini, J. P. (2014). Is There a Stable Relationship between Unemployment and Future Inflation? Evidence from U.S. Cities, Federal Reserve Bank of Minneapolis Working Paper 713.

Gautier, E. et al. (2023). Price Adjustment in the Euro Area in the Low-Inflation Period: Evidence from Consumer and Producer Micro Price Data. ECB Occasional Paper Series No. 319.

Hazell, J., Herreño, J., Nakamura, E., & Steinsson, J. (2022). The slope of the Phillips curve: Evidence from U.S. states. Quarterly Journal of Economics, 137(3), 1299–1344.

Higo, M. & Saita, Y. (2007). Price Setting in Japan. Bank of Japan Working Paper Series 07-E-20.

Ikeda, D. & Nishioka, S. (2007). Price Setting Behavior and Hazard Functions: Evidence from Japanese CPI Micro Data. Bank of Japan Working Paper Series 07-E-19.

Kaihatsu, S., Katagiri, M., & Shiraki, N. (2023). Phillips correlation and price-change distributions under declining trend inflation. Journal of Money, Credit and Banking, 55(5), 1271–1305.

Kishaba, Y. & Okuda, T. (2023). The Slope of the Phillips Curve for Service Prices in Japan: Regional Panel Data Approach. Bank of Japan Working Paper Series 23-E-8.

Klenow, P. J., & Kryvtsov, O. (2008). State-dependent or time-dependent pricing: Does it matter for recent U.S. inflation? Quarterly Journal of Economics, 123(4), 863–904.

McLeay, M., & Tenreyro, S. (2019). Optimal inflation and the identification of the Phillips curve. NBER Macroeconomics Annual, 2019, 199–255.

Nakamura, E., & Steinsson, J. (2008). Five facts about prices: A reevaluation of menu cost models. Quarterly Journal of Economics, 123(4), 1415–64.

Nakamura, E., Steinsson, J., Sun, P., & Villar, D. (2018). The elusive costs of inflation: Price dispersion during the U.S. great inflation. Quarterly Journal of Economics, 133(4), 1933–80.

Nishizaki, K., & Watanabe, T. (2000). Output-inflation trade-off at near-zero inflation rates. Journal of the Japanese and International Economies, 14(4), 304–326.

Sudo, N., Ueda, K., & Watanabe, K. (2014). Micro price dynamics during Japan’s lost decades: Micro price dynamics in Japan. Asian Economic Policy Review, 9(1), 44–64.

Funding

I thank Editor Etsuro Shioji, anonymous referee, Mitsuru Katagiri, Kota Watanabe, and Tsutomu Watanabe. This research is funded by JSPS Grants-in-Aid for Scientific Research (16KK0065).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ueda, K. Evidence on price stickiness in Japan. JER (2024). https://doi.org/10.1007/s42973-024-00161-w

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42973-024-00161-w