Abstract

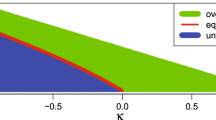

Underdispersed and overdispersed phenomena are often observed in practice. To deal with these phenomena, we introduce a new thinning-based integer-valued autoregressive process. Some probabilistic and statistical properties of the process are obtained. The asymptotic normality of the estimators of the model parameters, using conditional least squares, weighted conditional least squares and modified quasi-likelihood methods, are presented. One overdispersed real-data example and one underdispersed real-data example are given to show the flexibility and superiority of the new model.

Similar content being viewed by others

References

Alzaid, A. A., & Al-Osh, M. A. (1987). First-order integer-valued autoregressive (INAR(1)) process. Journal of Time Series Analysis, 8, 261–275.

Barreto-Souza, W. (2015). Zero-modified geometric INAR(1) process for modelling count time series with deflation or inflation of zeros. Journal of Time Series Analysis, 36, 839–852.

Barreto-Souza, W. (2017). Mixed Poisson INAR(1) processes. Statistical Papers,. https://doi.org/10.1007/s00362-017-0912-x. (in press).

Borges, P., Molinares, F. F., & Bourguignon, M. (2016). A geometric time series model with inflated-parameter Bernoulli counting series. Statistics and Probability Letters, 119, 264–272.

Bourguignon, M., Rodrigues, J., & Santosneto, K. (2019). Extended Poisson INAR(1) processes with equidispersion, underdispersion and overdispersion. Journal of Applied Statistics, 46, 101–118.

Bourguignon, M., & Vasconcellos, K. L. (2015). First order non-negative integer valued autoregressive processes with power series innovations. Brazilian Journal of Probability and Statistics, 29, 71–93.

Bourguignon, M., & Weiß, C. H. (2017). An INAR(1) process for modeling count time series with equidispersion, underdispersion and overdispersion. Test, 26, 847–868.

Cossette, H., Marceau, É., & Toureille, F. (2011). Risk models based on time series for count random variables. Insurance: Mathematics and Economics, 48, 19–28.

Freeland, R. K., & McCabe, B. P. M. (2004). Analysis of low count time series data by Poisson autoregression. Journal of Time Series Analysis, 25, 701–722.

Gómez-Déniz, E., Sarabia, J. M., & Calderín-Ojeda, E. (2011). A new discrete distribution with actuarial applications. Insurance: Mathematics and Economics, 48, 406–412.

Grunwald, G., Hyndman, R. J., Tedesco, L., & Tweedie, R. L. (2000). Non-Gaussian conditional linear AR(1) models. Australian and New Zealand Journal of Statistics, 42, 479–495.

Jazi, M. A., Jones, G., & Lai, C. D. (2012). First-order integer valued AR processes with zero inflated poisson innovations. Journal of Time Series Analysis, 33, 954–963.

Karlsen, H., & Tjøstheim, D. (1988). Consistent estimates for the Near(2) and Nlar(2) time series models. Journal of the Royal Statistical Society. Series B (Statistical Methodology), 50, 313–320.

Kim, H. Y., & Lee, S. (2017). On first-order integer-valued autoregressive process with Katz family innovations. Journal of Statistical Computation and Simulation, 87, 546–562.

Li, C., Wang, D., & Zhang, H. (2015). First-order mixed integer-valued autoregressive processes with zero-inflated generalized power series innovations. Journal of the Korean Statistical Society, 44, 232–246.

Ristić, M. M., Bakouch, H. S., & Nastić, A. S. (2009). A new geometric first-order integer-valued autoregressive (NGINAR(1)) process. Journal of Statistical Planning and Inference, 139, 2218–2226.

Schweer, S., & Weiß, C. H. (2014). Compound Poisson INAR (1) processes: Stochastic properties and testing for overdispersion. Computational Statistics and Data Analysis, 77, 267–284.

Scotto, M. G., Weiß, C. H., & Gouveia, S. (2015). Thinning-based models in the analysis of integer-valued time series: A review. Statistical Modelling, 15, 590–618.

Steutel, F. W., & Van Harn, K. (1979). Discrete analogues of self-decomposability and stability. The Annals of Probability, 7, 893–899.

Weiß, C. H. (2007). Controlling correlated processes of Poisson counts. Quality and Reliability Engineering International, 23, 741–754.

Weiß, C. H. (2008a). Serial dependence and regression of Poisson INARMA models. Journal of Statistical Planning and Inference, 138, 2975–2990.

Weiß, C. H. (2008b). Thinning operations for modeling time series of counts-a survey. AStA Advances in Statistical Analysis, 92, 319–341.

Weiß, C. H., Homburg, A., & Puig, P. (2019). Testing for zero inflation and overdispersion in INAR(1) models. Statistical Papers, 60, 473–498.

Zhang, H., Wang, D., & Zhu, F. (2010). Inference for INAR(\(p\)) processes with signed generalized power series thinning operator. Journal of Statistical Planning and Inference, 140, 667–683.

Zheng, H., Basawa, I. V., & Datta, S. (2007). First-order random coefficient integer-valued autoregressive processes. Journal of Statistical Planning and Inference, 137, 212–229.

Zhu, F. (2012a). Modeling overdispersed or underdispersed count data with generalized Poisson integer-valued GARCH models. Journal of Mathematical Analysis and Applications, 389, 58–71.

Zhu, F. (2012b). Modeling time series of counts with COM-Poisson INGARCH models. Mathematical and Computer Modelling, 56, 191–203.

Acknowledgements

We gratefully acknowledge the associate editor and anonymous reviewers for their serious work and thoughtful suggestions that have helped us improve this paper substantially. This work is supported by National Natural Science Foundation of China (Nos. 11731015, 11571051, 11501241, 11871028), Natural Science Foundation of Jilin Province (Nos. 20150520053JH, 20170101057JC, 20180101216JC), Program for Changbaishan Scholars of Jilin Province (2015010), and Science and Technology Program of Jilin Educational Department during the “13th Five-Year” Plan Period (No. 2016316).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

As we mentioned in the third paragraph of Sect. 2, the infinite sum in the mean and variance for GSC(\(\alpha \), \(\theta \)) are convergent, where \(\alpha <1\), \(\alpha \ne 0\) and \(0<\theta <1\). We illustrate it, as follows:

Let \(\alpha <0\). Denote \(S_n=\sum _{s=1}^{n}\log (1-\alpha \theta ^{s})\). Then, we have

By the Cauchy criterion of series, the infinite sum \(\sum _{s=1}^{\infty }\log (1-\alpha \theta ^{s})\) are convergent.

Denote \(S_n^{'}=\sum _{s=1}^{n}(2s-1)\log (1-\alpha \theta ^{s})\). Then, we have

using \(x\ge \log (1+x)\) for \(x\ge 0\). By the Cauchy criterion of series, the infinite sum \(\sum _{s=1}^{\infty }(2s-1)\log (1-\alpha \theta ^{s})\) are convergent. Following the same way, we can see that the two infinite sum are convergent when \(0<\alpha <1\). \(\square \)

Proof of Proposition 1

We have (i) and (iii), i.e.,

and

Then, we get

and

which yield (ii) and (iv), due to the stationarity; \(\mathrm {E}(X_{t})=\mathrm {E}(X_{t-1})\) and \(\mathrm {Var}(X_{t})=\mathrm {Var}(X_{t-1})\). Moreover, we have (v), i.e.,

\(\square \)

Proof of Theorem 1

We first introduce a random sequence \(\{X_{t}^{(n)}\}\),

where \(\mathrm {Cov}(X_{s}^{(n)},\epsilon _t)=0\) when \(s<t\) for any n.

As in Li et al. (2015), we can verify: existence of \(\{X_t\}\) satisfying (5), i.e., (A1) \(X_{t}^{(n)}\in L^2\), \(n>0\), (A2) \(X_t^{(n)}\) is a Cauchy sequence, (A3) \(\{X_t\}\) satisfies (5), uniqueness, strict stationarity and ergodicity. The details are omitted here to save space. \(\square \)

Proof of Theorem 2

From (6), solving \(\partial Q_1(\varvec{\eta })/\partial \alpha =0\) and \(\partial Q_1(\varvec{\eta })/\partial \mu _{\epsilon }=0\) lead to the CLS estimators of \(\alpha \) and \(\mu _{\epsilon }\). Now, let \(\mathcal {F}_n=\sigma \{X_0,X_1,\ldots ,X_n\}\), \(M_{n}^{(1)}=-\frac{1}{2}(\partial Q_1(\varvec{\eta })/\partial \alpha )=\sum _{t=1}^{n}\dot{\phi }X_{t-1}\big (X_t-\phi X_{t-1}-\mu _{\epsilon }\big )\), \(M_0^{(1)}=0\). Also, \(M_{n}^{(2)}=-\frac{1}{2}(\partial Q_1(\varvec{\eta })/\partial \mu _{\epsilon })=\sum _{t=1}^{n}\big (X_t-\phi X_{t-1}-\mu _{\epsilon }\big )\), \(M_0^{(2)}=0\). Then, it is easy to see that \(\{M_{n}^{(1)},\mathcal {F}_n\}_{n\ge 0}\) and \(\{M_{n}^{(2)},\mathcal {F}_n\}_{n\ge 0}\) are martingales. The martingale central limit theorem and Cramer-Wold’s device imply that

Using Taylor’s expansion, we have

Since we have proved that \(-\frac{1}{2\sqrt{n}}\frac{\partial Q_1(\varvec{\eta })}{\partial \varvec{\eta }} \mathop {\longrightarrow }\limits ^{d}N(\mathbf {0},\varvec{V_{CLS}})\), after some algebra, we have

This completes the proof. \(\square \)

Proof of Theorem 4

Following Zheng et al. (2007), we firstly suppose \(\varvec{\tau }\) is known. Let

Similar to Theorem 2, we have

Now, we replace \(V_{\varvec{\tau }}^{-2}(X_t|X_{t-1})\) by \(V_{\varvec{\widehat{\tau }}}^{-2}(X_t|X_{t-1})\), where \(\varvec{\widehat{\tau }}\) is a consistent estimator of \(\varvec{\tau }\). Then we want

For this we need to prove that \( \frac{1}{\sqrt{n}}L_{n}^{(i)}(\varvec{\widehat{\tau }},\varvec{\eta })- \frac{1}{\sqrt{n}}L_{n}^{(i)}(\varvec{\tau },\varvec{\eta })\mathop {\longrightarrow }\limits ^{P}0,~i=1,2 \) [its proof is omitted here, since the argument is the same as in Zheng et al. (2007)]. Following the proof of Theorem 2, by Taylor’s expansion and some algebra, we have

This completes the proof. \(\square \)

Rights and permissions

About this article

Cite this article

Kang, Y., Wang, D., Yang, K. et al. A new thinning-based INAR(1) process for underdispersed or overdispersed counts. J. Korean Stat. Soc. 49, 324–349 (2020). https://doi.org/10.1007/s42952-019-00010-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42952-019-00010-2