Abstract

This article examines the long-term growth path of the Danish economy from 1980 to 2017. Various developments and changes have emerged over the years to determine the robustness and legitimacy of the balance of payments constrained growth model. One of these changes is that capital flows have an important role in the growth process. In this study, relative prices, exchange rate and capital flows are questioned as important determinants. The study uses autoregressive distributed lag (ARDL) methodology to determine the both short- and long-run relationships among the variables. The outcome reveals that all the variables have significant impacts on both the short-run and long-run growth of Denmark. In the light of these findings, considering that the annual real growth of the Danish economy is 1.75%, it can be concluded that this estimation is correct and is proportional to the growth rate of Denmark from 1980 to 2017. It would be a correct assessment to consider income, relative prices and capital flows as important determinants of the growth of the Danish economy on the demand side. Weakening confidence indices and worsening expectations in Danish export markets could quickly affect Danish exports and trade investment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

This study investigates the balance of payment constrained growth model bringing a better understanding of the effects of export growth, capital flow, and relative prices in the long run between 1980 and 2017; by doing this, the impact of the Euro before and after is also questioned.

In 1999, the Euro was implemented in 11 countries, thus making trade easier and the losses arising from the exchange rate were eliminated to some extent. In addition, consumers are also allowed to shop more easily in other countries. In this way [1, 2, 13, 33], it is aimed to develop both imports and exports among Eurozone member countries faster than in the past. While this is considered as a trade-creation effect with member countries, it is expressed as a trade-distortion effect between non-member countries in the customs union theory (Vinner).

The period considered in this study is, therefore, important because before and after the effects of trade in the Eurozone are evaluated in the light of Danish economy and trade. In this way, the price differences and the effects of the exchange rate in the period before the Euro zone, when different currencies were used, were also indirectly questioned in the study.

The Danish economy has struggled for decades with the balance of current account deficit and debt, and this problem has even been described as the "Achilles heel" of the Danish economy of the Danish economy. However, since the beginning of the 1990s, the balance of payments started to give a surplus and this surplus has been maintained for almost 30 years, except for a few years. Well, at this point, this article would be right to examine ten years before and after 1990 to question this success of Denmark and the reasons behind it.

The effects of international trade on the growth performance of the Danish economy are also questioned. Therefore, investigating the main drivers of this process is imperative. Hence, the significance of considered variables affects the income growth, capital inflows, and real prices in the economy.

The structure of the paper shall be as follows: introduction, theoretical background in Section two and brief literature review, and model specification in Section three. Section four shall deal with empirical estimation, while Section five shall offer the conclusion and policy recommendation.

General glance on Danish economy and trade

Denmark is considered by the European Union and other non-European Union members as one of the most vibrant economies. It is largely characterized by a stable currency, low cost of investment, and low general price level. The impacts of considered variables on the domestic income growth of Denmark from a demand-led growth are researched. Especially, the balanced growth constrained framework where long-run growth of an economy is driven by world demand, import elasticity, and some recent extensions, by relative prices. The present study uses the modified versions of the balance of payment constraints that incorporate capital flows as an essential determinant of economic growth.

Denmark's recurrent external instability and significant external asset fluctuations reflect the UK's economic and financial integration with the European Single Market System and highlight London's key position as Europe's financial capital

Note that since the Post War era, Denmark has joined many international programs of exchange rate cooperation. These include the Bretton Woods Agreement of 1948 to 1971; the European exchange rate agreements, of 1972 – 1979 as well as the purported "snake" and the European Monetary System (EMS). The EMS was later transformed into an Economic and Monetary Union (EMU) in 1990 [8, 11, 21]. Nevertheless, the Danish policymakers have decided not to be part of the third phase of EMU, which started in full swing in 1999. Accordingly, the local exchange currency is, therefore, still the Danish Krone (DKK) and not the Euro although the Krone is pegged firmly to the Euro [14, 15, 17]. Given this scenario, understanding whether leaving the EMU has any impact on the Danish exchange rate is important. Therefore, we also include real effective exchange as another determinant of long-run growth.

This study covers the years 1980 and 2017 to analyze and better understand the success of the current account and balance of payments, which became positive in the 1990s and continues until today. As it is known until the 1990s, Denmark's current account was running a deficit in the balance of payments. In the 1980s, foreign debt had increased to 45 percent of the Gross Domestic Product (Autrup S. L.et al. 2015). In the 1990s, this gap was closed and then it always started to give surplus. At this point, this success of Denmark in the balance of payments is important.

The empirical investigations on the balance of trade effects of monetary integration were also questioned by Persson [28], Baldwin, [5] and Nitsch [22], who suggested that the ‘Rose effect ‘ was probably biased upwards, and that the trade effect of monetary union in the Eurozone is likely to be much smaller (see also Micco (2003), De Nardis and Vicarelli (2003)).Monetary integration cannot only be dependent on the trade effects; it is obvious that monetary integration also affects fiscal and monetary policies and the integration of member countries.

On the subject of the Optimum Currency Area, there are several arguments that investigate the effects of monetary integration on trade and growth rate. Rose [31], Rose and Van Wincoop E. [32], researched the relationship between monetary union and economic integration. They investigated the effects of currency unions on the trade flows and impact on balance of payments between members and they concluded that belonging to the same monetary union doubles the size of trade flows. According to De Grauwe (2012), integration does not lead to concentration effects but rather means that national borders will increasingly be less relevant in influencing the shape of these concentration effects. As a result, regions where industries are intensively located may still be significantly affected by asymmetric shocks [19, 20, 22, 24]. The probability that these regions overlap existing borders, however, will increase as integration proceeds.

The link between financial openness and long-run growth remains a theme of intense debate. Inconsistent with the principally positive view of trade integration, policymakers are often at variance roughly concerning the impact of monetary integration on the long-run growth of an economy. Theoretically, accessibility to overseas financials can support investment enterprises and overall growth in the beneficiary country, and accessibility to a much greater scope of investment prospects could contribute to more resourceful investments and consequently growth.

However, global insights fall short of providing convincing confirmation of the positive relationship between capital flows and growth. However, the interaction between growth and lagged capital flows depends on the type of flows, the economic situation and structure, and global growth patterns (Aizenman et al. 2011). The crucial argument here is that it is necessary to make the right decision by seeing that capital inflows and real prices have significant contributions to economic growth.

Literature review

We observed that the deep-seated question as to ‘why there are widespread differences in long-run growth experiences of countries across the globe has remained a controversial subject over the years. We depend on the theoretical background of this study on cumulative growth thinking which could stand for the Kaldor–Verdoorn Law [25, 28]. The main idea of Kaldor is that the long-run growth path is demand driven, in particular export driven. This hypothetical perspective is demonstrated by export-lead cumulative causation frameworks (ELCC). Accordingly [31, 35, 37, 40], any rise in the growth of exports growth rate leads to increases in the domestic income growth and enlarging export for ensuring trade balance. This cumulative transmission system was initially put forward by Dixon and Thirlwall (1975a) and the pioneering work of Thirlwall [38] introduced the standard balance-of-payments-constraint growth model (BPCG). The BPCG model as pioneered by Thirlwall [38] indicates that the major restriction on economic growth is because of the growth of exports and income elasticity of imports. The adaptation of the model differs from the export-led growth models by demonstrating that growth of capital inflow and terms of trade is also an essential determinant of long-run growth. The balance of payments of a particular nation determines its growth experience. This is also supported by Silva et. Al. (2018) study, he emphasized the need to consider the combined effect of both imports and exports on economic performance. In fact, in Kaldor's theory (known as Kaldor's laws), it is foreseen that both exports and imports will develop together without affecting the balance of payments negatively [16]. Grossman and Helpman [12] also discussed economic growth in terms of imports and stated that imports will also cause technological development and know-how increase in local manufacturers. This technical development was also emphasized by Solow's neoclassical growth model and its positive effects on the economy were evaluated in the long term [26].

It is obvious that capital inflow has also positive effects on financial markets. According to the Azis and Shin (2015), stability in the financial market has a positive impact on the real economy and not only positively affects financial assets, but also increases factor incomes.

In another study, Ghose Ajit K. (2004) noted that capital inflows to developing countries were reported to be largely outsourced and predicted to be generated by the attraction of potential demand for investment financing.

The external component of the balance of payments matters for long-run growth because of three major explanations. First, when worsening of balance-of-payments conditions is due to unfavorable long-run drifts in exports performance and patterns of imports, real growth of output and employment in the specific sectors of the economy affected [18]. Second, at the aggregate level, it can be stated as a maxim that no country can experience growth more rapidly than that rate compatible with balance-of-payments. And equilibrium conditions on the external account in the long run, except it, can fund continually rising deficits.

The third reason stems from a short-run policy desire of the financial and monetary planner. Current account deficit can be reduced by decreasing the borrowing capital and increasing the export capacity. However, this could lead to the accretion of monetary assets and creates capital for domestic investment in real sectors of the economy.

Studies such as Bairam and Dempster [4], Pacheco‐Lopez and Thirlwall (2006, [25]), Perraton [27], Thirlwall (2004), Thirlwall and Hussain [37], and Darku [6, 7] have used the model on different economies to observe the determinants of long-run growth and created wide-ranging conclusions. While several studies regarding the BPCG theory exist for many countries, Denmark has virtually except for group studies. For instance, Bairam [3] examines the growth experiences of European and North American countries to show that Denmark experienced substantial constraints on its balanced of payment, which grows above its Balance of payment optimal rate at the expense of acquiring external deficits. Similarly, McCombie& Thirlwall(1997) use the balance of payment constrained growth model to show that Denmark grows slower (at 2.5%) in the 1970s and 1.7% in the 1980s. Note that this group studies only concentrate on the original model in which only income is the only determinant. This study recognizes the possible impact of relative prices as well as capital flows to investigate the growth path of Denmark.

Overview of the Denmark economy from 1980 to 2017

Indeed, the economy of Denmark is often described as small, open, and extremely geared to trade with other nations. Its main trading partner is the European countries. Germany represents the main partner of the economy. However, Sweden, Great Britain as well as Norway become trade partner significantly with Denmark. The US and Japan are the most vital trading partners of the country outside the Union. Given the country’s dependence on international trade, the Danish economy has signed into collaborative organizations and agreements including the EU, OECD, and WTO.

The export structure of the economy has been substituted by manufactured products displacing agricultural goods. In 2020, it is estimated that agriculture contributes 1.37 percent, industry approximately 20.82 percent, and services sector approximately 65 percent of the gross domestic product of the Danish economy [36].

The GDP is the most important indicator and parameter for economic growth; however, the percentage of tax, consumption, and governmental expenditures affects the national saving and total production. The Danish economy has been on a positive trajectory between 1990 and the global financial crisis.

Denmark frequently aspires as much as achievable to regulate the level of economic activity and price level via fiscal policy instruments; whilst monetary policy option has to a large degree been designed at supporting exchange rate policy regime at the period. The aim is to ensure a stable exchange rate for the local currency—the Danish krone.

Even though the economy experiences some negative growth in 1981, 1982, and 1989, the major downturn in real GDP growth is from 2007 to 2010. The global financial crisis adversely affected the growth of the economy. Since 2011, real GDP has been on the rise; however not as robust as the pre-crisis period. Even though, real GDP growth has averaged 1.75% annually for the period 1980–2017; the Danish real GDP growth still is below the growth rate of the rest of the world (1.92%) measured by the growth of the European Union.

The Danish economy has regressed by approximately 2 percent due to the pandemic, as in the whole world. Compared to 2020, this year is going for the better with the reopening. The increase in private consumption and the decrease in employment after the closure had a negative impact on the Danish economy. In 2021, GDP is expected to grow by 2 percent and up to 4 percent this year. It projects a GDP growth of around 4 percent in 2022, the highest growth rate in the last 15 years [20].

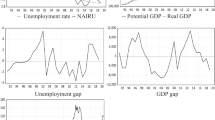

It is also important to point out that Denmark is one of the leading countries in the world in terms of capital flow. As a small country, the Danish economy is based on foreign trade and investments. Exports are the most important component of GDP with a 55 percent share [41]. Therefore, from an economic point of view, one of the most important factors for growth is capital. The inclusion of capital in the aforementioned model is the most natural reason. The most important reason for the steady surplus in the balance of payments since the 1990s and the increasing role of exports is due to the intense and high capital flow Fig. 1.

The nexus between EU real GDP and export performance in Denmark

A robust elasticity of exported products to real income is particularly responsible for a strong domestic economic performance. Figure 2 graphically shows the movement of growth of export flows and real GDP growth of the EU. Even though, with different degrees of deviation; it could be said that the fluctuation of EU income largely affects Danish exports.

Notable of these periods are in 1988, 1994, and 2000, when the EU real GDP is rising; and in 1993, 2003, 2009, and 2012, when EU real GDP is falling. Similar logical tendencies could be seen up to date.

Note that the service export sector is the main component that increases performance of the gross exports and the overall growth regardless of growing global trade and sturdy demand in Denmark’s major export market destinations [10].

In Fig. 3 terms of trade and export values in terms of percentage of GDP are given. The progress of export is evident for Danimark.

Terms of trade and Export value in% of GDP 1990 and 2021. source World bank Database: Exports of goods and services % of GDP https://data.worldbank.org/indicator/NE.EXP.GNFS.ZS?end=2021&locations=DK&start=1990 and. OECD data base terms of trade, https://data.oecd.org/trade/terms-of-trade.htm#indicator-chart

Method and empirical model

We use in this research autoregressive distributed lag (ARDL) methodology for estimating both short- and long-run relationships among the considered variables.

Several developments and modifications have emerged over the years to ascertain the robustness and legitimacy of Thirlwall’s balance of payment constrained growth model. One of such modifications is in the estimation of capital flows in the growth process.

Saving and investment variables are important for the formation of capital. Considering the importance and impact of capital flow, it has been included in the model. This stable capital flow and the growth of the developing trade in the direction of exports, especially when the trade has developed and the balance of payments has given a surplus in the last two or even three decades, is important. Impact of capital flow and estimation of such insufficiency, Thirlwall & Hussain [37] introduced the (Balance of Payment Compliance Guide) BOPCG model by adding capital flows into the estimation. The capital inflow or outflow can be better estimated by the growth of national income. The new equilibrium identity was changed to mirror the insertion of the new restriction or constraint. Pacheco‐Lopez and Thirlwall [25] and Darku [7], the present study uses the BPC growth framework that begins from the balance of payments equilibrium conditions as:

where X is the level of exports, \({P}_{d}\)is the domestic price level of exported goods, M is the level of imported goods, \({P}_{f}\) captures the overseas price level of imported goods, E is the nominal exchange rate, and K is the level of capital inflows.

where \({\beta }_{1}\) represents price elasticity of demand for exports, \({\delta }_{1}\) represents price elasticity of demand for import; \({\beta }_{2}\) represents the income elasticity of export demand;\({\delta }_{2}\) represents the income elasticity of demand for imports; Y represents domestic income of Denmark and WY represents world real income proxied by EU GDP.

Specifying the Eq. 1–3 in growth terms produces

Here, small letters show the growth rates of the variables expressed log form and  and θ represent the share of total import bill of which export earnings and flow of capital.

and θ represent the share of total import bill of which export earnings and flow of capital.

Continuing with log transformation of Eq. (2, 3) and substituting it into (4) and algebraically solving for domestic income give rise to:

Here, \(\theta\) represents a fraction of export earnings in overall earnings for the settlement, (Eq. 5) that any country’s growth rate can be disaggregated into four components:

-

(i)

Domestic income growth linked to changes in real terms of trade: (\({p}_{d}-{p}_{f}-e\))/\({\delta }_{2}\)

-

(ii)

Domestic income growth linked to changes terms of trade joined with the price sensitivities of exports and imports:

-

(iii)

Domestic income growth linked to exogenous adjustments in world real income

-

(iv)

Domestic income growth linked with real capital flows: \(\theta \left( {k - p_{d} } \right)/\delta_{2}\)

All data for variables are considered from world development, only the capital flows are considered from the OECD database. GDP of EU at constant prices is used as a proxy world real income. The economic growth of Denmark is measured by GDP at constant local prices. A real effective exchange rate is a measure of relative prices. Capital flow is the total of both private and official inflows of capital. Exports and imports are also taken at constant local prices. We expressed all the variables in log form to aid the estimation.

Application of method and empirical estimation

We used the autoregressive distributed lag (ARDL) model for estimating the short-run and long-run relationships among the variables of which introduced and developed by Pesaran, Shin, and Smith [29] for testing cointegration relationship. We use the ARDL approach because variables are not integrated in the same order. The unit root test results for questioning the stationarity indicate that some of the variables are integrated into I(1) and some in I (0). Similarly, the ARDL methodology depends on the estimation of a single equation. Given that the period is relatively long, we shall examine if there are structural in the data.

For cointegration investigation, it is expected that ΔYt will be modeled as a conditional error correction model (ECM):

where Δ is the first difference of the variable and, is the error correction mechanism that implies a speed of adjustment for the current account toward long-run equilibrium for. The coefficients \({b}_{i}\) and \({d}_{i}\) are multipliers for the independent variables. And \({u}_{i}\) is the error term. Z is a set of potential determinants of \(y\)(including, exports growth, capital flows, EU income, and real effective exchange rate).

We developed the ARDL estimation regarding the variables property where some variables are in I1 and some in I0 become stationary. The results from Table 1, show that the variables are integrated of the different orders; hence, the necessity of using the econometric procedure. All the variables are stationary after first differencing except capital flows which are stationary at levels.

Structural breakpoints in the data were equally tested and the results are presented in Table 2.

Estimated results and discussion

It is obvious that the variables are generally in agreement with the underlying theoretical postulation both in signs and significance. Generally, the coefficients are statistically both short- and long-run periods. Any upward movement in real income of the European Union via its positive consequence on export demand causes an enhancement in the domestic income growth of Denmark.

The real effective exchange rate is negative and significant in explaining trade stability suggesting that reduction in the cost of Denmark exports would improve demands for her products; improvement in the external performance in the short run. Even though REER carries the expected negative sign in tandem with its short-run value, it fails in terms of significance in the long run. This agrees with the original version of the balance of payment constraint growth theory that in the long run, relative prices are constant.

As earlier indicated in the modeling process, the sign of capital flows substantially depends on the empirical determination. The outcome shows that capital flows to Denmark are positive. This means that substantial inflow of financial resources has a tremendous implication on the growth performance of the Denmark in both short- and long-run growth periods.

The upper critical bounds of Pesaran et al. [29] for n \(\ge 35\) for F-test at 0.01, 0.05 and 0.10 are 6.368, 4.63 and 3.898, respectively, and 4.60, 3.99 and 3.66 for t-test. If the probability values of the diagnostics given parenthesis are greater than 0.05, it is concluded that there is no econometric model.

At the same time, error correction model results show that the variables have long-run relationship. And any drift into disequilibrium is adjusted with the speed of 77% once a year.

Similarly, the findings show that all the endogenous structural break dummy variables (Dummy_2007and Dumm_1998), become significant at 0. 05 level. The coefficient of structural break dummy variables (Dummy 2007) confirms the effect of the global financial crisis on the growth of the economy. The unrestricted error correction mechanism findings indicate that the considered variables are cointegrated. This is confirmed by the speed of the error correction term \(\sigma\). This implies that variables considered in this model are instantaneously adjusted into equilibrium with a speed of 77% per annum.

Moving further, the decision as to whether there is a long-run relationship between the variables is based on the conditions that the Probability values of F-stat and t-stat are less than 1, 5 or 10%. When the above holds, it is concluded that the null hypothesis of no long-run relationship at the respective levels at the corresponding levels of significance is rejected. The bounds test result shows that the F-stat is significant at 5% level given that it falls outside the critical bounds. Therefore, the null hypothesis is rejected and regarding the estimation there is long-run relationship among variables. Likewise, this is also confirmed at 1% value of t-statistics.

The Breusch–Pagan test and ARCH test for heteroskedasticity reveal that the null hypothesis is accepted and suggested no significance for heteroscedasticity. In addition, results of the LM test also indicate that there is no serial correlation among variables in the long run. Therefore, the coefficients are valid and without econometric problems.

Thirlwall’s initial model also requires to calculate the aggregate income responsiveness of demand for imports. Here, ARDL is equally used for the estimation:

Increases in total imports (\(m\)) depends on the increase of internal income (\(y\)) and increase of relative prices \(\left({p}_{d}-{p}_{f}-e\right)\). And a dummy variable is used for 1996 as fixed determinants. The long-run gross income elasticities are estimated as (\({\delta }_{2}=2.4\)) and (\({\delta }_{1}=0.29)\). While income elasticity is statistically significant at 0.1, no significant relationship was found between relative prices and imports.

Determination of balance of payment constrained growth rate

Estimated static long-term results and coefficients of an ARDL model for cointegration test are evaluated in Table 3. The ARDL results, the growth rates according to Table 3, the required long-run elasticities in Table 4, and when the relevant averages and shares are substituted in Eq. 5, the effect of balance of payments and relative prices and capital flows on the growth rate is calculated as \({y}_{DM}\)=1.73. The coefficients obtained as a result of the test estimated that the annual real growth of Denmark was 1.75%. This result shows that it has a positive effect on Danish growth. Similarly, real growth in world income has been estimated at 1.92 and has a positive effect on the model under consideration. However, the real effective exchange rate coefficient has negative effects on the model in the long run. In Table 4, the error correction term is estimated at 77% to bring the whole system into balance. It is seen that all regressors except REER are statistically significant and have a positive effect on the dependent variable export. The average growth of capital flows is also very high, which has a positive effect on the model under consideration. Since the share of export flows is also positively correlated, it supports the model and explains the reason for the high balance of payments in the Danish economy. Despite current account deficit, marginal budget surplus shows that the economy maintains a balanced growth over time, consistent with real statistics.

In this study, the growth of the economy, especially the share of exports, which is the most important component of GDP, is more than 50 percent and it has a serious contribution to capital flow. Likewise, income from the demand side and relative prices were also seen as important determinants of capital flow. However, considering that net exports have a positive value, it has been observed that the role of imports is not very effective. And yet, the deterioration in global trade results during the pandemic period had devastating consequences for Danish exports as well. Weakening confidence indices and worsening expectations in Denmark's export markets affected Danish exports as well as commercial investments. But in general, Danish exports constitute the most important part in terms of GDP components.

The Danish government has proposed to allocate additional funds to addressing COVID-19 through a fiscal relaxation of 0.1 percent of GDP in 2021. COVID-19. Additional funds amount to approximately 2.4 billion Danish crowns [20]. Meeting this target shows that efforts to increase the export share in the international market continue. Most importantly, the reversal of restrictions in the service sector and the post-pandemic reopening will accelerate the economy again.

As a matter of fact, the pandemic in many developed countries, such as in Denmark, as a result of the cut-off in supply and the fall in generalized commodity prices has put many companies in trouble and increased their debts [9]. Governments' continuous support to businesses and citizens due to the pandemic also increases the burden of debt.

Conclusion

In this study we investigated the economic growth path of Demark from the demand side. Our study particularly, highlights the relevance of export demand, capital movements, and relative prices. It employs autoregressive distributed lag econometric model to examine the importance of the variables for the period ranging from 1980 to 2017. The growth model indicates that balance of payment conditions are major restrictions on growth process. This primarily because it sets a frontier on demand to which supply could adapt.

The major implications of the study include: (i) Growth of exports could trigger a superior rate of growth in real GDP. This is essentially so because it supplies the needed foreign exchange earnings required in financing any import demand related with domestic income growth. (ii) Outflow of capital would further increase the constraints that the balance of payments inflicts on long-run growth. (iii) Price competitiveness would enhance the growth of domestic income by a way of raising exports and lessening import demands. Nevertheless, the sectors that substantially depend on critical intermediate capital factor inputs may experience some difficulties in the face of the declining value of the local currency.

To meet 1.8% in 2019 growth forecast suggests that effort toward increasing export share in the international market is important. Denmark ought to focus on external-oriented growth path development. Most importantly, reversing the constraint experienced in the service sector is important. Similarly, at the same time carefully making interest rates attractive to connect the financial sector with the global financial marketplace to attract more overseas financial capital would be appropriate. Removing or reducing institutional barriers will enable entrepreneurs and individuals to increase their credits and, thus, allow them to more easily regulate their receivables and liabilities (Kester et. al. 1995). Hence, there is the need for policy actions as well as institutional adjustments that would guarantee a more superior long-run growth of export as well as measures tailored towards raising the capital inflow efficiency. However, some researchers (Adams and Klobodu, 2017) have pointed out that long-term capital flows have different effects on economic growth in different countries. It has been observed that growth has a positive effect in some countries; while in other countries, it has been determined that borrowing in foreign currency has a negative effect on growth. The reason for this is the increase in the debt burden of developing countries as a result of high inflation and the overvaluation of foreign currency, and this negatively affects economic growth. Particularly, the interest debt of the capital that comes with borrowings creates serious problems. Due to the increase in the repayment of interest rates on debts, serious problems occur on the country's balance of payments. And the effectiveness of such financial capital inflows, which constrict long-term growth, should always be questioned.

As a result, the Danish monetary authorities need to be able to convert and maintain a stable exchange rate of the Kron against foreign currencies, thereby maintaining or maintaining stable and low domestic prices.

Data availability

Not applicable.

References

Autrup Søren Lejsgaard, Paul Lassenius Kramp, Erik Haller Pedersen and Morten Spange (2015), Balance of Payments, net foreign assets and foreign exchange reserve, Economics, Danmarks Nationalbank Monetary Review 4th Quarter 2015, https://www.nationalbanken.dk/en/publications/Documents/2015/12/Mon4Q_2016_Balance_Payments_Net_Foreign.pdf

Azis Iwan J. And Shin Hyun Song (2015), Managing Elevated Risk Global Liquidity, Capital Flows, and Macroprudential Policy—An Asian Perspective Chapter 5 Capital Flows and Income Distribution.96, https://link.springer.com/content/pdf/10.1007%2F978-981-287-284-5.pdf

Bairam, E. (1988). Balance of payments, the Harrod foreign trade multiplier and economic growth: The European and North American experience, 1970–85. Appl Eco, 20(12), 1635–1642.

Bairam, E., & Dempster, G. (1991). The Harrod foreign trade multiplier and economic growth in Asian Countries. Appl Eco, 23, 1719–1724.

Baldwin R. (2006), “Euro’s trade effects”, ECB Working Paper, n° 594

Darku, A. B. (2012). The balance of payments constraint growth model and the effect of trade liberalization on trade balance and growth in Ghana. African Fin J, 14(1), 38–67.

Darku, A. B. (2018). Exports, capital inflows, relative prices, and income growth in South Korea: An application of the balance of payments constraint growth model. Int J Fin Econ., 33, 1–8.

Dixon, R. J., & Thirlwall, A. P. (1975). Regional growth and unemployment in the United Kingdom. Macmillan.

EU Commission (2020, December): Analysis of Developments in EU Capital Flows in the Global Context Increasing uncertainty in the wake of the Covid-19 pandemic: Increasing uncertainty in the wake of the Covid-19 pandemic, https://www.ceps.eu/wp-content/uploads/2021/03/Analysis-of-Developments-in-EU-Capital-Flows-in-the-Global-Context.pdf

European Commission (2018). Commission Staff Working Document Country Report Denmark 2018. Brussels, SWD (2018) 203 final

Ghose Ajit K. (2004), Capital inflows and investment in developing countries http://www.ilo.org/wcmsp5/groups/public/---ed_emp/---emp_elm/documents/publication/wcms_114304.pdf

Grossman, G. M., & Helpman, E. (1997). “Trade and growth”, Innovation and Growth in the Global Economy, Cambridge, Massachusetts. India: The MIT Press.

Joshua, A., Yothin, J., & Donghyun, P. (2011). Capital flows and economic growth in the era of financial integration and crisis. Eco Review., 24, 371–396.

Kaldor, N. (1966). Causes of the slow rate of growth of the United Kingdom: An inaugural lecture. Cambridge University.

Kester Anne and Panel on International Capital Transactkions Comittee on National Statistics : Following the Money. (1995). The US Finance in the World Economy CH: Globalisation of the Finance Markets. Washington DC: National Academy Press.

Lamonica, M. T., & de Feijó, C. A. (2011). Crescimento e industrialização no Brasil: uma interpretação à luz das propostas de Kaldor. Brazilian J Polit Eco., 31, 122.

McCombie, J. S. (1997). On the Empirics of Balance-of-Payments–Constrained Growth. J Post Keynesian Eco, 19(3), 345–375.

McCombie, J., & Thirlwall, A. (1994). Economic Growth and the Balance of Payments Constraint. St. Martin’s Press.

Ministry of Foreign Affairs of Denmark, (2018). https://um.dk/en/about-us/economy-and-results/

Ministry of Finance (2021); Denmark’s Convergence program https://ec.europa.eu/info/sites/default/files/2021-denmark-convergence-programme_en.pdf

Narrdis, D. (2003). The impact of euro on trade: The (early) effect is not so Large. Economics and Politics of Europe: Nova Science Publisher.

Nitsch, V. (2001). Honey, I shrunk the currency union effect on trade. World Economy, 25(4), 457–474.

OECD data base terms of trade, https://data.oecd.org/trade/terms-of-trade.htm#indicator-chart

Office of Statistics. (2018). United Kingdom

Pacheco-López, P., & Thirlwall, A. P. (2007). Trade liberalisation and the trade-off between growth and the balance of payments in Latin America. Inter Review Applied Eco, 21(4), 469–490.

Paul de Grauwe. (2012). Economics of monetary Union (p. 128). Oxford University Press.

Perraton, J. (2003). Balance of payments constrained growth and developing countries: an examination of Thirlwall’s hypothesis. Inter Review Applied Eco, 17, 1–22.

Persson, T. (2001). currency unions and trade: how large is the treatment effect? Eco Policy, 33, 435–448.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. J applied eco, 16(3), 289–326.

Romer, D. (2011), “The Solow growth model”, Advanced Macroeconomics, New York, McGraw-Hill

Rose, A. K. (2000). One money one market: estimating the effects of common currencies on trade. Eco Policy, 30, 9–45.

Rose and Van Wincoop E. (2001). National Money as a Barrier to Trade: The Real Case for Monetary Union. Amer Eco Rev., 91(2), 386–390.

Samuel, A., & Klobodu, E. K. M. (2017). Capital flows and economic growth revisited: evidence from five Sub-Saharan African countries. Inter Appl Eco. https://doi.org/10.1080/02692171.2017.1355357

Silva Gercione Dionizio, Marília Fernandes Maciel Gomes and Evandro Camargos Teixeira (2018), The spillover effect of Chinese growth on South America: an analysis from international trade CEPAL Review No 126, https://repositorio.cepal.org/bitstream/handle/11362/44557/1/RVI126_Silva.pdf

Statistica.com (2020), Denmark: Share of economic sectors in the gross domestic product (GDP) from 2010 to 2020 https://www.statista.com/statistics/317288/share-of-economic-sectors-in-the-gdp-in-denmark/

Thirlwall, A. P. (1979). The balance-of-payments constraint as an explanation of international growth rate differences. Banca Nazionale del Lavoro., 128, 554.

Thirlwall, A. P., & Hussain, M. N. (1982). The balance of payments constraint, capital flows and growth rate differences between developing countries. Oxford Eco papers., 34, 498–510.

Thirwall (2007), When is trade more valuable than aid?, Journal of Development Studies, Volume 13, 1976 - Issue 1 (published online 23 Nov 2007), https://doi.org/10.1080/00220387608421606

US department state (2021), Investment Climate Statements: Denmark https://www.state.gov/reports/2021-investment-climate-statements/denmark/

Vinner, J. (1950). The Customs Union Issue. Garnegie Endowment for International Peace.

World bank Database: Exports of goods and services % of GDP https://data.worldbank.org/indicator/NE.EXP.GNFS.ZS?end=2021&locations=DK&start=1990

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

EA and MS wrote this paper, read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest. The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Akalpler, E., Shingil, M. The role of income, exports and capital flows on domestic income growth: empirical evidence from Denmark. IJEPS 17, 473–488 (2023). https://doi.org/10.1007/s42495-023-00107-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42495-023-00107-x