Abstract

To implement the technology for producing potato powder, significant investment is required. This study evaluated the techno-economic feasibility of the dried potato powder production process, based on a scenario developed in a starch plant process in Japan. The simulation was performed with SuperPro Designer® software. The annual production volume and the unit production cost were estimated to be 15,786,585 kg and 1056 Japanese yen/kg, respectively. According to economic evaluation indicators—the gross margin, return on investment, payback time, internal rate of return, and net present value (at a 7% interest rate)—the scenario was profitable and investment worthwhile. A sensitivity analysis was conducted to evaluate the impact of the variable parameters (the purchasing price of raw potatoes, the selling price of potato powder, and labor and electricity costs) on the net present value (at the 7% interest rate). The analysis suggested that the purchasing price of raw potatoes and the selling price of potato powder had particularly large impacts on the net present value.

Article Highlights

-

A techno-economic analysis of potato powder production was performed using SuperPro Designer12®.

-

The minimum production cost was estimated to be 1,056 JPY/ (kg of potato powder).

-

Potato powdering may be a beneficial use of nonstandard potatoes instead of using them in starch or processed foods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Approximately 5.22 million tonnes of food are wasted in Japan each a year [1] and food wastage globally amounts to approximately 900 million tons [2]. A large amount of energy is consumed in the production, storage, transportation, and disposal of food waste, thus producing greenhouse gases. Moreover, it has been pointed out that food waste may indirectly result in environmental issues such as soil erosion, deforestation, and water and air pollution [3,4,5,6]. Therefore, international interest in food waste is increasing as a result of both environmental concerns and food distribution issues.

Potatoes are one of the most consumed vegetables not only in Japan but worldwide. In Japan, approximately 2.1 million tonnes of potatoes are harvested each year. About 80% (1.7 million tonnes) of them are harvested in Hokkaido [1]. The largest use of potatoes is as a starch ingredient (34.3%), followed by raw food (26.6%), processed food (25.8%), and other uses, such as seeds and feed (13.3%). Production of potatoes for a starch ingredient occurs only in Hokkaido [7,8,9]. However, potatoes defined as too large, too small, or misshapen are not suitable for distribution. Potatoes categorized as nonstandard are sold at low prices for use as a starch ingredient or for processed foods (e.g., as an ingredient for salads or croquettes). In some cases, they are thrown away despite the fact that they would taste the same as the standard ones.

Potatoes contain about 80% water. Foods with a high moisture content undergo rapid quality deterioration because of biological and chemical changes. To preserve such foods, drying technologies and moisture controls to achieve a longer shelf-life. In addition, energy and space during transportation and storage can be saved by reducing the volume and mass of foods. As a result, drying techniques have enabled people to have a stable food supply and survive periods of food scarcity [10, 11]. Furthermore, nonstandard crops can be used for dried and powdered foods. Preserving and using potatoes in powdered form is expected to become a lean and sustainable way to consume them upstream and downstream in the potato supply chain.

Researchers have been investigating the properties of potatoes and developing technologies for drying them for some time [12,13,14,15]. However, capital funds are required to expand the technology for producing potato powder to pilot scale. Moreover, an acceptable plant design must ensure that production of a product that can be sold at a profit [16]. As the construction and operation of the pilot plant is expected to be costly, it is necessary to analyze and simulate its economy efficiency and profitability in advance.

Techno-economic analysis (TEA) is a valuable tool for connecting R&D, engineering, and business. TEA is useful throughout the technology development lifecycle, as innovators considering new ideas can use TEA to assess economic feasibility and potential. A process model can be developed using either spreadsheet software or process simulation software [17]. Various platforms for TEA have been developed and used, including Aspen, SuperPro Designer, and BioTEAM [18,19,20]. SuperPro Designer, one of the TEA platforms developed by Intelligen, Inc., has been used to perform TEAs in various industries, including energy, manufacturing, chemical processing, and waste treatment [21,22,23,24,25,26,27]. The food processing industry is another industry that could take advantage of TEA. At present, no TEA of potato powder production has been conducted.

The objective of this study was to determine effective ways to use potatoes, including nonstandard potatoes. This study focused on the powdering method and aimed to develop potato powder production as a new method of using nonstandard potatoes. We created and analyzed a virtual potato powder plant to evaluate its characteristics and profitability.

2 Materials and methods

The process was simulated with the aid of SuperPro Designer 12®. The operation mode was set to continuous mode with 1200 h/year. The plant was assumed to process 62.5 tons/hour (t/h) of potatoes, which is roughly equivalent to the average processing capacity of starch plants in Hokkaido. We assumed that raw potatoes were purchased for 200 Japanese yen (JPY)/kg and that the potato powder produced would be sold at 1200 JPY/kg. The currency was set to JPY, with the exchange rate with the United States dollar (USD) set to 130 JPY/USD. We assumed that the plant would be operated for 30 years after a 2-year construction and start-up phase.

2.1 Process design

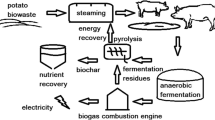

We adapted the process from a potato starch production plant that is currently in operation. Figure 1 illustrates the principal process of starch plants [28, 29]. Raw potatoes received by the plant are temporarily stored, then washed, and ground with water to become potato juice. Next, the potato juice is purified using a decanter, centrifugal sieve, and separator. Finally, an aqueous solution of starch is dehydrated and dried to form the starch product.

In our scenario, we designed the potato powder production process by adapting this potato starch plant process, essentially removing the process for purification. As shown in Fig. 2, we removed the decanter and separator from the production process to retain component from potato juice not to purify starch. The detailed process for producing potato powder is discussed in Sect. 2.1.1–2.1.4. Figure 3 shows the simulated process flowsheet for producing potato powder on SuperPro Designer 12®.

2.1.1 Raw potatoes

As noted above, we assumed that 62.5 t/h raw potatoes are transported to the plant, that 3,500 kg/h of stones and 100 kg/h of sand adhere to the raw potatoes, and that they are transported by trucks (P-10 truck (bulk)). The quantity-dependent cost was set at 2,500 JPY/MT. Transported potatoes are sifted to remove 99% of the adhering sand and 100% of the stones (P-1/VSCR-101 vibrating screen). The raw potatoes are temporarily stored (P-2/SL-102 solid storage). The working volume of the bin was set to 3,000 m3 and the height/diameter ratio was set at 3.0. Raw potatoes were assumed to contain 79.8% water, 16.0% starch, 1.0% carbohydrates other than starch, 0.1% lipids, 1.6% protein, 0.6% peel, and 0.9% minerals [29, 30]. The raw potatoes received are transported to the next process with 264 t/h of water.

2.1.2 Preparation before drying process

Raw potatoes are washed with 130 t/h water (Water_Wash) (P-4/WSH-101 washing (bulk flow)). In total, 99.0% of the sand and 99.9% of the water is discharged (S-112). Then, the washed potatoes are carried on a conveyor belt (P-5/BC-101 belt conveying), with the width and length of the conveyor belt set to 150 cm and 10 m, respectively.

After washing, potatoes are ground with 125 t/h water (Water_Add) by grinders (P-8/GR101 grinding) to form potato juice. We assumed that the plant had four grinders (213 kW in total). Potatoes juice consist of 0.33% carbohydrate, 0.03% lipid, 0.30% mineral, 0.53% protein, 5.33% starch, 79.8% potato water, 66.7% process water.

The potato juice is passed through a centrifugal sieve (P-14/SV-101) to remove the potato peel. In this process, 100 t/h water (Water_Sieve) is added to the wash. In total, 99% of the process water and potato water passes through the centrifugal sieve. The number of centrifugal sieves was set to 12.

2.1.3 Drying process

In total, 95.7% of the potato juice (S-114) is composed of water because a large amount of water is added to remove the sand and peel. In the next step, the potato juice is dehydrated using rotary vacuum filtration (P-16/RVF-101). The dehydrated cake contains 40.0% water. In addition, 100% of the starch and 35% of other components remain in the cake. The filtrate area was set to 74.2 m2.

Next, the dehydrated cake is dried in heated air. The drier (P-17/FBDR-101) takes 28 t/h air (Air_Dry). The air is composed of 80% nitrogen and 20% oxygen. The outlet gas temperature and the dried product temperature were set to 80.0 °C and 60.0 °C, respectively. The dried product contains 18.0% water.

The dried potato powder is temporarily stored in a silo (P-18/SL-101) before shipping. The size of the silo and the height/diameter ratio were set to 15,000 m3 and 3.00, respectively.

2.1.4 Wastewater treatment

A large amount of water is required to wash the raw potatoes and to remove the potato peel and any impurities. As a result, a great deal of water is discharged in the dehydration process. The wastewater must be treated before it is discharged because it contains organic waste. The cost of wastewater treatment, assumed to be 0.23 JPY/kg of wastewater, was estimated with reference to the current process in the starch plant.

2.2 Economic evaluation

The economic evaluation involved an estimation of costs, a profitability analysis, and a sensitivity analysis. The cost estimation and the calculation of indicators for the profitability analysis were conducted using SuperPro Designer 12®. The cumulative cash flow and the relationship between the discount rate and the net present value (NPV) were analyzed using Microsoft® Office® Excel for Microsoft 365, and the sensitivity analysis was also conducted using Excel.

2.2.1 Cost estimation

The estimation of the total capital investment required was based on the method proposed by Peters et al. [16]. The total capital investment cost includes the direct fixed capital cost, the working capital cost, and the start-up cost. The direct fixed capital cost is composed of the total plant direct cost (TPDC), the total plant indirect cost (TPIC), the contractor fee, and contingencies. We further subdivided the TPDC into the equipment purchase, installation, processing piping, instrumentation, insulation, electrical, building, yard improvement, and auxiliary facilities costs. Each cost was estimated as a percentage of the delivered equipment cost [16]. The equipment cost was established by SuperPro Designer 12® with the assumption that the unlisted equipment purchase cost was 20% of the total equipment purchase cost (PC). In addition, the working capital was estimated based on the expenses required for 30 days of labor, raw materials, utilities, and treatment. The start-up and validation costs were estimated as 5.00% of the direct fixed capital cost (DFC).

The operating cost includes raw material, labor, electricity, transportation, water treatment, and miscellaneous costs. The raw material is the raw potatoes, which are assumed to be purchased at 200 JPY/kg. The price of raw potatoes was determined with reference to the typical selling price of raw potatoes in Japan [7]. Labor, utility, and water treatment costs were determined with the support of the starch plant in Hokkaido and were assumed to be 150,000,000 JPY/year (16 full-time workers and 10 part-time workers), 39.0 JPY/kWh and 0.23 JPY/kg, respectively. The miscellaneous cost was also estimated with support from the starch plant in Hokkaido. The miscellaneous cost consists of fixed and variable costs, which were assumed to be 66,400,000 JPY/year and 7.98 JPY/kg, respectively. The DFC was assumed to depreciate using the straight-line method for a 30-year lifetime with a 5% salvage value.

The selling price of produced potato powder was hypothesized referring to the prices of potato flake products commercially available in Japan. It was set at 1200 JPY/kg. The revenue of the potato powder producer will be generated from selling the potato powder.

Table 1 shows the details of the parameters used for cost estimation.

2.2.2 Profitability analysis

The cost of constructing and operating the plant is expected to be very high. The profitability analysis was performed by calculating the total capital investment, the operating cost, revenue, the cost basis annual rate, the unit production cost, the gross margin, the return on investment (ROI), the payback time, the internal rate of return (IRR), and the NPV (at a 7.0% interest rate) as profitability performance indicators.

The gross margin is the ratio of profit (the difference between the revenue and the operating cost) to the revenue of potato powder sold, as defined in Eq. (1):

The ROI is the ratio of annual net profit to capital investment, defined as follows:

The payback time is the length of the time required for the total return to equal the capital investment, as follows:

The NPV indicates the difference between the present value of cash inflows and the present value of cash outflows over a lifetime. A positive NPV indicates that the scenario is profitable, whereas an investment with a negative NPV will result in a net loss. The NPV is defined in Eq. (4) as follows:

where \(t\) is the lifetime in years, \({CF}_{0}\) is the initial investment, \({CF}_{t}\) is the net cash flow during period \(t\), and \(d\) is the discount rate [27]. The IRR is a discount rate that makes the NPV equal zero, which reflects the efficiency of the investment. Furthermore, we calculated the NPV for an alternative discount rate (15%).

We anticipated a decrease of the plant’s production rate over its lifetime caused by an unusual circumstance. If the plant stands idle or operates at a low capacity, certain costs, such as those for raw materials and labor, are reduced. However, the costs of depreciation and maintenance continue at essentially the same rate even when the plant is not in full use [16]. To prepare for unforeseen circumstances such as decrease in yield of raw potatoes, the breakeven chart was plotted to determine minimum process capacity to gain profit. The capacity of the plant was scaled, and the revenue and annual operating costs (AOC) were calculated.

We calculated and illustrated the cumulative cash flow for each year (see Fig. 7). In addition, we calculated the NPV for various discount rates (7% and 10%) for each year and compared the cumulative cash flows. We also calculated the IRR to calculate the NPV for each year and determine the cash flow pattern when the final cash value equals zero.

2.2.3 Sensitivity analysis

As the economic environment and the labor market are anticipated to change over a plant’s lifetime, we performed a sensitivity analysis to evaluate the effect of changes in the variable parameters on the plant. The raw material cost, the selling price, the electricity cost, and the labor cost were each evaluated and set at a ± 50% variation at the beginning of the plant’s lifetime. The NPV at a 7% discount rate was used as an indicator.

3 Results and discussion

3.1 Mass balance and utilities

Table 2 shows the mass balance of the potato powder plant. In total, 75,000,000 tons of potatoes are processed in a year to produce potato powder. Thus, 15,800,000 tonnes of potato powder is produced in a year, which amounts to 13.2 tonnes in an hour (see Fig. 4). The potato powder produced consists of 18.0% water, 76.0% potato starch, 1.7% potato carbohydrate, 2.7% potato protein, 1.5% potato mineral, and 0.2% potato lipid.

Water management is important when producing dried powder. In this scenario, each year, 796,225 tonnes of wastewater that includes organic waste is discharged before the drying process (Water_Discharge). It consists of 92.4% process water, 7.3% potato water, 0.10% potato protein, 0.06% potato carbohydrate, 0.06% potato mineral, 0.06% potato peel, and 0.01% potato lipid. Moreover, in the drying process (P-17/FBDR-1), 5,790,000 tonnes of water is emitted in a water vapor state (Air_Emission Stream). In total, 81.9% of the water vapor comes from process water and 18.1% comes from potato water. In particular, as noted earlier, the Water_Discharge Stream contains organic waste (potato carbohydrate, protein, lipid, and peel) because potato peel is removed in the centrifugal sieving process (P-14/SV-101) and some water-soluble components run off with the water in the rotary vacuum filtration process (P-16/RVF-101). From the perspective of the environmental impact and efficient use of resources, the development of dehydration methods without component loss and with the effective use of potato peel is required.

Power demand for proposed process and the breakdown were also shown in Table 3. The power demand for grinder was the largest at 1,022,400.00 kWh-h/yr, accounting for 62.28% of the total power demand. It was found that the process of turning raw potatoes into potato juice consumes a large amount of electricity. Electricity cost was estimated based on this result and discussed in the below section.

3.2 Cost estimation

3.2.1 Initial investment

Table 4 shows the estimations of the equipment purchase cost and the direct fixed capital cost calculated according to the built-in price in SuperPro Designer 12®. The PC was approximately 1.2 billion JPY. The silo for storing potato powder (SL-101) was the most expensive equipment, estimated to amount to 424 million JPY, representing 35.0% of the PC. The next most expensive items were the grinder (12.2%), the centrifugal sieve (12.1%), and the silo for raw potatoes (11.0%). The DFC, estimated at approximately 7.0 billion JPY, was calculated by multiplying the factors by the PC. The components of the DFC were 3.82 billion JPY for the TPDC, 2.29 billion JPY for the TPIC, 305 million JPY for the contractors’ fees, and 611 million JPY for contingencies. In a more detailed classification, the PC and construction were the most expensive sections, accounting for 17.3% and 19.0%, respectively, of the DFC.

3.2.2 Operating cost

The AOC is shown in Table 5. It was estimated at approximately 16.7 billion JPY, 90.0% of which was the cost of raw materials (potatoes). Approximately 5.3% of the operating cost was facility-dependent including depreciation. Labor, water disposal, utilities, transportation and miscellaneous accounted for 0.90%, 1.10%, 0.38%, 1.19% and 1.15% of the operating cost, respectively. The unit production cost per 1 kg of potato powder was 1,056.07 JPY. In this scenario, the unit price of producing potato powder was assumed to be almost the same as that of producing potatoes for raw consumption because the cost for purchasing raw potatoes was a high proportion of these costs.

3.3 Profitability analysis

The indicators calculated to evaluate profitability are shown in Table 6. The total capital investment was estimated to be 16.6 billion JPY and the AOC was 16.7 billion JPY, as described in Sect. 3.2. Revenue is generated by selling produced potato powder at 1,200 JPY/kg. The annual production rate of potato powder was estimated to 15.8 million kg and the revenue was estimated to be 18.9 billion JPY/year. This means that the unit production cost was 1,056.07 JPY/kg while the unit production revenue was set at 1,200.00 JPY/kg. As a result, the gross margin was 11.99%, the ROI was 11.59%, and the payback time was 8.63 years. Thus, the initial investment can be recovered early during the plant’s lifetime.

According to the Report on the Survey of Corporations, the average gross margin in the food manufacturing industry was 25.1% in 2021 [31]. The gross margin was low compared with the industry average. In addition, the average ratio of costs–sales (operating cost/revenues) was 73.8% in the food manufacturing industry in Japan (Ministry of Agriculture, Forestry and Fisheries, Japan, 2010). In this scenario, the ratio of cost–sales was 88.0%, which was higher than average. Considering that 90.0% of the AOC was the raw material cost, it is necessary to purchase raw potatoes at lower price or sell potato powder at higher price.

Figure 5 shows the breakeven chart based on processing capacity. The breakeven point was 36.8% for this scenario. It is equivalent to 5800 tonnes of potato powder production. This result indicated that the plant could make profit even if some problem reduced production to 36.8%.

The relationship between discount rate and the NPV is shown in Fig. 6. The IRR was 12.48%. In Japan, the Money Lending Business Law (kashikingyo hou), and the Interest Rate Restriction Law (risoku seigen hou) limit loan interest rates to 15%–20%. The NPV became negative in the case of a 15% interest rate, the maximum interest rate. Based on these results, the cumulative cash flow and the NPV at various different discount rates (7%, 10%, 12.48%) for each year is illustrated in Fig. 7. For the cumulative cash flow, the payback time was 8.63 years, except for the construction and start-up period, as shown in Table 5. The final cumulative cash flow was approximately 51.1 billion JPY. Compared with the NPV at 7% and 10% discount rates, there is a gap of about 42.2 billion JPY and 48.2 billion JPY, respectively. Moreover, the NPV where the discount rate is greater than the IRR (12.48%) stays negative during the plant’s lifetime. To obtain more profit and stable management, it is essential to raise funds at the smallest possible discount rate (less than 12.48%).

3.4 Sensitivity analysis

To determine the influence of each variable parameter on the plant’s operations, we conducted a sensitivity analysis. As shown in Fig. 8, we found that the price of raw potatoes and the sale price of potato powder have very large impacts on the NPV. Moreover, an approximately 5% change in the prices of raw potatoes or potato powder can result in a negative NPV. This result is supported by the fact that 90% of the AOC is the raw material cost. The scenario should be reviewed in relation to the business environment to ensure that the plant continues to make a profit. The influence of labor and electricity costs was relatively low. The NPV remained positive even when the labor and electricity costs were varied ± 50%.

3.5 Comparison with starch purification process

The profitability index and composition of the powder of both processes were compared in Table 7. In the starch purification plant, nonstandard raw potato was purchased at a relatively low price and sold as starch at low prices, resulting in low operating costs and 0% of gross margin. On the other hand, the operating cost of the proposed process was approximately 10 times more expensive because we aimed to add value to nonstandard potato, but at the same time, the gross margin was 11.99% because the selling price was assumed to be the same level as that of standard one. When processed into starch, it is difficult to trade at a high price due to price competition with starch prices derived from other raw materials, but if processed as potato, it is possible to trade at a price equivalent to that of standard potato, and the profit can be returned to farmers. The quality of the powder in proposed process was also expected to be the same quality as standard potato. The percentages of the component except water were as follows; 92.56% of starch, 2.07% of carb., 3.29% of protein, 1.82% of mineral, and 0.24% of lipid. Since the proposed process is based on the starch purification process, there was a slight increase in the starch ratio due to water runoff of some components compared to the raw potato, but the quality of the powder is not considered to be a significant problem.

4 Conclusions and prospects

In this study, we performed TEA of a potato powder plant applying a potato starch purification system. We estimated that approximately 15,800,000 tonnes of potato powder could be produced by the plant per year. We estimated the total capital investment and AOC at 16.6 billion JPY and 16.7 billion JPY/year, respectively. Considering the NPV (8.87 billion JPY), the IRR (12.48%), the gross margin (11.99%), the ROI (11.59%) and the payback time (8.63 years) of the plant, the plant performed well, with good profitability in this scenario. The results showed that the initial investment could be recovered early in the plant’s lifetime. The AOC and the sensitivity analysis indicated that the price of purchasing raw potatoes and the sale price of potato powder have a large impact on the plant’s profitability.

This study showed that nonstandard potatoes can be sold at a price that differs little from the price of standard ones by using the powdering method. Powdering could represent a beneficial method of using nonstandard potatoes compared with the traditional methods for using such potatoes as an ingredient in starch or processed foods. However, it is necessary to ensure a stable demand to generate a stable profit in the actual operations of the plant, noting that our scenario assumed that there would be no excess inventory. Expansion of the uses of rehydrated powder is required to obtain sufficient demand and ensure the future prospects of powdered potatoes.

Data availability

The data generated or analyzed during this study are included in this published article.

Code availability

Not applicable.

References

Ministry of Agriculture, Forestry and Fisheries. Census of agriculture and forestry. Tokyo: Tokyo; 2022.

United Nations Environment Programme. Food waste index report 2021. Nairobi: UN Environment Programme; 2022.

Abeliotis K, Lasaridi K, Cosrtarelli V, Chroni C. The implications of food waste generation on climate change: the case of Greece. Sustain Prod Consum. 2015. https://doi.org/10.1016/j.spc.2015.06.006.

Mourad M. France moves toward a national policy against food waste, Natural Resources Defense Council, Inc. 2016. https://www.nrdc.org/sites/default/files/france-food-waste-policy-report.pdf. Accessed 21 Sep 2023.

United Nations. Sustainable development. https://sdgs.un.org/. Accessed 22 Mar 2023.

Venkat K. The climate change and economic impacts of food waste in the United States. Int J Food Dyn. 2011. https://doi.org/10.18461/ijfsd.v2i4.247.

Ministry of Agriculture, Forestry and Fisheries. Denpun no jukyu mitoshi ni tsuite (Outlook for Starch Supply and Demand). 2022. (in Japanese)

Ministry of Agriculture, Forestry and Fisheries. Reiwa 3 nendo imo denpun ni kansuru siryou (Data on potatoes and starch in 2021); 2022. (in Japanese)

Tamiya S. Bareihso no juyou henka to hinshu no doukou (Changes in demand and trends in potato varieties), Agriculture and Livestock Industries Corporation. 2016. https://www.alic.go.jp/joho-d/joho08_000646.html. Accessed 21 Sep 2023. (in Japanese)

Loncin M. Food engineering, principles and selected application. Cambridge: Academic Press; 1979.

Peter Z, Leif B. Food preservation techniques. Amsterdam: Elsevier; 2003.

Islam MN, Flink JN. Dehydration of potato. Int J Food Sci Technol. 1982. https://doi.org/10.1111/j.1365-2621.1982.tb00194.x.

Kujawska M, Olejnik A, Lewandowicz G, Kowalczeski P, Forjasz R, Jodynis-Liebert J. Spray-dried potato juice as a potential functional food component with gastrointestinal protective effect. Nutrients. 2018. https://doi.org/10.3390/nu10020259.

McMinn WAM, Magee TRA. Physical characteristics of dehydrated potatoes—part II. J Food Eng. 1997. https://doi.org/10.1016/S0260-8774(97)00040-X.

Saravacos GD. Effect of the drying method on the water sorption of dehydrated apple and potato. J Food Sci. 1967. https://doi.org/10.1111/j.1365-2621.1967.tb01963.x.

Peters MS, Timmerhaus KD, West RE. Plant design and economics for chemical engineers. 5th ed. New York: McGraw-Hill; 2003.

Burk C. Techno-economic analysis for new technology development. In: Romanowicz B, Laudon M, editors. Advanced Materials: TechConnect Briefs 2017, vol. 1. Washington, DC: TechConnect; 2017. p. 266–9.

AspenTech. https://www.aspentech.com/en. Accessed 22 Mar 2023.

Intelligen, Inc. https://www.intelligen.com/. Accessed 22 Mar 2023.

Bio Team—Life Science IT Consulting. https://bioteam.net/. Accessed 22 Mar 2023.

Flora JRV, McAnally AS, Petrides D. Treatment plant instructional modules based on SuperPro Designer® vol 27. Environm Model Softw. 1998. https://doi.org/10.1016/S1364-8152(98)00059-0.

Mel M, Yong AS, Avicenna ISI, Setyobudi RH. Simulation study for economic analysis of biogas production from agricultural biomass. Energy Proc. 2015. https://doi.org/10.1016/j.egypro.2015.01.026.

Joseph S, Renjanadevi B. Modeling and optimization of bioplastic production using superpro designer. In: Proceedings of the Yukthi 2021- The International Conference on Emerging Trends in Engineering. 2021. https://ssrn.com/abstract=4019994. Accessed 21 Sept 2023.

Koulouris A, Misailidis N, Petrides D. Application of process and digital twin models for production simulation and scheduling in the manufacturing of food ingredients and products. Food Bioprod Process. 2021. https://doi.org/10.1016/j.fbp.2021.01.016.

Bharathiraja B, Jayamuthunagai J, Sreejith R, Iyyappan J, Praveenkumar R. Techno economic analysis of malic acid production using crude glycerol derived from waste cooking oil. Biores Technol. 2022. https://doi.org/10.1016/j.biortech.2022.126956.

Mabrouki J, Abbassi MA, Khiari B, Jellali S, Zorpas AA, Jeguirim M. The dairy biorefinery: integrating treatment process for Tunisian cheese whey valorization. Chemosphere. 2022. https://doi.org/10.1016/j.chemosphere.2022.133567.

Wang H, Tsuang C, Ho M, Kaur G, Roelants SLKW, Stevens CV, Soetaert W, Lin GSK. Techno-economic evaluation of a biorefinery applying food waste for sophorolopid production—a case study for Hong Kong. Biores Technol. 2020. https://doi.org/10.1016/j.biortech.2020.122852.

Huwa E, Komaki T, Hizukuri S, Kainuma K. Denpun kagaku no jiten (in Japanese) (Encyclopedia of Starch Science). Tokyo: Asakura Publishing Co., Ltd.; 2010.

Nakamura M, Suzuki S. Denpun kagaku handbook (in Japanese) (Handbook of Starch Science). Tokyo: Asakura Publishing Co., Ltd.; 1997.

Ministry of Education. Standard tables of food composition in Japan Fifth Revised. Tokyo: Ministry of Education; 2005.

Ministry of Finance. Houjin kigyo toukei chousa (in Japanese) (Survey of Cooperations). Tokyo: Ministry of Finance; 2021.

Acknowledgements

We would like to express our great appreciation of the staff members of Japanese Agricultural Cooperatives (JA) Shihoro and Hokuren for their advice and support during this study. We thank Amanda Fitzgibbons PhD, from Edanz (https://jp.edanz.com/ac) for editing a draft of this manuscript.

Funding

This work received no external funding.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by Nagohira Sato, Naoto Shimizu and Mitsutoshi Nakajima. The first draft of the manuscript was written by Nagohira Sato, and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sato, N., Shimizu, N. & Nakajima, M. Techno economic analysis of the production of potato powder applying potato starch purification system in Japan. Discov Appl Sci 6, 253 (2024). https://doi.org/10.1007/s42452-024-05937-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42452-024-05937-8