Abstract

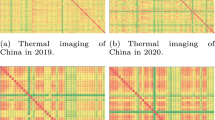

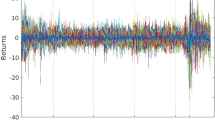

Market competition has a role that is directly or indirectly associated with the influential effects of individual sectors on other sectors of the financial market. The present work studies the relative position of stocks in the market through the identification of influential spreaders and their corresponding effect on the other sectors of the market using complex network analysis during and after the COVID-19-induced lockdown periods. The study uses daily data of NSE along with those of different countries like USA (Nasdaq), UK (UK stock exchange), Japan (Nikkei) and Brazil (Bovespa) from December 2019 to June 2021. The existing network approaches using different centrality measures failed to distinguish between the positive and negative influences of the different sectors in the market which act as spreaders. To overcome this problem, this paper presents an effective measure called LIEST (Local Influential Effects for a Specific Target) that can examine the positive and negative influences separately with respect to any period. LIEST considers the combined impact of all possible nodes which are at most three steps away from the specific target nodes in the networks. This study considers the transmission of financial influence originating at a source node (a particular stock) and propagating to target nodes through the financial market modeled as a complex network where the structure of the network is captured by correlation. The essence of non-linearity in the network dynamics without considering the single node effect becomes visible in the proposed network. A comparative analysis has been undertaken among the stocks drawn from financial markets around the world (USA, UK, Brazil and Japan) with that of the Indian stock to obtain an idea about the global market behaviour. As an example, the active participation of healthcare and consumer defensive sectors along with financial, industrial and technology sectors have been found to create an effective positive impact on the Indian market. Similar results have been obtained with stock market data obtained from other countries. In addition, in respect of spreading performance the proposed approach is found to be efficient as validated by the TRIVALENCY model.

Similar content being viewed by others

Data availability

The data sets (see Supplementary file Table: 22–26) analysed during the present study are available publicly in the website of Yahoo finance (https://finance.yahoo.com/).

Code availability

The codes to reproduce the results can be found at https://github.com/Anwesha-25/LIEST.

References

Albano, J. A., Messinger, D. W., & Rotman, S. R. (2012). Commute time distance transformation applied to spectral imagery and its utilization in material clustering. Optical Engineering, 51(7), 076202.

Almog, A., & Shmueli, E. (2019). Structural entropy: Monitoring correlation-based networks over time with application to financial markets. Scientific Reports, 9(1), 1–13.

Baker, M., & Wurgler, J. (2007). Investor sentiment in the stock market. Journal of Economic Perspectives, 21(2), 129–152.

Bhadola, P., & Deo, N. (2017). Extreme eigenvector analysis of global financial correlation matrices. Econophysics and sociophysics: Recent progress and future directions (pp. 59–69). Springer.

Boccaletti, S., Latora, V., Moreno, Y., Chavez, M., & Hwang, D. U. (2006). Complex networks: Structure and dynamics. Physics Reports, 424(4–5), 175–308.

Brin, S., & Page, L. (1998). The anatomy of a large-scale hypertextual web search engine. Computer Networks and ISDN Systems, 30(1–7), 107–117.

Brunetti, C., Harris, J. H., Mankad, S., & Michailidis, G. (2019). Interconnectedness in the interbank market. Journal of Financial Economics, 133(2), 520–538.

Burns, A. C. (1986). Generating marketing strategy priorities based on relative competitive position. Journal of Consumer Marketing, 3, 49–56.

Chatterjee, S., Mukherjee, I., & Barat, P. (2018). Analysis of the behaviour of the detrended BSE sensex data. Chaos, Solitons & Fractals, 113, 186–196.

Chen, D., Lü, L., Shang, M. S., Zhang, Y. C., & Zhou, T. (2012). Identifying influential nodes in complex networks. Physica A: Statistical Mechanics and its Applications, 391(4), 1777–1787.

Corsi, F., Lillo, F., Pirino, D., & Trapin, L. (2018). Measuring the propagation of financial distress with granger-causality tail risk networks. Journal of Financial Stability, 38, 18–36.

Cortés Ángel, A. P., & Eratalay, M. H. (2022). Deep diving into the S &P Europe 350 index network and its reaction to COVID-19. Journal of Computational Social Science, 5, 1343–1408.

Darbellay, G. A., & Wuertz, D. (2000). The entropy as a tool for analysing statistical dependences in financial time series. Physica A: Statistical Mechanics and its Applications, 287(3–4), 429–439.

De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Noise trader risk in financial markets. Journal of Political Economy, 98(4), 703–738.

Elliott, M., Golub, B., & Jackson, M. O. (2014). Financial networks and contagion. American Economic Review, 104(10), 3115–3153.

Feldhoff, J. H., Donner, R. V., Donges, J. F., Marwan, N., & Kurths, J. (2012). Geometric detection of coupling directions by means of inter-system recurrence networks. Physics Letters A, 376(46), 3504–3513.

Fraser, A. M., & Swinney, H. L. (1986). Independent coordinates for strange attractors from mutual information. Physical Review A, 33(2), 1134.

Frenzel, S., & Pompe, B. (2007). Partial mutual information for coupling analysis of multivariate time series. Physical Review Letters, 99(20), 204101.

Giardina, I., & Bouchaud, J. P. (2003). Bubbles, crashes and intermittency in agent based market models. The European Physical Journal B-Condensed Matter and Complex Systems, 31(3), 421–437.

Guilbeault, D., & Centola, D. (2021). Topological measures for identifying and predicting the spread of complex contagions. Nature Communications, 12(1), 1–9.

Guo, S., Seth, A. K., Kendrick, K. M., Zhou, C., & Feng, J. (2008). Partial granger causality-eliminating exogenous inputs and latent variables. Journal of Neuroscience Methods, 172(1), 79–93.

Haluszczynski, A., Laut, I., Modest, H., & Räth, C. (2017). Linear and nonlinear market correlations: Characterizing financial crises and portfolio optimization. Physical Review E, 96(6), 062315.

Hirsch, J. E. (2005). An index to quantify an individual’s scientific research output. Proceedings of the National Academy of Sciences, 102(46), 16569–16572.

Huang, C., Wen, S., Li, M., Wen, F., & Yang, X. (2021). An empirical evaluation of the influential nodes for stock market network: Chinese a-shares case. Finance Research Letters, 38, 101517.

Jaccard, P. (1912). The distribution of the flora in the alpine zone. 1. New Phytologist, 11(2), 37–50.

Ji, P., Ye, J., Mu, Y., Lin, W., Tian, Y., Hens, C., Perc, M., Tang, Y., Sun, J., & Kurths, J. (2023). Signal propagation in complex networks. Physics Reports, 1017, 1–96.

Khalil, G. E., Jones, E. C., & Fujimoto, K. (2021). Examining proximity exposure in a social network as a mechanism driving peer influence of adolescent smoking. Addictive Behaviors, 117, 106853.

Kirkpatrick, C. D., II., & Dahlquist, J. A. (2010). Technical analysis: the complete resource for financial market technicians. FT Press.

Kitsak, M., Gallos, L. K., Havlin, S., Liljeros, F., Muchnik, L., Stanley, H. E., & Makse, H. A. (2010). Identification of influential spreaders in complex networks. Nature Physics, 6(11), 888–893.

Kukreti, V., Pharasi, H. K., Gupta, P., & Kumar, S. (2020). A perspective on correlation-based financial networks and entropy measures. Frontiers in Physics, 8, 323.

Kumari, J., Sharma, V., & Chauhan, S. (2021). Prediction of stock price using machine learning techniques: A survey. In 2021 3rd International conference on advances in computing, communication control and networking (ICAC3N) (pp. 281–284). IEEE.

Laloux, L., Cizeau, P., Bouchaud, J. P., & Potters, M. (1999). Noise dressing of financial correlation matrices. Physical Review Letters, 83(7), 1467.

Leng, S., Ma, H., Kurths, J., Lai, Y. C., Lin, W., Aihara, K., & Chen, L. (2020). Partial cross mapping eliminates indirect causal influences. Nature Communications, 11(1), 1–9.

Li, H., Peng, R., Shan, L., Yi, Y., & Zhang, Z. (2019). Current flow group closeness centrality for complex networks? In The world wide web conference (pp. 961–971).

Lü, L., Zhang, Y. C., Yeung, C. H., & Zhou, T. (2011). Leaders in social networks, the delicious case. PLoS One, 6(6), e21202.

Lü, L., Zhou, T., Zhang, Q. M., & Stanley, H. E. (2016). The h-index of a network node and its relation to degree and coreness. Nature Communications, 7(1), 1–7.

Luan, Y., Bao, Z., & Zhang, H. (2021). Identifying influential spreaders in complex networks by considering the impact of the number of shortest paths. Journal of Systems Science and Complexity, 34(6), 2168–2181.

Ma, H., Aihara, K., & Chen, L. (2014). Detecting causality from nonlinear dynamics with short-term time series. Scientific Reports, 4(1), 1–10.

Majapa, M., & Gossel, S. J. (2016). Topology of the south African stock market network across the 2008 financial crisis. Physica A: Statistical Mechanics and its Applications, 445, 35–47.

Mantegna, R. N. (1999). Hierarchical structure in financial markets. The European Physical Journal B-Condensed Matter and Complex Systems, 11(1), 193–197.

Mantegna, R. N., & Stanley, H. E. (1999). Introduction to econophysics: Correlations and complexity in finance. Cambridge University Press.

Marschinski, R., & Kantz, H. (2002). Analysing the information flow between financial time series: An improved estimator for transfer entropy. The European Physical Journal B-Condensed Matter and Complex Systems, 30, 275–281.

Morone, F., & Makse, H. A. (2015). Influence maximization in complex networks through optimal percolation. Nature, 524(7563), 65–68.

Newman, M. E. (2003). The structure and function of complex networks. SIAM Review, 45(2), 167–256.

Newman, M. E. (2005). A measure of betweenness centrality based on random walks. Social Networks, 27(1), 39–54.

Newman, M. E. (2010). Networks–An introduction. Oxford University Press.

OECD. (2009). Competition and financial markets, key findings. Retrieved from https://www.oecd.org/daf/competition/43067294.pdf. 03 Aug 2022

Oldham, S., Fulcher, B., Parkes, L., Arnatkeviciūtė, A., Suo, C., & Fornito, A. (2019). Consistency and differences between centrality measures across distinct classes of networks. PLoS One, 14(7), e0220061.

Pan, R. K., & Sinha, S. (2007). Collective behavior of stock price movements in an emerging market. Physical Review E, 76(4), 046116.

Pharasi, H. K., Sharma, K., Chatterjee, R., Chakraborti, A., Leyvraz, F., & Seligman, T. H. (2018). Identifying long-term precursors of financial market crashes using correlation patterns. New Journal of Physics, 20(10), 103041.

Philip Kotler, P., Gary Armstrong, G., & Veronica Wong, V. (1996). Principles of marketing—European edition. Prentice Hall Europe.

Qu, J., Liu, Y., Tang, M., & Guan, S. (2022). Identification of the most influential stocks in financial networks. Chaos, Solitons & Fractals, 158, 111939.

Reddy, Y., & Sebastin, A. (2008). Interaction between forex and stock markets in India: An entropy approach. Vikalpa, 33(4), 27–46.

Richardson, M., & Domingos, P. (2002). Mining knowledge-sharing sites for viral marketing. In Proceedings of the eighth ACM SIGKDD international conference on knowledge discovery and data mining (pp. 61–70).

Rochat, Y. (2009). Closeness centrality extended to unconnected graphs: The harmonic centrality index. Tech. rep.

Rodrigues, F. A. (2019). Network centrality: an introduction. A mathematical modeling approach from nonlinear dynamics to complex systems (pp. 177–196). Springer.

Ross, S. M., Kelly, J. J., Sullivan, R. J., Perry, W. J., Mercer, D., Davis, R. M., Washburn, T. D., Sager, E. V., Boyce, J. B., & Bristow, V. L. (1996). Stochastic processes (Vol. 2). Wiley.

Rubinov, M., & Sporns, O. (2010). Complex network measures of brain connectivity: Uses and interpretations. Neuroimage, 52(3), 1059–1069.

Runge, J. (2018). Causal network reconstruction from time series: From theoretical assumptions to practical estimation. Chaos: An Interdisciplinary Journal of Nonlinear Science, 28(7), 075310.

Ryu, D., Ryu, D., & Yang, H. (2020). Investor sentiment, market competition, and financial crisis: Evidence from the Korean stock market. Emerging Markets Finance and Trade, 56(8), 1804–1816.

Saichaemchan, S., & Bhadola, P. (2021). Evolution, structure and dynamics of the Thai stock market: A network perspective. Journal of Physics: Conference Series., 1719, 012105.

Samal, A., Kumar, S., Yadav, Y., & Chakraborti, A. (2021). Network-centric indicators for fragility in global financial indices. Frontiers in Physics, 8, 624373.

Schreiber, T. (2000). Measuring information transfer. Physical Review Letters, 85(2), 461.

Segarra, S., & Ribeiro, A. (2015). Stability and continuity of centrality measures in weighted graphs. IEEE Transactions on Signal Processing, 64(3), 543–555.

Sharma, C., & Banerjee, K. (2015). A study of correlations in the stock market. Physica A: Statistical Mechanics and its Applications, 432, 321–330.

Sinha, S., & Pan, R. K. (2007). Uncovering the internal structure of the Indian financial market: Large cross-correlation behavior in the NSE. Econophysics of Markets and Business Networks (pp. 3–19). Springer.

Song, J., Feng, Z., & Qi, X. (2022). Spreading to localized targets in signed social networks. Frontiers in Physics, 9, 806259.

Upadhyay, S., Banerjee, A., & Panigrahi, P. K. (2020). Causal evolution of global crisis in financial networks. Physica A: Statistical Mechanics and its Applications, 554, 124690.

Wang, Z., Gao, X., Tang, R., Liu, X., Sun, Q., & Chen, Z. (2019). Identifying influential nodes based on fluctuation conduction network model. Physica A: Statistical Mechanics and its Applications, 514, 355–369.

Wu, T., Gao, X., An, S., & Liu, S. (2021). Time-varying pattern causality inference in global stock markets. International Review of Financial Analysis, 77, 101806.

Xu, S., Wang, P., Zhang, C. X., & Lü, J. J. (2018). Spectral learning algorithm reveals propagation capability of complex networks. IEEE Transactions on Cybernetics, 49(12), 4253–4261.

Yang, G., Benko, T. P., Cavaliere, M., Huang, J., & Perc, M. (2019). Identification of influential invaders in evolutionary populations. Scientific Reports, 9(1), 7305.

Acknowledgements

Author SU would like to acknowledge the financial support received under the project “Quantum information technologies with photonic devices (DST)” (Ref. No.: IISER-K/DoRD/R &P/2021-22/425) funded by QuEST, DST. Authors AS and IM would like to acknowledge the infrastructural and computational support provided by MAKAUT, WB during preparation of the manuscript.

Author information

Authors and Affiliations

Contributions

Authors AS and PKP conceptualized the idea upon discussion which was emphasized by authors SU and IM. Author AS designed the methodology. Author AS collected, systemically organised and analysed the data, visualised and interpreted the results with supervision from authors SU, IM and PKP. Author AS wrote the draft of the manuscript which was revised and edited by authors SU, IM and PKP.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic Supplementary Material

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sengupta, A., Upadhyay, S., Mukherjee, I. et al. A study of the effect of influential spreaders on the different sectors of Indian market and a few foreign markets: a complex networks perspective. J Comput Soc Sc (2023). https://doi.org/10.1007/s42001-023-00229-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42001-023-00229-4