Abstract

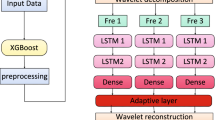

Stock market prediction is an interesting area of research where Technical Indicators (TI) play an important role. However, prediction of stock market movement is difficult due to the presence of noise and irregularities in the stock data. Data de-noising and decomposition techniques are apt to handle such noise. The data decomposition technique may lead to the generation of a large feature vector that needs to be handled carefully. Therefore, a suitable and effective feature engineering component must be included in the prediction model. To handle the above-mentioned issues, this paper proposes a stock market prediction model which offers a module for TI computation, feature engineering, and stock market prediction. A feature engineering component is proposed in which Discrete Wavelet Transform (DWT) is offered for data decomposition and Chicken Swarm Optimization (CSO) is offered to handle the large number of features generated through DWT. CSO is used to select the optimal feature subset. The proposed feature engineering component is named as DWT-CSO. The stock market trend prediction is performed by Machine Learning (ML) and Deep Learning (DL) models. The dataset of Indian (NIFTY50 and BSE) and US stock (S&P500 and DJI) indices is used for experimentation. The proposed DWT-CSO provided improved performance. The prediction models’ accuracy is increased by 19.59% (for S&P500), 18.33% (for DJI), 19.43% (for NIFTY50), 15.89% (for BSE). The performance of DWT-CSO is statistically analysed with Wilcoxon rank-sum test.

Similar content being viewed by others

References

Agarwal S, Muppalaneni NB (2022) Portfolio optimization in stocks using mean–variance optimization and the efficient frontier. Int J Inf Technol 14(6):2917–2926. doi: https://doi.org/10.1007/s41870-022-01052-2

Ayala J, García-Torres M, Noguera JLV, Gómez-Vela F, Divina F (2021) Technical analysis strategy optimization using a machine learning approach in stock market indices [formula presented]. Knowl-Based Syst 225:107119. https://doi.org/10.1016/j.knosys.2021.107119

Kumar R, Kumar P, Kumar Y (2022) Multi-step time series analysis and forecasting strategy using ARIMA and evolutionary algorithms. Int J Inf Technol 14(1):359–373. doi: https://doi.org/10.1007/s41870-021-00741-8

Thakkar A, Chaudhari K (2021) A comprehensive survey on portfolio optimization, stock price and trend prediction using particle swarm optimization, vol 28. Springer, Netherlands, pp. 4

Nayak SC, Sanjeev Kumar DC, Behera AK, Dehuri S (2020) Improving stock market prediction through linear combiners of predictive models BT. Computational Intell Data Min, 415–426

Diqi M, Hiswati ME, Nur AS (2022) StockGAN: robust stock price prediction using GAN algorithm. Int J Inf Technol 14(5):2309–2315. doi: https://doi.org/10.1007/s41870-022-00929-6

Liu X, Liu H, Guo Q, Zhang C (2020) Adaptive wavelet transform model for time series data prediction. Soft Comput 24(8):5877–5884. https://doi.org/10.1007/s00500-019-04400-w

Liang X, Ge Z, Sun L, He M, Chen H (2019) LSTM with wavelet transform based data preprocessing for stock price prediction. Math Probl Eng, 2019

Dastgerdi AK, Mercorelli P (2022) Investigating the effect of noise elimination on LSTM models for financial markets prediction using Kalman Filter and Wavelet Transform. WSEAS Trans Bus Econ 19:432–441

Liu K, Cheng J, Yi J (2022) Copper price forecasted by hybrid neural network with bayesian optimization and wavelet transform. Resour Policy 75, 102520, 10.1016/j.resourpol.2021.102520

Jarrah M, Salim N (2019) A recurrent neural network and a discrete wavelet transform to predict the saudi stock price trends. Int J Adv Comput Sci Appl 10(4):155–162. doi: https://doi.org/10.14569/ijacsa.2019.0100418

Van M, Kang H-J (2015) Two-stage feature selection for bearing fault diagnosis based on dual-tree complex wavelet transform and empirical mode decomposition. Proc Inst Mech Eng Part C J Mech Eng Sci 230(2):291–302. https://doi.org/10.1177/0954406215573976

Jović A, Brkić K, Bogunović N (2015) A review of feature selection methods with applications, in 2015 38th international convention on information and communication technology, electronics and microelectronics (MIPRO), pp. 1200–1205

Almomani O (2020) A feature selection model for network intrusion detection system based on PSO, GWO, FFA and GA algorithms. Symmetry (Basel) 12(6):1046

Deb S, Gao XZ, Tammi K, Kalita K, Mahanta P (2020) Recent studies on chicken swarm optimization algorithm: a review (2014–2018). Artif Intell Rev 53(3):1737–1765. https://doi.org/10.1007/s10462-019-09718-3

Meng X, Liu Y, Gao X, Zhang H (2014) A new bio-inspired algorithm: chicken swarm optimization. Lect Notes Comput Sci (Including Subser Lect Notes Artif Intell Lect Notes Bioinform) 8794:86–94. https://doi.org/10.1007/978-3-319-11857-4_10

Göçken M, Özçalici M, Boru A, Dosdoʇru AT (2016) Integrating metaheuristics and artificial neural networks for improved stock price prediction. Expert Syst Appl 44:320–331. https://doi.org/10.1016/j.eswa.2015.09.029

Kumar G, Jain S, Singh UP (2021) Stock market forecasting using computational intelligence: a survey, vol 28. Springer. Netherlands, pp. 3

Vuorenmaa T (2004) A multiresolution analysis of stock market volatility using wavelet methodology, Licent. Thesis, Univ. Helsinki, [Online]. Available: http://valotrading.com/assets/articles/multiresolution.pdf

Lahmiri S (2014) Wavelet low- and high-frequency components as features for predicting stock prices with backpropagation neural networks. J King Saud Univ - Comput Inf Sci 26(2):218–227. doi: https://doi.org/10.1016/j.jksuci.2013.12.001

Chandar SK, Sumathi M, Sivanandam SN (2016) Prediction of stock market price using hybrid of wavelet transform and artificial neural network. Indian J Sci Technol. https://doi.org/10.17485/ijst/2016/v9i8/87905

Jothimani D, Shankar R, Yadav SS (2016) Discrete wavelet transform-based prediction of stock index: a study on national stock exchange fifty index, arXiv Prepr. arXiv1605.07278

Qiu X, Suganthan PN, Amaratunga GAJ (2019) Fusion of multiple indicators with ensemble incremental learning techniques for stock price forecasting. J Bank Financ Technol 3(1):33–42. doi: https://doi.org/10.1007/s42786-018-00006-2

Tripathy N, Jaipuria S (2020) Forecasting stock market using discrete wavelet transforms forecasting stock market using discrete wavelet transforms and artificial neural networks model, no.November

Althelaya KA, Mohammed SA, El-Alfy ESM (2021) Combining deep learning and multiresolution analysis for stock market forecasting. IEEE Access 9:13099–13111. doi: https://doi.org/10.1109/ACCESS.2021.3051872

Chen S, Zhou C (2021) Stock prediction based on genetic algorithm feature selection and long short-term memory neural network. IEEE Access 9:9066–9072. https://doi.org/10.1109/ACCESS.2020.3047109

Wu D, Wang X, Wu S (2021) A hybrid method based on extreme learning machine and wavelet transform denoising for stock prediction. Entropy. https://doi.org/10.3390/e23040440

Syamala Rao P, Parthasaradhi Varma G, Durga Prasad C (2022) Financial time series forecasting using optimized multistage wavelet regression approach. Int J Inf Technol. doi: https://doi.org/10.1007/s41870-022-00924-x

Ji G, Yu J, Hu K, Xie J, Ji X (2022) An adaptive feature selection schema using improved technical indicators for predicting stock price movements. Expert Syst Appl 200:116941. doi: https://doi.org/10.1016/j.eswa.2022.116941

Yahoo Finance (2022) https://finance.yahoo.com/(Accessed 16 Nov 2022)

Chorafas DN (2005) Technical and fundamental analysis. In: The management of equity investments, pp. 131–155

Rath S, Samal P, Behera J (2020) Fundamental and technical analysis in future trading. Biot Res Today 2(4):60–63

Edwards RD, Magee J, Bassetti WHC (2018) Technical analysis of stock trends. CRC press

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Verma, S., Sahu, S.P. & Sahu, T.P. Discrete Wavelet Transform-based feature engineering for stock market prediction. Int. j. inf. tecnol. 15, 1179–1188 (2023). https://doi.org/10.1007/s41870-023-01157-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41870-023-01157-2