Abstract

Policies to support the deployment of renewable energy technologies have been widely established for power generation, heating, cooling, and transportation. However, as renewable energy technologies have become increasingly cost-competitive and more widely deployed, policymakers have begun to focus their attention on the adaption of existing policies to reflect the rapidly changing economics of these technologies and the impacts they have may have on the energy systems in which they are deployed. Optimal renewable energy policies moving forward must, therefore, be context specific and tailored to the unique political, economic and social circumstances of the regional, national or sub-national energy systems in which they are to be applied. The Gulf Cooperation Council (GCC) is a region where each member country has stated ambitions and targets for renewable energy but deployment to date has been minimal. Therefore, GCC ambitions must be translated into actions via defined policies and regulations that reflect regional context, and thus have the highest likelihood of achieving success. This paper investigates current trends in renewable energy policy with the aim of identifying those that will be the most effective and feasible to catalyze renewable energy in GCC countries. The findings show that utility-scale renewable energy auctions are a primary mode of stimulating renewable energy deployment internationally and this mechanism is optimally aligned with catalyzing renewable energy deployment in the GCC countries. However, further evolution of regionally tailored renewable energy policy will be required as auction mechanisms gain traction and renewable energy becomes increasingly prominent.

Similar content being viewed by others

Introduction and background

Renewable energy technologies are rapidly becoming a significant part of the global energy system. Policies to support renewable energy deployment have been widely established for power generation, heating, cooling, and transportation. The primary motivations for these policies have been climate change mitigation, energy security, energy system flexibility, energy system resiliency and economic development. In fact, by the end of 2015 renewable energy support policies had been implemented in more than 146 countries [1]. However, as renewable energy technologies have become increasingly cost-competitive and more widely deployed, policymakers have begun to focus their attention on the adaption of existing policies to reflect the rapidly changing economics of these technologies and the impacts they have may have on the energy systems in which they are deployed. Recent trends in renewable energy policy include integration of policy mechanisms, linkage between electricity, heating/cooling, and transport sector policies and the development of new mechanisms to integrate increasing amounts of renewable energy into energy systems. Importantly, however, appropriate renewable energy policies are context specific and, therefore, must be considered within the unique circumstances of the regional, national or sub-national energy systems in which they are to be applied.

The countries of the Gulf Cooperation Council (GCC) have each set targets for renewable energy deployment at the national or local level. To date, however, renewable energy deployment in the GCC has been minimal. Stated targets must, therefore, be supported by defined policies and regulations that reflect regional context, and thus have the highest likelihood of achieving stated ambitions. Although a body of literature does exist on the topic of renewable energy policy in the GCC [2,3,4,5,6], it generally does not seek to identify the optimal regional policy framework based on underlying motivations for regional energy system diversification and the most recent trends in global renewable energy policy. Hence, this paper reviews global trends in renewable energy policy and then specifically focuses on the application these trends to the GCC. The GCC context is reviewed with consideration of the rationale for regional renewable energy deployment, regional energy market structures and institutional capacity for renewables. The role that renewable energy is intended to play in defined regional energy strategies is assessed as well as supportive renewable energy targets and policy measures that are already in place. Sectors in the GCC where renewable energy deployment is most relevant are identified and the policies that afford the greatest opportunity for renewables in these sectors are proposed based on regional and global best practices. The findings show that utility-scale renewable energy auctions are a primary mode of stimulating renewable energy deployment internationally and this mechanism is optimally aligned with catalyzing renewable energy deployment in the GCC countries.

Discussion

While it is widely understood that energy policy is a cornerstone of renewable energy deployment, the policy frameworks most suitable to support renewable energy deployment differ based on context. Energy policy in general is concerned with political decisions for implementing programs that achieve energy related societal goals, including universal access to reliable and affordable energy sources that spur economic development. However, the specific formulation of regional, national or local energy policy must be tailored to context. For example, energy policy in the United States is aimed at ensuring the availability of secure, affordable and reliable energy while energy policy in the European Union specifically targets energy security, affordability and environmental sustainability [7]. The observed differences in energy policy objectives between the US, EU and other regions and countries are derived from contextual differences in the interrelated social, economic and political factors that shape policy formation. Hence, in the design of optimal policies to stimulate renewable energy deployment in the GCC, it is essential to first assess global renewable energy policy trends and then consider how these trends can be optimally tailored to meet underlying regional interests in the adoption of renewable energy.

Global renewable energy policy status and trends

The incorporation of increasing amounts of renewable energy into energy systems has have become a defining feature of the global energy landscape. Targets for renewable energy deployment have become widespread with 173 countries having adopted at least one type of renewable energy target by the end of 2015, which is more than four times the number in 2005 [1]. Furthermore, 146 countries have established renewable energy policies to support their targets and these policies are aimed at achieving context-specific outcomes that include climate change mitigation, energy access, energy security, public health and economic development. The cost-competitiveness of renewable energy, particularly renewable power, has been an additional stimulus for renewable energy deployment. Biomass for power, hydropower, geothermal, solar PV and onshore wind are now able to compete with fossil-fuel based power generation on purely a cost basis in many locations globally [8, 9]. Advances in the economics of solar and wind energy have been particularly impressive with the average cost of solar photovoltaic (PV) modules falling by nearly 80% between 2009 and 2014 and wind turbine average costs declining by nearly 33% over the same period [10]. Despite these dramatic cost reductions, the International Renewable Energy Agency (IRENA) forecasts that by 2025 utility-scale installed solar and wind costs may fall further with solar costs decreasing by an additional 57% and wind costs decreasing by an additional 12% (onshore) to 15% (offshore) relative to levels observed in 2015 [11].

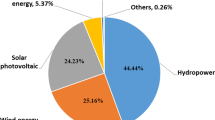

Although advances in all forms of renewable energy has been positive, renewable energy in the power sector has been most significant and has benefited from the fact that renewable energy policy has focused mainly on the power sector. By the end of 2015, 114 countries had adopted renewable energy policies for the power sector as opposed to 66 countries with transport sector policies and only 21 countries with heating and cooling policies [1]. Because of this policy orientation towards the power sector, support mechanisms for renewable power must adapt to changing market conditions to maintain a stable and attractive environment for renewable energy investments while at the same time ensuring a cost-effective and reliable energy system [12, 13]. The renewable energy support policies for consideration have been summarized elsewhere [14, 15] and fall under the broad themes of fiscal incentives, public financing and regulation. Fiscal incentives and public financing can support of any aspects of the research, development, demonstration and deployment lifecycle to achieve technology push and market pull for renewable energy technologies. Regulations focus on market support for renewable energy and can relate to quantity, quality, price or access for renewable energy [15, 16]. Generation focused regulatory policies are differentiated based on price determination and compensation schemes as shown in Table 1.

Although such classifications are convenient, there are many overlaps and variations in the implementation of each policy instrument [17]. For example, both FiTs and auctions in the form of tendersFootnote 1 are designed to provide electricity offtake and price certainty for project developers with the main difference being that payment rates for FiTs are predetermined by policymakers while competitive bidding sets the offtake price in auctions. Auctions reduce the chance that information asymmetry between policymakers and the private sector will lead to overcompensation for renewable energy projects, particularly during periods when technology costs are rapidly declining. Because the costs of FiTs are typically passed through to consumers via higher electricity prices or taxes, FiTs can quickly become unsustainable when set well above the cost-reflective price of fossil-based power generation. This issue with the FiT policy mechanism has been observed in several European countries [19]. Although auctions eliminate such issues, they can come with significant administrative costs and reduce the levels of small-scale generation and private sector engagement that FiTs have been effective at stimulating. Such considerations have made the debate on optimal policy for various contexts a topic of significant discussion [20].

FiT schemes originated in the United States and gained considerable traction in Europe from the early 1990s as an effective means of stimulating renewable energy deployment [16, 19]. However, the potential for market distortions and negative impacts on consumers from subsidies granted to renewable energy sources has led to a trend in renewable energy policy design away from standard FiTs and increasingly toward auctions [1]. The number of countries that have adopted renewable energy auctions increased from 6 in 2005 to at least 60 by early 2015 and auctions have been a major contributor to the nearly 80% reduction in contracted power purchase agreement (PPA) prices for utility-scale solar PV between 2010 and 2016 [21]. Because, however, auctions are most relevant to utility-scale projects, hybrid policy mechanisms are evolving that support deployment of renewables at multiple scales via new combinations and variations of traditional price, quantity and access-based policy mechanisms. Hybrid policies are aimed at addressing strategic interests such as supporting a diversity of renewable energy investors and project sizes, balancing markets where self-consumption of renewable energy has become less expensive than consuming electricity from the grid (i.e. “socket-parity” has been achieved) and integrating renewable electricity technologies into wholesale spot markets [17, 22, 23]. Furthermore, as the share of intermittent renewable energy achieves higher levels in electricity systems, policies are evolving to account for the full system level costs incurred by intermittent renewables as opposed to just levelized costs of electricity (LCOEs), which often are calculated without consideration of wider system impacts. System level assessments are geographically specific and bring an important understanding of the true lifecycle costs of intermittent renewable energy [24, 25]. In fact, system level considerations are leading to the convergence of electricity tariff and renewable energy policy design as the adoption of distributed renewables is increasingly impacting electricity system costs as well as the distribution of expenses among electricity market rate-payers [26].

Although not the particular focus of this paper, electricity tariff design is a key policy domain for renewable energy in the GCC because of its direct impact on the economic viability of distributed renewables. According to both the International Monetary Fund (IMF) and the International Energy Agency (IEA), GCC energy subsides for oil, natural gas and electricity in 2011 exceeded USD $100 billion with electricity subsidies alone reaching almost USD $30 billion in the same year [27]. However, the fiscal burden associated with such energy subsidies became unsustainable in GCC countries, resulting in a wave of reform measures since 2015 [28, 29]. These reforms will, over time, serve as key policy support for distributed renewables in the GCC. Furthermore, subsidy reforms that increase the price of natural gas and oil feedstocks provided to electricity and water utilities will serve to make renewable energy more cost competitive relative to fossil-fuel based power and water production [27].

The relative importance of these and other strategic and operational considerations is based on the specific regional, national or sub-national electricity market in which related policies are enacted. Hence, the most important matter in renewable energy policy for the GCC and globally is to deeply understand the context-specific rationale for renewable energy deployment and ensure that polices are designed and implemented accordingly. Historical review of renewable energy support polices in the European context has made clear that policies must be tailored to context if they are to have outcomes that are considered successful by the implementing government [16].

GCC energy system context

Increasing need for diversified sources of energy

GCC proved oil reserves are estimated at 493 billion barrels, representing 29% of the global total, and GCC proved natural gas reserves are estimated at 42 trillion cubic meters (Tcm), representing 22% of the global total [30]. Because of the GCC’s abundant hydrocarbon reserves, the regional energy mix is dominated by oil and natural gas in the power, industrial, transportation and buildings sectors. Qatar, Oman and the UAE use natural gas to meet more than 60% of their primary energy needs and almost 100% of their power needs [30]. In Bahrain, Saudi Arabia and particularly Kuwait, oil remains the primary means of meeting primary energy demand. In both Kuwait and Saudi Arabia, oil is burned for nearly 60 and 40% of power generation, respectively [31]. Domestic consumption of oil in the GCC has become problematic because consumption of oil products reduces the amount of oil available for export, creating a significant opportunity cost for oil exporting countries. Specifically, Saudi Arabia consumed more than a quarter its overall oil production in 2013 with direct burning of crude oil for power generation during the summer months (i.e. June through August) averaging more than 0.7 m b/d between 2009 and 2016 [32, 33]. Kuwait and Qatar each consumed approximately 16% of their oil consumption in 2014 and the UAE approximately 24% [32]. Unlike Kuwait and Saudi Arabia, however, UAE oil consumption was mainly in the transportation sector and not in the power sector, where crude burning for power averaged just less than 0.02 m b/d between 2013 and 2016 [33].

Although the GCC countries have substantial reserves of natural gas, much of the natural gas from non-associated reserves is geologically challenging to extract as it is either tightly bound or rich with hydrogen sulfide. This non-associated gas has estimated production costs of USD $3 to $9 per million Btu (MMBtu) as opposed to the less than USD $1 per MMBtu production costs of gas from associated reserves that is consumed domestically [34]. Hence, all GCC countries with the exception of Qatar are now faced with a shortage of cheap natural gas [35,36,37,38]. The reasons for the shortage include [35, 38]:

-

Rapid growth in demand for power;

-

High usage of gas reserves for enhanced oil recovery;

-

Heavy consumption of natural gas in the steel, aluminum and petrochemical industries that are core components of regional economies;

-

Technically challenging development of non-associated natural gas fields;

-

Subsidized natural gas prices that make the recovery of non-associated natural gas field development costs difficult for international oil companies; and

-

Long-term natural gas export commitments in countries such as the UAE and Oman.

Given these circumstances, the UAE, Kuwait, Bahrain and Oman have turned to LNG imports and Saudi Arabia is considering this as well [37, 39,40,41]. This is a clear sign that cost-effective, non-hydrocarbon energy sources are vitally needed in the region.

GCC electricity market structures

Until the 1990s, electricity systems globally were almost completely vertically integrated, regulated monopolies. Although this is still the case in much of Africa, by 2012 only 6% of the electricity consumed globally was produced within a monopoly context [42]. The trend, therefore, has been increased levels of competition and private sector integration. The most basic level of competition is the existence of independent power producers (IPPs) alongside a vertically integrated utility. This is in fact the dominant model today in Middle East and North Africa (MENA) region [43] although there are locations (e.g. Abu Dhabi in the UAE) where a state-owned holding company has subsidiaries that separately operate the different activities within the power sector value chain [4, 44]. The IPP model is one of competition-for-markets where potential investors compete against each other in an auction process and competition ends with a contract award and off-take governed by long-term PPAs. Although all GCC countries have initiated electricity sector reforms that could ultimately result in fully competitive electricity markets, this is not a near-term trajectory for GCC countries. The pathway toward electricity sector liberalization is well established [45, 46] and to date only Oman, Saudi Arabia and the UAE (Abu Dhabi and Dubai) have made significant strides by establishing independent electricity sector regulators and unbundling of their electricity sectors [30, 43]. Even in these cases, the regulatory authorities established are generally lacking true independence from the government and unbundling of electricity sector assets is on a legal rather than ownership basis. Hence, in the coming years the IPP model with centralized coordination is anticipated to be an anchor for new power sector policies throughout the GCC, particularly while rapid electricity demand growth and reform of subsidies for both power plant fuels (i.e., oil products and natural gas) and consumer electricity prices are addressed.

GCC motivations, plans and policies for renewable energy

There have been several comprehensive reports on the opportunities for renewable energy in the Middle East and North Africa (MENA) region [47, 48] as well as focused reports just on the GCC [30]. Renewable energy in the GCC has additionally been an ongoing topic of academic interest with many authors considering policies that could stimulate renewables adoption [3, 41, 49,50,51,52,53,54] and further developing economic top-down and technological bottom-up models to simulate policy impacts [55,56,57,58,59]. These studies show that while the current deployment of renewable energy in the GCC is very minimal, the opportunity is large, particularly for solar energy. While the social, economic, political and energy demand contexts of the GCC are generally positive for attracting investment for renewables, subsidized energy costs are a major barrier to distributed renewable energy while utility-scale deployments are hindered by legacy reliance on fossil-energy based generation and lack of consideration for the opportunity costs of using fossil fuels to meet domestic energy demand.

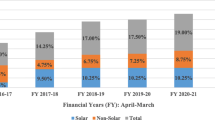

GCC countries have largely followed the global trend of prioritizing the power sector in their renewable energy targets (Table 2). Regional targets for electricity generation from renewable energy range from no defined target in Oman to 25% in Dubai by 2030. Although the UAE has a very ambitious national target for clean energy, the deliverable date of 2050 is rather far in the future.

As would be expected based on regional renewable energy resources, capacity targets primarily relate to solar and wind energy technologies given the excellent regional potential for these resources [60, 61]. Although renewable energy for the GCC power sector has promise, renewable energy is currently expected to play a very minimal role in industry and transportation based on current regional strategies and policies. IRENA’s REMap 2030 assessment includes renewable energy opportunities in the UAE, Kuwait and Saudi Arabia [62] and shows that the transportation sector is unlikely to have any significant contribution from renewable energy by 2030.Footnote 2 This result is consistent across the GCC as reflected by the national and sub-national policy targets shown in Table 2 as well as IRENA’s region and national GCC renewable energy assessments [30, 63]. While renewable fuels for transportation are unlikely in the GCC, at least in the near term, solar thermal energy for industrial process heat, may be viable. However, the exploitation of solar energy for process heat is not yet evident in the GCC. Solar heating in the near term is likely more viable for solar hot water in the GCC buildings sector.

While it is clear that GCC countries have ambitions for adoption of renewable energy in their power sectors, a more structured approach is needed for supporting policy development. As seen in Table 3, with the exception of the UAE, and in particular Dubai at the sub-national level, supporting policy frameworks for renewable energy deployment are almost entirely absent in GCC countries. The UAE particularly stands out among GCC countries with Dubai’s implementation of a net metering policy for distributed renewables [55].

Across the GCC, lack of a structured approach to policy formation is an often cited as a key hindrance to wider adoption of renewable energy support policies [6, 64]. As shown in Fig. 1, best practice would be to translate the GCC political visions for renewables into concrete energy strategies and scenarios that are operationalized through roadmaps and actions plans that ultimately are implemented via appropriate policy tools [48, 65]. A key early step in this approach is to identify the underlying social, political and/or economic motivations for regional renewable energy deployment.

The potential motivations for renewables in region include reduction in energy-related greenhouse gas emissions (and environment protection more widely), energy security, energy service cost minimization (for both business and residential consumers), and energy service accessibility [66]. Within the GCC context, the evidence suggests that the previously discussed need for diversified sources of energy to support energy security and energy cost minimization are driving forces for renewable energy. Access to electricity is not an issue as electrification is greater than 97% in all GCC countries [67]. Climate concerns do not seem to be at the core of regional energy agendas given the lack of commitment from GCC countries to lowering greenhouse gas (GHG) emissions as part of Intended Nationally Determined Contributions (INDCs) related to the COP21 Paris Agreement [68] (Table 4). Only Oman made a GHG reduction commitment and it is both small (2% relative to business as usual projections for 2030) and conditional.

Arguments have been made that a driving force for a regional transition to clean energy is job creation and economic development [30, 69]. However, the arguments are not compelling as the studies referenced rely on renewable energy deployment targets yet to be backed by concrete strategies, roadmaps, policies and regulations. For instance, IRENA’s clean energy job creation projections for the GCC were made prior to Saudi Arabia’s scaling back of its renewable energy target from 54 GW by 2032 to 9.5 GW by 2023 [41, 70]. Because 39% of the IRENA employment projections are based on employment in Saudi Arabia, the job creation projections seem highly optimistic even though Saudi Arabia does remain committed to job creation from renewable energy local content as part of the Saudi Vision 2030 [71]. Saudi Arabia’s National Transformation Program (NTP), which is the blueprint for the Saudi Vision 2030, specifies a 2020 target of 7,774 jobs to be created in nuclear and renewable energy by 2030 [72] but the expectation for jobs created specifically in renewable energy is not certain. GCC clean energy targets to date have generally lacked sufficient substance and stability to assume that the clean energy sector will be central to regional economic diversification strategies. It is also unclear whether the installation, operation and maintenance jobs that are a significant contributor to renewable energy employment multipliers are desirable for GCC countries that need high paying, knowledge focused jobs for their citizens.

Renewable energy policies tailored to the GCC

Competitive renewable energy auctions

Based on the information presented, a driving force for renewable energy adoption in the GCC is enhanced energy security at lowest cost in the power sector. That is, there is no clearly identifiable incentive for GCC countries to provide financial support for renewable energy technologies that are not cost competitive with fossil energy technologies. Furthermore, although renewable energy in the transportation and industrial sectors is an important consideration, there is currently no prioritization for these sectors by GCC countries. Hence, strategies and action plans that articulate appropriate targets for renewable energy adoption in industry and transportation are needed prior to consideration of specific policies for these sectors.

The policy framework most relevant to low cost renewable power, particularly at utility-scale, is auctioning [73,74,75]. In a renewable energy auction, the government issues a call for bids to procure a certain capacity of renewables-based electricity. Project developers who participate in the auction typically submit a bid with a price per unit of electricity at which they are able to deliver the project. The auctioning entity evaluates the offers on the basis of the bid price and other criteria and eventually signs a power purchase agreement with the successful bidder. Auctions differ from FiT schemes in that only selected project developers benefit from the support tariff and the tariff level is based on the prices indicated by the project developers in their bids during the auction process. Auctions can be of several forms [18, 73]:

-

First-price sealed-bid auction project developers submit sealed bids, and the awarded bidder pays the bid price. The auction aims for allocation of a single project to a single developer.

-

Pay-as-bid sealed-bid auction project developers submit sealed bids, and the awarded bidders pay different prices for their awarded projects under the total allocated auction volume.

-

Second-price sealed-bid auction project developers submit sealed bids, and the awarded bidder pays the highest losing bid price.

-

Descending-bid (or clock) auction starting from a high price, the auctioneer proposes a slightly lower price in every new bidding round and the participants make their offers, in terms of quantities they are willing to provide at the given price. The process continues until the quantity to be auctioned is reached at the lowest possible cost. Participants know each other’s bids and can adjust accordingly as multiple bidding rounds proceed.

-

Hybrid auction a two-phase auction in which the first phase operates as a descending clock auction, followed by the second phase operating as a pay-as-bid, sealed-bid auction.

The increasing interest in auction schemes globally is driven by their ability to achieve deployment of large-scale renewable electricity projects in a structured, cost-efficient and generally transparent manner. Record low PPAs for utility-scale solar PV have been realized via auctions in Mexico, Chile, Dubai (UAE) and most recently Abu Dhabi (UAE) with bids in each case coming in below USD $0.03 per kWh [76]. Other key strengths of auctions beyond achieving low costs are the following [74]:

-

Design flexibility to suit a variety of contexts;

-

Control over both the price and quantity of renewable energy delivered; and

-

Accountability for the commitments and liabilities between the involved parties via appropriately structured legal contracts.

Here it is important to note, however, that PPAs and LCOEs are not the same. PPAs are based on LCOEs relevant to the time of project delivery and include consideration of required investor returns as well as other parameters that may or may not be relevant to different auctions [77]. Hence, the favorable impact of auctions on recent PPA prices is not certain to be directly attributable to falling technology and project costs. In fact, auctions run the risk of attracting unrealistically low PPA bids. When considered holistically, auction drawbacks include failed project delivery if awarded bidders end up unable to meet their delivery obligations due to overly aggressive bidding, limited private sector and consumer engagement and relatively high administrative and transaction costs [75, 78].

Despite the inherent potential drawbacks in auction mechanisms, they remain a favored policy instrument due to the substantial amount of experience in auction design and implementation that has accrued from the numerous auctions conducted internationally [73, 74, 78,79,80]. A study of 20 renewable energy auctions in India and elsewhere globally found that auctions are almost always cost effective, with savings of up to 58% from determined baseline electricity tariffs [79]. Although only 17% of the auctions studied achieved greater than 75% of targeted deployment, the reasons identified for lack of implementation are very controllable with proper auction design. These reasons include tariff determination methodology, lack of performance-related penalties, insufficient payment security mechanisms (when off-taker risk was high), as well as lack of support policies for necessary permits and grid connection [73, 79]. Aggressive underbidding was not indicated as a key contributor to lack of implementation even though this is one of the most important risks to consider, particularly given the trend in rapidly falling PPAs. As shown in Fig. 2, utility-scale solar PV PPA prices fell precipitously between 2015 and mid 2016 with particular deviations from trend noted in Mexico and the UAE. In fact, the lowest PPAs for solar PV fell below those observed in the wind sector, which was a major new development given the substantially lower cost for wind energy until the end of 2015.

International PPA prices for utility-scale solar PV and onshore wind projects through early 2016 (Data from [81])

Within the UAE and broader MENA context, it is auctioning that has driven down the cost of renewable energy to the point that it is now cost competitive with hydrocarbon-based electricity generation. In fact, auctions are now the mechanism generally seen as most viable for spurring further solar energy adoption in the GCC [2, 4, 82]. Morocco and Dubai in the UAE have recently completed auctions that serve as case studies for regional implementation. These two countries are particularly relevant since Morocco has been ranked as having the best frameworks in place for renewable energy deployment across MENA [5, 83] and the UAE has achieved the same distinction within the GCC context [5, 6]. In both Morocco and Dubai, auctions have been conducted in the technology-specific, first-price sealed-bid format. Case studies for the Morocco and the UAE experiences provide useful insights regarding regionally relevant approaches to renewable energy auctions.

Morocco renewable energy auction case study

Morocco’s success in renewable energy auctions demonstrates the importance of institutions and coordination among key energy sector stakeholders. In Morocco these stakeholders include the Ministry of Energy, Mining, Water, and Environment (MEMEE), the Moroccan Agency for Solar Energy (MASEN) and the National Electricity Office (ONE) [73]. MEMEE has overall accountability for achieving Morocco’s ambitious renewable energy targets and implementing auctions, MASEN is the executive body in charge of solar auctions and ONE is in charge of wind and hydrocarbon auctions. Morocco’s auctions have both pre-qualification and evaluation phases. In the pre-qualification phase, the financial and technical capacity of each bidder is considered and short list of bidders is generated from this assessment. In the evaluation phase, winning bidders are selected from the shortlist according to rigorous assessment of technical specifications, the financial bid (including both financing and the proposed PPA) and local economic development contribution, which for recent projects was a 30% local content requirement based on plant capital cost. The auctions have been technology specific with wind projects receiving tariff commitments of 20 years and solar projects receiving 25 year commitments. Compliance has also been strict with penalties for delay and underperformance designated in the PPA agreements. Assessment of Morocco’s 160 MW Ouarzazate Noor 1 CSP Parabolic Trough project has shown that the auction for the project was successful with 200 bidders engaging and a final awarded PPA of USD $0.189 per kWh, which was 25% lower than the price that had been projected by MASEN and the lowest CSP tariff ever achieved at the time of the award in 2012 [84]. The auction success is attributed to policy and financial de-risking, achieved through:

-

Clear policy commitment of the Moroccan government to develop solar energy;

-

Strong domestic institutional capacity to transform commitment into concrete projects; and

-

Strong commitment of development finance institutions to provide concessional financing of USD $450 M.

Of further importance is the fact that MASEN is not only the electricity off-taker for the company resulting from the award, ACWA Power Ouarzazate, but is also part owner in the project company. Furthermore, the Ouarzazate project site has an established solar resource profile and all of the necessary grid connections at the site were ensured by the government. With the Moroccan government bringing such assurances, the next phases of the 500 MW Ouarzazate CSP project brought further success with strong developer interest and the Noor 2 CSP and Noor 3 CSP projects achieving continued PPA reductions. The awarded Noor 2 PPA was USD $0.1567 per kWh and the awarded Noor 3 PPA was USD $0.1541 per kWh [85]. Although initially focused on CSP, MASEN has also launched a dedicated IPP-based PV program called Noor IV. The first phase of this program was awarded at a tariff of approximately USD $0.048 per kWh [86], again demonstrating the value of Morocco’s approach to solar IPPs for driving low-cost renewable energy deployment.

UAE Renewable Energy Auction Case Study

While Morocco has until recently pursued CSP auctions, Dubai established early leadership in utility-scale solar PV auctions. In March 2015, the PPA was signed for Dubai’s first renewable energy IPP at the Mohammad bin Rashid Al Maktoum (MBR) Solar Park [87]. The 25-year PPA for 200 MW of auctioned solar PV was signed for the second phase of the solar park development at a record low price of USD $0.0584 per kWh with electricity offtake scheduled to start in 2017. Similar to Morocco, the Dubai Water and Electricity Authority (DEWA) has pursued a model of taking part ownership (51%) in the project consortium that won the bid and will also be the electricity off-taker from a government-established site. The auction for the second phase of the MBR Solar Park was followed by a similar auction for the third phase of the park in 2016 and resulted in the lowest ever bid for solar PV of USD $0.0299 per kWh [88]. Although this is a seemingly positive development, the nearly 50% reduction in tariff bids between 2015 and 2016 (refer to Fig. 2) brought into question whether bidding reflects true market fundamentals given that PV hardware costs had fallen only a fraction of this amount in the same time period [89]. Further assessment of the auction results, however, shows that the second and third lowest bids of USD $0.0369 per kWh and USD $0.0396 per kWh were also lower than all prior bids globally in solar PV auctions. Based on this result, Dubai clearly had implemented an environment and auction approach conducive to extremely low cost renewable energy PPAs.

The establishment of the MBR Solar Park is one very important factor for the results in Dubai because this designated government location ensures well known solar resources as well as necessary grid connections. Both factors, coupled with the credibility of DEWA as a stable electricity off-taker, support access to low-cost financing. Furthermore, the Dubai auctions have been for massive projects with the third phase auction targeting a mandatory 200 MW capacity to be commissioned in 2018 and two optional 300 MW tranches for delivery 2019 and 2020. The scale of these projects allows for substantial economies of scale when auction bids are developed. Similar to the auctions conducted in Morocco, Dubai has leveraged multiple qualification phases to ensure that only the strongest consortia are selected. In the MBR phase three auction, 97 consortia submitted an expression of interest (EOI) to participate in the tender but only about 40 were invited to submit a request to prequalify. Of these 40 consortia, 24 responded and 14 consortia were finally prequalified and invited to submit bids. Because of the very stringent DEWA auction requirements and the high cost associated with submitting a bid, only 5 consortia ended up submitting proposals. The lowest bid submitted was from a consortium consisting of Masdar, an Abu Dhabi owned company, and Spanish developer FRV, previously acquired by Saudi Arabia’s Abdul Latif Jameel (ALJ) group in 2015.

Even though it is clear that the Dubai approach to renewable energy auctions provides a framework for very low PPAs, there was still a question about how the Masdar consortia managed to outbid the others by 19%. Interviews conducted with those in the solar industry that are very familiar with the terms of the PPA awarded by Dubai in 2015 indicate that the price of USD $0.0584 per kWh was only achieved by extremely attractive financing terms offered by UAE banks with debt financing at 86% of the total project value with an interest rate near 4% and a 27 year tenor. Such attractive financing was complimented by minimal, if any, costs for land and grid connections and forward projections on improved technology performance from First Solar thin-film panels to be deployed for the project in 2017. In order for the Masdar consortium to achieve its 2016 bid price, there were clearly financing terms and other factors not readily replicated elsewhere, leaving in doubt whether the auction approach and outcome would be sustainable. The doubts have been short-lived, however, as further utility-scale solar PV auctions in both Dubai and Abu Dhabi have resulted in PPAs of less than USD $0.03 per kWh.

It is also now apparent that the PPAs being achieved in the UAE for utility-scaled solar PV plants that will be operational in 2018 and beyond may not be a result of significant subsidization or overly aggressive bidding. The unsubsidized LCOE for utility-scaled solar energy in 2016 in favorable geographies is falling between USD $0.046 per kWh and USD $0.061 per kWh [90], suggesting that LCOEs near or below USD $0.03 per kWh can be realistically achieved prior to 2020 in optimal locations where access to low-cost project financing is possible. As noted earlier, however, such LCOE figures are on a project basis only and will not represent the total cost of intermittent energy supply at very high levels of deployment. Policy makers much, therefore, additionally consider system balancing costs as an increasing share of intermittent renewable energy is incorporated into the power system.

In line with such considerations, the next utility-scale solar PV tender coming from Dubai will be for 200 MW of concentrated solar power (CSP) with 12 h of thermal energy storage to be operational by 2021. DEWA has announced an expected PPA for this project of approximately USD $0.08 per kWh [91]. While this PPA target is substantially lower than the USD $0.119 per kWh to USD $0.182 per kWh range seen in 2016 for CSP with storageFootnote 3 [90], it is much higher than the recent utility-scale solar PV PPAs. The reason for DEWA committing to this more expensive technology is that the energy storage provided will be essential to achieving the system level balancing that will be necessary for intermittent solar PV to play a major role in the Dubai’s plan is to have renewables providing 25% of its electricity by 2030 and 75% by 2050 [88]. Prior studies have indicated the economic value of CSP with thermal energy storage in UAE and North African electricity systems when substantial amounts of renewable energy [56, 92, 93]. However, the definition of “substantial” is context dependent as supply and demand strategies can be implemented to support substantial deployment of intermittent renewables, including storage, curtailment, geographic dispersion and load shaping [94]. The key policy message then from the Dubai CSP initiative is that the relevant cost of solar for locations in which renewable energy deployment will be substantial is not individual project PPAs but rather overall system costs. This reinforces the essential need for strategic and operational planning that allows policymakers to truly understand the long-term implications of their policy decisions.

Net Metering for distributed renewables

Although perhaps of more limited near term relevance in the GCC, feed-in-tariffs (FiTs) and net metering policies to support distributed renewables are relevant where electricity pricing is supportive. As already stated, renewable energy auctions can be very limiting with regard to private sector engagement as small firms tend to be left out. For this reason, hybrid policies that include both FiTs and auctions have been implemented in locations where both small and large renewable energy projects are desired [17]. The emirate of Dubai has implemented a net metering policy [95] and so stands out as one of the few GCC markets where distributed solar power will likely see significant deployment in the coming years as electricity tariffs are sufficiently high, ranging from USD $0.08 to USD $0.12 per kWh depending on consumer type (i.e. residential, commercial or industrial) and level of consumption [96, 97]. The higher electricity prices found in Dubai, which are similar in all other UAE emirates except for Abu Dhabi, are for consumption levels particularly relevant to commercial and industrial consumers and so these are the sectors where the economics of net metering will have near term viability [55]. Dubai’s approach to net metering allows each consumer that installs solar PV to install generation capacity up to the level of the consumer’s approved total load. Although there is a limitation on generation capacity, there is no limit to the amount of generated power. This means that a consumer can generate more electricity than consumed and the surplus energy is carried forward as credit to the following bill and there are no time or quantity restrictions imposed.

Dubai’s solar PV net metering policy, coupled with cost-reflective electricity tariffs already in place, is anticipated to stimulate up to 1.5 GW of rooftop solar by 2030 and play a key role in the emirate’s plan to have renewable energy generate 25% of its electricity by 2030 and 75% by 2050. As GCC countries continue to implement energy subsidy reforms and the cost of distributed renewable energy continues to fall, GCC markets other than Dubai may find net metering an attractive option for a lower transaction cost approach to renewables deployment with the additional benefit of wider private sector engagement. It is unclear, however, when electricity prices in GCC countries outside the UAE will be sufficiently high to make net metering attractive, particularly in the residential sector. Electricity prices across the GCC remain very low by international standards even following a substantial number of reforms that have been implemented since late 2014 [37]. Although the cost of distributed PV is highly specific the location in which the system is installed, benchmark pricing data from locations outside of the GCC suggests that supportive electricity prices must be on the order of USD $0.09 per kWh for commercial and industrial scale systems and USD $0.14 per kWh for residential systems [90]. This is generally consistent with prior work done on distributed PV in the Dubai context [55].

Solar thermal in the buildings sector

Surprisingly, no GCC country has a national solar water heating target despite the excellent regional solar resources. Solar water heating (SWH) requires particular consideration since it receives much less attention than solar power but is in fact a very low cost and effective means of improving energy performance in the buildings sector. In Dubai, installation of solar water heaters is required in all new villas and labor accommodations to provide 75% of domestic hot water requirements [56, 98]. Given the cost effectiveness of SWH, implementation of such SWH policy and regulation would be sensible throughout the GCC in the very near term.

Conclusions and policy insights

Renewable energy policy design continues to evolve and adapt to the rapidly falling costs of renewable energy technologies and lessons learned from government support mechanisms already implemented. Governments are no longer focused primarily on bridging a cost gap between renewables and fossil-based energy production. Rather, the major trend in renewable energy policy design is support for sustainable integration of cost effective renewables into energy systems at minimal burden to government finances. This trend is most relevant to the power sector where renewable energy technologies, such as solar and wind, are becoming economically viable in multiple geographies at a rapid pace.

Within the GCC, interest in renewable energy is strong as countries increasingly see the need to diversify their energy systems to address the unclear outlook for access to low cost hydrocarbon resources. Consistent with international trends, the main focus of GCC countries regarding energy system diversification has been the power sector. To date, however, most GCC countries have only announced renewable energy targets rather than implementing concrete policies and regulations to spur adoption of renewables. To address the gap between political ambition and action, clear strategies and action plans are needed to guide the development of appropriate policies and regulations. In the near term, however, GCC countries are already very well positioned to adopt the global trend of implementing renewable energy auctions to secure low-cost, clean energy supply in the power sector. The IPP model that is employed across GCC electricity markets can be adapted to renewable energy procurement and successful MENA examples already exist in Dubai and Morocco. The progress in these two locations derives from strong government support in the form of government provided renewable energy project sites, security of electricity offtake and certainty in attaining required permits and grid connections. These combined factors have attracted significant developer interest and supported access to very low cost project financing. It is important to consider, however, that there are limitations to the renewable energy auctions implemented in Dubai and Morocco. Specifically, competitive tendering for large utility-scale projects is an inherently lengthy process and the substantial size of the projects awarded to individual bidders limits overall private sector engagement. Furthermore, while significant government involvement has been instrumental to the success of the projects, the extent of government involvement to achieve record low PPAs, particularly in the UAE, remains unclear. Improved transparency will be essential in achieving long-term sustainability for auctioning as a policy support mechanism.

If GCC countries are able to accelerate and sustain deployment of renewable energy using utility-scale renewable energy auctions, the overall sector may see increased participation and diversification in the future. Distributed renewable for power generation is one such opportunity. In the GCC, distributed renewables for power, mainly in the form of rooftop solar PV, will be increasingly viable as electricity pricing reforms occur and the necessary policies and regulations, such as technical standards for grid connection, are implemented. Net metering already implemented in Dubai provides a good regional example of how distributed renewables can be implemented at low cost to the government and support a broader private sector engagement than is possible with very large utility-scale solar auctions. Importantly, SWH in buildings is already an economically viable regional form of distributed renewable energy and so all GCC countries should work to implement the necessary policies and regulations to achieve widespread SWH deployment. Dubai again provides a positive example for relevant regulations on this topic.

A final but very important consideration for GCC countries as they move ahead with renewable energy is to ensure electricity system reliability as intermittent renewable energy sources, particularly solar PV, are deployed to significant scale. At the present time, the UAE is the only GCC location where ambitions for solar energy deployment are sufficiently high that electricity system planning for high levels of PV is clearly required. Dubai’s plan to auction CSP with energy storage at an anticipated cost that is significantly higher than what has been seen for recent utility-scale solar PV auctions demonstrates that solar PPAs alone are not the most important consideration for renewable energy policymakers. Rather, ensuring adequate system balancing capacity, whether from generation, storage or demand management, must be considered as well. Others in the GCC can look to Dubai as an example of how this may be accomplished as their ambitions for renewable energy deployment grow.

In summary, the key message from this work to policymakers is that the GCC has an excellent opportunity now to capitalize on global trends in renewable energy policy design for acceleration of renewable energy deployment. Specifically, the region is well positioned for advancement in utility-scale renewable energy auctions via the first-price sealed-bid auction format that has shown success already. It must be noted, however, that while this general auction design is contextually appropriate, tailoring can still be done to ensure transparency, effectiveness and minimal administrative burdens for participation. Optimizing the overall approach to address these factors will be a critical consideration to ensuring the sustainability of this policy mechanism. Just as importantly, policymakers must consider system level costs and impacts from renewable energy deployment as the scale and scope of renewable energy expands across the GCC.

Notes

The terms auction and public tendering or competitive tendering are used interchangeably. In this paper, the scheme is referred to as an auction.

Among the GCC countries, only Qatar has a target for transportation at the national level.

It must be noted, however, that in early 2017 a record low bid of USD $0.063 per kWh was recorded in a power auction in Chile for the provision of dispatchable 24-h solar energy.

References

REN21: Renewables 2016 Global Status Report. REN21 Secretariat, Paris (2016)

Atalay, Y., Kalfagianni, A., Pattberg, P.: Renewable energy support mechanisms in the Gulf Cooperation Council states: analyzing the feasibility of feed-in tariffs and auction mechanisms. Renew. Sustain. Energy Rev. 72, 723–733 (2017). doi:10.1016/j.rser.2017.01.103

Abdmouleh, Z., Alammari, R.A.M., Gastli, A.: Recommendations on renewable energy policies for the GCC countries. Renew. Sustain. Energy Rev. 50, 1181–1191 (2015). doi:10.1016/j.rser.2015.05.057

Poudineh, R., Sen, A., Fattouh, B.: Advancing Renewable Energy in Resource-Rich Economies of the MENA. Oxford Institute for Energy Studies, Oxford (2016)

RCREEE: Arab Future Energy Index 2016: Renewable Energy. Regional Center for Renewable Energy and Energy Efficiency (RCREEE), Cairo (2016)

Mondal, M.A.H., Hawila, D., Kennedy, S., Mezher, T.: The GCC countries RE-readiness: strengths and gaps for development of renewable energy technologies. Renew. Sustain. Energy Rev. 54, 1114–1128 (2016). doi:10.1016/j.rser.2015.10.098

Hoppe, T., Coenen, F., van den Berg, M.: Illustrating the use of concepts from the discipline of policy studies in energy research: an explorative literature review. Energy Res. Soc. Sci. 21, 12–32 (2016). doi:10.1016/j.erss.2016.06.006

IRENA: Renewable Power Generation Costs in 2014. International Renewable Energy Agency (IRENA), Abu Dhabi (2015)

Lazard: Lazard Levelized Cost of Energy Analysis 9.0. Lazard, Hamilton (2015)

IRENA: REthinking Energy: Renewable Energy and Climate Change. International Renewable Energy Agency (IRENA), Abu Dhabi (2015)

IRENA: The Power to Change: Solar and Wind Cost Reduction Potential to 2025. International Renewable Energy Agency (IRENA), Abu Dhabi (2016)

IEA-RETD: Re transition—Transitioning to Policy Frameworks for Cost-Competitive Renewables. IEA Technology Collaboration Programme for Renewable Energy Technology Deployment (IEA-RETD), Utrecht (2016)

IRENA: Adapting renewable energy policies to dynamic market conditions. International Renewable Energy Agency (IRENA), Abu Dhabi (2014)

Abdmouleh, Z., Alammari, R.A.M., Gastli, A.: Review of policies encouraging renewable energy integration & best practices. Renew. Sustain. Energy Rev. 45, 249–262 (2015). doi:10.1016/j.rser.2015.01.035

IRENA: Evaluating Policies in Support of the Deployment of Renewable Power. International Renewable Energy Agency (IRENA), Abu Dhabi (2012)

Haas, R., Panzer, C., Resch, G., Ragwitz, M., Reece, G., Held, A.: A historical review of promotion strategies for electricity from renewable energy sources in EU countries. Renew. Sustain. Energy Rev. 15(2), 1003–1034 (2011). doi:10.1016/j.rser.2010.11.015

Couture, T.D., Jacobs, D., Rickerson, W., Healey, V.: The Next Generation of Renewable Electricity Policy, vol. NREL/TP-7A40-63149. National Renewable Energy Laboratory (NREL), Golden (2015)

Kylili, A., Fokaides, P.A.: Competitive auction mechanisms for the promotion renewable energy technologies: the case of the 50 MW photovoltaics projects in Cyprus. Renew. Sustain. Energy Rev. 42, 226–233 (2015). doi:10.1016/j.rser.2014.10.022

Pyrgou, A., Kylili, A., Fokaides, P.A.: The future of the Feed-in Tariff (FiT) scheme in Europe: the case of photovoltaics. Energy Policy 95, 94–102 (2016). doi:10.1016/j.enpol.2016.04.048

Becker, B., Fischer, D.: Promoting renewable electricity generation in emerging economies. Energy Policy 56, 446–455 (2013). doi:10.1016/j.enpol.2013.01.004

IRENA: Renewable Energy Auctions: Analysing 2016. International Renewable Energy Agency (IRENA), Abu Dhabi (2017)

Onifade, T.T.: Hybrid renewable energy support policy in the power sector: the contracts for difference and capacity market case study. Energy Policy 95, 390–401 (2016). doi:10.1016/j.enpol.2016.05.020

Elshurafa, A.M., Matar, W.: Adding Photovoltaics to the Saudi Power System: What are the Costs of Intermittency? vol. KS-1660-DP54A. The King Abdullah Petroleum Studies and Research Center (KAPSARC), Riyadh (2016)

Khatib, H., Difiglio, C.: Economics of nuclear and renewables. Energy Policy (2016). doi:10.1016/j.enpol.2016.04.013

Hirth, L.: The market value of variable renewables. The effect of solar wind power variability on their relative price. Energy Econ 38, 218–236 (2013). doi:10.1016/j.eneco.2013.02.004

Sioshansi, R.: Retail electricity tariff and mechanism design to incentivize distributed renewable generation. Energy Policy 95, 498–508 (2016). doi:10.1016/j.enpol.2015.12.041

Charles, C., Moerenhout, T., Bridle, R.: The Context of Fossil-Fuel Subsidies in the GCC Region and Their Impact on Renewable Energy Development. The International Institute for Sustainable Development, Winnipeg (2014)

Verme, P.: Subsidy Reforms in the Middle East and North Africa Region: A Review, vol. WPS7754. World Bank Group, Washington, DC (2016)

Fattouh, B., Sen, A., Moerenhout, T.: Striking the Right Balance? GCC Energy Pricing Reforms in a Low Price Environment. Oxford Institute for Energy Studies, Oxford (2016)

IRENA: Renewable Energy Market Analysis: The GCC Region. International Renewable Energy Agency (IRENA), Abu Dhabi (2016)

APICORP Energy Research: MENA power investment: finance and reform challenges. APICORP Energy Research, Al Khobar (2016)

Krane, J.: Reversing the trend in domestic energy consumption in the GCC: Consequences of success and failure?. The Abdullah Bin Hamad Al-Attiyah Foundation for Energy & Sustainable Development, Qatar (2015)

MEES: Gulf Crude Burn: Saudi Arabia Leads Fall From Sky-High Levels. Middle East Economic Survey (MEES), Beirut (2017)

Krane, J.: Stability versus sustainability: energy policy in the Gulf monarchies. Energy J. (2015). doi:10.5547/01956574.36.4.jkra

Komabargi, R., Waterlander, O., Sarraf, G., Sastry, A.: Gas Shortage in the GCC: How to Bridge the Gap. Booz & Company, New York (2010)

Krane, J., Wright, S.: Qatar ‘Rises Above’ Its Region: Geopolitics and the Rejection of the GCC Gas Market. Kuwait Programme on Development, Governance and Globalisation in the Gulf States, London (2014)

Lahn, G.: Fuel, Food and Utilities Price Reforms in the GCC: A Wake-up Call for Business. Royal Institute of International Affairs, London (2016)

Crown Prince Court, UAE Ministry of Foreign Affairs: Natural Gas: An Assessment of Global Trends and UAE Development. Crown Prince Court, Abu Dhabi (2014)

MEES: Will the ‘Golden Age Of Gas’ ever arrive?. Middle East Economic Survey (MEES), Beirut (2016)

APICORP Energy Research: MENA: LNG’s top growth target. APICORP Energy Research, Al Khobar (2016)

Griffiths, S.: A review and assessment of energy policy in the Middle East and North Africa region. Energy Policy 102, 249–269 (2017). doi:10.1016/j.enpol.2016.12.023

IEA: Re-powering Markets: Market design and regulation during the transition to low-carbon power systems. IEA Electricity Market Series, 2nd edn. OECD/IEA (International Energy Agency), Paris (2016)

Dyllick-Brenzinger, R.M., Finger, M.: Review of electricity sector reform in five large, oil- and gas-exporting MENA countries: current status and outlook. Energy Strategy Rev. 2(1), 31–45 (2013). doi:10.1016/j.esr.2013.03.004

Åberg, E., Myrsalieva, N., Emtairah, T.: Power market structure and renewable energy deployment experiences from the MENA region. Regul Investments Energy Markets (2016). doi:10.1016/b978-0-12-804436-0.00011-4

Littlechild, S.: Foreword: The Market versus Regulation. In: Pfaffenberger, W. (ed.) Electricity Market Reform, pp. xvii–xxix. Elsevier, Oxford (2006)

Joskow, P.L.: Introduction to Electricity Sector Liberalization: Lessons Learned from Cross-Country Studies, Fereidoon P. In: Pfaffenberger, W. (ed.) Electricity Market Reform, pp. 1–32. Elsevier, Oxford (2006)

REN21, IRENA, the United Arab Emirates: MENA Renewables Status Report. REN21 Secretariat, Paris (2013)

IRENA: League of Arab States: Pan-Arab Renewable Energy Strategy 2030. IRENA, Abu Dhabi (2014)

Bhutto, A.W., Bazmi, A.A., Zahedi, G., Klemeš, J.J.: A review of progress in renewable energy implementation in the Gulf Cooperation Council countries. J. Clean. Product. 71, 168–180 (2014). doi:10.1016/j.jclepro.2013.12.073

Lilliestam, J., Patt, A.: Barriers, risks and policies for renewables in the Gulf states. Energies 8(8), 8263–8285 (2015). doi:10.3390/en8088263

Atalay, Y., Biermann, F., Kalfagianni, A.: Adoption of renewable energy technologies in oil-rich countries: explaining policy variation in the Gulf Cooperation Council states. Renew. Energy 85, 206–214 (2016). doi:10.1016/j.renene.2015.06.045

Al-Amir, J., Abu-Hijleh, B.: Strategies and policies from promoting the use of renewable energy resource in the UAE. Renew. Sustain. Energy Rev. 26, 660–667 (2013). doi:10.1016/j.rser.2013.06.001

Alnaser, W.E., Alnaser, N.W.: The status of renewable energy in the GCC countries. Renew. Sustain. Energy Rev. 15(6), 3074–3098 (2011). doi:10.1016/j.rser.2011.03.021

Mezher, T., Dawelbait, G., Abbas, Z.: Renewable energy policy options for Abu Dhabi: drivers and barriers. Energy Policy 42, 315–328 (2012). doi:10.1016/j.enpol.2011.11.089

Griffiths, S., Mills, R.: Potential of rooftop solar photovoltaics in the energy system evolution of the United Arab Emirates. Energy Strategy Rev. 9, 1–7 (2016). doi:10.1016/j.esr.2015.11.001

Sgouridis, S., Abdullah, A., Griffiths, S., Saygin, D., Wagner, N., Gielen, D., Reinisch, H., McQueen, D.: RE-mapping the UAE’s energy transition: an economy-wide assessment of renewable energy options and their policy implications. Renew. Sustain. Energy Rev. 55, 1166–1180 (2016). doi:10.1016/j.rser.2015.05.039

Sgouridis, S., Griffiths, S., Kennedy, S., Khalid, A., Zurita, N.: A sustainable energy transition strategy for the United Arab Emirates: evaluation of options using an Integrated Energy Model. Energy Strategy Reviews 2(1), 8–18 (2013). doi:10.1016/j.esr.2013.03.002

Matar, W., Murphy, F., Pierru, A., Rioux, B.: Lowering Saudi Arabia’s fuel consumption and energy system costs without increasing end consumer prices. Energy Econ. 49, 558–569 (2015). doi:10.1016/j.eneco.2015.03.019

Mondal, M.A.H., Kennedy, S., Mezher, T.: Long-term optimization of United Arab Emirates energy future: policy implications. Appl. Energy 114, 466–474 (2014). doi:10.1016/j.apenergy.2013.10.013

IRENA: Investment opportunities in the GCC: suitability maps for grid-connected and off-grid solar and wind projects. International Renewable Energy Agency (IRENA), Abu Dhabi (2016)

Jacobson, M.Z., Delucchi, M.A., Bauer, Z.A.F., Goodman, S.C., Chapman, W.E., Cameron, M.A., Bozonnat, C., Chobadi, L., Erwin, J.R., Fobi, S.N., Goldstrom, O.K., Harrison, S.H., Kwasnik, T.M., Lo, J., Liu, J., Yi, C.J., Morris, S.B., Moy, K.R., O’Neill, P.L., Redfern, S., Schucker, R., Sontag, M.A., Wang, J., Weiner, E., Yachanin, A.S.: 100% Clean and Renewable Wind, Water, and Sunlight (WWS) All-Sector Energy Roadmaps for 139 Countries of the World. In: University, T.S.P.-S. (ed.). (2016)

IRENA: REmap: Roadmap for a Renewable Energy Future, 2016 Edition. International Renewable Energy Agency (IRENA), Abu Dhabi (2016)

IRENA: Sultanate of Oman: Renewables Readiness Assessment. International Renewable Energy Agency (IRENA), Abu Dhabi (2014)

APICORP Energy Research: Renewables in the Arab World: A New Phase. APICORP Research, Al Khobar (2016)

IRENA: Renewable Energy Target Setting. International Renewable Energy Agency (IRENA), Abu Dhabi (2015)

Bazilian, M., Outhred, H., Miller, A., Kimble, M.: Opinion: an energy policy approach to climate change. Energy Sustain. Dev. 14(4), 253–255 (2010). doi:10.1016/j.esd.2010.07.007

AFED: Arab Environment: Sustainable Consumption. Annual Report of Arab Forum for Environment and Development. Technical Publications, Beirut (2015)

Dagnet, Y., Waskow, D., Elliott, C., Northrop, E., Thwaites, J., Mogelgaard, K., Krnjaic, M., Levin, K., Mcgray, H.: Staying On Track From Paris: Advancing The Key Elements of The Paris Agreement. World Resources Institute, Washington, DC (2016)

Sooriyaarachchi, T.M., Tsai, I.T., El Khatib, S., Farid, A.M., Mezher, T.: Job creation potentials and skill requirements in, PV, CSP, wind, water-to-energy and energy efficiency value chains. Renew. Sustain. Energy Rev. 52, 653–668 (2015). doi:10.1016/j.rser.2015.07.143

MEES: Saudi Kicks Off New Solar Projects, Gets Realistic With Long-Term Goals. Middle East Economic Survey (MEES), Beirut (2016)

MEES: Saudi Arabia’s Transformation Plan Already Running Out of Time. Middle East Economic Survey (MEES), Beirut (2016)

Fattouh, B., Sen, A.: Saudi Arabia’s Vision 2030, Oil Policy and the Evolution of the Energy Sector. Oxford Institute for Energy Studies, Oxford (2016)

IRENA: Renewable Energy Auctions in Developing Countries. International Renewable Energy Agency (IRENA), Abu Dhabi (2013)

IRENA, CEM: Renewable Energy Auctions—A Guide to Design. International Renewable Energy Agency (IRENA), Abu Dhabi (2015)

Kreiss, J., Ehrhart, K.-M., Haufe, M.-C.: Appropriate design of auctions for renewable energy support – Prequalifications and penalties. Energy Policy 101, 512–520 (2017). doi:10.1016/j.enpol.2016.11.007

Energy Transitions Commission: Better Energy, Greater Prosperity: Achievable pathways to low-carbon energy systems. Energy Transitions Commission, New York (2017)

Miller, L., Carriveau, R., Harper, S., Singh, S.: Evaluating the link between LCOE and PPA elements and structure for wind energy. Energy Strategy Rev. 16, 33–42 (2017). doi:10.1016/j.esr.2017.02.006

del Río, P., Linares, P.: Back to the future? Rethinking auctions for renewable electricity support. Renew. Sustain. Energy Rev. 35, 42–56 (2014). doi:10.1016/j.rser.2014.03.039

Shrimali, G., Konda, C., Farooquee, A.A.: Designing renewable energy auctions for India: managing risks to maximize deployment and cost-effectiveness. Renew. Energy 97, 656–670 (2016). doi:10.1016/j.renene.2016.05.079

Moreno, R., Barroso, L.A., Rudnick, H., Mocarquer, S., Bezerra, B.: Auction approaches of long-term contracts to ensure generation investment in electricity markets: lessons from the Brazilian and Chilean experiences. Energy Policy 38(10), 5758–5769 (2010). doi:10.1016/j.enpol.2010.05.026

SolarPower Europe.: Global Market Outlook for Solar Power: 2016–2020. Solar Power Europe, Bruxelles (2016)

Ernst & Young LLP: MENA Cleantech Survey 2014. Ernst & Young LLP, London (2014)

Hawila, D., Mondal, M.A.H., Kennedy, S., Mezher, T.: Renewable energy readiness assessment for North African countries. Renew. Sustain. Energy Rev. 33, 128–140 (2014). doi:10.1016/j.rser.2014.01.066

Carafa, L., Frisari, G., Vidican, G.: Electricity transition in the Middle East and North Africa: a de-risking governance approach. J. Clean. Prod. (2015). doi:10.1016/j.jclepro.2015.07.012

MEED Insight.: MENA Power 2016: Investing in the Future Mena Power Projects 2016. London (2015)

MESIA: Solar Outlook Report 2017. Middle East Solar Industry Association (MESIA), Abu Dhabi (2017)

Salman, W.: DEWA Signs Power Purchase Agreement and Shareholder Agreement for Second-Phase 200 MW PV Plant at Mohammad bin Rashid Al Maktoum Solar Park. In: UAE State of Energy Report 2016. United Arab Emirates Ministry of Energy, United Arab Emirates (2016)

MEES: Dubai Sets New PV Cost Benchmark In 800 MW Phase Three Of Solar Park. Middle East Economic Survey (MEES), Beirut (2016)

Morris, C.: Understanding record-low 3-cent solar in Dubai in context. http://energytransition.de/2016/05/understanding-record-low-3-cent-solar-in-dubai-in-context/ (2016). Accessed August 5, 2016

Lazard: Lazard Levelized Cost of Energy Analysis 10.0. Lazard, Hamilton (2016)

Graves, L.: Dubai on course for another pricing record at Mohammed bin Rashid Al Maktoum Solar Park. http://www.thenational.ae/business/energy/dubai-on-course-for-another-pricing-record-at-mohammed-bin-rashid-al-maktoum-solar-park (2016)

Institute, M., IRENA: IRENA: Renewable Energy Prospects: United Arab Emirates, REmap 2030 analysis. IRENA, Abu Dhabi (2015)

Brand, B., Boudghene Stambouli, A., Zejli, D.: The value of dispatchability of CSP plants in the electricity systems of Morocco and Algeria. Energy Policy 47, 321–331 (2012). doi:10.1016/j.enpol.2012.04.073

Perez, R., Rábago, K.R., Trahan, M., Rawlings, L., Norris, B., Hoff, T., Putnam, M., Perez, M.: Achieving very high PV penetration—the need for an effective electricity remuneration framework and a central role for grid operators. Energy Policy 96, 27–35 (2016). doi:10.1016/j.enpol.2016.05.016

Salman, W.: The Shams Dubai Initiative. In: UAE State of Energy Report 2016. United Arab Emirates Ministry of Energy, United Arab Emirates (2016)

Krane, J., Hung, S.Y.E.: Energy Subsidy Reform in the Persian Gulf: The End of the Big Oil Giveaway. vol. Issue Brief no. 04.28.16. Rice University’s Baker Institute for Public Policy, Houston, Texas (2016)

Boersma, T., Griffiths, S.: Reforming Energy Subsidies: Initial Lessons from the United Arab Emirates. The Brookings Institution and The Masdar Institute of Science and Technology, Abu Dhabi (2016)

RCREEE: Arab Future Energy Index 2015: Energy Efficiency. Regional Center for Renewable Energy and Energy Efficiency (RCREEE), Cairo (2015)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author of this article is an Associate Editor and Editorial Board member of Energy Transitions. Therefore, a blind peer review process was conducted for the article to remove any potential conflict of interest.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Griffiths, S. Renewable energy policy trends and recommendations for GCC countries. Energy Transit 1, 3 (2017). https://doi.org/10.1007/s41825-017-0003-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41825-017-0003-6