Abstract

The roles of institutional quality’s impact on firm performance are becoming increasingly prominent in the literature. This is true in the Global North and South. Vietnam has seen less research on this topic than other developing countries, so this paper seeks to rectify this by examining whether or not institutional quality influences firm performance, as measured by total factor productivity (TFP). This paper also digs deeper into the sub-components to see which institutions are the most influential. We applied the General Method of Moments (GMM) approach to a firm-level panel dataset covering the 2010–2020 period to examine institutional quality's impact on firm TFP. Results are explored by firm size and by ownership type (domestic private, foreign and state-owned). Using rich datasets covering institutional quality at the provincial level in Vietnam and also individual firm performance from 2010 to 2020, we found that Time cost (how long it takes firms to deal with the government on various issues) and Labor policy (how easy it is to hire good quality labor) are the most important of the 10 institutions studied. Additionally, while not all institutions influence TFP, institutional quality overall (all 10 institutions combined) clearly has a positive influence on TFP. This study fills a research gap by examining the relationship between institutional quality and firm performance in Vietnam. The findings emphasize the significance of Time cost and Labor policy as influential institutions and highlight the positive overall impact of institutional quality on TFP. The policy recommendations offered provide valuable insights for the government to further enhance firm productivity through targeted measures.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The topic of institutional quality and economic performance is of growing interest globally. However, inconsistent findings have been reported regarding whether institutional quality influences a country’s economic activities. While it has been found that it lowers, though not significantly, economic growth in Nigeria (Ogbuabor et al. 2020), it was found to support economic growth in China (Cui 2017) as well as in the Middle East and North Africa (Kandil 2009). Similarly, institutional quality has been found to positively influence firm survival in Europe (Baumöhl and Kočenda 2022) as well as firm productivity, either directly (Chang 2023; Qui et al. 2021; Goedhuys and Srholec 2015; Alvi and Admed 2014) or indirectly, by moderating the impact of other negative influences, like climate change (Song et al. 2023). However, in a study of 28 African countries, the positive relationship with firm productivity was not statistically significant (Amin 2013). In Vietnam, institutional quality has been found to positively impact manufacturing firm productivity (Dinh et al. 2023). However, in a study of 13 lower middle income countries, including Vietnam, it was found to negatively influence overall economic growth (Ngo and Nguyen 2020).

Nobel laureate Douglas North highlighted institutions' crucial role in economic dynamics, shaping growth or stagnation. Yet, powerful actors may manipulate institutions for personal gain, complicating the business landscape and hindering fair competition. Institutions, formal and informal, form rules guiding entrepreneurial behavior and influencing firm productivity. Governments monitor attitudes and provide regulations, policies, and incentives to manage entrepreneurial activities. Research underscores institutions' impact on entrepreneurial decision-making, vital for business activities and productivity. Economic liberalization, labor market development, and government intervention affect business activities diversely, directly influencing the economy's trajectory and specific industries' performance (Baumol 1996; Miao et al. 2022; Morrissey and Udomkerdmongkol 2016; Sobel 2008). Therefore, focusing on institutional quality may be an important place to direct government attention to increase the productivity of firms. Hence, deeper investigation into institutional quality’s impact on firm productivity is called for.

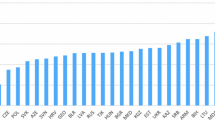

Vietnam appears to be an interesting case to examine the relationship between institutions and firm productivity for several reasons. Vietnam is an economy in transition, which has been widely acknowledged for its successful economic transformation over the last 4 decades from a centrally planned economy to a market-oriented one where the role of government has changed from monitoring and managing to governing and promoting economic activities (World Bank 2017). Over the last 4 decades, there have been significant changes in policies including adjustments in Enterprise Law (2014), Bidding Law (2014), and Investment Law (2015) which lift restrictions and provide firms with more freedom and a better business environment. The government has put forward five groups of solutions that need to be implemented in the short term, including: urgently removing obstacles and legal barriers to facilitate the mobilization of resources for investment in production and business activities; supporting cost reduction for enterprises, enhancing access to preferential capital sources, and state support resources; addressing supply chain disruptions, diversifying export markets, and expanding domestic markets; focusing on supporting enterprises to create opportunities and stable employment for workers; and intensifying the implementation of policies and solutions to support workers, training, retraining, and upskilling to enhance the skills of workers.Footnote 1 Local institutional quality shows a slow increasing trend over the 2010–2020 period with the provincial competitiveness index (PCI) across provinces centered around 55–62 points (out of 100) in 2010 and increasing to 63–65 points in 2020 (VCCI 2020). Provinces that are often at the top of the ladder (PCI > = 70 points) include Binh Duong, Quang Ninh, and Da Nang, while the PCI of Hanoi (the capital) and Ho Chi Minh city (the largest city) are often slightly higher than 65. These scores show that although the local institutional quality has been improved over time, gaps still remain, along with room for improvement. Vietnam also witnessed a significant improvement in both the number of firms and their performance (World Bank 2017). According to Ministry of Planning and Investment (2019), the number of Vietnamese enterprises has increased from around 300,000 firms in 2010 to more than 505,000 firms in 2016 and 684,000 firms in 2020 with an average of 100,000 newly established firms during the 2016–2020 periods.

Furthermore, Vietnam is among the fastest growing economies in the world (Hawksworth and Chen 2015) and the majority of that economic growth comes from firm development (WorldBank 2017a). It is important to see if institutions help promote this progress. It is important to examine whether, and to what extent, firm total factor productivity (TFP) has been influenced by those changes in the local institutions over the last decade. This is even more important in the light of research which found TFP growth in Vietnam slowed between 2000–2005 and 2006–2010 (Nguyen 2017).

The extant literature does discuss the relationship between institutional quality and TFP in Vietnam but not in great detail. What is missing is a deeper examination of the individual institutional components to see which are most important. As policy makers, like all decision makers, suffer from limitations in cognitive capacity (Verbeke and Lee 2021), it is important that they know where to focus their improvement efforts. Assuming institutional quality does impact firm TFP, which institutions should receive the most attention from policy makers? This study examines the relationship between provincial institutional quality and firm TFP, which has not been fully examined in the existing literature on Vietnam. Therefore, this paper aims to answer the following research questions: (i) How do institutions impact firm TFP? (ii) Which components of institution have the strongest impact on firm TFP? (iii) Does the impact of institutions on TFP vary across different types of ownership?

This research sheds some light on the impact of institutions on firm productivity, especially for Vietnam. Firstly, the paper is among the first studies in Vietnam which examine the impact of institutional quality on firm TFP in all measurable aspects of institutions using a rich and unique dataset about Vietnamese enterprises. We consider ten sub-indexes of provincial institutional quality and investigate the effect of each on firm TFP. We also explore any differences for varying types of firm ownership where we discover that local institutional quality appears to significantly impact local private firms but not state-owned enterprises (SOEs), while weak evidence is found for the impact on foreign direct investment (FDI) firms. Secondly, our study focuses on the impact of the time it takes for firms to deal with government officials as well as labor policy as the two most impactful aspects of institutions, which play a crucial role in improving firm TFP across provinces. To date, this information is missing from the existing literature on Vietnam.

The next section will review the relevant existing literature, followed by an explanation of the methods used in this investigation. Then, the results will be shown and discussed. Finally, conclusions will be drawn with recommendations for policy makers.

1.1 Literature review

There has been a growing body of literature about the relationship between institutions and firm productivity. Different levels of institutional quality might impact the allocation of firms’ resources and activities differently among societies that lead to different impacts on firm performance (Baumol 1996). Institutions regulate the “rules of the game” (Busse and Hefeker 2007; North 1990) that shape firm behavior by encouraging some activities and discouraging others (North 1990). Governments monitor firms’ attitudes (Fuentelsaz et al. 2015) and provide them with regulations, policies, and incentives to manage their entrepreneurial activities and increase human interactions (North 1990). A large body of the existing literature agrees that institutions affect entrepreneurial decision-making, which is crucial for business activities and the quality of entrepreneurship (Chambers and Munemo 2019; Chowdhury et al. 2019; Miao et al. 2022; North 1990; Sobel 2008).

There could be different routes through which institutions might impact business activities including economic liberalization (Angulo-Guerrero et al. 2017), labor market development (Chowdhury et al. 2019), copyright, and research and development activities (Bowen and De Clercq 2008; Hillier et al. 2011; Pindado et al. 2015) and these might impact firm productivity. It has been argued that institutions influence firm investment and accumulation of human and physical capital, which, in turn, influences firm long-term productivity growth (Mankiw et al. 1992; Rodrik et al. 2004; Eicher et al. 2006). Additionally, institutions might encourage firm productivity through the efficient allocation of resources where firms can access what they need fairly (Chang 2023). High institutional quality also reduces corruption and creates a fair, supportive investment environment for businesses with a good and stable legal structure that ensures stronger growth (Acemoglu and Robinson 2008). Good institutions also promote research and development activities, provide protection for intellectual rights, and encourage innovation and technological development, all of which boost firm performance (Loayza et al. 2005; Jung 2020; Chang 2023).

Empirical evidence has shown a relationship between institutional quality and firm productivity. Goedhuys and Srholec (2015), using a dataset of 15,425 manufacturing firms in 32 developing countries, found a significant positive impact of national institutions, such as technological infrastructure and the educational system, on firm TFP. Based on panel data of 46 countries worldwide, Qiu et al. (2022) found a positive impact of institutional quality on green TFP. More recently, Chang (2023) used a country-level dataset and found that institutional quality can increase TFP and firm value. Moreover, it was found that political institutional quality has the highest positive impact on firm value and technological progress (Chang 2023).

In Europe, Lasagni et al (2015) confirmed that the quality of local institutions plays a central role in explaining firm productivity in Italy. Agostino et al. (2020) showed that better local institutions help small- and medium-sized enterprises (SMEs) become more productive. This might be because skilled workers’ migration decisions are, at least in part, driven by a search for higher quality institutions (Nifo and Vecchione 2014). Using a sample of 814 European firms from 20 European countries with data covering the time between 2008 and 2017, Karmani and Boussaada (2021) found that strong institutional quality may result in increased regulatory pressures related to social responsibility compliance and can thereby enhance the corporate social responsibility and firm performance relationship. Borghi et al. (2016) explored the relative role of internal and external institutions and their interaction in determining TFP of electricity distribution firms in 16 EU countries. They discovered that public ownership of companies correlates with higher productivity in cases of high quality institutions and lower productivity in cases of low institutional quality. Similarly, in the telecommunications industry, in 90 countries, across five continents, during 2007–2015, public ownership was found to have a negative impact on firm-level TFP; however, this was mitigated by high external institutional quality and even reversed in some countries with a particularly favorable institutional environment (Castelnovo et al 2019). Meanwhile, Nyamah et al. (2022) empirically contributed that high institutional quality significantly improve agri-food processing firms’ performance.

There is also evidence of the impact of institutions on firm activity in Asian countries. For example, it was found that bureaucratic corruption negatively influences firm productivity in India (Raj and Sen 2017), China (Karplus et al 2021), Pakistan (Ghulam 2021), and Malaysia (Danquah and Sen 2021).

There is a limited amount of work in the existing literature on Vietnam that examines the relationship between firm productivity and institutional quality. Huynh (2022) examines the spatial effects of institutions on firm productivity using a firm-level dataset combined with the PCI data from VCCI (Vietnam Chamber of Commerce) during the 2011–2018 period. He finds that institutions not only have a direct impact on firm productivity in the same locality but also have an indirect impact on the productivity of firms in nearby provinces. The study also confirms the positive impact of control of corruption on firms’ profitability. However, there are several conflicting and inconsistent findings in this research regarding these main points, such as “control of corruption in a locality directly reduces the total factor productivity of enterprises in that locality” (Huynh 2022, p. 101) and “corruption control of the locality has a positive effect on firm performance in that locality” (Huynh 2022, p. 99). Vu and Tran (2021) examined the impact of government financial support on Vietnamese SME firm productivity. The findings indicate no evidence of the relationship between government financial support and firm TFP, although they find that access to financial support improves technological progress and growth in firm size, but has a negative impact on improving technical efficiency. Finally, Dinh et al. (2023) found that higher institutional quality improved TFP for manufacturing firms. To our best knowledge, these are the only three studies that closely investigate the impact of institutions on firm performance in Vietnam, in which one focuses on the cross-province effect of institutions, another focuses on SMEs only, while the third addresses only manufacturing firms. These studies, however, do not pay attention to all aspect of institutions.

There are a number of studies in Vietnam which focus on the impact of one specific aspect of institutions—corruption—on firm performance. General findings show that corruption is a hindrance to firm growth (Nguyen and van Dijk 2012; Nguyen et al. 2013; Van Vu et al. 2018; Bai et al. 2019, Hoang et al. 2022), firm innovation (Nguyen et al. 2016), and investment (Dang 2016). Hoang et al. (2022) investigate the impact of an anti-corruption campaign in 2013 on firm financial performance using a difference-in- differences approach. The study confirms that greater control of corruption does encourage private firm financial performance through improving institutional quality. Vu et al. (2018) examined the relationship between corruption and SME financial performance and found no significant evidence of this relationship. These studies, however, only focus on corruption, rather than institutions in general, and how it affects firm financial performance. Our study aims to fill this gap by investigating the effect of all measurable components of institutions on firm TFP, thus making it clearer on which aspects of institution policy makers should focus their improvement efforts.

2 Methods and data

2.1 TFP calculation

The Cobb–Douglas production function is one of the most popular forms of the production function, which is widely used in the existing literature (Blundell and Bond 2000; Khai and Yabe 2011; Meeusen and van Den Broeck 1977; Pham et al. 2010). Following this production function, total output of firm i in industry j at time t (\({Y}_{ijt}\)) is a function of its capital \(\left({K}_{ijt}\right)\), labour \(\left({L}_{ijt}\right)\) and total factor productivity \(\left({A}_{ijt}\right)\) detailed as following:

Taking the logarithm of both side of Eq. (1), we write:

In short, Eq. (2) is re-written as Eq. (3) below.

where: \({y}_{ijt}\) is the total output, \({k}_{ijt}\) is the capital stock, \({l}_{ijt}\) is the labor of enterprise i in sector j at time t, all in log form. We follow Wooldridge (2009) who suggests a one-step estimator using the GMM approach to estimate \(\widehat{{\beta }_{k}}\) and \(\widehat{{\beta }_{l}}\) to mitigate some potential issues. These results, then, allow us to obtain TFP, based on Eq. (3) as follow:

2.2 Estimation of the impact of institutions on firm TFP

To examine the relationship between institutions and firm total productivity, we examine the following model:

where \({TFP}_{ijt}\) denotes total factor productivity of firm i at time t; \({Institution}_{pt}\) refers to the institutional index of province p at time t, \({X}_{ijt}\) is a vector of control variables demonstrating firm characteristics and \({Y}_{jt}\) represents the industry’s specifics. \({\sigma }_{t}\) refers to firm unobserved individual effect (fixed effect) and \({\varepsilon }_{ijt}\) is the random error term. We take into account firm age, market share, profitability, export, labor productivity, and wage as control variables at the firm level. Share of foreign direct investment in the sector (FDI share) and market concentration (HHI) are used to control for sector characteristics.

The estimations of our benchmark model (5) may face some technical issues, most notably, the autocorrelation problem. By nature of productivity, it could depend on its own past (Wooldridge 2009), for example, some productivity shocks caused by changes in the economy’s context that are not observable (negative shock as a result of natural disasters such as severe floods or drought, or an unexpected health crisis such as Covid-19). Furthermore, some of the regressors (wage, labor productivity, etc.) might be correlated with the previous values of TFP, causing these to be predetermined regressors. Under the dynamic context, Eq. (5) becomes:

where \({TFP}_{i,j,\left(t-1\right)}\) is the value of TFP of the same firm in the previous year. Estimation of Eq. (6) using OLS estimation technique to subtract the firms’ mean values of the dependent and independent variables may generate a correlation between the dependent variable and the error term which is not mitigated by increasing the sample size (Nickell, 1981). To account for this problem, we follow Arellano and Bond (1991) to apply the generalized method of moments (GMM) estimation which uses lags of dependent variables to be instrument variables. According to Roodman (2009), GMM is highly appropriate for such models and data that have (i) a linear relationship model, (ii) a large number of observations and a small time span, (iii) the dependent variable is dynamic, depending on its own past; and (iv) some regressors are not strictly exogenous.

Our dataset covers the 2010–2020 period (t = 11) for all firms in manufacturing sectors (about 29,400 firms each year on average). Firm productivity is assumed to depend on its past value, due to path dependence and learning effects. Path dependence suggests that current productivity is influenced by historical decisions, technologies, and investments, creating inertia in productivity trends. Additionally, firms may learn from past experiences, refining processes and adopting innovations incrementally, thus shaping future productivity levels. This historical inertia and learning dynamics underscore the interplay between past and present TFP, which refers to a dynamic relationship in our Eq. (6). Some of our control variable in the vector \({X}_{ijt}\) (discussed in more detail in the following section) are not strictly exogenous, for instance, firm’s average wage or profiability might be correlated with the error terms.

In the Arellano-Bond GMM setup, the model consists of a system of equations for each time period where the lag values are used as the instrumental variables for the current time point. The first step of GMM is to take the first difference of Eq. (6), which removes the constant term and the individual effect:

The next step is to estimate Eq. (6) using the GMM technique with the second and third lags of TFP used as instruments for the \({TFP}_{ij,\left(t-1\right)}\). According to Roodman (2009), GMM uses the forward orthogonal deviations transformation, proposed by Arellano and Bover (1995), which subtracts the average of all available further observation from the current value, and it drops the last observation for each unit (firm) in the panel.

2.3 Data and variables

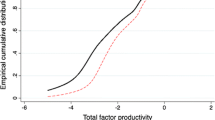

There are two main data sources for this paper. Firm level data comes from the Vietnam Enterprise Survey (VES), which is conducted by the General Statistics Office (GSO) annually. Institutional data comes from the Provincial Competitiveness Index (PCI), carried out by a collaboration between VCCI and USAID. VES is a survey that collects most information on firm characteristics and firm performance across all sectors, regions, and ownership types. All registered firms with more than 50 employees in big cities such as Hanoi and Ho Chi Minh city are included in the survey and firms with less than 50 employees are randomly selected. In other provinces, all firms are included. The cleaned dataset consists of 294,278 observations in the manufacturing sector. We focus on the manufacturing sector since this sector contributes 33.3% of the total GDP of the country (Central Intelligence Agency 2022). Of the 23 sub-sectors in the manufacturing industry,Footnote 2 fabricated metal products sector has the largest number of firms in the industry (16.17% of the sample). Based on our TFP estimation,Footnote 3 firms in the manufacture of chemicals and chemical products, of rubber products, of basic metals, of food products, of electrical equipment, and of motor vehicles, trailers, and semi-trailers are among those which have the highest productivity.

The second dataset used in the analysis comes from the PCI survey, which is conducted by the Vietnam Chamber of Commerce and Industry (VCCI) with the support of the United States Agency for International Development (USAID) in Vietnam. This is also an annual survey at the provincial level, obtained to provide information on provincial government quality. The overall PCI is constructed from ten sub-indexes covering different aspects of provincial governance, with scores ranging from 40 to 100. The higher the score, the better a province’s institutional quality. Overall, the PCI data show that Vietnam has experienced an increasing trend in institutional quality. These data are constructed from seven surveys (USAID 2021) on more than 8,000 domestic private firms and more than 1,200 foreign invested firms across all 63 provinces. While studies of other countries have used the World Bank’s Worldwide Governance Indicators, that dataset only covers the national level, not the provincial level, the PCI data are more granular and thus was chosen for this study. PCI measures and evaluates the quality of economic governance, business environment friendliness, and administrative reform efforts of provincial and municipal governments in Vietnam, aiming to promote the development of private economic sectors. According to the PCI website:

Built on the largest and most meticulous annual enterprise survey data in Vietnam to date, PCI serves as the collective voice of the private business community regarding the business environment across provinces and cities in Vietnam. PCI does not aim solely for scientific research purposes or to praise or criticize provinces with high or low PCI scores. Instead, it seeks to explore and explain why some provinces outperform others in private economic development, job creation, and economic growth. With the annual publication of results and publicly available data PCI serves as a valuable reference for provincial leaders, policymakers, and planners, enabling them to identify administrative bottlenecks and choose the most effective solutions for economic governance reforms.

PCI consists of ten component indexes covering key areas of economic governance relevant to enterprise development in provinces and cities. A locality is considered to have good governance quality when it exhibits: (1) low market entry costs; (2) easy land access and stable land use; (3) transparent business environment and public business information; (4) low unofficial costs; (5) swift inspection, examination, and enforcement of regulations and administrative procedures; (6) fair competition environment; (7) dynamic provincial government innovative in addressing business issues; (8) high-quality enterprise development support services; (9) good labor training policies; and (10) fair, efficient dispute resolution procedures and well-maintained law and order security.Footnote 4

For firm characteristics, we include labor and capital (both in log form) to estimate TFP (Blundell and Bond 2000). In the estimation to measure the impact of firm characteristics on TFP, we take into account the average wage that a firm pays to its employees since it is a way to encourage workers to be more productive (Van Biesebroeck 2017). Firm age is included to capture the learning-by-doing effect of firms over time (Ha et al. 2021; Vu and Tran 2021). It is evident that exporting activity may also encourage firm productivity (Alvarez and Lopez 2005; Arnold and Hussinger 2005) and, therefore, we take into account export as the log form of absolute value of exports. We use labor productivity to account for human capital of firms which is closely linked to TFP (Botev et al. 2019).

Profitability of firms is computed as the ratio of net profit to total assets. Market share is measured as the ratio of firm revenue out of total sector revenue.Footnote 5 To account for sector specifics, we accommodate gross output share of foreign direct investment in the sector (FDI share) since the presence of FDI might encourage firm productivity (Fujimori and Sato 2015; Newman et al. 2015).

For institutional quality, we use the PCI, which is constructed from ten sub-indexes measuring the quality of governance at the provincial level. The 2010–2020 period was chosen as the time-frame of this study because it is the most up-to-date data available from the GSO and the period covers some significant changes in government policy toward giving firms a more transparent, supportive business environment. While there are other sources of data which might be considered, such as those available from the World Bank or Transparency International, those data operate at the national level and do not contain information at the provincial level, which is what this study requires. Therefore, this study proceeded using the PCI data. Table 1 below provides detailed information about variables and Table 2 presents data statistics.

3 Results and discussion

We first estimate firm TFP (Eqs. 1–4) to be the input to estimate Eq. (6) using system GMM technique for the whole dataset for each institutional sub-index separately. We then separate the sample into sub-samples considering ownership type (private, SOE, FDI) and size of firm. Lag values of TFP and some control variables including wage, export, labor productivity, market share, and profitability are used as the instrument variables, since these firm specifics are likely to depend on their own lags (Arellano and Bond 1991; Roodman 2009). We report the Arellano Bond (AR) test for second-order correlation and the Hassen test for overidentification along with the results.

3.1 TFP and overall institutional quality

We examine the impact of the overall institutional quality (IQ) on firm TFP and find that there is strong evidence to confirm a positive impact. Results in Table 3 show that a one-point increase in IQ is associated with a 0.0195 point increased in firm TFP, on average. Higher IQ indicates a better business environment where the improvement might come from any combination of the ten components. Better institutions might mean that firms can more easily enter the market, access land and other natural resources, suffer less from corruption, and benefit from more transparency, more business support, a better labor force, better enforcement of law and order, etc. This finding is in line with existing literature which finds a positive impact from institutional quality on firm performance (Hung et al. 2021; Huynh et al. 2022). Surprisingly, improvements in IQ appear to only encourage private and FDI firms’ TFP, where no significant evidence of the same for SOEs was found. High institutional quality results in lessening information asymmetries and promotes information flow about market status, supplier and consumer conditions, which may provide a complete picture that might embolden business formation (Fogel et al. 2008). Government might implement policies that shape the business environment by applying incentives or barriers, which may promote or constrain business activities (Urbano et al. 2019). It is argued that regulations, property rights, and their implementation clear the way for entrepreneurial activities, especially innovative activities that build on trust and cooperation while corrupt environments and weak property protection might hamper information circulation and raise transaction costs and, hence, impede entrepreneurship (Fogel et al. 2008). Good governance generally indicates low bureaucracy, a more transparent system, and low level of corruption that may promote the creation of new businesses or investment (Fu et al. 2020). Moreover, higher institutional quality might facilitate innovation and enterprise creation better under a firm legal framework with strong monitoring mechanism that may encourage entrepreneurial activities (Dau and Cuervo-Cazurra 2014). This finding also aligns with the existing literature on Vietnam where positive impact is found for provincial institutional quality on firm performance (Huynh 2022; Tran et al. 2009; Vu 2021).

Results across regressions consistently indicate that firm characteristics do have an impact on firm TFP. Overall, wage, export status, labor productivity, and profitability are among those which positively affect firm TFP. Age appears to have a small negative impact on firm TFP while the market share of a firm does not have any statistically significant relationship with firm TFP, which is, somewhat, in line with findings from Lasagni et al. (2015). At the sector level, FDI appears to lower private firm TFP. Since we measure share of FDI by the proportion of FDI’s gross output out of the sector’s gross output, the higher share of FDI, the stronger the pressure from foreign competitors in that sector. This leads to poorer performance for private firms (this is often called horizontal spillovers from FDI (Newman et al. 2015, Ha et al. 2019).

3.2 TFP and individual impacts of institutional-sub components

In the next step, we dig deeper into the effect of each institution component on firm TFP. Table 4 presents results from ten models, in which each component of institution is used to examine the separate impact of these components on firm TFP.

An interesting story emerged when the results showed that eight out of ten sub-indexes are found to be clearly linked to firm productivity.

Time cost (indicating the time it takes for a business to interact with the government in the province) is the component that is found to have the strongest impact on TFP. The higher this index, the better. A one-point increase in Time cost (indicating less time needed to interact with local officials) is associated with a 0.106 point increase in firm TFP, holding other factors constant. A closer look into the components of Time cost reveals that this sub-index refers to the efficiency of the local government that helps reduce the time that firms need to spend for such activities like tax inspection, the volume of paperwork, or the time for a firm to understand and apply the province’s policies. Interestingly, although our findings reveal an important role of Time cost in improving firm TFP, it is weighted among the lightest of the PCI components (5%) (USAID 2021).

On average, 80% of firms (in 2020) agree that government officials are friendly, which is a strong improvement from 58% in 2014. When officials are allowed to be unhelpful, it can indicate that they are in the position to enforce rules in arbitrary ways, which leads to lower levels of efficiency for companies (Dolfsma 2011). This concern is further supported by the fact that only 66% (in 2020) agree that required paperwork is simple to complete (46% in 2014). When these two are taken together, we can imagine a firm which has to complete required paperwork and then asks government officials for support in understanding it, since the paperwork itself is unclear. They get an unfriendly or unhelpful response, leading to increased costs for the firm, thus lowering TFP. This finding is interesting not only because Time cost is the most influential sub-index in this study but also because it directly contradicts earlier findings, which concluded there was no evidence that Time cost influenced TFP (Huynh 2022).

Labor policy is the second largest institutional contributor to firm TFP. On average, a one-point increase in this index leads to a 0.09-point increase in firm TFP. Provincial labor policy aims to support firms, especially private firms, who may have difficulties in recruiting sufficient labor, to hire qualified labor for their business by providing labor fairs, and other supporting activities. It shows how supportive the local government is in terms of helping firms recruit unskilled workers, skilled workers, specialists, or mangers and the costs of training and recruiting labor as well as the quality of the labor force available. It is not surprising that this index is strongly correlated with firm TFP since quality of labor is crucial to manufacturing firms’ operations.

An increase in higher education quality, which is one component of Labor policy, is also a benefit to the individuals who receive the education. With better training, people can work at large or small firms. However, without sufficient training, the individuals may be limited to only working for a large firm which has the resources to provide their own training. A related issue is the costs firms pay to recruit new job candidates. Smaller firms are more likely to depend on government agencies as they may be unable to afford the higher costs of private recruiting firms (Zotto and Gustafsson 2008). However, larger firms, benefiting from greater economies of scale, are more able to afford professional in-house recruiting staff and private recruiting firms.

Surprisingly, Transparency and Legal institutions each appear to have a negative relationship with firm TFP. This could be the case where transparency and good enforcement of law and order increases the competition in the province, which may, in turn, lead to lower productivity for firms on average where firms might have a large number of competitors. Another possible reason might be where transparency limits the ability of firms to lobby or bribe local officials, it might also reduce the “grease the wheel” effect of corruption (Nguyen et al. 2020) and, therefore, results in a less productive business. Similarity, Legal institutions, described as an “avenue for lodging appeals against corrupt official behavior”,Footnote 6 shows that the better legal institutions, the more difficult for firms to bribe provincial officials and that might lead to a lower productivity for firms on average. These findings and arguments here hold for all firms across ownership or size. It is important to note that, although not every sub-index has an impact on firm TFP, the overall IQ score shows an important, and positive, role of overall institutional quality on firm TFP.

Only Informal charges (which refers the level of corruption) and Policy bias (representing the bias in the province’s policy against private firms) had no statistically significant effect. This is particularly important because according to Transparency International’s Corruption Perception Index,Footnote 7 Vietnam has been the 15th best performing country (out of 181 countries) at improving its control of corruption between 2012 and 2022. Vietnam has been the 10th best performing country between 2017 and 2022. While Vietnam has clearly put in serious effort to improve its control of corruption starting in 2015, the findings herein would imply that those efforts did not lead to improved firm TFP, though they may have led to other improvements.

3.3 Firm TFP and institutions by ownership

To see a clearer picture, we observe the relationship across different ownership types and sizes. Results for SOEs, private, and FDI firms are reported in Tables 5, 6 and 7 below.

There is a clear difference in the extent to which institutional quality impacts SOEs versus private and FDI firms. Although the PCI survey focuses on private firms’ perception of institutional quality, it represents the business environment at the provincial level, which affects all firms that operate in that province. However, findings show that there is no significant evidence of the relationship between institutional quality and SOEs’ TFP. Across all regressions on the SOE sample, no institution sub-index was found to have an impact on TFP. One possible reason for this is that SOE are either fully or mostly owned by the government, indicating that, perhaps because of state-ownership, they can enjoy more governmental favor. In the PCI survey, 21.75% of participants in 2013 agreed that provinces give greater privilege to SOEs. This increased to 29% in 2020 and roughly 20% of the private firms in the survey agreed that SOEs were given privileges for land and financial access.Footnote 8

Private firms, on the other hand, appear to be significantly impacted by institutional quality. We find that six out of the ten sub-indexes appear to be correlated with private firm TFP, in which Time cost and Labor policy have the strongest impact on firm productivity and this is consistent with the benchmark results in Table 3. Land access and Proactivity are also found to have a positive effect on private firms while Entry cost, Informal charges, and Law and order appear to have no effect on private firm TFP. Overall, improvements in provincial institutions do benefit private firms.

Results from the FDI subsample indicate a very different story. Among the ten sub-indexes, only Access to land and Informal charges are found to have a significant impact on FDI firm productivity. Land access in the survey is described as “A measure combining two dimensions of the land problems confronting entrepreneurs: how easy it is to access land and the security of tenure once land is acquired”.Footnote 9 Meanwhile, informal charges appear to positively encourage FDI firm productivity. That is, these findings support the idea that lower levels of corruption do help FDI firms to increase their productivity. We do not, however, find any evidence of corruption impacting the TFP of other firm types.

4 Conclusion and policy implication

This study utilizes a firm-level dataset obtained from the richest survey on enterprises in Vietnam to examine the impact of institutional quality on firm TFP. Using the GMM estimation technique, it is found that, overall, local institutional quality has a significant positive impact on firm TFP, indicating that better institutions mean higher firm productivity. Our analysis illuminates how institutional quality at the provincial level not only streamlines the operational landscape for businesses but also significantly improves their TFP. Central to our findings is the revelation that reducing the time cost associated with conducting business, through efficient regulatory frameworks and effective governance, serves as a crucial lever for enhancing firm TFP. This reduction in bureaucratic inertia and transaction costs allows firms to allocate resources more optimally, focus on core competencies, and embrace innovation, thereby driving productivity. Equally important is the impact of sound labor policies implemented at the provincial level. Our research indicates that well-crafted labor policies, which balance the needs of the workforce with the imperatives of business efficiency, significantly contribute to the enhancement of firm productivity. By ensuring a stable, skilled, and motivated workforce, these policies underpin the productivity gains that are essential for firms to thrive in competitive markets.

Notably, our analysis demonstrates that improvements in institutional quality are beneficial for both private firms and FDI entities, facilitating these firms in achieving higher TFP. This positive outcome is largely due to reduced operational time costs and the establishment of supportive labor policies at the provincial level. For private and FDI firms, better institutional environments mean less bureaucratic delay and a more predictable business setting, encouraging efficient resource use and innovation. However, the situation for state-owned enterprises (SOEs) is not the same, indicating that SOEs do not experience the same TFP benefits from enhanced provincial institutional quality as their private and foreign counterparts do. This divergence might be attributed to the different operational goals, regulatory oversight, and market dynamics that SOEs face, which may buffer them from the positive effects of institutional improvements seen in other sectors.

The findings suggest several policy recommendations to improve firm TFP by enhancing provincial institutional quality. First, implement measures aimed at enhancing overall institutional quality at the provincial level. This could involve reforms to improve governance, transparency, and regulatory efficiency. Furthermore, establish mechanisms for monitoring and evaluating the effectiveness of provincial institutions in supporting business activities and promoting productivity growth. By strengthening institutions, Vietnam can create a more conducive environment for firm TFP improvement.

Next, regarding time cost for business activities, launching targeted programs to reduce the time costs associated with doing business in Vietnam might be a solution to further improve firm TFP. This may include streamlining administrative procedures, further digitizing government services, and establishing one-stop service centers for business registration and licensing. Additionally, invest in infrastructure and logistics to improve transportation networks and reduce supply chain bottlenecks. By focusing on reducing time costs, Vietnam can enhance its attractiveness to private firms and FDI entities, ultimately boosting both firm TFP and overall country productivity.

Moreover, labor policy enhancement might be helpful to boost firm TFP by prioritizing reforms to enhance labor policies, balancing the needs of workers with the requirements of businesses. This could involve updating labor laws to reflect modern employment practices, promoting vocational training and skills development programs, and strengthening mechanisms for resolving labor disputes. Additionally, ensure that labor regulations are enforced fairly and consistently across provinces. By improving labor policies, Vietnam can create a skilled and productive workforce, benefiting private firms and FDI firms that rely on efficient labor markets.

In order to improve the Labor policy sub-index, policy changes should focus on improving the quality of education at higher education institutions (HEIs). Only 47% of firms (in 2020) agreed that HEIs are producing good quality graduates (up from 33% in 2014). Unfortunately, we see that HEIs are a bit too slow to change, including in the Global North, to meet the needs of industry. Indeed, many authors have remarked on the slowness and difficulty of getting HEIs to change (Burner 2018; Caruth 2013; Diamond 2006; Unin 2012). Some recommendations that have been made over the years to improve HEIs in Vietnam include: A greater emphasis on authentic assessment (Andre and Webster 2018); strengthening technology infrastructure (World Bank 2020); using learning management systems (Andre and Webster 2021); improving curriculum and pedagogy (World Bank 2020) by learning from, rather than copying, foreign HEIs (Tran, 2012); using learning analytics (Andre 2022); promoting metacognition (Webster and Andre 2022); and working more closely with industry (Tran 2019). Pushing HEIs to implement the suggestions of HEI researchers in Vietnam would go a long way toward improving the Labor policy scores for any province.

4.1 Limitations and avenues for further research

Although the paper contributes to the existing literature on Vietnam, there exist several limitations. First of all, the data for institutional quality is at the provincial level, which means that every firm in one province is assumed to be affected similarly by institutional quality. Despite controlling for firm characteristics, the results could be improved if the data allow researchers to examine the impact of institutions at the firm level. This is only possible if the enterprise survey includes information about the way firms work with local governments. The PCI survey does have such information at the firm level; however, the raw data are not made public. The second limitation of this paper is that we are only able to examine the formal institutional quality (as provincial governance), but not informal institutions, such as social norms, firm traditions and culture, etc., which might also have an impact on firm productivity. These limitations suggest that if the data are available, further investigations can explore the relationship more deeply.

Future research should focus on addressing the limitations identified in this study to enhance our understanding of the relationship between institutional quality and firm productivity. Firstly, researchers should endeavor to obtain data at the firm level rather than relying solely on provincial-level data. This can be achieved by incorporating information about the firms' interactions with local governments into enterprise surveys. Additionally, efforts should be made to make raw data from surveys like the PCI survey publicly available, enabling more comprehensive analyses.

Moreover, future studies should explore the impact of informal institutions, such as social norms and firm culture, on firm productivity alongside formal institutional quality. By considering both formal and informal institutions, researchers can gain a better understanding of their influence on firm performance. Addressing these research gaps would contribute to a more robust understanding of the complex relationship between institutions and firm productivity, thereby informing policy interventions and managerial decisions effectively.

Data availability

PCI data can be requested from the PCI website at https://pcivietnam.vn/. Vietnam Enterprise Survey data can be requested from the General Statistics Office at https://www.gso.gov.vn/.

Notes

More information can be found here: https://www.mpi.gov.vn/portal/Pages/2023/Mot-so-chinh-sach-giai-phap-

trong-tam-ho-tro-doanh-745408.aspx.

Information about sub-sectors in the manufacturing industry can be found here:

Results of the TFP estimation can be made available on request.

Details about PCI can be found here: https://pcivietnam.vn/gioi-thieu.html

We use sector at level 4 out of 5 levels in our VSIC system to compute market share here.

Transparency International’s Corruption Perception Index data can be found at.

https://images.transparencycdn.org/images/CPI2022_GlobalResultsTrends.xlsx

Detailed data for this could be found in the “Policy bias” component in 2013 and 2020: https://www.pcivietnam.vn/du-lieu-pci

References

Acemoglu, Robinson J (2008) The role of institutions in growth and development, vol 10. World Bank, Washington, DC

Agostino M, Di Tommaso MR, Nifo A, Rubini L, Trivieri F (2020) Institutional quality and firms’ productivity in European regions. Reg Stud 54(9):1275–1288

Alvarez R, Lopez RA (2005) Exporting and performance: evidence from Chilean plants. Can J Econ 38(4):1384–1400

Alvi S, Ahmed Ä (2014) Analyzing the impact of health and education on total factor productivity: a panel data approach. Indian Econ Rev 49:109–123

Amin AA (2013) Africa’s Development: Institutions, Economic Reforms and Growth. Int J Econ Financ Issues 3:324–336

Andre J (2022) Using learning analytics to change student behaviour in the global south. Vietnam J Educ Sci 18(2):46–58. https://doi.org/10.15625/2615-8957/22210205

Andre J, Webster R (2018) Making assessment more authentic in Vietnam. Leadership and Management in Higher Education in a Globalized World: Innovations and Best Practices, 14. Ho Chi Minh City: SEAMEO RETRAC

Andre J, Webster R (2021) Using learning analytics to improve resource utilization and student learning outcomes in Vietnam. In: 6th International Conference on Vietnamese Studies. Hanoi, VN: ICVNS.

Angulo-Guerrero MJ, Pérez-Moreno S, Abad-Guerrero IM (2017) How economic freedom affects opportunity and necessity entrepreneurship in the OECD countries. J Bus Res 73:30–37

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arnold JM, Hussinger K (2005) Export behavior and firm productivity in German manufacturing: a firm-level analysis. Rev World Econ 141(2):219–243

Bai J et al (2019) Firm growth and corruption: empirical evidence from Vietnam. Econ J 129(618):651–677

Baumöhl E, Kočenda E (2022) How firms survive in European emerging markets: a survey. East Eur Econ 60(5):393–417. https://doi.org/10.1080/00128775.2022.2099422

Baumol WJ (1996) Entrepreneurship: Productive, unproductive, and destructive. J Bus Ventur 11(1):3–22

Blundell R, Bond S (2000) GMM estimation with persistent panel data: an application to production functions. Economet Rev 19(3):321–340

Borghi E, Del Bo C, Florio M (2016) Institutions and firms’ productivity: evidence from electricity distribution in the EU. Oxford Bull Econ Stat 78(2):170–196

Botev J, Égert B, Smidova Z, Turner D (2019) A new macroeconomic measure of human capital with strong empirical links to productivity (OECD Economics Department Working Papers WP 1575; OECD Economics Department Working Papers, Vol. 1575). OECD. https://doi.org/10.1787/d12d7305-en

Bowen HP, De Clercq D (2008) Institutional context and the allocation of entrepreneurial effort. J Int Bus Stud 39(4):747–767

Burner T (2018) Why is educational change so difficult and how can we make it more effective? Forskning Og Forandring 1:122. https://doi.org/10.23865/fof.v1.1081

Busse M, Hefeker C (2007) Political risk, institutions and foreign direct investment. Eur J Polit Econ 23(2):397–415

Caruth GD (2013) Understanding resistance to change: a challenge for universities. Turk Online J Dist Educ 14(2):12–21

Castelnovo P, Del Bo CF, Florio M (2019) Quality of institutions and productivity of State-Invested Enterprises: international evidence from major telecom companies. Eur J Polit Econ 58:102–117

Central Intelligence Agency (2022) The CIA World Factbook 2022–2023. Skyhorse Publishing, New York

Chambers D, Munemo J (2019) Regulations, institutional quality and entrepreneurship. J Regul Econ 55(1):46–66

Chang C-C (2023) The impact of quality of institutions on firm performance: a global analysis. Int Rev Econ Financ 83:694–716

Chowdhury F et al (2019) Institutions and entrepreneurship quality. Entrep Theory Pract 43(1):51–81

Cui W (2017) Social trust, institution, and economic growth: evidence from China. Emerg Mark Financ Trade 53(6):1243–1261. https://doi.org/10.1080/1540496X.2016.1264299

Dang QV (2016) The impact of corruption on provincial development performance in Vietnam. Crime Law Soc Chang 65(4–5):325–350

Danquah M, Sen K (2021) Informal institutions, transaction risk, and firm productivity in Myanmar. Small Bus Econ 58:1721–1737. https://doi.org/10.1007/s11187-020-00441-w

Dau LA, Cuervo-Cazurra A (2014) To formalize or not to formalize: entrepreneurship and pro-market institutions. J Bus Ventur 29(5):668–686. https://doi.org/10.1016/j.jbusvent.2014.05.002

Diamond RM (2006) Why Colleges Are So Hard to Change. Inside Higher Ed. https://www.insidehighered.com/views/2006/09/08/why-colleges-are-so-hard-change. Retrieved 1 Mar 2023

Dinh QT, Nguyen MT, Quach HT, Vo QTT, Nguyen V (2023) The impacts of technological innovation and institutional quality on the productivity of Vietnamese manufacturing firms. Int J Adv Appl Sci 10(9):139–149. https://doi.org/10.21833/ijaas.2023.09.016

Dolfsma W (2011) Government failure—four types. J Econ Issues XLV:593–604. https://doi.org/10.2307/23071562

Eicher T, García-Peñalosa C, Teksoz U (2006) How do institutions lead some countries to produce so much more output per worker than others? In: Eicher T, García-Peñalosa C (eds) Institutions, development, and economic growth, pp 65–80. https://doi.org/10.7551/mitpress/3811.003.0006

Fogel K, Hawk A, Morck R, Yeung B (2008) Institutional obstacles to entrepreneurship. In the Oxford Handbook of Entrepreneurship. Oxford University Press London. https://doi.org/10.1093/oxfordhb/9780199546992.003.0020

Fu K, Wennberg K, Falkenhall B (2020) Productive entrepreneurship and the effectiveness of insolvency legislation: a cross-country study. Small Bus Econ 54(2):383–404

Fuentelsaz L, González C, Maícas JP, Montero J (2015) How different formal institutions affect opportunity and necessity entrepreneurship. BRQ Bus Res Q 18(4):246–258. https://doi.org/10.1016/j.brq.2015.02.001

Fujimori A, Sato T (2015) Productivity and technology diffusion in India: The spillover effects from foreign direct investment. J Policy Model 37(4):630–651

Ghulam Y (2021) Institutions and firms’ technological changes and productivity growth. Technol Forecast Soc Chang 171:120993

Goedhuys M, Srholec M (2015) Technological capabilities, institutions and firm productivity: a multilevel study. Eur J Dev Res 27:122–139

Ha VTC, Holmes M, Doan T, Hassan G (2021) Does foreign investment enhance domestic manufacturing firms’ labour productivity? Evidence from a quantile regression approach. Econ Chang Restruct 54:637–654

Hawksworth J, Chan D (2015) The World in 2050: Will the shift in global economic power continue? PricewaterhouseCoopers. https://doi.org/10.13140/RG.2.1.5120.7129

Hillier D, Pindado J, Queiroz V, d., & Torre, C. d. l. (2011) The impact of country-level corporate governance on research and development. J Int Bus Stud 42(1):76–98

Hoang K et al (2022) Anti-corruption campaign and firm financial performance: evidence from Vietnam firms. Eval Rev 46(2):103–137

Hung C, Vinh T, Thai Binh D (2021) The impact of firm size on the performance of Vietnamese private enterprises: a case study. Probl Perspect Manag 19:243–250. https://doi.org/10.21511/ppm.19(2).2021.20

Huynh TN (2022a) Spatial effects of institutional quality on firm performance: evidence from Vietnam. Asian-Pac Econ Lit 36(2):89–105. https://doi.org/10.1111/apel.12362

Huynh V, Ngoc P, Quyen N (2022) The effect of institutions on productivity spillovers from FDI to domestic firms: evidence in Vietnam. Glob Bus Finance Rev 27(3):28–40. https://doi.org/10.17549/gbfr.2022.27.3.28

Jung J (2020) Institutional quality, FDI, and productivity: a theoretical analysis. Sustainability 12(17):7057

Kandil M (2009) Determinants of institutional quality and their impact on economic growth in the MENA Region. Int J Dev Issues 8:134–167. https://doi.org/10.1108/14468950910997693

Karmani M, Boussaada R (2021) Corporate social responsibility and firm performance: does institutional quality matter? J Appl Acc Res 22(4):641–662. https://doi.org/10.1108/JAAR-07-2020-0153

Karplus VJ, Geissmann T, Zhang D (2021) Institutional complexity, management practices, and firm productivity. World Dev 142:105386

Khai HV, Yabe M (2011) Technical efficiency analysis of ric production in Vietnam. J ISSAAS 17(1):135–146

Lasagni A et al (2015) Firm productivity and institutional quality: evidence from Italian industry. J Reg Sci 55(5):774–800

Loayza NV, Oviedo AM, Serven L (2005) The impact of regulation on growth and informality - cross-country evidence. Policy, Research working paper; no. WPS 3623. World Bank Group, Washington, D.C. http://documents.worldbank.org/curated/en/212041468134383114/The-impact-of-regulation-on-growth-and-informality-cross-country-evidence. Retrieved 1 Mar 2023

Mankiw NG et al (1992) A contribution to the empirics of economic growth. Q J Econ 107(2):407–437

Meeusen W, van den Broeck J (1977) Efficiency estimation from Cobb-Douglas production functions with composed error. Int Econ Rev 18(2):435–444

Miao C, Gast J, Laouiti R, Nakara W (2022) Institutional factors, religiosity, and entrepreneurial activity: a quantitative examination across 85 countries. World Dev 149:105695

Ministry of Planning and Investment (2019) The white book: enterprises in Vietnam. Statistical Publisher, Hanoi

Morrissey O, Udomkerdmongkol M (2016) Response to ‘Institutions, foreign direct investment, and domestic investment: crowding out or crowding in?’ World Dev 88:10–11. https://doi.org/10.1016/j.worlddev.2016.08.001

Newman C et al (2015) Technology transfers, foreign investment and productivity spillovers. Eur Econ Rev 76:168–187

Ngo MN, Nguyen LD (2020) Economic growth, total factor productivity, and institution quality in low-middle income countries in Asia. J Asian Finance Econ Bus 7(7):251–260. https://doi.org/10.13106/JAFEB.2020.VOL7.NO7.251

Nguyen, HQ (2017) Business reforms and total factor productivity in Vietnamese manufacturing. Journal of Asian Economics 51:33–42. https://doi.org/10.1016/j.asieco.2017.06.003

Nguyen TT, van Dijk MA (2012) Corruption, growth, and governance: Private vs. state-owned firms in Vietnam. J Bank Finance 36(11):2935–2948

Nguyen TV et al (2013) Sub-national institutions, firm strategies, and firm performance: A multilevel study of private manufacturing firms in Vietnam. J World Bus 48(1):68–76

Nguyen NA et al (2016) The impact of petty corruption on firm innovation in Vietnam. Crime Law Soc Change 65(4–5):377–394

Nguyen TV, Le NTB, Dinh HLH, Pham HTL (2020) Greasing, rent-seeking bribes and firm growth: Evidence from garment and textile firms in Vietnam. Crime Law Soc Change 74(3):227–243. https://doi.org/10.1007/s10611-020-09893-3

Nifo A, Vecchione G (2014) Do institutions play a role in skilled migration? The Case of Italy. Reg Stud 48(10):1628–1649. https://doi.org/10.1080/00343404.2013.835799

North DC (1990) Institutions, institutional change and economic performance. Cambridge University Press

Nyamah EY, Attatsi PB, Nyamah EY, Opoku RK (2022) Agri-food value chain transparency and firm performance: the role of institutional quality. Prod Manuf Res 10(1):62–88

Ogbuabor J, Onuigbo F, Orji A, Anthony-Orji O (2020) Institutional quality and economic performance in Nigeria: a new evidence. Int J Econ Stat 8:38–49. https://doi.org/10.46300/9103.2020.8.7

Pham HT, Dao TL, Reilly B (2010) Technical efficiency in the Vietnamese manufacturing sector. J Int Dev 22(4):503–520

Pindado J, de Queiroz V, De la Torre C (2015) How do country-level governance characteristics impact the relationship between R & D and firm value? R&D Management 45(5):515–526

Qiu W, Zhang J, Wu H, Irfan M, Ahmad M (2022) The role of innovation investment and institutional quality on green total factor productivity: evidence from 46 countries along the “Belt and Road”. Environ Sci Pollut Res 29:16597–16611. https://doi.org/10.1007/s11356-021-16891-y

Raj R, Sen K (2017) Does institutional quality matter for firm performance? Evidence from India. South Asia Econ J 18(2):184–213

Rodrik D et al (2004) Institutions rule: the primacy of institutions over geography and integration in economic development. J Econ Growth 9:131–165

Roodman D (2009) How to do xtabond2: An introduction to difference and system GMM in Stata. Stand Genom Sci 9(1):86–136

Sobel RS (2008) Testing Baumol: Institutional quality and the productivity of entrepreneurship. J Bus Ventur 23(6):641–655

Song Y, Wang C, Wang Z (2023) Climate risk, institutional quality, and total factor productivity. Technol Forecast Soc Chang 189:122365. https://doi.org/10.1016/j.techfore.2023.122365

Tran TT (2019) Graduate employability: critical perspectives. In reforming vietnamese higher education. Springer. https://doi.org/10.1007/978-981-13-8918-4_6

Tran TB, Grafton RQ, Kompas T (2009) Institutions matter: The case of Vietnam. J Socio-Econ 38(1):1–12

Unin N (2012) Public Institutions are Slow to Change in Teaching and Learning. In: UiTM Sarawak Conference 2012 Proceedings. Presented at the UiTM Sarawak Conference, Perak, Malaysia. Perak, Malaysia. https://doi.org/10.13140/RG.2.2.24531.22566

Urbano D, Aparicio S, Audretsch D (2019) Twenty-five years of research on institutions, entrepreneurship, and economic growth: what has been learned? Small Bus Econ 53(1):21–49

USAID (2021) Provincial Competitiveness Index Report 2021. https://www.pcivietnam.vn/uploads//EN-Bao-cao-dai/2021_PCI_Report_final.pdf. Retrieved 1 Mar 2023

Van Biesebroeck J (2017) How tight is the link between wages and productivity? A survey of the literature. International Labour Organization. https://www.ilo.org/wcmsp5/groups/public/---ed_protect/---protrav/---travail/documents/publication/wcms_410267.pdf. Retrieved 1 Mar 2023

Van Vu H et al (2018) Corruption, types of corruption and firm financial performance: new evidence from a transitional economy. J Bus Ethics 148(4):847–885

VCCI (2020) Vietnam Provincial Competitiveness Index Report. http://pci2018.pcivietnam.vn/uploads/2019/BaoCaoPCI2018_VIE.pdf. Retrieved 1 Mar 2023

Verbeke A, Lee IHI (2021) International business strategy: rethinking the foundations of global corporate success (3rd edition). Cambridge University Press

Vu Q (2021) Political capital, provincial institution, and firm productivity: The case of small and medium sized enterprises in Vietnam. Int J Entrepr 25(5):1–11

Vu Q, Tran TQ (2021) Government financial support and firm productivity in Vietnam. Financ Res Lett 40:101667

Webster R, Andre J (2022) Employability in the digital economy: developing entrepreneurial and creative skills using metacognition to promote 21CL. In: Fifth International Conference on Contemporary Issues in Economics, Management, and Business. Presented at the Conference on Contemporary Issues in Economics, Management, and Business, National Economics University, Hanoi, VN. National Economics University, Hanoi, VN

Wooldridge JM (2009) On estimating firm-level production functions using proxy variables to control for unobservables. Econ Lett 104(3):112–114

World Bank (2017) Vietnam at a crossroads-Engaging in the next generation of global value chains. http://documents.worldbank.org/curated/en/808541488967692813/Vietnam-at-a-crossroads-engaging-in-the-next-generation-of-global-value-chains. Retrieved 1 Mar 2023

World Bank (2020) Improving the performance of higher education in Vietnam: strategic priorities and policy options (No. 148125). World Bank. https://openknowledge.worldbank.org/handle/10986/11872. Retrieved 1 Mar 2023

Zotto CD, Gustafsson V (2008) Human resource management as an entrepreneurial tool? In: Barrett R, Mayson S (eds) International handbook of entrepreneurship and HRM. Edward Elgar Publishing, pp 89–110

Acknowledgements

This research is funded by Vietnam National Foundation for Science and Technology Development (NAFOSTED) under grant number 502.01-2021.67

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest in this research.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Ha, V., Andre, J., Kim, A.T. et al. Total factor productivity and institutional quality in Vietnam: which institutions matter most?. Asia-Pac J Reg Sci 8, 705–736 (2024). https://doi.org/10.1007/s41685-024-00343-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-024-00343-9