Abstract

With rapidly accelerating real estate prices in China, the government has used changes in deed tax rates to affect demand. Tax rates have been increased for buyers of large or multiple homes to discourage speculative demand. We analyze the effects of deed tax rates on real estate prices over the period 2004–2013, estimating traditional dynamic models and dynamic spatial models. Results indicate that deed tax rate increases have a negative effect on pre-tax prices for both residential units and land use rights. Spatial spillover effects are also found in the residential market, with larger effects in the long term.

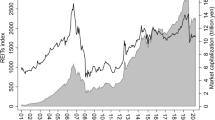

Source: China Statistical Yearbook

Source: Created in Google Geocharts. Data are from China Statistical Yearbook

Similar content being viewed by others

Notes

See Fang et al. (2015) for additional insights on residential real estate price dynamics in China.

Source: "Deed Tax." Taxation in China. Encyclopedia.com. 18 Jul. 2018, http://www.encyclopedia.com. Lower tax rates may be applied to residential real estate units.

Data are obtained from China Statistical Yearbook for each year between 2004 and 2013. The China Statistical Yearbook reports national and regional average selling prices of commercialized buildings. Commercialized building units are buildings, apartments, or any other kinds of real estate units sold at market prices. In this paper, we refer to the market of commercialized building units as the real estate market. The 30 regions do not include Tibet, Hong Kong, Macau and Taiwan.

The economically affordable housing is provided to middle- and low-income families by subsidizing commercial housing purchases or by offering low-rent public (social) housing.

We control for the effects of other policies implemented in Chinese real estate market during the estimation time period by including the regional fixed effects in the empirical analysis. We drop the year fixed effects as none of the year dummy variables are significant in any of the estimations as specified by Eq. (6).

"Deed Tax." Taxation in China. Encyclopedia.com. 18 Jul. 2018, http://www.encyclopedia.com.

In the China Statistical Yearbook, residential units are units used for residential purposes, including villas, apartments, government-owned enterprises staff dormitories, etc.; office-use units refers to units used for administration purposes by enterprises, public institutes, governments, schools, hospitals, etc.; Business-use units are units for commercial use, such as hotels, restaurants, shopping malls, bookstores, gas stations, grocery stores, etc. The statistical yearbook also reports data on real estate units used for other purposes. Given that its sales only constitute about 2% of the total commercialized real estate sold between 2004 and 2013 in China, we do not include real estate units used for other purposes in this paper.

A consequence of our data limitations is that we are unable to conduct an event study, Difference-in-Difference analysis, or regression discontinuity (RD) design.

In reality, it is more likely to be the case that there is a tax at time t − 1 and a change in tax policy at time t. However, introducing different taxes in both previous and current time periods only complicates the mathematical derivation of the results but leads to no difference from the case in which there is no tax in the previous period and the government starts to impose a tax in the current period.

The effect of the tax paid by producers is also analyzed in this model framework. We find that the tax paid by producers has a positive effect on the market price, \( p_{t} \). The market price in this case is the tax-inclusive price as producers take into consideration the tax on them when they establish the market price they charge for the real estate units.

We use provincial-level data as deed tax revenues are not publicly available for a majority of the cities in our sample.

Land space pending for development refers to the area of land with its use rights already approved by authorities and obtained by real estate development companies, but the land development has not started yet.

The statutory deed tax rate ranges from 1 to 5%. Our calculation of the average deed tax rate yields 289 of 300 observations within that range. In the calculation of the rate, the total value of real estate transactions may be biased downward since the total value of real estate transactions does not include transfers of owner-occupied real estate due to data limitations. The bias in total value of real estate transactions may bias the rate upward.

Spatially weighted explanatory variables and spatially autocorrelated error terms were also considered but neither extension proved to be a useful addition to the empirical performance of the dynamic SAR specification.

We also estimated dynamic SAR models using a spectral-normalized weight matrix where each element is divided by the modulus of the largest eigenvalue of the matrix. The results of that estimation are consistent with those reported in Table 4.

For the theory of tax incidence in imperfectly competitive markets, including an explanation of Seade’s E, see Myles (1995, pp. 358–363).

On October 22, 2008, the deed tax rate is lowered from 1.5 to 1% for the individual’s first purchase of a residential real estate unit that does not exceed 90 m2. From 2007 to 2008, the percentage of the unit sales of residential real estate unit that does not exceed 90 m2 was increased from 32 to 42%.

References

Altshuler R, Grubert H, Newlon TS (2000) Has U.S. investment abroad become more sensitive to tax rates? International taxation and multinational activity. University of Chicago Press, Illinois, pp 9–38

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Best MC, Kleven HJ (2015) Housing market responses to transaction taxes: evidence from notches and stimulus in the UK. Working paper

Capozza DR, Green RK, Hendershott PH (1996) Economic effects of fundamental tax reform. Brookings Institution Press, Washington, pp 171–210

Cohen J, Ioannides YM, Thanapisitiku W (2016) Spatial effects and house price dynamics in the USA. J Hous Econ 31:1–13

Dutkowsky DH, Sullivan RS (2014) Exercise taxes, consumer demand, over-shifting, and tax revenue. Public Budg Financ 34(3):111–125

Elhorst JP (2012) Dynamic spatial panels: models, methods, and inferences. J Geogr Syst 14(1):5–28

Fang H, Gu Q, Xiong W, Zhou L-A (2015) Demystifying the Chinese housing boom. In: Eichenbaum M, Parker J (eds) NBER Macroeconomics Annual, vol 30. University of Chicago Press, Illinois, pp 105–166

Hanson AR, Sullivan RS (2009) The incidence of tobacco taxation: evidence from geographic micro-level data. Natl Tax J 62(4):677–698

Kopczuk W, Munroe DJ (2014) Mansion tax: the effect of transfer taxes on the residential real estate market. NBER Working paper

Krantz DP, Weaver RD, Alter TR (1982) Residential property tax capitalization: consistent estimates using micro-level data. Land Econ 58(4):488–496

Kuang W, Ma Y (2010) Property tax, elasticity of supply and demand, and housing price. China Soft Sci 12:27–35

Myles G (1995) Public economics. Cambridge University Press, Cambridge

Myrdal G (1957) Economic theory of underdeveloped regions. Duckworth, London

Nanda A, Yeh J-H (2014) Spatio-temporal diffusion of residential land prices across Taipei regions. SpringPlus 3(1):505–519

Oikarinen E (2004) The diffusion of housing price movements from center to surrounding areas. J Hous Res 15(1):3–28

Poterba J (1984) Tax subsidies to owner-occupied housing: an asset market approach. Q J Econ 99(4):729–752

Slemrod J, Weber C, Shan H (2016) The behavioral response to housing transfer taxes: evidence from a notched change in D.C. policy. Working paper

Sullivan RS, Dutkowsky D (2012) The effect of cigarette taxation on prices: an empirical analysis using local-level data. Public Financ Rev 40(6):687–711

Wang H, Pan A, Zhao W (2014) Empirical investigation on the diffusion of housing prices across space and over time. Econ Rev 2014(4):85–95

Yamarik S (2000) Can tax policy help explain state-level macroeconomic growth? Econ Lett 68(2):211–215

Young DJ, Bielinska-Kwapisz A (2002) Alcohol taxes and beverage prices. Natl Tax J 55(1):57–73

Yu J, de Jong R, Lee L (2008) Quasi-maximum likelihood estimators for spatial dynamic panel data with fixed effects when both n and T are large. J Econom 146(1):118–134

Zhang W (2009) Evaluation of the measures of tax regulation of real estate industry which have been implemented since 2003—based on Poterba’s model. J Hum Inst Humanit Sci Technol 107(2):61–64

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Li, W., Anderson, J.E. & Schmidt, J.R. The effect of deed taxes on real estate prices in China. Asia-Pac J Reg Sci 4, 317–341 (2020). https://doi.org/10.1007/s41685-020-00147-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-020-00147-7