Abstract

Background

Innovative medicines are provided with dedicated funds and immediate market access in Italy. Innovativeness evaluation considers unmet need, added therapeutic value, and quality of the evidence.

Objective

We aimed to evaluate the internal consistency and drivers of the innovativeness appraisal process.

Methods

Appraisal reports on innovativeness refer to 1997–2021. We used both a descriptive approach and probabilistic multivariate analysis, using logistic regression models to compute odds ratios and 95% confidence intervals. The dependent variable is innovativeness status (innovative vs. non-innovative; full innovativeness vs. conditional innovativeness). Explanatory variables, besides the three above-mentioned domains, are the year of evaluation, drug type, target disease and population, and the number and type of available studies.

Results

Among the 141 medicines scrutinized, 31.9%, 29.8%, and 38.3% were evaluated as fully innovative, conditionally innovative, and non-innovative, respectively. Added therapeutic value and the quality of the evidence were associated with the odds of receiving innovative status, and full compared with conditional innovativeness; unmet need was not a predictive variable. Other factors played a minor role: medicines for both solid tumours and rare diseases are more likely to be judged innovative; conditional innovativeness is more probable for medicines for rare diseases.

Conclusions

Innovativeness status is driven by the added therapeutic value and quality of evidence. The appraisal process is internally consistent and predictable. This provides industry with a clear indication of what is needed to ensure that access to their medicines is prioritized.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Criteria to appraise innovativeness (unmet need, added therapeutic value, and quality of the evidence) were introduced in Italy in 2017. Innovative status provides the relevant medicine/indication for some advantages, including a dedicated fund and immediate access to regional markets. |

Our findings show that an innovativeness appraisal is driven by the added therapeutic value and quality of the evidence and that the appraisal process is highly transparent, internally consistent, and predictable. |

A transparent and predictable appraisal process is very important for all stakeholders. In particular, it provides the industry with a clear message that an important added therapeutic value and high quality of evidence are needed to prioritize market access for their products. |

1 Introduction

In Italy, patient access to new medicines is managed by the national Italian Medicines Agency (AIFA) [1] and the 21 individual regional governments. The AIFA evaluates the application for innovativeness status and negotiates with pharmaceutical companies regarding reimbursement, ex-factory price, hidden discounts on prices, and possible Managed Entry Agreements (MEAs). Price and reimbursement (P&R) are simultaneously negotiated by both the company holding the marketing authorization of the new indication and the AIFA. Negotiation is based on a multicriteria approach, including the unmet need, added therapeutic value, cost of comparators, dimension of the target population, cost effectiveness, and the drug and health care budget impact [1]. The AIFA is supported by two committees: the Technical Scientific Committee (CTS) and the Price and Reimbursement Committee (CPR). The former provides scientific support to P&R negotiation, e.g. if the CTS states that the new product is not providing an added therapeutic value, the CPR cannot allow the new products for a premium price. The latter negotiates the P&R with the marketing authorization holder, integrating the scientific evaluation with economic arguments. The P&R Request Form is published on the AIFA’s website [2]. The regions are accountable for health care spending and as such, enact diverse pharmaceutical policies, including cost sharing, formularies, procurement, and actions on prescribing behaviour [3].

Pharmaceutical policy has been strongly influenced by a cost-containment imperative. Spending on medicines is capped: one ceiling is set for drugs used in the retail pharmacy market and another for medicines procured by health authorities. This cost-containment approach has had an important impact on prices [4], time to access [5], and differences across regions in drug availability [6]. Notwithstanding, most drugs are available and covered by the Italian National Health Service, and the formal time to market access in Italy is shorter than in many other European countries [7].

Different actions have been implemented to accelerate access to treatments. Companies may apply for a speedier negotiation process (maximum 100 days) for orphan medicines and drugs used in hospital settings, but in return they must wait for the completion of P&R negotiation to obtain marketing authorization in Italy. Outcome-based MEAs were found to have a positive impact on the penetration rates of cancer medicines [8].

The most recent policy relates to innovative medicines: should a new medicine/indication be recognized as innovative, it is reimbursed through a dedicated fund and is granted immediate access to regional markets. A dedicated fund makes sure that the relevant resources are not diverted from innovative medicines to other expense items. In 2017, two separate funds were approved for cancer and all other medicines [9]. These two funds were merged in a single fund in 2022, to optimize the use of these dedicated resources: the two funds were not communicating vessels and the possible overspending on one of the two could be not compensated by possible underspending on the other. Pharmaceutical companies may apply for innovative status for indications approved by the European Medicines Agency (EMA). In principle, innovativeness status can be appraised by the AIFA without a company’s application, but this has never happened. The applications are appraised by AIFA’s CTS, which can decide for full innovativeness or conditional innovativeness status. The former lasts 3 years and provides for all the above-mentioned advantages (dedicated funds and immediate access to regional markets); conditional innovativeness lasts 18 months and can subsequently be converted into full innovativeness on the grounds of postmarketing data, but confers only the advantage of speedier access to the regional markets. Innovativeness status can be requested only for medicines indicated for serious diseases, i.e., life-threatening diseases, diseases requiring frequent hospitalization, or diseases that provoke disabilities that can seriously compromise quality of life.

In general, the concept of innovativeness is not straightforward. According to the EMA, an innovative medicine is “a medicine that contains an active substance or combination of active substances that has not been authorised before” [10]. A systematic review of the literature regarding dimensions included in the definitions of innovative medicines suggested that the novelty of an active substance is only the third most quoted domain and is not rewarded by Health Technology Assessment (HTA) bodies, whereas the therapeutic benefit provided by a new product and the absence of therapeutic alternatives are the most frequently cited attributes of an innovative medicine [11].

In Italy, the criteria introduced in 2017 to appraise innovativeness are in alignment with those most often cited in the literature, including unmet need, added therapeutic value, and quality of the evidence provided [12, 13]. Unmet need and added therapeutic value are ranked using a five-level scale (maximum, important, moderate, poor and absent) [14]. The quality of the evidence is ranked through a four-level scale (high, moderate, low, very low), known as the Grading of Recommendations, Assessment, Development, and Evaluation (GRADE) method [15]. Innovativeness status can be attributed to medicines/indications showing a maximum or important unmet need, added therapeutic value, and high quality of evidence, whereas innovativeness status cannot be awarded in the case of a poor/absent unmet need and added therapeutic value and low or very low quality of evidence. The only exception is represented by drugs for rare diseases, where innovativeness can be attributed even in the case of low quality of evidence, provided that a maximum or important unmet need and added therapeutic value are awarded [12].

Added therapeutic value should be demonstrated by validated clinical endpoints. Other advantages, such as higher patient convenience (e.g., due to a more manageable route of administration), are not considered and would result in scarce added therapeutic value for the relevant indication. Overall survival is quoted as the gold standard for cancer medicines; the use of surrogate endpoints should be justified.

Appraisal documents on innovativeness by the CTS do not have a direct impact on P&R negotiation. Notwithstanding, they are published on the AIFA website [16] once the P&R negotiation process is finalized. These documents illustrate the score assigned to the three criteria, the evidence considered, the rationale behind this score, and the final decision (full innovativeness vs. conditional innovativeness vs. no innovativeness) made by the CTS. The innovativeness appraisal is the most transparent evaluation conducted by the AIFA, whereas documents supporting the P&R negotiation are very rarely available in the public domain: only four ‘Report Tecnico-Scientifici’ (Technical Scientific Reports) have been published to date, and they all refer to advanced therapy medicinal products [17].

The availability of innovativeness documents may allow for analysing the determinants of innovativeness, i.e., which of the three criteria is the most important driver and whether variables other than the three above-mentioned criteria have influenced the appraisal process.

Our research aimed at investigating, on a large number of appraisal documents and using for the first time probabilistic multivariate analysis, the internal consistency and drivers of the innovativeness appraisal process.

2 Methods

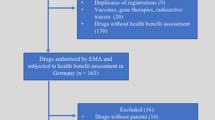

AIFA’s appraisal reports on innovativeness were retrieved from the relevant website [16]. We extracted the information for data analyses, as described elsewhere [12]. In brief, appraisal reports on innovativeness were downloaded from the AIFA website on 31 March 2022, for a total of 141 unique appraisal indication-specific reports. As mentioned, the innovativeness status is appraised per indication.

Descriptive analyses were conducted in order to investigate the impact of the three domains on the final decision regarding drug innovativeness. Categorical data were summarized as numbers (n) and percentages (%), and continuous variables were summarized as mean and median values, standard deviations (SD), and interquartile ranges. The association between categorical variables was assessed using the Chi-square or Fisher’s exact tests, when appropriate, while continuous variables were analysed using one-way analysis of variance or the corresponding non-parametric Kruskal–Wallis test. Associations were also quantified by computing multivariate odds ratios (ORs) of innovativeness (vs. non-innovativeness) and full innovativeness (vs. conditional innovativeness), with the corresponding 95% confidence intervals (CIs), through multiple logistic regression models, including variables for period of evaluation (2017–2018, 2019, or 2020–2021), type of drug (orphan vs. non-orphan drug), disease involved (rare vs. non-rare [18]; solid tumour vs. haematologic tumour vs. non-oncological condition), patient population (adults vs. paediatric or mixed), number of available studies (1 vs. >1), and in turn, the three domains of unmet need, added therapeutic value, and quality of clinical evidence (GRADE evaluation). The orphan designation of the medicine and disease rarity were included since they are explicitly mentioned as cases where a high rank for the quality of the evidence is very unlikely [12]. Due to the relatively small sample, multinomial logistic regression was not performed. A two-sided p-value <0.05 was considered statistically significant. Data analyses were conducted using SAS version 9.4 statistical software (SAS Institute, Inc., Cary, NC, USA).

3 Results

Overall, of 141 published drug reports, 45 (31.9%) were evaluated as fully innovative, 42 (29.8%) as conditionally innovative, and 54 (38.3%) as not innovative (Fig. 1).

Table 1 reports the frequency distribution of selected variables according to the final decision on drug innovativeness. The period of drug evaluations ranged between 2017 and 2021, with the largest number of evaluations conducted during 2019 (n = 37, 26.2%). Slightly more than half of the indications examined were related to rare diseases (51.8%); approximately 56% targeted oncological diseases (35.5% for solid tumours plus 20.6% for haematologic cancers). The target population of the drugs was solely adults in 109 reports (77.3%). Most drug reports were based on efficacy evidence from a single study (79.4%). With reference to comparisons between subgroups defined according to the final decision on drug innovativeness, medicines/indications evaluated as conditionally innovative were more frequently focused on drugs for rare diseases (71.4%) than those evaluated as fully innovative (53.5%) and not innovative (35.2%; p = 0.002). Medicines/indications evaluated as fully innovative were more frequently observed for a paediatric or mixed paediatric/adult population (37.8%) than those evaluated as conditionally innovative (19.0%) and not innovative (13.0%; p = 0.01).

Table 2 shows the distribution of evaluations for each of the three domains according to the final decision on drug innovativeness. Overall, as regard to unmet need, 9.9% of drug appraisal documents reported an evaluation of maximum need and 36.9% important need, whereas only 3.6% were assessed as little need and none as no need. With reference to the added therapeutic value, 0.7% of drugs were evaluated as maximum and 29.6% as important added value. In most instances, the unmet need (49.6%) and added therapeutic value (41.5%) were evaluated as moderate. The quality of clinical evidence using the GRADE scale was high in 14.2% of drug reports, moderate in 51.1%, low in 26.2%, and very low in 8.5% of drug reports. An association emerged between the evaluations for each domain and the final decision on drug innovativeness, with higher assessments of unmet need (p = 0.03), added therapeutic value (p < 0.001), and quality of evidence (GRADE; p = 0.03) in the subgroups of drug reports evaluated as fully or conditionally innovative.

Table 3 reports on multivariate results for the association between various factors, including the evaluations reported for each domain and the final decision on innovativeness, as well as full innovativeness (as compared with conditional innovativeness). Factors associated with evaluation as an innovative drug were rare disease (OR 5.41, 95% CI 1.81–16.16, for rare compared with non-rare disease) and type of disease (OR 3.54, 95% CI 1.24–10.12, for solid tumours compared with the reference non-oncologic disease). On the other hand, an inverse association emerged between rare disease designation and an evaluation of fully innovative versus conditionally innovative drugs (OR 0.22, 95% CI 0.05–0.90). In a separate analysis, we calculated the multivariate ORs for orphan drug designation versus non-orphan drug (by excluding the rare disease designation in the multivariate model, due to multicollinearity between these two covariates). We found that orphan drug designation was not associated with drug innovativeness (OR 1.72, 95% CI 0.68–4.30) or with an evaluation of fully innovative drug (OR 1.44, 95% CI 0.50–4.12).

A higher level evaluation in the added therapeutic value domain (OR 205.3, 95% CI 20.4–∞, for a continuous improvement of 1 level of evaluation) and in the GRADE evaluation domain (OR 3.00, 95% CI 1.63–5.53, for a continuous improvement of 1 level of evaluation) were also associated with the odds of receiving a final assessment of innovative drug. The domains of added therapeutic value (OR = ∞) and GRADE evaluation (OR 2.85, 95% CI 1.23–6.58) were associated with the final assessment of fully innovative drug, whereas the unmet need domain was not (OR 1.06, 95% CI 0.49–2.28). When we performed the analyses without adjusting for the number of studies, which could present some overlap with the GRADE evaluation domain, results were materially unchanged (i.e., the OR of innovative vs. non-innovative status for ‘quality of clinical evidence’ varied from 3.00 in the original analysis to 2.98 in the new analysis; the OR of fully innovative vs. conditionally innovative status for ‘quality of clinical evidence’ varied from 2.85 in the original analysis to 2.83 in the new analysis).

4 Discussion

To the best of our knowledge, our study is the most updated analysis on AIFA innovativeness status appraisals (based on 141 documents), quantitatively addressing the role of various covariates on the final decision of whether a drug is deemed innovative. For the first time, this analysis has introduced a multivariate probabilistic approach.

Our main findings are that the added therapeutic value and the quality of the evidence (GRADE evaluation) are the main determinants of both innovativeness status and full innovativeness versus conditional innovativeness. The unmet need is significantly higher for medicines that receive innovative status, but this does not seem to contribute to a positive evaluation of innovativeness. Other possible explanatory variables play a very limited role in influencing the appraisal process: solid tumours and rare disease designation are positively associated with a higher probability of receiving innovativeness status, while only rare disease designation had an (inverse) impact on obtaining full versus conditional innovativeness. In fact, a rare indication is more likely to receive innovativeness status, but conditional innovativeness is significantly more likely than full innovativeness. This was independent of the quality of clinical evidence that was adjusted for in the multivariable model. It is possible that data are still too sparse to model this issue or that residual confounding played a role. The issue therefore remains open to discussion.

Two papers have recently been published on this topic [13, 14]. Findings in these papers, in alignment with ours, showed that added therapeutic value is the most influential parameter, followed by GRADE evaluation, and that variables other than the criteria used for these appraisals do not influence decisions taken by AIFA’s CTS. In these two papers, the key drivers of drug innovativeness appraisal were scrutinized using a deterministic [13] and probabilistic [14] approach. The deterministic decision tree had several methodological limitations, since the model did not fit all the decisions taken. The probabilistic analysis was able to rely on a greater number of appraisal documents. However, the authors did not estimate ORs, and the set of potential explanatory variables other than the three criteria was limited (i.e., oncological or orphan drug). We overcome these limitations by performing a multivariate analysis. We simultaneously took into account a number of covariates potentially associated with AIFA decisions, such as period of assessment, rare disease designation (or alternatively orphan drug designation), type of disease (solid tumour, haematologic tumour, or non-oncological disease), target population, total number of studies in support, and domain of innovativeness. We quantitatively estimated the odds of receiving an evaluation of innovativeness versus non-innovativeness and full innovativeness versus conditional innovativeness, according to the above-mentioned factors considered together.

In other countries, unmet need, added therapeutic value, and quality of the evidence are used to make decisions on P&R. However, evaluation of the innovativeness status with an impact on access is lacking, unlike Italy’s policy of a dedicated fund and immediate access at the local level for innovative medicines. Hence, our findings are not comparable with other studies. For example, recent studies have highlighted that (1) in France the actual correlation between the added therapeutic value of cancer medicines and the price is low, even if statistically significant, and there is no correlation between the added benefit and price increases over comparators [19]; and (2) in Germany the annual treatment cost (net of discount) increment of new drugs over the comparator(s) is much higher when a considerable added benefit is acknowledged [20].

Limitations of this analysis are similar to our previous investigation [13]. However, the higher number of innovativeness appraisals available to date allowed us to fit multivariate logistic regression models for binary variables (i.e., innovative vs. non-innovative, and fully innovative vs. conditionally innovative). Multinomial analysis including all three evaluations together would be more appropriate but was not practicable with the current numbers of observations due to limits in the interpretation of the results and fitness of the model. Given the distribution of evaluations in the added therapeutic value domain, the OR was not estimable for the fully versus conditionally innovative model (OR = ∞). However, this gives further strength to the phenomenon interpretation; in fact, an added therapeutic value judgement of important or maximum for a drug almost always (40/41 times) resulted in a final evaluation of fully innovative, whereas all evaluations of conditionally innovative status were polarized around a judgement of ‘moderate’ for added therapeutic value.

In brief, our analysis shows that AIFA’s CTS mainly relies on two of the three criteria (added therapeutic value and quality of the evidence) to provide for innovativeness status and full versus conditional innovativeness. The third domain (unmet need) and other possible explanatory variables are either less relevant or not relevant. This, along with the publication of the innovativeness appraisal document, makes the process internally consistent and predictable since factors other than the core domains do not greatly influence the appraisal process. Internal consistency and predictability do not mean that the CTS appraisal is always aligned with industry’s expectations. In fact, 38% of requests were rejected since the actual score was not aligned with industry’s expectations to get innovativeness status. This means that if industry and CTS evaluations were aligned in terms of added therapeutic value and quality of the evidence, there would be no confounding factors that would make the appraisal diverge from that expected by the industry.

Another interesting finding of our research is that medicines for rare diseases are more likely to be evaluated as conditionally innovative. This result was expected. Medicines for rare diseases are often approved with a great deal of uncertainty as to the dimension and durability of their effects. This uncertainty may have influenced the CTS to decide for conditional innovativeness status, since data from registrational studies are not sufficiently mature to opt for full innovativeness. Furthermore, many drugs for rare diseases are conditionally approved, which requires subsequent real-world data collection that may strengthen the evidence that was provided at market launch. The higher probability of obtaining innovative status for solid tumours is less straightforward. The possible reason why medicines for solid tumours are more likely to receive innovativeness status could be that the surrogacy of the relevant endpoints has been more validated [21].

The introduction in 2017 of a structured process for the appraisal of innovativeness represented a step forward towards a higher level of transparency, which might also benefit the P&R negotiation. Italian legislation has officially stated that a premium price over the comparator(s) can be awarded to medicines that provide added therapeutic value [22]. However, the manner in which the level of added therapeutic value is converted into a premium price is still unknown. A more structured regulatory framework that rewards value through a premium price on the one side and enhances price competition for interchangeable products on the other would be very useful to efficiently allocate the available resources for health care.

5 Conclusions

This paper investigated the role played by three domains (unmet need, added therapeutic value, and quality of the evidence) compared with other variables (period of evaluation, target disease and population, rare disease designation, number and phase of studies, and randomized controlled trials supporting the application for innovative status) in driving the appraisal of innovativeness status for medicines in Italy. Our findings show that the appraisal process is (1) driven by the added therapeutic value and quality of the evidence and that other factors play a minor role; and (2) highly transparent, internally consistent, and predictable. Despite the fact that there is no perfect alignment between the industry’s expectations and the CTS final appraisals, transparency and predictability are very important to provide industry with a clear message on what medicines are prioritized in terms of access, since full innovativeness status provides immediate access at the regional level and coverage through a dedicated fund for the relevant medicine/indication. Our wish is that the predictability of the appraisal of innovative status will be expanded to P&R negotiation.

References

Jommi C, Minghetti P. Pharmaceutical pricing policies in Italy. In: Babar ZU, editor. Pharmaceutical prices in the 21st Century. London: Springer; 2015.

Italian Medicines Agency (AIFA). Linee guida per la compilazione del dossier a supporto della domanda di rimborsabilità e prezzo di un medicinale ai sensi del d.m. 2 agosto 2019. Versione 1.0 – 2020. Available at: https://www.aifa.gov.it/documents/20142/1283800/Linee_guida_dossier_domanda_rimborsabilita.pdf. Accessed 22 Nov 2022.

Jommi C, Costa E, Michelon A, et al. Multi-tier drugs assessment in a decentralised health care system. The Italian case-study. Health Policy. 2013;112(3):241–7.

Villa F, Tutone M, Altamura G, et al. Determinants of price negotiations for new drugs. The experience of the Italian Medicine Agency. Health Policy. 2019;123(6):595–600.

Lidonnici D, Ronco V, Isernia M, et al. Tempi di accesso dei farmaci nel periodo 2015–2017: analisi delle tempistiche di valutazione dell’Agenzia Italiana del Farmaco. Glob Reg Health Technol Assess. 2018;2018:1–9.

Prada M, Ruggeri M, Sansone C, et al. Timeline of authorization and reimbursement for oncology drugs in italy in the last 3 years. Med Access Point Care. 2017;1(1):e29–36.

EFPIA Patients W.A.I.T. Indicator 2021 Survey. Available at: www.efpia.eu/media/676539/efpia-patient-wait-indicator_update-july-2022_final.pdf. Accessed 25 Aug 2022.

Russo P, Mennini FS, Siviero PD, Rasi G. Time to market and patient access to new oncology products in Italy: a multistep pathway from European context to regional health care providers. Ann Oncol. 2010;21(10):2081–7.

Jommi C, Armeni P, Bertolani A, Costa F, Otto M. Il futuro dei Fondi per Farmaci Innovativi: risultati di uno studio basato su Delphi panel. Glob Reg Health Technol Assess. 2021;8(1):22–8.

EMA. Innovative Medicine. Available at: https://www.ema.europa.eu/en/glossary/innovative-medicine. Accessed 24 Aug 2022.

de Solà-Morales O, Cunningham D, Flume M, Overton PM, Shalet N, Capri S. Defining innovation with respect to new medicines: a systematic review from a payer perspective. Int J Technol Assess Health Care. 2018;34(3):224–40.

AIFA. Annex 1 - Criteria for the evaluation of innovation, Annex AIFA resolution no. 1535/2017. Available at: https://www.aifa.gov.it/en/farmaci-innovativi. Accessed 15 Jul 2022.

Galeone C, Bruzzi P, Jommi C. Key drivers of innovativeness appraisal for medicines: the Italian experience after the adoption of the new ranking system. BMJ Open. 2021;11(1): e041259.

Fortinguerra F, Perna S, Marini R, et al. The assessment of the innovativeness of a new medicine in Italy. Front Med. 2021;8(1): 793640.

Atkins D, Best D, Briss PA, et al. Grading quality of evidence and strength of recommendations. BMJ. 2004;328(7454):1490–4.

AIFA. Farmaci innovativi. Available at: https://www.aifa.gov.it/farmaci-innovativi. Accessed 24 Aug 2022.

AIFA. Report tecnico-scientifici per specialità medicinale. Available at: https://www.aifa.gov.it/report-tecnico-scientifici. Accessed 24 Aug 2022.

ORPHANET. Search for an orphan drug. Available at: https://www.orpha.net/consor4.01/www/cgi-bin/Drugs.php?lng=EN. Accessed 4 Jul 2022.

Rodwin MA, Mancini J, Duran S, et al. The use of “added benefit” to determine the price of new anti-cancer drugs in France, 2004–2017. Eur J Cancer. 2021;145(1):11–8.

Lauenroth VD, Stargardt T. Pharmaceutical pricing in Germany: How is value determined within the scope of AMNOG? Value Health. 2017;20(7):927–35.

Ciani O, Davis S, Tappenden P, et al. Validation of surrogate endpoints in advanced solid tumors: systematic review of statistical methods, results, and implications for policy makers. Int J Technol Assess Health Care. 2014;30(3):312–24.

Ministero della Salute. Decreto 2 agosto 2019. Criteri e modalità con cui l'Agenzia italiana del farmaco determina, mediante negoziazione, i prezzi dei farmaci rimborsati dal Servizio sanitario nazionale. Available at: https://www.gazzettaufficiale.it/eli/id/2020/07/24/20A03810/sg.

Acknowledgements

Editorial assistance (revision of the English text) was provided by Helen Banks (Cergas Bocconi, Milan, Italy).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

This research has been funded by an unrestricted grant from MSD to Cergas Bocconi, through the MSD Oncology Policy Grant Program.

Conflicts of interest

Claudio Jommi has reported that Cergas Bocconi received grants from MSD to conduct this study. Claudio Jommi has served as an advisory board member and paid speaker for Amgen, Astrazeneca, BMS, CSL Behring, Gilead, Incyte, MSD, Roche, Sanofi, and Takeda outside the submitted work. Carlotta Galeone has served as an advisory board member for Incyte outside the submitted work.

Role of the funder/sponsor

The funder had no role in the design and conduct of the study; collection, management, analysis, and interpretation of the data; preparation, review, or approval of the manuscript; and decision to submit the manuscript for publication.

Data availability statement

Data used in this paper are available on AIFA’s website (https://www.aifa.gov.it/farmaci-innovativi). The database created on the grounds of the available data is available on request.

Ethics approval, Consent to participate, Consent for publication, Code availability

Not applicable.

Author contributions

Concept and design: CG, CJ. Acquisition of data: CG. Analysis and interpretation of data: CG, CJ. Drafting of the manuscript: CG, CJ. Obtaining funding: CJ. Administrative, technical, or logistic support: Not needed. Supervision: CJ.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Jommi, C., Galeone, C. The Evaluation of Drug Innovativeness in Italy: Key Determinants and Internal Consistency. PharmacoEconomics Open 7, 373–381 (2023). https://doi.org/10.1007/s41669-023-00393-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41669-023-00393-3