Abstract

Crypto assets have lately become the chief interest of investors around the world. The excitement around, along with the promise of the nascent technology led to enormous speculation by impulsive investors. Despite a shaky understanding of the backbone technology, the price mechanism, and the business model, investors’ risk appetites pushed crypto market values to record highs. In addition, pricings are largely based on the perception of the market, making crypto assets naturally embedded with extreme volatility. Perhaps unsurprisingly, the new asset class has become an integral part of the investor’s portfolio, which traditionally consists of stock, commodities, forex, or any type of derivative. Therefore, it is critical to unearth possible connections between crypto currencies and traditional asset classes, scrutinizing correlational upheavals. Numerous research studies have focused on connectedness issues among the stock market, commodities, or other traditional asset classes. Scant attention has been paid, however, to similar issues when cryptos join the mix. We fill this void by studying the connectedness of the two biggest crypto assets to the stock market, both in terms of returns and volatility, through the Diebold Francis spillover model. In addition, through a novel bidirectional algorithm that is gaining currency in statistical inference, we locate times around which the nature of such connectedness alters. Subsequently, using Hausdorff-type metrics on such estimated changes, we cluster spillover patterns to describe changes in the dependencies between which two assets are evidenced to correlate with those between which other two. Creating an induced network from the cluster, we highlight which specific dependencies function as crucial hubs, how the impacts of drastic changes such as COVID-19 ripple through the networks—the Rings of Fire—of spillover dependencies.

Similar content being viewed by others

Introduction

The crypto market is fascinating: one tweet from Elon Musk can drive prices to their peaks. On the other hand, a piece of news about China’s reluctance to adopt the asset—a negative sentiment—can push down the prices. To some extent, it is true that every investment depends on the market sentiment. Crypto assets, however, take this trepidation to a new level, promoting extreme volatility—something many investors are prone to overlook. The market size of crypto assets stands at a whopping $913.73B, nearing silver's $1.4 trillion, Amazon’s and Google’s $1.7 trillion, and gold’s $12.3 trillion. Though its market size, currently, remains comparatively smaller, the crypto class skyrocketed to such size faster than any asset ever introduced.

Parallelly, the crypto market is suffering from the concentration risk. As of February 2022, Statista recorded that there are nearly over 10,000 digital coins—a massive increase from just a handful of coins in 2013 (Statista 2022a, b). However, Bitcoin has 43% share and Ethereum has 15%, so that 58% share are held by the two most popular coins (Coinmarketcap 2022). Due to this concentration, we are using Bitcoin and Ethereum to represent crypto assets in the research. In keeping with the overall market behavior, those two most popular crypto assets exhibit extreme volatilities. The price swing can reach 50% in one instance of price decrease or increase (Coinmarketcap 2022). Such roller-coaster movements can be detrimental to the overall portfolio of retail and institutional investors, and furthermore, when the connection between the crypto and the stock market is strong, a crash in the former can trigger a crash in the traditional financial system. The situation would not be unlike, what happened, quite analogously, during the 2008 financial crisis, when the banking system collapse spelled doom for the stock market. Either for assessing the relation to financial stability or as a references for international investor, who focus on diversified portfolio (Chemkha 2021), we think that it is vital to quantify the connectedness between crypto assets and the stock market.

In this work, we will characterize the connectedness between the crypto asset class and the stock market, over time. To represent the stock market, we will use the world’s major stock indices. This is because financial crisis contagion could arise from any country, such as Thailand in the Asian crisis, Greece in the European crisis, or the US in the 2008 global financial crisis. We will conduct large-scale explorations with indices of 29 major countries, representing 29 major economies.

Furthermore, the time varying effect of significant shock to the crypto asset also has been studied by many researchers. One study points out that crypto is highly affected by global health crisis, which is Covid 19 pandemic, and provides evidence that market efficiency is time varying Naeem and Karim 2021). More along these lines can be found in BBC (2022), Bloomberg (2022), Coin Telegraph (2022), Trending Topics (2022).

In contrast, there is another study that point a stability of crypto. The study illustrates that the informational efficiency of cryptocurrencies (Bitcoin, BNB, Cardano, Ethereum and XRP) has successfully withstood the shocks of the COVID-19 outbreak (Fernandes 2022). This is a controversial study because the argument is clearly on the other side of the table compared to most of crypto studies.

This large-scale study will create a large collection of spillover patterns (the notion will be recalled in section 3). In this study, we have 409 spillover sequences, each describing the interaction between a pair of assets. Through these 409 combinations, we will track the evolving nature of the dependencies, and detect the change-points (defined in section 3) for each combination.

Our key contributions will be revealed alongside our analysis in three stages. In the first, we will evaluate, through spillovers for both return and volatilities, the relationship between pairs of assets at a fixed snapshot in time. In the second, we will investigate the evolution of the connectedness over time, through spillovers of the rolling window type (recalled in section 3). A study of such scale, involving such diverse assets, is non-existent in the literature. In the last, we implement certain accurate statistical tests to pinpoint positions on these daily time series at which the flow underwent structural shifts. Frequently, as we will find, they correspond to times of economic or social turmoil, such as the ones around COVID-19-related stress. We measure the closeness of such breakpoints across pairs of such spillover sequences and cluster these dependence patterns to highlight changes in the dependencies between which two assets are evidenced to correlate with those between which other two. This enables investors, regulators, and market participants to identify certain collections of spillover patterns which undergo changes at similar times instigating questions on whether changes in the relationship between one pair of assets immediately bring about changes in the relationship between some other two, similar to volcanoes in the Pacific Ring of Fire erupting in unison.

Literature review

Since crypto’s inclusion as a lucrative tool for portfolio diversification, there emerged a huge interest to study this asset’s relationship with others, and its behavior. Corbet et al. (2018) found that the crypto asset is highly connected in its own asset class. Furthermore, they showed that crypto’s volatility is isolated in its own asset class, and to hedge value for crypto will be hard. They use different asset classes such as stock indices, bonds, and commodities, with specific focus on the stock indices such as the SP500 and the VIX. In this work, the diversity of the asset class is limited to only 3 (three) cryptos, 2 (two) stocks, 1 (one) exchange rate, and 2 (two) commodities. In our research, as a pivotal first step, we enlarge this set substantially, generalizing it to cover 29 major countries, to impart a deeper impact.

In the realm of more stock-focused research, Gil-Alana et al. (2020) confirms the lack of connectedness between crypto-assets and traditional asset classes. Using cointegration, they found no evidence of intra-cointegration between crypto asset class and inter-cointegration to other asset classes. However, because of the lack of connectedness, they argue that investors could utilize crypto as a hedging tool for other asset classes. Despite adding more individual cryptos such as Bitcoin, Ethereum, Litecoin, Ripple, Stellar, and Tether, the study, dealing only in Bond, Dollar, Gold, GSCI, S&P, and VIX, still lacks a broader representation of stock indices. We could argue that the US stock market could be a tentative representation of the world stock market. Nevertheless, in order to quantify the general connectedness between the crypto and the stock market, such assumptions merit closer scrutiny. Our analyses, inviting several developed and developing countries, are not tethered to such beliefs.

In another study, researchers reveal structural change in the connectedness evolving in 2020 as the market restructures in reaction to the unprecedented monetary injections as a counter to the COVID-19-induced economic standstill. The structural change is shown not only for cryptocurrencies considered separately but also when we jointly examine them with traditional assets (Kumar 2022).

Iyer (2022), in its IMF research, takes one step further by separating the emerging markets from advanced economies and analyzing both over time. This study found an increasing trajectory of interconnectedness between crypto-assets and equity assets. The study, crucially, lets time flow, in stark contrast with the previous study that only investigates a fixed snapshot in time. In our study, we aim to tread a similar temporal path, with upped complexity, laying emphasis on crucial highlights along the way. Furthermore, this IMF study also used a limited range of stock indices such as S&P500 and Russell 2000. As elaborated before, we believe every country should lend a voice in the analysis of the connection. This, among other reasons, is because global financial shocks could originate from any country and usually, smaller countries like Bolivia and Venezuela are more intertwined with the crypto world.

Through research specific to Africa, Kumah and Odei-Mensah (2021) show how an investor can integrate cryptos into his portfolio as a diversifying asset. They also found that there exists a weak integration between the African stock market and crypto-assets. While most studies found varying degrees of weak connection, in Australia, Frankovic et al. (2021) found stronger integration for CLS (cryptocurrency-linked stocks). They argue that a company’s stock, which has a public business relation with crypto, will have a significant unidirectional return spillover. They found substantial spillover effects among companies that have a large business exposure to the blockchain technology. However, it is common knowledge that crypto and stock markets are highly dependent on an investor’s confidence. If a global negative sentiment rises, a connection may become vivid. This phenomenon is studied by Caferra (2022). They found, by using Rényi Transfer Entropy, that sentiments heavily influence the movements in the market for stock and crypto-asset classes. This could explain why both asset classes converge in period of crisis.

In their extensive statistical analysis of the cryptocurrency market, Wątorek (2021) unveils a transformative evolution from an initial phase of weak connections (safe haven/portfolio diversification) towards a more mature market state (traditional financial asset). Employing a spectrum of correlation techniques, the study unveils the reasons that underpinning the different outcomes in prior research, which point a different conclusion differing between a strong and weak connection. In general, the cause is a different “phase of transition” of the crypto market. When the crypto are embraced as a hedge or a means of diversification, the statistic will signal a weak connection, which interpreted as the earlier stage of the market. Conversely, A strong correlation will show up when the crypto is viewed as a more normal asset, which interpreted as the mature stage. Indirectly, the conclusion further reinforces our hypothesis that crypto is mainly driven by investor sentiment.

The notion of the crypto market evolution also showed by a study that point out the co-movement between Bitcoin and S&P500, which argue as moment-dependent and varies across time and frequency. The study points out that there is very weak or even nonexistent connection between the two markets before 2018. Starting 2018, but mostly 2019 onwards, the interconnections emerge. The co-movements between the volatility of Bitcoin and S&P500 intensified around the COVID-19 outbreak, especially at mid-term scales (Bouri 2022). Furthermore, by employing multivariate transfer entropy, García-Medina (2020) arrives at a similar insight, suggesting that during periods of economic turbulence, the cryptocurrency market experiencing more interconnectedness.

In the crypto connectedness research above, Corbet et al. (2018), Frankovic et al. (2021), Iyer (2022), are using spillovers examined by Diebold and Yilmaz (2012). The model exploits generalized vector autoregression to reveal the forecast-error variance decomposition which is used subsequently to calculate gross and net directional spillovers. The advantage of the model is that it does not depend on the variable ordering—an improvement over Diebold and Yilmaz (2009). In addition, the model, through its rolling-window version, tracks dynamic spillovers over time, which will become the main objects of our change-point and cluster analysis.

We will begin this research with grand “to” and “from” spillovers over the entire period under study. This is in line with the common thread of spillover research outlined above; our key contribution at this initial stage will be Tables 4 and 5, where countries never examined before will be brought in. In addition, we will next investigate spillover movements over time, using Diebold and Yilmaz (2012)’s rolling-window offering. This analysis will enrich the study through the reported trajectory and the swings of the spillover movements. Symitsi and Chalvatzis (2018) found the difference between the short-term and long-term spillovers between bitcoin and an energy/technology company. They showed that, in the short term, the giver of spillover is the energy and technology company while, in the long term, bitcoin’s volatility acts as spillover giver to the energy and technology company.

To estimate volatilities over different regimes, a researcher can use sequential Monte Carlo to implement GARCH and EGARCH-based volatility models with an unknown number of change-points. Yümlü et al. (2015) argue that multiple regime-switching state space models can be useful in comparison to fitting a global and single GARCH or EGARCH model. Other studies utilize structural breaks in the crypto and equity market to investigate optimal trading strategies for cryptocurrencies and equities. James (2022) uses cluster analysis and argues that the techniques can identify sub-groups in each market. Furthermore, the structural breaks in the equity sector are demonstrated to be more uniform than those in the crypto market.

These structural breaks—defined fully in the next section—will play an important role in this research. Telli and Chen (2020) point out that their existence in the crypto market. They show how break characteristics differ between return and volatility sequences. Price quotes matter too: series, they found, quoted in BTC remained break-free. In addition, the study also found that the period of volatility is longer for series quoted in USD than those in BTC.

In this study, after we find the change points for the return and volatility spillover using a more accurate tool, we will produce a network diagram to highlight the grouping tendency of each spillover movement, with respect to those changes. In other research, without regards to such change-points, Lorenzo and Arroyo (2022) used three different partitional clustering algorithm to show that the crypto market typically segmented with a few clusters. With our larger dataset, myriad spillover combinations (crypto to crypto, stock to stock, and crypto to stock), and a more pointed intention (proximity of change-points as our guiding goal), we offer a much more revealing and a much more refined network study).

Beirne et al. (2009) study the spillover patterns between mature and younger stock markets in various countries and found older stock markets gave some degree of spillovers to the emerging ones. A network analysis, was however, avoided.

We reaffirm the three key ways in which our current research contributes to the existing literature. First, we examine a large data set involving 29 major stock markets sampled throughout the world, each representing the corresponding region, and the two biggest crypto assets: Bitcoin and Ethereum. An inclusion as thorough as this has never been done before and is, understandably, both timely and urgent. We summarize their possible dependencies through grand spillovers calculated over the entire study period. Next, we monitor the temporal flow of the connectedness with spillovers of the rolling window type and detect points at which the ongoing spillover nature fluctuates drastically. Researchers can probe deeper into the causes of which these change-points are effects; we highlight a few glaring ones. Lastly, we measure the closeness of such breakpoints across pairs of such spillover sequences and cluster these dependence patterns to describe changes in the dependencies between which two assets are evidenced to correlate with those between which other two. We offer networks induced from that cluster and calculate graph statistics (such as the various kinds of centrality) to discover which changes in relationships control general shock transference, be it inter- or intra-market.

Data and methodology

Data

In this study, due to reasons mentioned before, we used Bitcoin and Ethereum to represent crypto assets, along with 27 major stock indices in countries such as (Table 1).

The crypto sample for this study are Bitcoin (hereafter BTC) and Ethereum (hereafter ETH). The period studied is recent: from 15 November 2017 to 17 May 2022, and it includes multiple world global financial events such as the economic boom, pandemic, economic crisis, subsequent recovery and the Russia-Ukraine Conflict.

Methodology

In this section, we recall the concept of spillover—the tool through which we will examine the interplay between two assets, and certain change-detection algorithms—the exact ways in which we will pinpoint locations of radical shifts in such relationships.

Directional and net spillovers

We exploit the robust framework examined by Diebold and Yilmaz (2012) to calculate spillover from the return and historical volatility sequences. The return Rt is found as:

where

and the for the historical volatility, we modified the framework from Torun and Aksanu (2011), as follows:

where

Next, we calculate the weekly standard deviation from the daily data:

where

And finally:

where H\({ }_{i}\) is the historical volatility and\(\sqrt{T}=number\,of\,trading\,days\,in\,one\,year\,(252)\).

We feed the resulting data into the following steps to calculate the DY spillover index. The index focuses on directional spillovers in a generalized Vector Autoregressive (VAR) with a covariance stationary N-variable VAR(p) as follows:

We consider a covariance stationary N-variable VAR(p),

In a stationary N variable, a value of x at point t can be determine by the sum of the influence, which are the last lagged variable (Xt-1) multiple by each of the coeefecient (\({\Phi }_{i}\)). In here (\({\Phi }_{i}\)) determines how much the lag value dictate the future value of variable (X), where the number of the lag value up to (p).

Where the vectors, independent and sharing the same disturbances, will admit of the following moving average representation:

The spillover calculation depends on these moving average coefficients and the variance decomposition(s) which allow one to parse the forecast error variance of each variable. For the total spill, the formula is (details in Diebold and Yilmaz 2012):

The formula above explains the total of the spillover, Sg is the value and direction of pairwise spillover in a given time horison for each of asset class and (g) as the group of the financial asset. \({\widetilde{\theta }}_{ij}^{g}\left(H\right)\) represent a spillover of asset i and j belonging to the group (g). The sum of the spillover (exluding the self spillover) then divide by the total spillover (including total spillover), therefore it can be simplified as the total spillover (excluding self spillover) divide by the number of asset (N). Because we are using VAR as the basic of the model to calculate\(\theta\), we will first estimate the VAR model and focus on the result of impulse response analysis of asset j to a shock in asset i. The value of the response curve will be quantify to estimate the change in asset i shock influencing volatility in asset j.

and directional spillover is as follows:

In a similar fashion, we measure the directional volatility spillover transmitted from market i to all markets j as:

with net spillover defined by:

The net pairwise spillover is given, therefore, by:

We have collected, in this subsection, the key spillover definitions needed for our work. Details of, and complications that are inherent in such setups can be had from Diebold and Yilmaz (2012). The model

Change-detection algorithms

Spillovers, both return and volatility, are frequently suspected to change over time (Yarovaya et al. 2016). Through identifying such changes, we intend to bring out a new way of questioning and subsequently, demonstrating, the underlying connectedness of the market: by measuring how close the changes from one spillover sequence (between a pair of assets) are to the changes from another spillover sequence (between a different pair of assets). The more the closeness, the more connected they are in terms of spillover changes. To generate such sequences, that is, to create a time series of spillover values on which the changes are to be found, we generalize a fixed spillover table (such as Table 4) to a rolling pairwise time-dependent chain (still using the Diebold and Yilmaz (2012) convention). Such conversions are commonplace in the literature: Corbet et al. (2018) for instance, study them to see how certain linkages vary over time. Once such time series are found, we deploy a certain change-detection algorithm to locate times at which the spillover pattern (between a pair of assets) has shifted drastically. Imagine, for the spillover between assets A and B, two such times are June 7, 2018, and December 13th, 2020. Dates such as these will be known as change-points. Further, imagine for the spillover case between assets C and D, the change point set is {June 10, 2018, December 12, 2020}, while for the case between E and F, it is {January 5, 2018, March 17, 2019, February 13, 2021}. Then, viewed through any reasonable distance metric (we used the Hausdorff, described in the following section), the spillover movements between A and B seem similar to those between C and D in terms of the times when they undergo sudden shocks. Restricting one’s attention on such change points (instead of the entire sequence) is common in many areas: Bhaduri (2022) used them to measure the enormity of Covid waves, Zhan et al. (2019) to detect general non-stationarities, Bhaduri and Zhan (2018b) for quantifying time series data similarity, Bhaduri et al. (2017a, b) to detect drifts in big data, etc. In finance, such change points appear, among others, in (“Modeling Interaction between Bank Failure and Size”, 2016) who explored the connection between a bank’s size and its failure probability and in Huang (2012) who showed how, omitting such breaks may lead to overestimation of volatility transmission.

Formally, given a time series \({\left\{{\text{X}}_{1},\,{\text{X}}_{2},...,{\text{X}}_{\text{T}}\right\}}\), with \({\text{X}}_{\text{i}}\sim {\text{F}}_{\text{i}}\), some probability distribution function, a change-detection exercise consists of:

-

1.

choosing one of two competing hypotheses:

$$\begin{aligned}&{\text{H}}_{0}:{\text{X}}_{\text{i}}\sim {\text{F}}_{0}\left(\text{x};{\uptheta }_{0}\right),\text{i}=\text{1,2},..,\text{T}\\ &{\text{H}}_{\text{a}}:{\text{X}}_{\text{i}}\sim {\text{F}}_{0}(\text{x};{\uptheta }_{0}){\text{I}}_{\text{i}=\text{1,2},..,\text{k}}+{\text{F}}_{1}(\text{x};{\uptheta }_{1}){\text{I}}_{\text{i}=\text{k}+1,\text{k}+2,..,\text{T}}\end{aligned}$$(12) -

2.

sounding an alarm as soon as possible after the true change in case \({\text{H}}_{0}\) is rejected.

One construction that proves to be extremely useful was introduced by Hawkins et al. (2003) where with a given sample size, they have translated the entire problem into finding several of these two-sample statistics:

measuring the differences between the pre- and the post-change pieces for a fixed initial guess at k. The best guess of the true change will be that k which minimizes some overall loss function:

Over the years, several choices of these \({\text{D}}_{\text{k},\text{n}}\)s have been proposed, some (shown in Table 2) assuming specific parametric families (such as the exponential) for the \({\text{X}}_{\text{i}}\)s, others (shown in Table 3), assuming less demanding assumptions (such as tractable difference in characteristic functions).

These assumptions, however, restrict the applicability of these proposals only to cases where changes are sought in specific properties (such as the mean or the variance) or when, conditional on the change-point, the observations, both pre- and post-change are otherwise independent. Such assumptions are frequently questionable in financial settings where autocorrelations persist even within the pre- and post-change regions (leading to Hawkes process structure, evidenced, among others, by Rambaldi et al. (2018). We, therefore, implement the bidirectional proposal offered by Bhaduri (2018) and Ho et al. (2023) which is documented (Bhaduri 2022) to be more accurate in detecting changes under such less-structured systems. Using \({T}_{i}=\sum_{k=1}^{i}{X}_{k}\), we define two fresh statistics:

which rely on the same kernel (the log-combinations of the t-ratios) but act oppositely: \({Z}_{B}\) inflates while \(Z\) deflates in case \({X}_{i}\) s decrease progressively. Under a no-change scenario, these values are roughly equal.

and

offer further refinements, bettering classification power, regardless of when the change happens: early, midway, or late into the evolution. The null densities of these statistics are found to be approximately chi-squared (Bhaduri 2018). These null densities are needed to test whether the process does or does not contain a change (significantly extreme values point to the existence of one or more change-points). With such tools, the bidirectional proposal runs as follows (details in Bhaduri 2018):

-

Construct a series of hypotheses: \(\{{H}_{1},{H}_{2},...{H}_{m}\}\), p-values: \({p}_{1},{p}_{2},...{p}_{m}\).

-

\({H}_{i}\) tests stationarity on the first \(i+1\) events.

-

Pick a statistic: \(Z,{Z}_{B},R\) or \(L\) to carry these tests out with.

-

Order the p-values: \({p}_{(1)}<{p}_{(2)}<\cdots<{p}_{(m)}\).

-

Set \({S}_{i}:=\{k:{p}_{(k)}<\frac{k}{m}\alpha \}\)

$${\hat{\tau }}_{i}:=\left\{\begin{array}{ll}\text{min}\{k:{p}_{(k)}<\frac{k}{m}\alpha \},& {S}_{i}\ne {\varnothing }\\ \infty ,& {S}_{i}={\varnothing }\end{array}\right.$$ -

Earliest significant event: \(t\)-th \(\Rightarrow\) regime change between the \(t-1\)-th and the \(t\)-th event.

-

Start over.

The above proposal is, therefore, to do a sequence of tests, with one of the four fresh statistics, and we are claiming that if there is a test that sits on the first set of 16 observations and finds that the system is stationary, and if there is a neighboring test on the first set of 17 observations, that finds that the system is non-stationary, then a change must have happened somewhere in between the 16th and the 17th observations. Since we are doing a sequence of tests, the false discovery rate will have to be controlled. We achieve this using the proposal offered by Benjamini and Hochberg (1995). Interests in these change-point estimates are not purely theoretical: Bhaduri (2020), Bhaduri and Ho (2018a), Bhaduri et al. (2017a, b), Ho and Bhaduri (2017), Ho and Bhaduri (2015) show how such reliable estimates may improve forecasts on a compact interval sampled from the future. We apply this detection algorithm on our spillover sequences to detect general structural shifts as an additional check after implementing Hawkins et al. (2003)’s proposals listed in Tables 2 and 3. At times when the estimates disagree, we opt for those from the bidirectional approach due to its demonstrated reliability under messy systems, as mentioned above. We offer concrete examples of such change finding in the following section (Fig. 1) and execute certain interesting comparison tasks with such estimated change-points. This, however, remains our theoretical basis.

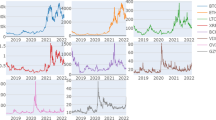

Change-points on return spillovers (for an illustrative, small-scale study) using the bidirectional algorithm (Bhaduri 2018) described in section "Change-detection algorithms". Times of strong structural shifts are marked in red. The period bordered by two neighboring strips become a stationary epoch, with unaltering statistical features

Empirical result

Return spillover

Our spillover findings on the returns case, for the full study period are presented in Table 4. We found interesting return spillover features that confirm earlier research results which were conducted less extensively, on distant time periods. First the spillover from the crypto to the stock market, recorded at 28.21, is not immensely noteworthy against the backdrop of the world stock market: compared to return spillovers given by the US—recorded at 139.58, and the UK—at 139.40, the magnitude of return spillover from Bitcoin and Ethereum to the stock market are more similar to return spillovers coming from Vietnam (24.01) and Shanghai (32.02) to the stock market. Furthermore, most of Bitcoin and Ethereum’s return spillover power is directed to their own asset class. This piece of result is consistent with research from Corbet et al. (2018) and Gil-Alana et al. (2020), who point out that Bitcoin and Ethereum have an isolated intra-connectedness and are not hugely influential in the world financial system.

Furthermore, we found that, within their own asset class, return spillovers from BTC to ETH (28.20) and from ETH to BTC (27.59) are much higher than the individual return spillovers received from the stock market. The return spillover from crypto to the stock market (28.21) is lower than the return spillover given by stock market to the crypto (53.33). This is in keeping with Frankovic et al. (2021), Nguyen (2022), who found evidence of the stock market influencing Bitcoin prices in periods of uncertainty. However, Caferra (2022) found that the prevailing market sentiment is a key source of connection between the stock and the crypto market. So, it is not clear whether the market sentiment or the stock market or which combination of the two remain responsible for crypto price fluctuations.

The second and the third biggest countries that adopted crypto are Vietnam (21%) and Philippines (20%). However, the Bitcoin and Ethereum return spillovers given to those countries are low, recorded at 0.67 and 0.95 respectively, while the return spillovers received are 0.52 and 1.08. The highest return spillover given by Bitcoin and Ethereum are recorded at 2.12 to Bulgaria and at 2.01 to France.

Next, turning to the world financial market, we discovered that two most influential stock markets are those in the US and the UK, who give out the highest return spillovers to others’ markets. This result is in accordance with investors’ beliefs that the US and UK stock market acted as the return for the world financial market. In addition, our results confirm the research by Yarovaya et al. (2016), Rapach et al. (2010), and Syriopoulos (2007), who also view the US or the UK as housing the most influential stock market in the world.

Volatility spillover

The volatility spillover results, condensed in Table 5 are, in certain ways, similar to those from our return analysis. From Bitcoin and Ethereum, the top three spillovers are given to Bulgaria (2.87), Colombia (2.69), and the US (2.55). Still, this volatility spillover is incomparable with those given by the two most influential stock markets: AS (124.15) and UK (120.81) and even lower than the lowest volatility spillover given by Argentina (16.99).

Crypto assets’ intra-spillovers are more impactful than inter-market spillovers from the crypto to the stock market. The spillover from Bitcoin to Ethereum is recorded at 23.00; that from Ethereum to Bitcoin at 24.96. This is analogous with the return case showed earlier, where the intra-market spillover is much higher than inter-market one. On the other hand, the top three inter-market spillovers to Bitcoin are received from Croatia (6.38), Brazil (5.88) and Colombia (5.42).

In the stock market asset class, the UK and the US are the top influencers again. There are some countries that currently give more volatility spillover than return spillover; those are Croatia and France. From its spillover, among the highest, Croatia gives to Brazil (8.97), Austria (9.39), and Turkey (7.90). In addition, Croatia becomes a net spillover giver to the US and the UK instead of becoming a net spillover receiver like most countries. France’s spillovers are given to Australia (10.37), Belgium (10.70), and UK (10.33), and, like Croatia, France also becomes a net spillover giver to the US and UK. This is also echoed by Yarovaya et al. (2016), where the connection between North American and the European region in terms of volatility, is found to be higher than that between Asian and South American regions.

Observations on the change-connectedness among spillover pairs

Treating the rolling windows spillover sequence between a pair of assets as a discrete stochastic process, we next proceed to locate times around which drastic shifts corrupted the flow, and subsequently, to measure the gap or the distance between the change-point sets of any two such spillover pairs. The motivation has been offered in section "Change-detection algorithms", along with the detection technique. Initially, we elaborate a small-scale study involving six spillover pairs to further clarify the approach, before moving on, in the following subsections to the more general analysis involving (29C2) or 406 pairs.

We sample six return (a similar analysis is valid on the volatility side too) rolling spillover sequences BTC-ETH, BTC-SHI, INA-IND, UK-US, AUS-BRA, and AUT-CRO. These sequences will prove to be interesting (in terms of “centrality”, defined below) in our ultimate large-scale analysis; they are graphed in various panels on Fig. 1. If we apply our bidirectional technique described in section "Change-detection algorithms" on each sequence, restarting the algorithm afresh each time a change is detected, our change point estimates will be the red vertical strips. A pair of adjoining strips enclose a phase where features of the process remained statistically stable (i.e., stationary, in a sense). Due to the demonstrated versatility of the detection method, such features need not be confined to only usual summaries like the mean, variance, skewness, kurtosis, and the process may even contain intractable dependencies. Crossing over one such separator amounts to entering a fresh period with radically different statistical properties. Most of these red change estimates are acceptable visually (they appear frequently at times of sharp gradient shifts) and historically (around, for instance, the 500 working days mark which roughly corresponds to the onset of COVID related chaos).

To quantify the temporal similarity of two such changepoint sets

we implement the Hausdorff metric:

and measure their separation through

The two sets \(\hat{\tau },{\tau }^{*}\) need not in general be of the same size which is why standard correlation or Euclidean-type metrics are unsuitable. Another key advantage behind the Hausdorff choice is it penalizes over-segmentation. Burg and Williams (2020) and Bhaduri (2022) describe other benefits of this specific metric. The smaller its value, the more similar are the two sets. As examples, consider the change points (in working days) from:

-

US-UK: {16, 31, 42, 57, 87, 98, 125,136, 146, 156, 170, 178, 190, 207, 231, 247, 261, 271, 311, 338, 360, 371, 381, 402, 411, 425, 449, 456, 481, 489, 499, 508, 529, 550, 564, 577}

-

INA-IND: {22, 39, 74, 104, 120, 135, 149, 174, 189, 200, 227, 240, 255, 266, 295, 311, 322, 342, 363, 381, 391, 418, 432, 441, 446, 466, 474, 487, 515, 542, 555, 583}.

-

AUT-CRO: {23, 28, 40, 47, 82, 92, 114, 128, 151, 172, 182, 196, 216, 225, 237, 250, 276, 300, 311, 322, 332, 363, 371, 396, 409, 424, 433, 449, 467, 478, 488, 512, 527, 546, 571, 576}.

The Hausdorff distance between the US-UK and the AUT-CRO sequences is 0.17 while the distance between the US-UK and the INA-IND sequences is 0.26. This shows that the times at which the US-UK spillover sequence undergoes drastic changes are more similar to the times at which the AUT-CRO sequence undergoes changes and less similar to the times at which the INA-IND sequence undergoes changes. For such an initial, small-scale study as this, this is also clear by inspecting the three sets above or by looking at how similarly the vertical separators are placed on the appropriate panels on Fig. 1. Such pairwise distances are stored as symmetric matrices (left panel, Fig. 2) or as larger heatmaps for the more general study involving 406 cases: Fig. 3a for the return sequences, Fig. 3b for the volatility sequences.

Heatmaps for the return (a) and the volatility (b) cases involving all 406 spillover combinations. Lighter values indicate similarity of change-points across one spillover pair, darker values indicate dissimilarity. We find return change points across dependencies to correlate; volatility change-points slightly less so

The distances behind these heat maps may be used to cluster spillover sequences in terms of similarities of their change patterns. The ideal number of clusters is found by marking the elbow on the within-sum-of-squares graph (Fig. 4a, b): the point beyond which additional cluster homogeneity is not worth the extra number of clusters (Rousseeuw 1987). Other methods for detecting the number of clusters exist—such as the one using “gap” statistic proposed by Tibshirani et al. (2001). We have chosen the Silhouette method both owing to its popularity and since a sensitivity analysis with these other methods didn’t generate drastically different numbers of clusters (hovers around 5 or 6, whatever the method). These optimal numbers are five for the return case and seven for the volatility case (Fig. 4, b, respectively). Accordingly, such clusters are identified on Figs. 5 and 6 with the right number of colors. Researchers can examine spillover sequences sharing the same color to conclude (and to probe deeper into why) changes in one closely mimic changes in the other. To the best of our knowledge, such a description has never been furnished even on a smaller scale with fewer assets. The study that comes closest is Wu et al. (2022) where we observe how shocks are spreading faster post-COVID, which, as our study finds, is a specific change-point. Our analysis, unlike the actual return and volatility sequences studied by Wu et al. (2022) looks instead at spillover dependencies and examines all general changes, not just those triggered by the pandemic.

Large-scale cluster, returns case. Changes in one spillover combination (formed by the relationship between two assets) from a certain group are likely to correlate with changes in a neighboring spillover combination from the same group. These five clusters form our five rings-of-fire in the returns case

Large-scale cluster, volatility case. Changes in one spillover combination (formed by the relationship between two assets) from a certain group are likely to correlate with changes in a neighboring spillover combination from the same group. These seven clusters form our seven rings-of-fire in the volatility case

Next, we exploit results from graph theory (Newman 2010, for instance) to glean further insights into the nature of the connectedness. First, using \(L\) as the Laplacian

where \(A\) is the similarity matrix (treating similarity as one minus the distances found above) and \(D\) the diagonal matrix of \(A\)’s row sums, we look at the multiplicity of zero as an eigenvalue of \(L\). For both the return and volatility spillover cases, we found this multiplicity to be 1, ensuring the graphs in Figs. 5 and 6 are fully connected. This ensures changes in one spillover dependence structure cannot stay insulated (like AUS-BRA in our small-scale scenario, Fig. 2) from those in the rest. The Fielder eigenvectors are collected next for both the return (Fig. 7) and volatility spillover (Fig. 8) cases. The components of these vectors show how connected the vertices are: negative values correspond to nodes which are less connected, positives to those which are well-connected. These components are arranged in an ascending order in Figs. 7 and 8, following the same color convention used for the respective clustering. We notice stronger connectedness in the return case, good homogeneity (that is, a thorough mixing of colors) in either case. This shows how membership in a given cluster may not guarantee connectedness of some kind (high or low), this being more vivid in the volatility spillover scenario.

Fielder eigen-components graphed for each of the 406 spillover combinations, the returns case. The same color convention has been retained from Fig. 5. With predominantly positive components, there is a general tendency among “return” nodes to stay connected

Fielder eigen-components graphed for each of the 406 spillover combinations, the volatility case. The same color convention has been retained from Fig. 6. With predominantly negative components, there is a general tendency among “volatility” nodes to stay isolated

The importance of a vertex, however, may be examined not just through its connectedness. To explore some of these other options, we generate, from the pairwise distances, an induced graph where an undirected edge is formed between two nodes if the distance between the nodes falls below a certain threshold. Such induced arrangements are known as \(\epsilon\)-neighborhood graphs studied by von Luxburg (2007), among others. In our cases, these thresholds were 0.35 for the return scenario and 0.45 for the volatility one. These were the median similarities in their respective cases and a sensitivity analysis with respect to these values did not produce significantly different results (to follow). For instance, the induced graph from our small-scale difference matrix is shown in the right panel of Fig. 2. We look, in the following subsection, at three key centrality measures:

-

1.

the degree centrality: this counts the number of immediate neighbors a node has.

-

2.

the closeness centrality: the inverse of the sum of all the distances between a given node and all other nodes.

-

3.

the between centrality: it measures the extent a node sits between pairs of other nodes in the network such that a path between the other nodes has to go through that node.

For our small-scale study on Fig. 2, for instance, the nodes INA-IND, US-UK, AUT-CRO have degree centrality 3 each, while BTC-ETH has 4, BTC-SHI has 1 and AUS-BRA has none. BTC-ETH also has the highest between centrality of 3. The higher these values are for a given node, the more prominent a role that node plays in the network. Frequently, but not always, these measures correlate (Luke 2015). We collect the full-scale findings in Appendix 1.

Connectedness of return spillover pairs

The analysis on return spillover connections over a fixed period, shown in section 4.1, can be extended by considering connections defined through closeness of change-point sets for a pair of asset class. The rationale and a small-scale study have been offered before; we currently conceptualize the fuller network and calculate three summaries: degree, closeness, and betweenness centralities. We will point out which pairs control the crucial hubs of change-information flow in a network induced from the cluster shown prior, with the same thresholds: 0.35 for the return and 0.45 for the volatility scenario. The spillover pair that is most connected in this “change-sense”, for instance, is the one whose changes are temporally similar to the changes from the largest number of other pairs. Sudden structural shifts in the dependence dynamics of the members contributing to this spillover pair, therefore, is likely to correlate with similar jolts in the relationships between the largest number of other pairs. The pair that is the least connected, on the other hand, remains isolated in this sense. Research on non-stationary time series justify our insistence on a network manufactured through change-conscious links instead of one formed by ordinary full-scale correlations among stocks. Chapman and Killick (2020), for instance, demonstrate how forecasts improve if one restricts attention to the last stationary phase, defined by the last change-point.

We found that (Appendix 1), surprisingly, Australia and Croatia’s return spillover dynamic is the one with the highest degree and closeness. The number of immediate neighbors that Australia–Croatia has, 343, trumps the one—331—of the pair formed between the most influential stock countries: UK–US, however one feels about the significance of a difference of 12 is hard to determine. In terms of closeness centrality, we report similar observations: Australia–Croatia: 0.86; the UK–US: 0.84, with a difference of 0.02. The dynamics of the Australia–Croatia return spillover is prominent in Europe, and being connected to other important countries makes it a reasonable proxy to the world stock market’s global changes. We maintain, through our analysis in section 4.1, that the UK–US interaction stays key overall, and—through our results here—that in terms of shock transference among pairwise dependencies, the Austria-Croatia connection merits equal attention.

In term of betweenness centrality, the BTC—Shanghai pair is the highest (290.28) while the Australian and Croatia pair is recorded at (205.53). The 15 nodes that top the popularity table (Appendix 1) remain largely similar regardless of the centrality tool used: degree or closeness. The betweenness criteria, however, extract somewhat different actors. Through a recollection of what these three quantities are designed to measure (offered above in section 4.3), this disagreement may fuel further lines of fruitful research.

Turning next to the other extreme of isolated spillover pairs, the Belgium–Croatia and Australia–Brazil pairs have the lowest network degree with 4 connections each. Closeness centrality also points out Belgium–Croatia and Australia–Brazil as the most isolated spillover pairs with 0.35 and 0.36 closeness values respectively, Betweenness centrality detect Australia–Brazil as the most isolated pair with a value of zero.

Connectedness of volatility spillover pairs

We next move on to similar analyses on the volatility side. The most connected spillover pair based on degree is Singapore–Croatia (355), tied with Shanghai–US (355) and based on closeness, Singapore–Croatia (0.88) and Shanghai–US (0.88). On the other hand, betweenness centrality point out BTC–Thailand with 422.77 and Shanghai–US with 374.14 as the two most connected spillover pairs.

For the most isolated, a rare agreement among the three methods of centrality calculation is reached. Each metric shows that Colombia–Malaysia is the most isolated spillover pair. We note inferential research on network structures are still being developed. Point estimates such as the network’s degree distribution, density or the closeness measures seen here may be extended (under certain assumptions) to include margins of error, offering confidence intervals. We point those interested in such matters to Zhang et al. (2015).

Discussion

Bitcoin and Ethereum have a predominantly isolated intra-connectedness, but they receive substantial inter-spillover from the stock market. This mean that instead of hugely influencing the stock market, Bitcoin and Ethereum are the ones influenced by the stocks. This will be a crucial insight for investors who are inclined on using Bitcoin and Ethereum as hedging tools. Due to the flow of influence from the stock market, the crypto asset class may pro-cyclically mimic the movements of stock and erode their hedging property.

Furthermore, the dynamics of spillover, we found, evolve differently in different periods. In periods of higher uncertainty, the amount of connections among the investment asset class is higher. This also applies to the crypto asset class and the stock market where they have uniform return and volatility movements in a period of crisis. Nevertheless, both markets are susceptible to news and market sentiments: information about turbulence, perceived or real, in the financial market sector, or hugely disrupting negative sentiments will push both asset classes.

Surprisingly, we found that Bulgaria is the country that receive the highest spillover from the crypto asset, not the US, the UK, or China, where interest and talks about crypto are widespread. However, this small European country actually hold most Bitcoin in the world: 1.017% more than El Salvador, which already integrated its traditional financial system to crypto. The varying degrees of connectivity observed between crypto assets and traditional financial assets can be attributed to the divergence in legal frameworks and the level of acceptance of crypto assets within each respective country, as highlighted by Raza et al. (2022).

In addition, Bulgaria is also home to the most wanted crypto queen, Ruja Ignatova. Our research uncovers how the Bulgarian stock market is receiving heat from the crypto price fluctuations. This should signal investors in the Bulgarian stock market to keep an eye on the dynamics of Bitcoin and Ethereum.

Conclusion

In this research, we explored the connectedness among major stock indices through a large-scale study exploiting Diebold and Yilmaz (2012)’s spillover setup, and described, through identifying structural breaks, how the nature of the dependence changes sequentially. We found that the connectedness between crypto assets and the traditional stock market evolves over time. This assertion finds support from the research conducted by Aslanidis (2021), which delves into the interconnected nature of the cryptocurrency market and found more interconnectedness in both volatility and returns. During stable times, the connection is weak and has a bidirectional flavor. This means that the crypto asset could become good portfolio diversifying tools. On the other hand, in a crisis, the magnitude of the connection increases considerably and exhibits a unidirectional behavior. This change of relationship is potentially dangerous. Investors who use crypto as a hedging tool to their portfolio, will be exposed to a high loss risk because of the pro-cyclical nature of crypto returns during a crisis.

Also, our findings are useful to regulators for financial stability decisions. Regulators such as the Financial Stability Board, International Monetary Fund, and European Central Bank routinely investigate (frequently underestimating) the connectedness of crypto assets to the traditional financial system. In the research, we found evidence of an increasing connectedness trajectory and based on our cluster and subsequent network, some pairs having stronger connections than most. The cluster partitions we detect—our rings of fire—along with our related network summaries, highlight the countries to which we should sound an alarm in the event of a crypto crash, apprehending shock transmissions.

Whether we detect it or not, whether we like it or not, we have been attending the funeral rites of archaic asset classes for many years and it has been a bizarre wake, especially with the emergence of potent alternatives such as cryptocurrencies. While such traditional tools as stocks, bonds, etc. may never sink into absolute oblivion, Bitcoins, Ethereum, and numerous others have lately been on an undeniable ascendancy. For a sound understanding of how well the new meshes and clashes with the old, and probably, more crucially, to instill in investors as a trust that is durable, a fuller analysis of dependence, embracing a larger sampling throughout the world, with emphasis on features like change-points that matter pragmatically (say, for, accurate forecasts), was becoming pressing by the day. Our current study, offering a thorough map of entanglement, remains devoted to these very exigencies that prompted it.

References

Aslanidis N, Bariviera AF, Perez-Laborda A (2021) Are cryptocurrencies becoming more interconnected? Econ Lett 199:109725. https://doi.org/10.1016/j.econlet.2021.109725

Beirne J, Caporale GM, Schulze-Ghattas M, Spagnolo N (2009) Working paper series volatility spillovers and contagion from mature to emerging stock markets. http://www.ecb.europa.eu

Benjaminit Y, Hochberg Y (1995) Controlling the false discovery rate: a practical and powerful approach to multiple testing. J R Stat Soc B 57(I):289–300

BBC (2022) Missing cryptoqueen: FBI adds Ruja Ignatova to top ten most wanted. Retrieved from https://www.bbc.com/news/world-us-canada-62005066. Accessed 12 June 2022

Bhaduri M (2018) Bi-directional testing for change point detection in Poisson bi-directional testing for change point detection in Poisson processes. UNLV theses, dissertations, professional papers, and capstones, 5–15. https://doi.org/10.34917/13568387

Bhaduri M (2020) On modifications to the Poisson-triggered hidden Markov paradigm through partitioned empirical recurrence rates ratios and its applications to natural hazards monitoring. Sci Rep. https://doi.org/10.1038/s41598-020-72803-z

Bhaduri M (2022) Contrary currents. Chance 35(1):26–33. https://doi.org/10.1080/09332480.2022.2039025

Bhaduri M, Ho CH (2018a) On a temporal investigation of hurricane strength and frequency. Environ Model Assess 24(5):495–507. https://doi.org/10.1007/s10666-018-9644-0

Bhaduri M, Zhan J (2018b) Using empirical recurrence rates ratio for time series data similarity. IEEE Access 6:30855–30864. https://doi.org/10.1109/ACCESS.2018.2837660

Bhaduri M, Zhan J, Chiu C (2017a) A novel weak estimator for dynamic systems. IEEE Access 5:27354–27365. https://doi.org/10.1109/ACCESS.2017.2771448

Bhaduri M, Zhan J, Chiu C, Zhan F (2017b) A novel online and non-parametric approach for drift detection in big data. IEEE Access 5:15883–15892. https://doi.org/10.1109/ACCESS.2017.2735378

Bloomberg (2022) El Salvador’s bircoin bet is working, finance minister says. Retrieved from https://www.bloomberg.com/news/articles/2022-07-28/el-salvador-s-bitcoin-bet-is-working-finance-minister-says. Accessed 12 June 2022

Bouri E, Kristoufek L, Azoury N (2022) Bitcoin and S&P500: co-movements of high-order moments in the time-frequency domain. PLoS ONE 17(11):e0277924. https://doi.org/10.1371/journal.pone.0277924

Buishand TA (1982) Some methods for testing the homogeneity of rainfall records. J Hydrol 58:1127

Caferra R (2022) Sentiment spillover and price dynamics: information flow in the cryptocurrency and stock market. Phys A Stat Mech Appl. https://doi.org/10.1016/j.physa.2022.126983

Chapman JL, Killick R (2020) An assessment of practitioners approaches to forecasting in the presence of changepoints. Qual Reliab Eng Int 36(8):2676–2687. https://doi.org/10.1002/qre.2712

Chemkha R, BenSaïda A, Ghorbel A (2021) Connectedness between cryptocurrencies and foreign exchange markets: implication for risk management. J Multinatl Financ Manag. https://doi.org/10.1016/j.mulfin.2020.100666

Chen J, Gupta AK (2011) Parametric statistical change point analysis: With applications to Genetics. In: Medicine and Finance. 2nd ed. Birkhauser

CoinMarketCap (2022) Retrieved from https://coinmarketcap.com/. Accessed 29 June 2022

Coin Telegraph (2022) $45,000 Bitcoin looks cheap when compared with gold’s marketcap. Retrieved from https://cointelegraph.com/news/45-000-bitcoin-looks-cheap-when-compared-to-gold-s-marketcap. Accessed 29 June 2022

Corbet S, Meegan A, Larkin C, Lucey B, Yarovaya L (2018) Exploring the dynamic relationships between cryptocurrencies and other financial assets. Econ Lett 165:28–34. https://doi.org/10.1016/j.econlet.2018.01.004

Diebold FX, Yilmaz K (2009) Measuring financial asset return and volatility spillovers, with application to global. Econ J 119(534):158–171

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006

Frankovic J, Liu B, Suardi S (2021) On spillover effects between cryptocurrency-linked stocks and the cryptocurrency market: evidence from Australia. Glob Financ J. https://doi.org/10.1016/j.gfj.2021.100642

Fernandes LHS, Bouri E, Silva JWL, Bejan L, de Araujo FHA (2022) The resilience of cryptocurrency market efficiency to COVID-19 shock. Phys A Stat Mech Appl 607:128218. https://doi.org/10.1016/j.physa.2022.128218

García-Medina A, Hernández C (2020) Network analysis of multivariate transfer entropy of cryptocurrencies in times of turbulence. Entropy 22(7):760

Gil-Alana LA, Abakah EJA, Rojo MFR (2020) Cryptocurrencies and stock market indices. Are they related? Res Int Bus Finance. https://doi.org/10.1016/j.ribaf.2019.101063

Hawkins DM, Deng Q (2010) A nonparametric change-point control chart. J Qual Technol 42(2):165173

Hawkins DM, Qiu P, Kang CW (2003) The changepoint model for statistical process control. J Qual Technol 35(4):355–366. https://doi.org/10.1080/00224065.2003.11980233

Ho CH, Bhaduri M (2015) On a novel approach to forecast sparse rare events: applications to Parkfield earthquake prediction. Nat Hazards 78(1):669–679. https://doi.org/10.1007/s11069-015-1739-1

Ho CH, Bhaduri M (2017) A quantitative insight into the dependence dynamics of the Kilauea and Mauna Loa Volcanoes, Hawaii. Math Geosci 49(7):893–911. https://doi.org/10.1007/s11004-017-9692-z

Ho C-H, Koo SK, Bhaduri M, Zhou L (2023) A cocktail of bidirectional tests for power symmetry and repairable system reliability. IEEE Trans Reliab. https://doi.org/10.1109/TR.2023.3250494

Huang PK (2012) Volatility transmission across stock index futures when there are structural changes in return variance. Appl Financ Econ 22(19):1603–1613. https://doi.org/10.1080/09603107.2012.669459

Iyer T (2022) Cryptic connections: spillovers between crypto and equity markets. Global Financial and Stability Notes, Monetary and capital markets, (1): 1–13. https://www.imf.org/en/Publications/global-financial-stability-notes/Issues/2022/01/10/Cryptic-Connections-511776

James N (2022) Evolutionary correlation, regime switching, spectral dynamics and optimal trading strategies for cryptocurrencies and equities. Phys D Nonlinear Phenom. https://doi.org/10.1016/j.physd.2022.133262

Kumah SP, Odei-Mensah J (2021) Are Cryptocurrencies and African stock markets integrated? Q Rev Econ Finance 81:330–341. https://doi.org/10.1016/j.qref.2021.06.022

Kumar A, Iqbal N, Mitra SK, Kristoufek L, Bouri E (2022) Connectedness among major cryptocurrencies in standard times and during the COVID-19 outbreak. J Int Financ Mark Inst Money. https://doi.org/10.1016/j.intfin.2022.101523

Lorenzo L, Arroyo J (2022) Analysis of the cryptocurrency market using different prototype-based clustering techniques. Financ Innov. https://doi.org/10.1186/s40854-021-00310-9

Luke DA (2015) A user’s guide to network analysis in R. http://www.springer.com/series/6991

Matteson DS, James NA (2013) A nonparametric approach for multiple change point analysis of multivariate data. ArXiv e-prints. To appear in the J Amer Stat Assoc 1306.4933

Naeem MA, Karim S (2021) Tail dependence between bitcoin and green financial assets. Econ Lett 208:110068. https://doi.org/10.1016/j.econlet.2021.110068

Newman M (2010) Networks: an introduction. Oxford University Press. https://doi.org/10.1093/acprof:oso/9780199206650.001.0001

Nguyen KQ (2022) The correlation between the stock market and Bitcoin during COVID-19 and other uncertainty periods. Finance Res Lett. https://doi.org/10.1016/j.frl.2021.102284

Pettitt AN (1979) A non-parametric approach to the change-point problem. J Royal Stat Soc C 28(2):126135

Rambaldi M, Filimonov V, Lillo F (2018) Detection of intensity bursts using Hawkes processes: an application to high-frequency financial data. Phys Rev E. https://doi.org/10.1103/PhysRevE.97.032318

Rapach DE, Strauss JK, Zhou G (2010) International stock return predictability what is the role of the United States? 1633–1662. http://ssrn.com/abstract=1572946

Raza SA, Ahmed M, Aloui C (2022) On the asymmetrical connectedness between cryptocurrencies and foreign exchange markets: evidence from the nonparametric quantile on quantile approach. Res Int Bus Finance 61:101627. https://doi.org/10.1016/j.ribaf.2022.101627

Ross GJ (2014) Sequential change detection in the presence of unknown parameters. Stat Comput 24(6):10171030

Ross GJ, Adams NM (2012) Two nonparametric control charts for detecting arbitrary distribution changes. J Qual Technol 44(12):102116

Ross GJ, Tasoulis DK, Adams NM (2011) Nonparametric monitoring of data streams for changes in location and scale. Technometrics 53(4):379389

Rousseuw PJ (1987) Silhouettes: a graphical aid to the interpretation and validation of cluster analysis. Comput Appl Math 20:53–65. https://doi.org/10.1016/0377-0427(87)90125-7

Statista (2022a) Number of cryptocurrencies worldwide from 2013 to February 2022a. Retrieved from https://www.statista.com/statistics/863917/number-crypto-coins-tokens/. Accessed 10 June 2022

Statista (2022b) Share of respondents who indicated they either owned or used cryptocurrencies in 56 countries and territories worldwide from 2019 to 2021. Retrieved from https://www.statista.com/statistics/1202468/global-cryptocurrency-ownership/. Accessed 10 June 2022b.

Symitsi E, Chalvatzis KJ (2018) Return, volatility and shock spillovers of Bitcoin with energy and technology companies. Econ Lett 170:127–130. https://doi.org/10.1016/j.econlet.2018.06.012

Syriopoulos T (2007) Dynamic linkages between emerging European and developed stock markets: has the EMU any impact? Int Rev Financ Anal 16(1):41–60. https://doi.org/10.1016/j.irfa.2005.02.003

Telli Ş, Chen H (2020) Structural breaks and trend awareness-based interaction in crypto markets. Phys A Stat Mech Appl. https://doi.org/10.1016/j.physa.2020.124913

Tibshirani R, Walther G, Hastie T (2001) Estimating the number of clusters in a data set via the gap statistic. J R Stat Soc B 63(2):411–423. https://doi.org/10.1111/1467-9868.00293

Torun M, Aksanu A (2011) On basic price model and volatility in multiple frequencies. Inst Electr Electron Eng 828

Trending Topics (2022) Bulgaria ahead of El Salvador in bitcoin holdings?. Retrieved from https://www.trendingtopics.eu/bulgaria-ahead-of-el-salvador-in-bitcoin-holdings/. Accessed 11 June 2022

van den Burg GJJ, Williams CKI (2020) An evaluation of change point detection algorithms. http://arxiv.org/abs/2003.06222

Von Luxburg U (2007) A tutorial on spectral clustering. Stat Comput 17(4):395–416. https://doi.org/10.1007/s11222-007-9033-z

Wątorek M, Drożdż S, Kwapień J, Minati L, Oświęcimka P, Stanuszek M (2021) Multiscale characteristics of the emerging global cryptocurrency market. Phys Rep 901:1–82

Wu J, Zhang C, Chen Y (2022) Analysis of risk correlations among stock markets during the COVID-19 pandemic. Int Rev Financ Anal 83:102220. https://doi.org/10.1016/j.irfa.2022.102220

Yarovaya L, Brzeszczyński J, Lau CKM (2016) Intra- and inter-regional return and volatility spillovers across emerging and developed markets: evidence from stock indices and stock index futures. Int Rev Financ Anal 43:96–114. https://doi.org/10.1016/j.irfa.2015.09.004

Yümlü MS, Gürgen FS, Cemgil AT, Okay N (2015) Bayesian changepoint and time-varying parameter learning in regime switching volatility models. Digit Signal Process Rev J 40(1):198–212. https://doi.org/10.1016/j.dsp.2015.02.001

Zhan F, Martinez A, Rai N, McConnell R, Swan M, Bhaduri M, Zhan J, Gewali L, Oh P (2019) Beyond cumulative sum charting in non-stationarity detection and estimation. IEEE Access 7:140860–140874. https://doi.org/10.1109/ACCESS.2019.2943446

Zhang Y, Kolaczyk ED, Spencer BD (2015) Estimating network degree distributions under sampling: an inverse problem, with applications to monitoring social media networks. Ann Appl Stat 9(1):166–199. https://doi.org/10.1214/14-AOAS800

Acknowledgements

The first author gratefully acknowledges the support of financial services authority. The second author gratefully acknowledges the support offered by the joint American Mathematical Society – Simons Foundation research grant (2020 cycle) for early-career mathematicians. Bentley University’s summer research support is also fondly recognized.

Author information

Authors and Affiliations

Contributions

HS: Conceptualization, Investigation, Resources, Visualization, Data Curation, Writing—Original draft, Project administration. MB: Conceptualization, Methodology, Investigation, Software, Formal analysis, Visualization, Writing—Original draft, Writing—Review and editing, Supervision, Funding acquisition.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1. Table of network summaries

Appendix 1. Table of network summaries

Returns | Volatilities | ||||||

|---|---|---|---|---|---|---|---|

Degree | Closeness | Betweenness | Degree | Closeness | Betweenness | ||

AUS.CRO | 343 | 0.86 | 205.53 | STI.CRO | 355 | 0.89 | 182.31 |

IND.AFS | 338 | 0.86 | 251.57 | SHI.US | 355 | 0.89 | 374.14 |

SHI.AFS | 338 | 0.85 | 167.09 | BGR.SHI | 352 | 0.88 | 199.98 |

CHN.COL | 337 | 0.86 | 249.11 | BRA.US | 350 | 0.88 | 210.65 |

BEL.CYP | 336 | 0.85 | 215.32 | THA.MEX | 350 | 0.88 | 150.19 |

INA.IND | 334 | 0.85 | 146.92 | VNI.CHN | 347 | 0.87 | 134.08 |

CHN.CRO | 332 | 0.85 | 267.02 | STI.FRA | 346 | 0.87 | 128.45 |

DNK.US | 332 | 0.84 | 131.88 | CYP.KOR | 346 | 0.87 | 129.77 |

IND.CHN | 331 | 0.84 | 232.7 | BRA.CRO | 345 | 0.87 | 200.88 |

VNI.FRA | 331 | 0.84 | 120.66 | INA.STI | 343 | 0.87 | 197.48 |

UK.US | 331 | 0.84 | 124.56 | STI.TUR | 343 | 0.87 | 163.0 |

THA.KOR | 331 | 0.84 | 135.4 | INA.MYS | 342 | 0.87 | 107.92 |

TUR.AFS | 331 | 0.84 | 154.38 | BEL.CRO | 342 | 0.86 | 149.26 |

ARG.AFS | 330 | 0.84 | 147.93 | PHL.MEX | 342 | 0.86 | 133.81 |

ARG.KOR | 330 | 0.84 | 179.99 | TUR.US | 342 | 0.86 | 101.44 |

BRA.SHI | 330 | 0.84 | 198.86 | BTC.CHN | 341 | 0.86 | 155.08 |

COL.FRA | 330 | 0.84 | 138.2 | INA.AFS | 341 | 0.86 | 132.86 |

TUR.FRA | 330 | 0.84 | 106.68 | IND.TUR | 340 | 0.86 | 138.76 |

ETH.FRA | 329 | 0.84 | 123.18 | CYP.US | 340 | 0.86 | 111.12 |

IND.UK | 328 | 0.84 | 137.54 | IND.PHL | 339 | 0.86 | 137.82 |

INA.STI | 327 | 0.84 | 131.72 | VNI.JPN | 339 | 0.86 | 165.69 |

IND.US | 327 | 0.84 | 132.85 | ARG.MEX | 339 | 0.86 | 131.57 |

AUS.AFS | 327 | 0.84 | 129.72 | SHI.CHN | 339 | 0.86 | 128.0 |

AUT.CRO | 327 | 0.83 | 124.37 | SHI.KOR | 339 | 0.86 | 100.44 |

BEL.KOR | 327 | 0.83 | 130.28 | TUR.KOR | 339 | 0.86 | 119.96 |

BGR.CHN | 327 | 0.84 | 186.33 | INA.CYP | 338 | 0.86 | 120.78 |

BTC.ETH | 326 | 0.83 | 153.41 | IND.KOR | 338 | 0.86 | 118.34 |

CYP.AFS | 326 | 0.83 | 137.78 | BGR.CYP | 338 | 0.86 | 81.27 |

PHL.TUR | 326 | 0.83 | 123.19 | CYP.PHL | 338 | 0.86 | 147.56 |

IND.ARG | 325 | 0.83 | 102.92 | ETH.BEL | 337 | 0.86 | 114.23 |

ARG.MYS | 325 | 0.83 | 162.16 | UK.AUS | 337 | 0.85 | 103.7 |

CRO.MYS | 325 | 0.83 | 116.28 | ARG.SHI | 337 | 0.85 | 143.71 |

THA.PHL | 325 | 0.83 | 140.39 | BRA.CHN | 337 | 0.86 | 113.35 |

ETH.AUS | 324 | 0.83 | 91.73 | CHN.DNK | 337 | 0.86 | 143.81 |

JPN.BEL | 324 | 0.83 | 170.43 | JPN.MYS | 336 | 0.85 | 85.42 |

BRA.FRA | 324 | 0.83 | 113.12 | SHI.PHL | 336 | 0.85 | 127.37 |

COL.CRO | 324 | 0.83 | 113.92 | INA.AUT | 335 | 0.85 | 221.97 |

INA.AFS | 323 | 0.83 | 113.08 | VNI.MEX | 335 | 0.85 | 96.32 |

UK.FRA | 323 | 0.83 | 137.66 | STI.US | 335 | 0.85 | 103.18 |

ARG.CRO | 323 | 0.83 | 126.16 | AUS.MEX | 335 | 0.85 | 93.72 |

BEL.PHL | 323 | 0.82 | 102.61 | INA.VNI | 334 | 0.85 | 103.44 |

BGR.TUR | 323 | 0.83 | 140.95 | AUS.FRA | 334 | 0.85 | 132.03 |

DNK.KOR | 323 | 0.83 | 106.38 | BRA.BEL | 334 | 0.85 | 99.48 |

IND.TUR | 322 | 0.82 | 129.07 | CHN.COL | 334 | 0.85 | 111.1 |

CRO.CYP | 322 | 0.83 | 191.81 | MYS.TUR | 334 | 0.85 | 145.38 |

IND.BEL | 321 | 0.83 | 100.96 | MYS.MEX | 334 | 0.85 | 83.79 |

JPN.CRO | 321 | 0.82 | 76.45 | TUR.MEX | 334 | 0.85 | 97.03 |

UK.AFS | 321 | 0.82 | 116.35 | MEX.AFS | 334 | 0.85 | 121.51 |

BEL.MYS | 321 | 0.83 | 130.69 | INA.DNK | 333 | 0.85 | 109.56 |

BEL.AFS | 321 | 0.82 | 156.02 | IND.MYS | 333 | 0.85 | 112.01 |

ETH.AUT | 320 | 0.83 | 267.57 | STI.AFS | 333 | 0.85 | 93.9 |

UK.DNK | 320 | 0.82 | 164.06 | ARG.CRO | 333 | 0.85 | 140.89 |

BRA.US | 320 | 0.82 | 107.45 | BEL.DNK | 333 | 0.85 | 85.45 |

AUT.AFS | 320 | 0.82 | 137.95 | KOR.FRA | 333 | 0.84 | 92.67 |

MYS.KOR | 320 | 0.82 | 147.13 | INA.UK | 332 | 0.85 | 72.8 |

INA.KOR | 319 | 0.82 | 127.37 | AUS.CHN | 332 | 0.85 | 125.86 |

AUS.BGR | 319 | 0.82 | 134.11 | BGR.PHL | 332 | 0.84 | 135.5 |

SHI.CYP | 319 | 0.82 | 93.65 | COL.CYP | 332 | 0.85 | 82.61 |

BTC.FRA | 318 | 0.82 | 117.02 | COL.AFS | 332 | 0.84 | 113.54 |

ETH.TUR | 318 | 0.82 | 160.23 | CRO.THA | 332 | 0.85 | 96.81 |

INA.BRA | 318 | 0.82 | 162.28 | IND.CHN | 331 | 0.85 | 88.75 |

VNI.KOR | 318 | 0.82 | 112.36 | STI.CHN | 331 | 0.85 | 100.65 |

AUT.MEX | 318 | 0.82 | 102.35 | CRO.CYP | 331 | 0.84 | 88.24 |

THA.MEX | 318 | 0.82 | 107.49 | BTC.CRO | 330 | 0.84 | 135.49 |

AFS.KOR | 318 | 0.82 | 96.94 | BTC.MYS | 330 | 0.84 | 88.52 |

INA.DNK | 317 | 0.82 | 66.26 | INA.FRA | 330 | 0.84 | 72.81 |

CHN.PHL | 317 | 0.82 | 79.99 | UK.CHN | 330 | 0.84 | 87.92 |

JPN.KOR | 316 | 0.81 | 90.35 | BEL.AFS | 330 | 0.84 | 72.09 |

KOR.FRA | 316 | 0.81 | 79.26 | BGR.COL | 330 | 0.84 | 105.47 |

BRA.MEX | 315 | 0.81 | 75.96 | JPN.CHN | 329 | 0.84 | 90.91 |

AUT.BGR | 315 | 0.82 | 156.29 | JPN.DNK | 329 | 0.84 | 124.95 |

BEL.BGR | 315 | 0.81 | 90.05 | BGR.MEX | 329 | 0.84 | 138.98 |

CRO.PHL | 315 | 0.81 | 103.33 | DNK.KOR | 329 | 0.84 | 72.83 |

CYP.US | 315 | 0.81 | 98.91 | US.FRA | 329 | 0.84 | 149.04 |

IND.STI | 314 | 0.81 | 110.78 | BTC.CYP | 328 | 0.84 | 68.56 |

UK.TUR | 314 | 0.81 | 110.58 | INA.CHN | 328 | 0.84 | 92.76 |

BEL.THA | 314 | 0.81 | 99.41 | INA.KOR | 328 | 0.84 | 71.31 |

BGR.PHL | 314 | 0.81 | 145.87 | IND.AFS | 328 | 0.84 | 87.0 |

SHI.MEX | 314 | 0.81 | 90.18 | AUS.BRA | 328 | 0.84 | 122.63 |

VNI.MEX | 313 | 0.81 | 89.46 | AUS.US | 328 | 0.84 | 81.08 |

JPN.DNK | 313 | 0.81 | 69.25 | BRA.AUT | 328 | 0.84 | 221.02 |

AUS.BEL | 313 | 0.81 | 106.14 | BRA.KOR | 328 | 0.84 | 112.07 |

BTC.UK | 312 | 0.81 | 88.93 | SHI.DNK | 328 | 0.84 | 61.58 |

BTC.AFS | 312 | 0.81 | 93.26 | CHN.KOR | 328 | 0.84 | 92.94 |

ETH.CYP | 312 | 0.81 | 126.67 | IND.BEL | 327 | 0.84 | 117.73 |

JPN.TUR | 312 | 0.81 | 147.87 | IND.FRA | 327 | 0.84 | 106.48 |

AUS.AUT | 312 | 0.81 | 125.92 | JPN.AFS | 327 | 0.84 | 77.16 |

BGR.CRO | 312 | 0.81 | 111.87 | AUT.KOR | 327 | 0.84 | 59.44 |

CRO.THA | 312 | 0.81 | 72.08 | BGR.CRO | 327 | 0.83 | 73.17 |

BTC.US | 311 | 0.81 | 91.2 | CRO.TUR | 327 | 0.84 | 60.98 |

STI.COL | 311 | 0.81 | 82.07 | DNK.FRA | 327 | 0.84 | 61.35 |

UK.THA | 311 | 0.81 | 78.07 | THA.TUR | 327 | 0.84 | 70.64 |

TUR.US | 311 | 0.81 | 87.84 | BTC.UK | 326 | 0.84 | 96.75 |

ETH.INA | 310 | 0.81 | 137.55 | ETH.IND | 326 | 0.83 | 111.12 |

INA.THA | 310 | 0.8 | 134.98 | ETH.AFS | 326 | 0.84 | 66.7 |

BTC.ARG | 309 | 0.81 | 72.48 | INA.COL | 326 | 0.84 | 61.87 |

UK.AUS | 309 | 0.8 | 76.31 | IND.AUS | 326 | 0.84 | 100.36 |

BEL.COL | 309 | 0.8 | 96.85 | VNI.CYP | 326 | 0.84 | 59.33 |

TUR.MEX | 309 | 0.8 | 85.18 | STI.SHI | 326 | 0.83 | 93.41 |

ETH.IND | 308 | 0.8 | 79.8 | UK.BRA | 326 | 0.83 | 74.66 |

INA.VNI | 308 | 0.8 | 101.26 | UK.FRA | 326 | 0.84 | 182.12 |

VNI.ARG | 308 | 0.8 | 144.92 | ARG.US | 326 | 0.84 | 77.8 |

VNI.CHN | 308 | 0.8 | 98.91 | BRA.CYP | 326 | 0.84 | 82.64 |

STI.AUT | 308 | 0.8 | 67.52 | SHI.AFS | 326 | 0.84 | 75.16 |

JPN.FRA | 308 | 0.8 | 83.47 | CYP.THA | 326 | 0.83 | 99.9 |

SHI.PHL | 308 | 0.8 | 80.08 | DNK.TUR | 326 | 0.84 | 76.24 |

BTC.COL | 307 | 0.8 | 93.91 | ETH.CYP | 325 | 0.84 | 99.38 |

ETH.ARG | 307 | 0.8 | 54.2 | IND.CYP | 325 | 0.83 | 104.35 |

ARG.CHN | 307 | 0.8 | 93.29 | VNI.KOR | 325 | 0.83 | 71.2 |

BRA.AUT | 307 | 0.8 | 82.18 | BRA.AFS | 325 | 0.83 | 73.39 |

BTC.IND | 306 | 0.8 | 72.11 | AUT.PHL | 325 | 0.83 | 88.72 |

ETH.JPN | 306 | 0.8 | 133.55 | CYP.DNK | 325 | 0.84 | 78.46 |

INA.BEL | 306 | 0.8 | 144.53 | BTC.AFS | 324 | 0.83 | 52.86 |

INA.CHN | 306 | 0.8 | 73.98 | BTC.KOR | 324 | 0.83 | 69.86 |

STI.MEX | 306 | 0.8 | 114.66 | ETH.BRA | 324 | 0.83 | 70.14 |

AUS.MEX | 306 | 0.8 | 143.11 | UK.BEL | 324 | 0.83 | 73.6 |

BRA.COL | 306 | 0.8 | 89.09 | ARG.BGR | 324 | 0.83 | 85.36 |

SHI.CRO | 306 | 0.8 | 56.46 | BEL.CHN | 324 | 0.83 | 55.61 |

THA.AFS | 306 | 0.8 | 89.99 | CHN.FRA | 324 | 0.83 | 113.32 |

BTC.INA | 305 | 0.8 | 73.3 | CYP.FRA | 324 | 0.83 | 115.39 |

BTC.AUT | 305 | 0.8 | 109.79 | THA.US | 324 | 0.83 | 87.01 |

JPN.THA | 305 | 0.8 | 78.2 | INA.MEX | 322 | 0.83 | 59.63 |

AUT.CHN | 305 | 0.8 | 214.99 | IND.COL | 322 | 0.83 | 68.21 |

BGR.THA | 305 | 0.8 | 113.0 | VNI.TUR | 322 | 0.83 | 55.44 |

SHI.KOR | 305 | 0.8 | 74.71 | UK.THA | 322 | 0.83 | 57.41 |

CHN.TUR | 305 | 0.8 | 82.88 | ARG.BEL | 322 | 0.83 | 100.93 |

CYP.PHL | 305 | 0.8 | 127.3 | ARG.KOR | 322 | 0.83 | 82.09 |

INA.AUS | 304 | 0.8 | 97.25 | AUS.CYP | 322 | 0.83 | 195.91 |

IND.AUS | 304 | 0.8 | 79.48 | AUT.CHN | 322 | 0.83 | 65.14 |

JPN.BGR | 304 | 0.8 | 62.44 | BEL.KOR | 322 | 0.83 | 62.53 |

JPN.SHI | 304 | 0.8 | 140.51 | ETH.JPN | 321 | 0.83 | 59.88 |

UK.BRA | 304 | 0.79 | 90.37 | INA.IND | 321 | 0.83 | 68.8 |

ARG.TUR | 304 | 0.79 | 118.26 | VNI.AUT | 321 | 0.82 | 53.93 |

BGR.AFS | 304 | 0.8 | 131.59 | AUT.CRO | 321 | 0.82 | 53.86 |

THA.US | 304 | 0.8 | 68.78 | THA.PHL | 321 | 0.82 | 65.95 |

BTC.PHL | 303 | 0.79 | 99.27 | AFS.KOR | 321 | 0.82 | 73.78 |

JPN.AUT | 303 | 0.79 | 89.82 | BTC.STI | 320 | 0.83 | 63.07 |

CHN.MYS | 303 | 0.79 | 89.42 | IND.BRA | 320 | 0.83 | 89.41 |

COL.THA | 303 | 0.79 | 79.96 | VNI.BEL | 320 | 0.82 | 58.99 |

JPN.UK | 302 | 0.79 | 88.12 | VNI.THA | 320 | 0.83 | 53.17 |

KOR.US | 302 | 0.79 | 67.25 | STI.THA | 320 | 0.82 | 100.09 |

ETH.AFS | 301 | 0.79 | 80.83 | COL.FRA | 320 | 0.82 | 51.07 |

INA.COL | 301 | 0.79 | 101.83 | VNI.AUS | 319 | 0.82 | 57.58 |

ARG.AUS | 301 | 0.79 | 80.31 | JPN.AUT | 319 | 0.82 | 76.38 |

BRA.THA | 301 | 0.79 | 79.82 | ARG.CHN | 319 | 0.82 | 59.5 |

BTC.VNI | 300 | 0.79 | 71.28 | BEL.TUR | 319 | 0.82 | 53.08 |

IND.COL | 300 | 0.79 | 84.04 | BTC.TUR | 318 | 0.82 | 44.1 |

VNI.STI | 300 | 0.79 | 65.92 | INA.PHL | 318 | 0.82 | 113.98 |

JPN.US | 300 | 0.79 | 82.89 | BTC.AUS | 317 | 0.82 | 55.15 |

UK.KOR | 300 | 0.79 | 56.67 | ETH.BGR | 317 | 0.82 | 67.63 |

ARG.CYP | 300 | 0.79 | 102.63 | INA.BEL | 317 | 0.82 | 46.88 |

SHI.THA | 300 | 0.79 | 123.95 | AUS.BEL | 317 | 0.82 | 119.29 |

CYP.MYS | 300 | 0.79 | 81.32 | COL.DNK | 317 | 0.82 | 49.79 |

STI.MYS | 299 | 0.79 | 55.81 | BTC.ARG | 316 | 0.82 | 44.93 |

UK.AUT | 299 | 0.79 | 101.24 | ARG.DNK | 316 | 0.82 | 63.03 |

PHL.MEX | 299 | 0.79 | 71.16 | AUS.AFS | 316 | 0.82 | 57.63 |

IND.THA | 298 | 0.78 | 102.41 | AUT.AFS | 316 | 0.82 | 45.74 |

IND.MEX | 298 | 0.79 | 79.87 | BGR.FRA | 316 | 0.82 | 50.41 |

JPN.AUS | 298 | 0.79 | 77.0 | MYS.FRA | 316 | 0.82 | 53.08 |

JPN.AFS | 298 | 0.79 | 93.28 | ETH.PHL | 315 | 0.82 | 48.19 |

AUS.FRA | 297 | 0.78 | 53.51 | VNI.UK | 315 | 0.82 | 43.37 |

DNK.FRA | 297 | 0.78 | 72.88 | STI.MYS | 315 | 0.82 | 46.47 |

MEX.KOR | 297 | 0.78 | 103.86 | AUS.KOR | 315 | 0.82 | 48.94 |

BTC.CRO | 296 | 0.78 | 76.04 | AUT.FRA | 315 | 0.82 | 79.7 |

BTC.KOR | 296 | 0.78 | 79.7 | CHN.TUR | 315 | 0.82 | 59.92 |

INA.AUT | 296 | 0.78 | 125.95 | BTC.VNI | 314 | 0.81 | 64.23 |

ARG.THA | 296 | 0.78 | 59.86 | IND.ARG | 314 | 0.81 | 85.6 |

AUS.THA | 296 | 0.78 | 58.23 | AUS.MYS | 314 | 0.81 | 46.83 |

AUT.FRA | 296 | 0.78 | 125.6 | MEX.FRA | 314 | 0.82 | 92.9 |

CHN.KOR | 296 | 0.78 | 57.74 | ETH.VNI | 313 | 0.81 | 57.08 |

DNK.AFS | 296 | 0.78 | 50.51 | INA.THA | 313 | 0.81 | 61.75 |

ETH.CRO | 295 | 0.78 | 146.13 | UK.US | 313 | 0.81 | 121.25 |