Abstract

This paper aims to quantify the linear and non-linear effects of government expenditure on output and public debt sustainability using the Local Projections (LP) approach on a dataset of 14 OECD countries considered for the 1981–2017 period. By employing the Blanchard and Perotti strategy to identify fiscal policy shocks, we show that government spending multipliers are close to one in linear models and that expansionary fiscal policy stimuli reduce the public debt-to-GDP ratio. When considering non-linearities using the smooth transition LP model, findings show that a fiscal policy shock leads to higher multipliers and a stronger reduction in the public debt-to-GDP ratio in economic phases characterised by a high rather than a low debt-to-GDP ratio. All results are confirmed even when government spending expectations are considered.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the years following the 2008 Global Financial Crisis (GFC), many advanced countries implemented fiscal consolidation policies to counteract the increasing levels of public debt and promote economic recovery. Such policies implied a reduction in government spending as they were presumed to stimulate private activity by reducing the burden of public debt and interest rates (Alesina et al., 2015; Corsetti et al., 2013). The rationale for this viewpoint is that fiscal multipliers are low or even negative and fiscal consolidation policies consequently produce non-Keynesian effects. However, the reality soon became evident in many advanced countries since fiscal consolidation plans had not yielded the expected results: economic growth had not returned, and public debt-to-GDP ratios had continued to rise.

Numerous economists and international institutions questioned the foundations of fiscal austerity, showing that multipliers were 0.7 to 1.3 units higher than what had been assumed by many economists (Blanchard & Leigh, 2013). The scholarly-based literature has demonstrated that multipliers are close to or even higher than 1 (Gechert, 2015), suggesting that consolidation policies have in fact slowed down economic growth, especially during periods of economic recession (Guajardo et al., 2014; Jordà & Taylor, 2016). More recently, DeLong and Summers (2012) and Fatás and Summers (2018) have proved that fiscal consolidations are self-defeating, as their long-term negative effects on GDP ultimately result in a higher debt-to-GDP ratio. Auerbach and Gorodnichenko (2017) have shown that a lower public debt-to-GDP ratio may in fact follow expansionary fiscal policies. In the last years, there has also been a shift in the policy recommendations put forward by the International Monetary Fund (IMF), which is historically known for its strong advocacy of consolidation policies. Because the 2020 IMF Fiscal Monitor advocated for a public investment stimulus to overcome the economic crisis caused by the COVID-19 pandemic (IMF, 2020), the fiscal policies launched in response to the COVID-19 crisis differed from those implemented by many countries after the 2008 GFC. In 2021, the US administration launched a $5.2 trillion fiscal plan for post-pandemic recovery, with a Bipartisan Infrastructure Deal (Infrastructure Investment and Jobs Act) of about $1.2 trillion. Moreover, although the US fiscal response has been much stronger than the one carried out in the eurozone (Romer, 2021), the EU has provided a fiscal stimulus package of about €2 trillion (EC, 2021). This includes €1.2 trillion earmarked for the EU’s long-term 2021–2027 budget and an €800 billion investment plan financed by NextGenerationEU. However, the European Commission’s Fiscal Policy Guidance for 2024 warns against indefinitely prolonging these fiscal stimuli (EC, 2023). In their proposed reform of the EU fiscal rules, the EC advise member states with high (exceeding 90%) and moderate (ranging between 60 and 90%) public debt-to-GDP ratios to implement fiscal consolidation policies. The objective of these policies is to curtail current public spending funded at the national level to ultimately reduce the public debt-to-GDP ratio.

Based on these premises, this paper aims to quantify the linear and non-linear effects of total public expenditure on GDP level as well as the sustainability of public debt. More concretely, our objective is to offer insights into whether the level of the public debt-to-GDP ratio may influence the magnitude of fiscal multipliers and the sustainability of fiscal stimuli. To do this, we apply the Local Projections (LP) approach to a dataset of 14 OECD countries considered for the 1981–2017 period, where fiscal policy shocks are identified through the Blanchard and Perotti strategy. In addition to linear modes, feasible non-linearities are considered using a smooth transition LP model (ST-LP). We aim to use ST-LP to assess whether the level of the public debt-to-GDP ratio might influence the magnitude of fiscal multipliers and the sustainability of fiscal stimuli. In doing so, we calculate the effect of government spending shocks on GDP and the public debt-to-GDP ratio by discriminating between high- and low-debt scenarios. We are particularly interested in assessing such non-linearities since policy prescriptions are needed to overcome stagnation and improve fiscal sustainability. This is especially crucial in the current economic phase, initiated by the COVID-19 pandemic and characterised by a growing public debt-to-GDP ratio. Our findings can be summarised as follows: (i) in linear models, fiscal multipliers are positive and greater than 1; (ii) fiscal multipliers are higher in a high-debt scenario than in a low-debt scenario; (iii) government spending shocks reduce the public debt-to-GDP ratio; (iv) a rise in government spending is followed by a greater reduction in the public debt-to-GDP ratio in a high-debt scenario than in a low-debt one. All findings are confirmed even when models incorporate government expenditure expectations.

The paper is organised as follows. Section 2 provides a literature review. Section 3 describes the data, methods, and the adopted identification strategy. Section 4 presents the findings, while Section 5 concludes by drawing some policy implications.

2 Fiscal multipliers and public debt sustainability: an overview

The empirical macroeconomic literature has usually employed advanced techniques to assess the impact of fiscal policy stimuli on GDP and the public debt-to-GDP ratio. These methods are based on vector autoregressive (VAR) models and the Local Projections (LP) approach.

VAR models can estimate fiscal policy shocks by imposing identification strategies on a reduced-form VAR. Four are the most widespread identification strategies. Three of these identify fiscal policy shocks through Structural VAR (SVAR) models as employed by: (i) the recursive approach grounded on Cholesky’s factorisation (Bachmann & Sims, 2012); (ii) Blanchard and Perotti’s (BP) strategy, which is similar to the recursive approach but models the relationship from output to net taxes by imposing an external parameter (Blanchard & Perotti, 2002); (iii) the sign approach where shocks are obtained by modelling the sign of the response functions (Mountford & Uhlig, 2009). The fourth method is based on the narrative approach that combines reduced-form VAR models with external instruments, typically dummy variables, identified through a qualitative assessment of fiscal policy stimuli uncorrelated to business cycle fluctuations. To identify fiscal shocks, this approach builds external instruments using official documents such as public announcements about historical episodes of changes in fiscal policy stances, legislative documents, and Business Week’s articles. These variables typically pertain to military build-ups and defence news, exogenous tax changes, and fiscal consolidation episodes (Alesina et al., 2015; Ben Zeev & Pappa, 2017; Ramey, 2011b; Romer & Romer, 2010).Footnote 1

More recently, several studies have estimated fiscal multipliers through the so-called Local Projections (LP) approach (Jordà, 2005), which is regarded as the natural alternative to SVAR models to compute impulse response functions (IRFs) (Auerbach & Gorodnichenko, 2017).Footnote 2 As argued by Jordà (2005), the LP approach offers several advantages compared to other empirical methods, as (i) it is estimated using a single regression technique; (ii) it is a flexible tool which can easily accommodate non-linearities; (iii) it is robust to misspecification; (iv) it enables the introduction of a high number of control variables as the parameters to be estimated are fewer than in other models (e.g. SVAR); (v) it does not impose dynamic restrictions on the IRFs, as computing separates functions for each horizon. Within the LP approach, fiscal policy shocks are obtained using military expenditure, public investment, forecast errors of the rate of growth of government spending, and the narrative approach (Abiad et al., 2016; Deleidi et al., 2020; Owyang et al., 2013; Ramey, 2016; Ramey & Zubairy, 2018). Relevant advancement in the LP approach was achieved when the SVAR and the LP were combined. Indeed, recent literature has computed structural shocks using SVAR models which have then been introduced into the LP equation (Auerbach & Gorodnichenko, 2017; Deleidi et al., 2023; Ramey & Zubairy, 2018).

The empirical literature on fiscal multipliers is vast. It typically shows that a GDP rise follows government spending stimuli, and that government expenditure multipliers are positive as they range between 0.8 and 1.5 (Auerbach & Gorodnichenko, 2012; Blanchard & Perotti, 2002; Caldara & Kamps, 2017; Deleidi et al., 2023; Galí et al., 2007; Gechert, 2015; Ramey & Zubairy, 2018; Ramey, 2011a, 2016).Footnote 3 Focusing on the US economy, Blanchard and Perotti (2002) estimate fiscal multipliers of government expenditure of 0.84 on impact and reaching a peak effect of 1.29, whereas Auerbach and Gorodnichenko (2012) compute a peak multiplier of 1. Similarly, Caldara and Kamps (2017) estimate multipliers between 1 and 1.3. Galí et al. (2007) find an impact multiplier of 0.91 and a peak of 1.31 eight quarters after the implementation of the fiscal policy stimuli. Beetsma et al. (2009) compute a multiplier of 1.17 on impact in EU countries, which reaches a peak of 1.50 after one year. Part of the literature has also assessed the impact of different classes of government spending by counterposing government investment with consumption, military with non-military spending, and government investment in research and development against non-innovative expenditures (Auerbach & Gorodnichenko, 2012; Ciaffi et al., 2024; Deleidi & Mazzucato, 2021). When different classes of government expenditure are compared, the most heated debate concerns the comparison between government consumption and investment. If, on the one hand, many studies support the thesis that government investment stimulates GDP more strongly than consumption expenditure (Deleidi, 2022; Gechert, 2015) due to the existence of long-run supply-side effects on the public and private capital stock (Ramey, 2020), on the other hand a few studies show that investment is not more effective than consumption in stimulating GDP (Boehm, 2020; Perotti, 2004b) because private investment is crowded out by government investment.Footnote 4

Another debate in the fiscal policy literature concerns state-dependent multipliers, which were first introduced by pioneering research by Auerbach and Gorodnichenko (2012). Many studies show that multipliers are higher in recessions than during economic expansions (Auerbach & Gorodnichenko, 2017; Berge et al., 2021; Fazzari et al., 2015; Fernández-Villaverde et al., 2019; Ghassibe & Zanetti, 2022; Riera-Crichton et al., 2015), and this is all the more so in extreme recessions (Boitani et al., 2022; Caggiano et al., 2015). The crowding-out effect of government spending on private investment and consumption is weaker during recessions than economic expansions due to a slower reaction of prices and interest rates and the presence of available excess capacity (Auerbach & Gorodnichenko, 2017). Conversely, Owyang et al. (2013) and Ramey and Zubairy (2018), question the common idea of state-dependent multipliers by estimating a-cyclical multipliers, while Alloza (2022) supports the thesis of higher multipliers in economic expansions than during recessions. Yet, although most of the literature estimate state dependent multipliers by focusing on the state of the business cycle, a few studies have estimated non-linear multipliers by considering the level of government indebtedness to assess whether a high (or low) public debt-to-GDP ratio matters in determining the magnitude of multipliers. Most studies show that multipliers are low, zero, and even negative when countries face a high public debt-to-GDP ratio. According to this view, fiscal stimuli are less effective on the output level as Ricardian agents would increase savings because of increased expectations of future tax hikes (Giavazzi et al., 2000; Perotti, 1999). For instance, by applying VAR techniques on a panel of 44 countries, Ilzetzki et al. (2013) show that multipliers are lower in the case of a high public debt-to-GDP ratio than in ‘normal’ times, assuming values close to zero on impact and negative in the long-run. Using a sample of 17 European countries and panel VAR techniques, Nickel and Tudyka (2014) show a positive response of GDP in the case of a moderate public debt-to-GDP ratio, which turns negative when the ratio increases. Using a panel of 13 countries, Fotiou (2022) shows that spending multipliers are lower in the case of high public debt. Consequently, spending-based fiscal consolidation policies produce a less pronounced effect on GDP and can stabilise public debt in a high-debt scenario. On the contrary, Corsetti et al. (2012), Caggiano et al. (2015), and Auerbach and Gorodnichenko (2017) – focusing on a sample of 17 OECD countries, the US economy, and 25 OECD countries respectively – find no differences in fiscal multipliers between low- and high-debt states. By applying the LP approach to euro area data, Boitani et al. (2022) find higher fiscal multipliers in the case of higher public debt, and they justify such results in terms of a strong negative correlation between the saving rate and the public debt-to-GDP ratio.

The magnitude of fiscal multipliers has important implications also for public debt sustainability. The values of fiscal multipliers computed by the scholarly-based literature (Gechert, 2015; Ramey, 2016, 2019) as well as recent studies showing that consolidation policies have permanent effects on output levels have cast doubt on the effectiveness of consolidation policies in lowering the public debt-to-GDP ratio (Fatás & Summers, 2018). Positive and sufficiently high fiscal multipliers are likely to have a substantial negative impact on the denominator of the public debt-to-GDP ratio. Therefore, attempts to reduce public debt via deficit reductions may be self-defeating and result in a higher public debt-to-GDP ratio through the short- and long-run negative effects of consolidation policies on economic activity.Footnote 5 In recent years, a few empirical studies have demonstrated the perverse effects that fiscal consolidation policies generate on the public debt-to-GDP ratio. Some studies confirm this outcome in the short- and medium-run, especially when countries with a debt-to-GDP ratio higher than 60% are considered (Eyraud & Weber, 2013). Many other studies reveal the long-term adverse effects of fiscal consolidation on the debt-to-GDP ratio, primarily through its negative impact on potential output (Fatás, 2019; Fatás & Summers, 2018; Gechert et al., 2019). Empirical evidence has also shown that a rise in government spending reduces the public debt-to-GDP ratio and thus improves fiscal sustainability, especially during periods of weak economic growth (Abiad et al., 2016). Auerbach and Gorodnichenko (2017) prove that a fiscal policy stimulus is likely to reduce the public debt-to-GDP ratio in periods of low debt, whereas it may increase the debt-to-GDP ratio in high-debt scenarios. Finally, when the effects of different classes of government spending on public debt sustainability are assessed, an increase in government investment is found to lead to a reduction in the public debt-to-GDP ratio (IMF, 2014; Abiad et al., 2016), whereas a rise in public consumption harms the sustainability of public debt (Petrović et al., 2021).

3 Data, methods, and the identification of fiscal policy shocks

3.1 Data

To assess the effects of government expenditure on GDP and the public debt-to-GDP ratio, we use the annual data provided by the OECD and the IMF. Our analysis is based on a sample of 14 countries considered for the period 1981–2017: Australia, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Japan, the Netherlands, Spain, the UK, and the US. The following variables are considered: GDP \(\left(Y\right)\), total government expenditure \(\left(G\right)\), the short-term interest rate \(\left(i\right)\), and the public debt-to-GDP ratio \(\left(D/Y\right)\).Footnote 6 The interest rate is included to control for the stance of monetary policy. \(Y\) and \(G\) are converted in real terms using the GDP deflator. All variables are converted to USD dollars using the PPP index and all but the interest rate and the debt-to-GDP ratio are in logarithmic form. Details on the employed variables and data sources are provided in Appendix 1, Table 3.

3.2 Methods and the identification of fiscal policy shocks

The LP approach is used to evaluate the impact of fiscal shocks on two main economic variables, namely GDP and the public debt-to-GDP ratio. This approach entails the estimation of a single equation that can be formalised as in (1), where the variable of interest \(\left(y_{i,t+h}\right)\) is considered at each horizon following the occurrence of the shock.

where \({\alpha }_{i}\) and \({\delta }_{\tau }\) are country and time fixed effects; \(y\) is the variable of interest considered at each horizon \(h=0, 1,\dots H\); \({shock}_{i,t}\) are the identified shocks; \({x}_{i,t-1}\) is composed by a set of control variables and includes the lag of all variables in the model.

Equation 1 represents a linear LP equation. However, because we also aim to assess the size of fiscal multipliers and the impact of expansionary spending stimuli on the public debt-to-GDP ratio during high and low public debt phases, we estimate a non-linear LP equation. To do this, we use the smooth transition LP approach (ST-LP) employed by Auerbach and Gorodnichenko (2017), which facilitates a smooth movement from periods of high public debt-to-GDP ratio to periods of low levels of debt.Footnote 7 The ST-LP can be summarised in Eq. (2):

where \(H-D\) and \(L-D\) subscripts indicate the high- and low-debt scenarios respectively. The transition function \(F\left({z}_{i,t}\right)\) is a measure of debt burden. Our method for defining the threshold for high and low debt diverges from the conventional approach found in the literature. Typically, the literature uses the debt-to-GDP ratio as a gauge of debt burden and it selects a specific threshold to delineate high or low debt (i.e. 100% in Corsetti et al., 2012; 60% in Ilzetzki et al., 2013; 90% in Boitani et al., 2022, and Fotiou, 2022). In contrast, aligning with the methodology employed by Auerbach and Gorodnichenko (2017), we estimate our threshold by using a within-country variation in public debt. Essentially, we compare the condition of a country at a time of low public debt with that of the same country at a time of high debt. This approach aims to avoid relying solely on absolute levels of public debt, which can distort our understanding of a government’s ability to effectively manage and service its debt.Footnote 8 This implies that we compare the different phases of the public debt-to-GDP ratio of one same country i, namely when it faces a low debt level and when it experiences a high debt level. Specifically, the employed transition function can be formalised in Eq. (3):

where \({z}_{i,t}\) is the public debt-to-GDP ratio at time \(t\), while \({z}_{i}^{min}\) and \({z}_{i}^{max}\) represent the minimum and the maximum value of that ratio over the sample period for country i. The transition function takes values between 0 and 1, where values close to 0 indicate periods of a low public debt-to-GDP ratio, whereas values near 1 indicate periods of a high public debt-to-GDP ratio.Footnote 9

To compute the IRFs in linear and non-linear models, we first identify government spending shocks \(\left({shock}_{i,t}\right)\) and then introduce them in the LP Eqs. 1 and 2. IRFs are estimated through the method applied by Auerbach and Gorodnichenko (2017, p. 11), which scales the identified fiscal shocks \(\left({w}_{i,t}^{G}\right)\) so that they are expressed as a percentage of GDP. To do that, we first calculate the average government spending-to-GDP ratio \(\left({s}_{i}^{G}={G}_{i}/{Y}_{i,}\right)\) over the sample period for each country i, and then we construct the fiscal policy shock as \({shock}_{i,t}={s}_{i}^{G}*{w}_{i,t}^{G}\).Footnote 10 In addition, following Ramey and Zubairy (2018), we estimate cumulative effects, because they measure the cumulative variation of \(Y\) and \(D/Y\) in relation to the cumulated variation of government spending during a given period, i.e. they represent the variation of \(Y\) and \(D/Y\) per unit of spending. The cumulative effects are estimated in three steps. First, the cumulative change of the dependent variable between \(t\) and \(t+h\) is computed (Eqs. 1 and 2). Second, the cumulative change of government expenditure between \(t\) and \(t+h\) is calculated by regressing Eqs. 1 and 2 with government expenditure \(\left({G}_{i,t+h}\right)\) as the dependent variable. Third, the cumulative multiplier is computed as the ratio between the \({\beta }^{h}\) coefficients estimated in the first and second steps.

One critical aspect is the use of a suitable identification strategy to estimate fiscal policy shocks that are to be introduced in Eqs. 1 and 2. In this paper, we compute shocks in an SVAR model by implementing the Blanchard and Perotti identification strategy augmented with the short-term interest rate to consider the monetary policy’s stance (Perotti, 2004a).Footnote 11 Using the BP strategy, we assume that government spending does not respond contemporaneously to other macroeconomic variables, which means the public expenditure \(\left(G\right)\) is not affected contemporaneously by the GDP and the interest rate. The GDP \(\left(Y\right)\) may be influenced contemporaneously by the government expenditure \(\left(G\right)\) , but it is not affected by the rate of interest \(\left(i\right)\). Finally, in line with the monetary policy literature, \(G\) and \(Y\) can influence the short-term interest rate \(\left(i\right)\) in the contemporaneous relationship, whereas the public and private sectors react with a lag to changes in interest rates (Bernanke et al., 2005; Cucciniello et al., 2022; Deleidi, 2022; Perotti, 2004a).Footnote 12 As shown in Eq. 4, the structural shocks are given by the residuals \(\left({w}_{i,t}^{G}\right)\) of the first equation of a VAR model:

where the total public expenditure \(\left({G}_{i,t}\right)\) is regressed on its one-year lagged value \(\left({G}_{i,t-1}\right)\), and on the lagged value of the GDP \(\left(Y_{i,t-1}\right)\), and the interest rate \(\left({i}_{i,t-1}\right)\). The model includes country and time fixed effect (\({\alpha }_{i}\) and \({\delta }_{\tau }\)).Footnote 13

To mitigate any potential model misspecification caused by the exclusion of fiscal expectations (Auerbach & Gorodnichenko, 2012; Blanchard & Perotti, 2002; Ramey, 2011b), we incorporate the government spending forecasts \(\left(\Delta {G}_{t|t-1}^{F}\right)\) released by the OECD in all the considered models.Footnote 14 Indeed, the impact of fiscal policy is influenced by the time lag between its announcement and implementation. This delay allows private agents to adjust their consumption and investment decisions based on anticipated changes in government expenditure. From an econometric perspective, if the model exclusively includes government expenditure without incorporating pertinent variables able to capture fiscal foresight, errors may arise. Biased estimates may occur if any relevant information represented by forecasts is omitted. As argued by Auerbach and Gorodnichenko (2012), the inclusion of \(\Delta {G}_{t|t-1}^{F}\) enables us to purify fiscal policy shocks from their anticipated or expected component and to estimate what has been defined as an unanticipated or unexpected fiscal shock \(\left({w}_{i,t}^{unexp}\right)\).Footnote 15 In this paper, we provide estimates of models that both include and do not incorporate expectations. When computing models that include expectations, we follow the methodology proposed by Auerbach and Gorodnichenko (2012, p. 16) and augment our VAR model with government spending forecasts \(\left(\Delta {G}_{t|t-1}^{F}\right)\). Technically, fiscal shocks are identified by applying the BP identification strategy, where \(\Delta {G}_{t|t-1}^{F}\) is the first ordered variable.

Finally, we consider two different model specifications when considering linear and non-linear models. Specifically, in model 1, variables are introduced in growth rates in Eqs. 1 and 2, while in model 2, variables are in log-level to preserve any cointegration relationship that may exist among considered variables (Auerbach & Gorodnichenko, 2012; Caggiano et al., 2015).

4 Findings

In this section, we report the findings on the effects of public expenditure \(\left(G\right)\) on GDP \(\left(Y\right)\) and the public debt-to-GDP ratio \(\left(D/Y\right)\). We display the local projections for linear and non-linear models 1 and 2, with and without fiscal expectations. In all the figures reported below (1–4), we display the dynamics of government spending \(\left(G\right)\), GDP \(\left(Y\right)\), and the public debt-to-GDP ratio \(\left(D/Y\right)\) to fiscal policy shocks.

Starting from the GDP \(\left(Y\right)\) responses to total public expenditure \(\left(G\right)\), Fig. 1 plots the IRFs of linear models 1 and 2 obtained through the BP identification strategy. The estimated IRFs show that fiscal policy shocks generate positive and long-lasting effects on government spending and GDP, which is reflected in the positive and often significant values of IRFs even five years after the initial shock. Such findings are confirmed when fiscal expectations \(\left(\Delta {G}^{F}\right)\) are incorporated in the model. Figure 2 displays the GDP responses of non-linear models, where the red lines are the findings obtained for high-debt scenarios, while the blue lines are those associated with low-debt scenarios. In Fig. 2, IRFs show a higher persistence, especially when high-debt scenarios are considered. Furthermore, the GDP responses \(\left(Y\right)\) in the high-debt scenario are higher than those obtained in the low-debt scenario. These findings are confirmed even when fiscal expectations \(\left(\Delta {G}^{F}\right)\) are considered in models 1 and 2.

Impulse Response Functions of \({\varvec{G}}\) on \({\varvec{Y}}\), non-linear models. \({\varvec{B}}{\varvec{P}}\) and \({\varvec{B}}{\varvec{P}}\) with \({\varvec{\Delta}}{{\varvec{G}}}^{{\varvec{F}}}\) identifications. Red lines represent IRFs obtained for the high-debt scenario; blue lines represent IRFs for the low-debt scenario. Dashed lines and shaded areas represent 68% confidence intervals. The horizontal axis shows the response horizon measured in years

Cumulative fiscal multipliers are reported in Table 1. The estimates obtained through linear models show that the multiplier in model 1 is equal to 0.72 on impact and the 5-year multiplier is 0.87. In the case of model 2, the impact multiplier is 1.09, while the 5-year multiplier is 0.81. When models 1 and 2 are augmented by fiscal expectations \(\left(\Delta {G}^{F}\right)\), multipliers are slightly higher than those obtained in models that do not encompass expectations. Notably, while average multipliers are 0.86 in model 1 and 1.03 in model 2 when excluding \(\Delta {G}^{F}\), the incorporation of expectations leads to average multipliers of 1 in model 1 and 1.09 in model 2. The cumulative multipliers obtained through non-linear models show that all multipliers computed in phases characterised by a high debt level are larger than those obtained in low-debt scenarios. Such findings are confirmed even when expectations are considered. Specifically, in model 1, impact multipliers in the high-debt scenario are equal to 0.64 and 0.80, the five-year multiplier assumes values of 1.56 and 1.51, and the average multiplier is equal to 1.33 in the model without expectations and 1.48 in the model incorporating expectations. Conversely, when looking at the findings obtained during economic phases of low debt, the multipliers obtained for model 1 are equal to 0.72 and 0.82 on impact, 0.06 and 0.52 five years after the implementation of the fiscal policy stimulus, and 0.36 and 0.52 on average. Slightly higher findings for low and high-debt scenarios are attained in model 2, where variables are in log-level. Our findings are in line with those provided by Boitani et al. (2022), showing that fiscal multipliers are higher during high-debt scenarios. The authors motivate these results by demonstrating that the saving rate negatively correlates with the public debt-to-GDP ratio.Footnote 16 Furthermore, as shown in Appendix 2 (Fig. 5) no correlation seems to exist between debt ratio and economic condition. Thus, the results we obtain do not appear to be driven by the fact that high debt periods coincide with periods of recession or vice versa (i.e. periods of low debt coincide with periods of expansion).

Our findings on the magnitude of multipliers in linear and non-linear models have several implications for public debt sustainability. When the effect of a government spending stimulus on the public debt-to-GDP ratio is evaluated, IRFs – estimated for linear models 1 and 2 and reported in Fig. 3 – show that a rise in government expenditure \(\left(G\right)\) improves public debt sustainability by lowering the public debt-to-GDP ratio \(\left(D/Y\right)\)). IRFs show highly persistent dynamics confirming that fiscal policy shocks generate long-lasting effects on \(D/Y\) up to even five years after the shock occurrence. These findings are validated also when fiscal expectations \(\left(\Delta {G}^{F}\right)\) are incorporated in models 1 and 2. Figure 4 reports the public debt-to-GDP ratio responses of non-linear models. The red lines are IRFs obtained for the high-debt scenario, and the blue lines are IRFs associated with the low-debt scenario. IRFs in Fig. 4 show high persistence, as public debt responses are negative and often statistically significant even five years after the occurrence of the spending stimuli, especially in high-debt scenarios.

Impulse response functions of \({\varvec{G}}\) on \({\varvec{D}}/{\varvec{Y}}\). \({\varvec{B}}{\varvec{P}}\) and \({\varvec{B}}{\varvec{P}}\) with \({\varvec{\Delta}}{{\varvec{G}}}^{{\varvec{F}}}\) identifications. Shaded areas represent 68% and 95% confidence intervals. The horizontal axis shows the response horizon measured in years

Impulse Response Functions of \({\varvec{G}}\) on \({\varvec{D}}/{\varvec{Y}}\), non-linear models. \({\varvec{B}}{\varvec{P}}\) and \({\varvec{B}}{\varvec{P}}\) with \({\varvec{\Delta}}{{\varvec{G}}}^{{\varvec{F}}}\) identifications. Red lines represent IRFs obtained for the high-debt scenario; blue lines represent IRFs for the low-debt scenario. Dashed lines and shaded areas represent 68% confidence intervals. The horizontal axis shows the response horizon measured in years

IRFs computed for linear and non-linear models make it possible to calculate the cumulative effects of government expenditures on the public debt-to-GDP ratio reported in Table 2. The cumulative effects obtained for linear models without expectations show that a 1-percent GDP increase in public spending reduces \(D/Y\) by 0.93 (model 1) and 1.73 (model 2) percentage points on impact. The persistent effect of public expenditures on GDP translates into a reduction in \(D/Y\) by 1.4 (model 1) and 1.64 (model 2) percentage points five years after the initial shock. On average, \(D/Y\) falls by 1.38 (model 1) and 1.98 (model 2) percentage points. When models 1 and 2 are augmented by fiscal expectations \(\left(\Delta {G}^{F}\right)\), the impact of a fiscal policy shock is amplified, resulting in a stronger cumulative effect compared to models that do not include expectations. Specifically, the incorporation of expectations leads the average cumulative effects of \(G\) on \(D/Y\) to be equal to 1.72 in model 1 and to 2.39 in model 2. The cumulative effects of \(D/Y\) estimated using non-linear models reflect the multipliers reported in Table 1: a rise in government expenditure leads to a more substantial reduction in the public debt-to-GDP ratio in phases characterised by a high debt level than in low-debt scenarios. Precisely, in a high-debt scenario, a fiscal policy stimulus is followed by an average reduction of 1.86 (in model 1 without \(\Delta {\text{G}}^{\text{F}}\)) and 2.08 (in model 1 with \(\Delta {\text{G}}^{\text{F}}\)) percentage points. The reduction of \(D/Y\) in model 2 is larger than the one computed for model 1, and it attains average values of 2.59 (in model 2 without \(\Delta {\text{G}}^{\text{F}}\)) and 2.97 (in model 2 with \(\Delta {\text{G}}^{\text{F}}\)) percentage points. Contrarily, findings in a low-debt scenario reveal an average reduction in \(D/Y\) of 0.34 (in model 1 without \(\Delta {\text{G}}^{\text{F}}\)), 0.87 (in model 1 with \(\Delta {\text{G}}^{\text{F}}\)), 1.03 (in model 2 without \(\Delta {\text{G}}^{\text{F}}\)), and 1.46 (in model 2 with \(\Delta {\text{G}}^{\text{F}}\)) percentage points. When the public debt-to-GDP ratio responses to spending shocks are considered, models encompassing fiscal expectations reveal a greater reduction in \(D/Y\) than the ones not incorporating expectations. Our findings in linear models are in line with those provided by Auerbach and Gorodnichenko (2017) and Fatás and Summers (2018) and show that expansionary fiscal policies lead to a lower public debt-to-GDP ratio. This implies that expenditure-based consolidation policies are likely to be self-defeating, resulting in a higher public debt-to-GDP ratio. However, in contrast with Auerbach and Gorodnichenko’s (2017) results, the effects on \(D/Y\) are stronger in scenarios characterised by a high debt level. Such results are motivated by the existence of a twofold mechanism. Firstly, the higher multipliers in high-debt scenarios are likely to reduce the public debt-to-GDP ratio as they exert a stronger effect on the denominator of \(D/Y\). Secondly, even if multipliers were equal in high- and low-debt scenarios, countries experiencing a high debt level would require a lower multiplier to decrease the public debt-to-GDP ratio. As proved in a few theoretical contributions, the condition that needs to be fulfilled to allow the debt-to-GDP ratio to fall as a result of a fiscal policy stimulus can be summarised as follows: \(m>Y/D\), where \(m\) is the fiscal multiplier, and \(Y/D\) is the inverse of the public debt-to-GDP (Ciccone, 2013; Di Bucchianico, 2019; Leão, 2013).Footnote 17 This condition also implies that expansionary fiscal policies are more likely to reduce the debt-to-GDP ratio when countries face a high level of debt, as the multiplier required to comply with the condition is lower.

In summary, our findings shed light on a few relevant issues for the fiscal policy literature. First, expansionary fiscal policies engender long-lasting positive effects on GDP and lower the public debt-to-GDP ratio, thus improving fiscal sustainability. Second, the multipliers estimated in linear models are in many specifications above the unit, ranging between 0.86 and 1.09 on average; the multipliers estimated in a high-debt scenario are higher than those computed in linear models and low-debt scenarios, and assume a maximum effect of 1.97. Third, our linear estimates show that a rise in government expenditure engenders a reduction in the public debt-to-GDP ratio. However, the most considerable reduction in the public debt-to-GDP ratio occurs when high-debt scenarios are contemplated. This result should be considered in light of the estimates of fiscal multipliers provided in Table 1, where higher multipliers are calculated for high-debt scenarios. Additionally, it is important to take into account the aforementioned condition, which allows the public debt-to-GDP ratio to decrease following a fiscal policy stimulus if the multiplier exceeds the inverse of the public debt-to-GDP ratio.

5 Conclusion and policy implications

In the aftermath of the 2008 Global Financial Crisis, many governments of advanced countries adopted fiscal consolidation policies to reduce the burden of increasing public debt and foster economic recovery. The supporters of fiscal consolidation policies assumed that fiscal multipliers were well below the unit and that consolidation policies would have non-Keynesian effects. In the years following the 2008 GFC, characterised by slow economic growth and an increase in sovereign debts, many economists and international institutions questioned the effectiveness of fiscal consolidation policies in boosting economic recovery. They pointed out that fiscal multipliers were higher than originally assumed (Blanchard & Leigh, 2013), and many studies confirmed that spending multipliers were close to the unit, ranging between 0.8 and 1.5. In addition, recent studies have proved that consolidation policies are likely to be self-defeating as they result in a higher public debt-to-GDP ratio (Fatás, 2019; Fatás & Summers, 2018), whereas well-designed fiscal expansions may promote public debt sustainability (Auerbach & Gorodnichenko, 2017). Analysing such issues is even more important in the current economic phase since many governments have tried to mitigate the effects of the COVID-19 pandemic emergency using fiscal levers. For instance, the US and EU administrations – which have been experiencing stagnating economies and growing debt-to-GDP ratios since the burst of the COVID-19 crisis – launched fiscal plans of about $5.2 and €2 trillion respectively.

The current paper aims to enter these debates by quantifying the linear and non-linear impacts of an increase in government expenditure on output and the public debt-to-GDP ratio. To do this, the Local Projections and the Smooth Transition Local Projections approaches have been applied to a dataset of 14 OECD countries considered for the 1981–2017 period. The Smooth Transition Local Projections model has been used to quantify the effect of government spending during scenarios characterised by high- and low-debt levels. Fiscal policy shocks have been identified through the Blanchard and Perotti identification strategy and introduced in the Local Projections equations. Our findings support the idea that expansionary fiscal policies produce Keynesian effects. The estimated IRFs show that fiscal policy shocks engender a persistent positive impact on GDP but a negative effect on the public debt-to-GDP ratio. In linear models, the fiscal multipliers associated with total government expenditure are positive and above the unit in many model specifications. In non-linear models, multipliers are larger in a high-debt scenario than in a low-debt one. Such results are in line with those obtained by Boitani et al. (2022) and with the idea of a negative correlation between the saving rate and the public debt-to-GDP ratio. The magnitude of fiscal multipliers has important implications also for public debt sustainability. When we evaluate the ability of expansionary fiscal policy to promote debt sustainability, our linear findings are in line with those provided by Auerbach and Gorodnichenko (2017), as they show that expansionary fiscal policy can reduce the public debt-to-GDP ratio. However, when non-linear models are considered, our findings provide an opposite picture compared with the one proposed by Auerbach and Gorodnichenko (2017). A higher reduction in the public debt-to-GDP ratio is found in high-debt phases compared to low-debt scenarios. A twofold mechanism can explain such non-linear results on public debt. First, higher fiscal multipliers in high-debt scenarios lead to a stronger effect on the denominator of the public debt-to-GDP ratio. Second, there is a theoretical condition wherein the debt-to-GDP decreases after a fiscal policy stimulus, that is when the fiscal multiplier is larger than the inverse of the public debt-to-GDP (Ciccone, 2013; Di Bucchianico, 2019). This also implies that as the public debt-to-GDP ratio increases, the necessary multiplier for reducing the public debt ratio decreases accordingly. Further development of this research will assess: (i) the impact of a fiscal plan composition, with public consumption and investment to be considered separately; (ii) non-linear fiscal multipliers associated with different phases of the business cycle; and (iii) the impact on the sectoral composition of output.

In conclusion, our findings bear important policy implications as they suggest that governments should implement expansionary fiscal policies to promote economic recovery and public debt sustainability. Our study also shows that a rise in government spending produces a strong positive effect on GDP while it lowers the public debt-to-GDP ratio considerably, especially in phases characterised by a high and growing debt level, like the one many advanced countries have been experiencing since the burst of COVID-19 pandemic. These implications appear even more relevant in light of the discussion on the reform of EU fiscal rules by the European Commission (EC, 2023). In this regard, to reduce public debt ratios, the Commission’s recent guidelines suggest that member states with high (exceeding 90%) and moderate (ranging between 60 and 90%) public debt-to-GDP ratios should implement fiscal consolidation policies. The primary aim of these policies is to reduce the current nationally financed public expenditure. If these guidelines are applied, the resulting reduction in public spending will have counterproductive effects on economic growth and the sustainability of public finance, especially in countries characterized by high public debt-to-GDP ratios.

Notes

The magnitude of multipliers varies across different studies (Gechert, 2015; Ramey, 2019), and such differences depend on divergence in either the countries’ peculiarities or the identification strategies implemented to calculate fiscal policy shocks (Caldara & Kamps, 2017; Ilzetzki et al., 2013; Ramey, 2019).

Net taxes are not included in our models since the scholarly-based literature has shown how their exclusion does not lead to any model misspecifications or alter the estimates of spending multipliers in any way (Ramey & Zubairy, 2018).

Compared with the threshold LP model (T-LP), which uses dummy variables equal to 0 or 1 to identify scenarios, the ST-LP enables a seamless transition from one regime to another. One of the key advantages of the ST-LP model is that, by exploiting variation in the degree of adherence to a particular regime, it uses the whole available sample rather than just a few observations tied to a discrete regime. This feature avoids unstable and imprecise estimates of the model’s parameters compared with the T-LP model (Auerbach & Gorodnichenko, 2012).

As Auerbach and Gorodnichenko (2017) argued, we consider this measure of debt burden because there is an apparent variation in the level of public debt a country may sustain.

The transition function enters in Eq. 2 with a lag \(F\left({z}_{i,t-1}\right)\) to avoid any contemporaneous feedback between fiscal shocks on the value of the state variable. Results are similar if we use \(F\left({z}_{ i,t}\right)\) instead of \(F\left({z}_{ i,t-1}\right)\) in Eq. 2. Findings are not reported in the paper but are available upon request.

Several studies have also divided fiscal policy shocks by potential GDP (Gordon & Krenn, 2010; Ramey & Zubairy, 2018). However, the available measures of potential output are sensitive to business cycle fluctuations (Auerbach & Gorodnichenko, 2017; Coibion et al., 2017). An additional method is the one proposed by Ramey and Zubairy (2018). It rescales the shock \(\left(w_{i,t}\right)\) using the value of \({G}_{i}/{Y}_{i,}\) at each point in time rather than its average value over the entire country sample \(\left(s_i^G\right)\). For the sake of simplicity, we report the findings of the model using the Auerbach and Gorodnichenko (2017) procedure. The results obtained by applying the Ramey and Zubairy (2018) procedure are in line with those reported in this paper and are available upon request.

The inclusion of the short-term interest rate allows the BP identification strategy to be extended to consider the effect of interest rates and hence the interaction between monetary and fiscal policies (Perotti, 2004a).

For the sake of simplicity, we do not report the responses of interest rates to fiscal shocks, but the IRFs are available upon request.

To identify exogenous fiscal shocks, the ordering of variables only applies to the contemporaneous relationship. In the VAR model, the relationship between variables is assessed through a lag structure. Due to the annual frequency of the data, we apply the standard approach found in the literature by setting a lag of 1.

We use the forecasts provided by the OECD in the Economic Outlook. Specifically, we use the forecasts made at \(t-1\) for the growth rate of real government purchases for time \(t\). These forecasts are available from year 1987, so this part of the empirical analysis is carried out for the period 1987–2017.

Sims (2012) and Perotti (2014) point out that the feasible distortions caused by the non-inclusion of expectations may be small in practice. This would imply that the IRFs obtained through models which do not include expectations are very similar to those considering them. Additionally, the use of yearly data may also mitigate the role of anticipation effects (Bénétrix & Lane, 2013; Auerbach & Gorodnichenko, 2017).

We run simple panel regressions with country and time fixed effects of the saving rate on the public debt-to-GDP ratio for the 14 OECD countries considered during the 1981–2017 period. Results indicate the presence of a negative and statistically significant correlation between the saving rate and the public debt-to-GDP ratio in our sample. The results are available upon request.

References

Abiad, A., Furceri, D., & Topalova, P. (2016). The macroeconomic effects of public investment: Evidence from advanced economies. Journal of Macroeconomics, 50, 224–240.

Alesina, A., Favero, C., & Giavazzi, F. (2015). The output effect of fiscal consolidation plans. Journal of International Economics, 96, S19–S42.

Alloza, M. (2022). Is fiscal policy more effective during recessions? International Economic Review, 63(3), 1271–1292.

Auerbach, A. J., & Gorodnichenko, Y. (2012). Measuring the output responses to fiscal policy. American Economic Journal: Economic Policy, 4(2), 1–27.

Auerbach, A. J., & Gorodnichenko, Y. (2013). Output spillovers from fiscal policy. American Economic Review, 103(3), 141–146.

Auerbach, A. J., & Gorodnichenko, Y. (2017). Fiscal stimulus and fiscal sustainability. NBER Working Paper No. 23789.

Bachmann, R., & Sims, E. R. (2012). Confidence and the transmission of government spending shocks. Journal of Monetary Economics, 59(3), 235–249.

Beetsma, R., Giuliodori, M., & Klaassen, F. (2009). Temporal aggregation and SVAR identification, with an application to fiscal policy. Economics Letters, 105(3), 253–255.

Ben Zeev, N., & Pappa, E. (2017). Chronicle of a war foretold: The macroeconomic effects of anticipated defence spending shocks. The Economic Journal, 127(603), 1568–1597.

Bénétrix, A., & Lane, P. R. (2013). Fiscal shocks and the real exchange rate. International Journal of Central Banking, 9(3), 6–37.

Berge, T., De Ridder, M., & Pfajfar, D. (2021). When is the fiscal multiplier high? A comparison of four business cycle phases. European Economic Review, 138, 103852.

Bernanke, B. S., Boivin, J., & Eliasz, P. (2005). Measuring the effects of monetary policy: A factor-augmented vector autoregressive (FAVAR) approach. The Quarterly Journal of Economics, 120(1), 387–422.

Blanchard, O. J., & Leigh, D. (2013). Growth forecast errors and fiscal multipliers. American Economic Review, 103(3), 117–120.

Blanchard, O., & Perotti, R. (2002). An empirical characterization of the dynamic effects of changes in government spending and taxes on output. The Quarterly Journal of Economics, 117(4), 1329–1368.

Boehm, C. E. (2020). Government consumption and investment: Does the composition of purchases affect the multiplier? Journal of Monetary Economics, 115, 80–93.

Boitani, A., Perdichizzi, S., & Punzo, C. (2022). Nonlinearities and expenditure multipliers in the Eurozone. Industrial and Corporate Change, 31(2), 552–575.

Caggiano, G., Castelnuovo, E., Colombo, V., & Nodari, G. (2015). Estimating fiscal multipliers: News from a non-linear world. The Economic Journal, 125(584), 746–776.

Caldara, D., & Kamps, C. (2017). The analytics of SVARs: A unified framework to measure fiscal multipliers. The Review of Economic Studies, 84(3), 1015–1040.

Ciaffi, G., Deleidi, M., & Mazzucato, M. (2024). Measuring the macroeconomic responses to public investment in innovation: evidence from OECD countries. Industrial and Corporate Change. https://doi.org/10.1093/icc/dtae005

Ciccone, R. (2013). Public debt and aggregate demand: Some unconventional analytics. In E. Levrero, A. Palumbo, & A. Stirati (Eds.), Sraffa and the reconstruction of economic theory (Vol. Two, pp. 15–43). Palgrave Macmillan.

Coibion, O., Gorodnichenko, Y., & Ulate, M. (2017). The cyclical sensitivity in estimates of potential output. NBER Working Paper No. 23580.

Corsetti, G., Kuester, K., Meier, A., & Müller, G. J. (2013). Sovereign risk, fiscal policy, and macroeconomic stability. The Economic Journal, 123(566), F99–F132.

Corsetti, G., Meier, A., & Müller, G. J. (2012). What determines government spending multipliers? Economic Policy, 27(72), 521–565.

Cucciniello, M. C., Deleidi, M., & Levrero, E. S. (2022). The cost channel of monetary policy: The case of the United States in the period 1959–2018. Structural Change and Economic Dynamics, 61, 409–433.

Deleidi, M. (2022). Quantifying multipliers in Italy: Does fiscal policy composition matter? Oxford Economic Papers, 74(2), 359–381.

Deleidi, M., Iafrate, F., & Levrero, E. S. (2020). Public investment fiscal multipliers: An empirical assessment for European countries. Structural Change and Economic Dynamics, 52, 354–365.

Deleidi, M., & Mazzucato, M. (2021). Directed innovation policies and the supermultiplier: An empirical assessment of mission-oriented policies in the US economy. Research Policy, 50(2), 104151.

Deleidi, M., Iafrate, F., & Levrero, E. S. (2023). Government investment fiscal multipliers: evidence from Euro-area countries. Macroeconomic dynamics, 27(2), 331–349.

DeLong, J. B., & Summers, L. H. (2012). Fiscal policy in a depressed economy. Brookings Papers on Economic Activity, 43(1), 233–297.

Di Bucchianico, S. (2019). A bit of Keynesian debt-to-GDP arithmetic for deficitcapped countries. Bulletin of Political Economy, 13(1), 55–83.

European Commission (EC). (2021). The EU’s 2021-2027 long-term budget & NextGenerationEU. European Commission, Directorate-General for Research and Innovation. https://doi.org/10.2761/808559

European Commission (EC). (2023). Communication from the Commission to the Council. Fiscal policy guidance for 2024. (8 March 2023). https://economy-finance.ec.europa.eu/economic-and-fiscal-governance/stability-and-growth-pact/fiscal-policy-guidance_en

Eyraud, L., & Weber, A. (2013). The challenge of debt reduction during fiscal consolidation. International Monetary Fund.

Fatás, A. (2019). Fiscal policy, potential output, and the shifting goalposts. IMF Economic Review, 67(3), 684–702.

Fatás, A., & Summers, L. H. (2018). The permanent effects of fiscal consolidations. Journal of International Economics, 112, 238–250.

Fazzari, S. M., Morley, J., & Panovska, I. (2015). State-dependent effects of fiscal policy. Studies in Nonlinear Dynamics & Econometrics, 19(3), 285–315.

Fernández-Villaverde, J., Mandelman, F., Yu, Y., & Zanetti, F. (2019). Search complementarities, aggregate fluctuations, and fiscal policy. NBER Working Paper No. 26210.

Fotiou, A. (2022). Non-linearities in fiscal policy: The role of debt. European Economic Review, 104212. https://doi.org/10.1016/j.euroecorev.2022.104212

Galí, J., López-Salido, J. D., & Vallés, J. (2007). Understanding the effects of government spending on consumption. Journal of the European Economic Association, 5(1), 227–270.

Gechert, S. (2015). What fiscal policy is most effective? A meta-regression analysis. Oxford Economic Papers, 67(3), 553–580.

Gechert, S., Horn, G., & Paetz, C. (2019). Long-term effects of fiscal stimulus and austerity in Europe. Oxford Bulletin of Economics and Statistics, 81(3), 647–666.

Ghassibe, M., & Zanetti, F. (2022). State dependence of fiscal multipliers: The source of fluctuations matters. Journal of Monetary Economics, 132, 1–23.

Giavazzi, F., Jappelli, T., & Pagano, M. (2000). Searching for non-linear effects of fiscal policy: Evidence from industrial and developing countries. European Economic Review, 44(7), 1259–1289.

Gordon, R. J., & Krenn, R. (2010). The end of the Great Depression: VAR insight on the roles of monetary and fiscal policy. NBER Working paper No. 16380.

Guajardo, J., Leigh, D., & Pescatori, A. (2014). Expansionary austerity? International evidence. Journal of the European Economic Association, 12(4), 949–968.

Ilzetzki, E., Mendoza, E. G., & Végh, C. A. (2013). How big (small?) are fiscal multipliers? Journal of Monetary Economics, 60(2), 239–254.

International Monetary Fund (IMF). (2014). Is it time for an infrastructure push? The macroeconomic effects of public investment. In World economic outlook: Legacies, clouds, uncertainties (pp. 75–112). International Monetary Fund.

International Monetary Fund (IMF). (2020). Public investment for the recovery. In Fiscal monitor: Policies for the recovery (pp. 33–54). International Monetary Fund.

Jordà, Ò. (2005). Estimation and inference of impulse responses by local projections. American Economic Review, 95(1), 161–182.

Jordà, Ò., & Taylor, A. M. (2016). The time for austerity: Estimating the average treatment effect of fiscal policy. The Economic Journal, 126(590), 219–255.

Leão, P. (2013). The effect of government spending on the debt to GDP ratio: Some Keynesian arithmetic. Metroeconomica, 64(3), 448–465.

Mountford, A., & Uhlig, H. (2009). What are the effects of fiscal policy shocks? Journal of Applied Econometrics, 24(6), 960–992.

Nickel, C., & Tudyka, A. (2014). Fiscal stimulus in times of high debt: Reconsidering multipliers and twin deficits. Journal of Money, Credit and Banking, 46(7), 1313–1344.

Owyang, M. T., Ramey, V. A., & Zubairy, S. (2013). Are government spending multipliers greater during periods of slack? Evidence from twentieth-century historical data. American Economic Review, 103(3), 129–134.

Perotti, R. (2004a). Estimating the effects of fiscal policy in OECD Countries. IGIER Working Paper No. 276, Innocenzo Gasparini Institute for Economic Research, Bocconi University.

Perotti, R. (2004b). Public investment: Another (different) Look. IGIER Working Paper No. 277, Innocenzo Gasparini Institute for Economic Research, Bocconi University.

Perotti, R. (2014). Defense government spending is contractionary, civilian government spending is expansionary. NBER Working Paper No. 20179.

Perotti, R. (1999). Fiscal policy in good times and bad. The Quarterly Journal of Economics, 114(4), 1399–1436.

Petrović, P., Arsić, M., & Nojković, A. (2021). Increasing public investment can be an effective policy in bad times: Evidence from emerging EU economies. Economic Modelling, 94, 580–597.

Ramey, V. A. (2020). The macroeconomic consequences of infrastructure investment. NBER Working Paper No. 27625.

Ramey, V. A. (2011a). Can government purchases stimulate the economy? Journal of Economic Literature, 49(3), 673–685.

Ramey, V. A. (2011b). Identifying government spending shocks: It’s all in the timing. The Quarterly Journal of Economics, 126(1), 1–50.

Ramey, V. A. (2016). Macroeconomic shocks and their propagation. Handbook of Macroeconomics, 2, 71–162.

Ramey, V. A. (2019). Ten years after the financial crisis: What have we learned from the renaissance in fiscal research? Journal of Economic Perspectives, 33(2), 89–114.

Ramey, V., & Zubairy, S. (2018). Government spending multipliers in good times and in bad: Evidence from U.S. historical data. Journal of Political Economy, 126, 850–901.

Riera-Crichton, D., Vegh, C. A., & Vuletin, G. (2015). Procyclical and countercyclical fiscal multipliers: Evidence from OECD countries. Journal of International Money and Finance, 52, 15–31.

Romer, C. D. (2021). The fiscal policy response to the pandemic. Brookings Papers on Economic Activity, 89–110. https://www.brookings.edu/wp-content/uploads/2021/03/15872-BPEA-SP21_WEB_Romer.pdf

Romer, C. D., & Romer, D. H. (2010). The macroeconomic effects of tax changes: Estimates based on a new measure of fiscal shocks. American Economic Review, 100(3), 763–801.

Sims, E. R. (2012). News, non-invertibility, and structural VARs. In DSGE models in macroeconomics: Estimation, evaluation, and new developments. Emerald Group Publishing Limited.

Acknowledgements

This paper is developed in the context of the Italian National Research Project – PRIN 2017 ‘Regional Policies, Institutions and Cohesion in the South of Italy’ (Project code 2017-4BE543; website www.prin2017-mezzogiorno.unirc.it), financed by the Italian Ministry of Education, University and Scientific Research from 2020 to 2023.

Funding

Open access funding provided by Università degli Studi dell’Aquila within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

See Table 3.

Appendix 2

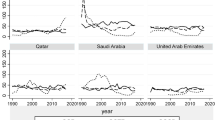

In Fig. 5 we show graphs for the 14 OECD countries in which we compare the debt-to-GDP ratio with the probability of being in a state of recession. In particular, the probability of recession is defined by a logistic function (Auerbach & Gorodnichenko, 2013, 2017): \(F\left({z}_{i,t}\right)=\frac{\text{exp}(-\gamma {z}_{i,t})}{1+\text{exp}(-\gamma {z}_{i,t})}\), where \({z}_{i,t}\) measures the state of the business cycle and \(\gamma\) is a parameter that influences the transition speed between the two regimes of expansion and recession. In this case, \({z}_{i,t}\) is the cyclical component computed as the change in the logarithm of output from its trend value, obtained using the one-sided Hodrick-Prescott (HP) filter, and we set the \(\gamma\) value to 2.3 (Caggiano et al., 2015; Auerbach and Gorodnichenko 2013, 2017). Results are unaffected by parameter variations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ciaffi, G., Deleidi, M. & Capriati, M. Government spending, multipliers, and public debt sustainability: an empirical assessment for OECD countries. Econ Polit (2024). https://doi.org/10.1007/s40888-024-00335-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40888-024-00335-0

Keywords

- Fiscal multipliers

- Non-linearities

- Public debt sustainability

- Government expenditure

- Local projections

- OECD countries