Abstract

This paper analyzes the relationship between the likelihood that Italian firms implement bank debt restructuring and the trade credit. It uses a sample of 2377 Italian firms over the period of 2010–2014. The empirical analysis shows that the amount of payables and the unexpected delay in the payment of trade credit are strictly related to the firm’s financial distress. Specifically, the findings suggest that companies in financial distress have used trade credit extensively and suffer from the deferment of receivables. This result supports the hypothesis of a potential credit contagion channel in the supply chain with a cascading effect between buyers and suppliers.

Similar content being viewed by others

Notes

The literature offers several definitions of financial distress. In early studies, economists such as Beaver (1966) considered financial distress to reflect an acclaimed event, such as bankruptcy, bond default and so on. Alternatively, Gordon (1971) identified financial distress as a state of negative profitability and/or a condition of over-indebtedness. Subsequently, Andrade and Kaplan (1998) interpreted financial distress as also including when a borrower tries to restructure debt to avoid default. This paper follows the latter, broad definition.

The “irrelevance principle” of capital structure (Modigliani and Miller 1958) is the result of efficient markets: with perfect information, absence of fiscal distortions, agency costs, etc. This assumption also implies an irrelevance between financing by trade credit or by alternative sources of funding (Lewellen et al. 1980). However, this theory has been overcome by the seminal study of Jaffee and Stiglitz (1990), which considered the existence of a risk premium for external financing produced by imperfections in financial markets in order to explain the choice of trade credit.

Klapper et al. (2012) identified three main motivations to explain why firms prefer trade credit: suppliers grant cheaper borrowing costs to their buyers; it increases the buyers’ market power to obtain favorable price discrimination; and it provides a warranty, assuring buyers of product quality. Above all, these authors argued that trade credit financing does not depend on financial motives, but on the buyer–supplier relationship. This relationship is stronger in countries such as Italy, which are characterized mainly by small and medium-sized firms and where the asymmetric information is so relevant that it determines a systematic recourse to trade credit. In this regard, Mateut (2014) has shown that suppliers demand their younger and riskier customers to make more advance payments, and these prepayments also increase with the supplier’s relative bargaining power.

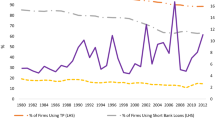

According to Panetta (2014), loans to firms with repayment difficulties (“non-performing loans”) accounted for almost a quarter of all credit to the sector, which increased by 10% in only the last 2 years (2013 and 2014). Within this aggregate, the component with the highest probability of loss for the banks (“bad debts”) accounted for 12% of loans. Credit losses absorbed a large part of the banks’ operating profits. According to UN data, in 2015 the EU average for non-performing loans as a percentage of total loans was 6%; in Italy the ratio has reached 17%.

The conjunctural instability of bank debt certainly does not favor the growth of investment by companies. On the contrary, to increase their competitiveness and efficiency, companies have not exploited the strengthening of capital that occurred in the pre-crisis decade. The coverage of investment using equity remained low (38%), and productivity and profitability remained stationary.

For instance, Altman and Sabato (2007) applied logistic regression using several accounting ratios (i.e. liquidity, profitability and leverage) to set up a credit risk model for small- and medium-sized firms (SMEs). They found that the out-of-sample prediction power of the logistic model was almost 30% higher than that of a generic corporate model. However, Zhou et al. (2012) have evaluated the prediction performance of 21 empirical models with different features (parametric, non-parametric and neural networks), finding that all models were time-sensitive and, in the long run, do not differ significantly in terms of predictive performance.

Shumway (2001) considers the hazard model as a binary logit model that includes each firm-year as a separate observation but consequently corrects for the period at risk and allows for time-varying covariates, which improves its validity beyond that of theoretical and empirical approaches with respect to static models.

We reject the fixed-effect estimator for two reasons: (1) we are interested in the account of time-invariant characteristics, such as the geographical location, firm age, firm size; and (2) the Hausman test supports this choice. In detail, the Hausman test results for our specifications are χ2(14) = 15.83; p value: 32.36%.

In addition, Altman et al. (2010) have shown that smaller companies facing economic decline and financial distress increase the line of credit to clients and also request more credit from suppliers.

We checked for the endogeneity of the trade variables by using three endogeneity tests. The Wald test (p = 0.9409), the Durbin (p = 0.8449) and Wu-Hausman (p = 0.8461) accept the null hypothesis of exogeneity of the trade variables.

It would be interesting to investigate also the role of debit delay. However, the BIRD survey collects the information regarding the debit delay only for 1 year (2000) and only for the industrial firms, while the other trade variables refer to several years and both for industrial and service firms. Therefore, this lack of data does not allow implementing this type of investigation. We are aware that it is a limitation of our analysis.

It is worth noting that the survey collects this information in discrete terms and, as a consequence, our variable follows the structure of the survey.

Franks and Sussman (2005) showed that, in contrast to bank management, trade creditors expanded their lending to distressed companies. At the same time, they found an average bank recovery rate of 75%, while the medium recovery rates for trade creditors were less than 3%, or zero.

As for the variable Bankdebt, this variable is codified in discrete term in the Bank of Italy survey.

In order to avoid the perfect multi-collinearity problem (Gujarati 2004; Gulati et al. 2009), the Export coefficients were estimated by use of a reference group (i.e., export sales equal to 0). Therefore, the estimated coefficients of the other groups should be evaluated against the reference category.

Buehler et al. (2012) found lower bankruptcy rates in regions with favorable business conditions.

According to Svimez (2016), in the period 2008–2015, cumulative GDP growth (− 12.3%) was almost two times lower than that of the Northern Center (− 7.1%).

The sample composition is constructed by the research department, which annually collects the data to represent the whole Italian economy in terms of its composition by firm size, sector and geographical location. The population of the survey is divided into strata, and from each one a certain number of firms is extracted on a random basis. These firms make up the sample to be observed (one-stage stratified sample design). The strata are combinations of branch of activity, size class (in terms of number of employees) and the regional location of the firm’s head office.

In more detail, as stated in the BIRD methodological note, on page 4 “the target population of the ‘direct reporting’ is the entirety of Italian non-financial and insurance firms and corresponds to the corporations registered in Italy’s Chambers of Commerce (about one million firms in 2015). The list of firms selected to be part of the sample is restricted to corporations with a turnover exceeding €10 million. So the survey excludes the smallest firms and those not obliged to submit a cash flow statement, such as individual companies, for which cross-border flows are attested to be modest”. The collected data are subjected to a system of quality checks. The data are verified at different levels, with each check being run on data that have passed the previous level. In particular, Bank of Italy officers “check for the compatibility of values with the range allowed by the question, the time consistency of panel data, the balancing of certain figures and the presence of outliers. The data-entry procedure then rejects everything outside the defined range of the variable or incompatible with the internal consistency of the questionnaires. Data accepted by the procedure may still be outside certain thresholds based on past statistics or external information. In this case the data are highlighted for the attention of the interviewers, who check them and, if necessary, contact the firm for clarification. Confirmation is recorded in a special field. Only at this point is the checked data entered in the database. A treatment apart is reserved for data on firms affected by extraordinary events, such as mergers or splits. These firms are only included in the estimate if the data for final results, preliminary results and forecasts refer to a set of factories and workers that is homogeneous with the data collected in the same survey. The respondent ensures their homogeneity either by considering the extraordinary event to have taken place at the beginning of the year of the final results, or by pretending the event never occurred and reconstructing the data accordingly; if this is not possible, the firm is excluded from further” Bank of Italy (2010–2015).

In BIRD, access to a dataset is possible exclusively through submission of a set of commands in one of the packages supported (SAS or Stata) and before passing the batch programme on to the package parser, a legitimacy check is performed by the Bank of Italy officers. Therefore, we have carried out our statistical analyses without having direct access to the micro data. Bank of Italy (2010–2015). For more detail regarding how the data can be accessed, see https://www.bancaditalia.it/statistiche/basi-dati/bird/impreseindustriali-e-servizi/imprese/2_database_utilisation.pdf?language_id=1.

The variable referring to average number of days paid late is not reported in Table 2.

Consider that (Age) corresponds to the firm’s year of foundation, and therefore is inversely related to the firm’s age.

In order to capture the eventual non-monotonic effects of age, we also ran an alternative regression, including the square of age. However, in contrast to Altman et al. (2010), this variable was not statistically significant, so we decided to estimate only the eventual linear effect.

Both are indicators of the explanatory power of the model, calculated as R2 = 1 − L1/L0 where L1 is the log-likelihood value for the estimated model (1), and L0 is the log-likelihood value for the model estimated using only the constant. However, Cox and Snell’s R2 = 1 − (L0/L1)2/N reflects the improvement of the full model over the intercept model (the smaller the ratio, the greater the enhancement).

Pearson’s χ2 test examines the sum of the squared differences between the observed and expected number of cases per covariate pattern divided by its standard error.

The relative operating curve is generated by plotting the cumulative distribution function of the correct predicted probability in the y-axis versus the cumulative distribution function of detected false positive probability in the x-axis. The AUC span ranged from 0.50 for the useless (random) discriminant model and 1.0 for the perfect forecasting model.

Following Altman et al. (2010), we fixed two alternative thresholds, first 30% and then 10% (close to the average value of Debt restructuring), as early warning signals of financial stress. The latter threshold seemed to perform better in this regard. Other studies found that the mean value of the dependent variable is a consistent estimator of the unconditional probability of success, given that it appears that a cutoff of 30% would perform badly here (missing over 90% of all true positive cases).

Consequently, the relative misclassification errors are, respectively, 33.34 and 8.27%.

References

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate Bankruptcy. Journal of Finance, 23(4), 589–609.

Altman, E. I., & Sabato, G. (2007). Modelling credit risk for SMEs: Evidence from the US market. Abacus, 43(3), 332–357.

Altman, E. I., Sabato, G., & Wilson, N. (2010). The value of non-financial information in small and medium-sized enterprise risk management. Journal of Credit Risk, 6(2), 95–127.

Andrade, G., & Kaplan, S. N. (1998). How costly is financial (not Economic) Distress? Evidence from highly leveraged transactions that became distressed. Journal of Finance, 53(5), 1443–1493.

Bank of Italy. (2010–2015). Survey of industrial and service firms and business outlook.

Bank of Italy. (2014). The Financial Condition of Households and Firms, Annual Report.

Bartelsman, E., Scarpetta, S., & Schivardi, F. (2005). Comparative analysis of firm demographics and survival: Evidence from micro-level sources in OECD countries. Industrial and Corporate Change, 14(3), 365–391.

Bastos, R., & Pindado, J. (2013). Trade credit during a financial crisis: A panel data analysis. Journal of Business Research, 66(5), 614–620.

Beaver, H. W. (1966). Financial ratios as predictors of failure. Journal of Accounting Research, 4(3), 71–111.

Bernanke, B. S., Gertler, M., & Gilchrist, S. (1999). The financial accelerator in a quantitative business cycle framework. Handbook of Macroeconomics, 1, 1341–1393.

Biais, B., & Gollier, C. (1997). Trade credit and credit rationing. Review of Financial Studies, 10(4), 903–937.

Boissay, F., & Gropp, R. (2013). Payment defaults and interfirm liquidity provision. Review of Finance, 17(6), 1853–1894.

Borensztein, E., & Lee, J. W. (2002). Financial crisis and credit crunch in Korea: Evidence from firm-level data. Journal of Monetary Economics, 49(4), 853–875.

Buehler, S., Kaiser, C., & Jaeger, F. (2012). The geographic determinants of Bankruptcy: Evidence from Switzerland. Small Business Economics, 39(1), 231–251.

Burkart, M., & Ellingsen, T. (2004). In-Kind finance: A theory of trade credit. The American Economic Review, 94(3), 569–590.

Casey, E., & O’Toole, C. M. (2014). Bank lending constraints, trade credit and alternative financing during the financial crisis: Evidence from European SMEs. Journal of Corporate Finance, 27, 173–193.

Choi, W. G., & Kim, Y. (2005). Trade credit and the effect of macro-financial shocks: Evidence from US panel data. Journal of Financial and Quantitative Analysis, 40(4), 897–925.

Ciampi, F. (2015). Corporate governance characteristics and default prediction modeling for small enterprises. An empirical analysis of Italian firms. Journal of Business Research, 68(5), 1012–1025.

Connell, W. (2014). Economic Impact of Late Payments (No. 531). Directorate General Economic and Financial Affairs (DG ECFIN), European Commission.

Cuñat, V. (2007). Trade credit: Suppliers as debt collectors and insurance providers. Review of Financial Studies, 20(2), 491–527.

Danielson, M. G., & Scott, J. A. (2004). Bank loan availability and trade credit demand. Financial Review, 39(4), 579–600.

Dun & Bradstreet, Inc. Business Economics Division (1994). The business failure record. New York: Dun & Bradstreet, Inc., Business Economics Division.

El Kalak, I., & Hudson, R. (2016). The effect of size on the failure probabilities of SMEs: An empirical study on the US market using discrete hazard model. International Review of Financial Analysis, 43(1), 135–145.

Ericson, R., & Pakes, A. (1995). Markov-perfect industry dynamics: A framework for empirical work. Review of Economic Studies, 62(1), 53–82.

Faini, R., Galli, G., & Giannini, C. (1993). Finance and development: The case of Southern Italy, 158–213. In A. Giovannini (Ed.), Finance and issues and experience. Development: Cambridge University Press.

Fama, E. F. (1985). What’s different about banks? Journal of Monetary Economics, 15(1), 29–39.

Fawcett, T. (2006). An introduction to ROC analysis. Pattern Recognition Letters, 27(8), 861–874.

Franks, J., & Sussman, O. (2005). Financial distress and bank restructuring of small to medium sized UK companies. Review of Finance, 9(1), 65–96.

Fritsch, M., Brixy, U., & Falck, O. (2006). The effect of industry, region, and time on new business survival: A multi-dimensional analysis. Review of Industrial Organization, 28(3), 285–306.

Garcia-Appendini, E., & Montoriol-Garriga, J. (2013). Firms as liquidity providers: Evidence from the 2007–2008 financial crisis. Journal of Financial Economics, 109(1), 272–291.

Geroski, P. A., & Gregg, P. (1996). What makes firms vulnerable to recessionary pressures? European Economic Review, 40(3), 551–557.

Gordon, M. J. (1971). Towards a theory of financial distress. Journal of Finance, 26(2), 347–356.

Guariglia, A., Spaliara, M.-E., & Tsoukas, S. (2016). To what extent does the interest burden affect firm survival? Evidence from a panel of UK firms during the recent financial crisis. Oxford Bulletin of Economics and Statistics, 78, 576–594.

Gujarati, D. (2004). Basic econometrics (4th ed.). New York: McGraw-Hill.

Gulati, R., Lavie, D., & Singh, H. (2009). The nature of partnering experience and the gains from alliances. Strategic Management Journal, 30(11), 1213–1233.

Hopenhayn, H. A. (1992). Entry, exit, and firm dynamics in long run equilibrium. Econometrica, 60(5), 1127–1150.

Hosmer, D. W., Jr., Lemeshow, S., & Sturdivant, R. X. (2013). Applied logistic regression (3rd ed.). Hoboken: Wiley.

Hudson, J. (1987). The age, regional, and industrial structure of company liquidations. Journal of Business Finance and Accounting, 14(2), 199–213.

Jacobson, T., & Von Schedvin, E. (2015). Trade credit and the propagation of corporate failure: An empirical analysis. Econometrica, 83(4), 1315–1371.

Jaffee, D., & Stiglitz, J.E. (1990). Credit rationing, handbook of monetary economics, vol. II. Chapter 16 in handbook of monetary economics, vol. 2, (pp. 837–888). Elsevier.

Jorion, P., & Zhang, G. (2009). Credit contagion from counterparty risk. The Journal of Finance, 64(5), 2053–2087.

Jovanovic, B. (1982). Favorable selection with asymmetric information. Quarterly Journal of Economics, 97(3), 535–539.

Klapper, L., Laeven, L., & Rajan, R. (2012). Trade credit contracts. Review of Financial Studies, 25(3), 838–867.

Krueger, A., & Tornell, A. (1999). The role of bank restructuring in recovering from crises: Mexico 1995–98. National Bureau of Economic Research (NBER) Working Paper n. 7042.

Lennox, C. S. (1999). The accuracy and incremental information content of audit reports in predicting bankruptcy. Journal of Business Finance & Accounting, 26(5–6), 757–778.

Lewellen, W. G., McConnell, J. J., & Scott, J. A. (1980). Capital market influences on trade credit policies. Journal of Financial Research, 3(2), 105–113.

Lou, K. R., & Wang, W. C. (2013). Optimal trade credit and order quantity when trade credit impacts on both demand rate and default risk. Journal of the Operational Research Society, 64(10), 1551–1556.

Love, I., & Zaidi, R. (2010). Trade credit, bank credit and financial crisis. International Review of Finance, 10(1), 125–147.

Mateut, S. (2014). Reverse trade credit or default risk? Explaining the use of prepayments by firms. Journal of Corporate Finance, 29, 303–326.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Melitz, M. J., & Ottaviano, G. I. (2008). Market size, trade, and productivity. Review of Economic Studies, 75(1), 295–316.

Modigliani, F., & Miller, H. M. (1958). The cost of capital, corporation finance and the theory of investment. American Economic Review, 48(3), 261–297.

Molina, C. A., & Preve, L. A. (2012). An empirical analysis of the effect of financial distress on trade credit. Financial Management, 41(1), 187–205.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221.

Opler, T. C., & Titman, S. (1994). Financial distress and corporate performance. Journal of Finance, 49(3), 1015–1040.

Pakes, A., & Ericson, R. (1998). Empirical implications of alternative models of firm dynamics. Journal of Economic Theory, 79(1), 1–45.

Panetta, F. (2014). A Financial System for Growth. In Italians’ Savings are in support of growth, BIS.

Paul, S., & Wilson, N. (2007). The determinants of trade credit demand: Survey evidence and empirical analysis. Journal of Accounting, Business and Management, 14(1), 96–116.

Petersen, M. A., & Rajan, R. G. (1997). Trade credit: Theories and evidence. Review of Financial Studies, 10(3), 661–691.

Sayari, N., & Mugan, F. C. S. (2013). Cash flow statement as an evidence for financial distress. Universal Journal of Accounting and Finance, 1(3), 95–103.

Shumway, T. (2001). Forecasting Bankruptcy more accurately: A simple hazard model. Journal of Business, 74(1), 101–124.

Svimez. (2016). Rapporto Svimez 2016 sull’economia del Mezzogiorno. Bologna: Il Mulino.

Wilner, B. S. (2000). The exploitation of relationships in financial distress: The case of trade credit. Journal of Finance, 55(1), 153–178.

Zhou, L., Lai, K. K., & Jerome, J. (2012). Empirical models based on features ranking techniques for corporate financial distress prediction. Computers and Mathematics with Applications, 64(8), 2484–2496.

Acknowledgements

The authors are grateful to the research department team of Bank of Italy for their support in the various remote elaborations. The authors thank two anonymous referees for their critical comments and suggestions. The usual disclaimer applies. Both authors contributed equally to each section of the article.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Forgione, A.F., Migliardo, C. An empirical analysis of the impact of trade credit on bank debt restructuring. Econ Polit 36, 415–438 (2019). https://doi.org/10.1007/s40888-018-0110-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-018-0110-x