Abstract

The information and communication technology (ICT) of trade balance is one of the main facilitators of any business sustainability. As ICT and financial inclusion eases access to knowledge and enhances significantly developing several human skills and competencies, its impact in industrial sectors has mainly recognized as positive. But digitalization as well arguable comes with some other challenges, while disruptive digital innovations exerted on different industries and economies. In this spirit, this study aims to measure the impact of financial access and the information and communication technology (ICT) trade balance on the dark and bright sides of digitalization. Data has been collected from 31 countries of Organisation for Economic Co-operation and Development (OECD) for the period of 2008–2019. Technological growth, technological innovation, technological performance risk and ethical proxies were used to examine the dark and bright sides of digitalization. The main findings were consistent and confirmed by the estimated panel least squares, fixed and random effects, feasible generalized least squares and system generalized method of moments (S-GMM) estimators. Financial access has found to have a significant negative impact on the digitalization proxies reflecting the dark side of digitalization in all estimators. Whereas, the ICT trade balance has found to have a significant positive impact on digitalization proxies reflecting the bright side of digitalization in most estimators. These results contribute to the policy debate on the importance of digital finance models and ICT exports awareness when promoting the bright side of digitalization. Furthermore, policy makers should monitor and update information that is disclosed digitally as the results of this study extended support the creative destruction theory which implicitly included economic innovation and the business cycle theories.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Information communication technology (ICT) trade balance have been commonly associated with digitalizing manufacturing while their importance of financial access in service companies and banks have received less attention in the current literature. This views the main focus of the international trade on manufacturing industry comparing to the usage in banks/service’s companies (Balgobin & Dubus, 2022; Francois & Hoekman, 2010; Myovella et al., 2021). Despite of this view, digital transformation have constantly affected societies and economies (Ayyagari et al., 2011) as well institutional entrepreneurship (Tumbas et al., 2018). This transformation leads to unusual radical shifts in digital infrastructures (Cabral, 2021; Mignamissi & Djijo, 2021; Øvrelid & Bygstad, 2019; Rodon & Eaton, 2021).

This transformational revolution of digitalization has brought great benefits at different levels i.e. individual, societal, and organizational whereas these meaningful merits possess a dark side effects which also affect negatively human well-beings when dealing with IS (Tarafdar et al., 2015b). Growth and sustainability however have become a necessity to any business to acclimatize the new ICT conditions and climate. Theory of product life cycle indicates that business organizations growth consists of different steps to grow and sustain in the market, i.e., introduction, growth, maturity and decline (Lorentz et al., 2016). The maturity stage as a critical phase requires continuous innovation to sustain the business performance. However, the innovation in the financial services as called digital finance imitates more easily access for businesses to increase the growth of their economy (Calvano et al., 2021; Mohseni & Cao, 2020; Ozili, 2018; Waheed & Rashid, 2021). Furthermore, according to Silber (1983) the theory of financial innovations emphasized the idea that increased expansion in obtaining benefits from money-related institutions is the main reason for financial inclusion, and most of the fundamental ideas behind new innovations are the shortcomings of the money-related business sector.

In light of the prevalence of wealth inequality in society and its negative effect on technological growth, standard growth theory assumes that long-term income per capita growth mainly comes from increases in digital investments and technological innovations (Aghion & Howitt, 1998). According to the theory of creative destruction (Schumpeter, 1912), technological progress plays a vital role in financial and economic development by increasing the production function and is the main reason behind any economic growth (KallalaI & Guetat, 2020; Ngo & McCann, 2019). Similarly, according to classical growth models (Solow, 1956), growth is determined by the crucial role played by technological progress, namely, its enhancement of the production function, which leads to a significant increase in productivity, especially when different production factors are to produce high technology products.

Furthermore, the theory of creative destruction suggests that the key driving force behind economic growth is the replacement of existing enterprises with innovative organizations. Meanwhile, the endogenous growth theory asserts that technological progress is the central stage of economic development e.g., (Aghion & Howitt, 1992, 1998; Boikos, 2020; Romer, 1990). Recently, technology has had a prominent role in innovation and invention activities, especially in the financial and industrial sectors (Barefoot, 2020; Almudi et al., 2013) and led numerous countries to export and/or import various information and communication technology (ICT) goods. Hence, the technology sector is a crucial driver in a country’s economy through the technological investment opportunities available to foreign investors (Abubakar & Handayani, 2018). However, it can be very challenging for small and medium-sized enterprises (SMEs) and individuals to gain access to finance in the present climate of intense competition. Financial access refers to the ability of individuals and institutions to obtain financial services, including credit, deposits, insurance and risk management services (Diniz et al., 2012).

Financial access supports emerging companies through credit, especially in entrepreneurial projects, while they work to utilize any opportunities for increase credits and ICT investments (Kerr & Nanda, 2015; Yoshino & Morgan, 2016). Thus, improving financial access will improve the economy and the ICT trade balance, enhance competition and stimulate the employment sector (Wagner, 2019). This will help increase the income of individuals, especially those with a low income, as limited access to financial resources through credit can weaken the financial capacity of individuals and lead them to use internal financial sources. Consequently, they might lose many economic opportunities, and the cohesion of their social network may decline; this reflects the dark side of financial technology (FinTech) (Tarafdar et al., 2015a; Yang et al., 2020).

Although technological growth reflects the adaptation of various industrial and financial sectors to digital applications in order to achieve creativity of production, adopting digital technology can also negatively affect entrepreneurial projects due to technological risks from unsafe applications. Thus, technology has a dark side that investors are averse to the risks of the dark side of technology (Caruana, 2016; Ozili, 2018; Helm et al., 2019). This dark side is known among a literal community of information systems, and it is usually linked with another term, technostress, which represents the negative direct or indirect effects of technology on the body, behavior, attitudes or thoughts (Weil & Rosen, 1997).

Meanwhile, the increased individual workload that results from using information systems, e.g., being permanently connected or struggling to catch up with the latest technology, leads to opposite behavioral and/or psychological responses for adopting the digitalization (Ragu-Nathan et al., 2008). When users feel psychologically exhausted or their satisfaction levels slope down (Tarafdar et al., 2011), their expected behavioral response is a drastic reduction in performance (Broni, et al., 2016) or a cessation of the use of the technology (Harris et al., 2014). Thus, the increased use of information systems has dual (negative/dark and positive/bright) effects on end users, and the negative effects may adversely influence their behavioral and/or psychological responses. In this regard, as mentioned above, one of the dark sides of technology is stress, which is responsible for many health issues and may push individuals to stop using digitalization (Rizzo et al., 1970; Tarafdar et al., 2011).

Even though the increasing pervasiveness of digital transformation in the financial sector can lead to dual consequences, countries must operate within the digital network in order to achieve progress in the world of financial and technological innovation, compete on the international stage and obtain an international classification of a product (Tedeschi et al., 2014). However, according to Fanta and Makina (2019), explorations of the link between financial inclusion and technology are still in the early stages due to several factors (Beyene Fanta & Makina, 2019). First, few studies have examined the relationship between technology and financial inclusion because the availability of time series data for both topics is limited. Second, the main aim of the rapid development of technologies in the financial sector is profit rather than financial inclusion. However, FinTech, which is recognized as a merger of technology and the financial sector, supports financial inclusion by allowing lower transaction costs while boosting poor of society.

Researchers have not yet studied the bright and dark sides of digitalization in much detail, especially the nexus of financial access and the ICT trade balance. Furthermore, previous studies in the financial field have not examined the effects of both financial access and the ICT trade balance on an ethical proxy (secure internet servers), a technological growth proxy (high-technology exports (% of manufactured exports)), a technological innovation proxy (patent applications, residents) and a technological performance risk proxy (individuals using the internet (% of population)).

To address this research gap, we aimed to answer the following important question in the present study: Does the use of digitalization for financial access and the ICT trade balance increase or decrease: (1) the ethical proxy, (2) the technological growth proxy, (3) the technological performance risk proxy and (4) the technological innovation proxy? To answer this question, we analyzed the dark and bright sides of the digitalization paradigm nexus of financial access and ICT trade balance in 31 OECD countries during the period of 2008–2019. We investigated various financing sources of investments in technology and technological growth indicators using a panel data methodology to understand the dark and bright sides of digitalization risks and the vulnerability of digital platforms in the selected OECD countries.

In addition, in spite of the rising greatness and significance of technological investments and ICT international trade in sectors, such as services, very little research has investigated the indicators/factors motivating companies to invest in technology (Yang et al., 2020). Hence, we aimed to provide important insights for researchers and practitioners regarding the digitalization in the financial sector and whether increasing financial access (which is expected to be followed by ICT exports and imports) has a positive (bright) or negative (dark) impact on the sector.

The innovation of the present study lies in its focus on the dark and bright sides of digitalization, which have been explored in terms of ethical, technological, innovation and technological risks, as well as its examination of how digital finance institutions and innovators can develop and deliver products and services. The study findings can help policy makers and customers understand the negative and positive aspects of digitalization and use those insights to make innovative applications more useful for organizations within the financial access system. In addition, digitalization enhances the rapid pace of the modern lifestyle. Furthermore, technological innovation can increase the efficiency of financial inclusion and digitalization, thereby enhancing the diverse stages of financial expansion and reducing technology-related risks. Moreover, the study highlights the importance of financial technology (FinTech) companies in increasing exports of technological applications and innovation services and keeping patent applications as indicators of innovation in order to increase high-technology exports.

The rest of this paper is structured as follows. Section 2 describes the literature review. Section 3 explains the econometric model and the data specification under the methodology. Section 4 presents the empirical results. Section 5 presents a discussion of the results. Section 6 concludes the paper and suggests policy implications.

2 Literature review

The digital finance theory of change is a set hypothesis that was developed to explain how financial and economic changes impact the digital finance ecosystem. Our model focuses on financial access and ICT trade balance proxies and four core proxies that influence, incentivize and reflect changes in dark and bright digitalization. These changes enable digital finance institutions and innovators to develop and deliver digital finance products and services.

2.1 Financial access and the ethical proxy

Financial access or inclusion refers to access to official financial services at a reasonable cost for all groups in a country regardless of their economic status but especially for low-income of society (Diniz et al., 2012). Financial access can be a vital part of the government’s strategies to reduce poverty and grow the economy. Furthermore, innovative technology and new communication tools have changed the organizations within the financial system, in addition, digitalization enhanced the rapidity and protection shaping the modern lifestyle (Boskov & Drakulevski, 2017). However, customers and policy makers have fears about data safekeeping (Caruana, 2016; Ozili, 2018), especially in terms of the security of internet servers (Gollapudi et al., 2019). Many studies have stated that financial inclusion can be related to the number of web servers that promise secure online transactions (Diniz et al., 2012; Caruana, 2016; Gollapudi et al., 2019; Helm et al., 2019). Accordingly, we posed the following research question:

RQ1: How does financial access lead to an increase in the use of internet servers that guarantee secure online transactions (ethical proxy)?

2.2 Financial access and the technological growth proxy

While it is widely known that technological growth related to mobile technology and the internet supports broader access to financial services, very few scholars have analyzed these associations (Abubakar & Handayani, 2018). Fanta and Makina (2019) reported a strong positive relationship between financial inclusion and technology (Beyene Fanta & Makina, 2019). Financial inclusion is a very critical subject because it can negatively or positively affect lives and provide new opportunities for the global evolution of civilizations (Boskov & Drakulevski, 2017) and the growth of small businesses (Boshkov, 2016) and technological exports (Gonzalez et al., 2014; Burjorjee & Scola, 2015; Helm et al., 2019; Yang et al., 2020). Since high-technology exports are among the main technological growth indicators of ICT trade (Kabaklarli et al., 2017; Xing, 2014), we posed the following research question:

RQ2: How does financial access push towards an increase in high-technology exports (technological growth proxy)?

2.3 Financial access and the technological innovation proxy

Financial innovation is a critical element in expanding financial inclusion (Beck et al., 2015). Technological inventions, such as mobile banking, can raise the financial inclusion rate when, for example, dropping transaction costs for the poor and far areas remotely (Yoshino & Morgan, 2016). Many studies, however, have highlighted the significance of internal finance sources and borrowing from banks to support technological innovation investments (Kerr & Nanda, 2015).

Meanwhile, patent, design and trademark applications/numbers can be important indicators of technological innovation (Agoba et al., 2017; Caruana, 2016; Kabaklarli et al., 2017; Nemoto & Koreen, 2019). Although technological innovation can increase the efficiency of financial inclusion, understanding the relationship between financial inclusion and digitalization requires investigation at diverse stages of financial expansion (Agoba et al., 2017). Consequently, we posed the following research question:

RQ3: How does financial access push towards an increase in industrial design, patent and trademark applications (technological innovation proxy)?

2.4 Financial access and the technological performance risk proxy

The most substantial driver of financial access nowadays is technology (Beyene Fanta & Makina, 2019). However, it is very important to manage potential risks associated with using mobile phones and mobile networks for electronic money (Sotomayor, 2012), maintaining consumers’ trust in immature high-technology financial systems (Beyene Fanta & Makina, 2019), competing in financial markets (Helm et al., 2019), ensuring consumers’ data security and preventing cyberattacks (Barefoot, 2020). Thus, understanding the relationship between financial inclusion and technological performance risks is becoming increasingly important. The number of mobile and telephone subscriptions (Beyene Fanta & Makina, 2019; Fabling & Grimes, 2021) and the number of individuals using the internet and broadband subscriptions (OECD, 2000, 2008) can give good indications of whether financial access can increase technological performance risk. Accordingly, we posed the following research question:

RQ4: How does financial access push towards an increase in the use of the internet, fixed broadband subscriptions and fixed telephone subscriptions by individuals (technological performance risk proxy)?

2.5 ICT trade balance and the ethical proxy

Using secure internet servers, especially for e-commerce, has been found to affect the relationship between the ICT trade balance and secure online transactions (Parham et al., 2001; CIS, 2019). Gnanasambandam et al. (2012) found that e-commerce server security accounted for 48% of ICT exports for McKinsey platforms (Gnanasambandam et al., 2012). ICTs for business usage mainly include computers, internet access and internet servers for e-commerce (Parham et al., 2001; Nguyen et al., 2020). A sum of secure internet servers in OECD countries offers a good ratio of the fundamental IT infrastructure that handles e-commerce actions (Knauth, 2004; OECD, 2003). According to Lakka et al. (2012), Apache server imports and exports depend on the ICT trade balance, internal and external technological infrastructures, education and skill levels (Lakka et al., 2012). In a report for OCED (2008), ICT exports were found to focus high on computing system security. Consequently, we posed the following research question:

RQ5: How do ICT exports and imports, i.e., the ICT trade balance, push towards an increase in the use of internet servers that guarantee secure online transactions (ethical proxy)?

2.6 ICT trade balance and the technological growth proxy

Yang et al. (2020) identified a significant positive relationship between companies’ exporting and ICT investment choices. A reduction in ICT investments can be related to a sharp drop in ICT equipment exports and imports (Baudchon, 2002). Digitalization signifies the continuing consequences of ICT use, representing the cultural, political and socio-technical characteristics of ICT in practice (Diniz et al., 2012). Meanwhile, nations that have industrialized progressive technology infrastructures can attain better economic growth rates (Kabaklarli et al., 2017). Furthermore, high-technology products positively contribute to the ICT trade balance (Sachwald, 2006). In fact, Xing (2014) found that in 2014, 82% of China's high-technology exports consisted of assembled products made from imported components. Therefore, we posed the following research question:

RQ6: How do ICT exports and imports, i.e., the ICT trade balance, push towards an increase in high-technology exports (technological growth proxy)?

2.7 ICT trade balance and the technological innovation proxy

ICTs are imperative bases of innovation in various sectors, especially the financial sector (Diniz et al., 2012). Moreover, ICT exports inspire innovation and research and development (Friedewald et al., 2004; Lazonick, 2009; Yeo et al., 2014). As FinTech companies continue to export technological applications, innovation is expected to grow (Helm et al., 2019). Kabaklarli et al. (2017) provided strong evidence that patent applications are indicators of innovation and have a significant positive influence on high-technology exports. Cavdar and Aydin (2015) confirmed that patents and patent applications are the most regularly used indicators for judging technological growth (Cavdar & Aydin, 2015). Accordingly, we posed the following research question:

RQ7: How do ICT exports and imports, i.e., the ICT trade balance, push towards an increase in industrial design, patent and trademark applications (technological innovation proxy)?

2.8 ICT trade balance and the technological performance risk proxy

Companies that export and invest in technology have meaningfully better access to external and internal funding sources (Yang et al., 2020). However, as firms adopt innovation solutions, they also need to consider the associated risks of innovation (Helm et al., 2019). Many concerns and risks, such as cyberattacks and customer data security issues, can be attributed to the wide usage of digital technologies (Caruana, 2016; Ozili, 2018). E-commerce server security accounted for in 2012 for almost half of all ICT exports of McKinsey technologies (Gnanasambandam et al., 2012). Many studies explained the risks of digitalization such as credit risk, operational risk, compliance risk (Abubakar & Handayani, 2018) and network security risks (Sotomayor, 2012). Many studies noted that the number of individuals using the internet, fixed broadband subscriptions and fixed telephone subscriptions is a main indicator of how ICT exports and imports lead to an increase in the technological performance risk proxy (Gnanasambandam et al., 2012; Asongu & Odhiambo, 2018; Asongu et al., 2019). Accordingly, we posed the following research question:

RQ8: How do ICT exports and imports, i.e., the ICT trade balance, push towards an increase in the internet, fixed broadband subscriptions and fixed telephone subscriptions used by individuals (technological performance risk proxy)?

3 Methodology

This section describes the econometric models used to examine the hypotheses in this study.

3.1 Econometric model data specification

The panel data technique was used to meet the goals of the current study. Data on the variables were collected from the World Development Indicators for the period of 2008–2019 (The World Bank, 2018). Financial access, the ICT trade balance and the dark and bright sides of digitalization were examined for 31 OECD countries. All OECD countries except six were included in this study; Greece, Ireland, Luxembourg, the Netherlands, Slovenia and the United States were not included because full data was unavailable for the study period. “Appendix A” lists the countries included in the study.

Two proxies were used for the independent variables; the financial access proxy was measured by the number of commercial bank branches (per 100,000 adults) (LOGCBB), and the ICT trade balance proxy was measured by the difference between ICT exports (% of total exports) and ICT imports (% total imports) (ICTTB). Four control variables were used: GDP per capita growth (annual %) (GDPG); inflation, GDP deflator (annual %) (IGD); automated teller machines (ATMs) (LOGATM); and trademark applications, direct resident (LOGTMA).

Dark and bright digitalization was used as the dependent variable and divided into four proxies: the ethical proxy was measured by secure internet servers (LOGSIS); the technological growth proxy was measured by high-technology exports (% of manufactured exports) (LOGHTE); the technological innovation proxy was measured by patent applications, residents (LOGPA); and the technological performance risk proxy was measured by productivity through the individuals using the internet (% of population) (LOGIUI). All of the variable definitions are available in “Appendix B”.

The present study’s variables were selected to create a paradigm to measure the dark and bright sides of digitalization and support the ongoing debate between dark and bright sides perspectives, which has not been sufficiently investigated. To overcome this gap, the study investigated the people implementing the process in the banking financial sector. In addition, the study analyzed the use of governance for digitization through the net trade balance of technology-related goods and its implications for growth rates and technological innovations while also measuring technology risks and strengthening the model with an ethical scale, which is an important indicator in adopting technology. Furthermore, the variables were chosen based on the light of the importance of diagnosing the technological sector, especially since some individuals may not benefit from the social impact of technology due to their inability to bear the costs or lack of knowledge or education about the importance of technology. In addition, the control variables, including GDP per capita growth, inflation, automated teller machines and trademark applications, were considered the main determinants of digitalization and finance access that support the robustness of the paradigm of the study.

The 12-year time period examined in this study includes the financial crisis in 2008, which was very critical period for the OECD markets, which are focused on how to realize the immense promises of digital technologies for economic growth and financial markets.

The main justification for examining OECD countries in this study was that digital technologies play a vital role in transforming OECD economies and enhancing the productivity of firms. However, despite ongoing digitalization, OECD countries have registered a decline in productivity growth over the past few decades for multiple reasons, including the global financial crisis, which has reduced credit and investment and led to a decline in business dynamism. To date, aggregate productivity gains from digitalization have not been able to compensate for these headwinds. Indeed, digital technologies have strong complementarity in terms of firms’ capabilities and assets as well as policies that enhance competition and efficient resource reallocation in the economy. Shortfalls in these complementary factors in OECD countries have slowed the expansion of digital technologies and reduced productivity benefits. Hence, digitalization has spread unequally across firms. The findings highlight OECD trends and opportunities as well as challenges based on the dark and bright sides of digital economies. They also explain the effects of financial access and the ICT trade balance on digitalization, and these insights can be used to meet public policy objectives. The variables were selected based on their role and importance in the growth of the OECD economies.

The main model was formulated as follows based on the study variables:

where \({\mathrm{Dep}}_{\mathrm{i},\mathrm{t}}\) refers to LOGIUIit, LOGSISit, LOGHTEit and LOGPAit as the dark and bright sides of the digitalization proxy of country I at time t; these variables are the dependent variables. The \({\mathrm{Indepdent}.\mathrm{Var}}_{\mathrm{i},\mathrm{t}}\) are the proxies of the financial access and ICT trade balance indicators. The \({\mathrm{control variables}}_{\mathrm{i},\mathrm{t}}\) include four variables: GDPG, IGD, LOGATM and LOGTMA.

To make the study more robust, a number of estimators, including descriptive statistics for all variables as well as figures to the direction based on the mean of the variables, a correlation matrix and augmented Im–Pesaran–Shin (IPS) and Levin–Lin–Chu (LLC) unit root tests, were used. Panel least squares (PLS) was used as the basic regression, followed by fixed effect (FE), random effect (RE) and regression with Driscoll–Kraay standard errors for FE. The feasible general least squares (FGLS) and dynamic panel data estimators of the two-step system generalized method of moments (S-GMM) estimator were also used. Additional diagnostic tests, including the Wooldridge test for autocorrelation and the modified Wald test for groupwise heteroskedasticity, were used, and cross-sectional independence was examined using the Pesaran CD test and the Breusch–Pagan (B–P) Lagrangian multiplier (LM) test of independence. The Hausman test was used to show whether FE or RE was the appropriate model for this study. In the S-GMM estimator used the Arellano–Bond test for second-order serial correlation and the Hansen test.

Time series and cross-sectional panel data were used to minimize the multicollinearity problem (De Hoyos & Sarafidis, 2006). This issue was solved using parameters, and the endogeneity problem was solved using dynamic intertemporality, the individuality of the entities and the degree of freedom (Hsiao, 2007). Additionally, the panel managed heterogeneity (the microunit) (Baltagi, 2012) based on time and country observations. As a pre-estimator, the stationary properties of the variables were checked using unit root tests, including the IPS (1997, 2003) test. This test combines cross-sectional and time series data as the IPS supposes a linear trend for each cross-sectional unit (N), assuming that siS(I = 1…,2…, N) denotes the t-statistics for testing unit roots and lets E(siS) = µ and v(siS) = \(\sigma\)2.

To increase robustness, the LLC unit root test was used as the main model explained ∆uit = wiqi,t−1 +\(\sum_{I=1}^{Zi}\mathrm{\varphi },\)i,l ∆yi,t−l + αiyit + εit, where yit are the deterministic components, wi = 0 explains that there is a unit root for individual I on u process, wi < 0 refers to the deterministic component as a stationarity process, and zi indicates that the results were identical and negative First, PLS was applied to examine the hypotheses. This estimator ignores the group structure possibility and supposes that the different periods are in the same trend. Then, FE and RE, were applied as known panel data. These estimators suffer from two main issues: heterogeneity and endogeneity (Wooldridge, 2010). Therefore, we applied the Hausman test to determine whether to use FE or RE (Johnston & Dinardo, 1997).

FE explained each group as non-random and of a specific fixed quantity. FE refers to coefficients as one time-invariant intercept for each subject in the regression models and supposes that the independent variables are correlated with individual specific effects. RE refers to inferences about the distribution of values that are explained as predictor variables. It shows the variance of the values at different levels to control unobserved heterogeneity when the heterogeneity issue is constant during the time period and uncorrelated with independent variables. Hoechle (2007) suggested using regression with Driscoll-Kraay standard errors for FE if the Pesaran test shows cross-sectional dependence on the residuals of the study (Hoechle, 2007). There was PLS estimator bias in most models and some heteroskedasticity and autocorrelation problems in the models used. The FGLS estimator was used to overcome these problems. FGLS assumes that α is consistent and available by \({\hat{\upalpha }}\); we changed Ω to Ω = Ω (\({\hat\!\!\,\hat{\upalpha }}\)) to use FGLS and supposed that α and Ω were known by using a finite set of parameters to refer to Ω. Panel data sometimes poses a problem between the error term and the explanatory variable(s) or reverse causality between study variables as per the equation E (ε|X) ≠ 0 (Baltagi, 2012). This situation indicates an endogeneity problem and a failure of PLS due to bias (Baltagi, 2012). The panel data used instruments correlated with explanatory variables to mitigate the endogeneity problem as per \(E\left(Q|\mathrm{Y}\right)\ne 0\) and \(E\left(\varepsilon |\mathrm{Q}\right)=0\) conditions, where \(\mathrm{Y}\) is the explanatory variable, and \(\mathrm{Q}\) shows the instrumental variable. To meet this requirement, the S-GMM estimator was used (Arellano & Bover, 1995; Blundell & Bond, 1998). Since the S-GMM estimator creates internal instrument proliferation and lags for endogenous variables, it was used to deal with a zero level of error when adding lags to dependent variables (Blundell & Bond, 1998). The S-GMM estimator conducts sufficient orthogonality on instrumenting lags, allowing for a more consistent parameter related to endogeneity and unobserved individual country effects (Arellano & Bover, 1995).

4 Results

This section is divided into nine subsections that explains how the study hypotheses were tested.

4.1 Descriptive statistics

Preliminary analysis was used to show the descriptive statistics, correlations and unit root tests of all variables. Table 1 presents the variables for 372 observations of 31 countries over the period of 2008–2019 and shows the standard deviation, mean, median, skewness, kurtosis and Jarque–Bera data.

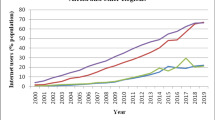

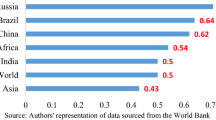

4.2 Average annual growth of variables from: 2008 to 2019

The average of the four dependent variables and the two independent variables over the period of 2008–2019 for 31 OECD countries are presented in Fig. 1. LOGIUI, LOGCBB and LOGHTE are in constant lines; LOGIUI is above LOGCBB and LOGHTE, and LOGCBB is above LOGHTE. LOGPA is high and more than the other variables and also had constant growth. LOGSIS increased throughout the study period, achieving its highest value in 2019. In contrast, ICTTB declined throughout the study period, achieving its lowest value in 2016. Figure 2 depicts the four control variables. LOGTMA is the highest line, and it was constant over the study period, and LOGATM is below LOGTMA, and it was also constant. GDPG declined from 2008 to 2009 due to the financial crisis of 2008, then it increased until 2017 when it started to decline.

4.3 Correlation matrix

Table 2 shows the correlation coefficients for all regressors and the significant variables. There were positive relationships between ICTTB and LOGHTE (0.284042) and between LOGCBB and LOGIUI, LOGSIS and LOGHTE (−0.029864, −0.058615 and −0.120354) and positive relationships between ICTTB and LOGIUI, LOGPA and LOGHTE (0.011634, 0.138299 and 0.284042) and between LOGCBB and LOGPA (0.105067). The results are consistent with financial, economic and technological theories. The values were significant because the strength of the coefficients of most of the variables was less than 40%; this pre-test indicated that there was no multicollinearity between predictor and response as two variables (Evans, 1996).

4.4 Unit root tests

Table 3 shows the IPS and LLC unit root test results. These tests were conducted to check the stationarity of the variables. These tests were run at the level and in the first difference order. Most of the variables were integrated at the order I(0), while all variables were integrated at the order I(1). Based on these results, all variables were considered stationary at the first difference.

4.5 Panel least squares (PLS)

The PLS results for all eight models are presented in Table 4. Models 2, 4, 6 and 8 showed a significant negative relationship between LOGCBB and LOGIUI. This indicates that financial access had a negative relationship with the bright and dark sides of digitalization. A 1% increase in LOGCBB led to −0.062, −0.794, −0.273 and −0.543 decreases in LOGIUI, LOGSIS, LOGHTE and LOGPA, respectively. There were also significant negative relationships between ICTTB and LOGIUI (Model 1) and between ICTTB and LOGSIS (Model 3). A 1% increase in ICTTB led to −0.002 and −0.039 decreases in LOGIUI and LOGSIS, respectively. Meanwhile, there were significant positive relationships between ICTTB and LOGHTE (Model 5) and between ICTTB and LOGPA (Model 7). A 1% increase in ICTTB led to 0.015 and 0.034 increases in LOGHTE and LOGPA, respectively. The probability of the F-value was significant in all eight models, implying that all models were appropriate and fit. The control variables were significant in all models except Models 5, 6 and 7 in which GDPG (LOGHTE and LOGCBB), (LOGHTE and ICTTB) and (LOGPA and ICTTB) were insignificant. Regarding the control variables, LOGATM showed positive significance in all models, while IGD showed negative significance in all models. The other two control variables showed mixed signals depending on the model used.

4.6 Fixed effect (FE) and random effect (RE) regression with Driscoll–Kraay standard errors

As shown in Table 5, FE and RE were applied to overcome the heterogeneity issue, and the Hausman test was run to determine whether FE or RE was the appropriate model for this study. All of the models depended on FE except Model 5 (ICTTB_LOGHTE), which depended on RE. Next, the Pesaran test was run and revealed that cross-sectional dependence was present in all models; FE and RE regression with Driscoll-Kraay standard errors was used to correct this issue. Model 8 (LOGCBB_LOGPA) remained as FE only. Diagnostic test explanations are presented in Sect. 4.8.

The FE results confirmed the significance and signals of the coefficients of the PLS results for all models except Model 8 (LOGCBB_LOGPA), which was positive and significant, and Model 7 (LOGPA_ICTTB), which was positive and insignificant. This indicates that financial access had a negative relationship with the bright and dark sides of digitalization. A 1% increase in LOGCBB led to −0.241, −4.88 and −0.052 decreases in LOGIUI, LOGSIS and LOGHTE, respectively. There were significant negative relationships between ICTTB and LOGIUI (Model 1) and between ICTTB and LOGSIS (Model 3). A 1% increase in ICTTB led to −0.009 and −0.128 decreases in LOGIUI and LOGSIS, respectively. Meanwhile, there was a significant positive relationship between ICTTB and LOGHTE (Model 5). A 1% increase in ICTTB led to a −0.017 increase in LOGHTE. The probability of the F-value was significant in all eight models, implying that all models were appropriate and fit. The control variables were significant in all models except Models 5, 6 and 7 in which GDPG (LOGHTE and LOGCBB), (LOGHTE and ICTTB) and (LOGPA and ICTTB) were insignificant. The control variables that were most affected by ICTTB were GDPG and LOGTMA, while control variables that were most affected LOGCBB were LOGTMA and LOGATM.

4.7 Feasible generalized least squares (FGLS) estimator

The FGLS estimator was applied to overcome the issues of heteroskedasticity and serial correlation in the models. This estimator confirmed the PLS, FE and RE results in all models. As shown in Table 6, there was a significant negative relationship between LOGCBB and LOGIUI in Models 2, 4, 6 and 8. There were also significant negative relationships between ICTTB and LOGIUI (Model 1) and between ICTTB and LOGSIS (Model 3). Meanwhile, there were significant positive relationships between ICTTB and LOGHTE (Model 5) and between ICTTB and LOGPA (Model 7). The probability of Wald chi2(5) was significant in all eight models, implying that all models were appropriate and fit.

4.8 Dynamic panel-data estimation, two-step system GMM (S-GMM) estimator

The S-GMM estimator was used to overcome the endogeneity issue. As shown in Table 7, the financial access results confirmed the PLS, FR, RE and FGLS results. There were significant negative relationships in Models 2, 4, 6 and 8. A 1% increase in LOGCBB led to −0.579, −0.391, −0.148 and −0.926 decreases in LOGIUI, LOGSIS, LOGHTE and LOGPA, respectively. There were also significant negative relationships between ICTTB and LOGIUI (Model 1) and between ICTTB and LOGSIS (Model 3). A 1% increase in ICTTB led to −0.036 and −0.030 decreases in LOGIUI and LOGSIS, respectively. Meanwhile, there were significant positive relationships between ICTTB and LOGHTE (Model 5) and between ICTTB and LOGPA (Model 7). A 1% increase in ICTTB led to 0.010 and 0.008 increases in LOGHTE and LOGPA, respectively. All the models confirmed the robustness. The control variables that were most affected by ICTTB were LOGATM, LOGTMA and GDPG, while the control variables that were most affected by LOGCBB were GDPG and LOGTMA.

4.9 Diagnostic tests

Many diagnostic tests were applied in this study to increase the robustness and show that all estimators were appropriate, fit the models and were consistent and unbiased. As shown in Table 3, the stationarity of all variables was confirmed using unit root tests; most of the variables were at order I(0), and all variables were at I(I). Table 5 shows the results of the Hausman test, which was conducted to determine whether FE or RE was the best fit for the models; based on the results, we selected FE for seven models because the p-value was below 0.05, and we selected RE for Model 5. Table 5 presents the results of the Pesaran cross-sectional dependence (CD) test, which was conducted to show the cross-sectional dependence of the models and whether the residuals were correlated across entities; the findings showed that all of the models had cross-sectional dependence (contemporaneous correlation). Therefore, we used the adjustment estimator of FE suggested by Hoechle (2007) to conduct a regression with Driscoll–Kraay standard errors for FE.

The B–P LM test for RE was also used; the null hypothesis in the LM test mentions that variances across entities are zero. The findings showed that RE was appropriate because the p-value was less than 0.05. The results of the modified Wald test for groupwise heteroskedasticity and the Wooldridge test for autocorrelation shown in Table 5 indicate the presence of heteroskedasticity and serial correlation in the data. To address the problems identified in these pre-tests, the FGLS estimator was used to remove the heteroskedasticity and serial correlation in the models; the results shown in Table 6 indicate that the panels were homoscedastic and that there was no autocorrelation in all eight study models. The S-GMM estimator was applied to solve the endogeneity issue; the Hansen-J test statistics shown in Table 7 indicate that the instruments were exogenous and not over-identified. Furthermore, the estimator showed no autocorrelation among the residuals based on the Arellano–Bond test for AR (2).

5 Discussion

5.1 Financial access and the dark sides of digitalization

As shown in Tables 4, 5, 6 and 7, financial access had a significant negative impact on digitalization proxies and reflected the bright digital side in all estimators. Policy makers should find methods to establish trust by providing clear, accurate and unbiased information about existing regulations and systems in order to support and protect individuals and inform them of the potential benefits of digital products and services.

The results can be explained by a lack of trust and awareness among customers regarding digital financial services that led to a decrease in efforts to access financial resources. These results are consistent with Ozili (2018) and Caruana’s (2016) finding that customers and policy makers both have fears about data safekeeping. The new opportunities for the global evolution of civilizations lead to doubts about digitalization (Boskov & Drakulevski, 2017). According to Agoba et al. (2017), the relationship between technological innovation and financial expansion still needs more investigation. Tarafdar et al., (2015a, 2015b) noted that information technology risk has a potentially negative effect on the well-being of individuals. Helm et al. (2019) suggested that if the innovation has a high risk, this influences negatively on digitalization.

The high manufacturing activities in the market have a high risk in the operational systems and reflected negatively for adopting the customers (Carayon, 1993; Corbett, 1987). According to Kling (1996), the negative consequences of digitalization include loss of privacy, intellectual piracy, identity theft and software-related accidents (Kling, 1996). However, Markus and Mentzer (2014) confirmed that system designers and users should not expect all of these negative consequences. The dark side of digitalization comes from negative outcomes related to individuals, organizations, industry and society such as the adverse workplace and task-related (Gupta et al., 2013; Selander & Henfridsson, 2012) problems of IT use-related e.g., (D’Arcy et al., 2014; Turel et al., 2011) conflicts of work life (Chen & Karahanna, 2014; Turel et al., 2011) and reduced employee commitment, turnover of employees and security breaches (Tarafdar et al., 2015a). Meanwhile, super-fast, automated trading algorithms that trading firms use on a high-speed IT network to determine caused problems in financial services operations by paying an additional exchange fee (Markus & Mentzer, 2014).

5.2 ICT trade balance and the bright side of digitalization

As shown in Tables 4, 5, 6 and 7, the ICT trade balance had a significant positive impact on digitalization proxies and reflected the bright side of digitalization in all estimators. This can be explained by the idea that spending a huge amount on high-technology exports leads to a high level of awareness about digitalization.

The current findings of this study, consistent and confirmed by using secure internet servers for all commercial operations, reflected a positive effect on the growth of digitalization (Parham et al., 2001; Gnanasambandam et al., 2012; CIS, 2019). According to Yang et al. (2020), companies’ ICT exports have a positive effect on ICT investment choices. Pradhan et al., (2018b, 2020) found that foreign direct investment and financial development are important for expanding the use of mobile phones, innovation diffusion and ICT diffusion in the long run. Pradhan et al. (2016b) supported the short-term relationship between financial depth and economic growth.

Additionally, ICT investments can be related to a sharp drop in ICT equipment exports and imports (Baudchon, 2002). Pradhan and Sahoo (2021) found short- and long-term relationships between financial inclusion and economic growth in mobile phone market. These results support those of Pradhan et al. (2017a) , who found a long-run equilibrium relationship between broadband penetration, financial development and economic growth. Pradhan et al., (2016a, 2018a) identified Granger causality among economic growth, telecommunications infrastructure and financial development, as information technology policy formulation plays an important role in ICT infrastructure development. Sachwald (2006) and Xing (2014) found that high-technology products positively contribute to the ICT trade balance. The financial access is positively related to ICT innovation (Friedewald et al., 2004; Lazonick, 2009; Diniz et al., 2012; Yeo et al., 2014). In addition, patent applications bring the trust of customers, then enhance the positive growth of high-technology exports (Cavdar & Aydin, 2015; Kabaklarli et al., 2017) as well as the digital applications exported by FinTech companies. In fact, ICT infrastructure development is a main factor in achieving sustainable economic development (Pradhan et al., 2021), and created technological and economic policies are important for ICT penetration, financial sector development and economic growth (Pradhan et al., 2017b). The findings of many studies are in line with our results related to risk performance and how ICT exports and imports push towards an increase in the technological performance risk proxy (Gnanasambandam et al., 2012; Caruana, 2016; Asongu & Odhiambo, 2018; Ozili, 2018).

6 Conclusion and policy implications

Financial access has been gaining attention in emerging and developing economies around the world. The main topic of concern involves individuals and firms who have access to financial products. Another issue is that some groups may be excluded from accessing financial services because of a lack of sufficient income or because of high-risk financial conditions that are unattractive to banks and other financial institutions. Meanwhile, all countries seek to increase their technological exports to create a positive ICT trade balance that reflects the extent of their technological progress.

The present study aimed to show the impact of financial access and ICT trade balance on digitalization in 31 OECD countries over the period of 2008–2019. Since digitalization has a dark side and a bright side, it is necessary to examine indicators to determine country-level digitalization trends. The main findings were consistent and confirmed by PLS, FE, RE, FGLS and S-GMM estimators. Financial access had a significant negative impact on digitalization proxies and reflected the dark side of digitalization in all estimators. This indicates that a lack of trust in the financial services systems among consumers hinders financial inclusion efforts, reducing the positive impact on digitalization indicators and reflecting the dark side of digitalization. However, trust functions as a strong tool for reducing uncertainty in complex environments. Therefore, policy makers must make significant efforts to establish safety regulations and awareness of the different types of financial products and services delivered through digital business. Furthermore, consumers should know their rights and obligations in the digital world.

The findings also showed that the ICT trade balance had a significant positive impact on digitalization proxies and reflected the bright side of digitalization in most estimators. These results indicate that a large amount of spending on technology-intensive equipment requires adequate knowledge of rights and full awareness about the digitalization for adopting the bright side of digitalization and rising the user’s trust. Managing digitalization in a secure manner prevents unauthorized access to personal information and reduces risks related to behaviors involved in digital commerce, which contributes to the creation of an appropriate environment for adopting digitalization.

The study findings can help policy makers assess the implications of the dark and bright sides of new technologies and identify the merits and risks related to their use in finance in OECD countries. Significant growth in the development of digital financial and service products and the global nature of many electronic financial applications have led to the promotion of consistent procedures and policy responses to prevent regulatory control and address emerging risks. Moreover, the COVID-19 pandemic has accelerated the digitalization of public administration and financial systems in OECD countries, which ensures mean their sustainable internal and external competitiveness. This has encouraged increased coordination of global programs. Furthermore, the adoption of digitalization has great implications for government attention to the efficient implementation of financial access via innovative technologies (FinTech).

The negative implications of digitization include the inability of individuals to access finances due to the high costs of technology. In other words, the exclusion of vulnerable population groups has created a gap between technological progress and social impact. This situation has made it difficult to build social and political systems capable of appropriately directing digitization to serve society. In addition, most disputes between countries have centered on digital patents, weakening negotiations between countries between countries. Moreover, the merits of digitalization are constrained by structural factors, such as limits on access to data and information management, use and speed process, social inequalities and low competitiveness.

Policy makers should encourage digital financial transactions within a secure framework and with easy terms and ensure awareness of the importance and accuracy of financial transactions and the speed of their implementation in a low-risk framework. They should also work to clarify the best method for mitigating potential risks in credit through digital programs, while continuously monitoring the use of digital credit. Policy makers have played a role in enabling efficient digital transformation in OECD countries by ensuring that the necessary complementary factors are achieved. Specifically, policy makers should promote the following actions to support digitalization for successful digital transformation: (1) upgrade skills by enhancing education and training systems’ provision of the cognitive, technical and managerial skills that are crucial for digital economies; (2) promote efficient labor and capital reallocation; (3) deal better with new competition challenges; (4) minimize the financial constraints that hinder digitalization; and (5) support more digital government services as well as the tax system related to digitalization. Six OECD countries were excluded from the present study due to unavailable data, which is considered a limitation. Future studies should consider environmental, income index and socioeconomic indicators, such as internet crime, identity theft and related issues, cyberattacks and loss of privacy, as factors determining the dark and bright sides of digitalization.

Data availability

Source of data sets are available in: World Development Indicators (WDI) 2008–2019, “World Bank”, retrieved on 01-10-2019 Available at the link: https://data.worldbank.org/.

References

Abubakar, L. & Handayani, T. (2018). Financial technology: Legal challenges for Indonesia financial sector. In: IOP Conference Series: Earth Environmental Science 175 IOP Conference Series: Earth and Environmental Science, p. 12204. https://doi.org/10.1088/1755-1315/175/1/012204.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 351. https://doi.org/10.2307/2951599

Aghion, P., & Howitt, P. W. (1998). Endogenous Growth Theory. The MIT Press.

Agoba, A. M., Sare, Y. A., & Bugri-Anarfo, E. (2017). Financial inclusion and monetary policy: A review of recent studies. Ghana Journal of Development Studies, 14(1), 231. https://doi.org/10.4314/gjds.v14i1.12

Almudi, I., Fatas-Villafranca, F., & Izquierdo, L. R. (2013). Industry dynamics, technological regimes and the role of demand. Journal of Evolutionary Economics, 23(5), 1073–1098.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

Asongu, S. A., & Odhiambo, N. M. (2018). ICT, financial access and gender inclusion in the formal economic sector: Evidence from Africa. African Finance Journal, 20(2), 45–65. https://doi.org/10.2139/ssrn.3305000

Asongu, S. A., Orim, S. M. I., & Nting, R. T. (2019). Inequality, information technology and inclusive education in sub-Saharan Africa. Technological Forecasting and Social Change, 146, 380–389. https://doi.org/10.1016/j.techfore.2019.06.006

Ayyagari, M., Demirgüç-Kunt, A. & Maksimovic, V. (2011). Firm innovation in emerging markets: The role of finance, governance, and competition. The Journal of Financial and Quantitative Analysis 46(6), 1545–1580. https://www.jstor.org/stable/41409661 . Accessed 25 May 2021.

Balgobin, Y., & Dubus, A. (2022). Mobile phones, mobile Internet, and employment in Uganda. Telecommunications Policy, 46(5), 102348.

Baltagi, B. H. (2012). Econometric Analysis of Panel Data (4th ed.). Wiley.

Barefoot, J. A. (2020). Digital Technology Risks for Finance: Dangers Embedded in Fintech and Regtech. 151. https://www.hks.harvard.edu/centers/mrcbg/publications/awp/awp151. Accessed 11 May 2021.

Baudchon, H. (2002). The aftermath of the “new economy” bust : A case study of five OECD countries. In: Documents de Travail de l’OFCE.

Beck, T., Senbet, L., & Simbanegavi, W. (2015). Financial Inclusion and Innovation in Africa: An overview. Journal of African Economies, 24(1), i3–i11. https://doi.org/10.1093/jae/eju031

Beyene Fanta, A. & Makina, D. (2019). The relationship between technology and financial inclusion: Cross-sectional evidence. In: Extending Financial Inclusion in Africa (pp. 211–230). Elsevier. https://doi.org/10.1016/B978-0-12-814164-9.00010-4

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Boikos, S. (2020). Capital utilization, obsolescence and technological progress. The Journal of Economic Asymmetries, 22, e00170.

Boshkov, T. (2016). Growing the Global Economy Through SMEs International Aspirations (1st ed.). LAP LAMBERT Academic Publishing.

Boskov, T. & Drakulevski, L. (2017). Addressing the role of risk management and digital finance technology on financial inclusion. Quality-Access to Success 18(161), 113–115. http://eprints.ugd.edu.mk/18591/. Accessed 1 May 2021.

Broni, A. A., Owusu-Ansah, C. M., & Takyi, L. N. (2016). Influence of ICT on the graduate students’ use of electronic resources: leadership lessons. International Journal of Educational Leadership, 6(1), 117–127.

Burjorjee, D. M. & Scola, B. (2015). A Market Systems Approach to Financial Inclusion Guidelines for Funders. https://www.cgap.org. Accessed 11 May 2021.

Cabral, L. (2021). Merger policy in digital industries. Information Economics and Policy, 54, 100866.

Calvano, E., & Polo, M. (2021). Market power, competition and innovation in digital markets: A survey. Information Economics and Policy, 54, 100853.

Carayon, P. (1993). Effect of electronic performance monitoring on job design and worker stress: Review of the literature and conceptual model. In: Human Factors (pp. 385–395). SAGE Publications. https://doi.org/10.1177/001872089303500301.

Caruana, J. (2016). Financial inclusion and the fintech revolution: Implications for supervision and oversight. In: M. Gamser et al. (eds) Third GPFI-FSI Conference on Standard-Setting Bodies and Innovative Financial Inclusion: New Frontiers in the Supervision and Oversight of Digital Financial Services.

Cavdar, S. C., & Aydin, A. D. (2015). An empirical analysis about technological development and innovation indicators. Procedia-Social and Behavioral Sciences, 195, 1486–1495. https://doi.org/10.1016/j.sbspro.2015.06.449

Chen, A. & Karahanna, E. (2014). Boundaryless technology: Understanding the effects of technology-mediated interruptions across the boundaries between work and personal life. AIS Transactions on Human–Computer Interaction 6(2), 16–36. https://aisel.aisnet.org/thci/vol6/iss2/1. Accessed 12 May 2021.

CIS, C. for I. S. (2019). The Digital Potential of the EDB Member Countries—Eurasian Development Bank. Retrieved from https://eabr.org/upload/iblock/566/EABR_Digital_Potential_EN.pdf. Accessed 1 May 2022.

Corbett, J. M. (1987). A psychological study of advanced manufacturing technology: The concept of coupling. Behaviour and Information Technology, 6(4), 441–453. https://doi.org/10.1080/01449298708901855

D’Arcy, J., Herath, T., & Shoss, M. K. (2014). Understanding employee responses to stressful information security requirements: A coping perspective. Journal of Management Information Systems, 31(2), 285–318. https://doi.org/10.2753/MIS0742-1222310210

De Hoyos, R. E., & Sarafidis, V. (2006). Testing for cross-sectional dependence in panel-data models. Stata Journal, 6(4), 482–496. https://doi.org/10.1177/1536867x0600600403

Diniz, E., Birochi, R., & Pozzebon, M. (2012). Triggers and barriers to financial inclusion: The use of ICT-based branchless banking in an Amazon county. Electronic Commerce Research and Applications, 11(5), 484–494. https://doi.org/10.1016/j.elerap.2011.07.006

Evans, R. H. (1996). An analysis of criterion variable reliability in conjoint analysis. Perceptual and Motor Skills, 84(3), 988–990. https://doi.org/10.2466/pms.1996.82.3.988

Fabling, R., & Grimes, A. (2021). Picking up speed: Does ultrafast broadband increase firm productivity? Information Economics and Policy, 57, 100937.

Fanta, A. B., & Makina, D. (2019). The relationship betweentechnology and financial inclusion: Cross-sectional evidence. In Extending financial inclusion in Africa (pp. 211–230). Academic Press. https://doi.org/10.1016/B978-0-12-814164-9.00010-4.

Francois, J., & Hoekman, B. (2010). Services trade and policy. Journal of Economic Literature, 48(3), 642–692. https://doi.org/10.1257/jel.48.3.642

Friedewald, M. et al. (2004). Benchmarking National and Regional Policies in Support of the Competitiveness of the ICT Sector in the EU. https://www.researchgate.net/publication/319301354_Benchmarking_national_and_regional_policies_in_support_of_the_competitiveness_of_the_ICT_sector_in_the_EU. Accessed 11 May 2021.

Gnanasambandam, C. et al. (2012). Online and Upcoming: The Internet’s Impact on India, Technology, Media and Telecom Practice.

Gollapudi, S. P. V., et al. (2019). Promoting better financial inclusion through web page transformation—A systematic literature review. Journal of Banking and Financial Technology, 3(2), 131–147. https://doi.org/10.1007/s42786-019-00010-0

Gonzalez, A. et al. (2014). Exporting Financial Services in Latin America and the Caribbean, Economic Modelling. Elsevier. https://doi.org/10.1016/j.econmod.2014.04.013.

Gupta, A., Li, H., & Sharda, R. (2013). Should I send this message? Understanding the impact of interruptions, social hierarchy and perceived task complexity on user performance and perceived workload. Decision Support Systems, 55(1), 135–145. https://doi.org/10.1016/j.dss.2012.12.035

Harris, J. K., et al. (2014). Communication about childhood obesity on Twitter. American Journal of Public Health, 104(7), e62–e69. https://doi.org/10.2105/AJPH.2013.301860

Helm, T., Low, A. & Joshua, T. (2019). The Positive Impact of Technology on the Financial Services Sector in the United Kingdom is Unprecedented Globally, UK FinTech-State of the Nation.

Hoechle, D. (2007). Robust standard errors for panel regressions with cross-sectional dependence. Stata Journal, 7(3), 281–312. https://doi.org/10.1177/1536867x0700700301

Hsiao, C. (2007). Panel data analysis-advantages and challenges. TEST, 16(1), 1–22. https://doi.org/10.1007/s11749-007-0046-x

Johnston, J., & Dinardo, J. (1997). Econometric Methods. McGraw-Hill.

Kabaklarli, E., Duran, M. S., & Üçler, Y. T. (2017). The determinants of high-technology exports: A panel data approach for selected OECD countries. DIEM: Dubrovnik International Economic Meeting, 3(1), 888–900.

KallalaI, S., & Guetat, I. (2020). Fiscal stance, election year and 2007 crisis, evidence from OECD countries (1980–2017). The Journal of Economic Asymmetries, 21, e00163.

Kerr, W. R., & Nanda, R. (2015). Financing innovation. Annual Review of Financial Economics, 7, 445–462. https://doi.org/10.1146/annurev-financial-111914-041825

Kling, R. (1996). Computerization and Controversy: value conflicts and social choices. 2nd ed. (Ed. R. Kling). San Diego: Academic Press.

Knauth, B. (2004). Information Society Statistics—Pocketbook—2003 Edition—Products Pocketbooks—Eurostat. Retrieved from https://ec.europa.eu/eurostat/documents/3930297/5954006/KS-56-03-093-EN.PDF.pdf/9e688cc4-5b60-45a7-8aa4-6bb6fcb4b7ac?t=1415007135000. Accessed 1 May 2022.

Lakka, S., et al. (2012). Exploring the determinants of the OSS market potential: The case of the Apache web server. Telecommunications Policy, 36(1), 51–68. https://doi.org/10.1016/j.telpol.2011.11.018

Lazonick, W. (2009). What is new, and permanent, about the" new economy"? In: W. Lazonick (Ed.), Sustainable Prosperity in the New Economy? Business Organization and High-Tech Employment in the United States. 1st edn. W.E. Upjohn Institute for Employment Research.

Lorentz, A., Ciarli, T., Savona, M., & Valente, M. (2016). The effect of demand-driven structural transformations on growth and technological change. Journal of Evolutionary Economics, 26(1), 219–246.

Markus, M. L. & Mentzer, K. (2014). Foresight for a responsible future with ICT. In: Information Systems Frontiers (pp. 353–368). Kluwer Academic Publishers. https://doi.org/10.1007/s10796-013-9479-9.

Mignamissi, D., & Djijo, T. A. J. (2021). Digital divide and financial development in Africa. Telecommunications Policy, 45(9), 102199.

Mohseni, R. M., & Cao, J. (2020). Monetary policy and financial economic growth. The Journal of Economic Asymmetries, 22, e00169.

Myovella, G., Karacuka, M., & Haucap, J. (2021). Determinants of digitalization and digital divide in Sub-Saharan African economies: A spatial Durbin analysis. Telecommunications Policy, 45(10), 102224.

Nemoto, N. & Koreen, M. (2019). Digital Innovation Can Improve Financial Access for SMEs. 1st edn. https://www.rieti.go.jp/en/projects/t20japan/tf9/pb1.html. Accessed 11 May 2021.

Ngo, C. N., & McCann, C. R. (2019). Rethinking rent seeking for technological change and development. Journal of Evolutionary Economics, 29(2), 721–740.

Nguyen, C., Su, T., & Doytchc, N. (2020). The drivers of financial development: Global evidence from internet and mobile usage. Information Economics and Policy, 53, 100892.

OECD. (2000). Information Technology Outlook 2000 ICTs, E-commerce and the Information Economy. http://www.oecd.org/dsti/sti/it/prod/it-out2000-e.htm. Accessed 11 May 2021.

OECD. (2003). Science, Technology and Industry Scoreboard 2003. OECD. https://doi.org/10.1787/sti_scoreboard-2003-en

OECD. (2008). Information Technology Outlook 2008 Highlights. https://doi.org/10.1787/472683503145.

Øvrelid, E., & Bygstad, B. (2019). The role of discourse in transforming digital infrastructures. Journal of Information Technology, 34(3), 221–242. https://doi.org/10.1177/0268396219831994

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329–340. https://doi.org/10.1016/j.bir.2017.12.003

Parham, D., Roberts, P. & Sun, H. (2001). Information technology and Australia’s productivity surge. In: Development and Comp Systems. https://ideas.repec.org/p/wpa/wuwpdc/0110006.html. Accessed 11 May 2021.

Pradhan, R. P., Arvin, M., Bahmani, S., & Bennett, S. (2017a). Broadband penetration, financial development, and economic growth nexus: Evidence from the Arab League countries. Macroeconomics and Finance in Emerging Market Economies, 10(2), 151–171.

Pradhan, R. P., Arvin, M. B., & Hall, J. H. (2016a). Economic growth, development of telecommunications infrastructure, and financial development in Asia, 1991–2012. The Quarterly Review of Economics and Finance, 59, 25–38.

Pradhan, R. P., Arvin, M., Hall, J., & Bennett, S. (2018b). Mobile telephony, economic growth, financial development, foreign direct investment, and imports of ICT goods: The case of the G-20 countries. Journal of Industrial and Business Economics, 45(2), 279–310.

Pradhan, R. P., Arvin, M. B., Nair, M., Bahmani, S., & Bennett, S. E. (2017b). ICT-finance-growth nexus: Empirical evidence from the next-11 countries. Cuadernos De Economia, 40(113), 115–134.

Pradhan, R. P., Arvin, M. B., Nair, M., & Bennett, S. E. (2020). Sustainable economic growth in the European Union: The role of ICT, venture capital, and innovation. Review of Financial Economics, 38(1), 34–62.

Pradhan, R. P., Arvin, M. B., Nair, M. S., Hall, J. H., & Bennett, S. E. (2021). Sustainable economic development in India: The dynamics between financial inclusion, ICT development, and economic growth. Technological Forecasting and Social Change, 169(21), 1–19.

Pradhan, R. P., Arvin, M. B., Norman, N. R., & Bennett, S. E. (2016b). Financial depth, internet penetration rates and economic growth: country-panel evidence. Applied Economics, 48(4), 331–343.

Pradhan, R. P., Mallik, G., & Bagchi, T. P. (2018a). Information communication technology (ICT) infrastructure and economic growth: A causality evinced by cross-country panel data. IIMB Management Review, 30(1), 91–103.

Pradhan, R. P., & Sahoo, P. (2021). Are there links between financial inclusion, mobile telephony, and economic growth? Evidence from Indian states. Applied Economics Letters, 28(4), 310–314.

Ragu-Nathan, T. S., et al. (2008). The consequences of technostress for end users in organizations: Conceptual development and validation. Information Systems Research, 19(4), 417–433. https://doi.org/10.1287/isre.1070.0165

Rizzo, J. R., House, R. J., & Lirtzman, S. I. (1970). Role conflict and ambiguity in complex organizations. Administrative Science Quarterly, 15(2), 163. https://doi.org/10.2307/2391486

Rodon, J., & Eaton, B. (2021). Digital infrastructure evolution as generative entrenchment: The formation of a core-periphery structure. Journal of Information Technology. https://doi.org/10.1177/02683962211013362

Romer, P. M. (1990). Endogenous technological change. Journal of Political Economy 98(5), 71–102. https://www.jstor.org/stable/i352289?refreqid=excelsior%3A2eeab25b1887c36079888301dc9780e8 . Accessed 1 May 2021.

Sachwald, F. (2006). China, high or low tech power ? The contrasted picture of China’s scientific and technological capabilities | request PDF. In: Tokyo Club Macro Conference (pp. 6–7). Tokyo.

Schumpeter, J. (1912). Theorie der Wirtschaftlichen Entwicklung. Duncker und Humblot.

Selander, L., & Henfridsson, O. (2012). Cynicism as user resistance in IT implementation. Information Systems Journal, 22(4), 289–312. https://doi.org/10.1111/j.1365-2575.2011.00386.x

Silber, W. L. (1983). The Process of Financial Innovation. The American Economic Review, 73, 89–95.

Solow, R. M. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70(1), 65–94. https://doi.org/10.2307/1884513

Sotomayor, N. L. (2012). Setting the regulatory landscape for the provision of electronic money in Peru. Innovations: Technology, Governance, Globalization, 6(4), 105–116. https://doi.org/10.1162/INOV_a_00105

Tarafdar, M., et al. (2011). Crossing to the dark side: Examining creators, outcomes, and inhibitors of technostress. Communications of the ACM, 54(9), 113–120. https://doi.org/10.1145/1995376.1995403

Tarafdar, M., Gupta, A., & Turel, O. (2015a). Introduction to the special issue on “dark side of information technology use”—Part two. Information Systems Journal (blackwell Publishing Ltd). https://doi.org/10.1111/isj.12076

Tarafdar, M., Pullins, E. B., & Ragu-Nathan, T. S. (2015b). Technostress: Negative effect on performance and possible mitigations. Information Systems Journal, 25(2), 103–132. https://doi.org/10.1111/isj.12042

Tedeschi, G., Vitali, S., & Gallegati, M. (2014). The dynamic of innovation networks: A switching model on technological change. Journal of Evolutionary Economics, 24(4), 817–834.

The World Bank. (2018). World Development Indicators | DataBank. https://databank.worldbank.org/source/world-development-indicators. Accessed 12 May 2021.

Tumbas, S., Berente, N., & vom Brocke, J. (2018). Digital innovation and institutional entrepreneurship: Chief Digital Officer perspectives of their emerging role. Journal of Information Technology, 33(3), 188–202. https://doi.org/10.1057/s41265-018-0055-0

Turel, O., Serenko, A., & Giles, P. (2011). Integrating technology addiction and use: An empirical investigation of online auction users. MIS Quarterly: Management Information Systems, 35(4), 1043–1061. https://doi.org/10.2307/41409972

Wagner, J. (2019). Access to finance and exports—Comparable evidence for small and medium enterprises from industry and services in 25 European Countries. Open Economies Review, 30(4), 739–757. https://doi.org/10.1007/s11079-019-09534-w

Waheed, F., & Rashid, A. (2021). Credit frictions, fiscal imbalances, monetary policy autonomy, and monetary policy rules. The Journal of Economic Asymmetries, 23, e00192.

Weil, M. M. & Rosen, L. D. (eds.). (1997). Technostress : Coping with Technology @Work @Home @Play. Wiley. https://lib.ugent.be/en/catalog/rug01:000826059 . Accessed 15 May 2021.

Wooldridge, J. M. (2010). Econometric Analysis of Cross Section and Panel Data (2nd ed.). Cambridge, Mass.: The MIT Press.

Xing, Y. (2014). China’s high-tech exports: The myth and reality. Asian Economic Papers, 13(1), 109–123. https://doi.org/10.1162/ASEP_a_00256

Yang, S., et al. (2020). Access to finance, technology investments and exporting decisions of Indian Services Firms. Open Economies Review, 31(5), 1009–1036. https://doi.org/10.1007/s11079-020-09595-2

Yeo, Y. H. et al. (2014). The assessment of information and communication technology (ICT) policy in South Korea. in Lecture Notes in Electrical Engineering (pp. 1241–1249). Springer. https://doi.org/10.1007/978-3-642-41674-3_172.

Yoshino, N. & Morgan, P.J. (2016). Overview of financial inclusion, regulation, and education. In: ADBI Working Papers. 591. Asian Development Bank Institute. https://ideas.repec.org/p/ris/adbiwp/0591.html. Accessed 12 May 2021.

Funding

There is no funding for this manuscript.

Author information

Authors and Affiliations

Contributions

All authors have a same contribution. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical standard

The authors declare that this research article is in compliance with the ethical standards of this journal.

Informed consent

This article does not contain any information that requires informed consent.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Definitions of the variables

Variable and abbreviation | Definition |

|---|---|

Independent variables | |

Financial access (LOGCBB) | This refers to ability of individuals and enterprises to obtain unlimited access without hindrance to all financial services, such as credit, deposits and electronic payments, which are covered by all risks |

ICT trade balance (ICTTB) | This refers to the difference between exports and imports in the trade balance for electronic goods, such as computers |

Dependent variables | |

Ethical proxy measured by secure internet servers (LOGSIS) | This includes the protection of all online transactions through secure encryption |

Technological growth proxy measured by high-technology exports (% of manufactured exports) (LOGHTE) | This refers to products that require a high expenditure of research and development, such as pharmaceutical transactions, aerospace and computers and other electronic equipment |

Technological innovation proxy measured by patent applications, residents (LOGPA) | This represents protection for the owner of the invention and the patent for a certain period within a particular country |

Technological performance risk proxy measured by productivity through individuals using the internet (% of population) (LOGIUI) | This refers to the number of internet service users in the world |

Control variables | |

GDP per capita growth (annual %) (GDPG) | This is the gross domestic product divided by the purchase prices of the total added value of all productive sectors in the economy in addition to the product taxes |

Inflation, GDP deflator (annual %) (IGD) | This includes the annual growth in the prices for goods and services and reflects price changes at the level of the economy as a whole. In other words, it includes the current domestic prices in relation to the gross domestic product, which is evaluated at the constant domestic price |

Trademark applications, direct resident (LOGTMA) | This includes applications that are registered as a trademark at the local and regional levels to establish their intellectual property rights |

Automated teller machines (ATMs) (LOGATM) | This measures the extent of individuals’ ability to carry out financial operations through an electronic teller machine without the need for a teller employee or a visit to a bank |

Appendix B

The OECD's 37 members are: Austria, Australia, Belgium, Canada, Chile, Colombia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, Mexico, The Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Alraja, M.N., Alshubiri, F., Khashab, B.M. et al. The financial access, ICT trade balance and dark and bright sides of digitalization nexus in OECD countries. Eurasian Econ Rev 13, 177–209 (2023). https://doi.org/10.1007/s40822-023-00228-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-023-00228-w

Keywords

- Financial access

- ICT trade balance

- Dark and bright sides of digitalization

- Standard neo-classical growth theory

- Theory of product life cycle

- Diffusion of innovations theory

- Theory of creative destruction

- Theory of financial innovations