Abstract

This paper analyzes how a country’s formal institutional quality impacts the performance of listed companies across different Latin American countries (namely, Argentina, Brazil, Colombia, Mexico, Peru, and Chile) and industries. Latin America provides a unique setting to address this question due to the region’s high institutional instability. The sample consists of 571 large listed companies, with a total of 8576 observations, for the period 2004–2019. Results show that the quality of a country’s formal institutions is positively related to firm performance, measured through two alternative variables (ROA and Tobin’s Q). Additionally, countries that are signatories of the ICSID agreement provide companies with a more stable environment in which to do business, which ultimately has a positive impact on their performance. However, as the number of cases recorded before the ICSID increases, the relationship turns negative. The paper provides a more comprehensive understanding of formal institutions by considering six alternative governance dimensions. Moreover, international arbitration is found to be a substitute for formal institutions in Latin American countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The implementation of market-supporting institutions, i.e., policies that help to strengthen free-market relationships in a country (Meyer et al., 2009; Banalieva et al., 2018; Elango & Lahiri, 2014), has been one of the pillars of economic and business development in most Latin American countries since the 1990s.Footnote 1 Previous research on this topic has found a positive effect of pro-market institutions on a country’s economic growth (e.g., Campos & Horvath, 2012) since the quality of a country’s institutional characteristics helps to reduce information asymmetries and uncertainty (Díez-Esteban et al., 2019; La Porta et al., 1999). However, the results obtained when examining the effect of market-supporting institutions on firm-level dimensions, such as financial performance, are ambiguous (see Banalieva et al., 2018). This issue is especially relevant in emerging countries, such as Latin American ones, where institutional frameworks are fragile (Hartwell & Malinowska, 2019).

Following North (1992, 2005), institutions can be defined as the “rules of the game”. A country’s pro-market institutions should provide incentives for as well as establish restrictions on economic players in terms of liberalization, deregulation and privatization (Banalieva et al., 2018; Hartwell & Malinowska, 2019). Although institutions have been approached from the “formal” perspective, i.e., shaping government policies and the features of the legal system (Voigt, 2013), analysis of a country’s informal institutions is also gaining in importance (Baltaci et al., 2022; Díez-Esteban et al., 2019). Previous literature has extensively shown that formal institutions are influenced by national culture values (Díez-Esteban et al., 2019; Hartwell, 2021; Heise & MacKinnon, 2010; Kwok & Tadesse, 2006; Li et al., 2013; Licht et al., 2005). Likewise, formal institutions are also shaped by a country’s social capital (Grootaert & Van Bastelaer, 2002). Again, the relevance of informal institutions is especially significant in countries where formal frameworks are absent or weak (Hartwell & Malinowska, 2019), which is the case of Latin American countries. Using the concept of “institutional volatility” (Berggren et al., 2012; Henisz, 2004), Hartwell (2018) explains that it is not enough for a country to have high-quality formal institutions: a country must also evidence institutional stability, otherwise informal institutions will have to play a more active role in reducing information asymmetries and uncertainty (Franck, 2005).

Although some countries, such as Chile, do have high-quality formal institutions, most Latin American countries exhibit high levels of institutional volatility. This ultimately leads to the need for alternatives in order to ensure that “the rules of the game” are respected. While this issue has recently been studied for emerging Eastern European countries, whose economies have also been undergoing a process of pro-market institutional implementation since the late 1980s (e.g., Banalieva et al., 2018; Berggren et al., 2012; Elango & Lahiri, 2014; Hartwell, 2018), attention paid to the Latin American setting remains surprisingly scant.

In this regard, this paper aims to analyze the role played by international arbitration as a substitute for formal institutions. Specifically, international arbitration provided by the International Centre for Settlement of Investment Disputes (ICSID),Footnote 2 belonging to the World Bank, has proven crucial in protecting investors’ rights in most Latin American countries over the last few decades (Fach Gómez & Titi, 2016). Most international investment agreements (IIAs) signed by Latin American countries offer foreign investors the possibility of resorting to international arbitration before the ICSID or ad hoc arbitration through the United Nations Conference on Trade and Development (UNCTAD) rules. In addition, international arbitration is the preferred solution for investors when a state-company dispute arises. In low-quality and highly-volatile institutional countries, this mechanism guarantees that investors will be given a fair final decision through a fast and flexible procedure over which parties have considerable control (Franck, 2005). Not surprisingly, the majority of lawsuits brought before the ICSID in recent years have been filed by companies operating in Latin America (see Table 1).

Considering the above, this research seeks to further develop the literature linking pro-market institutional quality and firm performance in the thus far underexplored Latin American environment. Using a large sample of 571 companies for the period 2004–2019, we look at how a country’s formal institutional quality impacts the financial performance of listed companies in Argentina, Brazil, Colombia, Mexico, Peru, and Chile. Additionally, the role played by international arbitration as a substitution mechanism for formal institutions is also tested. The main finding reveals that the formal quality of a country’s institutions, proxied by Worldwide Governance Indicators (WGI) (commonly used by literature, as in Berggren et al., 2012) is positively related to a company’s performance, measured through two alternative variables (ROA and Tobin’s Q). We also find that being a signatory country to the ICSID agreement is positively related to firm financial performance, but that as the number of cases registered increases, the relationship turns negative.

The study contributes to the literature in several ways. First, we add fresh evidence to the pro-market institutions and firm performance puzzle. As stated by Banalieva et al. (2018), previous literature has obtained mixed results because of the asymmetric effects a country’s formal institutional quality has on firm performance. Hence, analyzing this problem in an underexplored setting such as Latin America helps to better understand and define institutions (Voigt, 2013, 2018). We show that the definition of what constitutes formal institutions needs to be understood from different perspectives that are related not only to public efficiency but also to society’s perception thereof. Second, and following the strand of literature on institutional volatility and uncertainty, this study is the first to consider what impact international arbitration as a substitute for formal institutions might have on firm financial performance. Latin America provides a unique setting to analyze how the increase in transaction costs and information asymmetries related to institutional volatility may be mitigated by arbitration mechanisms, which ultimately affects firms’ financial performance.

The paper is structured as follows. The literature review on the relationship between formal institutions and firm performance is provided in the next section together with the proposed hypotheses. The sample, variables description, and empirical methodology are explained in Sect. 3. In Sect. 4, the results obtained are shown and discussed. The last section provides the relevant conclusions of the study, the implications and possible directions for future research.

2 Literature review

Over the last three decades, many studies have reported a direct influence of pro-market institutions on a country’s economic growth and development (e.g., Beck & Laeven, 2006; Dollar & Kraay, 2003; Goedhuys & Srholec, 2015; Nakabashi et al., 2013; Rodrik et al., 2004; Vijayaraghavan & Ward, 2001), based on propositions from the literature on economic growth. Another stream of literature analyzes the influence of institutions on economic performance by examining direct effects (Efendic & Pugh, 2015) and indirect effects that occur through different channels: domestic private and foreign investment (Dang, 2009), trade (Rodrik et al, 2004), the stock of human and social capital (Acemoglu et al., 2014; Bartlett et al., 2013; Dias & Tebaldi, 2012; Raiser, 1999), or entrepreneurship levels (Estrin & Mickiewicz, 2011; Williams & Vorley, 2015; Yay et al., 2018).

However, firm-level studies have failed to reach a consensus when seeking to determine what impact institutional quality has on firm performance. On the one hand, market-supporting institutions may have an asymmetric effect on firm performance, depending on the countries in question (Banalieva et al., 2018). Given that the Latin American setting has been underexplored, it provides a unique opportunity to examine how the quality of formal institutions affects firms’ financial performance. In addition, the high institutional volatility found in most Latin American countries advocates exploring the role played by substitutes of formal institutions, such as international arbitration (Franck, 2005). The research proposes an integration approach, combining insights from both institutional theory and signaling theory to better understand the economic context of emerging economies such as those in Latin America.

2.1 Pro-market institutions and firm performance in Latin America

According to contemporary institutional theory (North, 1990, 1991, 1992, 2005), a company usually operates in uncertain environments, which is also characterized by high transactions costs (Liu et al., 2021). Specifically, companies will be discouraged from investing in risky projects in countries where there is high institutional volatility due to the high transaction and market costs (Hartwell, 2018; Hollingsworth, 2002; Khan et al., 2021) related to uncertainty. Institutional theory considers that a country’s formal institutions are related to those political structures and processes that clearly stipulate the rights and duties of citizens, including companies (Aidis, 2005; Fogel et al., 2006; Matemilola et al., 2019). In this sense, countries with higher quality institutions have less formal and informal trade barriers, which makes international trade relations easier and firms more profitable (Bilgin et al., 2017).

For the case of emerging countries, the seminal paper by Peng et al. (2008) follows institutional theory in highlighting the importance of a country’s institutional setting when explaining companies’ strategic behavior and performance. Specifically, by combining principles from the resource-based view of the firm (Barney, 1991) and the industrial organization paradigm (Porter, 1980), the authors point out the need to better understand the specific institutional upheavals which occur in many developing and emerging countries.

Countries with weak formal institutions are usually characterized by having narrower capital markets (La Porta et al., 1999), which limits the availability of funds for companies to engage in profitable investments that increase shareholders' returns (Matemilola et al., 2019). Similarly, a weaker institutional environment prevents companies from engaging in innovative or productive investments since transaction costs and uncertainty are high (North, 2005; Peng et al., 2008). The theory of opportunity exploitation (Shane, 2003) states that the quality of formal institutions reduces information asymmetries and encourages free exchange of information, which ultimately facilitates innovation and enhances firm performance.

Considering the above, it can be concluded that the quality of a country’s formal institutions determines a firm’s performance and its survival. This issue is especially relevant in emerging economies like Latin America (Cárdenas et al., 2018), where traditional economic and political uncertainty may discourage companies from undertaking riskier and innovative investment projects, which will ultimately affect their performance. When a county promotes better formal institutions, transactions costs and information asymmetry are reduced, thus improving the business environment for companies (Khan et al., 2021; Matemilola et al., 2019; Bjornskov, 2010).

According to the signaling theory, when governments implement policies that allow a friendly business setting to be created, potential investors will trust the credibility of those countries (Walsh, 2007) and will therefore be more willing to engage in productive investments (Huang, 2013; Saeed & Zamir, 2021). Such positive governmental signals are the cumulative consensus of competing coalitions of interest groups, and reflect the balance of power between these groups (Rajan & Zingales, 2003). In addition, the quality of a country’s formal institutions prevents external monitoring costs when governments become involved in negotiating commercial agreements or bilateral cooperation (Fang & Owen, 2011).

Companies in emerging countries, such as those in Latin America, will consequently make their investment decisions following the policy choices of the corresponding government. In economies with high uncertainty levels in terms of political, legal and economic stability, the best strategy for companies will be determined by the credibility of a country’s policy (Díez-Esteban et al., 2016), which will ultimately influence firm performance (Walsh, 2007).

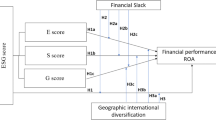

Considering the above, the first hypothesis is proposed as follows:

H1: The quality of formal institutions in Latin America has a positive impact on firm performance.

2.2 Institutional volatility: the role of international arbitration

As often highlighted, Latin American countries are characterized by displaying high levels of institutional volatility. However, while high-quality institutions are performance-enhancing because they reduce uncertainty and transaction costs and provide incentives for productive behavior, the effects of institutional volatility per se and the subsequent instability are theoretically ambiguous (Berggren et al., 2012).

Institutional instability means that although a country may have high standards in terms of pro-market institutions, its stability may not be invariant or semi-permanent (Hartwell, 2018). Thus, investors need an alternative frame through which to ensure that the “rules of the game” will be adhered to and respected when institutions become weak or are indeed absent (Berggren et al., 2012; Hartwell, 2018). In such cases, “alternative” institutions are needed to provide certain property rights (Franck, 2005). However, although several papers have addressed this issue from different perspectives, focusing particularly on the macroeconomic level (Berggren et al., 2012; Hartwell, 2018; Williamson & Kerekes, 2011), studies exploring what effect highly unstable environments have on firm-level performance are non-existent.

One of the most relevant tools to overcome institutional volatility is international arbitration (Pinkham & Peng, 2017). In fact, most of the IIAs signed by Latin American countries offer the possibility of resorting to international arbitration before the ICSID, whereas recourse to a host country’s domestic courts is not contemplated in most IIAs.Footnote 3 It therefore comes as no surprise that international arbitration is the preferred solution for investors who need to seek a solution to their difference with the host State of the investment when formal institutions are absent (White III, 2015; Hanefeld, 2012).

While institutional instability introduces greater information asymmetries and transactions costs because investors’ rights are less protected (Hartwell, 2018), international arbitration helps to reduce such instability and uncertainty. On the one hand, being a signatory of the ICSID convention helps a less institutionally stable country to attract investments and to provide a more reliable economic setting (Elango & Lahiri, 2014). On the other hand, when a country has alternatives to traditional formal institutions, companies will be more likely to engage in riskier investments, which ultimately enhances firm performance.

Thus, the second hypothesis is defined as follows:

H2: Belonging to a country in the ICSID convention has a positive impact on firm performance.

Going a step further, the quality of international arbitration also needs to be tested. This refers not to the efficiency of the ICSID procedure but to the number of times a company needs to resort to said mechanism: in other words, the positive effect for a company of a country belonging to the ICSID will be even greater when the company has no need to resort to said mechanism. Although international arbitration provides a fair frame for resolving disputes when a country lacks formal institutions, the costs involved in the procedure are comparatively higher (Franck, 2005; Williamson & Kerekes, 2011). Thus, it is expected that when a country has too many cases under international arbitration, companies will be reluctant to invest in riskier and value creating-projects. In addition, as a substitute for formal institutions, the number of cases under institutional arbitration reveals a failure in a country’s pro-market institutional quality.

Accordingly, the third hypothesis is stated as follows:

H3: The number of cases a country has before the ICSID has a negative impact on firm performance.

3 Data and methodology

3.1 Sample and data sources

The dataset includes 571 listed companies from Argentina, Brazil, Colombia, Mexico, Peru, and Chile for the 2004–2019 period with a total of 5526 firm-year observations. The initial sample comprised a list of companies from most of the Latin American countries. However, due to lack of information for the period considered and for most of the firm-level variables, the final sample does not include those countries. Additionally, the final sample does not consider all listed companies in the six countries, again because ownership structure and other relevant firm-level financial data are difficult to obtain. The final sample thus comprises non-financial companies of different sizes and from a diverse set of countries in order to cover different institutional backgrounds. Moreover, two countries in the sample help to test the effect of belonging to the ICSID convention: Brazil, which has not signed the ICSID agreement, and Mexico, which signed the ICSID agreement on 26 August 2018.Footnote 4

Accounting data was obtained from financial statements (balance sheet and profit and loss statements), and from Refinitive Eikon™ database. Data for modeling each country’s formal institutions was obtained from the World Bank Governance IndicatorsFootnote 5 while information regarding the number and characteristics of ICSID cases was manually collected from the ICSID database.Footnote 6

Table 2 provides a summary of the sample by country and industry.

3.2 Description of the variables and model specification

3.2.1 Firm performance

The relevant dependent variable is firm performance. Following prior literature in this field, two alternative variables of firm performance are considered. First, return on assets (ROA) is a commonly used performance measure of profitability and quality of earnings. It is calculated as the ratio of EBIT to total assets (Strouhal et al., 2018). Second, a market-based measure is proxied by Tobin’s Q, calculated as the ratio of the market value to book value of each company. As a market measure of value creation, a higher Tobin’s Q implies that when a company undertakes positive NPV projects the market value of the firm exceeds the replacement cost of its assets (Díez-Esteban et al., 2014).

3.2.2 Institutional quality

Following prior related research (e.g., Golovko & Sahin, 2021; Yay et al., 2018), data on quality of governance and institutional setting are drawn from the Worldwide Governance Indicators (WGI) issued by the World Bank and the Global Entrepreneurship Monitor survey (Matemilola et al., 2019). WGI aggregate indicators are constructed over six dimensions of governance based on the governance perception of enterprise, citizen and expert survey respondents across countries (Kaufmann, et al. 2010).

Voice and accountability (VAC) reflects perceptions of the extent to which a country's citizens are able to participate in selecting their government, as well as freedom of expression, freedom of association, and a free media. Political stability (POLSTAB) and absence of violence/terrorism capture perceptions of the likelihood the government will be destabilized or overthrown by unconstitutional or violent means. Government effectiveness (GOVERN) measures perceptions of the quality of public services, the quality of the civil service and its degree of independence from political pressures. Regulatory quality (REGQ) represents perceptions of government’s ability to formulate and implement sound policies and regulations that permit and promote private sector development. Rule of law (RULELAW) captures perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts. Control of corruption (CORRUPT) shows perceptions of the extent to which public power is exercised for private gain.Footnote 7 Each governance variable estimation ranges from approximately − 2.5 (weak) to 2.5 (strong) governance performance.

While there is criticism of the WGI approach, and indeed of perception-based indicators in general, Kaufmann et al. (2010) provide strong arguments as to why data on perceptions provide more value to measuring governance. Agents, including enterprises, make decisions (such as investment decisions or decisions to use a public service) based on their perception of various aspects of the quality of governance (e.g., the investment climate and quality of public services). Some aspects of governance cannot be captured in any other way than by perception, with the level of corruption being the obvious case. Furthermore, when contrasting objective and subjective measures, these authors note that reality is often better reflected through subjective measures, often where there are differences in formally envisaged procedures and legal acts (as objective measures) that do not correspond to usual practice (viewed as reality through subjective measures).

3.2.3 ICSID arbitration

ICSID arbitration as a substitute of missing or weak formal institutions plays a key role in the Latin American setting. After manually collecting each case information from the ICSID database, two different variables were built. First, a dummy variable (ICSID) that takes the value 1 if the country has signed the ICSID agreement, and 0 otherwise. In the sample, Brazil has not signed the ICSID agreement, and México has only been a member since mid-2018. Second, the variable (CASES) accounts for the annual number of cases a country has before the ICSID.

3.2.4 Control variables

The first set of control variables accounts for each firm’s characteristics. Firm size (SIZE) is measured as the natural logarithm of total assets. Previous literature suggests that firm size and performance are positively related, given that larger firms are better able to diversify and invest in unrelated business (Díez-Esteban et al., 2013), thereby making them more profitable.

Firm leverage ratio (LEV) is also considered, and is calculated as the ratio of total liabilities to total assets (Díez-Esteban et al., 2019). The rationale is that highly indebted firms are less prone to invest, regardless of their growth opportunities, which will make them less profitable.

Each country’s macroeconomic conditions are also included in the model; namely, the lagged yearly change in GDP (Nenu et al., 2018), the net inflows of foreign direct investment (FDI) as a percentage of GDP (Borin & Mancini, 2016), the inflation rate (INF) (Beck et al., 2005), and the unemployment rate (UNEMP) (Lombardi et al., 2018). As regards GDP growth, firms are expected to perform better in periods of economic growth (García-Gómez et al., 2021). For the case of FDI, previous literature shows that rapid FDI expansion (as has been the case in most Latin American countries over the last two decades) may harm firm performance. In industries where globalization pressures are high, especially when carried out by firms with superior internal resources and capabilities, internal costs increase, which ultimately reduces firm performance (Chang & Rhee, 2011). The last two macroeconomic variables are representative of the Latin American setting. While inflation (and hyperinflation in some cases) has shaken many countries in the region (Jalles, 2017), the unemployment rate—as an indirect way of measuring informality—helps to understand the economic cycle.

Lastly, shareholder concentration is measured through the proportion of shares held by the reference shareholder (OWN1).Footnote 8 Previous studies have shown that companies with a higher ownership concentration provide higher levels of profitability (Díez-Esteban et al., 2013; Hu & Izumida, 2008) and achieve greater productivity (Claessens & Djankov, 1999). In a subsequent analysis, we also consider shareholder nationality in order to analyze whether the impact of institutions on firm performance differs for local or international companies.

Since different industries face different performance levels, appropriate sectorial dummies (see Table 1) have also been included. Our model thus includes industry dummies and year dummies (INDUSTRY and YEAR, respectively). Moreover, all variables have been winsorized at the 1st and 99th percentiles in order to minimize the effect of outliers and data errors (Barnett & Lewis, 1994). A summary of the proposed relationships, as well as each variable’s description, is reported in Table 3.

In order to examine what impact institutional quality and belonging to the ICSID agreement has Latin American firms’ performance, a model specification similar to Banalieva et al. (2018) is carried out as follows:

-

(a)

Model (1) for testing formal institutional quality:

$${Firm \;Performance}_{i,t}={\beta }_{0}+{{\beta }_{1}Firm Performance}_{i,t-1}+{\beta }_{2}{VAC}_{t}+{\beta }_{3}{POLSTAB}_{t}+{\beta }_{4}{GOVERN}_{t}+{\beta }_{5}{REGQ}_{t}+{\beta }_{6}{RULELAW}_{t}+{\beta }_{7}{CORRUPT}_{t}+{\beta }_{8}{SIZE}_{i,t}+{ \beta }_{9}{LEV}_{i,t}+{{\beta }_{10}{GDP}_{t}+\beta }_{11}{FDI}_{t}+{{\beta }_{12}{INF}_{t}+\beta }_{13}{UNEMP}_{t}+ {{\beta }_{14}OWN1}_{i,t}+Industry+Year+ {\upeta }_{\mathrm{i}} +{\upvarepsilon }_{\mathrm{i},\mathrm{t}}$$(1) -

(b)

Model (2) for testing the role of ICSID arbitration:

$${Firm\; Performance}_{i,t}={\beta }_{0}+{{\beta }_{1}Firm Performance}_{i,t-1}+{\beta }_{2}{ICSID}_{t}+{\beta }_{3}{CASES}_{t}+{\beta }_{4}{SIZE}_{i,t}+{ \beta }_{5}{LEV}_{i,t}+{{\beta }_{6}{GDP}_{t}+\beta }_{7}{FDI}_{t}+{{\beta }_{8}{INF}_{t}+\beta }_{9}{UNEMP}_{t}+ {{\beta }_{10}OWN1}_{i,t}+Industry+Year+ {\upeta }_{\mathrm{i}} +{\upvarepsilon }_{\mathrm{i},\mathrm{t}}$$(2) -

(c)

Model (3) for testing the joint effect of rule of law quality and ICSID arbitration:

$${Firm \;Performance}_{i,t}={\beta }_{0}+{{\beta }_{1}Firm Performance}_{i,t-1}+{\beta }_{2}{ICSID}_{t}+{\beta }_{3}{CASES}_{t}+{{\beta }_{4}{RULELAW}_{t}+{\beta }_{5}{{RULELAW}_{t}*ICSID}_{t}+ \beta }_{6}{SIZE}_{i,t}+{ \beta }_{7}{LEV}_{i,t}+{{\beta }_{8}{GDP}_{t}+\beta }_{9}{FDI}_{t}+{{\beta }_{10}{INF}_{t}+\beta }_{11}{UNEMP}_{t}+ {{\beta }_{12}OWN1}_{i,t}+Industry+Year+ {\upeta }_{\mathrm{i}} +{\upvarepsilon }_{\mathrm{i},\mathrm{t}}$$(3)where firm performance refers to both ROA and Tobins’ Q, i is the company, t the year, \({\upeta }_{\mathrm{i}}\) represents the fixed-effects term, and εi,t denotes the stochastic error. The \({\upbeta }_{0}\) are firm or industry fixed effects. Industry and year dummies (Industry and Year) are also included.

3.3 Empirical method

Firstly, the descriptive statistics of the variables used are reported to show the main characteristics of the sample and to examine data consistency with the results of previous research. This step provides preliminary evidence on the relationship between firm performance and institutional setting.

Second, the proposed hypotheses are tested through an empirical analysis. An appropriate panel data methodology (Arellano & Bond, 1991; Arellano & Bover, 1990; Bond, 2002) is used to estimate the empirical models. By using this econometric technique, constant unobserved heterogeneity (represented by the fixed-effects term \({\upeta }_{\mathrm{i}}\)) can be controlled. Moreover, by using the system estimator (an enhanced version of the GMM estimator in which variable differences are also used as instruments in levels by equations) we avoid any possible endogeneity among the independent variables (Blundell & Bond, 2000; Blundell et al., 2000; Bond, 2002).

GMM estimators are consistent when there is no second order serial correlation in the error term (assessed through the AR2 test) and instruments are valid (tested through the Hansen test of over-identifying restrictions). Model specification tests are shown in Tables 6, 7, 8, 9, 10, 11, 12, 13 and 14.

4 Empirical results

4.1 Descriptive statistics

The sample under analysis is described in Table 4, where the main descriptive statistics of the variables are presented.

Significant variability in performance variable values (either for ROA or Tobin’s Q) can be seen. On average, firms in the sample are profitable (14.58%) and create value (Tobin’s Q mean value is above 1). As regards institutional variables, whose values range from − 2.5 (weak) to 2.5 (strong), values reveal that the selected countries in the sample do not generally show good governance performance. No country reaches the highest value for any of the variables, and two of the dimensions (political stability and rule of law) have negative average values. As regards firm-level control variables, the sample includes different-sized companies, with a leverage mean ratio of 25.88%, and there is a high concentration in terms of ownership (on average, the reference shareholder holds 44.83% of shares). Finally, macroeconomic variables show that, on average, GDP growth for the six countries is 6%, while the inflation rate is 7.52% (with maximum levels of 50.92%). FDI flows also vary significantly, although the unemployment rate is not too high when compared to developed countries.

The Pearson correlations for all the variables are shown in Table 5.

Both performance measurements (ROA and Tobin’s Q) reveal statistically significant relationships with most of the variables related to formal institutions. However, the high correlation between them suggests that they should be analyzed separately.

4.2 Multivariate analysis

Tables 6 and 7 report the results from estimating Eq. (1) including the six dimensions that shape a country’s formal institutions according to the WGI. As reported in the previous section, the high correlation among the variables that describe the institutional environment leads us to examine them separately. Alternatively, because multicollinearity issues might arise if all the variables are included in the model at the same time, a composite index of the six WGI variables (WGI Index) was calculatedFootnote 9 (Hartwell, 2013). Results are reported in column 7 in both tables.

For both performance measurements (ROA and Tobin’s Q), the six variables that shape formal institutions in a country have a significant positive effect. This relationship is even stronger when considering the market perspective (Tobin’s Q). The effect remains positive when considering the WGI composite index. It can therefore be concluded that Latin American countries with higher levels of voice and accountability, political stability, government efficiency, regulatory quality, rule of law and control of corruption provide companies with a more stable business environment, which is ultimately more value-creating. These results confirm our first hypothesis.

Institutional and signaling theories, the quality of formal institutions increases firm performance in Latin American countries, as transaction costs and information asymmetries are reduced. Additionally, by promoting competitiveness for business, companies can engage in more profitable investments and thereby enhance their performance. Moreover, by improving formal institutional quality, governments also send credible signals to the markets, allowing managers and investors to feel confident when taking strategic decisions and so boosting firm performance.

As regards the control variables, the effect of company size and leverage varies. For company size, it is negatively and significantly related only to the market measure of firm performance. Since companies in the sample are listed companies (and so, relatively large), they have probably exceeded their optimal size and are therefore not creating value (Huerta et al., 2010). As for leverage, the negative effect is only significant for ROA. The non-significant effect when considering Tobin’s Q can be explained through the trade-off theory. Ownership concentration is negative and significant for both ROA and Tobin’s Q. Contrary to the expected relationship, since companies in our sample are highly concentrated in terms of ownership (on average, 44.83% of shares are held by the reference shareholder), there is a trade-off effect and the optimal ownership concentration turn-point is exceeded (Díez-Esteban et al., 2014). As regards macroeconomic variables, GDP growth reveals a non-significant effect, whereas the foreign direct investment ratio (FDI) is negative, contrary to the expected sign. This result can be explained in the context of Latin American countries, which are characterized by lower local competition rates. Thus, when FDI increases, it has a negative impact on firm performance. As regards the inflation rate (INF), the relationship with firm performance is negative, which confirms the predicted undesirable effects of inflation. Finally, the unemployment rate (UNEMP) relationship with firm performance is positive, revealing how important informal employment is in the region.

One key issue addressed in this research concerns the impact of international arbitration on firm performance. Table 8 reports the results for the two variables considered: being a signatory of the ICSID agreement (ICSID), and the number of cases registered before the ICSID by country (CASES), as defined in model (2). Additionally, columns 2 and 5 provide the results for model (3) specification. Considering that ICSID arbitration is a substitute for formal institutions, consisting of a narrowly-circumscribed set of property rights for investors in a country where broad property rights are circumspect, the joint effect of both rule of law and ICSID membership is to be tested.

In this case, when a country belongs to the ICSID agreement there is a significant positive effect on firm performance, thereby confirming the second hypothesis. When considering the number of cases, the relationship is significantly negative, thus confirming the third hypothesis. Belonging to the ICSID agreement is thus an adequate alternative to a country’s internal formal institutions, since it instils confidence in managers and investors should a controversy arise. When formal institutions are absent or are highly volatile, international arbitration helps to reduce information asymmetries and transaction costs. However, as the number of cases grows, companies may have doubts vis-à-vis engaging in new investments, even though they might be profitable. Accordingly, the result for the RULELAW*ICSID variable is positive, revealing that the quality of both formal and “informal” institutions helps to improve firms’ performance.

4.3 Additional analyses

In this section, additional analyses have been carried out in an effort to make the results more robust and to better understand the relationship between formal institutional quality and firm performance. First, countries who are not signatories of the ICSID agreement (Brazil has never been a member, whereas Mexico has only been a member since mid-2018) were excluded. Estimation results for model 1 are reported in Tables 9 and 10 (for ROA and Tobin’s Q, respectively).

The results obtained are analogous to those previously calculated for the whole sample. Internal formal institutional quality is positively related to firm performance, regardless of whether the country is an ICSID signatory or not. Complementary to the results obtained in Table 8, this result reveals that being an ICSID signatory is in some cases a substitute and in others a complementary dimension in terms of shaping a country’s institutional quality.

In this sense, examining whether belonging to the ICSID is only relevant for foreign companies emerges as a key question. The effect of being an ICSID signatory and the number of cases against a country regarding firm performance for both national or foreign companies is shown in Tables 11 (for the case of ROA) and 12 (for the case of Tobin’s Q). For this purpose, the sample was divided into two groups, using the variable OWN1 as the criterion. Specifically, the reference shareholder’s nationality has been used to identify a company as either national or foreign.

Although, a priori, it might seem that being an ICSID signatory is only relevant for foreign companies, results confirm that it also exerts a positive effect on firm performance for national companies. In fact, when a country helps to reduce information asymmetries to foreign investors it also benefits national companies by encouraging greater competition and innovation (Khan et al., 2021; Crespi et al., 2014), which ultimately enhances firm performance (Yildiz, 2021). On the other hand, when a country increases the number of cases registered this also has a negative effect on firm performance for national companies.

Finally, an industry analysis was conducted. The sample was divided into two general sectors; namely, services and industrial. Results are reported in Tables 13 and 14.

Although the results are analogous to those previously obtained (i.e., the positive relationship for being an ICSID signatory and a negative effect for the number of cases), the effect is stronger for industrial companies. These results are consistent considering that, according to the ICSID database, 122 cases out of a total of 179 during the period 2004–2019 are related to industrial companies.

5 Conclusions, implications and limitations

This paper analyzes the relationship between a country’s formal institutions and firm performance. A large sample of 571 companies from Argentina, Brazil, Colombia, Mexico, Peru, and Chile over the period 2004–2019 is used. According to institutional and signaling theories, the main finding shows that a country’s formal institutional quality is positively related to a company’s performance, measured through two alternative variables (ROA and Tobin’s Q). In order to characterize a country’s formal institutions, the six dimensions offered by the Worldwide Governance Indicators (WGI) are used.

Additionally, the analysis considers the effects of international arbitration as a substitute for formal institutions. Specifically, countries that are signatories of the ICSID agreement are seen to provide companies with a more stable environment for conducting business, which ultimately has a positively impact on their performance. However, as the number of cases registered before the ICSID increases, the relationship turns negative. Not surprisingly, the joint effect of a country’s rule of law and being an ICSID member is also positively related to firm performance.

Additional analyses confirm the positive effect of being an ICSID signatory, since the results do not change when Brazil and Mexico are excluded from the analysis. Moreover, national companies also benefit indirectly from international arbitration mechanisms. Lastly, this effect is stronger for industrial companies.

Several implications for both practitioners and politicians can be derived from the results. First, governments should promote improved formal institutions if they wish companies to create value. This is particularly relevant in Latin America, where formal institutions need to be consolidated and defined from different perspectives. Unlike previous studies in the field, this research focuses on six different dimensions which governments should pay close attention to.

Second, in a context of increasing economic integration, where businesses are also more complex, there is a need to establish legal tools aside from the national courts so as to instil greater confidence in investors. One such tool is related to international arbitration. Since Latin American countries are the ones which present most cases before the ICSID, the results obtained show how important it is to have this kind of mechanism in upcoming IIAs in order to reduce uncertainty and institutional volatility.

Third, managers should consider the various dimensions of formal institutions when taking their strategic decisions. Doing business in institutionally more stable countries that also provide consistent legal tools when disputes emerge is more value creating for companies. Accordingly, investors will have a greater incentive to invest in companies that take these aspects into account.

As for limitations and directions for future research, the findings are not applicable to all Latin American countries and companies in the region. This is a relevant point, since data availability for the region is biased due to the lack of transparency, among other reasons. Additionally, alternative measures of performance (efficiency, productivity, etc.) may also extend the influence that formal institutions have on companies. Furthermore, the study can be expanded by including an analysis of traditional informal institutions such as national culture or religion.

Notes

The Washington Consensus (1989) promoted a set of ten economic policies to develop pro-market institutions and the liberalization of the economy in the region of Latin America.

The ICSID provides arbitration and conciliation services to help resolve international investment disputes between individuals or companies and states.

IIAs also typically include standards of protection for foreign investors, including fair and equitable treatment, full protection and security, the principle of non-discrimination, the most-favored-nation clause, investor protection against expropriation, and the commitment to allow the free transfer of income.

Prior to that date, cases against Mexico followed the regulations complement of the ICSID.

The information is updated on the following website: https://info.worldbank.org/governance/wgi/.

The characteristics of each case have been analyzed individually using the information provided by the ICSID case database: https://icsid.worldbank.org/cases/case-database.

Further explanation of the aggregate indicators is provided in Kaufmann et al., (2010, p. 4).

For the purpose of this study, a minimum of 5% of shares is needed to be considered as a reference shareholder. Several databases, such as Thomson Eikon, Marketguide and WorldVest, also make use of this ratio to identify reference shareholders.

To calculate the index, a principal component approach has been used.

References

Acemoglu, D., Gallego, F. A., & Robinson, J. A. (2014). Institutions, human capital, and development. Annual Reviews of Economics, 6(1), 875–912.

Ahn, M., & York, A. (2011). Resource-based and institution-based approaches to biotechnology industry development in Malaysia. Asia Pacific Journal of Management, 28, 257–275.

Aidis, R. (2005). Institutional barriers to small-and medium-sized enterprise operations in transition countries. Small Business Economics, 25(4), 305–317.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(194), 277–297.

Arellano, M., & Bover, O. (1990). La econometría de datos de panel. Investigaciones Económicas., 14(1), 3–45.

Baltaci, A., Cergibozan, R., & Ari, A. (2022). Cultural values and the global financial crisis: A missing link? Eurasian Economic Review. https://doi.org/10.1007/s40822-022-00208-6

Banalieva, E. R., Cuervo-Cazurra, A., & Sarathy, R. (2018). Dynamics of pro-market institutions and firm performance. Journal of International Business Studies, 49, 858–880.

Barnett, V., & Lewis, T. (1994). Outliers in statistical data. Wiley.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Bartlett, W., Čučković, N., Krešimir, J. and Nojkovič, A. (2013). Institutional quality and growth in EU neighbourhood countries. WP05/11 Search working paper. http://www.ub.edu/searchproject/wp-content/uploads/2013/01/WP-5.11.pdf (accessed January 10, 2021)

Beck, T., Demirgüç-Kunt, A. S. L. I., & Maksimovic, V. (2005). Financial and legal constraints to growth: Does firm size matter? The Journal of Finance, 60(1), 137–177.

Beck, T., & Laeven, L. (2006). Institution building and growth in transition economies. Journal of Economic Growth, 11(2), 157–186.

Berggren, N., Bergh, A., & Bjørnskov, C. (2012). The growth effects of institutional instability. Journal of Institutional Economics, 8(2), 187–224.

Bilgin, M. H., Gozgor, G., & Lau, C. K. M. (2017). Institutions and gravity model: The role of political economy and corporate governance. Eurasian Business Review, 7, 421–436.

Bjornskov, C. (2010). Formal institutions and subjective well-being: Revisiting the cross-country evidence. Journal of Development Economics., 92(2), 115–124.

Blundell, R., & Bond, S. (2000). GMM estimation with persistent panel data: An application to production functions. Econometric Reviews, 19(3), 321–340.

Blundell, R., Bond, S., & Windmeijer, F. (2000). Estimation in dynamic panel data models: Improving on the performance of the standard GMM estimator. In T. Baltagi, B. Fomby, & B. Carter Hill (Eds.), Nonstationary panels, panel cointegration, and dynamic panels (pp. 53–92). Bingley.

Bond, S. (2002). Working Paper 9/02, the institute for fiscal studies 2002. Dynamic panel data models: A guide to micro data methods and practice.

Borin, A., & Mancini, M. (2016). Foreign direct investment and firm performance: An empirical analysis of Italian firms. Review of World Economics, 152, 705–732.

Bowen, H., & De Clercq, D. (2008). Institutional context and the allocation of entrepreneurial effort. Journal of International Business Studies, 39(4), 747–767.

Bromiley, P., & Harris, J. (2014). A comparison of alternative measures of organizational aspirations. Strategic Management Journal, 35, 338–357.

Campos, N., & Horvath, R. (2012). Reform redux: Measurement, determinants and growth implications. European Journal of Political Economy, 28, 227–237.

Cárdenas, G., García, S., & Salas, A. (2018). Institutional framework and governance in Latin America. International Journal of Emerging Markets, 13(5), 1088–1107.

Chang, S. J., & Rhee, J. (2011). Rapid FDI expansion and firm performance. Journal of International Business Studies, 42, 979–994.

Claessens, S., & Djankov, S. (1999). Ownership concentration and corporate performance in the Czech Republic. Journal of Comparative Economics, 27, 498–513.

Crespi, G., Arias-Ortiz, E., Tacsir, E., Vargas, F., & Zuñiga, P. (2014). Innovation for economic performance: The case of Latin American firms. Eurasian Business Review, 4, 31–50.

Dang, V. (2009). Institutional determinants of investment in transition economies. Economics and Finance Working Paper Series No. 09–33. Brunel University West London. https://pdfs.semanticscholar.org/e03e/96fa9c61cc160b765afcac49f9036f4ddca3.pdf. (accessed January 10, 2021)

Dias, J., & Tebaldi, E. (2012). Institutions, human capital, and growth: The institutional mechanism. Structural Change and Economic Dynamics, 23(3), 300–312.

Díez-Esteban, J. M., Farinha, J. B., & García-Gómez, C. D. (2016). The role of institutional investors in propagating the 2007 financial crisis in Southern Europe. Research in International Business and Finance, 9, 49–68.

Díez-Esteban, J. M., Farinha, J. B., & García-Gómez, C. D. (2019). How does national culture affect corporate risk-taking? Eurasian Business Review, 9, 49–68.

Díez-Esteban, J. M., García-Gómez, C. D., & López de Foronda, O. (2014). Corporate risk taking and financial crisis: The role of institutional investors. Transformations in Business and Economics, 13(31), 124–142.

Díez-Esteban, J. M., García-Gómez, C. D., & López Iturriaga, F. J. (2013). Evidencia internacional sobre la influencia de los grandes accionistas en el riesgo corporativo (International evidence on the influence of large shareholders on corporate risk taking). Spanish Journal of Finance and Accounting, 42(160), 487–512.

Dollar, D., & Kraay, A. (2003). Institutions, trade, and growth. Journal of Monetary Economics, 50(1), 133–162.

Efendic, A., & Pugh, J. (2015). Institutional effects on economic performance in post socialist transition: A dynamic panel analysis. Acta Oeconomica, 65(4), 503–523.

Elango, B., & Lahiri, S. (2014). Do market-supporting institutional characteristics explain firm performance? Evidence from emerging markets. Thunderbird International Business Review, 56(2), 145–155.

Estrin, S., & Mickiewicz, T. (2011). Entrepreneurship in transition economies: The role of institutions and generational changes. In M. Minniti (Ed.), The dynamics of entrepreneurship: Evidence from global entrepreneurship monitor data (pp. 181–208). Publisher.

Fach Gomez, K. (2011). Latin America and ICSID: David versus Goliath. Law and Business Review of the Americas, 17(2), 195–230.

Fach Gómez, K., & Titi, C. (2016). International investment law and ISDS: Mapping contemporary Latin America. Journal of World Investment and Trade, 17(4), 511–514.

Fang, S., & Owen, E. (2011). International institutions and credible commitment of non-democracies. Review of International Organizations, 6, 141–162.

Fogel, K., Hawk, A., Morck, R., & Yeung, B. (2006). Institutional obstacles to entrepreneurship. In M. Casson, B. Yeung, A. Basu, & N. Wadeson (Eds.), Oxford handbook of entrepreneurship. Oxford University Press.

Franck, S. D. (2005). The nature and enforcement of investor rights under investment treaties: Do investment treaties have a bright future. UC Davis J Int L L and Pol’y, 12, 47.

García-Gómez, C. D., Bilgin, M. H., Demir, E., & Díez-Esteban, J. M. (2021). Leverage and performance: The case of the US hospitality industry. Quantitative Finance and Economics, 5(2), 228–246.

Goedhuys, M., & Srholec, M. (2015). Technological capabilities, institutions and firm productivity: A multilevel study. European Journal of Development Research, 27(1), 122–139.

Golovko, A., & Sahin, H. (2021). Analysis of international trade integration of Eurasian countries: Gravity model approach. Eurasian Economic Review. https://doi.org/10.1007/s40822-021-00168-3

Grootaert, C., & Van Bastelaer, T. (2002). Social Capital: from definition to measurement. In C. Grootaert & T. Van Bastelaer (Eds.), Understanding and measuring social capital: a multi-disciplinary tool for practitioners. The International Bank for Reconstruction and Development.

Hanefeld, I. (2012). Arbitration in Banking and Finance. NYUJL & Bus., 9, 917.

Hartwell, C. A. (2013). Institutional barriers in the transition to market: Examining performance and divergence in transition economies. Springer.

Hartwell, C. A. (2018). The impact of institutional volatility on financial volatility in transition economies. Journal of Comparative Economics, 46(2), 598–615.

Hartwell, C. A. (2021). Identity and the evolution of institutions: Evidence from partition and interwar Poland. Forum for Social Economics, 50(1), 61–82.

Hartwell, C. A., & Malinowska, A. P. (2019). Informal institutions and firm valuation. Emerging Markets Review, 40, 100603.

Heise, D., & MacKinnon, N. (2010). Self, identity, and social institutions. Springer.

Henisz, W. J. (2004). Political institutions and policy volatility. Economics & Politics, 16(1), 1–27.

Hollingsworth, J. R. (2002). On institutional embeddedness. In J. R. Hollingsworth, K. Muller, & E. Hollingsworth (Eds.), Advancing socio-economics: An Institutionalist Perspective. Rowman & Littlefield Publishers Inc.

Hu, Y., & Izumida, S. (2008). Ownership concentration and corporate performance: A causal analysis with Japanese panel data. Corporate Governance: An International Review, 16(4), 342–358.

Huang, H. (2013). Signal left, turn right: Central rhetoric and local reform in China. Political Research Quarterly, 66(2), 292–305.

Huerta, P., Contreras, S., Almodovar, P., & Navas, J. (2010). Influencia del tamaño empresarial sobre los resultados: Un estudio comparativo entre empresas chilenas y españolas. Revista Venezolana De Gerencia, 15(50), 207–230.

Jalles, J. T. (2017). Inflation forecasts’ performance in Latin America. Review of Development Finance, 7(2), 157–168.

Kaufmann, D., Kraay, A. and Mastruzzi. M. 2010. Worldwide Governance Indicators methodology and analytical issues. Policy Research Working Paper 5430. World Bank, September. https://doi.org/10.1596/1813-9450-5430 (accessed January 10, 2021)

Khan, M., Lockhart, J., & Bathurst, R. (2021). The institutional analysis of CSR: Learnings from an emerging country. Emerging Markets Review, 46, 100752.

Kim, K. H., Kim, M., & Qian, C. (2018). Effects of corporate social responsibility on corporate financial performance: A competitive-action perspective. Journal of Management, 44(3), 1097–1118.

Kwok, C. C. Y., & Tadesse, S. (2006). National culture and financial systems. Journal of International Business Studies, 37, 227–247.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (1999). The quality of government. Journal of Law Economics & Organisation, 15(1), 222–279.

Li, K., Griffin, D. W., Yue, H., & Zhao, L. (2013). How does culture influence corporate risk-taking? Journal of Corporate Finance, 23, 1–22.

Licht, A. N., Goldschmidt, C., & Schwartz, S. (2005). Culture, law, and corporate governance. International Review of Law and Economics, 25, 229–255.

Liu, W., De Sisto, M., & Li, W. H. (2021). How does the turnover of local officials make firms more charitable? A comprehensive analysis of corporate philanthropy in China. Emerging Markets Review, 46, 100748.

Liu, W., Yang, H., & Zhang, G. (2012). Does family business excel in firm performance? An institution-based view. Asia Pacific Journal of Management, 29, 965–987.

Lombardi, S., Skans, O. N., & Vikström, J. (2018). Targeted wage subsidies and firm performance. Labour Economics, 53, 33–45.

Manolova, T., Eunni, R., & Gyoshev, B. (2008). Institutional environments for entrepreneurship: Evidence from emerging economies in Eastern Europe. Entrepreneurship Theory and Practice, 32(1), 203–218.

Matemilola, B. T., Bany-Ariffin, A. N., Azman-Saini, W. N. W., & Annuar Nassir, Md. (2019). Impact of institutional quality on the capital structure of firms in developing countries. Emerging Markets Review, 39, 175–209.

Meyer, K. E., Estrin, S., Bhaumik, S. K., & Peng, M. W. (2009). Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30(1), 61–80.

Nakabashi, L., Gonçalves Pereira, E. A., & Sachsida, A. (2013). Institutions and growth: A developing country case study. Journal of Economic Studies, 40(5), 614–634.

Nenu, E. A., Vintila, G., & Gherghina, S. F. (2018). The impact of capital structure on risk and firm performance: Empirical evidence for the Bucharest Stock Exchange listed companies. International Journal of Financial Studies, 6(2), 41.

North, D. (1990). Institutions, institutional change and economic performance. Cambridge University Press.

North, D. (1991). Institutions. Journal of Economic Perspectives, 5(1), 97–112.

North, D. (1992). Institutions and economic theory. American Economist, 36(1), 3–7.

North, D. (2005). Understanding the process of economic change. Princeton University Press.

Peng, M. W. (2003). Institutional transitions and strategic choices. Academy of Management Review, 28, 275–296.

Peng, M. W., Wang, D., & Jiang, Y. (2008). An Institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies, 39(5), 920–936.

Pinkham, B. C., & Peng, M. W. (2017). Overcoming institutional voids via arbitration. Journal of International Business Studies, 48(3), 344–359.

Porter, M. E. (1980). Competitive strategy: Techniques for analysing industries and competitors. Free Press.

Raiser, M. (1999). Trust in transition. Postcommunist transformation and the social sciences: cross disciplinary approaches. Conference proceedings, Berlin.

Rajan, R., & Zingales, L. (2003). The great reversals: The politics of financial development in the twentieth century. Journal of Financial Economics, 69, 5–50.

Rodrik, D., Subramanian, A., & Trebbi, F. (2004). Institutions rule: The primacy of institutions over geography and integration in economic development. Journal of Economic Growth, 9(2), 131–165.

Saeed, A., & Zamir, F. (2021). How does CSR disclosure affect dividend payments in emerging markets? Emerging Markets Review, 46, 100747.

Shane, S. (2003). A general theory of entrepreneurship. Edward Elgar.

Strouhal, J., Štamfestová, P., Ključnikov, A., & Vincúrová, Z. (2018). Different approaches to the ebit construction and their impact on corporate financial performance based on the return on assets: Some evidence from Czech top 100 companies. Journal of Competitiveness, 10(1), 144.

Vijayaraghavan M. and Ward, W. A. 2001. Institutions and economic growth: Empirical evidence from a cross-national analysis. Center for International Trade, Working Paper 001302. http://Ageconsearch.Umn.Edu/Bitstream/112952/2/Citpaper11.Pdf (accessed January 10, 2021)

Voigt, S. (2013). How (not) to measure institutions. Journal of Institutional Economics, 9(1), 1–26.

Voigt, S. (2018). How to measure informal institutions. Journal of Institutional Economics, 14(1), 1–22.

Walsh, J. (2007). Do states play signaling games? Cooperation and Conflict, 42(4), 442–459.

White, G. O., III., Chizema, A., Canabal, A., & Perry, M. J. (2015). Legal system uncertainty and FDI attraction in Southeast Asia. International Journal of Emerging Markets, 10(3), 572–597.

Williams, N., & Vorley, T. (2015). Institutional asymmetry: How formal and informal institutions affect entrepreneurship in Bulgaria. International Small Business Journal, 33(8), 840–861.

Williamson, C. R., & Kerekes, C. B. (2011). Securing private property: Formal versus informal institutions. The Journal of Law and Economics, 54(3), 537–572.

Yasar, M., Morrison Paul, C. J., & Ward, M. R. (2011). Property rights institutions and firm performance: A cross-country analysis. World Development, 39(4), 648–661.

Yay, T., Yay, G. G., & Aksoy, T. (2018). Impact of institutions on entrepreneurship: A panel data analysis. Eurasian Economic Review, 8, 131–160.

Yildiz, Y. (2021). Foreign institutional investors, information asymmetries, and asset valuation in emerging markets. Research in International Business and Finance, 56, 101381.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature. This research was supported by the Spanish Ministry of Science and Innovation (Grant PID2020-114797GB-I00).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Enriquez-Perales, S., García-Gómez, C.D., Díez-Esteban, J.M. et al. Formal institutions, ICSID arbitration and firm performance: evidence from Latin America. Eurasian Bus Rev 13, 429–464 (2023). https://doi.org/10.1007/s40821-022-00213-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40821-022-00213-4