Abstract

We investigate how banks’ internal ratings were affected by the first lockdown shock in Italy (March-June 2020). Using monthly proprietary data from a regional bank between October 2019 and January 2022, and adding credit registry data and balance sheet data of client firms, we estimate the lockdown effect on the change in six different ratings assigned by the bank to client firms in June 2020 and December 2020. We obtain three main results. First, controlling for both supply and demand factors, the lockdown is associated with a decline in four of the six ratings. Second, the lockdown effect also depends on specific firm characteristics, i.e. the lockdown effect appears to be mitigated in the presence of high turnover or for firms belonging to essential sectors. However, these interaction effects do not hold for all ratings, suggesting that each type of rating is influenced by different firm characteristics. Third, once we consider a full interaction model, the lockdown effect disappears in the medium term.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Covid-19 pandemic had a significant impact on both real and financial markets worldwide, both immediately and in the months that followed (Pagano & Zechner, 2022). Governments responded asymmetrically, deciding on an ad hoc basis whether to implement lockdowns, i.e. policies to keep people indoors (Di Porto et al., 2022). These lockdowns had different characteristics, as they could be local or national, of different duration, and with different categories of people allowed to move.

Italy was the first Western country to experience a local and then a national lockdown during the months between March 2020 and the first days of June 2020. This was an unexpected endeavour that restricted the movements of millions of people and forced the majority of the population to stay mostly at home. Therefore, this situation provides an excellent opportunity to study the effects of the lockdown on various dimensions. The shock was significant, unexpected, and exogenous, with no information on the timing of the policy reversal. Additionally, the Covid-19 lockdown increased uncertainty in several areas, particularly in the health and productive sectors (Altig et al., 2020).

The Covid-19 lockdown caused a reallocation shock as it affected the productive capacity of firms in various sectors and altered the demand for products. This led to a restriction in the consumption of certain goods and services while encouraging the use of online services, streaming platforms, and other similar services (?).

Italian firms were significantly impacted by this crisis. According to De Socio et al. (2020), who used a sample of one hundred thousand firms, the average profits of Italian businesses decreased by two-thirds compared to the 2018 balance sheet data. Additionally, the probability of default increased by 1% to reach 3\(-\)4.4% compared to pre-crisis levels. Furthermore, debt to the most risky owners increased to 23% from the pre-crisis level of 13%.

According to Pagano and Zechner (2022), the banking system’s stability, along with fiscal space and monetary policy flexibility, played a significant role in the swift recovery. However, it is unclear how quickly the banking industry was able to assess the changing risk profiles of client companies and which factors played a role and to what extent.

This paper addresses the impact of the lockdown shock on banks’ internal ratings. This research question is interesting for several reasons. First, the ability of banks to adapt to changing economic conditions is crucial for their survival and performance (Calcagnini et al., 2018). Second, internal ratings-based (IRB) models use ratings to better reflect changing risks to bank assets and to adjust buffers accordingly. There has been a significant amount of literature evaluating banks’ internal ratings, even before they became part of the IRB system (Berg & Koziol, 2017; Jacobson et al., 2006). Recently, Fiordelisi et al. (2022) compared banks using the standardized approach (SA) with those using the IRB approach. In summary, banks’ internal ratings are based on the information they have on their customers and form the basis for their assessment of creditworthiness.

We answer this question by leveraging a proprietary dataset from a regional bankFootnote 1 located in the central part of Italy. The dataset contains monthly data from the credit registry, monthly data on the bank’s internal ratings of its clients, and annual balance sheet data. Information is available for six types of bank rating: Total (Tot), Credit Registry (CR), Balance Sheet (BS), Credit Event (CE), Dimensional (Dim), and Behavioral (Be). These ratings are commonly used in Italian credit risk management and are compiled by the bank. With the exception of the CR Rating, which is obtained from information provided by the Bank of Italy. The bank ratings use both quantitative and qualitative information, including economic-financial, managerial, and organizational parameters of the firm, as well as sectorial, geographical, and macroeconomic data. The ratings range from 1 (the lowest Probability of Default - PD) to 12 (the highest PD).Footnote 2

The dependent variables in our analysis are the monthly changes in each rating. We estimate the impact of the lockdown shock on these variables while controlling for both demand and supply factors. To account for demand factors, we introduced a dummy variable for firms that registered higher sales in the lockdown year than in 2019, capturing higher than usual demand in the year of the lockdown. Additionally, a dummy variable is used to represent profits that exceed the 2019 level, accounting for higher revenues relative to costs. To account for supply factors we used another dummy variable that identifies firms belonging to essential sectors, which were not affected by the lockdown. Firms operating in essential sectors experienced smaller negative effects on their labor supply compared to other firms affected by the lockdown. This resulted in larger labor supply issues for the latter.Footnote 3 Panel ordered logit models were used to estimate the coefficients.Footnote 4

The estimation of the lockdown shock is not causal due to the prompt and heavy response of the government, the European Central Bank, and banking regulators (Altavilla et al., 2023). Governments utilized various instruments, such as public loan guarantees (Cascarino et al., 2022; De Socio et al., 2020). For this reason, our estimation includes both the shock and the effects of fiscal and monetary policies. We examine how banks’ ratings responded after the shock. It is important to note this limitation, but our findings still offer valuable insights.

Our study enhances the existing economic literature by investigating the impact of the initial lockdown shock across three dimensions. Firstly, we examine the variation in different internal ratings following the lockdown. Secondly, we analyse how the lockdown effect interacts with both supply and demand-side factors, as well as firm size and sector, using detailed information on firm characteristics. Thirdly, our data structure enables us to consider both short- and medium-term changes in the bank’s internal rating in response to the lockdown.

The results show that the lockdown effect is present and diminishes over time in four out of six ratings, with the exception of the Balance Sheet and the Credit Event one, where there is no effect at all. It appears that the bank has taken the lockdown into account when evaluating firms, resulting in an increase in firm riskiness after the lockdown. However, this effect is also related to firm characteristics. Both supply and demand factors are statistically significant for three out of six ratings: Total, Credit Registry and Behavioral. In these cases, firms with sales higher than those in 2019 had a negative impact on ratings. This suggests a mechanism whereby increasing business during lockdown decreases banks’ internal ratings. On the other hand, the impact of the Essential sector is minimal on the Total and Credit Registry ratings, but more significant on the Dimensional and Behavioral ratings. Additionally, in the first two ratings, being in the Essential sector category appears to decrease the decline of the Total rating while increasing that of the Credit Registry rating. Lastly, the variable High Profit is only statistically significant for the Behavioral rating. It is probable that this balance sheet information is fully integrated into the calculation of the other rating variables. Furthermore, we present evidence of the impact of the lockdown on company ratings for firms of varying sizes based on sales (Micro, Small, Medium, Large) and across different sectors (Construction, Manufacturing, Information Services and Commerce). The results demonstrate a significant heterogeneity in the effect of the lockdown on rating fluctuations.

Finally, the results for Total Rating without balance sheet variables are presented, expanding the sample for June 2020 from around 5,000 to 35,000 observations. This new dataset includes a significant number of micro, small, and medium-sized firms that were previously omitted due to a lack of balance sheet information. The findings largely confirm the previous results, indicating a negative and statistically significant impact of the lockdown shock that decreases over time. Thus, although there is evidence of higher default probabilities for firms following the lockdown, this effect appears to diminish in the medium term.

All of these findings suggest that each type of rating is influenced by different firm characteristics, complementing each other.

The remainder of the paper is organized as follows. Section 2 details the literature review, Sect. 3 explains the data and the empirical strategy, Sect. 4 describes the results, and Sect. 5 concludes.

2 Literature review

This paper contributes to two main strands of the economic literature: the literature that studies banks’ internal ratings and the literature of lockdown effects on bank ratings.

Regarding the former literature, it is crucial to explain the difference between Internal Rating Based (IRB) and Standardized Approach (SA) frameworks, i.e. two different frameworks for the assessment of credit risk. After the Basel II enforcement in 2007, banks may opt for IRB in order to avoid placing a fixed risk weight to unrated borrowers, that is the rule under SA.Footnote 5In this way, banks are incentivized to assess risk in order to charge more to risky customers and less to safer ones (Gallo, 2021). Fiordelisi et al. (2022) compare the lending behavior of IRB and SA banks after the Covid-19 shock by using a Difference-in-Difference strategy. They find that IRB banks decreased lending more to high risk borrowers than SA banks, in line with the incentives given by the use of IRB (see also Gallo, 2021). Furthermore, they compare “large exposures" (more than 300 million euros in bank-firm relationship or more than 10 % weights in regulatory capital) between SA and IRB banks (by design controlling for common demand shocks), finding that IRB banks reduced the exposure to borrowers more than SA banks. In the same vein, Gallo (2021) analyzes banks’ lending policies between IRB and SA banks during the period 2007-2017. The author finds that in a context of declining rates and credit growth, IRB banks decreased interest rates less to riskier rather than safer borrowers, compared to SA banks. In addition, existing credit relationship were more likely to end between IRB banks and riskier borrowers who could not find credit in SA banks, probably due to costs of switching banks. All in all, this paper confirms that, as planned, IRB models tend to penalize riskier borrowers. Berrospide et al. (2021) analyze bank lending policies to Small and Medium Sized firms (SMEs) during the pandemic, comparing “buffer-constrained” banks to “buffer-unconstrained” ones.Footnote 6 Banks with capital ratios close to the regulatory buffers cut back on lending more, by 1.4% on a quarterly basis, and were 4% more likely to end the lending relationship.

There have been several papers debating the consistency of IRB models across banks. Jacobson et al. (2006) cast doubts on the ability of internal rating systems to be consistent across different banks. Recently, Stepankova and Teply (2023) compare 4.9 million probability of defaults (PD) between January 2016 and June 2020, finding that there is substantial variance between PD estimates and that it is correlated with variables of firm type, industry and location. Moreover, the Covid-19 impact on the PD variance was important. Montes et al. (2018) use the European Banking Authority (EBA) data for the 2014 stress test to study the correlation between IRB approach and risk weights of European banks, obtaining a clearly negative relation between the two, even after controlling for location, portfolio variables, and bank characteristics. Berg and Koziol (2017) analyze the consistency of banks internal ratings with German credit registry data between 2008 and 2012 for 40 banks and 17000 corporate borrowers, finding large differences across banks in the probability of default, largely unexplained by banks’ fixed effects. Cucinelli et al. (2018) find a brighter side of IRB models. Between 2008 and 2015, after the GFC, in Europe IRB banks were able to curb the increase in credit risk better than SA banks, as meant by regulators.

Regarding the literature on lockdown effects, Pagano and Zechner (2022) study the impact of Covid-19 on firms. The authors find a variety of effects due to the increase in uncertainty and to the reallocation shock, i.e. to the asymmetric impact of demand and supply shocks. Stock price reacted differently across firms, depending on characteristics such as their resilience to social distancing, financial flexibility, and corporate culture. The authors find also an impact on real variables as sales, employment and growth and medium term responses of companies to government measures. De Socio et al. (2020) study the impact of Covid-19 pandemic on liquidity, firm capital structure and profitability for 730 thousands firms in Italy, then analysing the impact of the shock on probabilities of default (PD) for a subgroup of 279 thousand firms. Profits decreased by two thirds respect to pre-crisis data, financial leverage increased between 1 and 2 %, probability of default increased by 1 % and debt to most risky owners increased by 10 %. Altavilla et al. (2023) describe all the measures taken by the European authorities during the pandemic, so excluding national government additional responses. There were monetary policy, micro-prudential and macro-prudential regulation interventions. Across all EU countries banks were hit by sharp repricing of risks and high funding costs. The price of bank shares fell, bank CDS spreads rose and bank bond yields rose sharply, before gradually reversing as better news emerged. Findings show that without monetary policy measures, loan to firms would have been 3 % lower, while without micro-prudential and macro-prudential interventions, regulatory capital requirements would have been 1.5 % point higher.

Our study builds upon these works by advancing the understanding of the the impact of the first lockdown on a local bank’s various internal ratings of business customers. In the next session, we will describe the dataset and the empirical strategy in detail.

3 Data and empirical strategy

This section firstly describes data used, secondly defines the empirical equations and estimation methods.

3.1 Data

Our analysis uses a proprietary dataset that provides monthly information on the internal ratings of client companies of a local Italian bank in central Italy. The data has been assembled by merging monthly credit registry data and annual balance sheet data with monthly data on bank’s rating for each client firm.

We have information related to six different ratings: Total (Tot), Credit Registry (CR), Balance Sheet (BS), Credit Event (CE), Dimensional (Dim), Behavioral (Be). These ratings are customary in Italian credit risk management and are assembled by the bank, with the exception of the CR rating that is obtained starting from information provided by the Bank of Italy. The Bank of Italy uses data from intermediaries (mainly banks and financial companies) on loans and guarantees granted to their customers, guarantees received from their customers and on loans or guarantees purchased from other intermediaries. Eventually, the Bank of Italy informs participating intermediaries about the overall indebtedness of their customers, the types of loans they have had, and whether or not they have made their paymentsFootnote 7. The CR rating considers two types of analyses. First the analysis of anomalies that are defined serious, non-serious or collateral on short term risks. Second, the analysis of trends related to the performance of medium and long term risks, the number of reporting companies, revocable risks trend, performance on self-liquidating risks, and the trend in short term maturity risks

Among the five bank internal ratings, both quantitative and qualitative information are used, such as the economic-financial, managerial and organizational parameters of the firm analyzed, as well as sectorial data, geographical, and macroeconomic. The quantitative information are extrapolated from the company’s financial statements, and the key variables are liquidity, solvency, and profitability. As regards the qualitative aspects, top management, the strategy and development plans, the sector of activity, the reference markets in which the company operates, and any negativity or protests possibly also extended to the reference persons of the company itself are taken into account.

The BS Rating is intended to capture the company’s financial strength and performance. Overall, the rating is determined by the bank and based on information related to the company’s debt levels, profitability, and liquidity. To this aim, the balance sheet is reclassified according to financial criteria to assess the balance between the structure of investments and the structure of financing sources. Assets and liabilities are reclassified according to the criterion of increasing liquidity/disability to facilitate the analysis of the short-term and long-term financial balance, measured on stocks. The BS rating also incorporates an assessment of potential solvency, and identifies the contribution of the various sources of financial resources, i.e. the total capital available from financial sources, operational and miscellaneous.

The information analysed in the CE rating module comes from external providers and is related to firm insolvency proceedings, prejudicial acts, and procedure analyses as follows. The insolvency analysis makes a first classification of events according to their “qualitative” severity; secondly, it is considered the insolvency seniority so that protest with seniority less than or equal to 2 years has more weight than another with seniority greater than 2; thirdly, there are grading changes according to “classes” of the protested amount. The credit event analyses consider both the qualitative severity of the event and the registration amount of the legal mortgages, if any. Finally, the procedure analysis is based on existing and past procedures.

The Dim rating considers the firm riskiness in relation to the size of the customer’s outstanding financial debt (taken from the latest available CR data) compared to the magnitudes expressed by the latest balance sheet for corporate businesses. For SMEs, the DR consists of two indicators: the Asset Coverage, which expresses the share of total credit facilities covered by the applicant’s property and stocks; and the Repayment Capacity, which expresses the applicant’s ability to meet financial and non-financial expenses through its income.

The Be rating system used by the bank evaluates a firm’s performance based on specific instances of conduct and performance dimensions, which are rated numerically. The assessment of the customer relationship is based on monthly analyses conducted by the bank, taking into account the firm’s status (internal classification of the counterparty). The provided information includes data on signature, guarantees received, loans, current and derivative accounts, trade receivables, restructured receivables, and impaired receivables. A score ranging from 0 to 100 is assigned to the information, where 0 indicates the absence of anomalies.

Finally, the Tot rating is obtained from a weighted average of all the other ratings, and considering additional information regarding the the bank-firm relationship, the firm performances, and the CR information.

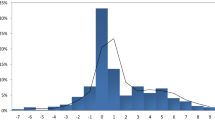

On qualitative scales, the ratings and can be either excellent, good, fair, or poor. As previously stated, in our sample, the original ratings are in classes from value 1 (the lowest PD) to value 12 (the highest PD). However, to consistently estimate our models, we flipped the sign to have higher values being the best ones, and define the six dependent variables as \(\Delta\) Rating\(_{t+1}\) = Rating\(_{t+1}\)-Rating\(_{t}\). Each \(\Delta\) Rating captures, therefore, the monthly variation of rating that ranges from -12 (the maximum possible negative variation) to +12 (the maximum possible improvement). Table 1 tabulates the distribution of \(\Delta\) Rating variables, showing some common figures and some peculiarities. Firstly, the majority of values taken by all \(\Delta\) Rating variables is zero, ranging from the 77% percentage of the \(\Delta\) Tot Rating to the 99% of the \(\Delta\) Pre Rating, suggesting that the bank assessment of the firm riskiness implies rarely a variation of the internal ratings, regardless of the specific rating considered. However, the different internal ratings, capturing risk profiles related to heterogeneous firm characteristics, consistently show diverse variability.

The six dependent variables are computed as \(\Delta\) Rating\(_{t+1}\) = Rating\(_{t+1}\)-Rating\(_{t}\). Each \(\Delta\) Rating captures the monthly variation of the respective rating that ranges from -12 (the maximum possible negative variation) to +12 (the maximum possible improvement).

Table 2 shows the Correlation Matrix for the 6 Ratings. As expected, the \(\Delta\) Tot Rating is positively correlated with all the other ratings. The highest correlating being with the \(\Delta\) BS Rating, and the lowest with the \(\Delta\) Pre Rating. On the contrary, \(\Delta\) Dim Rating does not appear to be related to the \(\Delta\) CR Rating, while showing a negative correlation with \(\Delta\) Be Rating.

The aim of the paper is to assess the impact of the lockdown on rating variation. Thus, the first independent variable is “Lockdown” that is a dummy variable that takes a value equal to 1 for the months from March to June 2020, and 0 otherwise. Moreover, following Di Porto et al. (2022) we added the dummy “Essential Sector” that takes a value equal to 1 if firms belong to the sectors that were not affected by the lockdown, i.e. those sectors that the Italian government defined as the ones that did not have to stop production.Footnote 8

We control for demand shocks by means of two variables. The first one aims at capturing firms with positive demand during the lockdown year and it is a dummy variable named “High Sales” that takes the value of 1 for firms whose 2020 sales were higher than the 2019 ones, and 0 otherwise. The second one is a dummy variable named “High Profit” that takes the value of 1 for firms with 2020 profits higher than the 2019 ones, capturing firms that had overall better profitability during the lockdown year.

We added a full set of controls to account for both bank-firm interactions and for balance sheet variables. Among the former, we add a variable named “First Information” that measures the amount of information that banks require from clients. We also use the current and lagged percentage of credit not paid back to the bank, labelled “Index not paid”. These variables are intended to capture additional measured of firm riskiness for the bank, and contribute to measure the solvency of the firm. About the latter, we use information related to current and lagged standardized values of “Perman capital”, “Sales”, and measures of profitability that capture the firm’s ability to create value and make a profit by adequately remunerating the capital invested in the firm such as “EBIT”, and “EBITDA”. These variables provide additional information on firm performances. Moreover, to control for firm overall indebtedness, and the consistency of assets and activities and the debt ratio with respect to equity, we control for current and lagged values of “Short term debt” and “Medium long debt” , and also for the firm “Liquidity ratio”, that captures the ability to achieve financial equilibrium conditions both in the short and in the medium term. All the balance sheet variables have been standardized by subtracting their sample means and divided by their sample standard errors.

Summary statistics of the variables are shown in Table 3.

The following variables have monthly variation: \(\Delta\) Tot Rating, \(\Delta\) CR Rating, \(\Delta\) BS Rating, \(\Delta\) CE Rating, \(\Delta\) Dim Rating, \(\Delta\) Be Rating, Lockdown, First Information, Index Not Paid. The variables that vary annually are: Perman Capital, Short Debt, Medium Debt, Sales, Liquidity Ratio, EBIT EBITDA.

Moreover, Figs. 1 and 2 show the firm distribution according to size and sectors, respectively. The definition of firm size follows the European Commission recommendation of May 6, 2003 (GUCE L 124/36 del 20/05/2003). According to firm sales, the category of Micro-sized enterprises consists of enterprises which annual revenues do not exceed 2 million euros, Small-sized firm sales are between 2 million and 10 million, Medium-sized firm sales range between 10 and 50 million, and Large-sized firms have sales above 50 million euro.Footnote 9 The majority of firms are micro- and small-sized firms, in line with national distribution. As for sector definition, we use ATECO codes and focus on four main sectors: Construction, Manufacturing, Information Services and Commerce that cover about the 70% of firm sectors.

3.2 Empirical strategy

The aim of this research paper is to investigate the impact of the lockdown shock on the six bank internal ratings, and to disentangle how such a impact depends on both supply- and demand-side factors, as well as firm size and sector. Consistent with these purposes, the empirical strategy makes use of step-by-step analyses. That is, a baseline model was gradually enriched with variables and interactions in order to make the impact of each independent variable on changes in the various ratings as clear as possible.

The following Model 1 represents the baseline empirical strategy:

where the dependent variable \(\Delta\) Ratings refers to the change of the six different bank internal ratings, the full set of controls refers to variables defined in Table 3, i and t refers to the firm and the month, respectively.

While we expect a negative sign for the estimated coefficient \(\hat{\alpha _1}\), we do not have a strong prior on the sign of \(\hat{\alpha _2}\), \(\hat{\alpha _3}\) and \(\hat{\alpha _4}\). Indeed, the change in rating may vary positively or negatively with the regressors, depending on hidden changes in credit demand and supply by the individual firm.

For each rating variation, we also estimate three additional empirical models that augment Model 1 with interactions as follows. Model 2 contains the interactions between the Lockdown dummy and the High Sales dummy to investigate whether the lockdown effect is moderated by firm size. Thus, Model 2 is defined by the following empirical equation:

In Model 2 a positive (negative) and statistically significant estimated coefficient \(\hat{\beta _3}\) would suggest a lower (greater) negative impact of the lockdown on rating variation for larger (smaller) firms according to their sales.

Model 3 enriches Model 1 by adding the interactions between the Lockdown shock and Essential sectors:

In Model 3 we expect a positive estimate coefficient \(\hat{\delta _3}\), so that the overall impact of the lockdown on rating variation of firms operating in essential sectors is lower than for other firms.

Finally, Model 4 refers to the full specification containing the interaction between the three variables Lockdown, Essential sectors and High Sales and is represented by the following empirical specification:

We use panel random-effects ordered logit estimation to take care of the ordered data.Footnote 10 The specific modeling task of ordinal logit regression is to predict the expected relative frequency distribution of cases across the ranked categories of the dependent variable under any combination of values on relevant independent variables. Moreover, this non-linear and ordinal approach may avoid problems with linear approaches such as inaccurate predictions, unsound statistical hypothesis testing and measurement error, especially in the tails of the distribution.

In the next Section 4, we discuss results for the full specification Model 4, while the findings of Models 1-3 for all the six rating types are reported in the Appendix. In addition, in the subsection 4.2 we show regression results for the impact of the lockdown shock on the change in total rating (i.e. \(\Delta\) Tot Rating) in the medium run. In doing so, we consider a dataset without balance sheet variables hence containing up to 35 thousand firms until January 2022.

4 Results

We present the main results for the panel ordered logit estimation: the dependent variables are the change in the 6 bank ratings: Total (Tot), Credit Registry (CR), Balance Sheet (BS), Credit Event (CE), Dimensional (Dim), Behavioral (Be). The comparison between all the four Models are left in the Appendix, while we show here graphs that compare estimated coefficients for the main variables for Model 4: Lockdown, Essential Sectors, High Sales and their interactions. We show both the very-short run effects that refer to the period October 2019-June 2020 and the short run effects for October 2019-December 2020 under the full set of controls.Footnote 11 We included sectoral and size dummies, but they were not statistically significant.

First, we show the Figures for the main coefficients for each change in rating (Figs. 3, 4, 5, 6, 7, 8).

The Lockdown variable is negative and statistically significant. However, the lockdown effect, although negative, is decreasing at the timing of December 2020, suggesting that the worsening of the rating as a consequence of the lockdown was larger just after the lockdown than at a longer time horizon. High profit is never statistically significant (see also findings in the Appendix). Likely, the bank internal rating fully controls for firm profitability. Interestingly, we obtain that the deterioration of the rating at the end of the year due to the Lockdown shock is larger for no High Sales no Essential sectors firms than for the other (the estimated coefficient is equal to \(-\)0.444 compared to \(-\)0.388 of High Sales and Essential sectors firms. See Table 6.).

Figure 4 shows results of Model 4 when the dependent variable is \(\Delta\) CR Rating. Differently from the previous estimates related to the \(\Delta\) Tot Rating, we obtain that High Profit and High Sales firms are positively associated to improvements in the firm rating, at least in the shortest time. The estimated coefficients of the lockdown effect are always negative and statistically significant, and increasing in absolute value over time. This latter finding suggests that the overall firm riskiness, that takes into account information gathered from all the intermediaries with whom the company interacts, as captured by Bank of Italy, increases over time. However, the increase seems to be smaller for firms with high sales. Operating in an essential sector does not seem to have an effect.

Figure 5 shows results of Model 4 when the dependent variable is \(\Delta\) BS Rating that is mainly based on balance sheet variables. We obtain that the Lockdown coefficient is slightly positive at both time horizons. Similarly, we do not find any clear statistically significant correlation between the dependent variable and other possible explanatory variables. The intuition behind these findings is that this rating type does not appear to be useful in capturing short term shocks that might affect firm default probabilities, as it is mainly based on variables that change on yearly base.

Similar empirical estimates are obtained when we estimate the impact of the Lockdown shock on firm \(\Delta\) CE Rating as shown in Fig. 6. Again, this rating type is mainly related to information on credit events such as insolvency proceedings and insolvencies, that usually do not change over the short run.

The variable \(\Delta\) Dim Rating depends on the size of the customer’s outstanding financial debt. Figure 7 shows that the lockdown shock has a negative and statistically significant estimated coefficient and the impact does not decline overtime. Firms that are High Sales and (or) and High Profits do not appear to experiment a change in Dimensional Rating different from that of other firms, as well as those that operate in Essential sectors. There is a larger impact of the Lockdown variable for firms that are both in Essential sectors and High Sales, especially in the short term.

Considering \(\Delta\) Be Rating as dependent variable, the estimated coefficients of the Lockdown variable are always negative and statistically significant and are the largest in size compared to the ones of the previous dependent variables, as shown in Fig. 8. Thus, this finding suggests that the firm riskiness measured by means of behaviours and conduct in response to the Lockdown shock has increased. Interestingly, firms operating in Essential sectors are positively related to improvements in the Behavioral Rating. Indeed, these firms did not have to change their production plan as they were not affected by the Lockdown, and likely reacted strategically to the changing environment. The lockdown effect was lower for High Sales firms than for the other, suggesting a positive effect of the demand shock on these firms.

The next Figs. 9 and 10 show the short- and medium-term effects for the main coefficients by comparing all the rating variations, respectively.

4.1 Firm heterogeneity and lockdown effects

To further investigate the possible role of firm heterogeneity on the lockdown impact on rating deterioration, we break down the above analyses for firms in different size class and firms beloning to different business sectors for the short term i.e. October 2019 - June 2020. Figures 11, 12, 13 and 14 graphically show the estimated coefficients of Model 4 for the sub-samples of Micro, Small, Medium and Large firms, respectively.

Micro-sized and small-sized firms exhibit similar estimated coefficients and statistical significance. The estimated coefficient of the Lockdown shock is negative and statistically significant. Medium-sized firms also show the statistically significance of the essential sector in two out of six ratings. Differently, Large-sized firms see the additional importance of the “High Sales” variable both individually and in its interaction with the “Lockdown” variable. Overall, firm heterogeneity respect to firm size is important in understanding the lockdown impact on rating deterioration.

Figures 15, 16, 17 and 18 graphically show the estimated coefficients of Model 4 for the sub-samples of firms belonging to the Construction, Manufacturing, Information service, and Commence sectors, respectively for the very short term i.e. October 2019- June 2020.

The firms in the construction sector do not appear to have been negatively impacted by the lockdown variable in terms of their rating. However, the firms in the manufacturing and commerce sectors show negative coefficients for the ’Lockdown’ variable. The firms in the information services sector do not show any negative impact of the ’Lockdown’ variable, but the ’High Sales’ variable plays a role, which can be positive or negative depending on the rating considered. Overall, it is important to consider firm heterogeneity with respect to firm sectors in order to understand the impact of the lockdown on rating deterioration.

4.2 The lockdown effect in the Medium Run

Our empirical findings seem to suggest a negative impact of the lockdown shock on firm overall riskiness, and that such effect changes over time becoming less relevant at the end of the 2020 year. Thus, in this Section we focus on the effect of the lockdown shock on the dependent variable \(\Delta\) Tot Rating over a longer period of time, i.e., until January 2022.

This dataset is built without balance sheet variables, thus expanding the sample for June 2020 from around 5 thousand to 35 thousand observations. This new dataset, then, comprises a lot more micro-, small- and medium-sized firms that were omitted from the previous results due to lack of balance sheet information. We opted to focus on Total Rating for some reasons. Firstly, Total Rating is the main rating used by the bank to assess the quality of its borrowers. Secondly, the results from the previous section show that the Lockdown is negatively correlated to some, but not all, ratings.Footnote 12 To implement this analysis we focus on the baseline specification defined in Model 1 and on the full-interaction Model 4. However, we cannot use balance sheet variables for which we do not have updated information, that is, with respect to the estimates of the previous Models some controls are missing.Footnote 13

Estimates are shown in Table 4, in which the first three columns refer to Model 1, while the last three columns to Model 4, and to the periods October 2019 - June 2020, -December 2020 and - January 2022, respectively. Results largely confirms previous findings: the estimated coefficient of the lockdown shock is negative and statistically significant with a decreasing impact over time. Results from the full-interaction Model 4 suggest that the impact disappears in January 2022. Firms operating in Essential sectors are positively associated to improvements in firm quality, as well as High Profit firms.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1)-(2) refer to Model 1, while columns (4)-(6) to Model 4. Timing of estimation is June 2020 for columns (1 ) and (4), December 2020 for columns (2) and (5), January 2022 for columns (3) and (6). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted.

5 Conclusion

This paper details the impact of a large, unexpected shock such as the 2020 Italian Covid lockdown on the change in six firm ratings by using the data from one Italian local bank between October 2019 and January 2022. Five out of six ratings are customary in Italian credit risk management and are assembled by the bank according to different quantitative and qualitative firm information. Thus, some ratings are related to economic-financial, managerial and organizational firm characteristics, while others refer to the firm strategy and development plans, the sector of activity, the reference markets, or any negativity or protests. The sixth rating, instead, is gathered by the Bank of Italy Credit Registry that uses data from intermediaries on loans and guarantees granted to their customers, guarantees received from their customers and on loans or guarantees purchased from other intermediaries.

To take care of the ordered data, we use panel random-effects ordered logit estimation whose specific modeling task is to predict the expected relative frequency distribution of cases across the ranked categories of the rating variable under any combination of values on relevant independent variables, among which we control for both supply-side and demand-side factors. We obtain three main findings.

First, controlling for both supply and demand factors, the lockdown is associated to a decrease of the firm quality, i.e. a decrease in four out of six ratings.

Second, the lockdown effect depends also on specific firm characteristics, that is the lockdown effect appears to be mitigated in the presence of high sales (demand-side factor) or for firms that belong to essential sectors (supply-side factors). However, these interaction effects do not hold for all ratings suggesting that each type of rating is influenced by different firm characteristics, so that they complement each other.

Third, we also focus on the effect of the lockdown shock on the change in Total Rating over a longer period of time, i.e., until January 2022. Estimates suggest that once we account for the full-interaction model, the lockdown negative effect disappears in the medium run.

The study indicates that banks should evaluate the creditworthiness of their customers using diverse ratings that can capture various firm issues. Additionally, the study found that although bank internal ratings did not fully incorporate the negative shock in the very-short and short term, they did so in the medium run.

Data Availibility Statement

Data sharing is not possible due to the sensitive data used.

Notes

This definition is used because the bank branches and clients are primarily located within one province. Further details cannot be provided due to privacy reasons.

In the empirical analyses, we modify the dependent variables so that higher values correspond to improved ratings (i.e. lower default probability). Section 3 provides further details on each rating.

Physical production has ceased and new methods of smart-working have been implemented, requiring significant adjustments to the new normality.

We also tested the same approach with fewer rating classes and found that the results remained consistent.

In 2018 the Basel Committee on Banking Supervision (BCBS) revised the credit risk framework as part of the Basel III reform package. The calculation of risk-weighted assets (RWAs) can be done by using two main approaches: (i) under the SA, banks use a prescribed risk weight schedule for calculating RWAs, and the risk weights depend on asset class and are generally linked to external ratings; (ii) under the IRB approach, banks can use their internal rating systems for credit risk, subject to the explicit approval of their respective supervisors. Similarly to Basel II, banks can use either the advanced IRB approach (ie use their internal estimates of risk parameters such as probability of default (PD), loss-given-default (LGD) and exposure-at-default (EAD)) or the foundation IRB approach (ie use only their internal estimates of PD). However, enhancements to and constraints on the application of IRB approaches for certain asset classes have been introduced under Basel III. See https://www.bis.org/fsi/fsisummaries/rcrf.pdf

Regulatory capital buffers are equity capital prepared to absorb losses in difficult times.

There is a reporting threshold: a customer is reported if the sum to be repaid to the intermediary is equal to or over €30,000; this threshold is lowered to €250 if the customer has a bad debt. Intermediaries classify a customer as a bad debtor and report them as such to the CR when they believe that he or she is in serious difficulty with loan repayments. This classification assumes that the intermediary has assessed the customer’s overall financial situation and has not made it based on single events, such as one or more late debt repayments. See https://www.bancaditalia.it/statistiche/raccolta-dati/centrale-rischi/

See Di Porto et al. (2022) for the full list of sectors.

We do not have data on employees for all firms in the sample.

We make use of the Stata command xtologit. According to this method, the actual values taken on by the dependent variable are irrelevant, although larger values are assumed to correspond to “higher” outcomes. The conditional distribution of the dependent variable given the random effects is assumed to be multinomial with success probability determined by the logistic cumulative distribution function.

See Table 3 for the full list of control variables.

Similar exercises might have been done for all ratings, but have been omitted for reasons of space.

The missing controls are: “Perman capital std”, “Sales std”, “EBIT std”, and “EBITDA std”, “Short term debt” and “Medium long debt” , “Liquidity ratio std”, current and lagged.

References

Altavilla, C., Barbiero, F., Boucinha, M., & Burlon, L. (2023). The great lockdown: pandemic response policies and bank lending conditions. European Economic Review, 156, 104478.

Altig, D., Baker, S., Barrero, J. M., Bloom, N., Bunn, P., Chen, S., Davis, S. J., Leather, J., Meyer, B., Mihaylov, E., et al. (2020). Economic uncertainty before and during the covid-19 pandemic. Journal of Public Economics, 191, 104274.

Berg, T., & Koziol, P. (2017). An analysis of the consistency of banks internal ratings. Journal of Banking & Finance, 78, 27–41.

Berrospide, J. M., Gupta, A., & Seay, M. P. (2021). Un-used bank capital buffers and credit supply shocks at smes during the pandemic.

Calcagnini, G., Cole, R., Giombini, G., & Grandicelli, G. (2018). Hierarchy of bank loan approval and loan performance. Economia Politica, 35, 935–954.

Cascarino, G., Gallo, R., Palazzo, F., & Sette, E. (2022). Public guarantees and credit additionality during the covid-19 pandemic. Bank of Italy Temi di Discussione (Working Paper) No, 1369.

Cucinelli, D., Di Battista, M. L., Marchese, M., & Nieri, L. (2018). Credit risk in european banks: The bright side of the internal ratings based approach. Journal of Banking & Finance, 93, 213–229.

De Socio, A., Narizzano, S., Orlando, T., Parlapiano, F., Rodano, G., Sette, E., & Viggiano, G. (2020). Gli effetti della pandemia sul fabbisogno di liquidità, sul bilancio e sulla rischiosità delle imprese. Bank of Italy, Covid-19 Note, (13).

Di Porto, E., Naticchioni, P., & Scrutinio, V. (2022). Lockdown, essential sectors, and covid-19: Lessons from italy. Journal of Health Economics, 81, 102572.

Fiordelisi, F., Maddaloni, A., Fusi, G., & Marques-Ibanez, D. (2022). Pandemic lending: micro and macro effects of model-based regulation.

Gallo, R. (2021). The irb approach and bank lending to firms. Bank of Italy Temi di Discussione (Working Paper) No, 1347.

Jacobson, T., Lindé, J., & Roszbach, K. (2006). Internal ratings systems, implied credit risk and the consistency of banks risk classification policies. Journal of Banking & Finance, 30(7), 1899–1926.

Montes, C. P., Artigas, C. T., Cristófoli, M. E., & San Segundo, N. L. (2018). The impact of the irb approach on the risk weights of european banks. Journal of Financial Stability, 39, 147–166.

Pagano, M., & Zechner, J. (2022). Covid-19 and corporate finance. The Review of Corporate Finance Studies, 11(4), 849–879.

Stepankova, B., & Teply, P. (2023). Consistency of banks’ internal probability of default estimates: Empirical evidence from the covid-19 crisis. Journal of Banking & Finance, 154, 106969.

Funding

Open access funding provided by Università degli Studi di Urbino Carlo Bo within the CRUI-CARE Agreement. This work has been developed in the framework of the research project on “Consumers and firms: the effects of the pandemic on financial fragility and over- indebtedness”, financed by DESP-University of Urbino, Italy.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Non-financial interests

The authors have no relevant financial or non-financial interests to disclose.

Conflict of interest

The authors have no Conflict of interest to declare that are relevant to the content of this article.

Additional information

This work was developed in the framework of the research project on “Consumers and firms: the effects of the pandemic on financial fragility and over-indebtedness”, supported by DESP, University of Urbino Carlo Bo, Italy. We thank two anonymous reviewers and participants at the international conference on Financial Fragility and Financial Education of Households and Firms, held at the University of Urbino, 8-9th June 2023, for providing valuable comments that allowed us to greatly improve the quality of the manuscript. Finally, we thank Alex Borisov for all the helpful discussions on the topic. Declarations of interest: none. Usual disclaimers apply.

Appendix: estimation results

Appendix: estimation results

We present main results for the panel ordered logit estimation of change in ratings onto our regressors. Results are organized with two tables per rating: the first table shows the estimated coefficients of Model 1 in the first two columns, and the estimated coefficients of Model 2 in the following two columns, i.e. considers the interaction between the Lockdown dummy and the High Sales dummy. The second table shows in the first two columns results from Model 3, i.e. it takes into account of the interaction between the Lockdown shock and Essential Sectors, and in the last two columns reports estimated coefficients of Model 4 that is, it considers the interaction between the three variables, namely the Lockdown , the Essential sectors and the High sales dummy. Finally, in each table, timing of estimation is June 2020 for columns (1) and (3), December 2020 for columns (2) and (4), so that we can analize the impact of our main explanatory variables on changes in Rating at different time horizons.Footnote 14

Tables 5 and 6 show estimated coefficients for the dependent variable \(\Delta\) Total Rating. As expected, in all models the estimated coefficient of the Lockdown Shock variable is negative and statistically significant. However, the lockdown effect, although negative, is decreasing at the timing of December 2020, suggesting that the worsening of the rating as a consequence of the lockdown was larger just after the lockdown than at a longer time horizon. High profit is never statistically significant. Likely, the bank internal rating fully controls for firm profitability. On the other side, Table 5 shows that the estimated coefficient of the H.Sales dummy is negative and statistically significant at the end of the year (columns (2) and (4)), suggesting that there was a deterioration of the firm riskiness for the best performing firms, controlling fro a full set of firm characteristics. Moreover, when we allow for the interaction between \(Lock.\#H.Sales\) we obtain that the best performing firms experimented a decrease of the Rating larger than other firms at June 2020 as a consequence of the lockdown, while reacting better than others at the longer period. According to Table 5 the change in Total Rating does not depend on whether the firm is operating in essential sectors. However, columns (1) and (2) of Table 6 show that the Lockdown negative impact on the change in rating is smaller for firms that belong to essential sectors. Finally, columns (3) and (4) of Table 6 show the estimated coefficients of Model 4, that takes into account for possible triple interactions. Interestingly, we obtain that the deterioration of the rating at the end of the year due to the Lockdown shock is larger for no High Sales no Essential sectors firms than for the other firms (the estimated coefficient is equal to \(-\)0.444 compared to \(-\)0.388 of High Sales and Ess. firms) .

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 1, while columns (3) and (4) to Model 2. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 3, while columns (3) and (4) to Model 4. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Tables 7 and 8 show the estimated coefficients of Models (1)-(2) and (3)-(4), whose dependent variable is \(\Delta\) CR Rating, respectively. Differently from the previous estimates related to the \(\Delta\) Total Rating, we obtain that High Profit and High Sales firms are positively associated to improvements in the firm rating, at least in the shortest time, as shown in Table 7. The estimated coefficients of the lockdown effect are always negative and statistically significant, and increasing overtime. This latter finding suggests that the overall firm riskiness, that takes into account information gathered from all the intermediaries with whom the company interacts, as captured by Bank of Italy, increases over time. However, the increase appears smaller for High Sales firms. Operating in an essential sector does not seem to have an effect, as shown both from Table 7 and from Table 8 that models all possible interactions.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 1, while columns (3) and (4) to Model 2. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 3, while columns (3) and (4) to Model 4. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Tables 9 and 10 show results for the \(\Delta\) BS Rating. As stated above, this rating is mainly based on balance sheet variables, thus as expected, we obtain that the estimated coefficient of the lockdown shock dummy variable is not statistically significant except that in Model 4 at December 2020 with a positive sign (column (4) Table 10). Similarly, we do not find any clear statistically significant correlation between the dependent variable and other possible explanatory variables. The intuition behind these findings is that this rating type does not appear to be useful in capturing short term shocks that might affect firm default probabilities, as it is mainly based on variables that change on yearly base.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 1, while columns (3) and (4) to Model 2. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 3, while columns (3) and (4) to Model 4. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Similar empirical estimates are obtained when we estimate the impact of the Lock. on firm \(\Delta\) Credit Event Rating, as shown in Tables 11 and 12. Again, this rating type is mainly related to information related to prejudicial acts, insolvency proceedings and insolvencies, that usually do not change over the short run.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 1, while columns (3) and (4) to Model 2. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 3, while columns (3) and (4) to Model 4. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Tables 13 and 14 show results related to estimates of Models 1-2 and Models 3-4, respectively, when the dependent variable is \(\Delta\) Dimensional Rating. The lockdown shock has negative estimated coefficients throughout the models and the impact does not decline overtime. Firms that belong to the High Sales and (or) and High Profits do not appear to experiment a change in Dimensional Rating different from others, as well as those that operate in Essential sectors. However, the estimates of the full-interaction Model 4 suggest a larger impact of the Lock. variable for Ess. - H.Sales firms, in both periods (see columns (3) and (4) of Table 14).

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 1, while columns (3) and (4) to Model 2. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 3, while columns (3) and (4) to Model 4. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Finally, Tables 15 and 16 show estimated coefficients of Models 1-4 when we consider \(\Delta\) Behavioral Rating as dependent variable. The estimated coefficients of the Lock_Shock variable are always negative and statistically significant and are the largest in size compared to the ones of the previous dependent variables. Thus, this finding suggests that the firm riskiness measured by means of behaviours and conduct in response to the Lockdown shock has increased. Interestingly, firms operating in Essential sectors are positively related to improvements in the Behavioral Rating, and this estimate is robust to all the alternative specifications shown. Indeed, these firms did not have to change their production plan as they were not affected by the Lockdown, and likely reacted strategically to the changing environment. There is some evidence that High Profit and High Sales firms are associated to an increase in riskiness in Table 15, while results from Models 3 and 4 suggest that the lockdown effect was lower for High_Sales firms.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 1, while columns (3) and (4) to Model 2. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Estimation done by using the xtologit command for panel ordered logit in Stata. Columns (1) and (2) refer to Model 3, while columns (3) and (4) to Model 4. Timing of estimation is June 2020 for columns (1 ) and (3), December 2020 for columns (2) and (4). \(\sigma ^2_u\) is estimated panel level variance. Cut off points from ordered logit are omitted. The full list of control variables is: First info lag, Index not paid, Index not paid lag, Perman capital std, Perman capital stdlag, Short debt std, Short debt stdlag, Medium long debt std, Medium long debt stdlag, Sales std Sales stdlag, Liquidity ratio std, Liquidity ratio stdlag, EBIT std, EBIT stdlag, EBITDA std and EBIDA stdlag. The definition “std” implies a mean-variance standardization.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Calcagnini, G., Favaretto, F. & Giombini, G. The effect of 2020 lockdown on bank internal ratings. J. Ind. Bus. Econ. (2024). https://doi.org/10.1007/s40812-024-00312-5

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40812-024-00312-5