Abstract

This study uses network theory to analyze the structure and concentration of the Greek public procurement market, focusing on the relationships between Contracting Authorities (CAs) and Economic Operators (EOs) within different Common Procurement Vocabulary (CPV) groups. By examining degree distribution curves and identifying dominant economic operators, we gain valuable insights into market dynamics and competition in Greece. The findings reveal the presence of market concentration, where a few EOs receive a disproportionate share of contracts within certain CPV groups which suggests potential market dominance and lack of competition. In contrast, some CPV groups demonstrate a more balanced distribution of contracts among EOs, suggesting a healthier competitive environment. The analysis of degree distributions between sub-networks based on CPV groups indicates variations in market structures between sectors. These differences highlight the heterogeneity in the Greek public procurement market, as well as the need for sector-specific policy interventions. Given that the concentration of contract awards raises competition, fairness and transparency concerns, the implications of the findings are important for policymakers, regulators and stakeholders involved in the Greek public procurement market. While this study provides valuable information, limitations including variations in data availability and potential inaccuracies in recorded information exist. Future research should address these limitations and explore the effects of market concentration on CPV codes in greater depth. This study contributes to the public procurement literature and serves as a basis for further research and policy making in the Greek procurement sector.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Public procurement, now widely recognized as one of the vital components of public administration (Basheka, 2013; Bröchner, 2010; Fagan, 1999; Schrouder, 2010; Thai, 2001), is linked to economic growth, competition enhancement, policy achievement, and innovation promotion (Flynn & Davis, 2014; Geroski, 2006; Grega & Nemec, 2015; Wan, 2014). But this is only one facet as this function is also associated with challenges such as corruption, collusion and unwanted favoritism (Arozamena & Weinschelbaum, 2009; Burguet & Che, 2004; Celentani & Ganuza, 2002; Ganuza & Hauk, 2004; Ishii, 2009; Kumar et al., 2015; Laffont & Tirole, 1991). In response to these challenges, and with 14% of its total GDP in public procurement, the EU has adopted a series of measures to combat anti-competitive behavior (European Parliament and Council of the European Union 2014a; European Commission, 2023a, 2023b). Yet, regardless of those efforts, achieving healthy competition still remains a challenge.

Τhis paper focuses on the less explored field of market concentration within the public procurement market of a specific EU member state. Leveraging data from the Greek public procurement market for the period 2019 to 2021, and by merging network theory with data analysis, it sheds light on the dynamics of the Greek procurement market, and identifies potential instances of dominance. Unlike past studies which investigate market concentration using traditional concentration indexes, this paper introduces a fresh approach to determine market concentration. Directed networks are developed that capture the interactions between Economic Operators (EOs) and Contracting Authorities (CAs). For every group under the Common Procurement Vocabulary, a probability-degree scatterplot is constructed, including data from all three years. The main contribution of the study lies in the systematic analysis of degree distribution curves, with an emphasis on tail behavior. This method allows us to distinguish varied levels of market concentration within CPV categories.

The purpose of this study is to analyze the architecture of the Greek public procurement market using network theory and to identify the presence or not of CPV group cases with market concentration.

The research questions for this study were:

Q1: Ηow can we use the tail behavior of the degree distribution curves and what does it indicate about the concentration of the market in each CPV group?

Q2: Do CPV-based subnetworks have significantly different degree distributions?

Q3: Are there CPV groups with significant dominant economic operators in their network?

The paper contributes to the enrichment of the current literature by adding a new method for measuring and comparing market concentration across different markets. It complements existing knowledge on public procurement markets, projecting the real picture that prevails in the Greek public procurement market. In this way, it offers valuable insights which may be of interest to policymakers and supervisory authorities in the formulation of strategies aimed at maintaining market balance, but also to economic operators to shape their entry strategies appropriately (e.g. targeting sectors that are found to have either stable or low market concentration). In addition, the emphasis on Greece, an EU member state, serves as a comprehensive case study. This could form the basis for future comparative research across EU member states. Finally, the methodology of this study can form the basis or a part of a monitoring system of the public procurement market by the authorities on their fight against collusion, corruption and fraud. This, acquires particular value after the announcement by the EU (European Commission, 2023b) of the creation of the European Public Procurement Data Space.Footnote 1

2 Literature review

Despite its wide history, public procurement is an area that has not received as much attention as one would expect from researchers, compared to its importance for the functioning of public administration, but also the impact of its outcomes on society as a whole. Just in the last decades we observe a recognition of its value, which led an increasing number of researchers to deal with it (Flynn & Davis, 2014; McCue & Gianakis, 2001). The body of research is constantly increasing, and one trend we notice is that scholars are increasingly looking at public procurement through the lens of network theory, an approach which also allows the study of market concentration in a wider range than before. Nevertheless, there is still a lot to be done, and the effort seen by the authorities to provide access to increasingly reliable data will be crucial for future research. This section contains a summary of the current state of research that will lead to the identification of existing gaps and contribute to the theoretical framing of the study.

Concentration is an indicator of market structure that could not be missing from the study of the public procurement. After all, it is a market that is directly linked to the overall well-being of the public, and therefore requires both recognition and protection. Several scholars investigated market concentration in public procurement across a range of sectors, administration levels, and countries using various methodologies. Pavel (2016) for example, dealt with contracts in the field of municipal waste management in the Czech Republic for the years 2005–2014. He argued that market concentration indicators correlate positively with the results of public tenders and negatively with the number of bids. Regarding the market sector he examined, he found that in contrast to other sectors, municipal waste management in the Czech Republic, is an oligopolistic public procurement market, with relatively high prices. Wouters et al. (2019), focused on the medicines market in South Africa for the years 2003–2016. They measured market concentration using the Herfindahl–Hirschman Index—HHI (Herfindahl, 1950; Hirschman, 1945) and discovered that it is a competitive market (HHI < 2.500) where the public sector purchases medicines at lower prices than the private. This may also explain the average 40% drop in prices they saw during this period. Svoboda (2016), also used concentration indexes to examine public procurement market structure. He focused on 5 areas (construction industry, informatics and telecommunications, automotive industry, waste management and education) of the Czech public procurement market for the years 2007 and 2011 to test 4 hypotheses based on common economic knowledge about the impact of concentration on corresponding parameters of this market. Beyond the HHI, he also used the Concentration Index—CI (Kakwani et al., 1997), the Concentration Ratio—CR (Saving, 1970), the Hall-Tideman Index – HTI (Hall & Tideman, 1967), and the Gini Coefficient – GC (Gini, 1912). His results indicate that the influence of market concentration in public procurement, can be different than the expected based on common knowledge. He attributed these findings to the fact that in the public procurement market, the public interest prevails over the principles of the market, as well as to the fact that the parameters (e.g. final price) of the specific market may be affected by situations of corruption or low transparency that we meet in public procurement. It is also worth mentioning, that according to the results of his study the waste management industry is competitive (HHI = 886.87, 2007; HHI = 1472.52, 2011), in contrast with Pavel (2016), who showed that in the same country for the period 2005–2014, the municipal waste management market is considered concentrated. Lyra et al. (2022), provide a systematic literature review on the most recent techniques that have been applied to detect collusion, corruption and fraud in public procurement. In their review, which is based on Scopus repository, they detect the first relevant article to be published in 1991. After that, they observe a steadily increasing trend in publications from 2000 onwards which becomes even more intense since 2016. The most common techniques they came across are machine learning, network science, and statistics, with some papers containing combinations of the above. A possible explanation for this trend has to do with the availability of public procurement open data, which respectively increased in the last decades.

The clear connections between contracting authorities and economic operators combined with the abundance and the volume of open data, make network theory ideal for the study of public procurement. Wachs et al. (2021), taking advantage of network analysis, examined over 4 million contracts of EU public procurement for the period 2008–2016, to detect insights of corruption risk in 25 EU member states – M/S. Considering the public procurement market as bipartite network, they mapped and examined each M/S procurement market, for corruption risk in the sense of single-bidder contracts, and found similarities in the levels of corruption risk, but differences in its distribution among M/S. Furthermore, by focusing on network clustering, they found evidence of topological clustering among all M/S and years. According to them, when corruption risk is clustered, corruption has several roots in the M/S, and when the opposite applies, the government itself is the primary source of corruption. Wachs et al. (2021), identified the degree of centralization as an indicator of corruption risk and poor quality of the government. For the purposes of this study, it is also important to note that they used the alpha parameter of the fitted power-law distribution in order to compare the distribution of the number of contracts awarded and won in each country, and to reach the relevant conclusions.

Xiao et al. (2021), examined 216 collusion cases in China’s construction public procurement market, using network theory, to detect possible relationships of bid-riggers. They used the overall network density and the average path length to investigate the characteristics of the network, the degree and betweenness centrality to examine its centrality, and the closeness centrality and the condensation coefficient to analyze its cohesion. They found that collusive networks are sparse, small, concentrated, and random and resulted in three types of collusive bidding structure: contract, spontaneous, and shadow, each one with different combinations of network accessibility, centrality, and stability. Wachs and Kertész (2019), also used network theory to investigate collusive behaviors, this time in the Georgian public procurement market. They examined about 150,000 public procurement notices for the period 2011 to 2016, coming up with a cartel-detection algorithm based on the cohesion and the exclusivity of each network. These are topological features of networks which in a corresponding case (school milk market in 1980s’ Ohio) were found to exhibit high values for a known cartel group. However, this is an exclusively suggestive method which, although it cannot prove the existence of collusion, can nevertheless demonstrate possible cases for further control by the authorities.

Fazekas et al. (2017) and Czibik et al. (2021), included in their approaches the Corruption Risk Index (CRI). The former conducted a study on the public procurement markets of the Czech Republic and Hungary. They detected that buyers with high CRI tend to contract with 10–15% fewer suppliers. Moreover, they managed to link government turnovers with changes in the networks of buyers with high CRI. As they mention, these buyers, which they characteristically call “captured”, show significantly larger changes in their contractual relationships during government changes than other buyers. Czibik et al. (2021) dealt with the procurement of defense material in the European Union. They found evidence that the risk of corruption in defense procurement is higher than in other public procurement sectors. However, on a country-by-country basis, they identified a correlation between the risk of corruption in defense procurement and other areas of procurement. Furthermore, they showed that this risk varies significantly between EU countries. This risk is not random, but clustered, with some countries having higher clustering in the center of the market network, while others on the periphery.

Nevertheless, the above mentioned “captured” Contracting Authorities are not the only cases where we encounter disproportionate concentration on the contractual behavior. Fountoukidis et al. (2023), focused on the competitive conditions and the behavior of both the EOs, and the CAs. They proposed a monitoring tool, based on network entropy, able to detect in real time non-competitive behaviors. An application of this tool on the pacemakers’ public procurement market, in 28 EU Member States, Norway, the EU institutions, Iceland, Switzerland and Georgia during the period 2009–2019, revealed cases of possible buyers’ domination, as well as cases of possible preferential treatment of economic operators. In general, they found that the specific market operated competitively. However, by examining the degree centrality, they discovered certain EOs who dominated the market.

Regarding Greece, as far as we are able to know, there is no corresponding research that approaches the issue of public procurement, from the perspective of network theory. Furthermore, we have so far found no research that examines a country's public procurement market as a whole for cases of centralization and specifically, research by CPV group. A study focusing on each separate CPV group by examining the concentration of economic operators in it could on the one hand highlight cases of market dominance, providing indications to supervisory authorities for regulation, and on the other hand areas where potential bidders could exploit the development of healthy competition or monopolies to target in them. The present study comes to fill the above gap, examining by CPV group the entire Greek public procurement market for the years 2019–2021, and comparing these groups with each other in terms of market structure based on the concentration presented by the bidders.

3 Research design

3.1 Public procurement market as network

The relations between Contracting Authorities and Economic operators in public procurement can be described with the form of a network, as we have already seen in the previous section. For this study, we define as public procurement network the graph \(G=\left(V,E\right)\) where \(V\) is the set of nodes that contains all the Economic Operators \(j\) and the Contracting Authorities \(i\). \(E\) is the set of directed edges \(\left(j,i\right)\) connecting nodes j with one or more nodes i, one or more times.

An alternative way to represent a network is the adjacency matrix. This method will allow us to present necessary metrics for our analysis. The adjacency matrix of a directed network is described as below:

or

According to Graph theory (Newman, 2010) the degree \({k}_{i}\) of a node i in a network is the number of edges \(\left\{i,j\right\}\) connected to it.

For directed networks we define two type of degrees for each node. The in-degree that is the number of incoming edges and the out-degree that is the number of outgoing edges.

The total number of edges in a directed network is equal to the ingoing as well as to the outgoing edges of all vertices.

Therefore, we will focus only on the term of the out-degree, that is the number of edges which begin from the nodes of Economic Operators and end to those of Contracting Authorities.

The out-degree distribution of a network is the fraction of nodes with degree \(k\) described as.

where \({k}^{out}\): the out-degree, \({P}_{out}\left(k\right)\): the probability that a node has out-degree \(k\), \(n{k}^{out}\): the number of nodes in the network with out-degree \(k\) and \(N\): the total number of nodes in the network.

3.2 Detecting market concentration in public procurement networks

By taking advantage of the out-degree distribution of the network we can analyze the relationship between the probability of a node having a certain degree \({k}^{out}\) and the value of the \({k}^{out}\) itself. This relationship can be expressed with the following equation:

where \({b}_{0}\): the y-intercept of the regression line, \({b}_{1}\): the slope of the regression line, which represents the power-law exponent of the degree distribution, and \(\varepsilon\): the error term.

The above linear regression model allows us to approximately fit a regression line in our data, which slope equals to \({b}_{1}\). In the Cartesian coordinate system the above equation takes the following form:

where \(C\): the normalization constant, and \(a\): the power-law exponent.

For a given set of nodes, each with degree \({k}^{out}\), the above results in a curve for the analysis of which we can utilize the value of \(a\). For \(a<0\) (Fig. 1), the curve goes closer to the x-axis as \({k}_{j}^{out}\) increases, becoming steeper and more sharply angled as the value of a becomes more negative. For \(0<a<1\) (Fig. 2), the curve is a decreasing function where when \({k}_{j}^{out}\) increases, \({P}_{out}\left(k\right)\) increases at a decreasing rate, becoming flatter and flatter as a decreases. Finally, for \(a>1\) (Fig. 3), the curve is an increasing function. When \({k}_{j}^{out}\) increases, \({P}_{out}\left(k\right)\) also increases at an increasing rate with the curve becoming steeper as \(a\) increases. It is considered appropriate to mention that according to Newman (2010), the power law is obeyed in the tail of the distribution, which is the section on which this particular study focuses to investigate market concentration as analyzed below.

Let E(i, j) be the nodes that represent CAs and EOs respectively. Thus given a specific set of EOs and CAs, the out-degree of EOs in this directed network represents the number of edges, that is the number of connections between EOs and CAs. If we now exclude from this set those bidders who didn't win a contract, then the out-degree of an EO’s node [E(j)] would represent the number of contracts that were awarded to that EO. Therefore, in this case the out-degree distribution indicates the distribution of the frequency of contract awards among EOs in the network, and reveals the concentration of contract awards among certain EOs. When \(a>0\), the curve is an increasing function. When this happens, we observe that larger percentages of economic operators show higher values of \({k}_{j}^{out}.\) Αs \(a\) tends to 0, the curve becomes flatter, until the point where all values of \({k}_{j}^{out}\) having the same frequency (\(a=0)\), and then, as \(a\) decreases bellow 0 we observe that the more its value decreases, the economic operators with high values of \({k}_{j}^{out}\) occupy an increasingly smaller percentage. In other words, for \(a<0\) a small percentage of economic operators dominates the market. Therefore, a highly skewed distribution where a few EOs receive a disproportionate share of the contracts would suggest concentration in the contracting process. Such insights could be useful both for the policy makers and for the economic operators. The former could use them in identifying potential biases, opportunities for improving efficiency and fairness in the contracting process, and improving competition, while the latter could exploit the information to identify potential market segments to enter.

3.3 Data and methodology

To answer our research questions (Q2 & Q3) we used the platform opentender.euFootnote 2 focusing on Greek public procurement data, for the period 2019—2021. For each of these years, we processed our data (Opentender, 2022) as follows, using the R Statistical Software (R Core Team, 2022):

-

i.

We kept only cases with winning bids, by deleting those with missing or NA (Not Available) values in column “bid_isWinning”.

-

ii.

We excluded all cases with a value “tender_nationalProcedureType” other than open (“pt_open”), because in those restricted procedures, competition does not develop freely.

-

iii.

Using the ‘stringdist’ R package (Van der Loo, 2014), we performed entity resolution and deduplication for both the contracting authorities and the economic operators using a similarity threshold of 0.9 for the bidders’ names and one of 0.95 for the names of the contracting authorities.

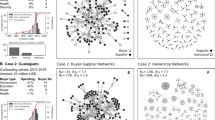

In our examination of the data, we initially constructed three networks representing three consecutive years, as detailed in Appendix A (Figs. 4, 5 and 6). Then to delve deeper into sector-specific concentration patterns, we grouped their nodes based on the first three digits of the main Common Procurement Vocabulary (CPV) code, labeled to as "tender_mainCpv" in the dataset. The CPV code is a standardized numerical system used by Contracting Authorities (CAs) to describe the subject matter of public procurement contracts. The code consists of eight digits, organized into divisions, groups, classes, categories, and subcategories, providing a hierarchical structure for classifying procurement items.

Table 1 illustrates the structure of the CPV codes, demonstrating the increasing level of detail as we move from divisions to subcategories. The system encompasses various levels: subcategories, categories, classes, and groups, with each level capturing more precise subject matters (5.756 subcategories, 2379 categories, 1002 classes, and 272 groups). In this study, we focused on the classification by group, because of its balanced approach. Sensitivity increases significantly when moving to classes, categories and subcategories. With this in mind, group-level research ensures a position of balance. For example, divisions, with only 45 categories, may be too broad for analysis at the national level, while going deeper into classes or categories may risk too much sensitivity. Using groups allows us to capture more meaningful and specific market dynamics within the scope of this study.

Therefore we plotted the out-degree distribution graph for those CPV group subnetworks, and approximately fitted a curve of the form \(y={x}^{a}\) in each. This analysis allows us to assess the concentration of contract awards among Economic Operators within specific CPV groups. By examining the tail behavior of the degree distribution curves and evaluating the value of the exponent \(a\), we can gain insights into the dominance and market concentration of EOs. This approach provides a detailed understanding of the distribution patterns and reveals whether a few EOs hold disproportionate market shares compared to others within each CPV group.

In this research design, we have outlined a comprehensive approach to analyzing the structure of the Greek public procurement market using network theory. By representing the relationships between CAs and EOs as a network and utilizing the concept of degree distribution, we aim to identify market concentration within different CPV groups.

3.4 Descriptive statistics

The methodology involves constructing directed networks, calculating out-degree distributions, and fitting regression models to investigate the concentration of contract awards among EOs. Table 2 presents the key descriptive statistics for each year:

-

i.

Number of Nodes: This represents the total number of entities or nodes in the network.

-

ii.

Number of EOs (Economic Operators): It shows how many unique economic operators are present in the network.

-

iii.

Number of CAs (Contracting Authorities): This indicates the number of contracting authorities involved in the network.

-

iv.

Number of Edges (Contracts Awarded): The edges in the network represent contracts awarded. The number of edges signifies the volume of contract awards in each year.

-

v.

Out Degree Median: This statistic gives the median out-degree, which is the median number of contracts awarded to EOs. It provides information about the central tendency of contract awards among EOs.

-

vi.

Out Degree Mean: The mean out-degree represents the average number of contracts awarded to EOs. It offers insights into the average concentration of contract awards.

These statistics provide an overview of the network characteristics and can be used to better understand the structure of the Greek public procurement market.

Our data analysis will shed light on the tail behavior of degree distribution curves, the differences in degree distributions among CPV group-based subnetworks, and the presence of significant dominant economic operators. The findings from this study have the potential to inform policy makers and economic operators, aiding in the identification of biases, improvements in efficiency and fairness, and the identification of potential market segments. The subsequent section will present the results of the analysis, providing valuable insights into the structure and concentration of the Greek public procurement market.

3.5 Main analysis

The analysis of the data revealed intriguing insights into the performance of various CPV codes over multiple years. The concentration measure (α) indicates the level of market concentration within each CPV network. A negative α value (< 0) suggests a higher degree of concentration, pointing to the dominance of a few economic operators in the market. A positive α value (> 0) indicates a more balanced distribution of economic operators within the network. Monopolistic markets are identified when α values are not available, and R-squared value is 0. While R2 values typically indicate model fit, in this context, they primarily serve to identify monopolies. Afterall regardless of the R2 value, as stated by Newman (2010), the power law is obeyed in the tail of the distribution, which is the section where the focus was concentrated in this research to study market concentration.

Visual representations illustrating the data for each year (2019 to 2021) are detailed in Appendix B, offering a comprehensive overview of the observed trends. Additionally, Appendix C presents a table summarizing the results and providing average values for the analyzed data. Both the plots and the table consolidate the key findings and allow for a quick comparison of performance across different CPV codes and years. Among the CPV codes analyzed, some notable findings include:

-

(i)

CPV code 356 – “Military aircrafts, missiles and spacecrafts”

-

No contests were launched during 2019, which suggests a lack of market activity.

-

In 2020, there was a single EO that received 100% of market share.

-

In 2021, the α value was -1 indicating high concentration.

-

-

(ii)

CPV code 904 – “Sewage services”.

-

In 2019, two EOs shared 50% of the market each.

-

In 2020, the α value was − 1.044 indicating high concentration.

-

In 2021 R-quared value was 0.00, while a value for α was not available, which indicates a monopolistic market as seen in the corresponding graph.

-

-

(iii)

CPV code 720 – “IT services: consulting, software development, Internet, and support”

-

In 2019 the value of α was − 0.45.

-

In 2020 the value of α was − 1.044.

-

In 2021, the value of α was − 0.5.

-

All the above indicate high concentration in the market for IT services.

-

(iv)

CPV code 794 – “Business and management consultancy and related services”

-

In both 2019 and 2020, the α value was negative, − 0.807 and − 1.374 respectively, indicating high concentration.

-

In 2021, the value of a was 0.267, suggesting that there is a degree of diversity in the market.

-

-

(v)

CPV code 793 – “Market and economic research; polling and statistics”

-

In both 2019 and 2020, the α value was negative, − 0.179 and − 2.17 respectively, indicating high concentration.

-

In 2021, the value of a was 0.542, suggesting a degree of diversity in the market.

-

In addition to highly concentrated groups, our results also highlighted groups that develop a healthy competitive environment among economic operators, with the following being more typical:

-

(i)

CPV code 220 – “Printed matter and related products”

-

In 2019, the value of a was 1.

-

In 2020, the value of a was 0.569.

-

In 2021, the value of a was 1.

-

-

(ii)

CPV code 790 – “Business services: law, marketing, consulting, recruitment, printing and security”

-

In 2019, the value of a was 1.

-

In 2020, the value of a was 0.697.

-

In 2021, the value of a was 0.792.

-

-

(iii)

CPV code 092 – “Petroleum, coal and oil products”

-

In 2019, the value of a was 0.745.

-

In 2020, the value of a was 0.723.

-

In 2021, the value of a was 0.893.

-

The above, not only describe the competitive environment but also signify a stable market condition.

-

(iv)

CPV code 351 – “Emergency and security equipment”

-

In 2019, the value of a was 1.

-

In 2020, the value of a was 0.5.

-

In 2021, the value of a was 0.758.

-

-

(v)

CPV code 374 – “Sports goods and equipment”

-

In 2019, the α value was 2, indicating a diverse market.

-

In 2020, the α value was − 0.782, representing a period of variations in market concentration.

-

In 2021, the α value was 1, indicating a return to a diverse market environment.

-

Our results also revealed that in the year 2019, 26 CPV groups exhibited high concentration (a < 0), indicating a significant dominance of economic operators within those groups. Additionally, 68 CPV groups were identified as monopolistic where the parameter “a” was unavailable and R2 value was 0. Moving to the year 2020, we observed 46 highly concentrated CPV groups and 65 monopolistic groups. Finally, in 2021, we identified only 6 highly concentrated CPV groups and 71 monopolistic groups. While the reduction in highly concentrated markets might imply some improvement in competition, the rise in monopolistic conditions raises concerns about market competitiveness. This shift from highly concentrated markets to increased monopolistic conditions suggests evolving market dynamics. It calls for careful consideration of regulatory and policy measures to ensure fair competition and market access.

It is also worth noting that according to our results, we identified 91 CPV groups in which no contests were launched during the examined period of 2019–2021.

CPV group 030—Agricultural, farming, fishing, forestry and related products

CPV group 031—Agricultural and horticultural products

CPV group 140—Mining, basic metals and related products

CPV group 143—Chemical and fertiliser minerals

CPV group 144—Salt and pure sodium chloride

CPV group 145—Related mining and quarrying products

CPV group 146—Metal ores and alloys

CPV group 147—Basic metals

CPV group 148—Miscellaneous non-metallic mineral products

CPV group 149—Recovered secondary raw materials

CPV group 159—Beverages, tobacco and related products

CPV group 164—Spraying machinery for agriculture or horticulture

CPV group 165—Self-loading or unloading trailers and semi-trailers for agriculture

CPV group 168—Parts of agricultural and forestry machinery

CPV group 185—Jewellery, watches and related articles

CPV group 186—Furs and articles of fur

CPV group 190—Leather and textile fabrics, plastic and rubber materials

CPV group 191—Leather

CPV group 194—Textile yarn and thread

CPV group 197—Synthetic rubber and fibres

CPV group 222—Newspapers, journals, periodicals and magazines

CPV group 223—Postcards, greeting cards and other printed matter

CPV group 226—Ink

CPV group 245—Plastics in primary forms

CPV group 320—Radio, television, communication, telecommunication and related equipment

CPV group 370—Musical instruments, sport goods, games, toys, handicraft, art materials and accessories

CPV group 378—Handicraft and art supplies

CPV group 387—Time registers and the like; parking meters

CPV group 411—Natural water

CPV group 423—Industrial or laboratory furnaces, incinerators and ovens

CPV group 428—Machinery for paper or paperboard production

CPV group 431—Mining equipment

CPV group 434—Mineral-processing and foundry mould-forming machinery

CPV group 435—Track-laying vehicles

CPV group 437—Machinery for metallurgy and associated parts

CPV group 438—Workshop equipment

CPV group 445—Tools, locks, keys, hinges, fasteners, chain and springs.

CPV group 484—Business transaction and personal business software package

CPV group 510—Installation services (except software)

CPV group 512—Installation services of equipment for measuring, checking, testing and navigating

CPV group 514—Installation services of medical and surgical equipment

CPV group 515—Installation services of machinery and equipment

CPV group 517—Installation services of fire protection equipment

CPV group 518—Installation services of metal containers

CPV group 519—Installation services of guidance and control systems

CPV group 559—Retail trade services

CPV group 602—Railway transport services

CPV group 603—Pipeline transport services

CPV group 605—Space transport services

CPV group 630—Supporting and auxiliary transport services; travel agencies services

CPV group 640—Postal and telecommunications services

CPV group 650—Public utilities

CPV group 652—Gas distribution and related services

CPV group 654—Other sources of energy supplies and distribution

CPV group 660—Financial and insurance services

CPV group 666—Treasury services

CPV group 667—Reinsurance services

CPV group 700—Real estate services

CPV group 702—Renting or leasing services of own property

CPV group 717—Monitoring and control services

CPV group 719—Laboratory services

CPV group 721—Hardware consultancy services

CPV group 727—Computer network services

CPV group 728—Computer audit and testing services

CPV group 733—Design and execution of research and development

CPV group 734—Research and Development services on security and defence materials

CPV group 750—Administration, defence and social security services

CPV group 753—Compulsory social security services

CPV group 761—Professional services for the gas industry

CPV group 762—Professional services for the oil industry

CPV group 763—Drilling services

CPV group 764—Rig-positioning services

CPV group 765—Onshore and offshore services

CPV group 774—Zoological services

CPV group 775—Animal husbandry services

CPV group 776—Hunting services

CPV group 777—Services incidental to fishing

CPV group 778—Aquaculture services

CPV group 779—Apiculture services

CPV group 802—Secondary education services

CPV group 803—Higher education services

CPV group 804—Adult and other education services

CPV group 806—Training services in defence and security materials

CPV group 850—Health and social work services

CPV group 922—Radio and television services

CPV group 924—News-agency services

CPV group 927—Cybercafé services

CPV group 980—Other community, social and personal services

CPV group 982—Equal opportunities consultancy services

CPV group 985—Private households with employed persons

CPV group 989—Services provided by extra-territorial organisations and bodies

In conclusion, the analysis of the data shed light on the concentration levels and market dynamics within the Greek public procurement sector. The calculated concentration measure (a) allowed us to identify patterns of market concentration and evaluate the fit of the linear regression models. Our findings revealed both highly concentrated and monopolistic markets across various CPV codes, indicating the dominance of a few economic operators. Conversely, we also identified CPV codes that fostered a healthy competitive environment among economic operators. The detailed overview available in the appendices provides a visual representation of trends over the years. While these observations offer significant knowledge about market dynamics and competition within the Greek public procurement sector, they primarily act as indicators for deeper exploration. They do not definitively prove the existence of collusion or corruption, emphasizing the importance of monitoring and fostering a more balanced market landscape.

4 Discussion

In this study, we employed network theory to analyze the structure and concentration of the Greek public procurement market. By representing the relationships between Contracting Authorities (CAs) and Economic Operators (EOs) as a network and examining the out-degree distribution of EOs, we gained valuable insights into the distribution patterns and market dynamics within different Common Procurement Vocabulary (CPV) groups. Our findings shed light on the concentration of contract awards among EOs and the presence of dominant players in specific CPV codes. It is important to note that these results provide informative indicators for further exploration rather than definitive evidence of collusion or corruption. However, they could help policy makers and stakeholders to identify areas of market concentration in order to promote a more balanced and competitive procurement environment in Greece.

By examining the tail of the degree distribution, we can identify the presence of dominant economic operators and assess the level of market concentration. In our study, we observed that a negative exponent (a < 0) points to a highly concentrated market, where a few economic operators receive a disproportionate share within a particular CPV group. This suggests a potential lack of competition and possible market dominance by certain economic operators. In the CPV group 793—"Market and economic research; polling and statistics", we found the highest negative exponent (α = -2.17) for the year 2020, which reveals high concentration. This suggests that a few economic operators within this CPV group are consistently awarded a significant number of contracts, while others have limited access to the market. This finding has important implications for policymakers and economic operators, as it highlights the need for measures to promote competition, improve efficiency, and ensure fairness in the contracting process within the hotel services sector. In contrast, the CPV group 382—" Geological and geophysical instruments" exhibited a different pattern. The degree distribution curve for this CPV group showed the highest positive exponent observed (a = 1.631) in the year 2021, indicating a more balanced distribution of contracts among economic operators. This suggests a healthier competitive environment within the sector, where a wider range of economic operators have access to procurement opportunities.

The analysis of the degree distributions among the CPV subnetworks revealed variations, pointing to significantly different market structures. By constructing directed networks and calculating out-degree distributions, we observed distinct distributions among CPV groups. For example, CPV code 720—"IT services: consulting, software development, Internet, and support" exhibited consistent negative values of α across all three years, indicating a concentrated market with dominant economic operators. In contrast, CPV code 220 " Printed matter and related products" displayed positive values of α, suggesting a more competitive environment with a balanced distribution of economic operators. Such findings highlight the heterogeneity in market dynamics between various sectors of the Greek public procurement market.

Our study also noticed the presence of CPV groups with significant dominant economic operators within their networks. In particular, several CPV codes exhibited high concentration with a notable and stable prevalence of specific market players within those groups. For instance, CPV code 720—" IT services: consulting, software development, Internet and support" displayed a negative α value in all years. Similarly, CPV code 907—"Environmental services" exhibited positive α value only in the year 2021 (0.354) and negative values across the other two years (2019 and 2020), pointing to the presence of dominant firms in the network. These findings emphasize the importance of identifying CPV groups with significant dominant economic operators, as they may have implications for competition, efficiency, and fairness within the Greek public procurement market.

Moreover, when analyzing the Greek public procurement market in its entirety, the findings suggest a transition from highly concentrated markets to increased monopolistic conditions. These results provide important implications for policymakers, regulators, and stakeholders involved in the market. The concentration of contract awards among a few dominant economic operators within specific CPV groups raises concerns about competition, transparency, and fair market access for other economic operators. It suggests a potential lack of equal opportunities for participation and may prevent innovation and economic growth within these sectors. To foster a more balanced and competitive procurement environment, several measures can be considered.

First, promoting transparency and availability of information is crucial to improving the observed situation. Prioritizing the publication of detailed information on contract awards could provide a clearer picture of the market structure and support decision-making. This can help detect potential monopolistic behavior and encourage new economic operators to join. Second, taking measures to improve competition in highly concentrated CPV groups is necessary. This could be achieved by placing more emphasis on competitive bidding processes but also by encouraging smaller economic operators who are unable to participate individually to participate jointly. These initiatives can help distribute opportunities more evenly, reduce market concentration, and foster a more competitive landscape. In addition, the monitoring in the public procurement market should be strengthened to detect and prevent anti-competitive practices such as bid-rigging, collusion and abuse of a dominant position. Third, cooperation between stakeholders (both private and public) could be useful in identifying barriers to entry as well as taking effective measures to promote competition.

The approach used in this study offers a straightforward method to investigate market concentration across an entire country's public procurement landscape. However, it is crucial to understand that while our findings provide information regarding the presence of dominant bidders, they don't conclusively indicate collusion or corruption. Such concentration can arise when some companies consistently win due to superior efficiency or when auctions are tailored to favor certain product qualities. This knowledge equips authorities to implement additional evaluations and checks, offering them the clarity needed to distinguish between efficiency-driven market dynamics and potential irregularities, thus ensuring market integrity. Nonetheless, further research is needed to explore the root causes and possible consequences of concentration in the Greek public procurement market.

At this point, it is considered important to acknowledge the limitations associated with the data, including variations in data availability between years and CPV codes, as well as potential inaccuracies in recorded information. A particular challenge arose from the differences in titles of contracting authorities and economic operators registered on the online platforms during procurement procedures. To address this issue, an entity resolution and deduplication process was carried out for both contracting authorities and economic operators. However, despite our efforts to improve data quality, we should keep in mind that some level of error still exists, which must be considered when drawing conclusions based on those findings. By addressing limitations and improving data accuracy, future studies can further explore the effects of concentration and market dynamics on CPV codes. This would contribute to a more robust understanding of market behavior, allowing policy makers, industry practitioners and researchers to make evidence-based decisions.

5 Conclusion

In conclusion, our study used network theory to analyze the structure and concentration of the Greek public procurement market, focusing specifically on the relationships between Contracting Authorities (CAs) and Economic Operators (EOs) within different Common Procurement Vocabulary (CPV) groups. Through the analysis of degree distribution curves, variations in degree distributions between sub-networks based on CPV groups and the identification of dominant economic operators, we have gained valuable insights into market dynamics and competition in the Greek public procurement sector.

Our findings reveal the presence of market concentration and dominant economic operators in certain CPV groups. Negative exponents seen in degree distribution curves indicate highly concentrated markets where a few EOs receive a disproportionate share of contracts. This suggests a possible lack of competition and market dominance by certain economic operators. Conversely, positive exponents indicate a better distributed picture of contracts among EOs, implying a more competitively healthy environment. The concentration of contract awards raises concerns about competition, transparency and fair market access. To promote a more balanced and competitive procurement environment, measures such as promoting transparency, increasing competition within highly concentrated CPV groups, and strengthening enforcement and cooperation between stakeholders are crucial.

It is also important to acknowledge that the limitations of our study, include variations in data availability and potential inaccuracies in recorded information. Despite efforts to improve data quality, some level of error or misclassification may still exist. Future research should address these limitations and explore the effects of concentration and market dynamics on CPV codes to improve our understanding of market behavior. By implementing evidence-based strategies and addressing the identified issues, policymakers can work to create a more balanced and competitive procurement environment in Greece.

Change history

06 July 2024

A Correction to this paper has been published: https://doi.org/10.1007/s40812-024-00317-0

Notes

The European Public Procurement Data Space will be an integrated space for public procurement data above and below the EU thresholds, combined with an analytics toolset using advanced technologies (European Commission, 2023b).

The platform opentender.eu is part of the DIGIWHIST project.

References

Arozamena, L., & Weinschelbaum, F. (2009). The effect of corruption on bidding behavior in first-price auctions. European Economic Review, 53, 645–657. https://doi.org/10.1016/j.euroecorev.2008.11.001

Basheka, B.C., 2013. The Science of Public Procurement and Administration, in: International Public Procurement Conference (IPPC). pp. 289–330.

Bröchner, J. (2010). Innovation and ancient Roman facilities management. Journal of Facilities Management, 8, 246–255. https://doi.org/10.1108/14725961011078963

Burguet, R., & Che, Y.-K. (2004). Competitive Procurement with Corruption. The Rand Journal of Economics, 35, 50. https://doi.org/10.2307/1593729

Celentani, M., & Ganuza, J. J. (2002). Corruption and competition in procurement. European Economic Review, 46, 1273–1303. https://doi.org/10.1016/S0014-2921(01)00147-7

Czibik, Á., Fazekas, M., Sanchez, A. H., & Wachs, J. (2021). Networked corruption risks in european defense procurement. In O. Granados & J. Nicolás-Carlock (Eds.), Corruption Networks: Understanding Complex Systems (pp. 67–87). Cham: Springer.

The European Commission, 2008. Public Procurement in the European Union Guide to the Common Procurement Vocabulary (CPV) Guide to the Common Procurement Vocabulary.

European Parliament, Council of the European Union, 2014b. Directive 2014/25/EU of the European Parliament and of the Council of 26 February 2014 on procurement by entities operating in the water, energy, transport and postal services sectors and repealing Directive 2004/17/EC. Official Journal of the European Union L, 243–374.

European Parliament, Council of the European Union, 2014a. Directive 2014/24/EU of the European Parliament and of the Council of 26 February 2014 on public procurement and repealing Directive 2004/18/EC. Official Journal of the European Union L, 65–242.

European Parliament, Council of the European Union, 2014c. Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC. Official Journal of the European Union L, 1–61.

European Commission, 2023b. COMMUNICATION FROM THE COMMISSION Public Procurement: A data space to improve public spending, boost data-driven policy-making and improve access to tenders for SMEs. Official Journal of the European Union CI, 1–11.

European Commission, 2023a. Public procurement [WWW Document]. URL https://single-market-economy.ec.europa.eu/single-market/public-procurement_en (accessed 4.1.23).

Fagan, G. (1999). Bathing in public in the roman world. University of Michigan Press, Ann Arbor, MI. https://doi.org/10.3998/mpub.14923

Fazekas, M., Skuhrovec, J., & Wachs, J. (2017). Corruption, government turnover, and public contracting market structure insights using network analysis and objective corruption proxies Working Paper series: GTI-WP/2017:02. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3103402

Flynn, A., & Davis, P. (2014). Theory in public procurement research. Journal of Public Procurement, 14, 139–180. https://doi.org/10.1108/jopp-14-02-2014-b001

Fountoukidis, I. G., Antoniou, I. E., & Varsakelis, N. C. (2023). Competitive conditions in the public procurement markets: An investigation with network analysis. Journal of Industrial and Business Economics. https://doi.org/10.1007/s40812-022-00251-z

Ganuza, J. J., & Hauk, E. (2004). Economic integration and corruption. International Journal of Industrial Organization, 22, 1463–1484. https://doi.org/10.1016/j.ijindorg.2004.09.004

Geroski, P. A. (2006). Procurement Policy as a Tool of Industrial Policy. https://doi.org/10.1080/758523673

Gini, C., 1912. Variabilità e Mutabilità. Contributo allo Studio delle Distribuzioni e delle Relazioni Statistiche. C. Cuppini, Bologna

Grega, M., & Nemec, J. (2015). Factors influencing final price of public procurement: evidence from Slovakia. Procedia Economics and Finance, 25, 543–551. https://doi.org/10.1016/s2212-5671(15)00768-6

Hall, M., & Tideman, N. (1967). Measures of concentration. Journal of American Statistical Association, 62, 162–168. https://doi.org/10.1080/01621459.1967.10482897

Herfindahl, O.C., 1950. Concentration in the steel industry. Dissertation: Columbia University.

Hirschman, A.O., 1945. National power and the structure of foreign trade.

Ishii, R. (2009). Favor exchange in collusion: Empirical study of repeated procurement auctions in Japan. International Journal of Industrial Organization, 27, 137–144. https://doi.org/10.1016/j.ijindorg.2008.05.006

Kakwani, N., Wagstaff, A., & Van Doorslaer, E. (1997). Socioeconomic inequalities in health: Measurement, computation, and statistical inference. J Econom, 77, 87–103. https://doi.org/10.1016/S0304-4076(96)01807-6

Kumar, V., Marshall, R. C., Marx, L. M., & Samkharadze, L. (2015). Buyer resistance for cartel versus merger. International Journal of Industrial Organization, 39, 71–80. https://doi.org/10.1016/j.ijindorg.2015.02.002

Laffont, J. J., & Tirole, J. (1991). Auction design and favoritism. International Journal of Industrial Organization, 9, 9–42. https://doi.org/10.1016/0167-7187(91)90003-4

Lyra, M. S., Damásio, B., Pinheiro, F. L., & Bacao, F. (2022). Fraud, corruption, and collusion in public procurement activities, a systematic literature review on data-driven methods. Appl Netw Sci. https://doi.org/10.1007/s41109-022-00523-6

McCue, C. P., & Gianakis, G. A. (2001). Public purchasing: Who’s minding the store? Journal of Public Procurement, 1, 71–95. https://doi.org/10.1108/JOPP-01-01-2001-B002

Newman, M. (2010). Networks. Oxford University Press. https://doi.org/10.1093/acprof:oso/9780199206650.001.0001

Opentender, 2022. Making Public Tenders More Transparent.

Pavel, J., 2016. Public Procurement Market and the Municipal Waste Management, in: Sedmihradská, L. (Ed.), Proceedings of the 21th International Conference Theoretical and Practical Aspects of Public Finance. University of Economics, Prague Faculty of Finance and Accounting Department o Public Finance, Praha, pp. 172–176.

R Core Team, 2022. R: A Language and Environment for Statistical Computing.

Saving, T. (1970). Concentration ratios and the degree of monopoly. International Economic Review (philadelphia), 11, 139–146.

Schrouder, S., 2010. Public Procurement in the Caribbean: Confronting the Challenges and Opportunities., in: 4th International Public Procurement Conference.

Svoboda, P., 2016. ANALYSIS OF MARKET CONCENTRATION IN SELECTED SECTORS OF PUBLIC PROCUREMENT 64, 121. https://doi.org/10.11118/actaun201664031073

Thai, K. V. (2001). Public procurement re-examined. Journal of Public Procurement, 1, 9–50. https://doi.org/10.1108/JOPP-01-01-2001-B001

The Commission of the European Communities, 2007. COMMISSION REGULATION (EC) No 213/2008 of 28 November 2007 amending Regulation (EC) No 2195/2002 of the European Parliament and of the Council on the Common Procurement Vocabulary (CPV) and Directives 2004/17/EC and 2004/18/EC of the European Parliament and of the Council on public procurement procedures, as regards the revision of the CPV. Official Journal of the European Union L, 1–375.

Van der Loo, M. P. J. (2014). The stringdist package for approximate string matching. R J, 6, 111–122.

Wachs, J., Fazekas, M., & Kertész, J. (2021). Corruption risk in contracting markets: A network science perspective. Int J Data Sci Anal, 12, 45–60. https://doi.org/10.1007/s41060-019-00204-1

Wachs, J., & Kertész, J. (2019). A network approach to cartel detection in public auction markets. Scientific Reports. https://doi.org/10.1038/s41598-019-47198-1

Wan, R. (2014). Public procurement of innovation policy: Competition regulation, market structure and dominant design. Journal of Public Procurement, 14, 483–504.

Wouters, O. J., Sandberg, D. M., Pillay, A., & Kanavos, P. G. (2019). The impact of pharmaceutical tendering on prices and market concentration in South Africa over a 14-year period. Social Science and Medicine, 220, 362–370. https://doi.org/10.1016/J.SOCSCIMED.2018.11.029

Xiao, L., Ye, K., Zhou, J., Ye, X., & Tekka, R. S. (2021). A social network-based examination on bid riggers’ relationships in the construction industry: A case study of China. Buildings. https://doi.org/10.3390/buildings11080363

Funding

Open access funding provided by HEAL-Link Greece.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A Network Analysis of Greek Public Procurement: Graphs from 2019–2021

Appendix B – CPV Group Subnetworks (2019–2021): Measuring Market Concentration via Degree Distribution

Appendix C – Summary of Concentration Measure (α) for Each CPV Group Network by Year

CPV group | Description | 2019 | 2020 | 2021 | Average α | |||

|---|---|---|---|---|---|---|---|---|

α | R2 | α | R2 | α | R2 | |||

798 | Printing and related services | 2 | NaN | n/a | n/a | n/a | 0 | 2.00 |

382 | Geological and geophysical instruments | 0.415 | NaN | n/a | 0 | 1.631 | NaN | 1.02 |

032 | Cereals, potatoes, vegetables, fruits and nuts | 1 | NaN | 1 | NaN | n/a | 0 | 1.00 |

156 | Grain mill products, starches and starch products | 1 | NaN | n/a | 0 | n/a | n/a | 1.00 |

157 | Animal feedstuffs | 1 | NaN | n/a | n/a | n/a | n/a | 1.00 |

160 | Agricultural machinery | n/a | 0 | n/a | n/a | 1 | NaN | 1.00 |

228 | Paper or paperboard registers, account books, binders, forms and other articles of printed stationery | 1 | NaN | n/a | n/a | n/a | 0 | 1.00 |

242 | Dyes and pigments | n/a | n/a | n/a | n/a | 1 | NaN | 1.00 |

243 | Basic inorganic and organic chemicals | 1 | NaN | n/a | 0 | n/a | 0 | 1.00 |

312 | Electricity distribution and control apparatus | n/a | 0 | n/a | 0 | 1 | NaN | 1.00 |

314 | Accumulators, primary cells and primary batteries | 1 | NaN | n/a | 0 | n/a | n/a | 1.00 |

390 | Furniture (incl. office furniture), furnishings, domestic appliances (excl. lighting) and cleaning products | n/a | 0 | 1 | NaN | 1 | NaN | 1.00 |

397 | Domestic appliances | 1 | NaN | n/a | n/a | n/a | 0 | 1.00 |

449 | Stone for construction, limestone, gypsum and slate | n/a | 0 | 1 | NaN | n/a | 0 | 1.00 |

487 | Software package utilities | 1 | NaN | n/a | n/a | n/a | 0 | 1.00 |

489 | Miscellaneous software package and computer systems | n/a | 0 | n/a | n/a | 1 | NaN | 1.00 |

631 | Cargo handling and storage services | n/a | 0 | n/a | 0 | 1 | NaN | 1.00 |

637 | Support services for land, water and air transport | n/a | 0 | n/a | 0 | 1 | NaN | 1.00 |

661 | Banking and investment services | n/a | 0 | n/a | 0 | 1 | NaN | 1.00 |

715 | Construction− related services | n/a | n/a | n/a | 0 | 1 | NaN | 1.00 |

766 | Pipeline-inspection services | n/a | n/a | n/a | 0 | 1 | NaN | 1.00 |

770 | Agricultural, forestry, horticultural, aquacultural and apicultural services | 1 | NaN | n/a | n/a | n/a | n/a | 1.00 |

801 | Primary education services | n/a | n/a | n/a | n/a | 1 | NaN | 1.00 |

921 | Motion picture and video services | 1 | NaN | n/a | 0 | 1 | NaN | 1.00 |

983 | Miscellaneous services | n/a | 0 | 1 | NaN | n/a | 0 | 1.00 |

444 | Miscellaneous fabricated products and related items | n/a | 0 | 1 | NaN | 0.879 | 0.973 | 0.94 |

220 | Printed matter and related products | 1 | NaN | 0.569 | NaN | 1 | NaN | 0.86 |

790 | Business services: law, marketing, consulting, recruitment, printing and security | 1 | NaN | 0.697 | 0.996 | 0.792 | NaN | 0.83 |

421 | Machinery for the production and use of mechanical power | 0.751 | 0.981 | 0.87 | 0.64 | n/a | 0 | 0.81 |

221 | Printed books, brochures and leaflets | 0.777 | 0.641 | 0.829 | 0.971 | n/a | 0 | 0.80 |

092 | Petroleum, coal and oil products | 0.745 | 0.847 | 0.723 | 0.779 | 0.87 | 0.893 | 0.78 |

358 | Individual and support equipment | 1 | NaN | 0.527 | 0.878 | n/a | 0 | 0.76 |

310 | Electrical machinery, apparatus, equipment and consumables; lighting | 1 | NaN | n/a | n/a | 0.509 | 0.902 | 0.75 |

351 | Emergency and security equipment | 1 | NaN | 0.5 | NaN | 0.758 | 0.839 | 0.75 |

732 | Research and development consultancy services | 0.5 | NaN | 1 | NaN | n/a | n/a | 0.75 |

374 | Sports goods and equipment | 2 | NaN | − 0.782 | 0.827 | 1 | NaN | 0.74 |

392 | Furnishing | 0.569 | NaN | 0.598 | 0.846 | 1 | NaN | 0.72 |

552 | Camping sites and other non-hotel accommodation | 1 | NaN | 0.415 | NaN | n/a | n/a | 0.71 |

398 | Cleaning and polishing products | 0.774 | 0.872 | 0.554 | 0.762 | 0.794 | 0.876 | 0.71 |

180 | Clothing, footwear, luggage articles and accessories | 0.381 | 0.824 | 1 | NaN | n/a | n/a | 0.69 |

188 | Footwear | n/a | 0 | 0.371 | 0.714 | 1 | NaN | 0.69 |

772 | Forestry services | 0.369 | NaN | 1 | NaN | n/a | 0 | 0.68 |

155 | Dairy products | 0.93 | 0.843 | 0.428 | 0.327 | 0.68 | 0.706 | 0.68 |

795 | Office-support services | n/a | 0 | 0.673 | 0.811 | n/a | 0 | 0.67 |

181 | Occupational clothing, special workwear and accessories | 0.594 | 0.841 | 0.409 | 0.36 | 1 | NaN | 0.67 |

189 | Luggage, saddlery, sacks and bags | n/a | n/a | n/a | n/a | 0.661 | 0.973 | 0.66 |

600 | Transport services (excl. Waste transport) | 0.661 | 0.891 | n/a | 0 | n/a | 0 | 0.66 |

771 | Agricultural services | 0.581 | 0.797 | 0.4 | 0.585 | 1 | NaN | 0.66 |

442 | Structural products | 0.208 | NaN | 0.688 | 0.692 | 1 | NaN | 0.63 |

926 | Sporting services | 0.631 | 0.926 | n/a | 0 | n/a | n/a | 0.63 |

355 | Warships and associated parts | 0.892 | 0.611 | − 0.002 | 0 | 1 | NaN | 0.63 |

555 | Canteen and catering services | 0.835 | 0.963 | 0.543 | 0.86 | 0.473 | 0.853 | 0.62 |

430 | Machinery for mining, quarrying, construction equipment | − 0.161 | 0.055 | 1 | NaN | 1 | NaN | 0.61 |

425 | Cooling and ventilation equipment | n/a | 0 | 0.222 | 0.049 | 1 | NaN | 0.61 |

301 | Office machinery, equipment and supplies except computers, printers and furniture | 0.675 | 0.678 | 0.317 | 0.324 | 0.792 | 0.926 | 0.59 |

090 | Petroleum products, fuel, electricity and other sources of energy | 0.5 | 0.587 | 0.517 | 0.414 | 0.714 | 0.939 | 0.58 |

184 | Special clothing and accessories | n/a | 0 | 0.5 | NaN | n/a | 0 | 0.50 |

241 | Gases | 0 | n/a | n/a | 0 | 1 | NaN | 0.50 |

420 | Industrial machinery | 1 | NaN | n/a | n/a | 0 | n/a | 0.50 |

853 | Social work and related services | 1 | NaN | 0.353 | 0.385 | 0.139 | NaN | 0.50 |

151 | Animal products, meat and meat products | 0.246 | 0.551 | 0.747 | 0.994 | n/a | 0 | 0.50 |

339 | Post-mortem and mortuary equipment and supplies | n/a | n/a | 0.483 | 0.599 | n/a | n/a | 0.48 |

091 | Fuels | 0.505 | 0.629 | 0.314 | 0.263 | 0.626 | 0.607 | 0.48 |

381 | Navigational and meteorological instruments | n/a | n/a | n/a | 0 | 0.442 | NaN | 0.44 |

504 | Repair and maintenance services of medical and precision equipment | 0.313 | 0.243 | 0.379 | 0.249 | 0.528 | 0.76 | 0.41 |

300 | Office and computing machinery, equipment and supplies except furniture and software packages | 0.367 | 0.27 | 0.481 | 0.733 | 0.352 | 0.758 | 0.40 |

153 | Fruit, vegetables and related products | n/a | n/a | n/a | 0 | 0.387 | NaN | 0.39 |

152 | Prepared and preserved fish | 0.38 | 0.498 | n/a | n/a | n/a | 0 | 0.38 |

317 | Electronic, electromechanical and electrotechnical supplies | 0.374 | 0.312 | n/a | 0 | n/a | 0 | 0.37 |

323 | Television and radio receivers, and sound or video recording or reproducing apparatus | 0.339 | NaN | 0.193 | NaN | 0.581 | 0.702 | 0.37 |

601 | Road transport services | 0.214 | 0.171 | 0.266 | 0.135 | 0.622 | 0.673 | 0.37 |

604 | Air transport services | n/a | 0 | − 0.292 | 0.133 | 1 | NaN | 0.35 |

641 | Post and courier services | 0 | n/a | 0.045 | 0.009 | 1 | NaN | 0.35 |

150 | Food, beverages, tobacco and related products | 0.472 | 0.496 | 0.104 | 0.05 | 0.46 | 0.376 | 0.35 |

800 | Education and training services | 0.569 | NaN | 0.12 | 0.027 | n/a | 0 | 0.34 |

343 | Parts and accessories for vehicles and their engines | 0.314 | 0.977 | 0.113 | 0.052 | 0.605 | 0.652 | 0.34 |

386 | Optical instruments | 0 | n/a | 0 | 0 | 1 | NaN | 0.33 |

906 | Cleaning and sanitation services in urban or rural areas, and related services | 0.36 | 0.385 | 0.114 | 0.033 | 0.519 | 0.761 | 0.33 |

337 | Personal care products | − 0.199 | 0.09 | 0.181 | 0.193 | 1 | NaN | 0.33 |

158 | Miscellaneous food products | 0.42 | 0.354 | 0.046 | 0.007 | 0.512 | 0.528 | 0.33 |

488 | Information systems and servers | n/a | 0 | n/a | 0 | 0.326 | 0.348 | 0.33 |

034 | Forestry and logging products | n/a | n/a | n/a | 0 | 0.317 | NaN | 0.32 |

503 | Repair, maintenance and associated services related to personal computers, office equipment, telecommunications and audio-visual equipment | − 0.222 | NaN | 0.369 | NaN | 0.772 | 0.504 | 0.31 |

480 | Software package and information systems | 1.392 | 0.988 | − 0.49 | 0.413 | 0 | n/a | 0.30 |

909 | Cleaning and sanitation services | 0.224 | 0.1 | 0.054 | 0.014 | 0.563 | 0.577 | 0.28 |

642 | Telecommunications services | 1 | NaN | 0.369 | NaN | − 0.585 | NaN | 0.26 |

505 | Repair and maintenance services for pumps, valves, taps and metal containers and machinery | n/a | 0 | − 0.491 | 0.692 | 1 | NaN | 0.25 |

249 | Fine and various chemical products | − 0.139 | 0.265 | 0.465 | 0.414 | 0.429 | 0.429 | 0.25 |

316 | Electrical equipment and apparatus | 0.506 | 0.997 | − 0.171 | 0.074 | 0.415 | 0.99 | 0.25 |

432 | Earthmoving and excavating machinery, and associated parts | − 0.133 | 0.075 | − 0.022 | 0.002 | 0.9 | 0.912 | 0.25 |

380 | Laboratory, optical and precision equipments (excl. glasses) | 0.319 | 0.333 | 0.001 | 0 | 0.365 | 0.34 | 0.23 |

551 | Hotel services | n/a | 0 | n/a | n/a | 0.208 | NaN | 0.21 |

349 | Miscellaneous transport equipment and spare parts | − 0.125 | 0.045 | 0.161 | 0.109 | 0.532 | 0.567 | 0.19 |

341 | Motor vehicles | 0.186 | 0.079 | − 0.012 | 0 | 0.378 | 0.43 | 0.18 |

433 | Construction machinery and equipment | 0.367 | 0.27 | n/a | 0 | 0 | n/a | 0.18 |

302 | Computer equipment and supplies | − 0.344 | 0.305 | 0.236 | 0.277 | 0.658 | 0.667 | 0.18 |

501 | Repair, maintenance and associated services of vehicles and related equipment | 0.215 | 0.147 | − 0.208 | 0.169 | 0.539 | 0.653 | 0.18 |

722 | Software programming and consultancy services | 0.263 | 0.047 | − 0.148 | 0.187 | 0.419 | 0.211 | 0.18 |

331 | Medical equipments | 0.298 | 0.256 | − 0.063 | 0.014 | 0.298 | 0.182 | 0.18 |

389 | Miscellaneous evaluation or testing instruments | n/a | 0 | 0.15 | 0.436 | n/a | n/a | 0.15 |

093 | Electricity, heating, solar and nuclear energy | 0.368 | NaN | − 0.631 | NaN | 0.702 | NaN | 0.15 |

426 | Machine tools | n/a | n/a | 0.139 | NaN | n/a | n/a | 0.14 |

340 | Transport equipment and auxiliary products to transportation | − 0.151 | 0.093 | 0.14 | 0.42 | 0.397 | 0.565 | 0.13 |

507 | Repair and maintenance services of building installations | − 0.197 | 0.555 | 0.226 | 0.53 | 0.337 | 0.256 | 0.12 |

851 | Health services | n/a | n/a | n/a | 0 | 0.115 | NaN | 0.12 |

336 | Pharmaceutical products | 0.553 | 0.715 | − 0.639 | 0.467 | 0.428 | 0.467 | 0.11 |

244 | Fertilisers and nitrogen compounds | 0 | n/a | n/a | 0 | 0.226 | NaN | 0.11 |

330 | Medical equipments, pharmaceuticals and personal care products | n/a | 0 | − 0.381 | 0.497 | 0.606 | 0.673 | 0.11 |

196 | Leather, textile, rubber and plastic waste | n/a | n/a | 0.095 | 0.042 | n/a | 0 | 0.10 |

429 | Miscellaneous general and special− purpose machinery | − 0.396 | 0.314 | 0.182 | 0.049 | 0.471 | 0.988 | 0.09 |

142 | Sand and clay | 0.569 | NaN | − 1.322 | NaN | 1 | NaN | 0.08 |

383 | Measuring instruments | 0.414 | 0.407 | − 0.278 | 0.867 | n/a | 0 | 0.07 |

163 | Harvesting machinery | n/a | n/a | 0.052 | 0.006 | n/a | n/a | 0.05 |

751 | Administration services | n/a | n/a | 0 | n/a | 0.102 | NaN | 0.05 |

385 | Checking and testing apparatus | − 0.506 | 0.737 | 0.264 | 0.182 | 0.329 | 0.611 | 0.03 |

799 | Miscellaneous business and business-related services | 0.72 | 0.997 | − 1 | NaN | 0.337 | 0.256 | 0.02 |

446 | Tanks, reservoirs and containers; central-heating radiators and boilers | 0.333 | NaN | − 0.287 | 0.957 | 0 | n/a | 0.02 |

154 | Animal or vegetable oils and fats | n/a | 0 | 0.015 | 0.001 | n/a | 0 | 0.02 |

342 | Vehicle bodies, trailers or semi-trailers | 0 | n/a | n/a | 0 | n/a | 0 | 0.00 |

852 | Veterinary services | 1 | NaN | − 1 | NaN | n/a | 0 | 0.00 |

923 | Entertainment services | 0 | n/a | n/a | 0 | n/a | 0 | 0.00 |

553 | Restaurant and food-serving services | − 0.292 | 0.75 | − 0.17 | NaN | 0.394 | 0.316 | − 0.02 |

773 | Horticultural services | 0.547 | 0.622 | − 1.044 | 0.439 | 0.34 | 0.304 | − 0.05 |

384 | Instruments for checking physical characteristics | 0.241 | 0.193 | − 0.776 | 0.739 | 0.361 | 0.372 | − 0.06 |

311 | Electric motors, generators and transformers | n/a | 0 | − 0.161 | NaN | 0 | n/a | − 0.08 |

441 | Construction materials and associated items | − 0.589 | 0.72 | 0.17 | 0.056 | 0.142 | 0.031 | − 0.09 |

905 | Refuse and waste related services | 0.101 | 0.057 | − 0.831 | 0.903 | 0.451 | 0.366 | − 0.09 |

393 | Miscellaneous equipment | − 0.262 | NaN | 0.031 | 0.01 | n/a | n/a | − 0.12 |

375 | Games and toys; fairground amusements | − 0.214 | 0.395 | − 0.506 | 0.411 | 0.337 | 0.256 | − 0.13 |

500 | Repair and maintenance services | 0.25 | 0.144 | − 0.325 | 0.208 | − 0.341 | 0.297 | − 0.14 |

805 | Training services | 0.035 | 0.024 | − 1 | NaN | 0.492 | 0.362 | − 0.16 |

424 | Lifting and handling equipment and parts | n/a | 0 | − 0.734 | 0.538 | 0.411 | 0.574 | − 0.16 |

797 | Investigation and security services | − 0.106 | 0.07 | − 0.541 | 0.567 | − 0.048 | NaN | − 0.23 |

183 | Garments | n/a | n/a | − 0.234 | 0.611 | n/a | n/a | − 0.23 |

391 | Furniture | 0.066 | 0.008 | − 1.459 | NaN | 0.648 | 0.626 | − 0.25 |

324 | Networks | 0.023 | 0.002 | − 1.076 | 0.483 | 0.301 | NaN | − 0.25 |

452 | Works for complete or part construction and civil engineering work | 0.11 | 0.018 | − 1.45 | 0.859 | 0.579 | 0.465 | − 0.25 |

701 | Real estate services with own property | n/a | n/a | − 0.262 | NaN | n/a | n/a | − 0.26 |

325 | Telecommunications equipment and supplies | 0.208 | NaN | − 0.734 | 0.538 | n/a | 0 | − 0.26 |

453 | Building installation work | − 0.292 | NaN | n/a | 0 | n/a | 0 | − 0.29 |

506 | Repair and maintenance services of security and defence materials | n/a | n/a | 0.415 | NaN | − 1 | NaN | − 0.29 |

716 | Technical testing, analysis and consultancy services | 0 | n/a | − 0.585 | NaN | n/a | n/a | − 0.29 |

907 | Environmental services | − 0.737 | NaN | − 0.519 | 0.296 | 0.354 | NaN | − 0.30 |

502 | Repair, maintenance and associated services related to aircraft, railways, roads and marine equipment | − 0.485 | NaN | − 0.737 | NaN | 0.257 | 0.128 | − 0.32 |

315 | Lighting equipment and electric lamps | n/a | 0 | − 1 | NaN | 0.311 | 0.697 | − 0.34 |

713 | Engineering services | − 0.231 | 0.116 | − 1.16 | 0.658 | 0.357 | 0.187 | − 0.34 |

665 | Insurance and pension services | − 0.292 | NaN | − 1.585 | NaN | 0.631 | 0.926 | − 0.42 |

792 | Accounting, auditing and fiscal services | n/a | 0 | − 1.322 | NaN | 0.387 | NaN | − 0.47 |

322 | Transmission apparatus for radiotelephony, radiotelegraphy, radio broadcasting and television | − 0.585 | NaN | n/a | 0 | n/a | 0 | − 0.59 |

481 | Industry specific software package | − 0.585 | NaN | n/a | n/a | n/a | 0 | − 0.59 |

793 | Market and economic research; polling and statistics | − 0.179 | 0.074 | − 2.17 | NaN | 0.542 | NaN | − 0.60 |

794 | Business and management consultancy and related services | − 0.807 | NaN | − 1.374 | 0.965 | 0.267 | NaN | − 0.64 |

720 | IT services: consulting, software development, Internet and support | − 0.45 | 0.951 | − 1.044 | 0.75 | − 0.5 | 0.75 | − 0.66 |

904 | Sewage services | 0 | n/a | − 1.585 | NaN | n/a | 0 | − 0.79 |

356 | Military aircrafts, missiles and spacecrafts | n/a | n/a | n/a | 0 | − 1 | NaN | − 1.00 |

033 | Farming, hunting and fishing products | n/a | 0 | n/a | n/a | n/a | 0 | n/a |

161 | Agricultural and forestry machinery for soil preparation or cultivation | n/a | n/a | n/a | 0 | n/a | 0 | n/a |

166 | Specialist agricultural or forestry machinery | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

167 | Tractors | n/a | n/a | n/a | n/a | n/a | 0 | n/a |

182 | Outerwear | n/a | n/a | n/a | 0 | n/a | 0 | n/a |

192 | Textile fabrics and related items | n/a | n/a | n/a | n/a | n/a | 0 | n/a |

195 | Rubber and plastic materials | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

224 | Stamps, cheque forms, banknotes, stock certificates, trade advertising material, catalogues and manuals | n/a | 0 | n/a | 0 | n/a | n/a | n/a |

225 | Printing plates or cylinders or other media for use in printing | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

229 | Miscellaneous printed matter | n/a | n/a | n/a | n/a | n/a | 0 | n/a |

240 | Chemical products | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

246 | Explosives | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

313 | Insulated wire and cable | n/a | 0 | n/a | n/a | n/a | 0 | n/a |

344 | Motorcycles, bicycles and sidecars | n/a | 0 | n/a | 0 | n/a | n/a | n/a |

345 | Ships and boats | n/a | 0 | n/a | n/a | n/a | 0 | n/a |

346 | Railway and tramway locomotives and rolling stock and associated parts | n/a | n/a | n/a | n/a | n/a | 0 | n/a |

347 | Aircraft and spacecraft | n/a | 0 | n/a | 0 | n/a | 0 | n/a |

350 | Security, fire-fighting, police and defence equipment | n/a | n/a | n/a | 0 | n/a | n/a | n/a |

352 | Police equipment | n/a | n/a | n/a | n/a | n/a | 0 | n/a |

353 | Weapons, ammunition and associated parts | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

354 | Military vehicles and associated parts | n/a | n/a | n/a | n/a | n/a | 0 | n/a |

357 | Military electronic systems | n/a | n/a | n/a | n/a | n/a | 0 | n/a |

373 | Musical instruments and parts | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

388 | Industrial process control equipment and remote-control equipment | n/a | n/a | n/a | 0 | n/a | 0 | n/a |

395 | Textile articles | n/a | 0 | n/a | 0 | n/a | n/a | n/a |

410 | Collected and purified water | n/a | n/a | n/a | 0 | n/a | n/a | n/a |

422 | Machinery for food, beverage and tobacco processing and associated parts | n/a | n/a | n/a | 0 | n/a | n/a | n/a |

427 | Machinery for textile, apparel and leather production | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

436 | Parts of machinery for mining, quarrying and construction | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

440 | Construction structures and materials; auxiliary products to construction (except electric apparatus) | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

443 | Cable, wire and related products | n/a | 0 | n/a | 0 | n/a | 0 | n/a |

448 | Paints, varnishes and mastics | n/a | n/a | n/a | n/a | n/a | 0 | n/a |

450 | Construction work | n/a | 0 | n/a | 0 | n/a | 0 | n/a |

451 | Site preparation work | n/a | 0 | n/a | 0 | n/a | 0 | n/a |

454 | Building completion work | n/a | 0 | n/a | 0 | n/a | 0 | n/a |

455 | Hire of construction and civil engineering machinery and equipment with operator | n/a | 0 | n/a | n/a | n/a | 0 | n/a |

482 | Networking, Internet and intranet software package | n/a | 0 | n/a | n/a | n/a | 0 | n/a |

483 | Document creation, drawing, imaging, scheduling and productivity software package | n/a | n/a | n/a | 0 | n/a | 0 | n/a |

485 | Communication and multimedia software package | n/a | n/a | n/a | 0 | n/a | n/a | n/a |

486 | Database and operating software package | n/a | n/a | n/a | 0 | n/a | 0 | n/a |

508 | Miscellaneous repair and maintenance services | n/a | 0 | n/a | 0 | n/a | 0 | n/a |

511 | Installation services of electrical and mechanical equipment | n/a | n/a | n/a | 0 | n/a | 0 | n/a |

513 | Installation services of communications equipment | n/a | n/a | n/a | 0 | n/a | n/a | n/a |

516 | Installation services of computers and office equipment | n/a | 0 | n/a | 0 | n/a | n/a | n/a |

550 | Hotel, restaurant and retail trade services | n/a | 0 | n/a | n/a | n/a | n/a | n/a |

554 | Beverage-serving services | n/a | 0 | n/a | 0 | n/a | 0 | n/a |

606 | Water transport services | n/a | n/a | n/a | 0 | n/a | n/a | n/a |

635 | Travel agency, tour operator and tourist assistance services | n/a | 0 | n/a | n/a | n/a | 0 | n/a |

651 | Water distribution and related services | n/a | 0 | n/a | n/a | n/a | 0 | n/a |

653 | Electricity distribution and related services | n/a | 0 | n/a | n/a | n/a | n/a | n/a |