Abstract

This paper studies the interplay of integration into EU value chains and industrial development measured by labour productivity. We focus on the mediating role of domestic institutions compared to technological determinants for the distribution of the economic value generated along the European and global value chains. Our integration indicator measures value chain trade within the Single Market relative to global value chain networks. Using a simultaneous equation model, we find an overall positive effect of integration on labour productivity, which is driven by upstream integration. While the effect of productivity on integration is positive, it decreases with increasing productivity levels. Highly productive industries rather seek global value chain trade than regional integration. Better domestic institutions facilitate EU integration, although they favour industries with less complex product portfolios and lower levels of knowledge cumulativeness. This creates politically unwanted specialisation effects leading to an unequal distribution of the economic value generated.

Similar content being viewed by others

1 Introduction

The vastly asymmetric economic performance of EU Member States has put strain on the European Union (EU) as a whole. What used to be labelled a convergence engine (Gill & Raiser, 2012) seems to have stalled. The widely proposed remedy is to further regulatory harmonization facilitating deeper economic integration (Wolfmayr et al., 2019). Economically, this is a controversial approach.

Firstly, while a deep Regional Trade Agreement (RTA), such as the EU, can potentially contribute to improve the legal framework conditions for firms and industries by reducing inefficiencies its impact depends on member state institutions implementing and enforcing them. If the harmonization of rules is incomplete, hard to monitor or enforce, efforts for deeper integration may not lead to the desired convergence. Secondly, different economic forces such as technical progress, productivity or agglomeration economies need to be considered. They affect convergence and dispersion in both regional and global value chains.

The EU poses a viable setting to study such effects. A recent study shows that the economic crisis in the years 2008/2009 and beyond has left an uneven legacy along geographical fault lines (Eurofound, 2021). Central and eastern European countries have converged towards the leading north-western region economically by integrating more strongly, whereas southern Europe was increasingly left behind. At the same time a gap between high institutional quality in the north-west and low institutional quality in the South-East has persisted, such that economic integration did not translate into substantial convergence in terms of social and labor market outcomes.

This paper contributes to the understanding of the economic integration process inside the EU by taking a closer look at the interplay of differences in economic performance, technological specialization, as well as institutions and the integration into EU value chains. We paint a differentiated picture drawing on the quality of domestic institutions as policy measures, product complexity and knowledge cumulativeness as proxies for the knowledge content, and the enlargement of Central and Eastern European Countries in the 2000s.

We examine three research questions. Firstly, we study how the integration into the EU has affected sector level productivity in contrast to integration into global value chains. We distinguish between forward and backward integration to obtain a differentiated picture on the type of sectoral linkages. Secondly, we examine the effect of EU membership and domestic institutions on value chain integration. Eventually, we examine the contrasting role of technological factors and productivity as a driver of integration.

The results indicate that the upstream integration into the EU has a positive impact on the labor productivity of industries. However, we uncover a negative effect of forward integration into the EU on productivity. The propensity to integrate increases with productivity, but not linearly. The most productive industries rather integrate into global rather than regional value chains. Hence, the EU is not necessarily an environment where the most productive industries thrive. Finally, domestic institutions shape the integration process of both non-Member and Member States. Market-based domestic institutions favor the integration of industries with less complex product portfolios and lower levels of knowledge cumulativeness. This may be driven solely by the architecture of the Single Market, or it may indicate that the interplay of the EU with domestic institutions induces selection effects, which again may lead to unwanted specialization outcomes.

The main data source for this study is the WIOD database for the years 2000 to 2014 covering all 27 EU countries as well as a few non-EU countries. This data source has been matched to indicators of institutional quality from various sources as well as indicators capturing the technological sophistication of industries drawn from Eurostat or constructed from the BACI database on bilateral trade flows.

We make two contributions to the literature. First, we provide evidence on the mixed effects that EU integration has on economic performance. Second, we add to the economic literature on the effects of institutions and technological determinants on value chain integration.

2 Economic performance and the determinants of value chain participation

2.1 Value chain integration and productivity

The relationship between global value chain integration and productivity is highly endogenous. Value chain integration is an important driver of productivity. At the same time productivity is an important driver of trade participation and value chain integration.

This co-evolutionary pattern has contributed to increasingly dispersed supply chains over the past decades (Johnson, 2018; Timmer et al., 2014).

Looking at the impact of value chain integration on productivity first, several contributions highlight the positive impact of offshoring, i.e., the relocation of business activities to other countries, on productivity (Amiti & Wei, 2009; Castellani et al., 2015; Grossman & Rossi-Hansberg, 2008). Formai and Vergara Caffareli (2016) find that offshoring significantly increases sectoral productivity in countries that rely on global sourcing. Sourcing in long chains drives technology improvement whereas sourcing in wide chains leads to a reallocation of resources to more productive firms. Firm level studies also shed light on other potential channels through which the participation in global value chains translates into higher labor productivity. Trade and foreign affiliates are key drivers of productivity gains providing firms with greater access to better‐quality or more diversified imported inputs (Amiti & Konings, 2007; Goldberg et al., 2010; Görg et al., 2008).

Trade and value chain integration affect productivity also through learning effects. When firms enter international markets, they acquire new knowledge through the demands of new customers and adopt new production techniques which has a positive effect on productivity (Damijan et al., 2010; de Loecker, 2013). The literature has pointed to selection effects through trade, with more productive firms integrating into value chains. The increase of the market size comes with increased opportunities but also more intense competition that drives out less productive firms (Helpman et al., 2004, Melitz & Ottaviano, 2008). As the firm size distribution in trade follows a Pareto distribution (Chaney, 2008; Luttmer, 2007) trade is dominated by a few larger firms that decide simultaneously on the set of production locations, export markets, input sources, products to export, and inputs to import (Bernard et al., 2018). Productivity, as well as forward and backward integration into global value chains are therefore co-determined.

2.2 Integration into regional and global value chains

The participation in international value chains is driven by Ricardian productivity factors, factor endowments, and institutions (Chor, 2010). E.g., Costinot (2009) shows that educated workers and supporting institutions are complementary sources of comparative advantages in industries producing more complex products. Higher technological knowhow and a better educated workforce are associated with trade in more complex products. Several studies have reaffirmed the role of factor endowments showing that countries' relative endowments are informative of their patterns of trade (Debaere, 2003; Romalis, 2004). Finally, there is a vast body of literature showing that institutional quality of contracting and property rights, labor market regulations and the development of and access to financial markets have industry-specific effects on productivity and lead to comparative advantages which are key to trade participation and value chain integration (see Nunn & Trefler, 2014 for an overview).

However, global value chains operate at different geographical scales and there are centripetal and centrifugal forces (Baldwin, 2013; Venables, 1996) that either drive dispersion or agglomeration. On the one hand, technological progress and initial productivity levels are key factors driving dispersion (Amador & Cabral, 2016). On the other hand, high value-added tasks are likely to cluster in space under the presence of strong local complementarities (Baldwin & Venables, 2013) and this may favour trading relationships in regional value chains (Cingolani et al., 2018; Ravenhill, 2014).

While institutions contribute to the emergence of comparative advantages, they may also favor regional rather than global production networks especially through deep RTAs (Baldwin, 2011). Their particular importance lies in the fact that they typically go beyond tariff-based agreements for market access and cover a large set of policy areas both at and behind the border. Baldwin (2011) labels RTAs as ‘foreign factories for domestic reforms’. This underscores the importance of institutional and legal arrangements to assure property rights, rights of establishment and antitrust policies. Given the pervasive nature of deep RTAs impacting many policy areas, functioning national institutions translating the agreements into domestic legal norms are key (Ruta, 2017). Domestic institutions play a role in the process of value chain integration. First, institutions affect integration by moderating the national implementation of an RTA. This requires the adoption of new or the adjustment of existing regulations. Depending on the institutional set up and the quality of given domestic institutions, they will either tame or enhance their impact on value chain integration by favoring the development and maintenance of comparative advantages in some industries, while having little or sometimes even adverse effects on others.

To sum up, this literature shows that productivity, forward and backward integration in global value chains are co-determined. Integration itself is driven by comparative advantages and these depend on factor endowments, technological capabilities and institutions. The literature is less clear on whether the value chain integration takes place at more regional or global levels.

However, there are opposing forces at work that have so far not been systematically studied. Technical progress and technologically complex and sophisticated products seem to favor global value chain integration, whereas agglomeration economies and resulting trade complementarities and RTAs support regional value chain integration. So, whether deep RTAs foster global value chain integration as argued, for instance, by Laget et al. (2020) will depend on the specific characteristics of the institutions that interact both with the provisions of the RTAs and the technological characteristics. Institutions affect both comparative advantages and the quality and degree of integration in RTAs. Hence, they play a crucial role in determining the direction of this integration process. This has not previously been studied. Our paper examines this question by looking at the impact of EU accession and national institutions on the direction of value chain integration. We assess their importance relative to productivity and determinants of comparative advantages.

3 Data and indicators

We use multiple sources to construct indicators at the industry level measuring performance, industry characteristics and the extent of European market integration to address the research questions. In addition, we use indicators capturing the institutional characteristics of countries in which these industries operate.Footnote 1

Labor productivity is computed at the industry level using data on deflated value added per person employed provided by the WIOD database (base year 2010; WIOD deflators). The sample covers 54 sectors of all 27 current EU member countries, the United Kingdom, Norway and Switzerland between year 2000 and 2014.Footnote 2 We use labor productivity because it can be calculated in a straightforward fashion for a larger number of countries.Footnote 3 It is a single-factor productivity measure. To account for the sensitivity to changes of other inputs and relative factor prices, we control for technology and demand shocks at the sector level.

The measures of the forward and backward value chain integration into the EU have been computed at the industry level using WIOD. The indicators reflect the effective economic interrelations within the EU. These indicators have been proposed by Friesenbichler et al. (2021) to study the impact of European integration on producer prices, and have been constructed as follows: First, the difference between the value-added share of imported intermediate goods along the value chain from EU member countries and from non-EU countries is calculated, representing an industry’s backward integration into the Single Market. The higher the backward integration indicator, the greater the value-added content of foreign intermediates from the EU used in domestic production becomes. The benchmark is the value-added content of non-EU countries. Second, relying on a sector’s value added that is consumed abroad, a measure of forward integration is constructed. It is defined as the differences between the value-added share whose final use is in another EU Member State and whose final use is in an extra-EU country. If an industry’s final demand is in an EU Member States rather than in non-EU countries, the indicator is positive (see Appendix).

The analysis uses information about the national EU membership status that captures legal and institutional aspects that pave the way for economic integration. Following Böheim and Friesenbichler (2016), the indicator (Non-EU Member) is constructed as a binary variable. It captures the year in which the final step of accession takes place, i.e., after accession countries have implemented the Community Acquis and join the Single Market. Hence, the legal and institutional aspects of the Single Market can be considered in the analysis.

We argue that there is a two-pronged nexus between domestic institutions and integration in a regional trade bloc: first, through the transposition of RTA related provisions into domestic regulations and second, through comparative advantages. Following the literature (Nunn & Trefler, 2014), we use different measures for the quality of national institutions related to three dimensions: (1) contracting and property rights, (2) labor market regulations, and (3) development of and access to financial markets.

The first institutional indicator measures de jure and de facto aspects of the rule of law and is obtained from the World Bank’s Governance Indicators. It captures perceptions of the extent to which agents have confidence in and abide by society's rules (Kaufmann et al., 2011). It reflects the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence. Higher values indicate better institutions. Second, labor market regulation indicators by the Fraser Institute account for the presence of minimum wage setting, hiring and firing regulations, centralized collective bargaining, mandated cost of hiring, mandated cost of worker dismissal, working hours’ regulations and mandatory conscription (Gwartney et al., 2019). The components are weighted equally. High values designate labor markets determined by market forces rather than national regulations.

Third, we account for the functionality of financial markets by including information on financial resources provided to the private sector by banks.Footnote 4 The channels comprise loans, purchases of nonequity securities, and trade credits and other accounts receivable that establish a claim for repayment (Beck, 2003; Levine, 2005; Rajan & Zingales, 1998). Domestic credits to the private sector by banks as a proportion of GDP is obtained from the World Development Indicators database.

The EU-integration of an industry is co-determined by its comparative advantage, and the complementarity of its output to regional value chains. Hence, we use the standard Balassa index of revealed comparative advantage (Balassa, 1965) and a sectoral measure of trade complementarity based on the indicator developed for the country level by Michaely (1996) to control for the impact of specialization on forward and backward integration.Footnote 5 These measures are calculated for both the manufacturing and service sectors using WIOD data.

We use an indicator capturing the average complexity of the exported products approximating the sectoral specialization. Technological sophistication and the complexity of the involved transactions are potential factors of dispersion in value chain integration (Gereffi et al., 2005). We use the complexity measure by Klimek et al. (2012), which captures the technological and human capital intensity of the exporting sectors. The complexity scores have been calculated at the level of HS-6-digit product lines and were aggregated at the sector level using the export share of the product line, which was calculated using the BACI database (Gaulier & Zignago, 2010).

Labor productivity can be criticized as a measure of economic performance. It is a single-factor productivity measure which is sensitive to changes in the excluded inputs and relative factor prices. It is confounded by changes in technology and the degree of capacity utilization and factor accumulation (Bernard & Jones, 1996; Syverson, 2011). We use multiple control variables to account for potential bias. Using the WIOD data on hours worked and deflated value added at the sector level, we first calculate sectoral technology and demand shocks following the approach proposed by Hölzl and Reinstaller (2007). Studies have shown that these productivity shocks are genuinely autonomous and technology-driven productivity advances (Alexius & Carlsson, 2005; Francis & Ramey, 2005). Similarly, output changes induced by (cyclical) fluctuations in demand for the domestic production allows controlling for variations in labor productivity induced by changes in capacity utilization.

Moreover, we use sectoral Eurostat data on business expenditures on research and development (BERD) as a percentage of GDP and the share of employees with tertiary education in the total number of persons employed to control for a sector’s knowledge intensity. We also include the amount of investments per person employed from the SBS database by Eurostat to include a proxy for capital.

4 Empirical strategy

We use a simultaneous system of equations to address the research questions due to the simultaneous nature of productivity as both a potential driver and an outcome of value chain integration. We estimate (1) the relationship between labor productivity and economic integration along the (regional) value chain, and (2) the role of national institutions on the integration process. Using the forward and backward integration indicators allows us to (3) differentiate between the effects of upstream and downstream integration in regional value chains compared to global ones. The following three equations are estimated simultaneously using a three-stage least square estimator accounting for endogenous variables and allowing for correlation of disturbance terms from different equations.

with \({\varepsilon }_{ijtk}\) being a random error term such that \(\mathrm{\rm E}[ {\varepsilon }_{ijtk}{\varepsilon }_{ijto}]={\sigma }_{ko}\) where k and o indicate the equation number. While equation (I) focuses on competitiveness measured by labor productivity, \({\mathrm{LP}}_{\mathrm{ijt}}\), which varies over countries i and industries j and year t, equations (II) and (III) describe the level forward and backward integration into the Single Market, \({\mathrm{FI}}_{\mathrm{ijt}}\) and \({\mathrm{BI}}_{\mathrm{ijt}}\) respectively. \({\mathrm{LP}}_{\mathrm{ijt}}\), \({\mathrm{FI}}_{\mathrm{ijt}}\) and \({\mathrm{BI}}_{\mathrm{ijt}}\) are endogenous to the system.

We use equation (I) to test the first research question, asking how value chain integration into a regional trade bloc affects sector level labor productivity. Previous literature reports mixed effects on productivity of forward and backward integration into the Single Market. A positive sign of \({\upbeta }_{1}\) and \({\upbeta }_{2}\) would indicate a reduction in transaction costs due to the Common Market, while a negative sign would indicate that technology, quality and efficiency improvements from global sourcing outweigh the positive effects of the regional trade agreement. \({\mathrm{X}}_{\mathrm{ijt}}\) is a vector of exogeneous control variables in the productivity equation. We expect a positive impact of business expenditure on R&D, investment and the share of tertiary educated on industry-level productivity. Technology and demand shocks should correlate positively with productivity. All three equations include industry and time fixed effects, \({\lambda }_{j}\) and \({\tau }_{t}\), controlling for unobserved variation at the sector level and over time.

Equation (II) and (III) consider integration as the outcome of both the comparative advantages and competitiveness measured by labor productivity and the institutional environment. In this model, the trade-related integration indicators \({\mathrm{FI}}_{\mathrm{ijt}}\) and \({\mathrm{BI}}_{\mathrm{ijt}}\) are affected by labor productivity and legal or institutional aspects. Yet, the level of competitiveness could affect integration into the Single Market in a non-linear manner. E.g., more productive firms might source internationally while less productive firms, lacking capabilities, source regionally (Altomonte & Ottaviano, 2011).Footnote 6 To account for the process of integration at different levels of competitiveness, we include both the sector level-productivity, \({\mathrm{LP}}_{\mathrm{ijt}}\), as well as its squared value, \({\text{LP}}_{\mathrm{ijt}}^{2}\), in the equations (II) to (III). A self-selection of more productive firms being active in the global value chain (in contrast to regional sourcing) should be reflected on the aggregate industry level. Thus, the regression model allows for non-linear effects of labor productivity on integration into the Single Market.

National institutions are measured by the quality of contract enforcement and property rights, i.e., the rule of law (\({\mathrm{ROL}}_{\mathrm{it}}\)), labor market regulations (\({\mathrm{LMR}}_{\mathrm{it}}\)) and a measure of financial intermediaries’ development, such as the amount of credits given by banks to the private sector (\({\mathrm{Credit}}_{\mathrm{it}}\)). Certainly, the measures for the institutional framework only vary between countries and over time. To account for the role of the supranational legal framework driving the economic integration into the Single market, the binary variable \(non{\mathrm{EU }}_{\mathrm{it}}\) is included. It takes on the value of one in the years in which a country was not an official EU Member State, and zero otherwise. Not being an official EU Member State implies that a country is not (yet) required to fully implement the Acquis Communautaire.

\({M}_{ijt}\) is a vector of control variables that includes a sector's comparative advantage of a given country, implicitly capturing the complementarity of the output to regional value chains. Theory suggests that a country whose industrial structure resembles that of other Member States should be able to integrate easily into the Single Market. The expected effects of high revealed comparative advantages on regional value chain integration are ambiguous, however. On the one hand, we would expect a country’s most efficient sectors or those with unique capabilities or resources to be more likely to be active globally and thus more integrated into global value chains. On the other hand, a sector that produces with relative lower marginal costs might easily find customers within a regional trade block. Buyers will benefit from lower production costs over and above lower transfer costs.

In a second step, interaction terms between the EU membership dummy and the measures of the domestic institutional quality are included in equations (II) and (III). These capture the role of EU membership on national institutions, which again affect the integration into the Single Market. Finally, we control for different moderating effects of national institutions on integration depending on the complexity of a sector’s product portfolio.Footnote 7 Low-tech and less sophisticated production is expected to rather occur within the EU. However, these effects might be shaped by national institutions, like labor market regulations.Footnote 8

5 Results

We present the regression results of the system of equations in Table 1 excluding (SEM 1 and SEM 3) and including (SEM 2 and SEM 4) controls for RCA and trade complementarity in the integration equations.Footnote 9 The results of equation (I) show that forward integration into the Single Market negatively affects productivity, while backward integration is positively related to productivity. Both coefficients are significant in all specifications. All other control variables’ coefficients show the expected signs. The higher the share of employees with tertiary education, investments per person employed, and business expenditures in R&D the higher is industry-level productivity. Technology and demand shocks have a positive impact on labor productivity. However, the coefficients of demand shocks are not significant. The regression results of equation (I) is robust to other specifications.

Next, the regression results of equation (IIa) in column SEM 1 reveal that an industry’s level of productivity has a positive and significant impact on forward integration into the Single Market. However, the effect decreases with increasing productivity as indicated by the negative and significant coefficient of \({\text{LP}}_{\mathrm{ijt}}^{2}\). These relations are robust in all SEM regressions.

The results for the effects of domestic institutions on integrations are mixed. The coefficient of Rule of Law is positive and significant in SEM 1, but it turns negative when RCA and trade complementarity are introduced (SEM 2). The coefficients of labor market restrictions are positive and significant in all specifications. The more a labor market is shaped by market forces rather than regulations the higher the level of forward integration becomes. In contrast, the higher the share of domestic credit to the private sector by banks in GDP the lower the forward integration into the Single Market is. This result is robust in all specifications.

Finally, the coefficient of non-EU membership (i.e., countries that hold accession candidate status prior to full EU membership) is positive and significant when controlled for a sector’s RCA and trade complementarity (SEM 2). The results for backward integration (equation IIIa) reflect the results from equation (IIa) in SEM1. Yet, the indicator for labor market restrictions (\({\mathrm{LMR}}_{\mathrm{it}}\)) loses its significance. The quality of national institutions has a robust positive impact on backward integration. The coefficient of Rule of Law is significantly positive in all specifications. The RCA itself has a statistically significant and negative impact on forward integration. This suggests that with increasing national comparative advantages sectors become less integrated regionally, but rather globally. The coefficient of a sector’s trade complementarity is not significantly different from zero in most specifications.

The regression results of equations (IIb) and (IIIb) in column SEM 3 and SEM 4 provide a differentiated picture of the impact of national institutions and EU membership on economic integration into the Single Market. The negative coefficient of the interaction term ‘ROL*Non-EU member’ in equation (IIIb) indicates that the positive effect of high-quality institutions on backward integration is dampened for non-EU countries. In contrast, when controlling for a sector’s RCA and trade complementarity, the net effect of Rule of Law on forward integration is significantly positive for non-EU members, while for Member States the effect remains negative, though weak. Furthermore, the impact of RCA on backward integration is now significantly positive, suggesting that with increasing RCA sectors increase their sourcing activities in regional value chains.

Table 2 reports the results for the manufacturing sector only, where a more specific indicator on technological specialization can be used. Over and above RCA and trade complementarity, we use complexity to capture the impact of specialization on integration. The indicator captures the depth and breadth of the knowledge base needed to produce the sectoral output.

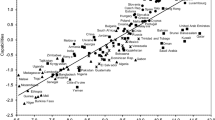

Columns SEM 1 and SEM 2 in Table 2 show that the overall effect of ‘complexity’ on forward and backward integration in (IIc) and (IIIc) is significantly different from zero and negative. Industries characterized by more sophisticated and high-tech product portfolios are less integrated in the Single Market but tend to source and sell globally. This holds when we control for the sectoral trade complementarity and RCA. Columns SEM 3 and SEM 4 provide more insights into the interaction of the degree of complexity of industries, institutions, and their impact on integration processes. Complexity has a positive impact on forward and on backward integration, which is dampened and even superposed by national institutions, particularly labor market flexibility. The more complex the industry’s product portfolio and the more flexible the domestic labor market are the less integrated the industry is.

Reducing the sample to manufacturing only and controlling for the complexity of an industry’s product portfolio, we find a significantly positive impact of non-EU membership on forward integration. This is robust in all specifications and supports the idea of strong trade relations preceding EU accession. Access to financial markets has no significant impact on the degree of backward integration, while it remains important for forward integration. By construction, the complexity indicator is correlated with RCA, which explains the loss of significance of the coefficient of RCA. The remaining regression results are robust and comparable to the results for the total economy presented in Table 1.

6 Discussion

The results for the forward and backward integration into the European Union show an interesting pattern. From the literature review in Sect. 2 we would expect that firms in the most productive sectors predominantly source their inputs and their markets globally. We should therefore expect to see a negative association between our forward and backward integration measures and the sectoral labor productivity. The results show that while forward integration has a negative impact on sectoral productivity, we observe a positive effect for backward integration. The latter is considerably larger than the former. Given the value-chain trade structures in which downstream integration plays a bigger role than forward linkages (see descriptive statistics in the Appendix), this implies that integration into the EU as a regional trade bloc has an overall positive effect on productivity.

Looking at the backward linkages first, prior research shows that trade in imported inputs has a positive impact on firm level performance and that particularly trade liberalization has a positive effect on the performance of importing firms (Amiti & Konings, 2007; Halpern et al., 2015; Kasahara & Rodrigue, 2008; Ramanarayanan, 2020). Our results imply that industries integrating into the EU reap the benefits of integration mostly through backward integration into that region.

Forward linkages in turn exert the opposite effect on productivity, even though of considerably smaller magnitude. There may be two possible reasons for this. The first is that firms in the most productive sectors defy “gravity” (Martin & Mayneris, 2015). Firms in these sectors are able to overcome more easily constraints associated with more remote but possibly highly profitable markets such as language or regulatory barriers, and they will in particular do so, if the markets outside the regional trade agreement are more profitable. Which leads to the second reason for the negative association between productivity and forward integration.

This finding may be related to inefficiencies and market distortions related to the Single Market cumulate downstream markets in the EU. It is in line with the results reported by Friesenbichler et al. (2021) who, using identical indicators for forward and backward integration as the ones presently used, show that forward integration into the EU increases producer prices whereas backward integration decreases them.

This would support the view that coordination problems within deep RTAs can lead to efficiency losses within the common market (Jorzik & Mueller-Langer, 2020), which in turn will induce firms in the most productive sectors to select markets outside the RTA. The interests of RTA members are likely to be aligned with respect to the rules governing the trade bloc's relationship with outside markets, but not necessarily the internal market. To protect domestic industries, RTA members have an incentive to deviate from the treaty, especially in domains where the direct enforcement of the treaty is difficult. This may result in weaknesses in the legal and practical implementation of the RTA, including the monitoring and enforcement of the rules. The elimination of the lacking harmonization of rules and regulations in the EU Single Market could result in intra-EU trade effects of up to + 7.6% (Wolfmayr et al., 2019).

For instance, deviations from RTA rules are reflected in national product norms, safety regulations or phytosanitary standards (Blind et al., 2018). Hence, market access within the trade bloc comes with compliance costs that may act as entry barriers, which affects the goods consumed within the EU (Dallas et al., 2019). Thus, the inefficiencies arising from market distortions caused by national deviations from EU rules propagate downstream. Even though forward integration may have negative effects, industries still have an incentive to integrate, because its benefits are largely reaped through backward integration.

The results for the equations with forward and backward integration as dependent variables shed further light on these linkages. For the factors driving integration into the RTA we observe a positive, but concave relationship with an industry’s productivity level. The level of forward and backward integration of industries increases with productivity. However, for the most productive industries, trade distance and the market size of nearby trading partner are less important both as a constraint and a necessary criterion for market selection. As shown by the literature reviewed in Sect. 2, more productive firms and industries increasingly source inputs and seek business opportunities globally. However, the individual mechanisms of how productivity and forward and backward integration into the RTA are interconnected can only be clarified empirically using firm-level data. This remains an open research questions for the future.

Technological sophistication, the quality of domestic institutions and the extent to which they are market based seem to play a role in explaining the observed relation between productivity and forward and backward integration. For the manufacturing industries, a higher product complexity score, which implies a higher degree of technological sophistication, is negatively related to both forward and backward integration. Hence, producers of complex products tend to integrate into global rather than regional value chains. This indicates that the regional market is either less attractive for both sourcing input and selling final products, or that the institutional set up of the RTA does not favor these sectors.

The results show that not being an EU member has a weakly positive effect on forward integration, especially for manufacturing industries. While the opposite sign for the coefficient might be expected, the finding is plausible given that EU accession, like acceding most deep RTAs, is a long and gradual process in which lead structures in institutional reforms have been documented. Accession countries are required to implement the Acquis Communautaire, the accumulated legislation, legal acts and court decisions that constitute the body of European Union law. This implies domestic reforms and legal provisions to become part of the EU before becoming an actual member. The incentive structure after the accession changes insofar that, ceteris paribus, post-accession compliance with EU law is likely to deteriorate which hampers deeper integration. Once countries have joined, reform efforts may slow down leading to a partial reversal of value chain integration (Berglof, 2013).

The accession process might entail preceding treaties affecting the legacy of value chain structures. Agreements like the Pan-European Cumulation System (PECS) have favored integration into the Common Market through the adoption of common rules of origin, allowing regional cumulation to occur as early as 1997. Afterwards, EU producers have increasingly sourced inputs from industries in Central and Eastern Europe, thereby promoting their forward integration into the EU (Kaminski & Ng, 2005; Marin, 2006).

The role of domestic institutions in the value chain integration process is multifaceted as the literature review would suggest. We find that forward integration into the EU is less attractive for knowledge intensive industries with high levels of knowledge cumulativeness. The estimated elasticities of the domestic labor market institutions have by far the largest impact on forward and backward integration, especially in manufacturing industries. The general effect is positive, suggesting that industries located in countries with more flexible, less regulated labor markets integrate more deeply with respect to both backward and forward linkages. The literature on the relationship between labor market institutions and trade suggests that employment protection and stable industrial relations support the constitution of industry-specific cumulative knowledge bases. This supports the development of comparative advantages in sectors with complex product portfolios and greater export volatility (Bassanini & Ernst, 2002; Costinot, 2009; Cuñat & Melitz, 2010; Tang, 2012).

Reversely, our results imply that the integration into EU value chains rather favors industries with less complex product portfolios and a lower degree of knowledge cumulativeness. However, examining this effect separately for member- and non-member countries shows a more differentiated outcome. For industries within the EU, market-based labor markets are an important driver of both forward and backward integration. However, for industries in extra-EU countries, the degree of labor market flexibility has no significant effect on value chain integration.

More market-based domestic labor market institutions have an adverse effect on manufacturing sectors producing more complex products. We analyze the relationship between sector’s product complexity and the integration into the Single Market, while controlling for the degree of labor market flexibility. The results indicate a positive baseline effect of complexity on both forward and backward integration. However, this effect is strongly attenuated for manufacturing industries in countries with more market-based domestic labor market institutions. Hence, while flexible labor markets favor integration into EU value chains, they adversely affect the regional integration of more technology intense manufacturing sectors.

The rule of law is important for the domestic implementation of the Acquis Communautaire. Imperfectly enforced contracting and property rights entail higher costs and uncertainty (Anderson & Marcouiller, 2002). This is particularly important for industries which rely on relationship-specific investments or which are characterized by a complex product portfolio, high job task complexity, high levels of intangible investments and high technology intensity (Antràs & Chor, 2013; Chor, 2010; Levchenko, 2007; Nunn, 2007). If low-tech industries integrate into the EU, one would expect a relatively weak impact of this indicator on forward or backward integration, while the opposite is expected for high-tech industries. Hence, the integration of industries with different technological intensities is likely to induce heterogeneous effects.

Our results suggest that the heterogeneity may be related to different effects of the rule of law on forward and backward integration. We find a positive effect of the indicator on backward integration. This effect is dampened for industries in countries which were not (yet) Member States. Hence, the effect of the rule of law on backward integration mostly matters for EU Member States. The results are more ambiguous for its impact on forward integration, especially when controlling for the comparative advantage of an industry. Generally, the effects point into the opposite direction as those for backward integration.

The results for the financial development indicator show that industries located in countries where banks provide a higher share of domestic credit to the private sector tend to be less integrated into the Single Market. This particularly holds for less forward integrated industries. Integration into the EU was less attractive for industries in countries with more developed financial markets. EU integration may therefore select against industries and companies that are relatively more dependent on external financing, i.e. with larger capital expenditures relative to cash flow from operations (Beck, 2003; Chor, 2010; Svaleryd & Vlachos, 2005).

Excluding Portugal, Italy, Greece, Spain, and Ireland to account for the potential effects of the run up to the financial crisis 2008/09 does not change the results for labor market institutions. Industries with a high cumulative knowledge are typically capital intensive. Integration into EU value chains is more likely when industries produce less complex products with a lower degree of knowledge cumulativeness. Both interaction terms point into the same direction, i.e., this is not driven by the level of institutional development of the accession countries.

7 Conclusions

We have explored if value chain integration can help explain the unequal distribution of the economic value generated in the EU. The results presented in this paper show that the integration into EU value chains has, on average, a positive impact on economic performance. Yet, underneath the surface the effects of integration are multifaceted.

On the one hand, our results suggest that market inefficiencies cumulate along downstream value chains impacting negatively on productivity. This issue has been recognized by the European Commission, which has called for a completion of the Single Market in several policy communications over the past years. On the other hand, our results suggest that the Single Market favors the integration of low-cost industries with less complex product portfolios and lower levels of knowledge cumulativeness, while reducing the propensity of the most productive industries to integrate into the regional trade bloc.

Value chain integration is shaped by national institutions, pointing at the crucial role of public policies (Kaplinsky, 2000). Differences between Southern Europe and the rest of the EU become evident. Integration is fostered by flexible labor market regimes, sound legal institutions and contract enforcement, especially for upstream supplier relationships. This set-up of the EU relates to the knowledge content of economic activities. It promotes the integration of industries with less complex product portfolios and lower levels of knowledge cumulativeness. Hence, it promotes low-cost production in lower cost, catching-up economies of Central and Eastern Europe. This has adverse effects on the EU’s overall performance. This could be driven by the characteristics of the EU and the architecture of the Single Market institutions. Yet, it may also be the result of the interplay of the regional trade agreement’s framework with domestic institutions giving rise to unwanted outcomes.

Notes

Table 1 in the Online Appendix presents an overview of the dependent variables as well as of all explanatory variables included in the subsequent regressions and related descriptive statistics.

Thus, the sample includes ‘old’ EU members, non-EU countries as well as countries that switched their membership status during the observation period.

The literature critical of the use of total factor productivity derived using aggregate production functions should not go unmentioned (Felipe & Fisher, 2003).

That is deposit taking corporations except central banks.

See the Online Appendix details on the calculation of the sectoral trade complementarity index. Note that the higher the trade complementarity index the more similar is a country to the other EU Member States.

While this explanation of the potential endogeneity between market integration and productivity refers to micro-economic processes, it is plausible that it is also applicable to the industry level, because the sector data are weighted averages of company level data.

We thereby restrict the sample to the manufacturing sector.

Multiple robustness checks (limited country sample, 2SLS) support our main results (see Online Appendix).

The first stages pass the Kleibergen-Paap rank LM statistic (for underidentification), the Kleibergen-Paap rank and the Cragg-Donald Wald F statistic (for weak identification).

References

Alexius, A., & Carlsson, M. (2005). Measures of technology and the business cycle. Review of Economics and Statistics, 87(2), 299–307. https://doi.org/10.1162/0034653053970285

Altomonte, C., & Ottaviano, G. I. (2011). The role of international production sharing in EU productivity and competitiveness. European Investment Bank Papers, 16(1), 62–89.

Amador, J., & Cabral, S. (2016). Global value chains: A survey of drivers and measures. Journal of Economic Surveys, 30(2), 278–301. https://doi.org/10.1111/joes.12097

Amiti, M., & Konings, J. (2007). Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. American Economic Review, 97(5), 1611–1638.

Amiti, M., & Wei, S. J. (2009). Service offshoring and productivity: Evidence from the US. World Economy, 32(2), 203–220.

Anderson, J. E., & Marcouiller, D. (2002). Insecurity and the pattern of trade: An empirical investigation. Review of Economics and Statistics, 84(2), 342–352.

Antràs, P., & Chor, D. (2013). Organizing the global value chain. Econometrica, 81(6), 2127–2204. https://doi.org/10.3982/ECTA10813

Balassa, B. (1965). Trade liberalisation and “revealed” comparative advantage 1. The Manchester School, 33(2), 99–123.

Baldwin, R. (2011). Trade and industrialisation after globalisation’s 2nd unbundling: How building and joining a supply chain are different and why it matters (No. 0898–2937). National Bureau of Economic Research.

Baldwin, R. (2013). Global supply chains: Why they emerged, why they matter, and where they are going. In D. K. Elms & P. Low (Eds.), Global value chains in a changing world (pp. 13–59). World Trade Organization (WTO).

Baldwin, R., & Venables, A. J. (2013). Spiders and snakes: Offshoring and agglomeration in the global economy. Journal of International Economics, 90(2), 245–254.

Bassanini, A., & Ernst, E. (2002). Labour market regulation, industrial relations and technological regimes: A tale of comparative advantage. Industrial and Corporate Change, 11(3), 391–426.

Beck, T. (2003). Financial dependence and international trade. Review of International Economics, 11(2), 296–316.

Berglof, E. (2013). Stuck in transition? (Transition Report). European Bank for Reconstruction and Development.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2018). Global firms. Journal of Economic Literature, 56(2), 565–619.

Bernard, A. B., & Jones, C. I. (1996). Comparing apples to oranges: Productivity convergence and measurement across industries and countries. The American Economic Review, 86(5), 1216–1238.

Blind, K., Mangelsdorf, A., Niebel, C., & Ramel, F. (2018). Standards in the global value chains of the European Single Market. Review of International Political Economy, 25(1), 28–48.

Böheim, M., & Friesenbichler, K. (2016). Exporting the competition policy regime of the European Union: Success or failure? Empirical evidence for acceding countries. JCMS: Journal of Common Market Studies, 54(3), 569–582. https://doi.org/10.1111/jcms.1232

Castellani, D., Mancusi, M. L., Santangelo, G. D., & Zanfei, A. (2015). Exploring the links between offshoring and innovation. Journal of Industrial and Business Economics, 42, 1–7.

Chaney, T. (2008). Distorted gravity: The intensive and extensive margins of international trade. American Economic Review, 98(4), 1707–1721.

Chor, D. (2010). Unpacking sources of comparative advantage: A quantitative approach. Journal of International Economics, 82(2), 152–167.

Cingolani, I., Iapadre, L., & Tajoli, L. (2018). International production networks and the world trade structure. International Economics, 153, 11–33. https://doi.org/10.1016/j.inteco.2017.10.002

Costinot, A. (2009). On the origins of comparative advantage. Journal of International Economics, 77(2), 255–264.

Cuñat, A., & Melitz, M. J. (2010). A many-country, many-good model of labor market rigidities as a source of comparative advantage. Journal of the European Economic Association, 8(2–3), 434–441.

Dallas, M. P., Ponte, S., & Sturgeon, T. J. (2019). Power in global value chains. Review of International Political Economy, 26(4), 666–694.

Damijan, P. J., Kostevc, C., & Polanec, S. (2010). From innovation to exporting or vice versa. The World Economy, 33(3), 374–398. https://doi.org/10.1111/j.1467-9701.2010.01260.x

De Loecker, J. (2013). Detecting learning by exporting. American Economic Journal: Microeconomics, 5(3), 1–21.

Debaere, P. (2003). Relative factor abundance and trade. Journal of Political Economy, 111, 589–610.

Eurofound. (2021). Monitoring convergence in the European Union: Looking backwards to move forward—Upward convergence through crises. Challenges and prospects in the EU series. Luxembourg: Publications Office of the European Union.

Felipe, J., & Fisher, F. M. (2003). Aggregation in production functions: What applied economists should know. Metroeconomica, 54(2–3), 208–262.

Formai, S., & Vergara Caffarelli, F. (2016). Quantifying the productivity effects of global sourcing. Bank of Italy Temi Di Discussione (Working Paper) No, 1075.

Francis, N., & Ramey, V. A. (2005). Is the technology-driven real business cycle hypothesis dead? Shocks and aggregate fluctuations revisited. Journal of Monetary Economics, 52(8), 1379–1399.

Friesenbichler, K. S., Kuegler, A., & Reinstaller, A. (2021). Does value chain integration dampen producer price developments? Evidence from the European Union. The World Economy, 44(1), 89–106.

Gaulier, G., & Zignago, S. (2010). BACI: International trade database at the product-level. The 1994–2007 Version. 2010–2023.

Gereffi, G., Humphrey, J., & Sturgeon, T. (2005). The governance of global value chains. Review of International Political Economy, 12(1), 78–104.

Gill, I. S., & Raiser, M. (2012). Golden growth: Restoring the lustre of the European economic model. World Bank Publications.

Goldberg, P. K., Khandelwal, A. K., Pavcnik, N., & Topalova, P. (2010). Imported intermediate inputs and domestic product growth: Evidence from India. The Quarterly Journal of Economics, 125(4), 1727–1767.

Görg, H., Hanley, A., & Strobl, E. (2008). Productivity effects of international outsourcing: Evidence from plant-level data. Canadian Journal of Economics, 41(2), 670–688.

Grossman, G. M., & Rossi-Hansberg, E. (2008). Trading tasks: A simple theory of offshoring. American Economic Review, 98, 1978–1997.

Gwartney, J., Lawson, R., Hall, J., & Murphy, R. (2019). Economic freedom of the world: 2019 Annual report. Fraser Institute.

Halpern, L., Koren, M., & Szeidl, A. (2015). Imported inputs and productivity. American Economic Review, 105(12), 3660–3703.

Helpman, E., Melitz, M. J., & Yeaple, S. R. (2004). Export versus FDI with heterogeneous firms. American Economic Review, 94(1), 300–316. https://doi.org/10.1257/000282804322970814

Hölzl, W., & Reinstaller, A. (2007). The impact of productivity and demand shocks on structural dynamics: Evidence from Austrian manufacturing. Structural Change and Economic Dynamics, 18(2), 145–166.

Johnson, R. C. (2018). Measuring global value chains. Annual Review of Economics, 10(1), 207–236.

Jorzik, N., & Mueller-Langer, F. (2020). Multilateral stability and efficiency of trade agreements: A network formation approach. The World Economy, 43(2), 355–370.

Kaminski, B., & Ng, F. (2005). Production disintegration and integration of Central Europe into global markets. International Review of Economics and Finance, 14(3), 377–390.

Kaplinsky, R. (2000). Globalisation and unequalisation: What can be learned from value chain analysis? Journal of Development Studies, 37(2), 117–146.

Kasahara, H., & Rodrigue, J. (2008). Does the use of imported intermediates increase productivity? Plant-level evidence. Journal of Development Economics, 87(1), 106–118. https://doi.org/10.1016/j.jdeveco.2007.12.008

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2011). The worldwide governance indicators: Methodology and analytical issues. Hague Journal on the Rule of Law, 3(2), 220–246.

Klimek, P., Hausmann, R., & Thurner, S. (2012). Empirical confirmation of creative destruction from world trade data. PLoS ONE, 7(6), e38924.

Laget, E., Osnago, A., Rocha, N., & Ruta, M. (2020). Deep trade agreements and global value chains. Review of Industrial Organization, 57(2), 379–410.

Levchenko, A. A. (2007). Institutional quality and international trade. The Review of Economic Studies, 74(3), 791–819.

Levine, R. (2005). Finance and growth: Theory and evidence. Handbook of Economic Growth, 1, 865–934.

Luttmer, E. G. J. (2007). Selection, growth, and the size distribution of firms. Quarterly Journal of Economics, 122(3), 1103–1144.

Marin, D. (2006). A new international division of labor in Europe: Outsourcing and offshoring to Eastern Europe. Journal of the European Economic Association, 4(2–3), 612–622. https://doi.org/10.1162/jeea.2006.4.2-3.612

Martin J., Mayneris F., (2015). High-End Variety Exporters Defying Gravity: Micro Facts and Aggregate Implications. Journal of International Economics, 96(1), 55–71.Melitz, M. J., & Ottaviano, G. I. (2008). Market size, trade, and productivity. The Review of Economic Studies, 75(1), 295–316.

Melitz, M. J., & Ottaviano, G. I. (2008). Market size, trade, and productivity. The Review of Economic Studies, 75(1), 295–316.

Michaely, M. (1996). Trade preferential agreements in Latin America: An ex-ante assessment (no. 1583). World bank policy research working papers. World Bank Publications.

Nunn, N. (2007). Relationship-specificity, incomplete contracts, and the pattern of trade. The Quarterly Journal of Economics, 122, 569–600.

Nunn, N., & Trefler, D. (2014). Domestic institutions as a source of comparative advantage. In G. Gopinath, E. Helpman, & K. Rogoff (Eds.), Handbook of international economics (Vol. 4, pp. 263–315). Elsevier.

Rajan, R. G., & Zingales, L. (1998). Financial dependence and growth. The American Economic Review, 88, 559–586.

Ramanarayanan, A. (2020). Imported inputs and the gains from trade. Journal of International Economics, 122, 103260. https://doi.org/10.1016/j.jinteco.2019.103260

Ravenhill, J. (2014). Global value chains and development. Review of International Political Economy, 21(1), 264–274.

Romalis, J. (2004). Factor proportions and the structure of commodity trade. The American Economic Review, 94(1), 67–97.

Ruta, M. (2017). Preferential trade agreements and global value chains: Theory, evidence, and open questions. The World Bank.

Svaleryd, H., & Vlachos, J. (2005). Financial markets, the pattern of industrial specialization and comparative advantage: Evidence from OECD countries. European Economic Review, 49(1), 113–144.

Syverson, C. (2011). What determines productivity? Journal of Economic Literature, 49(2), 326–365. https://doi.org/10.1257/jel.49.2.326

Tang, H. (2012). Labor market institutions, firm-specific skills, and trade patterns. Journal of International Economics, 87(2), 337–351.

Timmer, M. P., Erumban, A. A., Los, B., Stehrer, R., & De Vries, G. J. (2014). Slicing up global value chains. Journal of Economic Perspectives, 28(2), 99–118.

Venables, A. J. (1996). Localization of industry and trade performance. Oxford Review of Economic Policy, 12(3), 52–60.

Wolfmayr, Y., Friesenbichler, K., Oberhofer, H., Pfaffermayr, M., Siedschlag, I., Di Ubaldo, M., Tong Koeckling, M., & Yang, W. (2019). The performance of the Single Market for goods after 25 years. European Commission, DG GROW. http://aei.pitt.edu/101925/1/BKMNEXT388.pdf

Acknowledgements

This work was supported by the European Union’s Horizon 2020 research and innovation programme (Grant Agreement no. 822781).

Funding

Open access funding provided by Österreichisches Institut für Wirtschaftsforschung (WIFO) - Austrian Institute of Economic Research.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kügler, A., Reinstaller, A. & Friesenbichler, K.S. Can value chain integration explain the diverging economic performance within the EU?. J. Ind. Bus. Econ. 50, 25–47 (2023). https://doi.org/10.1007/s40812-022-00236-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-022-00236-y