Abstract

The paper presents a simple model of oligopoly, in which three firms produce differentiated goods. The degree of product substitutability is not uniform across goods. Merger profitability from the firms’ perspective is investigated. The model shows that the merger profitability depends on the degree of good differentiation. Contrary to what seems to emerge from different models, merger between firms that supply “more similar” product is more profitable as compared to merger between firms supplying more differentiated goods.

Similar content being viewed by others

Notes

Notice that, in Fig. 1, firm 2 is located in a position equi-distant to the other two firms, so that firm 1 and 3 are symmetric with respect to firm 2. Asymmetry in product differentiation is modelled in a fairly ad hoc way, just to distinguish in a simple (dichotomous) way between a small and a large degree of product differentiation.

Linear demand functions like (1′–1″) are widely used in literature, following Spence (1976) and Singh and Vives (1984). They can be derived from an underlying consumer utility maximization problem. The corresponding quasi-linear quadratic utility function, in the specific case at hand, is \(U = M\sum\nolimits_{{i = 1}}^{3} {q_{i} } - \beta \sum\nolimits_{{i = 1}}^{3} {q_{i} ^{2} } - 2\gamma (q_{1} q_{2} + q_{2} q_{3} ) - 2\delta q_{1} q_{3}\) and consumers’ surplus is CS = β(q12 + q22 + q32)/2. However, evaluations on consumers’ utility, and social welfare, though possible, are not dealt with by the present paper, which focuses on the profitability from the firms’ standpoint.

See, e.g., news article by F. Ziveri (28th May 2019), “FCA e Renault: fusione all’orizzonte”, https://www.ultimavoce.it/fca-fiat-renault-fusione/; or by il Foglio-Redazione (9th July 2019), “Provaci ancora John” https://www.ilfoglio.it/economia/2019/07/09/news/provaci-ancora-john-264379/; (both as accessed on June 20th, 2020).

References

Baker, J. B., & Bresnahan, T. F. (1985). The gains form merger or collusion in product-differentiated industries. Journal of Industrial Economics, 33, 427–444.

Brekke, K. R., Siciliani, L., & Straume, O. R. (2017). Horizontal mergers and product quality. Canadian Journal of Economics, 50, 1063–1103.

Deneckere, R., & Davidson, C. (1985). Incentives to form coalitions with Bertrand competition. The RAND Journal of Economics, 16, 473–486.

Ebina, T., & Shimizu, D. (2009). Sequential mergers with differing differentiation levels. Australian Economic Papers, 48, 237–251.

Fanti, L., Meccheri, N. (2012). Differentiated duopoly and merger profitability under monopoly central union and convex cost. Discussion paper, University of Pisa Department of Economics, No. 134.

Farrel, J., & Shapiro, C. (1990). Horizontal mergers: An equilibrium analysis. The American Economic Review, 80, 107–126.

Faulì-Oller, R., & Sandonis, J. (2018). Horizonatal mergers in oligopoly. In L. C. Corciòn & M. A. Marini (Eds.), Handbook of game theory and industrial organization (Vol. 2, pp. 7–33). Cheltenham: Edward Elgar.

Federico, G., Langus, G., & Valletti, T. (2018). Horizontal mergers and product innovation. International Journal of Industrial Organization, 59, 1–23.

Hsu, J., & Wanf, X. H. (2010). Horizontal mergers in a differentiated Cournot oligopoly. Bulletin of Economic Research, 62, 305–314.

Ivaldi, M., Jullien, B., Rey, P., Seabright, P., Tirole, J. (2003a). The economics of tacit collusion. Final report for DG Competition European Commission. https://ec.europa.eu/competition/mergers/studies_reports/the_economics_of_tacit_collusion_en.pdf. Accessed 20 June 2020.

Ivaldi, M., Jullien, B., Rey, P. Seabright, Tirole, J. (2003b). The economics of unilateral effects. Interim report for DG COMP European Commission. http://idei.fr/sites/default/files/medias/doc/wp/2003/economics_unilaterals.pdf. Accessed 20 June 2020.

Jullien, B., & Lefouili, T. (2018). Horizontal mergers and innovation. Journal of Competition Law and Economics, 64, 364–392.

Majumdar, S. K., Moussawi, R., & Yaylacicegi, U. (2019). Mergers and wages in digital networks: A public interest perspective. Journal of Industry, Competition and Trade, 19, 583–615.

McElroy, F. W. (1993). The effects of mergers in markets for differentiated products. Review of Industrial Organization, 8, 69–81.

Perry, M. K., & Porter, R. H. (1985). Oligopoly and the incentive for horizontal merger. The American Economic Review, 75, 219–227.

Pinto, B. P., & Sibley, D. S. (2016). Unilateral effects with endogenous quality. Review of Industrial Organization, 49, 449–464.

Salant, S., Switzer, S., & Reynolds, R. (1983). Losses from horizontal mergers: The effects of an exogenous change in industry structure on Cournot-Nash equilibrium. The Quarterly Journal of Economics, 98, 185–199.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly. RAND Journal of Economics, 1, 546–554.

Spence, A. M. (1976). Product differentiation and welfare. American Economic Review, 66, 407–414.

Acknowledgements

The author thanks the anonymous reviewers for detailed and constructive comments during the review process. Thanks also go to Tiziana Cuccia and Luca Lambertini for useful discussions, and—for his guidance—to Gianpaolo Rossini, to whose memory I wish to dedicate this paper. All errors are the author’s responsibility.

Funding

Support from PTR2018-20 and PiaCeRi Programmes (internal funds of the University of Catania for supporting scientific research) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No conflicts or competing interests to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Proof of Corollary 1 (merger between firm 1 and 2: comparison of pre-merger and post-merger production levels)

As to the difference \(q_{1}^{{M1\& 2}} - q_{2}^{{M1\& 2}} = \frac{{A(\gamma - \delta )(2\beta + \gamma - \delta )}}{{2[4\beta ^{3} - \beta (5\gamma ^{2} + \delta ^{2} ) + 2\gamma ^{2} \delta ]}}\), its sign is unambiguously positive, as both the numerator and the denominator are positive, under the assumptions at hand.

As to the difference \(q_{2}^{{M1\& 2}} - q_{2}^{*} = A\left( {\frac{{4\beta ^{2} - 6\beta \gamma + \delta (3\gamma - \delta )}}{{2[4\beta ^{3} - \beta (5\gamma ^{2} + \delta ^{2} ) + 2\gamma ^{2} \delta ]}} - \frac{{2(\beta - \gamma ) + \delta }}{{2(2\beta ^{2} + \beta \delta - \gamma ^{2} )}}} \right)\), while it is unclearly signed from an analytical point of view, all numerical simulations (fixing \(\beta = 1\)) show that the difference is negative in the relevant parameter range.

As to the difference \(q_{1}^{{M1\& 2}} - q_{1}^{*} = A\left( {\frac{{4\beta ^{2} - 2\beta (2\gamma + \delta ) + \gamma ^{2} + \gamma \delta }}{{2[4\beta ^{3} - \beta (5\gamma ^{2} + \delta ^{2} ) + 2\gamma ^{2} \delta ]}} - \frac{{2\beta - \gamma }}{{2(2\beta ^{2} + \beta \delta - \gamma ^{2} )}}} \right)\), which is unclearly signed from an analytical point of view, numerical simulations show that it is usually negative, apart from the case where parameter \(\gamma\) is above a threshold level (that is, not too far from \(\beta\)), which means that the differentiation between 1 and 2 is somewhat limited. For instance, and just to give a numerical example. If A = 10, \(\beta = 1\) and \(\delta = 0.2\), the post-merger level of production of firm 1 is smaller than the pre-merger level for \(0.2 < \gamma < 0.639\), while it is larger otherwise in the sensible parameter range, \(0.639 < \gamma < 0.733\) [upper-bound 0.733 is due to condition (8)]. By the way, and not surprisingly, numerical simulations show that the threshold level of \(\gamma\), above which the merger entails a positive variation in firm 1’s production, increases with \(\beta\).

Since the reaction function of firm 3 is negatively sloped with respect to opponents’ production levels, we expect that its production level necessarily increases, if q1 decreases, while the outcome could be ambiguous in the parameter space where q1 increases. As a matter of fact, numerical simulations show that firm 3’s production level unambiguously increases as a consequence of the merger between of firm 1 and 2. This is fully consistent with the evidence concerning the sum of production levels of firms 1 and 2, which is unambiguously smaller after merging, as compared to pre-merger equilibrium allocation. QED.

Appendix 2: Proof of Corollary 2 (merger between firm 1 and 2: comparison of pre-merger and post-merger profits)

Profit levels given by (10) can be obtained by simple substitution of (7) into profit functions.

As to the difference \(\pi_{1}^{M1\& 2} - \pi_{1}^{*}\), its signs is unclear from an analytical point of view. However, note that parameter A has a pure scale effect. Fixing A = 10 and \(\beta = 1\), one can numerically check that the differential is positive in the whole sensible parameter space concerning \(\gamma\) and \(\delta\).

As to the difference \(\pi_{2}^{M1\& 2} - \pi_{2}^{*}\), its signs is unclear from an analytical point of view. Again, A has a pure scale effect. Fixing \(\beta = 1\), numerical simulation prove that this difference can be positive or negative, depending on combination of (admissible) parameter \(\gamma\) and \(\delta\). For instance, Figure 2 reports the plot of the difference as a function of \(\gamma\), having set \(\delta = 0.2\). (Remember that, in this case, it makes sense to evaluate the outcome for \(0.2 < \gamma < 0.733\)); the difference is positive for \(0.2 < \gamma < 0.355\), while it is negative for larger values.

As to the difference \((\pi_{1}^{M1\& 2} + \pi_{1}^{M1\& 2} ) - (\pi_{1}^{*} + \pi_{2}^{*} )\), numerical simulations show that it is always positive in the relevant parameter space. It is interesting to report that the difference is monotonically increasing in \(\gamma\) (for given values of all other parameters) and monotonically decreasing in \(\delta\), for given values of all other parameters.

Appendix 3: Proof of Corollary 3 (merger between firm 1 and 3: comparison of pre-merger and post-merger profits)

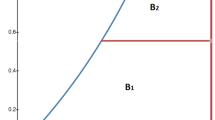

The difference \(\pi_{i}^{M1\& 3} - \pi_{i}^{*}\), i = 1, 3, that is, the profit differential post vs pre-merger profit of each merging firm is analytically cumbersome. However, numerical simulations show that it can be positive or negative, depending on parameter configuration. More specifically, the difference is positive if the difference \(\gamma - \delta\) is limited, while it is negative if the distance between \(\delta\) and \(\gamma\) is large enough. For instance, let us set A = 10, \(\beta = 1\). Moreover, if \(\gamma = 0.5\), the pattern of \(\pi_{i}^{M1\& 3} - \pi_{i}^{*}\) is reported by Fig. 3a, which shows that the differential is positive for \(0.457 < \delta < \gamma = 0.5\). Alternatively, Fig. 3b reports the pattern of the difference \(\pi_{i}^{M1\& 3} - \pi_{i}^{*}\) as a function of \(\gamma\) under the parameter configuration A = 10, \(\beta = 1\) and \(\delta = 0.2\); clearly, the difference is positive if \(0.2 = \delta < \gamma < 0.323\), while it is negative for larger values of \(\gamma\). So, verbally, the merger between 1 and 3 is profitable for the merging firms, if the goods produced by firms 2 and 3 are pretty similar, that is, the parameter capturing the degree of differentiation of good 1 with respect to good 2 (\(\gamma\)) and good 3 (\(\delta\)) are “not too different”.

Numerical simulations concerning the difference \(\pi_{2}^{M1\& 3} - \pi_{2}^{*}\) are not reported for the sake of brevity; they unambiguously show that the difference is positive, for any economically meaningful parameter configuration (normalizing A = 10, \(\beta = 1\)).

a Pattern of \((\pi_{i}^{M1\& 3} - \pi_{i}^{*} ),\) i = 1, 3 as a function of \(\delta\), having set: A = 10, \(\beta = 1\), \(\gamma = 0.5\). Outcome is economically meaningful for \(0 < \delta < \gamma = 0.5\). b Pattern of \(\pi_{i}^{M1\& 3} - \pi_{i}^{*}\) as a function of \(\gamma\), having set: A = 10, \(\beta = 1\), \(\delta = 0.2\). Outcome is economically meaningful for \(0.2 < \gamma < 0.733\)

Appendix 4: Proof of Corollary 4 (comparison of firm 1’s payoff, in case of merger with firm 2 or firm 3, alternatively)

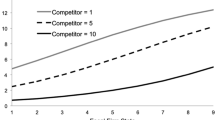

The expression of the difference \((\pi _{1}^{{M1\& 2}} - \pi _{1}^{{M1\& 3}} )\) is very cumbersome and cannot be analytically signed. For this reason, we resort to numerical simulation. Having normalised A = 10 and \(\beta = 1\), three-dimensional graphs show positive values for the difference at hand, for any possible economically meaningful combination of \(\delta ,\gamma\). More clearly, we report two two-dimension graphs, having added, respectively a numerical value concerning \(\gamma\) and a numerical value concerning \(\delta\), alternatively. Under A = 10, \(\beta = 1\), and having set \(\gamma = 0.5\), then the difference \(\gamma = 0.5\) as a function of \(\pi _{1}^{{M1\& 2}} - \pi _{1}^{{M1\& 3}}\)(with \(\delta\)) turns out to be always positive and monotonically decreasing in \(0 < \delta < \gamma = 0.5\), over the economically relevant parameter space (see Fig. 4a); obviously, the difference is zero in the limiting case \(\delta = \gamma\): in such a case, the products of firms 2 and 3 are homogeneous, and it makes no difference for firm 1 to merge with firm 2 or 3. Similarly, under A = 10, \(\beta = 1\), \(\delta = 0.2\) the difference is always positive and increasing in \(\gamma\) (Fig. 4b) over the whole relevant parametrical space (remember that, in this case, the parameter space is economically meaningful for \(0.2 < \gamma < 0.733\)). Also in this case, the difference is zero in the limiting case in which \(\delta = 0.2 = \gamma\), that corresponds to the case of homogeneous productions of firms 2 and 3. Thus, the more differentiated are the goods of firms 2 and 3, the more profitable is for firm1 to merge with the closer firm, as compared to the merger with the firm providing the more differentiated good.

a Pattern of \(\pi _{1}^{{M1\& 2}} - \pi _{1}^{{M1\& 3}}\) as a function of \(\delta\), having set: A = 10, \(\beta = 1\), \(\gamma = 0.5\). Outcome is economically meaningful for \(0 < \delta < \gamma = 0.5\). b Pattern of \(\pi _{1}^{{M1\& 2}} - \pi _{1}^{{M1\& 3}}\) as a function of \(\gamma\), having set: A = 10, \(\beta = 1\), \(\delta = 0.2\). Outcome is economically meaningful for \(0.2 < \gamma < 0.733\)

Rights and permissions

About this article

Cite this article

Cellini, R. Whom should I merge with? How product substitutability affects merger profitability. J. Ind. Bus. Econ. 48, 337–353 (2021). https://doi.org/10.1007/s40812-020-00180-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-020-00180-9