Abstract

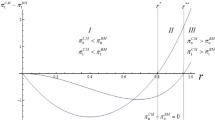

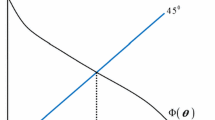

The 1980s market reforms in Europe led to far-reaching privatization. However, empirical data show that some countries experienced deterioration in market performance, such as in consumer prices and welfare, during a certain period. Although theorists have focused on the change in the stock holding rate and the degree of product differentiation between privatization, few paid attention to the change in competition mode or intensity. To grasp how the structural change of privatization can affect market performance, we investigate the infinitesimal change in competition intensity by parameterizing it, apart from using the traditional method of making a simple comparison between Cournot and Bertrand equilibria. Thus, we parameterize the intensity of competition, and consider a mixed duopoly market with product differentiation accompanying partial privatization using a linear supply function approach. We observe a non-monotonic change in prices, profits, and social welfare in the plane of the degree of product differentiation and privatization, when competition becomes aggressive. Intuitively, when the semi-public firm promotes privatization, the market is an ordinary private duopoly and the competition becomes weak, while the competition can be aggressive with nationalization, since the semi-public firm tries to lower its price to improve consumer surplus. Further, the thresholds’ roughly common property—the right-upwardness—depends on the degree of the cross-price effect. Analytically, these counterintuitive phenomena are caused by the indirect effect inherent in linear supply function competition.

Similar content being viewed by others

Notes

See Matsumura (1998).

Matsumura and Okamura (2015), who examined a mixed market using a relative profit approach, noted that evaluating the intensity of competition by the number of firms can be misleading because it changes the market structure. Supporting their claims, we refrain from constructing the oligopoly model.

After the early work on SFE by Grossman (1981) and Hart (1985), Klemperer and Meyer (1989) constructed a basic model. Green and Newbery (1992) analyzed the British electricity industry using SFE. Baldick et al. (2004) studied electricity markets using the linear version of SFE. For a comprehensive survey of SFE, see Vives (2001) (section 7.2).

There are two primary reasons for adopting the symmetric cost function. The first is for a theoretical comparison with other studies, such as Delbono and Lambertini (2015). The second is to avoid bankruptcy within the LSFE model. That is, the setting of asymmetric costs probably yields separate equilibrium prices between the two firms, whereas SFE is programmed to yield an identical price between the two.

This discussion was developed earlier in Matsumura (1998).

As in Delbono and Lambertini (2015), replacing the linear supply function as \(q_i=\alpha _i+\beta _ip_i\) leads to the same equilibria.

Delbono and Lambertini (2015) showed that linear dependence holds in both linear cost and quadratic cost cases. Moreover, the authors note that the dependence holds even if the timing of determining \(\alpha _i\) and \(\beta _i\) differs.

The denominator of \(RF_0\) is minimized when \(\lambda =1\), which is positive. Further, the stability condition between \(RF_0\) and \(RF_1\) is satisfied.

The main results are obtained; the existence of non-monotonicity on prices and profits is also supported on other points of \(\beta\). Note that the interval of \(\delta\) is limited as \(\beta\) increases because of \(\beta <1/\sqrt{1-\delta ^2}\). For example, if \(\beta =10\), \(\delta\) is limited to \(\delta >0.995\); to analyze the \(\delta -\lambda\) square, \(\beta \le 1\) must be assumed.

For earlier work on the cross-price effect, see Dixit (1979).

References

Baldick, R., Grant, R., & Kahn, E. (2004). Theory and application of linear supply function equilibrium in electricity markets. Journal of Regulatory Economics, 25(2), 143–167.

De Fraja, G., & Delbono, F. (1989). Alternative strategies of a public enterprise in oligopoly. Oxford Economic Papers, 41(2), 302–311.

Delbono, F., & Lambertini, L. (2015). On the properties of linear supply functions in oligopoly. Economics Letters, 136, 22–24.

Delbono, F., & Lambertini, L. (2016a). Bertrand versus Cournot with convex variable costs. Economic Theory Bulletin, 4(1), 73–83.

Delbono, F., & Lambertini, L. (2016b). Ranking Bertrand, Cournot, and supply function equilibria in oligopoly. Energy Economics, 60, 73–78.

Dixit, A. (1979). A model of duopoly suggesting a theory of entry barriers. The Bell Journal of Economics, 10(1), 20–32.

Florio, M. (2007). Electricity prices as signals for the evaluation of reforms: An empirical analysis of four European countries. International Review of Applied Economics, 21(1), 1–27.

Fries, S., & Taci, A. (2005). Cost efficiency of banks in transition: Evidence from 289 banks in 15 post-communist countries. Journal of Banking & Finance, 29, 55–81.

Ghosh, A., & Mitra, M. (2010). Comparing Bertrand and Cournot in mixed markets. Economics Letters, 109, 72–74.

Green, R. J., & Newbery, D. M. (1992). Competition in the British electricity spot market. Journal of Political Economy, 100, 929–953.

Grossman, S. (1981). Nash equilibrium and the industrial organization on markets with large fixed costs. Econometrica, 49, 1149–1172.

Häckner, J. (2000). A note on price and quantity competition in differentiated oligopolies. Journal of Economic Theory, 93, 233–239.

Haraguchi, J., & Matsumura, T. (2016). Cournot-Bertrand comparison in a mixed oligopoly. Journal of Economics, 117, 117–136.

Hart, O. (1985). Imperfect competition in general equilibrium: An overview of recent work. In K. Arrow & S. Honkapohja (Eds.), Frontiers of Economics. Oxford: Basil Blackwell.

Klemperer, P. D., & Meyer, M. A. (1989). Supply function equilibria in oligopoly under uncertainty. Econometrica, 57(6), 1243–1277.

Kopel, M. (2015). Price and quantity contracts in a mixed duopoly with a social concerned firm. Managerial and Decision Economics, 36, 559–566.

Liberati, P. (2005). UK privatization and household welfare. FinanzArchiv/Public Finance Analysis, 61(2), 220–255.

Matsumura, T. (1998). Partial privatization in mixed duopoly. Journal of Public Economics, 70, 473–483.

Matsumura, T., & Ogawa, A. (2012). Price versus quantity in a mixed duopoly. Economics Letters, 116, 174–177.

Matsumura, T., & Okamura, M. (2015). Competition and privatization policies revisited: The payoff interdependence approach. Journal of Economics, 116, 137–150.

Megginson, W., & Netter, J. (2001). From state to market: A survey of empirical studies on privatization. Journal of Economics Literature, 39, 321–389.

Menezes, F. M., & Quiggin, J. (2012). More competitors or more competition? Market concentration and the intensity of competition. Economics Letters, 117, 712–714.

Merrill, W. C., & Schneider, N. (1966). Government firms in oligopoly industries: A short-run analysis. The Quarterly Journal of Economics, 80(3), 400–412.

Motta, M. (2004). Competition policy. New York: Cambridge University Press.

Scrimitore, M. (2014). Profitability under commitment in Cournot and Bertrand mixed markets. Journal of Institutional and Theoretical Economics, 170, 684–703.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly. RAND Journal of Economics, 15(4), 546–554.

Tirole, J. (1988). The Theory of Industrial Organization. Cambridge: The MIT Press.

Vickers, J., & Yarrow, G. (1988). Privatization: An economic analysis. Cambridge: The MIT Press.

Vives, X. (2001). Oligopoly Pricing: Old Ideas and New Tools. Cambridge: The MIT Press.

Zhang, Y., Parker, D., & Kirkpatrick, C. (2008). Electricity sector reform in developing countries: an econometric assessment of the effects of privatization, competition and regulation. Journal of Regulatory Economics, 33(2), 159–178.

Zhang, A., Zhang, Y., & Zhao, R. (2001). Impact of ownership and competition on the productivity of Chinese enterprises. Journal of Comparative Economics, 29, 327–346.

Acknowledgements

The author is grateful to Tomomichi Mizuno (Kobe University), Takashi Yanagawa (Kobe University), and the anonymous referees for their helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Rights and permissions

About this article

Cite this article

Yamane, K. Mixed duopoly and the indirect effect in linear supply function competition. Econ Polit Ind 45, 519–532 (2018). https://doi.org/10.1007/s40812-018-0103-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-018-0103-3