Abstract

The housing market is a key channel for monetary policy transmission. The literature has focused mainly on cyclical fluctuations in house prices rather than other indicators to account for housing market dynamics, such as residential transactions. This paper investigated the impact of the monetary policy stance on the housing market by considering residential transactions (together with house prices). First, we estimated a structural vector autoregressive (VAR) model for Italy from 1999Q1 to 2019Q4 using Cholesky structural identification. Second, we used an external instrument to identify the contemporaneous response of all endogenous variables to the shock of interest (Proxy-VAR). Our results indicate that transactions are more significantly reactive than house prices to a restrictive monetary policy shock. After a policy rate increases, the sudden stop in exchange volumes and the low degree of liquidity perceived in the housing market can contribute to shaping the housing wealth effect captured by prices. The results are supported by a robustness analysis based on local projections. Therefore, policy-makers should consider the role of residential transactions in evaluating the effectiveness of monetary policy transmission.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper stems from the idea that transaction volumes provide valuable information and have often been neglected in properly understanding the dynamics of the housing cycle and, therefore, the monetary policy transmission mechanism. This claim is based on the documented evidence, largely consistent with the honeycomb cycle, showing that transactions are more responsive to shocks than to house prices.

The honeycomb housing cycle, as also noted by Janssen et al. (1994), emphasises that in two out of the six cyclical phases of the residential property cycle, prices are stable, although the volume of exchanged properties varies. Hence, in the housing market, price rigidity can be at the origin of price inefficiency, in the sense that house prices cannot be used as the only signal capable of encompassing all the information of the residential real estate sector. This is because the real estate market is fraught with frictions, and its price swings do not function as an efficient mechanism for allocating resources. For this reason, taking these frictions into account is necessary to understand the contribution of the real estate sector to monetary policy transmission. The lack of information during the cyclical phases of the housing cycle characterised by steady prices can be successfully addressed with the valuable information provided by property transactions, which can fill in the analysis of what price fluctuations miss.

After the outbreak of the great financial crisis of 2007–2009, fluctuations in house prices were vigorously debated in the macroeconomic literature, and many authors questioned the role that monetary policy may have played, for instance, in feeding and, subsequently, “bursting” the US housing bubble, often referred to as the subprime mortgage crisis. One of the first contributions is by Taylor (2007), who documented how recent years of “great moderation” may have contributed not only to the extraordinary increase in housing demand but also to the strong growth in house prices, fuelling the positive trend of growth in the value of assets already at work since the mid-1990s. In fact, there is no doubt that loose monetary policies can push the inflation of assets (Taylor 2009), but particular attention must be given when a price boom is accompanied by a lending boom. In addition, Leamer (2007, 2015), focusing on the U.S. housing market, studied the role of other indicators relevant to the housing market cycle, such as residential investment, during recessionary phases, suggesting that policy-maker intervention should be concentrated in phases of the housing cycle when the volume of construction is growing.

As documented below, the literature has investigated the mechanisms of monetary policy transmission through the housing sector (Iacoviello 2005; Iacoviello and Minetti 2008; Iacoviello and Neri 2010). However, these empirical studies have mainly focused on the role of house prices as a cyclical indicator in the housing market, without studying the response of volumes of market transactions to monetary policy shocks. Our aim here is to fill this gap, showing that the sluggish response of prices, found in some of the existing studies, is related not only to an asymmetric response of prices to monetary shocks (Tsai 2013) but also to an intrinsic stability of prices in some of the cyclical phases of the housing cycle. Therefore, it can be assumed that adjustment following monetary shocks to the housing market occurs according to the size of the transacted volumes. However, this should not lead to the conclusion that house prices are a variable to be omitted. In fact, transactions can be considered a complementary variable and not an alternative to the information contained in house prices (Garriga and Hedlund 2020). The two housing variables used are different by nature, and it is therefore interesting to model them together and study the effects that monetary policy manoeuvres simultaneously have on both.

Against this background, in this paper investigates the monetary policy transmission mechanism through the housing market over the last twenty years, taking Italy as a case study. As highlighted by Iacoviello and Minetti (2008, p.71), “there are reasons to expect that the housing market is particularly exposed to the credit channel, hence representing a better environment to capture its presence than the broader economy”.

To assess the impact of a restrictive monetary policy shock on housing and credit variables, we first estimated a structural vector autoregression (VAR model) using a Cholesky structural identification; second, we used an external instrument to identify the contemporaneous response of all endogenous variables to the shock of interest (Proxy-VAR).

Our main novelty is the introduction of residential transactions, which, to our knowledge, has hitherto been omitted and is modelled as an endogenous key variable. The results indicate that housing markets contribute to shaping the effectiveness of monetary policy and that transactions are more significantly reactive than house prices to a policy shock, supporting the view that transactions respond more sensitively to a restrictive monetary stance. Thus, the response of the housing market is mainly concentrated on the size of the exchanged volume rather than on the asset price. This result recalls an issue largely debated in the literature about the importance of channels through which the housing cycle is related to other sectors in the economy, including the wealth effect, through which increases in the value of the housing stock increase consumption demand. This channel has been largely downsized (e.g., Calomiris et al. 2009). Therefore, macroeconomic policies that focus on stabilizing house prices should consider the condition of liquidity in the housing market to correctly estimate the effect of housing wealth (Garriga and Hedlund 2020).

The rest of the paper is structured as follows: Sect. 2 presents a brief literature framework to justify the potential relevance of residential transactions in macroeconomic topics; Sect. 3 describes the housing market in Italy; Sect. 4 presents the data and methods; Sect. 5 presents the empirical results; and Sect. 6 provides the robustness check with local projection outcomes. Finally, Sect. 7 concludes.

2 The Relevance of the Housing Market for Monetary Policy Transmission

The literature on monetary policy transmission has highlighted the relevance of the asset price channel (Bernanke et al. 1999; Bernanke and Gertler 2000). Monetary policy could impact asset prices, which in turn can produce—through the wealth effect—changes in consumption levels and fluctuations in financial and real investment.

After the 2008 crisis, the housing market assumed a central role in the spread of economic and monetary shocks.Footnote 1 In many developed countries, housing is the most important asset in households’ balance sheets, which explains policy-makers’ attention to house price cyclical fluctuations or persistent patterns far from fundamental levels. In fact, there is a large body of literature documenting house prices as a major indicator of the housing market cycle with respect to other relevant variables, such as residential investments. This is mainly because the information contained in house price dynamics can trigger collateral mechanisms and, consequently, wealth effects, which can also translate into affordable borrowing for consumption (see Iacoviello 2005; Iacoviello and Neri 2010; Lee and Song 2015).

In this context, the presence of the credit channel also plays an important role. As is known, the credit channel is not an independent transmission channel but rather an additional mechanism to the monetary channel (Bernanke and Gertler 1995). In fact, the interest rate tool, which mainly impacts credit demand, can be mitigated or amplified by the credit channel through balance sheet effects (namely, changes in the borrower’s wealth: assets values, net worth and liquidity) and bank-lending effects (namely, changes in the lenders’ assets: deposits and credit supply).

In addition, different characteristics in terms of the flexibility/development of residential mortgage markets are relevant for the monetary policy transmission shocks through the housing market, as demonstrated in Calza et al. (2013) or in Dokko et al. (2011), who found that, in the United States and other countries, a marked easing in terms and/or standards for mortgage credit translates into more rapid increases in house prices.Footnote 2 Consistently, the empirical literature examining the role of the housing market in the monetary transmission mechanism has usually focused on house prices, choosing the nominal interest rate as a measure of monetary policy shocks (e.g., Bjørnland and Jacobsen 2010). Some studies have enriched the analysis to specifically examine the role of the credit channel (Iacoviello and Minetti 2008). In all the contributions, the only variable employed to summarize relevant information from the housing market is prices; for instance, quantities and housing investment are claimed to be not informative because of their sluggish adjustment (a time-to-build effect).Footnote 3 However, a more attentive analysis of the literature reveals some shortcomings of this approach. For instance, the loss aversion model (Genesove and Mayer 2001) suggests that in a bust phase, the seller’s reservation prices show significant downwards rigidity with respect to buyers' offers. As such, prices provide reliable information on real estate market dynamics during expansionary phases, but this is not entirely true in downturns, when the deterioration of housing liquidity is central to explaining observed patterns (Garriga and Hedlund 2020).

Further support for this warning is traceable to the honeycomb cycle theory (Janssen et al. 1994), providing a method for dating the residential real estate cycle that jointly examines price and volume dynamics. According to this approach, in two out of the six sequential cyclical phases, house prices are stagnant and, therefore, stable with respect to external shock impulses. In contrast, in these same two phases, residential transactions are strongly influenced by external factors and market expectations. Furthermore, according to this theory, the fluctuations of transactions are leading with respect to prices and in constant movement as they never go through a stagnant phase.

The relevance of transaction volumes in shaping the housing market is further reinforced by the search model of Berkovec and Goodman (1996), where existing home sales respond more quickly than prices to changes in housing demand. This theoretical claim is supported by the empirical evidence provided by Oikarinen (2012), who, using data for the 1988–2008 period in Finland, showed that the response of house prices to income, interest rate and debt shocks is substantially slower than that of sales to demand shocks. Likewise, Tsai (2014, 2019) highlighted how house prices individually are not very informative for housing cyclical fluctuations but, together with the number of transactions (volumes), can lead to a greater understanding of housing market cyclical dynamics.

The aforementioned literature shows that the volume of market transactions is a valid indicator of the housing cycle and is more informative than prices for alternating hot and cold phases in the housing market.Footnote 4 Hence, transactions, which are more sensitive to demand shocks and fluctuations in the external variables that impact the real estate cycle, may play a nonnegligible role in explaining monetary policy transmission. It is plausible that a monetary shock could accelerate the fall of transactions in the residential real estate market since an increase in the rate is equivalent to an increase in the cost of credit by eliminating the significant share of market demand that would have been able to access it only through the mortgage market.

In summary, there are valid reasons that lead to the classification of transactions as a key and complementary variable to house prices to better understand the transmission mechanism of policy-maker decisions. First, as already mentioned in the literature, it is not certain that prices are responsive to tight monetary policy. Second, in the definition of the housing market, it is known that cyclical prices are not the only relevant variable, as they present important limits (including house price rigidity supported by downwards rigidity during periods of decline). Finally, Bernanke and Gertler (1995) and Iacoviello and Minetti (2008) showed that residential investments are not informative for studying monetary policy transmissions. For these reasons, it is worth investigating whether residential transactions are a missing key variable in building a housing market–monetary policy framework.

3 Housing Market Evolution in Italy

As previously mentioned, transactions can be considered as a key and complementary variable to house prices to better understand the transmission mechanism of monetary policy. The number of transactions does not include house price information, such as the ability to borrow by placing guarantees and potential wealth effects on consumption and investment. Nevertheless, house prices, as a measure of wealth and consequent effects on consumption, can only be informative if there is a liquidity mechanism such that this wealth can be translated into consumption.Footnote 5

In this regard, it appears clear that the intrinsic nature of transactions cannot be translated into a proxy measure of household wealth (such as house prices), nor can it be a proxy of the stock of houses in the market. Transactions are only a good proxy for the degree of liquidity in the market; elsewhere (Garriga and Hedlund 2020), they have been proven to be an amplifier of markets’ mechanisms affecting the value of housing wealth.

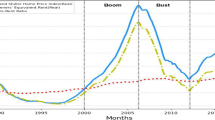

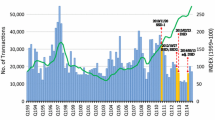

Figure 1 shows how the inversion of the growth/decrease trend of the number of transactions anticipates that of house prices, consistent with the conception of the adjustment process in the search model (Berkovec and Goodman 1996) supported by empirical evidence where volumes drive prices (Hort 2000). In fact, transactions first experienced a slowdown, starting an inversion of the growth trend between 2003 and 2004, when the beginning of the bubble period for Italy was highlighted (Baffigi and Piselli 2019). This rate of decline became more marked after the US housing bubble burst between 2006 and 2007. In the meantime, it clearly appears that prices are constantly growing, at least until the third quarter of 2007, when they enter a phase of stagnation that lasted until 2011. This evidence also emerges more properly from Fig. 2, which reports the honeycomb cycle dated with annual data (2000–2020).

Using the honeycomb approach, Marzano et al. (2023) investigated the presence of housing cycles in Italy starting in 1927. The analysis of cyclical phases highlights that the shape of the honeycomb hexagonal pattern varies considerably with the historical period under consideration. They documented that the dynamics of the housing market are consistent with the honeycomb approach only from the second half of the 1970s and that the last housing cycle (the longest compared to the other two cycles detected and the only cycle that sequentially touches all six cyclical phases) started in 2000 and ended in 2019 before the spread of the pandemic shock. However, contrary to what is expected from the literature, their observations show that this last Italian housing cycle tends not to necessarily be contained within the time scale of a single business and credit cycle. This aspect may signal how the Italian housing market was able to cushion (at least in terms of the rate of fall in asset value) the blow of the Great Recession caused by the bursting of the U.S. housing bubble.

In addition to loss aversion of the assets that make the price rigid downwards (Genesove and Mayer 2001), what probably caused prices to begin their slow decline before collapsing excessively could be due to the more scrupulous functioning of the Italian financial market following the outbreak of the subprime mortgage crisis.Footnote 6 The Italian banking system, in fact, resisted the impact of the bursting of the bubble better than other countries. This was possibly due to (a) an intermediation model mainly oriented towards retail loans and deposits, (b) the rather limited indebtedness of the economy’s private sector, and (c) strict regulation and careful supervision by the Bank of Italy (Ciocca 2010).Footnote 7

In fact, in terms of mortgage structure, Italy belongs to the “low-development-growth” category and is one of the few OECD countries that has not resorted to mortgage-backed securitization (Assenmacher-Wesche and Gerlach 2008; Calza et al. 2013), which has proven to be a leading reason for the disastrous financial consequences following the bursting of the US housing bubble.

These are key features in that different characteristics between countries in terms of flexibility/development of the residential mortgage markets can be relevant to the impact of monetary policy shocks.

Furthermore, the strong expansionary monetary policy set by the European Central Bank (ECB) starting in 2009 with a constant decrease in interest rates to handle the spread of the great financial crisis, combined with the substantial rescue plans of troubled credit institutions provided by governments to the banks of their respective national systems, could have contributed significantly to containing the consequences of the systemic risk given by the financialisation of the economies, which in recent decades have become more interconnected.

In Italy, the banking system was not assisted by significant public support measures until the end of 2011,Footnote 8 when the greatest difficulties for Italian banks were determined by the sovereign debt crisis (which worsened from mid-2011), causing the following: first, a deterioration in banking activities (due to large direct investments by credit institutions in domestic public securities); and second, substantial credit rationing, which was particularly felt by both households and firms.Footnote 9

The subsequent austerity policy implemented by the Italian government led to a two-year recession (2012–2013), in which the two variables of the real estate cycle were substantially decreasing. However, the transactions began a phase of recovery in the housing market as early as 2014, unlike house prices, which only became stagnant from 2016 (with an average annual real change variation of 0.3%).

4 Data and Methods

We examine the responses of housing and credit market variables to a monetary shock in two steps. First, we estimate a structural VAR model using a recursive scheme to identify structural shocks. Second, we use an external instrument consistent with the Proxy-VAR approach (Stock and Watson 2012; Mertens and Ravn 2013; Gertler and Karadi 2015).

4.1 Data

For the empirical analysis, a quarterly dataset was constructed from 1999Q1 to 2019Q4Footnote 10 for Italy (see Appendix A1 for the data description and sources). This interval covered a time horizon characterized by significant historical events, including, in order, the loss of monetary sovereignty for Italy with the establishment of the European Monetary Union (EMU) in 1999, the global financial crisis of 2007–2008, and the European sovereign debt crisis of 2010–2011.

The vector of endogenous variables is composed of different blocks of variables. The first block refers to the residential real estate market, for which the number of residential transactions (TR) and the real residential property price index (HP) are used. The TR is provided by Scenari Immobiliari on an annual basis. We obtained quarterly data representation using the Chow and Lin (1971) method with residential investments as the quarterly indicator series for interpolation. The second block accounted for credit market variables, including the stock of real housing loans (HL) and the spread between the interest rate on mortgage loans and the risk-free interest rate for Italy (SP). Moreover, real GDP (Y) and the consumer price index (CPI) were added as macroeconomic variables. Finally, the 3-month interbank rate (R) was used to measure the impact of the monetary policy stance. The choice of the interbank rate as a proxy for the policy rate is common in empirical studies (Iacoviello and Minetti 2008; Giannone et al. 2019) because (overnight) interbank rates are often interpreted as target rates for monetary policy (Illes and Lombardi 2013). Finally, the EURIBOR is usually the reference rate for variable-rate mortgages.

Log transformation for all variables was applied, except for the short-term interest rate (R) and spread (SP), which are included in levels and percentage points.

4.2 VAR Model Specification

Monetary policy decisions may affect credit conditions in different ways. A VAR model was run to assess how the housing market contributes to propagating the effects of monetary policy in the presence of (i) a traditional monetary policy transmission mechanism, where a monetary interest rate shock directly affects the volume of housing loans by reducing demand from borrowers, and (ii) a credit channel mechanism, where the monetary policy shock affects the external finance premium by increasing the mortgage spread and reducing lending supply.Footnote 11 Hence, with this specification, we evaluate the effects of a restrictive monetary policy on the housing market, focusing on transactions and house prices, accounting for the role of the credit market, measured by housing loans and mortgage spread.

The VAR(p) model is specified as follows:

where \({Y}_{t}\) is a vector of endogenous variables; a is the constant term; A(L) is a matrix polynomial in the lag operator L; and \({\varepsilon }_{t}\) is the error term.

Following the approach of Iacoviello and Minetti (2008), the vector of endogenous variables (\({Y}_{t}\)) consists of housing market variables (residential transactions and house prices index), macroeconomic variables (real GDP and consumer price index), credit variables (housing loans and spread between mortgage and risk-free interest rate), and the policy rate. Unlike their contribution, we combine the “loans regression” and the “spread regression” together in a single VAR model.Footnote 12

Since we worked with quarterly data, the model was estimated by setting a lag order equal to four (\(p=4\)). The selected lag order ensures the absence of autocorrelation.

As highlighted by Kilian and Lütkepohl (2017, Chapter 2), in the VAR(p) model with p > 1, standard Gaussian inference on individual VAR slope parameters remains asymptotically valid even in the presence of I(1) variables.Footnote 13 Furthermore, Fanchon and Wendel (1992) suggested that a VAR model estimated with nonstationary and cointegrated data yields consistent parameter estimates. Therefore, Augmented Dickey–Fuller (ADF) tests were carried out on the series to test for the presence of a unit root. The tests, reported in the tables in Appendix A3, reject the null hypothesis of stationarity for all variables, suggesting that all variables are integrated of order one. We also performed the Johansen cointegration test, which indicates at least four cointegrating vectors. Thus, the model was estimated with nonstationary series.

Finally, the stability condition of the model was ensured. We checked that all eigenvalues were in the unit circle.

4.2.1 Structural Shock Identification

The structural shocks were identified through the recursive method of Cholesky decomposition. The variables were ordered by putting the less endogenous elements, i.e., real components, before the more endogenous elements. Thus, the variables are ordered as follows: Y (real GDP); CPI (consumer price index); R (3-month interbank rate); TR (number of residential transactions); HP (real house prices index); SP (spread between interest rate on mortgage loans and risk-free interest rate); and HL (real housing loans).

All endogenous variables are measured at the country level, except the policy rate; this might first appear to assume that the ECB reacts only to the Italian economic cycle rather than to all euro area (EA) countries. However, we trust in the proposed structural identification because the Italian economy plays a significant role in EA monetary policy decisions, with its GDP accounting for 17% of the total euro. In addition, the Italian business cycle is strongly correlated with that of the EA as a whole, as is the inflation rate. Therefore, we follow a standard identification scheme for macroeconomic variables, according to which a monetary policy shock has a delayed impact on output and prices, which do not respond simultaneously to changes in monetary variables, whereas a shock to output and prices causes an immediate response from monetary authorities (Bernanke and Blinder 1992). This assumption is also made in most VAR contributions on the effects of monetary policy shocks (Christiano et al. 1999; Peersman and Smets 2003; Boeckx et al. 2017). In contrast, monetary policy shock may impact housing and credit variables; therefore, it was previously placed in the Cholesky order (Iacoviello and Minetti 2008).

Transactions were placed before house prices. This specification order is consistent with the empirical literature, such as the search model approach (Berkovec and Goodman 1996), where, in a lead–lag relationship, volumes drive prices (Hort 2000), and applications of the honeycomb cycle to the Italian case (Fig. 2) show precisely the hexagonal pattern in recent decades. According to the definition of this cyclical approach, changes in transactions anticipate changes in the sign of house prices in some phases. Furthermore, consistent with the loss aversion model, for the honeycomb cycle approach, prices have two phases in which there may be a period of stagnation, while the number of transactions is never modelled as a stagnant variable.

The ordering of housing loans after spread responds to the assumption of the market power of banks in the credit market (Wang et al. 2022), which is also consistent with Granger causality tests, showing that spreading (weakly) Granger causes loans, rejecting the opposite causality.

4.2.2 Testing for Informational Sufficiency

As underlined in Giannone and Reichlin (2006), the identification of structural shocks in the SVAR model requires the assumption of fundamentalness, which implies that the information set of the model is sufficient to recover structural shocks. Conversely, nonfundamentalness occurs when the model's information set fails to capture all relevant shocks, leading to misinterpretation of economic dynamics (Hansen and Sargent 1991; Lippi and Reichlin 1993). This implies that the data generating process (DGP) omits variables influenced by structural shocks that are not captured within the model.

In our setup, we assume that omitting residential transactions from the housing market–monetary policy framework might cause a nonfundamental representation of the model. To address this point, we empirically detected nonfundamentalness by checking whether the block of endogenous variables is (weakly) exogenous with respect to residential transactions (Giannone and Reichlin 2006). Following Giannone and Reichlin (2006), Forni and Gambetti (2014), and Kilian and Murphy (2014), we checked the sufficient information of the VAR model by performing the Granger causality test. The model is informationally sufficient if the null hypothesis of no Granger causality of transactions is not rejected. In our model, this is equivalent to rejecting the null hypothesis that the lags of TR are jointly zero in all the other equations. The test is \({\chi }^{2}\left(24\right)=71.28 \left(0.00\right)\), confirming the nonfundamentalness of the model without transactions. This evidence confirms that our specification is preferable to a standard specification (without transactions). In Sect. 5, while presenting the results, the responses of the two models to a restrictive monetary policy shock are also discussed.

4.3 Proxy-VAR Specification

Our identification strategy in the previous section works by imposing a set of restrictions: within a period, the policy rate is assumed to respond to macroeconomic variables in the VAR, but not vice versa. However, over a period, policy changes also influence financial variables, which in turn can affect the policy decisions (Gertler and Karadi 2015). This response may also include the indirect effect of economic variables on the policy rate through the financial system. Therefore, to properly recognize the response of economic and financial variables to changes in monetary policy, it is necessary to identify exogenous policy surprises.

An alternative strategy for identifying monetary policy shocks is based on high-frequency identification, where policy surprises are identified from the intraday response of asset prices.

The literature supports the assumption that monetary policy does not react to asset prices within a day and that causality goes from monetary policy to asset prices (see, for instance, Gertler and Karadi 2015; Caldara and Herbst 2019). Therefore, the intraday response of asset prices can be considered as an external monetary policy shock.

To study the effect of monetary policy shock on the dynamics of the endogenous variables, we estimated a Proxy-SVAR model using an external instrument as a proxy for an exogenous structural shock of interest (Stock and Watson 2012; Mertens and Ravn 2013). The model with p lags is specified as follows:

where \({Y}_{t}\) is a \(n x 1\) vector of endogenous variables; a is a constant term; A(L) is a matrix polynomial in the lag operator L; S is n × n matrices; and \({\varepsilon }_{t}\) is a vector of n structural shocks. Following Stock and Watson’s (2012) notation, we assume that the monetary policy shock corresponds to the first column of S, denoted by \({S}_{1}\). Column j of matrix S provides the contemporaneous effect of a change in structural shock j on each variable in \({Y}_{t}\).

The IRF of \({Y}_{t}\) with respect to a monetary policy shock is then given by:

Monetary policy shocks \({S}_{1}\) were identified through an external instrument, \({Z}_{t}\), which is an \(z x 1\) vector of instrumental variables that satisfies the following conditions:

Specifically, it is assumed that the proxy variable is correlated with the structural shock of interest—in this case, the monetary policy shock (\({\varepsilon }^{R}\))—and uncorrelated with the other structural shocks (\({\varepsilon }^{Y}\)).

To identify the proxy, we use the dataset provided by Altavilla et al. (2019), in which the market perception of the ECB’s political communication is summarized in four main factors.Footnote 14 These factors elicit large and long-lasting market reactions and help explain changes in asset prices in response to politicians’ speeches and other news. We chose the “timing” factor as the external shock because, according to the authors, it captures changes in expectations at a short horizon (consistently with our original identification) and has little effect on interest rates at longer maturities.

The vector \({Y}_{t}\) considers the same endogenous variables and the lag order (\(p=4\)) as in the baseline VAR model. The sample period has been reduced from 2002Q1 to 2019Q4, as the instrument is available since 2002.

5 Empirical Results

In this section, we analyse the impulse response functions (IRFs) of the estimation methods discussed in Sect. 4.

5.1 VAR Model IRFs

To measure the impact of monetary policy shocks on housing variables, orthogonalized impulse response functions (OIRFs) were calculated. A positive shock of one standard deviation to the short-term interest rate (R) was simulated. The OIRFs were also calculated for the model without residential transactions. In the following figures, we directly compare all the IRFs from the VARs with and without transactions.Footnote 15

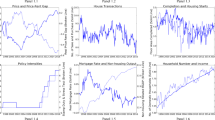

Figure 3 shows the responses of GDP, inflation, the housing market, and credit variables. The housing variables and housing loans reacted with a negative sign as expected, and the rise in spread captures an increase in the external finance premium potentially connected to a credit channel.Footnote 16

OIRFs of the VAR(4) model. Response of real GDP (Y), consumer price index (CPI), residential transactions (TR), real house price index (HP), spread (SP), and real housing loans (HL) to a positive shock to the monetary policy variable (R). The blue lines represent the OIRFs of the model with transactions, while the red lines represent those of the model without transactions. The shaded areas and dotted lines identify the 90% confidence intervals for the models with and without transactions, respectively

Both housing variables decreased after monetary tightening, and Fig. 3 shows that transactions are immediately more sensitive to monetary policy shocks than house prices.Footnote 17 Indeed, the response of house prices to a one-standard deviation shock in R displays a very moderate semielasticity of approximately less than 0.5 percent. In contrast, when examining the quantitative dimension of the housing market, it was found that transactions are immediately and significantly affected by a contractionary monetary policy shock, with a semielasticity of approximately 1 percent on the impact and up to almost 2 percent after four quarters. Therefore, the semielasticity of transactions appears to be twice that of house prices in response to a restrictive monetary policy shock.

Interestingly, in the model without transactions, the response of prices is persistent: an increase in the interest rate implies a higher discount rate for asset values, which declines permanently. However, the comparison between the OIRFs obtained with and without transactions shows that omitting transactions tends to overestimate the deflationary effect of a restrictive monetary policy shock on residential assets and hence the wealth effect operating through the house price channel.

Indeed, once the volumes are included in the analysis, house prices are only marginally affected by a monetary contraction, whereas the effects of a restrictive monetary policy shock are immediately mirrored in a less liquid housing market, meaning that households find it more difficult to sell their homes. Our evidence supports the claim that the housing market is an important channel for monetary policy transmission, but the transmission mechanism largely relies on volumes. The importance of the price/volume interaction has been well addressed in Garriga and Hedlund (2020), who deemed this mechanism crucial in shaping the elasticity of consumption to housing wealth.

Concerning the credit side, the immediate contraction of housing loans in response to monetary tightening highlights the credit channel mechanism. However, it could not be determined whether this was due to a decrease in the demand for loans or to credit rationing phenomena. Excluding transactions from the model made the response of HL to an increase in R similar to the response with transactions. However, after five periods, housing loans still appeared to suffer a larger recessionary shock in the model without transactions. This could be related to the overestimated loss in housing wealth that occurs when transactions are excluded from the model.

The spread rises significantly about two periods after the monetary contraction and remains above the steady state for about more than a year. Thus, the response of SP is consistent with a credit channel transmission mechanism.Footnote 18 We also note that in the model without transactions, the restrictive monetary policy shock seems to have a significant impact only after 5 lags. The deteriorated housing market liquidity, with the (mild) decline in residential prices, increases the risk of default, which motivates us to observe a larger risk premium (our spread variable) in the model with transactions.

Figure 3 also shows the behaviour of other endogenous factors to a restrictive monetary policy. Consistent with macroeconomic theory, a rise in the interest rate corresponds to a negative response of GDP (Y) and price level (CPI). The policy interest rate has no immediate effect on variables that respond after approximately four (GDP) or eight (CPI) periods to monetary policy contraction. This is a direct result of our identification assumption. The effect on output peaks after six quarters and returns to the baseline scenario. According to the literature (see, for instance, Mojon and Peersman 2001; Peersman and Smets 2003), prices respond more slowly, but the effects of the monetary policy shock are more persistent. The results for both variables are similar for both specifications (with and without transactions).

5.2 Proxy-VAR IRFs

As for the baseline VAR model, the IRFs of Proxy-VAR were calculated with and without residential transactions. Figure 4 shows the responses of the endogenous variables to a positive shock of one standard deviation to the short-term interest rate.

IRFs of the Proxy-VAR(4) model. Response of real GDP (Y), consumer price index (CPI), residential transactions (TR), real house price index (HP), spread (SP), and real housing loans (HL) to a positive monetary policy shock (R_IV Identification). The blue lines represent the OIRFs of the model with transactions, while the red lines represent those of the model without transactions. The shaded areas and dotted lines identify the 90% confidence intervals for the models with and without transactions, respectively

We observe remarkably similar effects, and in some cases even stronger effects, when transactions are included in the model. This result is particularly pronounced for the Y, HL and SP variables. The differences with respect to the IRFs of the VAR (see Fig. 3) could be attributed to utilizing the interbank rate as a monetary policy shock, which, under Cholesky identification, might distort the estimated effects due to the possible existence of endogeneity issues between the interbank rate (R) and credit channels. Indeed, the inclusion of TR in the model strengthens the influence of the credit channel alongside the recessionary mechanism on the real economy (Y). Consequently, the instrumented shock affecting residential transactions seems to contribute to a sluggish recovery of the real economy (Y) and housing loans (HL). Moreover, when TR is included in the model, the cost of credit (SP) also appears to increase and persist significantly longer than in the model that considers only house prices.

6 Robustness with Local Projections

To verify the strength of our results, we employ an alternative methodology for identifying the model with an external monetary policy shock. As in the Proxy-VAR model, shock identification is based on the high-frequency variable “timing”, according to which policy surprises are detected from the intraday response of asset prices (Altavilla et al. 2019).

To evaluate the impact of external policy shock, we use the Local Projections (LPs) methodology (Jordà, 2005; Ramey and Zubairy 2018). As pointed out by Jordà (2005), the local projection method is a natural and preferable alternative to VAR. However, the most recent literature has stressed that VAR and local projection estimators of impulse responses should not be considered conceptually different methods when the estimation is linear and we can flexibly control for lagged data (Plagborg-Møller and Wolf 2021).

The method requires estimating a series of regressions for each variable for each horizon h. The linear model LP(h) is specified as follows:

where \({x}_{t}\) is the variable of interest; \({\alpha }_{h}\) is the constant term; \({z}_{t}\) is a vector of control variables; \(\psi \left(L\right)\) is a polynomial in the lag operator; \(shock\) is the exogenous monetary policy shock; and \({\varepsilon }_{t}\) is the error term. The coefficient \({\beta }_{h}\) corresponds to the response of x at time \(t+h\) to the shock variable at time t.Footnote 19 The impulse responses are the sequence of all estimated \({\beta }_{h}\). Our vector of control variables, z, contains Y (real GDP), CPI (consumer price index), TR (number of residential transactions), HP (real house prices index), SP (spread between interest rate on mortgage loans and risk-free interest rate) and HL (real housing loans). In addition, z includes lags of \(shock\) to control for any serial correlation in the shock variable itself. The term \(\psi \left(L\right)\) is a polynomial of order 4.

The IRFs presented in Fig. 5 provide a further robustness check of the results obtained in the previous models. A positive shock of one standard deviation to the external shock “timing” was simulated. As expected, the results for the housing variables and housing loans reacted with a negative, and the rise in spread reflects an increase in the external finance premium following the shock. The main result is confirmed that transactions appear more responsive than house prices to a restrictive monetary policy shock.

7 Conclusion and Remarks

Focusing only on house prices to understand the mechanism of monetary policy transmission through the housing market is reductive, as due to problems of loss aversion, the rigidity of house prices could misguidedly suggest that the market is not affected by policy-makers’ decisions or that it is only slightly influenced in the event of price stability or slowdown following a restrictive shock.

In this paper, the mechanism of monetary policy transmission shocks through the housing market in Italy over the last twenty years was studied, and residential transactions were proposed as a further variable to model the housing market. Italy was taken as a particularly interesting case study because it features a strong and solid housing and banking sector. Indeed, it is one of the developed countries with the highest homeownership rate and one of the few countries that did not use mortgage-backed securitization during the US housing bubble. Additionally, the mortgage market in which there is limited indebtedness of the economic private sector is accompanied by strict regulation.

To assess the impact of a restrictive monetary policy shock on housing and credit variables, we first estimated a structural VAR using a Cholesky identification, and then a Proxy-VAR, where an external instrument is used to identify an exogenous shock to the monetary policy variable. The results of IRFs in both models indicate that transactions are more responsive than house prices to a restrictive monetary policy stance, importantly contributing to shape the effects of monetary policy, and this is also supported by the IFRs based on local projections (LPs), used as a robustness check.

The comparison between the IRFs obtained with and without transactions in both the structural VARs and in the LPs shows that omitting transactions tends to overestimate the deflationary effect of a restrictive monetary policy shock on residential assets and hence the wealth effect operating through the house price channel. Indeed, once the volumes are included in the analysis, house prices are only marginally affected by a monetary contraction, whereas the effects of a restrictive monetary policy shock are immediately mirrored in a less liquid housing market, meaning that households find it more difficult to sell their homes. The degree of liquidity of the housing market appears to be further important in the proxy-VAR IRFs, where the inclusion of transaction seems to shed light on a veritable additional channel in the mechanism of transmission, not working through a mitigated house price decline, rather than through a reinforced credit channel. The sudden stop in the exchanged volumes of housing increases the credit risk in mortgage market, thus contributing to explain the sluggish recovery we observe in our analysis.

These results suggest that transactions are a key and complementary variable to prices for understanding the transmission mechanism of policy-makers’ decisions. Wealth effects originating in the housing market can play a crucial role in shaping the aggregate response to a monetary shock. Our evidence has shown that the response of the housing market is mainly concentrated in exchange volumes (i.e., transactions). Therefore, a restrictive monetary policy mainly translates into a sudden stop in exchanged volumes, and the low degree of liquidity perceived in the housing market can help account for the so-called “mythical” nature of the housing wealth effect captured by prices (Calomiris et al. 2009). As a result, macroeconomic policies that focus on stabilizing house prices have less impact on consumption through the wealth effect.

In conclusion, this study shows that particular attention must be given to residential transactions, as they are crucial in predicting the hot and cold phases of the housing market, contributing to shaping the true extent of housing wealth. Given that the housing market plays a key role in the aggregate economy, political and economic institutions must continuously monitor all the variables that shape residential real estate cycles.

Furthermore, statistical institutions should invest in collecting accurate and high-frequency data on housing transactions, which to date are much less available than other financial variables related to the housing market.

A valid extension of this research could analyse the response of a similar model to both an expansionary and a restrictive monetary policy in a nonlinear framework in search of potential asymmetries in the adjustment of transactions and prices.

Data availability

Data available on request from the authors.

Notes

For a broader discussion on the relevance of real estate cycles and housing market before the crisis see Pyhrr et al. (1999).

In this context central banks should intervene through macroprudential instruments given that the threat of a systemic risk derives precisely from financial instability. See Hartmann (2015) for a detailed list of lenders and borrowers macroprudential instruments.

Similarly, Bernanke and Gertler (1995) argue that residential investments are not informative to study the monetary policy transmission.

As defined by Ceron and Suarez (2006) a hot phase is typically associated with a price boom phase, where transactions are abundant, average sales times are short and prices tend to grow quickly, while a cold phase is typically associated with a phase of low market liquidity with fewer transactions, longer average sales times and moderate or negative price growth.

For instance, through mortgage equity withdrawal (MEW) we have a potential wealth effect translated into consumption. MEWs are typically present in those mortgage markets classified as flexibility or development (Calza et al. 2013). Since Italy is not among the countries that use MEWs, the only variable that can help in terms of measuring the liquidity of the real estate market could be transactions. This liquidity could then also have effects on consumption.

Despite the bursting of the real estate bubble in the USA, which began to deflate towards the end of 2006 and worsened in terms of loss of housing value between 2007 and 2008, annual real house prices in Italy continued to rise until 2007 (peak year) and then slowed down until 2011, decreasing by -1.4% per year on average.

The Bank of Italy, in this period of great uncertainty in the financial markets, put in place a strengthening of control over the internal liquidity of credit institutions. Without these interventions, the impact of the most acute phase of the crisis, unleashed after the Lehman bankruptcy, could have been much more intense and drastic for Italy as well.

The State limited itself to subscribing to subordinated bonds for a total amount of just over 4 billion euros, against the commitment of the issuing institutions not to reduce the credit granted to the real economy (Consob 2013).

This was especially the case for small and medium-sized enterprises (SMEs), which make up a very large share of the Italian economy and are often purely family-owned. Ferrara et al. (2018), using a single set of data provided by the Bank of Italy for the period 2010–2016, documented that SMEs have experienced more severe credit constraints compared to large firms during the last economic and financial crisis. Otherwise, for the Italian large firms, it appears to have caused greater volatility rather than actual credit rationing.

We cut our sample back to 2019 to exclude from the analysis the outliers caused by the pandemic shock due to the spread of COVID-19.

A rise in spread between the mortgage rate (RM) and risk-free rate (Rtb) for Italy could capture the increase in the external finance premium risk associated with a credit channel.

We also run the loans and spread regression separately. The results are alike and available upon request.

Their data are provided monthly from 2002 onwards. To obtain a quarterly time series, we take the value of the last month of each quarter.

We keep the IRFs projection to only 12 quarters to ease the comparison between the VAR approach and the local projection analysis. Indeeed, as well pointed out in Kilian and Lütkepohl (2017), VARs that control for many lags tend to agree at short and medium horizons with local projections that also control for a rich or the same set of lags. At long horizons, however, the methods may differ significantly.

However, as pointed out by Iacoviello and Minetti (2008), the analysis of the spread encounters two principal problems for detecting a possible credit channel. First, an increase in the default probability of the borrower could result in higher required collateral rather than higher mortgage rates. Second, if quantity rationing were large in the credit market, the spread would fail to capture an increase in nonprice rationing of mortgage demand.

Furthermore, to check the strength of our estimation with the lag augmentation, VAR(5) model, the main results of the impact on transactions is robust and significant, while house prices lose significance (see Appendix A.4). A lag augmentation could be useful to check the robustness when the estimates are in levels (see Toda and Yamamoto 1995; Allen and Fildes 2001; Kilian and Lütkepohl 2017).

A further robustness analysis was performed using another difference as a proxy of external finance premium risk in the VAR(4) model specification. In this case, the spread used (SP10y) is given by the difference between RM (Harmonized Interest Rates-Loans for House Purchases) and RL10y (Long-Term Government Bond Yields: 10-Year) as a potential proxy for the risk-free. The impact of R on the other endogenous is substantially the same as Figs. 3. We only found a principal difference in the response of spread now significant and positive from the impact and for just over a year (see Appendix A.5).

Robust standard errors can be estimated using the approach by Newey and West (1987).

References

Allen PG & Fildes R (2001) Econometric forecasting. Principles of forecasting: a handbook for researchers and practitioners, 303–362. https://doi.org/10.1007/978-0-306-47630-3_15

Altavilla C, Brugnolini L, Gürkaynak RS, Motto R, Ragusa G (2019) Measuring euro area monetary policy. J Monet Econ 108:162–179

Assenmacher-Wesche K & Gerlach S (2008) Financial structure and the impact of monetary policy on asset prices. Swiss National Bank

Baffigi A & Piselli P (2019) Valuation and return: the Italian Housing Market 1927–2015. Banca d’Italia, mimeo, paper presented at CEBRA conference, July 18–20, NYC, USA

Berkovec JA, Goodman JL (1996) Turnover as a measure of demand of existing homes. Real Estate Econ 24(4):421–440. https://doi.org/10.1111/1540-6229.00698

Bernanke BS, Blinder AS (1992) The federal funds rate and the channels of monetary transmission. Am Econ Rev 82(4):901–921

Bernanke BS, Gertler M (1995) Inside the black box: the credit channel of monetary policy transmission. J Econ Perspect 9(4):27–48. https://doi.org/10.1257/jep.9.4.27

Bernanke BS, Gertler M, Gilchrist S (1999) The financial accelerator in a quantitative business cycle framework. Handb Macroecon 1:1341–1393. https://doi.org/10.1016/S1574-0048(99)10034-X

Bernanke BS & Gertler M (2000) Monetary policy and asset price volatility. NBER Working Paper, no. 7559. https://doi.org/10.3386/w7559

Bjørnland HC, Jacobsen DH (2010) The role of house prices in the monetary policy transmission mechanism in small open economies. J Financ Stab 6(4):218–229. https://doi.org/10.1016/j.jfs.2010.02.001

Boeckx J, Dossche M, Peersman G (2017) Effectiveness and transmission of the ECB’s balance sheet policies. Int J Cent Bank 13(1):297–333. https://doi.org/10.2139/ssrn.2482978

Caldara D, Herbst E (2019) Monetary policy, real activity, and credit spreads: evidence from Bayesian proxy SVARs. Am Econ J Macroecon 11(1):157–192

Calomiris C, Longhofer SD & Miles W (2009) The (mythical?) housing wealth effect (No. w15075). National Bureau of Economic Research. https://doi.org/10.3386/w15075

Calza A, Monacelli T, Stracca L (2013) Housing finance and monetary policy. J Eur Econ Assoc 11(suppl_1):101–122. https://doi.org/10.1111/j.1542-4774.2012.01095.x

Ceron JA & Suarez J (2006) Hot and cold housing markets: international evidence. London, UK: Centre for Economic Policy Research, CEPR Discussion Paper 5411

Chow GC, Lin A (1971) Best linear unbiased interpolation, distribution, and extrapolation of time series by related series. Rev Econ Stat 53(4):372–375. https://doi.org/10.2307/1928739

Christiano LJ, Eichenbaum M, Evans CL (1999) Monetary policy shocks: What have we learned and to what end? Handb Macroecon 1:65–148

Ciocca P (2010) La Specificità Italiana Nella Crisi in Atto. Moneta e Credito 63(249):51–58

Consob (2013) “Relazione per l’anno 2012”, Roma

Dokko J, Doyle BM, Kiley MT, Kim J, Sherlund S, Sim J, Van Den Heuvel S (2011) Monetary policy and the global housing bubble. Econ Policy 26(66):237–287. https://doi.org/10.1111/j.1468-0327.2011.00262.x

Fanchon P, Wendel J (1992) Estimating VAR models under non-stationarity and cointegration: alternative approaches for forecasting cattle prices. Appl Econ 24(2):207–217. https://doi.org/10.1080/00036849200000119

Ferrara M, Marzano E, Rubinacci R (2018) Credit rationing and firms’size: exploratory analysis of the effect of the great recession (2010–2016) in Italy. Metody Ilościowe w Badaniach Ekonomicznych 19(4):347–354. https://doi.org/10.22630/MIBE.2018.19.4.33

Forni M, Gambetti L (2014) Sufficient information in structural VARs. J Monet Econ 66:124–136

Garriga C, Hedlund A (2020) Mortgage debt, consumption, and illiquid housing markets in the great recession. Am Econ Rev 110(6):1603–1634

Genesove D, Mayer C (2001) Loss aversion and seller behavior: evidence from the housing market. Quart J Econ 116(4):1233–1260. https://doi.org/10.1162/003355301753265561

Gertler M, Karadi P (2015) Monetary policy surprises, credit costs, and economic activity. Am Econ J Macroecon 7(1):44–76

Giannone D, Lenza M, Reichlin L (2019) Money, credit, monetary policy and the business cycle in the euro area: what has changed since the crisis?, ECB Working Paper Series No 2226/January 2019

Giannone D, Reichlin L (2006) Does information help recovering structural shocks from past observations? J Eur Econ Assoc 4(2–3):455–465

Hansen LP & Sargent TJ (1991) Two difficulties in interpreting vector autoregressions. In: Rational expectations econometrics. Westview Press

Hartmann P (2015) Real estate markets and macroprudential policy in Europe. J Money Credit Bank 47(S1):69–80. https://doi.org/10.1111/jmcb.12192

Hort K (2000) Prices and turnover in the market for owner-occupied homes. Reg Sci Urban Econ 30(1):99–119. https://doi.org/10.1016/S0166-0462(99)00028-9

Iacoviello M (2005) House prices, borrowing constraints, and monetary policy in the business cycle. Am Econ Rev 95(3):739–764. https://doi.org/10.1257/0002828054201477

Iacoviello M, Minetti R (2008) The credit channel of monetary policy: evidence from the housing market. J Macroecon 30(1):69–96. https://doi.org/10.1016/j.jmacro.2006.12.001

Iacoviello M, Neri S (2010) Housing market spillovers: evidence from an estimated DSGE model. Am Econ J Macroecon 2(2):125–164. https://doi.org/10.1257/mac.2.2.125

Illes A and Lombardi M (2013) Interest rate pass-through since the financial crisis, BIS Quarterly Review, September 2013

Janssen J, Kruijt B & Needham B (1994) The honeycomb cycle in real estate. J Real Estate Res 9(2):237–252. https://www.jstor.org/stable/44095493

Jordà Ò (2005) Estimation and inference of impulse responses by local projections. Am Econ Rev 95(1):161–182

Kilian L, Lütkepohl H (2017) Structural vector autoregressive analysis. Cambridge University Press

Kilian L, Murphy DP (2014) The role of inventories and speculative trading in the global market for crude oil. J Appl Economet 29(3):454–478

Leamer EE (2015) Housing really is the business cycle: what survives the lessons of 2008–09? J Money Credit Bank 47(S1):43–50. https://doi.org/10.1111/jmcb.12189

Leamer EE (2007) Housing is the business cycle. NBER Working Paper, no. 13428, 149–233. https://doi.org/10.3386/w13428

Lee J, Song J (2015) Housing and business cycles in Korea: a multi-sector Bayesian DSGE approach. Econ Model 45:99–108. https://doi.org/10.1016/j.econmod.2014.11.009

Lippi M, Reichlin L (1993) The dynamic effects of aggregate demand and supply disturbances: comment. Am Econ Rev 83(3):644–652

Marzano E, Piselli P, Rubinacci R (2023) The housing cycle as shaped by prices and transactions: a tentative application of the honeycomb approach for Italy (1927–2019). J Eur Real Estate Res 16(1):2–21. https://doi.org/10.1108/JERER-02-2021-0011

Mertens K, Ravn MO (2013) The dynamic effects of personal and corporate income tax changes in the United States. Am Econ Rev 103(4):1212–1247

Mojon B & Peersman G (2001) A VAR description of the effects of monetary policy in the individual countries of the euro area. European Central Bank Working Paper Series, 92, 1–49. https://doi.org/10.2139/ssrn.303801

Newey WK, West KD (1987) Hypothesis testing with efficient method of moments estimation. Int Econ Rev 28(3):777–787

Oikarinen E (2012) Empirical evidence on the reaction speeds of housing prices and sales to demand shocks. J Hous Econ 21(1):41–54. https://doi.org/10.1016/j.jhe.2012.01.004

Peersman G & Smets F (2003) The monetary transmission mechanism in the euro area: evidence from VAR analysis. In: Monetary policy transmission in the Euro area (pp 36–55). Cambridge University Press. https://doi.org/10.2139/ssrn.356269

Plagborg-Møller M, Wolf CK (2021) Local projections and VARs estimate the same impulse responses. Econometrica 89(2):955–980

Pyhrr S, Roulac S, Born W (1999) Real estate cycles and their strategic implications for investors and portfolio managers in the global economy. J Real Estate Res 18(1):7–68. https://doi.org/10.1080/10835547.1999.12090986

Ramey VA, Zubairy S (2018) Government spending multipliers in good times and in bad: evidence from US historical data. J Polit Econ 126(2):850–901

Sims CA, Stock JH, Watson MW (1990) Inference in linear time series models with some unit roots. Econometrica. https://doi.org/10.2307/2938337

Stock J & Watson M (2012) Disentangling the channels of the 2007–2009 recession. Brookings Papers on Economic Activity, Spring, 81–135

Taylor JB (2007) Housing and monetary policy, National Bureau of Economic Research, No. w13682. https://doi.org/10.3386/w13682

Taylor JB (2009) The financial crisis and the policy responses: an empirical analysis of what went wrong, National Bureau of Economic Research, No. w14631. http://www.nber.org/papers/w14631

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econometrics 66(1–2):225–250. https://doi.org/10.1016/0304-4076(94)01616-8

Tsai IC (2013) The asymmetric impacts of monetary policy on housing prices: A viewpoint of housing price rigidity. Econ Model 31:405–413. https://doi.org/10.1016/j.econmod.2012.12.012

Tsai IC (2014) Ripple effect in house prices and trading volume in the UK housing market: new viewpoint and evidence. Econ Model 40:68–75. https://doi.org/10.1016/j.econmod.2014.03.026

Tsai IC (2019) Dynamic price–volume causality in the American housing market: a signal of market conditions. North Am J Econ Finance 48:385–400. https://doi.org/10.1016/j.najef.2019.03.010

Wang Y, Whited MT, Wu Y, Xiao K (2022) Bank market power and monetary policy transmission: evidence from a structural estimation. J Finance 77(4):2093–2141

Acknowledgements

Elisabetta Marzano gratefully acknowledges financial support from University of Naples Parthenope, Department of Economic and Legal Studies, project CoRNDiS, DM MUR 737/2021, CUP I55F21003620001.

Funding

Open access funding provided by Università Parthenope di Napoli within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors report there are no competing interests to declare. The views expressed are those of the authors and do not necessarily reflect the views of the Bank of Italy. Any errors are our own.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A1: Data Description and Sources

See Table 1.

Appendix A2: Trend Plot of Endogenous Variables

See Fig. 6.

Trend plot of endogenous variables. HP: log of real house prices index; TR: log of number of residential transactions; Y: log of real GDP; CPI: log of consumer price index; R: short-term interest rate (interbank rate), percentage; HL: log of real loans from banks and credit institutions for housing loans and mortgage; SP: Spread between mortgage rate and the safe rate (treasury bill), percentage

Appendix A3: Unit-Root Tests

Appendix A4: OIRFs of the VAR Model with \({\varvec{p}}=5\)

See Fig. 7.

OIRFs of the VAR(5) model. Response of real GDP (Y), consumer price index (CPI), residential transactions (TR), real house price index (HP), spread (SP), and real housing loans (HL) to a positive shock to the monetary policy variable (R). The blue lines represent the OIRFs of the model with transactions, while the red lines represent those of the model without transactions. The shaded areas and dotted lines identify the 90% confidence intervals for the models with and without transactions, respectively

Appendix A5: OIRFs of the VAR Model with SP10y as a Spread Proxy

See Fig. 8.

OIRFs of the VAR(4) model. Response of real GDP (Y), consumer price index (CPI), residential transactions (TR), real house price index (HP), spread (SP10y), and real housing loans (HL) to a positive shock to the monetary policy variable (R). The blue lines represent the OIRFs of the model with transactions, while the red lines represent those of the model without transactions. The shaded areas and dotted lines identify the 90% confidence intervals for the models with and without transactions, respectively

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fiorelli, C., Marzano, E., Piselli, P. et al. The Role of House Prices and Transactions in Monetary Policy Transmission: The Case of Italy. Ital Econ J (2024). https://doi.org/10.1007/s40797-024-00282-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40797-024-00282-6