Abstract

The aim of this paper is to assess the effect of university research on total factor productivity in Italy. The impact of universities on firms’ performance is highly complex, nevertheless we shall attempt to verify how geographical location, sector and firm size may influence this relationship. Results show that university R&D does not seem to affect firm productivity, yet if we consider geographical location and sector, we find that universities have a positive effect on the performance of firms located in the North of Italy and on firms operating in the specialised supplier sector. Several robustness checks confirm the significant role played by universities especially in the North of Italy. Finally, the policy implications of these findings are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The purpose of this paper is to investigate the role played by positive externalities produced by universities in the productivity of local firms. Our main hypothesis is that, regardless of formal university-firm relationships, firms can benefit from knowledge ‘spillovers’ from nearby universities, which can be used to improve their productivity either directly or indirectly via innovation output. Such spillovers can arise through informal information transmission via the local personal networks of university and industry professionals, participation in conferences and presentations, or other kinds of knowledge transmissions from academia to industry (Varga 2000).

The role of university research in the stimulation of technological innovation and higher productivity is due to its nature as a public good, which determines positive externalities to the private sector (Anselin et al. 1997). Firms access external knowledge at a cost that is lower than the cost of producing this value internally or of acquiring it externally (Harhoff 2000). The cost of transferring such knowledge is a function of physical distance and gives rise to localised externalities (Siegel et al. 2003). According to Adams (2002), the open science of universities draws firms to locate near academic institutions: firms go to local universities to obtain information that is current and not proprietary. Yusuf (2008) explains that the closer one gets to the knowledge frontier, the larger the human factor in the transmission process and, consequently, the importance of networking and circulation of knowledge workers. In a nutshell, the presence of a university may contribute to the creation of a social and cultural climate that promotes networks of formal and informal interaction, allowing the resulting spillovers to be more easily absorbed by local firms.

The first conceptualizations of this process were provided by Arrow (1962) and Nelson et al. (1959), and further refined by Griliches (1979), Nelson (1982), Cohen and Levinthal (1989). From an empirical point of view, however, there are few studies that explicitly analyse the impact of academic research, and consider its impact on innovation (among others, see Acs et al. 1992; Anselin et al. 1997; Audretsch et al. 2012; Del Barrio-Castro et al. 2005; Jaffe 1989; Leten et al. 2011; Piergiovanni et al. 1997), or on regional economic growth (Carree et al. 2014; Duch et al. 2011; Goldstein and Drucker 2006). Unlike previous studies, we assess the effect of the university research on firm total factor productivity (TFP). This variable, generally regarded to be the best metric of economic efficiency, is crucial especially for those countries, such as Italy, which suffer from low productivity (ISTAT 2007a; OECD 2007; Van Ark et al. 2007). Yet, few studies have investigated the impact of university knowledge on firm productivity, and all have considered formal R&D co-operation (Arvanitis et al. 2008; Belderbos et al. 2004; Harris et al. 2011; Medda et al. 2005), and are thus incomparable with our analysis. More similar to our contribution is the study by Audretsch and Lehmann (2005) who, assessing the effect of knowledge generated by universities on the rate of growth of firms in terms of employees, provided the “missing link” between the literature on firm growth and that studying university spillovers. To the best of our knowledge, however, ours is the first paper which specifically addresses the effect of university R&D spillovers on firm productivity.

We measure university research by using the total research spending by the university. As a productivity measure, we estimate TFP at firm level by employing the Levinsohn and Petrin (2003) approach and the UniCredit-Capitalia (2008). Firm data are combined with indicators of university research in the province where a firm is located. In so doing, we rely on previous research results which stress that a good deal of knowledge is embodied in people and organisations, and spatially clustered (Jaffe 1989; Audretsch and Feldman 1996; Anselin et al. 1997).

We also evaluate if firm size, sector and geographical location influence the relationship between local universities and firm productivity: in particular, whether university research effects hold uniformly across regions, whether local university spillovers could be specific to certain industries, and whether firm size matters.

Results show that university R&D does not seem to improve firm productivity. However, if we consider geographical location and sector, we find that universities have a positive effect on the performance of firms located in the North of Italy and those operating in the specialised supplier sector. Several robustness checks are performed, confirming the significant role played by universities especially in the North of Italy.

The paper is organized as follows. The following section describes data and indicators employed. We then illustrate methodology and results. The final section concludes.

2 Data and Descriptive Statistics

2.1 Firm Data

Our firm-level data come from the Xth UniCredit-Capitalia (2008), which covers the period 2004-2006 and is compiled on the basis of the information from a questionnaire sent to a sample of Italian manufacturing firms.Footnote 1 The survey is complemented with balance sheet data for the period 1998–2006.

Information on the sample is reported in Table 1. Sampled firms are mainly small-medium sized, family-owned, belonging to supplier-dominated sectors or specialized suppliers located predominantly in Northern Italy. Table 1 also reports TFP average for 2006 estimated with the Levinsohn and Petrin (2003) approach (see Appendix 1). Marked differences emerge across different groups. Productivity appears to be higher for large enterprises, non-family firms, firms belonging to the science based sector and located in the North.

2.2 University Indicators

Past research underlines the fact that the spillover of human capital and research from universities to industry is mainly in the nature of tacit knowledge (Acs et al. 1992; Jaffe 1989). Tacit knowledge cannot be easily transferred over large distances or bought via the market. Jaffe (1989) and Audretsch and Feldman (1996) provided evidence that knowledge spillovers are geographically bound and located close to the knowledge source. Furthermore, Anselin et al. (1997) prove that the geographical scope of knowledge spillovers is restricted to a limited number of neighbouring regions or to regions within a given maximum distance from the region of interest.

Considering the relevance of geographic proximity for tacit knowledge, we choose the province (NUTS 3 level)Footnote 2 as the territorial unit for university variables. We use data collected from Italian universities, both public and private, to build university-related indicators: university R&D indicator \(( {RD^{UNIV}})\).

Total research spending by the u-th university\(( {RD^{UNIV}})\) is given by:

where RDP is the cost for professors and assistant professors (from now on “researchers”), F represents the expenditure for doctoral and post-doctoral fellowships and RDDEP is R&D expenditure by departments. Specific university variables are provided by ANVUR.Footnote 3

Expenditure for academic research personnel ( RDP) is proxied by

with s = 1.....14 discipline groups,Footnote 4 \(p = \) position (1 for professors and 2 for assistant professors) and where:

\(\overline{S} _{pu} \) is the average expenditure on personnel for position p and university u;

\(N_{psu} \) is the number of research staff for position p, scientific area s and university u;

\(t_s \) is the percentage of time spent on research by academics for each scientific area s.

The percentage of the time spent on research by university professors and assistant professors for each scientific area (\(t_{s})\) is published by ISTAT (2007b). These coefficients are the results of the survey on the distribution of working time of Italian academics, primarily the time devoted to teaching and research, for the academic year 2004–2005.Footnote 5

As regards F, data on post-doctoral fellowships were available from ANVUR Annual Survey, while doctoral fellowships were calculated by considering the number of PhD students provided by ANVUR and the cost per fellowship in 2004.Footnote 6

The final component of our proxy of university research expenditure is departmental expenses for research, that is

with d = 1 ......n \(_{u}\) departments in university u and \(Pay_{du} \) represents total expenditure for research by department d of university u.Footnote 7

The correlation between the ISTAT data on university R&D expenditure available at regional level and our estimates aggregated on a regional basis is very high (0.98) and this gives us confidence that the procedure used is correct.

To pool the university indicator with the company dataset, the former is aggregated on a provincial basisFootnote 8 and then added to each company dataset based on its location. The 76 universities considered are based in 49 out of the 107 Italian provinces. In particular, 37 provinces have just one university, 8 provinces have 2 universities and 1 province (Pisa) has 3 universities; a marked concentration of universities exists in the provinces of Naples (5 universities), Milan (7) and Rome (8).

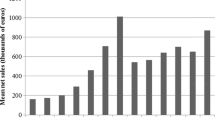

Table 2 reports statistics regarding the university indicator aggregated by location: Northern provinces spend, on average, 1.4 times the amount spent by Southern provinces.

3 Empirical Strategy and Results

3.1 Empirical Strategy

The baseline model considered in our analysis is the following:

for i = 1,...,N firms and j = 1,2,...,P provinces.

\(\omega \) indicates the firm TFP in 2006 estimated by the Levinsohn and Petrin (2003) approach, Int_assets indicates the 2005 intangible assets per employee (in millions of euro), CL is the 2005 cost of labour per employee as a proxy of labour quality,Footnote 9 D_small takes the value one if the firm is small (less than 50 employees) and zero in other cases, D_pav is equal to one if the firm is in the supplier dominated sector according to the Pavitt taxonomy, D_North assumes the value of one if the firm is located in the North of Italy, and D_fam takes the value of one in the case of a family-owned firm. Finally, \(\varepsilon _{ij}\) is the error term. In order to address the effect on TFP of university research, we have included in the equation [4] \(RD^{UNIV} \)which stands for the intensity of R&D at universities located in the same province as the firm in 2004.Footnote 10

As regards the estimation method, since firms from the same province are likely to be more similar to each other than firms from different provinces (because of socio-economic factors for example) the assumption that the errors are independent might be violated. For this reason we control for the potential downward bias in the estimated errors by clustering firms at provincial level. The regression with the cluster option relaxes the assumption of independence and, therefore, compared with the OLS without clustering, increases the error term to accommodate the lack of independence of firms within each province.

3.2 Results

Estimates of equation [4] are reported in column (1) of Table 3. Results show that firms in the supplier dominated sector and small firms have, ceteris paribus, a lower TFP while firms located in Northern Italy exhibit higher productivity, as already stressed by the literature (Aiello et al. 2012; Ascari and Di Cosmo 2005; Byrne et al. 2009). Moreover, as expected, family firms are less efficient (Cucculelli and Marchionne 2012 ; Cucculelli et al. 2014), TFP is positively affected by the quality of the labour force (Ascari and Di Cosmo 2005; Ciccone 2004) while intangible assets have no significant effect. As regards the specific variable of interest, we find that university research does not significantly affect firm TFP, confirming the uneasy relationship between universities and industry in Italy (Poma and Ramaciotti 2008).

It is difficult to compare our results with those obtained by other contributions since, to the best of our knowledge, this is the first paper which specifically addresses the effect of University R&D spillovers on firm productivity.Footnote 11 Indeed, empirical studies that pursue similar research questions have investigated the impact of academic research on innovation (among others, see Acs et al. 1992; Anselin et al. 1997; Audretsch et al. 2012; Del Barrio-Castro et al. 2005; Leten et al. 2011; Jaffe 1989; Piergiovanni et al. 1997) or on firm growth in terms of number of employees (Audretsch and Lehmann 2005) or on regional economic growth (Carree et al. 2014; Duch et al. 2011; Goldstein and Drucker 2006). The results suggest a positive relationship between universities and firm performance.

However, regional specificities may affect the university-firm relationship. A key question is whether the effects of university research hold uniformly across regions or whether regions with different levels of economic development respond differently. Considering the dualistic nature of Italian economy, this aspect is relevant: the regions of the North are as prosperous as those of Central and Northern Europe, while the South is the largest backward region within the EU-15 (Iuzzolino et al. 2011). The key question is whether communities near universities have the capabilities to absorb and exploit the knowledge that universities generate. Even though new knowledge is generated in many places, only those regions that can absorb and apply such ideas are able to turn it into economic growth.

Moreover, local university spillovers could be specific to certain industries: knowledge spillovers appear to be particularly important in sectors where new knowledge can be assumed to be of special importance (Anselin et al. 2000a; Döring and Schnellenbach 2006).

Finally, firm size also matters. Smaller firms do not have the resources to maintain large scale R&D departments and, therefore, spillovers from the research activities of universities could, in theory, play a more decisive role for them (Acs et al. 1994). However, others argue that large firms are more likely to benefit from university research since they employ staff with a science and engineering background who are able to exploit the results of university research (Cohen et al. 1998; Laursen and Salters 2004).

In order to consider these aspects we have estimated equation [4] by considering geographical location, sector and firm size. Results of these estimations are also reported in Table 3.

When we consider the location (columns 2–3), we find that universities have a positive effect on the performance of Northern firms only: universities seem to affect firm performance only in an industrialized context, such as the North of Italy. In more detail, for Northern firms we observe a positive and significant impact on TFP of R&D by universities located in the same province, which suggests that proximity to a university is not a sufficient condition for a significant effect on industry. This is in line with the concept of “the critical mass of agglomeration” suggested by Varga (2000) according to which there is a need of a certain level of agglomeration, in particular of concentration of high technology production, as one would find in a metropolitan area in order for local academic knowledge transfers to be effective. Furthermore, our result provides further support for the conjecture that regions that already have a relatively higher productivity level and a larger stock of knowledge, as the Northern regions of Italy, absorb incoming knowledge relatively easier (Döring and Schnellenbach 2006). Finally, our results are in line with those obtained by Carree et al. (2014), who by measuring the contribution of teaching, publication and intellectual property rights on the growth of value added for Italian provinces between 2001 and 2006, show that universities play a key role when they are associated with sustained entrepreneurial activity in the province. Similarly, Arvanitis et al. (2008) found that university knowledge and technology transfer to firms imply, ceteris paribus, higher labour productivity for a sample of Swiss firms over the period 2002–2004.

Unfortunately our results do not help discern whether the effect of university research is greater for small-medium or large companies: the coefficients of university indicators are always not significant when we split our sample on the basis of size (columns 4–5).

As Anselin et al. (2000a) for the US, we do not find that academic externalities are uniform across sectors.Footnote 12 Only for the specialised suppliers is there a positive and significant effect of university research on TFP (columns 7–10). Our findings, however, are not in line with Anselin et al. (2000b).Footnote 13 Indeed, they find that university research is only positive in the electronics sector (science based), while there is no effect for the machinery and instruments sectors (specialised suppliers). Our findings could reflect the Italian pattern that tends to be less “science based” and more concentrated in the machinery sector, the backbone of Italian exports, and in traditional sectors.

3.3 Robustness Checks

We performed a number of robustness checks in order to test the stability of the results.

Theories dating back to Marshall suggest that agglomeration may result in greater firm efficiency by providing industry specific complementary assets that may either lower the cost of supplies to the firm or create greater specialisation in both input and output market (Feldman 1999). In our case, overall agglomeration economies could also play a role since the high concentration of companies and industries in the Northern part of the country creates more capacity to exploit university products providing better infrastructure for developing innovation. As regards this aspect, we have included, in equation [4], the ratio of the number of firms in the restricted industry (manufacturing, mining, and energy) located in the province to population as agglomeration indicators. The results show that inclusion of this indicator in the equation affects neither the sign nor the significance of the university indicator in the case of the Italian sample as a whole, or when the sample is split on the basis of location (Table 4). This means that University R&D positively affects the TFP of Northern firms only. However, we now find that University R&D has a positive and significant effect for small firms too, while the effect is never significant when we split the sample according to the Pavitt taxonomy.

We have considered whether the knowledge flows from universities located in a larger geographical context than the provincial level may also play a role in firm TFP. We have estimated eq. [4] by using university R&D indicator referring to the other provinces of the same region in which each firm is located. Results, available upon request, show that the relative coefficient is never significant. Moreover, the effect of university R&D of the province in which firm is located is once again significant for Northern firms but not for specialized suppliers.

As a further robustness check, another indicator of university research, that is the ratio of S&T researchers to employment in the restricted industry located in the same province of each firm is employed. Hence, we have estimated equation [4] with the inclusion of this indicator instead of University R&D.Footnote 14 Results, reported in Table 5, confirm those obtained when R&D university is used: academic research positively and significantly affects productivity of Northern firms and firms in the specialized suppliers sector.

As highlighted in the seminal articles of Mansfield (1991, (1995) the higher the quality of academic research the more likely it is to contribute to industrial innovation. In order to take account of the effects of academic research performance, a proxy of the quality of university research is included in equation [4]. Research performance indicators are based on the evaluation of research output carried out over the period 2001–2003 by CIVR-VTR (MIUR 2007) which produced a composite indicator for the various universities.Footnote 15 The effect of the CIVR indicator is positive and significant for the whole sample and for almost all groups considered (Table 6). From our results it seems that the higher the quality of universities located in the province the more widespread is the effect on the firm’s performance. Quality research seems to affect not only Northern firms and firms in the specialized suppliers sector, but also small firms, those located in the Centre-South, and businesses operating in the supplier dominated sector.

Finally, we have also controlled for the quality of primary and secondary education on firm performance. Indeed, a high level of primary and secondary education in a province may generate both skilled workers for manufacturing firms, and researchers for universities. So, the quality of primary and secondary education may work as a hidden factor explaining the performance of firms and university in terms of research output.

To take account of this aspect, we have included a proxy of the quality of education, using the 2010 INVALSI test scores by province, that is the Average Scores in Language obtained in the fifth year of primary schools and in the third of secondary schools (first grade) in each province.Footnote 16 The language test is built to measure reading proficiency (in particular the ability of students to understand and interpret a text) and lexical and grammatical knowledge.Footnote 17 We use the 2009/2010 wave because this wave was the first to test and collect data for the entire population of Italian school students. Second, and most important for our purposes, data are available at the provincial level.Footnote 18 Results, reported in Table 7, confirm those found in the previous estimations: academic research, proxied by both the intensity of university R&D and the share of S&T researchers, positively and significantly affects productivity of Northern firms, while the effect of these two indicators is not significant for Central-Southern firms. Moreover, the results concerning the CIVR indicator are also confirmed: the firm’s performance is positively and significantly influenced by the quality of universities located in the province, whatever the location.Footnote 19

Finally, we have included in the equation [4] Research Contracts, in order to verify that the link between university and firm performance is not induced by other hidden factors, such as formal relationships between universities and firms. Research Contracts are measured as the intensity to value added of third-party funding for research projects received in 2004 by universities in the province where each firm is located. Once again, the results seem to be robust as the effect of the University indicators on firm performance does not vary substantially.

4 Conclusion and Policy Implications

The relationships between university and industry have become of central concern for applied economics in recent years. On one hand, some supporters of Open Science consider that greater commercial orientation of university research hinders the generation of positive externalities from university research to other firms, thereby inhibiting knowledge transfer, e.g. as a result of patented research, as sponsoring companies attempt to protect their interests and increase their market power (Argyres and Liebeskind 1998; Dasgupta and David 1994; Stern 2004; Colombo et al. 2010). Others, on the other hand, support the so-called Triple Helix model (Etzkowitz and Leydesdorff 2000) believing that greater commercial orientation may facilitate the absorption by local firms of university research, and will encourage the latter to produce knowledge of commercial value (Di Gregorio and Shane 2003), as well as to become more directly involved in entrepreneurial activities, such as consultancy work for industry, and collaboration and participation in start-ups (Cohen et al. 1998; Roberts and Malone 1996).

An increasing number of studies examine the effect of universities on innovation or growth, while the impact of universities on firm productivity is rarely investigated. None of these studies refers to Italy. Nevertheless, empirical evidence documenting the disappointing performance of the Italian economy highlights the role of TFP as a key factor in the decline of labour productivity in Italy over recent decades. We contribute to this debate by assessing the role of universities in fostering the productivity of Italian firms, but we are aware that these issues could also be of interest to many other European countries.

Overall, the results show that universities do not seem to play a significant role in improving firm productivity. Universities matter only through the mediation of other actors.

Firstly, a local context is required in which the knowledge that universities generate can be exploited: only where there is a dynamic industrial system, as in the North of Italy, can universities have a positive effect on firm productivity. This does not mean that universities may not be able to foster economic growth of weak economies. Indeed, publicly funded research could be crucial if we are to avoid increasing the gap between areas with different levels of development. That said, clearly other policies measures are also needed in order to improve the economic context and fully benefit from university research.

Secondly, local university spillovers are specific to certain industries: only for the specialised supplier sector does university research have a positive effect on productivity, while there is no effect for the science based sector, which is the sector where the interaction between universities and industry should be greatest. Our findings could reflect the Italian pattern of specialisation that tends to be more concentrated in the machinery sector, the backbone of Italy’s exports, rather than in the science based one. This result leads us a similar conclusion to the previous one: university-firm interaction is effective in sectors which are able to exploit the opportunities that university research can offer.

Several robustness checks confirm these results. In particular, three robustness checks deserve more attention: the first regards the inclusion of an indicator of provincial firm agglomeration which confirms the positive result of university R&D obtained for Northern firms and, in addition, determines a positive and significant effect also for small firms, while the effect is never significant when we split the sample according to the Pavitt taxonomy. The second refers to the inclusion of another indicator of academic research, that is S&T researchers per employees in the restricted industry. In this case, the results confirm those obtained when university R&D is used. Finally, the inclusion of an indicator of the quality of university, positively affects the performance of all firms except medium-large enterprises and firms operating in the scale intensive or science based sector. It may well be the case that university quality matters because high-quality universities are likely to offer the most valuable resources and skills.

In conclusion, despite the enthusiasm for university–industry links, we found that only a limited number of firms actually benefit from the presence of universities. The results do not imply that universities make no contribution to firm productivity, but rather suggest that their contribution is concentrated in certain specific geographical areas and in a few industrial sectors. Our results contribute to the ongoing debate on the effectiveness of academic research in enhancing firm performance and stimulating economic growth. In that sense, they can provide guidance to policy makers on the context in which the transfer of knowledge from universities could be most effective. Policies aimed at increasing knowledge transfer from universities to businesses have, up till now, been formulated without taking regional and sectorial policies into account. We believe, on the contrary, that it is necessary to redefine them by considering the close interconnections between the different policies. Otherwise the risk is, on the one hand, to exclude certain areas and sectors from the benefits of university research and, on the other, to hold researchers to account for failings beyond their control. In other words, universities can carry out a complementary role, but cannot substitute policy actors at regional and sectoral level.

Notes

The survey design includes all firms with a minimum of 500 employees. A sample of firms with between 11 to 500 employees is selected according to three stratifications: geographical area, Pavitt sector and firm size. Although the survey covers the period 2004–2006, some parts of the questionnaire refer to 2006 only.

Provinces are one of the three different levels of government (regions, provinces and municipalities) in Italy. According to the basic principles of the Nomenclature of Territorial Units for Statistics (NUTS) established by Eurostat and used by the European Commission, Italian provinces are NUTS 3 level.

The ANVUR Annual survey database relative to 2004 includes 79 universities. Removing from the population two telematic universities and one university with no data on expenditure on personnel brought down the count of research universities to 76. Databases are available at: http://www.anvur.org/?q=content/rilevazioni-annuali. Data from private universities have been collected from https://nuclei.cineca.it/cgi-bin/2005/sommario.pl.

MIUR aggregates disciplines in 14 groups (“settori scientifico-disciplinari”): Mathematics and Computer Sciences; Physics; Chemistry; Earth Sciences; Biology; Medicine; Agricultural and Veterinary Sciences; Civil Engineering and Architecture; Industrial and Computer Engineering; Ancient History, Philology, Literature and Art History; History, Philosophy, Pedagogy and Psychology; Law; Economics and Statistics; Political and Social Sciences. In the S&T fields we consider the first nine groups.

The research activity includes the time spent on research, i.e. the creative work aimed at acquiring new knowledge, and the use of such knowledge in new applications. It also includes the time involved in the coordination of research projects carried out by researchers and PhD students and in conferences and seminars. For example, chemists spend, on average, 56 % of their working time doing research, while academics in the field of medicine spend 29 %.

For the universities where information on postdoctoral fellowships were not available on the ANVUR Annual Survey database, we collect data at http://www.anvur.org/?q=content/rilevazioni-annuali.

Departmental expenditure for research activities represents 26.8% of our university R&D indicator.

For the multi-campus universities with an organized central campus and several peripheral ones, we refer the data to the province of the central location of the multi-campus university, since in most cases teaching activity alone is performed locally, whereas research is retained at the central location (one exception is “Università Cattolica del Sacro Cuore”).

Cost of labour per employee should be correlated with skill intensity if more skilled workers receive higher wages.

Intangible assets per employee and cost of labour are deflated by considering producer price index for industrial products and consumer price index for families of workers and office workers from ISTAT, respectively.

It is worth noting that for Anselin et al. (2000a) the dependent variable is the count of innovations.

Data on S&T researchers comes from ANVUR. In the S&T fields we consider the first nine groups: Mathematics and Computer Sciences; Physics; Chemistry; Earth Sciences; Biology; Medicine; Agricultural and Veterinary Sciences; Civil Engineering and Architecture; Industrial and Computer Engineering.

The composite indicator, suitable to be used for the allocation of state funds, includes: quality of the products; property rights on the products; international mobility propensity; advanced training propensity; ability to attract financial resources; ability to use available funds to finance research projects.

Data are collected by the National Institute for the Educational Evaluation of Instruction and Training (INVALSI), which is in charge of testing the Italian students’ performances through a series of standardized tests in mathematics and language. These tests were introduced on a small sample of schools in the second and fifth grade in the academic year 2007-08, and since the academic year 2009–2010 these tests have been taken by all students in Italy at the end of second, fifth, sixth, and eight grade.

The tests are composed mainly of multiple choice questions, in which the students are given four options to choose from; in mathematics tests there are also few open questions. The test score is calculated as a percentage of correct answers out the total and hence varies between 0 and 100.

As regards the reference time period, INVALSI indicators refer to 2010, while our dependent variable refers to 2006. However, the difference in the time reference does not, in the authors’ opinion, pose major problems, insofar as it is reasonable to assume that educational changes occur slowly over time.

We have also considered, instead of Language test scores, Mathematics test scores which measure knowledge of the mathematics contents and logical and cognitive processes used in the mathematical reasoning. Results, available upon request, mainly confirm those obtained with the inclusion of Language test scores.

References

Acs ZJ, Audretsch DB, Feldman MP (1992) Real effects of academic research: comment. Am Econ Rev 82:363–367

Acs ZJ, Audretsch DB, Feldman MP (1994) R&D spillovers and recipient firm size. Rev Econ Stat 76:336–340

Adams JD (2002) Comparative localization of academic and industrial spillovers. J Econ Geogr 2:253–278

Aiello F, Pupo V, Ricotta F (2012) Un’analisi territoriale della produttività totale dei fattori in Italia”. Scienze Regionali Ital J Reg Sci 11(2):23–46

Aiello F, Pupo V, Ricotta F (2014) Explaining TFP at firm level in Italy. Does location matter? Spat Econ Anal 9:51–70

Anselin L, Varga A, Acs Z (1997) Local geographic spillovers between university research and high technology innovations. J Urban Econ 42:422–448

Anselin L, Varga A, Acs Z (2000a) Geographic and sectoral characteristics of academic knowledge externalities. Pap Reg Sci 79:435–443

Anselin L, Varga A, Acs Z (2000b) Geographical spillovers and university research: a spatial econometric perspective. Growth & Change 31:501–515

Argyres NS, Liebeskind JP (1998) Privatizing the intellectual commons: universities and the commercialization of biotechnology. J Econ Behav Org 35:427–454

Arrow K (1962) Economic welfare and the allocation of resources for invention. In: Nelson Richard R (ed) Rate Dir Inven Act. Princeton University Press, Princeton, NJ, pp 609–625

Arvanitis S, Sydow N, Woerter M (2008) Is there any impact of university-industry knowledge transfer on innovation and productivity? An empirical analysis based on Swiss firm data. Rev Ind Org 32:77–94

Ascari G, Di Cosmo V (2005) Determinants of total factor productivity in the Italian regions. Scienze Regionali Ital J Reg Sci 4:27–49

Audretsch DB, Feldman MP (1996) R&D spillovers and the geography of innovation and production. Am Econ Rev 86:630–640

Audretsch DB, Hülsbeck M, Lehmann EE (2012) Regional competitiveness, university spillovers, and entrepreneurial activity. Small Bus Econ 39(3):587–601

Audretsch D, Lehmann E, Warning S (2004) University spillovers: does the kind of science matter? Ind Innov 11:193–206

Audretsch DB, Lehmann EE (2005) Mansfield’s missing link: the impact of knowledge spillovers on firm growth. J Technol Transf 30:207–210

Belderbos R, Carree M, Lokshin B (2004) Cooperative R&D and firm performance. Res Policy 33:1477–1492

Bugamelli M, Cannari L, Lotti F, Magri S (2012) Radici e possibili rimedi del gap innovativo del sistema produttivo italiano, Bank of Italy, Questioni di economia e finanza (Occasional Papers), n. 121

Byrne JP, Fazio G, Piacentino D (2009) Total factor productivity convergence among Italian regions: some evidence from panel unit root tests. Reg Stud 43:63–76

Carree M, Della Malva A, Santarelli E (2014) The Contribution of Universities to Growth: Empirical Evidence for Italy. J Technol Transf 39:393–414

Ciccone A (2004) Human Capital as a Factor of Growth and Employment at the Regional level: The Case of Italy. Report for the European Commission, DG for Employment and Social Affairs, February, Brussels

Cohen WM, Levinthal DA (1989) Innovation and learning. Econ J 99:569–596

Cohen WM, Florida R, Randazzese L, Walsh J (1998) Industry and the academy: uneasy partners in the cause of technological advance. In: Noll RG (ed) Challenges to research universities (ch. 7). Brookings Institute Press, Washington, DC

Cohen WM, Nelson RR, Walsh JP (2002) Links and impacts: the influence of public research on industrial R&D. Manag Sci 48:1–23

Colombo MG, D’Adda D, Piva E (2010) The contribution of university research to the growth of academic start-ups: an empirical analysis. J Technol Transf 35:113–140

Cucculelli M, Mannarino L, Pupo V, Ricotta F (2014) Owner-management, firm age and productivity in Italian family firms. J Small Bus Manag 52:325–343

Cucculelli M, Marchionne F (2012) Market opportunities and owner identity: are family firms different? J Corp Finance 18:476–495

Dasgupta P, David P (1994) Towards a new economics of science. Res Policy 23(5):487–521

Del Barrio-Castro T, García-Quevedo J (2005) Effects of university research on the geography of innovation. Reg Stud 39:1217–1229

Di Gregorio D, Shane S (2003) Why do some universities generate more start-ups than others? Res Policy 32(2):209–227

Döring T, Schnellenbach J (2006) What do we know about geographical knowledge spillovers and regional growth?: A survey of the literature. Reg Stud 40:375–395

Duch N, García-Estévez J, Parellada M (2011) Universities and Regional Economic Growth in Spanish Regions, IEB (Barcelona Institute of Economics) Working papers, n.6

Etzkowitz H, Leydesdorff L (2000) The dynamics of innovation: from National Systems and “Mode 2” to a Triple Helix of university-industry-government relations. Res Policy 29(2):109–123

Feldman MP (1999) The new economics of innovation, spillovers and agglomeration: a review of empirical studies. Econ Innov New Technol 8:5–25

Goldstein H, Drucker J (2006) The economic development impacts of universities on regions: do size and distance matter? Econ Dev Quart 20:22–43

Greenhalgh C, Rogers M (2004) The value of innovation: the interaction of competition, R&D and IP. University of Oxford, Department of Economics, Discussion paper series, n 192

Griliches Z (1979) Issues in assessing the contribution of R & D to productivity growth. Bell J Econ 10:92–116

Harhoff D (2000) R&D spillovers, technological proximity, and productivity growth: evidence from German panel data. Schmalenbach Bus Rev 52:238–260

Harris R, Li QC, Moffat J (2011) The impact of higher education institution-firm knowledge links on firm-level productivity in Britain. Appl Econ Lett 18:1243–1246

ISTAT (2007a) Misure di produttività, in Statistiche in breve, Roma

ISTAT (2007b) La Ricerca e Sviluppo in Italia nel 2005, Statistiche in breve, 11 ottobre

Iuzzolino G., Pellegrini G., Viesti G., 2011, Convergence among Italian Regions, 1861–2011, Bank of Italy, Economic History Working Papers, n. 22

Jaffe AB (1989) Real effects of academic research. Am Econ Rev 79:967–970

Laursen K, Salters A (2004) Searching high and low: what types of firms use universities as a source of innovation? Res Policy 33:1201–1215

Leten B, Landoni P, Van Looy B (2011) Developing Technology in the Vicinity of Science: Do Firms Benefit? An Overview and Empirical Assessment on the Level of Italian Provinces. In: Massimo G Colombo, Luca Grilli, Lucia Piscitello and Cristina Rossi-Lamastra (eds) Science and Innovation Policy for the New Knowledge Economy, PRIME Series on Research and Innovation Policy in Europe

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70:317–341

Mansfield E (1991) Academic research and industrial innovation. Res Policy 20(1):1–12

Mansfield E (1995) Academic research underlying industrial innovations: sources, characteristics and financing. Rev Econ Stat 77:55–62

Medda G, Piga C, Siegel DS (2005) University R&D and firm productivity: evidence from Italy. J Technol Transf 30:199–205

MIUR, Comitato di Indirizzo per la Valutazione della Ricerca (2007) Relazione finale, Roma 8 febbraio

Nelson RR (1959) The simple economics of basic scientific research. J Political Econ 77:297–306

Nelson R (1982) The role of knowledge in R & D efficiency. Quart J Econ 97:453–470

NETVAL (2006) La valorizzazione della ricerca nelle università italiane. Quarto rapporto annuale (http://netval.it)

OECD (2007) Economic survey: Italy. OECD, Parigi

Piergiovanni R, Santarelli E, Vivarelli M (1997) From which source do small firms derive their innovative inputs? Some evidence from Italian industry. Rev Ind Org 12:243–258

Poma L, Ramaciotti L (2008) La valorizzazione della ricerca universitaria mediante l’interpolazione dei saperi. Infrastrutture materiali ed immateriali, l’industria, XXIX, 269–297

Roberts EB, Malone D (1996) Policies and structures for spinning off new companies from research and development organizations. R & D Manag 26(1):17–48

Siegel DS, Westhead P, Wright M (2003) Assessing the impact of university science parks on research productivity: exploratory firm-level evidence from the United Kingdom. Int J Ind Org 21(9):1357–1369

Stern S (2004) Do scientists pay to be scientists? Manag Sci 50(6):835–853

UniCredit-Capitalia (2008) Decima indagine sulle imprese manifatturiere italiane. Rapporto Corporate, n.1

Van Ark B, O’Mahony M, Ypma G (2007) Productivity in the European Union: a comparative industry approach. In: The EU KLEMS Productivity Report, n. 1, European Commission, Brussel

Varga A (2000) Local academic knowledge transfers and the concentration of economic activity. J Reg Sci 40:289–309

Yusuf S (2008) Intermediating knowledge exchange between universities and businesses. Res Policy 37:1167–1174

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: A Measure of TFP

The TFP used in this paper has been estimated in Aiello et al. (2012). Before estimating the TFP, a data cleaning procedure on Unicredit-Capitalia database was carried out: firms with negative values of value added from the original archive and firms with a growth rate of value added and of employees below the first or above the ninety-ninth percentile of the distribution were eliminated. Finally, firms for which data regarding employees was not available for at least 7 years were also excluded. In order to compute the TFP at firm level, we first estimated the following log-linear specification of a production function by using Levinsohn and Petrin (2003) approach:

with i = 1,........N firms, t = 1998, ......2006 and where y represents the value added, l the number of employees,

\(k^{MAT}\) the stock of physical capital, \(\beta _0\) measures the average efficiency and \(u_{it} \) represents the deviation of firm i from this average at time t. The error term can be decomposed into two parts:

where the term \(\omega _{it} \) represents the productivity of firm i at time t and \(\eta _{it} \) is a stochastic term which includes not only the measurement error, but also the shocks which are unobservable to firms, and, therefore, do not correlate with inputs.

Productivity \(\omega _{it} \) is known to the firm which, therefore, in the case of positive shocks, can decide to increase production by raising the level of inputs. This determines a problem of simultaneity which Levinsohn and Petrin (2003) resolved by identifying, in the demand for intermediate goods, a proxy related to the variations in TFP known to firms.

Equation [5] was estimated by utilizing as proxy for the stock of physical capital the tangible fixed assets and the demand for intermediate goods was measured by the operating costs. The value added has been deflated by using the ISTAT production price index available for each ATECO sector. As regards the tangible fixed assets, data have been deflated by using the average production price indices of the following sectors: machines and mechanical appliances, electrical machines and electrical equipment, electronics and optics and means of transport. For the operating costs, we adopt the intermediate consumption deflator calculated by using data from ISTAT.

Appendix 2: List and Description of Variables used in the Empirical Analysis

Rights and permissions

About this article

Cite this article

Cardamone, P., Pupo, V. & Ricotta, F. Do Firms Benefit from University Research? Evidence from Italy. Ital Econ J 2, 445–471 (2016). https://doi.org/10.1007/s40797-016-0035-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40797-016-0035-x