Abstract

Working capital management (WCM) concerns decisions on the levels and turnover of the inventories, receivables, cash and current liabilities of a company. Consequently, WCM affects the profitability of an enterprise. This paper aims to determine the relationship between profitability and WCM, characterised by components of the company’s operating cycle. The research is based on meta-analysis and meta-regression methods that allow for the combination and analysis of the outcomes of individual empirical studies using statistical methods. Our final research sample consists of 43 scientific papers from 2003 to 2018. These studies covered almost 62,000 enterprises in 35 countries from 1992 to 2017. Our results indicate that there is a common, negative relationship between profitability and the cash conversion cycle (CCC). This relationship is conspicuous in various countries and in different economic contexts. A negative, statistically significant relationship was also detected between profitability and average collection period (ACP), the accounts payable period (APP) and inventory turnover cycle (ITC) as well. We also identified moderators of the diagnosed dependencies on the grounds of macroeconomic and institutional factors. The richer the economy, the weaker a negative impact of CCC on profitability. The higher the protection of creditors and debtors, the weaker the negative relationship between profitability and ITC. The opposite is applicable to inflation and ACP and APP, unemployment and CCC, ACP and APP, the availability of credit and APP and the degree of capital market development and CCC and ACP. The aforementioned macroeconomic and institutional factors cause the negative relationship between particular components of the operating cycle and profitability to deepen even further. Our research contributes to the existing knowledge by confirming that the negative relationship between profitability and all components of the operating cycle is dominant in the global economy. It also indicates that there are macroeconomic and institutional moderators of the strength and direction of these relationships.

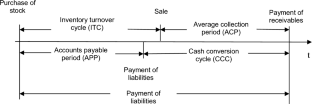

Source: Own elaboration based on (Brealey et al. 2016)

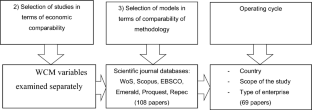

Source: Own elaboration

Similar content being viewed by others

References

Abuzayed B (2012) Working capital management and firms’ performance in emerging markets: the case of Jordan. Int J Manag Financ 8(2):155–179. https://doi.org/10.1108/17439131211216620

Aggarwal A, Chaudhary R (2015) Effect of working capital management on the profitability of Indian firms. IOSR J Bus Manag 17(8):34–43

Ahmed K, Courtis JK (1999) Associations between corporate characteristics and disclosure levels in annual reports: a meta-analysis. British Accounting Rev. https://doi.org/10.1006/bare.1998.0082

Alavinasab SM, Davoudi E (2013) Studying the relationship between working capital management and profitability of listed companies in Tehran stock exchange. Bus Manag Dynam 2(7):1–8. https://doi.org/10.1109/TLT.2009.30

Aloe A (2014) An empirical investigation of partial effect sizes in meta-analysis of correlational data. J Gen Psychol 141(1):47–64. https://doi.org/10.1080/00221309.2013.853021

Alshammari T (2018) International journal of economics and financial issues performance effects of working capital in emerging markets. Int J Econ Financ Issues 8(5):80–87

Aregbeyen O (2013) The effects of working capital management on profitability of Nigerian manufacturing firms. J Bus Econ Manag 14(3):520–534. https://doi.org/10.3846/16111699.2011.651626

Baños-Caballero S, García-Teruel PJ, Martínez-Solano P (2012) How does working capital management affect the profitability of Spanish SMEs? Small Bus Econ 39(2):517–529. https://doi.org/10.1007/s11187-011-9317-8

Baños-Caballero S, García-Teruel PJ, Martínez-Solano P (2019) Net operating working capital and firm value: a cross-country analysis. BRQ Bus Res Quart, Press,. https://doi.org/10.1016/j.brq.2019.03.003

Bijmolt T, Pieters R (2001) Meta-analysis in marketing when studies contain multiple measurements. Mark Lett 12(2):157–169

Blinder AS, Maccini LJ (1991) The resurgence of inventory research: What have we learned? J Econ Surv 5:291–328

Brealey RA, Myers SC, Allen F (2016) Principles of corporate finance—principles of corporate finance (12th edition), 12th edn. McGraw-Hill Education, OH

Brown S, Homer P, Inman J (1998) A meta-analysis of relationships between ad-evoked feelings and advertising responses. J Mark Res 35:114–126

Chang CC (2018) Cash conversion cycle and corporate performance: Global evidence. Int Rev Econ Financ 56:568–581. https://doi.org/10.1016/j.iref.2017.12.014

Charitou M, Lois P, Santoso HB (2012) The relationship between working capital management and firm’s profitability: a empirical investigation for an emerging Asian country. Int Bus Econ Res J 11(8):839–849

Charitou MS, Elfani M, Lois P (2016) The effect of working capital management on firm’s profitability: empirical evidence from an emerging market. J Bus Econ Res 14(3):111–118

de Jong A, Kabir R, Nguyen TT (2008) Capital structure around the world: the roles of firm-and country-specific determinants. J Bank Financ 32:1954–1969. https://doi.org/10.1016/j.jbankfin.2007.12.034

Deloof M (2003) Does working capital management affect profitability of Belgian firms? J Bus Financ Acc. https://doi.org/10.1111/1468-5957.00008

Den M, Oruc E (2009) Relationship between efficiency level of working capital management and return on total assets in ISE (Istanbul Stock Exchange). Int J Bus Manag. https://doi.org/10.5539/ijbm.v4n10p109

Ding S, Guariglia A, Knight J (2013) Investment and financing constraints in China: does working capital management make a difference? J Bank Financ. https://doi.org/10.1016/j.jbankfin.2012.03.025

Duval SJ, Tweedie RL (2000) A nonparametric `trim and fill’ method of accounting for publication bias in meta-analysis. J Am Stat Assoc 95(449):89–98

Eljelly AMA (2004) Liquidity—profitability tradeoff: an empirical investigation in an emerging market. Int J Commer Manag 14(2):48–61. https://doi.org/10.1108/10569210480000179

Erasmus PD (2010) Working capital management and profitability: the relationship between the net trade cycle and return on assets. Manag Dyn 19(1):2–10. https://doi.org/10.1016/j.tics.2008.07.006

García-Teruel PJ, Martínez-Solano P (2007) Effects of working capital management on SME profitability. Int J Manag Financ 3(2):164–177. https://doi.org/10.1108/17439130710738718

Geyer-Klingeberg J, Hang M, Rathgeber A (2020) Meta-analysis in finance research: opportunities, challenges, and contemporary applications. Int Rev Financ Anal. https://doi.org/10.1016/j.irfa.2020.101524

Gill A, Biger N, Mathur N (2010) The relationship between working capital management and profitability: evidence from the United States. Bus Econ J 10(1):1–9

Gitman LJ (1974) Estimating corporate liquidity requirements: a simplified approach. Financ Rev. https://doi.org/10.1111/j.1540-6288.1974.tb01453.x

Glass GV (1976) Primary, secondary, and meta-analysis of research. Educ Res. https://doi.org/10.1002/hlca.200390194

Hang M, Geyer-Klingeberg J, Rathgeber AW, Stöckl S (2018) Measurement matters—a meta-study of the determinants of corporate capital structure. Quart Rev Econ Financ 68:211–225. https://doi.org/10.1016/j.qref.2017.11.011

Hanji MB (2017) Meta-analysis in psychiatry research: fundamental and advanced methods. Apple Academic Press, Toronto; New Jersey

Hoang TV (2015) Impact of capital management on firm profitability: the case of listed manufacturing firms on Ho chi minh stock exchange. Asian Econ Financ Rev 5(5):779–789. https://doi.org/10.18488/journal.aefr/2015.5.5/102.5.779.789

Hsieh C, Chen YW (2013) Working capital management and profitability of publicly traded Chinese companies. Asian Pacyfic J Econ Bus 17(1):1–11

Jaworski J, Czerwonka L (2018) Relationship between profitability and liquidity of enterprises listed on warsaw stock exchange. In: 35th International Scientific Conference on Economic and Social Development—Sustainability from an Economic and Social Perspective Book of Proceedings (pp 15–16). https://doi.org/10.2139/ssrn.2338107

Jaworski J, Czerwonka L (2019) Meta-study on relationship between macroeconomic and institutional environment and internal determinants of enterprises’ capital structure. Econ Res-Ekonomska Istrazivanja 32(1):2614–2637. https://doi.org/10.1080/1331677X.2019.1650653

Jose ML, Lancaster C, Stevens JL (1996) Corporate returns and cash conversion cycles. J Econ Financ 20(1):33–46. https://doi.org/10.1007/BF02920497

Karaduman HA, Akbas HE, Ozsozgun A, Durer S (2010) Effects of working capital management on profitability: the case for selected companies in the Istanbul stock exchange (2005–2008). Int J Econ Financ Stud 2(2):48–54

Keskin R, Gokalp F (2016) The effects of working capital management on firm’s profitability: panel data analysis. Doğuş Üniversitesi Dergisi 17(1):15–25

Kieschnick RL, Laplante M, Moussawi R (2011) Working capital management and shareholder wealth. Rev Financ 17(5):1827–1852.

Kroes JR, Manikas AS (2014) Cash flow management and manufacturing firm financial performance: a longitudinal perspective. Int J Prod Econ. https://doi.org/10.1016/j.ijpe.2013.11.008

Kusuma H, Dhiyaullatief Bachtiar A (2018) Working capital management and corporate performance: evidence from Indonesia. J Manag Bus Administ. Central Europe, 26(2): 76–88

Lazaridis I, Tryfonidis D (2006) Relationship between working capital management and profitability of listed companies in the athens stock exchange. J Financ Manag Anal 19(l): 26–35

Li CG, Dong HM, Chen S, Yang Y (2014) Working capital management, corporate performance, and strategic choices of the wholesale and retail industry in China. Scientific World J. https://doi.org/10.1155/2014/953945

Lin TT (2015) Working capital requirement and the unemployment volatility puzzle. J Macroecon 46:201–217. https://doi.org/10.1016/j.jmacro.2015.05.006

Littell JH, Corcoran J, Pillai V (2008) Systematic reviews and meta analysis. Oxford Univ Press. https://doi.org/10.1093/acprof

Lyngstadaas H, Berg T (2016) Working capital management: evidence from Norway. Int J Manag Financ 12(3):295–313. https://doi.org/10.1108/IJMF-01-2016-0012

Mansoori E, Muhammad J (2012) The effect of working capital management on firm’s Profitability. Interdiscip J Contemporary Res Bus, pp 472–486

Mathuva DM (2010) The influence of working capital management components on corporate profitability: a survey on Kenyan listed firms. Res J Bus Manag 4(1):1–11. https://doi.org/10.3923/rjbm.2010.1.11

Michaelas N, Chittenden F, Poutziouris P (1999) Financial policy and capital structure choice in UK SMEs: evidence from company panel data. Small Bus Econ 12:113–130

Mokhova N, Zinecker M (2014) Macroeconomic factors and corporate capital structure. Procedia Soc Behav Sci 110:530–540. https://doi.org/10.1016/j.sbspro.2013.12.897

Napompech K (2012) Effect of Wcm on the profitability of thai firm. Int J Trade, Ecnomics Financ 3(3):227–232

Ng SH, Ye C, Ong TS, Teh BH (2017) The impact of working capital management on firm’s profitability: evidence from Malaysian listed manufacturing firms. Int J Econ Financ Issues 7(3):662–670. https://doi.org/10.11114/afa.v4i1.2949

Nobanee H, Abdullatif M, Alhajjar M (2011) Cash conversion cycle and firm’s performance of Japanese firms. Asian Rev Account 19(2):147–156. https://doi.org/10.1108/13217341111181078

North D (1990) Institutions, institutional change and economic performance. Harvard University Press, Cambridge

Nyamweno CN, Olweny T (2014) Effect of working capital management on performance of firms listed at the Nairobi securities exchange. Econ Financ Rev 3(11):1–14

Padachi K (2006) Trends in working capital management and its impact on firms’ performance: an analysis of Mauritian small manufacturing firms. Int Rev Bus Res Papers 2(2):45–58

Pais MA, Gama PM (2015) Working capital management and SMEs profitability: Portuguese evidence. Int J Manag Financ 11(3):341–358. https://doi.org/10.1108/IJMF-11-2014-0170

Peterson R (1994) A meta-analysis of Cronbach’s coefficient alpha. J Consumer Res 21:381–391

R Core Team (2019) R: A language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. https://www.R-project.org/

Raheman A, Afza T, Qayyum A, Bodla M (2010) Working capital management and corporate performance of manufacturing sector in Pakistan. Int Res J Financ Econ 47(1):156–169

Rosenthal R (1991) Meta-analytic procedures for social research. Sage, Newbury Park

Ross S, Westerfield RW, Jordan BD (2013) Fundementals of corporate finance 10e. In McGraw-Hill Irwin, New York

Saldanli A (2012) The relationship between liquidity and profitability—an empirical study on the ISE-100 manufacturing sector. J Suleyman Demirel Univ Inst Soc Sci 16:167–176

Şamiloğlu F, Akgün Aİ (2016) The relationship between working capital management and profitability: evidence. Bus Econ Res J 7(2):1–14

Schmidt FL, Hunter JE (2004) Methods of meta-analysis: correcting error and bias in research findings. In: Methods of Meta-Analysis: Correcting Error and Bias in Research Findings (2nd edition). Thousand Oaks. https://doi.org/10.4135/9781483398105

Sethuraman R (1995) A meta-analysis of national brand and store brand cross-promotional price elasticities. Mark Lett 6(4):275–286

Shelby LB, Vaske J (2008) Understanding meta-analysis: a review of the methodological literature. Leis Sci. https://doi.org/10.1080/01490400701881366

Shin H-H, Soenen L (1998) Efficiency of working capital management and corporate profitability. Financ Pract Educ 8(2):37–45. https://doi.org/10.1002/(SICI)1099-0518(20000515)38:10%3c1753::AID-POLA600%3e3.0.CO;2-O

Shrivastava A, Kumar N, Kumar P (2017) Bayesian analysis of working capital management on corporate profitability: evidence from India. J Econ Stud 44(4):568–584. https://doi.org/10.1108/JES-11-2015-0207

Singh HP, Kumar S, Colombage S (2017) Working capital management and firm profitability: a meta-analysis. Qualitat Res Financ Mark 9(1):34–47. https://doi.org/10.1108/QRFM-06-2016-0018

Smith K (1980) Profitability versus liquidity tradeoffs in working capital management. In: Smith K (ed) Readings on the management of working capital. West Publishing Company, St. Paul, pp 549–562

Smith JK (1987) Trade credit and informational asymmetry. J Financ 42:863–872

Suurmond R, van Rhee H, Hak T (2017) Introduction, comparison, and validation of meta-essentials: a free and simple tool for meta-analysis. Res Synthesis Methods. https://doi.org/10.1002/jrsm.1260

Tauringana V, Adjapong Afrifa G (2013) The relative importance of working capital management and its components to SMEs’ profitability. J Small Bus Enterp Dev 20(3):453–469. https://doi.org/10.1108/JSBED-12-2011-0029

Tran H, Abbott M, Jin Yap C (2017) How does working capital management affect the profitability of Vietnamese small-and medium-sized enterprises? J Small Bus Enterp Dev 24(1):2–11. https://doi.org/10.1108/JSBED-05-2016-0070

Troilo M, Walkup BR, Abe M, Lee S (2019) Legal systems and the financing of working capital. Int Rev Econ Financ 64:641–656. https://doi.org/10.1016/j.iref.2018.01.010

Ugurlu E, Jindrichovska I, Kubickova D (2014) Working capital management in Czech SMEs : an econometric approach. Procedia Econ Business Administrat, pp 311–317

Ukaegbu B (2014) The significance of working capital management in determining firm profitability: evidence from developing economies in Africa. Res Int Bus Financ 31:1–16. https://doi.org/10.1016/j.ribaf.2013.11.005

Vahid TK, Elham G, Mohsen A, khosroshahi, Mohammadreza, E (2012) Working capital management and corporate performance: evidence from Iranian companies. Procedia Soc Behav Sci 62:1313–1318. https://doi.org/10.1016/j.sbspro.2012.09.225

Valipour H, Jamshidi A (2012) Determining the optimal efficiency index of working capital management and its relationship with efficiency of assets in categorized industries: evidence from Tehran stock exchange ( TSE ). Adv Manag Appl Econ 2(2):191–209

Viechtbauer W (2010) Conducting meta-analyses in R with the metafor package. J Statist Softw 36(3):1–48

Vural G, Sokmen AG, Cetenak E (2012) Affects of working capital management on firm’s performance: evidence from Turkey. Int J Econ Financ Issues 2(4):488–495

Wöhrmann A, Knauer T, Gefken J (2012) Kostenmanagement in Krisenzeiten: rentabilitätssteigerung durch working capital management? Zeitschrift Für Controll Manag 56:83–88. https://doi.org/10.1365/s12176-012-0649-2

Yazdanfar D, Öhman P (2014) The impact of cash conversion cycle on firm profitability: an empirical study based on Swedish data. Int J Manag Financ 10(4):442–452. https://doi.org/10.1108/IJMF-12-2013-0137

Yunos RM, Nazaruddin N, Ghapar FA, Ahmad SA, Zakaria NB (2015) Working capital management in Malaysian government-linked companies. Procedia Econ Financ 31(15):573–580. https://doi.org/10.1016/S2212-5671(15)01203-4

Funding

There are no special grants and institutions supporting submitted study.

Author information

Authors and Affiliations

Contributions

Both authors contributed to the study conception and design. JJ is especially responsible for literature review and research question and hypotheses formulation, whereas LC for empirical study elaboration. Discussion and conclusions are the results of common work.

Corresponding authors

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

See Table

Appendix 2

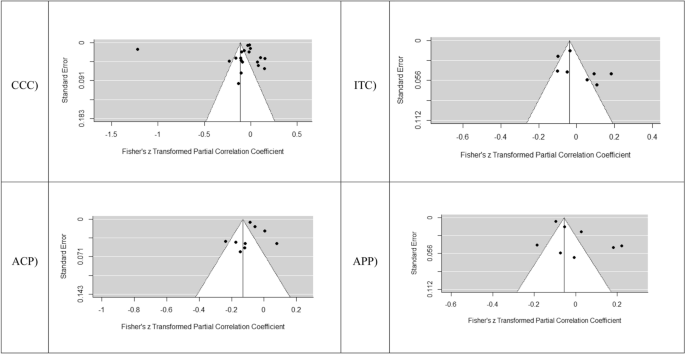

See Fig.

Appendix 3

See Table

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jaworski, J., Czerwonka, L. Profitability and working capital management: a meta-study in macroeconomic and institutional conditions. Decision (2024). https://doi.org/10.1007/s40622-023-00372-x

Accepted:

Published:

DOI: https://doi.org/10.1007/s40622-023-00372-x