Abstract

Present study explores the efficacy/performance of association rules for prediction of global stock indices. Global stock indices data for the last 12 years are used to develop the prediction models. The data consists of several technical indicators. Technical indicators were converted to categorical variables and rules were extracted using association rules. The performance of mined rules was tested for global stock indices considered in this study. Based on the findings of the study, it can be concluded that association rules have potential to provide profitable returns with a fair degree of model parsimony. The outcome of the study indicate that Stochastic Oscillator %K%D, relative strength index (RSI), Disparity 5 Days and Disparity 10 Days are the common market signal sources across all stock indices. Along with these, investors can make decisions using additional indications from rate of change (ROC), commodity channel index (CCI) and Momentum. Association rules can be used for profitable decision making with limited number of technical indicators. Limited number of technical indicators are easy to handle even for smaller retail investors. Trading decisions made on the basis of mined association rule were able to comprehensively beat buy-and-hold return for the selected indices included in the study.

Similar content being viewed by others

References

Achelis SB (1995) Technical analysis from A to Z. Probus Publishing, Chicago, p 1995

Agrawal R, Srikant R (1994) Fast algorithms for mining association rules in large databases. In: Proceedings of the 20th international conference on very large data bases, Santiago de Chile, pp 487–499

Altay E, Satman MH (2005) Stock market forecasting: artificial neural network and linear regression comparison in an emerging market. J Financ Manag Anal 18(2):18–33

Anonymous (2016) Retrieved 18 Mar from https://www.msci.com/market-classification

Arafah AA, Mukhlashi I (2015) The application of fuzzy association rule on co-movement analyze of Indonesian stock price. Procedia Comput Sci 59:235–243

Argiddi RV, Apte SS (2012) Future trend prediction of Indian IT stock market using association rule mining of transaction data. Int J Comput Appl 39:30–34

Asadi S, Hadavandi E, Mehmanpazir F, Masoud M, Nakhostin MM (2012) Hybridization of evolutionary levenberg- marquardt neural networks and data pre- processing for stock market prediction. Knowl Based Syst 35:245–258

Atsalakis GS, Valavanis KP (2009) Forecasting stock market short-term trends using a neuro-fuzzy based methodology. Expert Syst Appl 36:10696–10707

Cao L, Tay FEH (2001) Financial forecasting using support vector machines. Neural Comput Appl 10:184–192

Chang J, Jung Y, Yeon K, Jun J, Shin D, Kim H (1996) Technical indicators and analysis methods. Jinritamgu Publishing, Seoul

Chen W, Shih J, Wu S (2006) Comparison of support-vector machines and back propagation neural networks in forecasting the six major Asian stock markets. Int J Electron Fin 1(1):49–67

Cheng KC, Huang MJ, Fu CK, Wang KH, Wang HM, Lin LH (2021) Establishing a multiple-criteria decision-making model for stock investment decisions using data mining techniques. Sustainability 13(6):3100

Choi J (1995) Technical indicators. Jinritamgu Publishing, Seoul

Hahsler M, Grün B, Hornik K (2005) Arules - a computational environment for mining association rules and frequent item sets. J Stat Softw 14(15):1–25

Hajizadeh E, Ardakani HD, Shahrabi J (2010) Application of data mining techniques in stock markets: a survey. J Econ Int Finance 2:109–118

Hammad AAA, Ali SMA, Hall EL (2009) Forecasting The Jordanian Stock Prices Using Artificial Neural Network. http://www.min.uc.edu/robotics/papers/paper2007/Final%20NNIE%2007%20SOUMA%20Alhaj%20Ali%206p.pdf

Han J, Kamber M, Pei J (2012) Data mining concepts and techniques, 3rd edn. Elsevier Inc., Waltham, USA

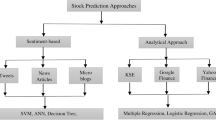

Hargreaves C, Hao Y (2013) Prediction of stock performance using analytical techniques. J Emerg Technol Web Intell 5(2):136–142

Hong H, Torous W, Valkanov R (2007) Do industries lead the stock market? J Financ Econ 83:367–396

Hoon Na S, Sohn SY (2011) Forecasting changes in Korea composite stock price index(KOSPI) using association rules. Expert Syst Appl 38:9046–9049

Huang W, Nakamori Y, Wang S (2005) Forecasting stock market movement direction with support vector machine. Comput Operat Res 32:2513–2522

Kaosar MG, Xu Z, Yi X (2009) Distributed association rule mining with minimum communication overhead. In: Kennedy PJ, Ong KL, Christen P (eds) Proc. 8th Res practice info technology, Victoria University, Australia, vol 101, pp 17–23

Kartal B, Sert MF, Kutlu M (2022) Determination of the world stock indices’ co-movements by association rule mining. J Econ Fin Admin Sci 56:4565. https://doi.org/10.1108/JEFAS-04-2020-0150

Kaufman PJ (2013) Trading systems and methods. John Wiley & Sons, New York, NY, p 2013

Kaur J, Dharni K (2022) Application and performance of data mining techniques in stock market: a review. Intell Syst Acc Fin Manag 29(2):45646. https://doi.org/10.1002/isaf.1518

Kim K (2003) Financial time series forecasting using support vector machines. Neurocomputing 55:307–319. https://doi.org/10.1016/S0925-2312(03)00372-2

Kim K (2006) Artificial neural networks with evolutionary instance selection for financial forecasting. Expert Sys Appl 30:519–526. https://doi.org/10.1016/j.eswa.2005.10.007

Kumar M, Thenmozhi M (2006) Forecasting stock index movement: a comparison of support vector machines and random forest. Indian Institute of Capital Markets 9th Capital Markets Conference Paper, 2005. http://ssrn.com/abstract=876544

Liao S, Chou S (2013) Data mining investigation of co-movements on Taiwan and China stock markets for future investment portfolio. Expert Syst Appl 40:1542–1554

Liao S, Ho H, Lin H (2008) Mining stock category association and cluster on Taiwan stock market. Expert Syst Appl 35:19–29

Liu H, Setino R (1996) A probabilistic approach to feature selection. In: ML Proceedings 13th ICML, pp 319–327

Lu H, Han J, Feng L (1998) Stock movement prediction and N-dimensional intertransaction association rules. In: Proceedings of the Third ACM SIGMOD international conference on management of data workshop on research issues in Data Mining and Knowledge Discovery, vol. 12, pp 1–7

Majumder M, Hussian MD (2010) Forecasting of Indian stock market index using artificial neural network. https://www.nse-india.com/content/research/FinalPaper206.pdf

Masum ZH (2019) Mining stock category association on Tehran stock market. Soft Comput 23:1165–1177

Mizuno H, Kosaka M, Yajima H (1998) Application of neural network to technical analysis of stock market prediction. Stud Inf Control 7:111–120

Murphy JJ (1986) Technical Analysis of the Futures Markets: A Comprehensive Guide to Trading Methods and Applications. Prentice-Hall, New York

Nakhaeizadeh G, Steurer E, Bartmae K (2002) Banking and finance. In: Klosgen W, Zytkow J (eds) Handbook of data mining and knowledge discovery, Oxford Univ. Press, Oxford, pp 771–780

Piatetsky-Shapiro G, Frawley WJ, Matheus CJ (1992) Knowledge discovery in databases: an overview. AI Mag 13:57–70

Piatetsky-Shapiro G (1991) Discovery, analysis, and presentation of strong rules. Knowl Discov Databases 248:255–264

Rosner B, Glynn RJ, Lee MLT (2006) The Wilcoxon signed rank test for paired comparisons of clustered data. Biometrics 62:185–192

Schumaker RP, Chen H (2009) Textual analysis of stock market prediction using breaking financial news: the Azfin text system. ACM Trans Inf Syst 27:1–19

Teixeira LA, De Oliveira ALI (2010) A method for automatic stock trading combining technical analysis and nearest neighbor classification. Expert Syst Appl 37:6885–6890. https://doi.org/10.1016/j.eswa.2010.03.033

Ting J, Fu TC, Chung FL (2006) Mining of stock data: intra- and inter-stock pattern associative classification. In: Proceedings of the 2006 international conference on data mining, pp 30–36

Tjung LC, Kwon O, Tseng KC, Geist AB (2010) Forecasting financial stocks using data mining. J Global Eco Fin 3:13–26

Umbarkar SS, Nandgaonkar PSS (2015) Using association rule mining: stock market events prediction from financial news. Int J Sci Res (IJSR) 4:1958–1963

Vojinovic Z, Kecman V, Seidel R (2001) A data mining approach to financial time series modelling and forecasting. Int J Intell Syst Acc Fin Manag 10:225–239. https://doi.org/10.1002/isaf.207

Wakchaware S (2014) Large databases–association rule mining. Int J Res Emerg Sci Technol 1(4):19–26

Wilcoxon F (1945) Individual comparisons by ranking methods. Biometrics Bull 1(6):80–83

Yasodha P, Kannan M (2011) Analysis of a population of diabetic patients databases in Weka Tool. Int J Sci Eng Res 2(5):1–5

Zhai Y, Hsu A, Halgamuge SK (2007) Combining news and technical indicators in daily stock price trends prediction. In: Proceedings of the 4th international symposium on neural networks: advances in neural networks, Part III. Nanjing, China: Springer-Verlag, pp 1087–1096

Zhang D, Jiang Q, Li X (2007) Application of neural networks in financial data mining. Int J Comput Electr Autom Control Inf Eng 1:225–228

Zheng Z, Kohavi R, Mason L (2001) Real world performance of association rule algorithms, KDD

Funding

Authors acknowledge the support of Indian Council of Social Science Research (ICSSR) for carrying out this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We have no conflicts of interest to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Annexure I : Few examples of rules mined for DJIA.

Antecedent | ||||||||

|---|---|---|---|---|---|---|---|---|

Consequent | Stochastic Oscillator %K%D | RSI | Disparity 5 Days | Disparity 10 Days | ROC | Momentum | Confidence value | Lift value |

Increase | Buy | – | Buy | – | Buy | – | 0.91 | 1.68 |

Increase | Buy | – | Buy | – | Buy | Buy | 0.91 | 1.68 |

Increase | Buy | – | Buy | Buy | Buy | – | 0.91 | 1.68 |

Increase | Buy | – | Buy | Buy | - | Buy | 0.91 | 1.68 |

Increase | Buy | – | Buy | Buy | Buy | Buy | 0.91 | 1.68 |

Increase | Buy | – | – | Buy | Buy | – | 0.91 | 1.68 |

Increase | Buy | – | – | Buy | Buy | Buy | 0.91 | 1.68 |

Increase | Buy | – | – | – | Buy | - | 0.91 | 1.68 |

Increase | Buy | – | – | – | - | Buy | 0.91 | 1.68 |

Increase | Buy | Hold | – | – | Buy | - | 0.90 | 1.67 |

Increase | Buy | Hold | – | – | - | Buy | 0.90 | 1.67 |

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kaur, J., Dharni, K. Assessing efficacy of association rules for predicting global stock indices. Decision 49, 329–339 (2022). https://doi.org/10.1007/s40622-022-00327-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40622-022-00327-8