Abstract

Purpose of Review

Balancing a large share of solar and wind power generation in the power system will require a well synchronized coordination of all possible flexibility sources. This entails developing market designs that incentivize flexibility providers, and define new flexibility products. To this end, the paper reviews latest trends in the characterization of flexibility by understanding its dimensions in terms of time, spatiality, resource type, and associated risks. Also, as aggregators have emerged as important actors to deliver, and to reward end-user flexibility, the paper reviews latest trends in the topic.

Recent Findings

The review reports latest trends and discussions on power system flexibility and their relations to market design. The current academic literature indicates that there are open question and limited research on how to reward short-term flexibility while considering its long-term economic viability. Demand-side flexibility through aggregation holds great potential to integrate renewables.

Summary

Research in power system flexibility has to put effort on analysing new time-structures of electricity markets and define new marketplaces that consider the integration of new flexibility products, actors (e.g. aggregators, end-users), and mechanisms (e.g. TSO-DSO coordination).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In order to balance large amounts of variable renewable energy resources in highly decarbonized energy systems, the coordination of flexibility sources is essential. For example, under a 2050 scenario, countries in West Central Europe might need to rely on storage capacities (mainly hydropower) between + 21 TWh to -23 TWh over the year [1]. Furthermore, the need for balancing hour by hour varies between ca + 300 GW and -200GW. Also, studies in [1,2,3,4] note that with a RES penetration above 30% of the annual electricity consumption, there is a significant increase in required flexibility.

Raising flexibility for a high share of wind and solar power generation in the power system will not only require centralized solutions and the use of conventional generation units. In this regard, demand-side flexibility and smart grids have been constantly heralded as potential sources to balance renewables [5, 6]. Various studies have estimated the monetary benefits of end-user flexibility in different market settings and services. For example, Table 1 describes country specific cases where demand response programs report the overall benefits for the system (e.g. grid costs reductions) or the individual value to the end-user. Most of these studies work with the premise that a market for these services exist, and that flexibility providers can deliver accurately their flexibility. This illustrates that incentivizing flexibility entails developing new market designs that takes into account new time-structures of wholesale markets, the spatial availability of flexibility providers, and the definition of new marketplaces. That is, some of the research frontiers in power system flexibility are to (i) better understand the characterization of flexibility, (ii) develop mechanisms to raise and reward flexibility (e.g. aggregation), and (iii) propose new market designs that integrate and operate flexibility assets effectively. To this purpose, the paper provides a literature review on these topics by focusing on the latest trends in assessing flexibility, the market designs challenges, and the enablers of flexibility (e.g. aggregators).

In the following chapter we first review the different characterizations of flexibility, in “Flexibility Aggregation” we review the role of aggregation, and in “Market Designs for Flexibility” we discuss needs for new market design. The review concludes with a summary and discussion in “Conclusions”.

Flexibility Characterization

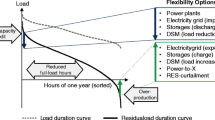

This section reviews flexibility characterization approaches. Authors in [15] state: “Flexibility is the change in the generation and/or consumption pattern of electricity according to an external signal in order to meet energy system needs”. However, flexibility touches upon multiple other aspects on balancing the supply and demand operations of power systems. Flexibility characterization has been an important research area to align flexibility needs with different dimensions or services for the power system.

de Vries and Verzijlbergh [16] characterize flexibility by considering three physical dimensions: infrastructure, geography, energy carrier integration, as well as time. Other recent work [17] describes four dimensions: the power output capacity (MW), the moment of provision, duration, and the specific location of resources. Similarly, Ela et al. [18] considers three dimensions of flexibility: power output capacity (MW), speed of power output change (MW/min), and the duration of energy levels (hours of MW). In a more recent study, Kara et al. [6] discusses four dimensions when characterizing a flexibility products or services: (i) time, (ii) spatiality, (iii) resource type/technology, and (iv) risk. Next, we describe these four dimensions with examples from the existing literature:

-

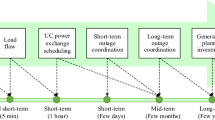

Time: This dimension covers aspects suggested by [17] such as the response or activation time of flexibility, the duration (availability), and ramping characteristics. The time dimension also relates to the time window when the flexibility is available, required or scheduled. This ranges from seconds, within the day, day ahead and up to time dimensions relevant for long-term capacity planning. The duration or availability of a flexibility resource has an impact on cost-efficiency of the flexibility scheduling [19]. Therefore, different market designs and their time resolutions are based on how to efficiently meet customer needs [20]. The objective is to establish markets where resource allocation is efficient both in the long-term (investments) and in the short-term (operations). Products and services with different time characteristics can participate in multiple markets, but often they will have advantages according to their time characteristics and related cost functions.

-

Spatiality: The spatiality dimension considers that some flexibility resource technologies are relevant only on a local scale, whereas others are available system wide. In practice, there is a specter ranging between single devices, neighborhood, city, region, and country. The availability across these locations depends both on the service, for example active or reactive power provision, and congestion management on the grid. While active power may be transmitted over large distances, reactive power cannot be, due to network losses. Several authors discuss how the spatiality dimension of the flexibility resource can affect the efficiency of the services provided [21,22,23].

-

Resource type: The technology or resource type of a flexibility provider is characterized as demand-side (e.g. prosumers), supply-side (e.g. conventional generators), grid-side (e.g. transmission or distribution) or storage-side (e.g. batteries or pumped hydro). In this paper, we focus mainly on demand-side resources. Demand-side flexibility can improve the overall efficiency of the energy system and market. When a congestion problem occurs, either at distribution or transmission grid level, demand-side resources are useful for congestion management. The demand-side technologies are often applicable for local problems in short time intervals (e.g. voltage fluctuations, grid congestion, network losses, and islanding). In addition to the mitigation for grid problems and ancillary services (e.g. [24]), the demand-side flexibility and other flexibility technologies can also improve the variable renewable resources integration to power markets and systems [25,26,27]. Industry, households, and aggregators are flexibility resources for the demand-side flexibility [28]. EVs are emerging as flexibility resources; they can shift their consumption in the short-term (grid-to-vehicle), while selling remaining electricity to the grid (vehicle-to-grid, V2G) [29, 30]. There are a number of papers estimating optimal scheduling of EV charging at the individual level based on direct control or indirect control (prices) [31,32,33]. There is fewer literature that estimates the potential for EV flexibility activation at the population level. Bordin and Tomasgard [34] uses cross-elasticities to estimate flexibility effects of price signals in a market with several subpopulations, seeing how prices shift demand between two time periods.

-

Risk: The risk profile of a flexibility asset is defined by its availability probability distribution. This could be a multivariate distribution for variables such as activation time, duration, available power and ramping speeds. This distribution is relevant when considering the firmness of a service. A firm services is characterized with the feature that it will not be disrupted or unavailable when delivery is requested. Aggregators, with a portfolio of uncorrelated or negatively correlated assets with different properties, can often provide firm service delivery, while individual prosumers may have problems guaranteeing such reliability [35]. The shortfall risk for flexibility can be foreseen if a robust flexibility metric exists, according to [36]. Examples of shortfall risk is discussed by [37,38,39]. Another demand-side risk to consider in flexibility assets is the rebound effect [40, 41]. During peak hours, a demand-side participant could decrease its consumption in the grid and reduce the possibility of network congestion. During off-peak hours, the same participant might increase its consumption due to lower prices, possibly congesting the distribution grid at another time (e.g. EV charging).

As we discuss in the following section, aggregation of demand-side flexibility resources has become an important enabler to raise and to reward flexibility.

Flexibility Aggregation

Definition and Value of Aggregation

Due to low volume, engagement cost, and reliability issues, some authors claim that small consumers on the demand-side can not participate in markets directly to provide flexibility [42]. This brings the opportunity for an “aggregator” to aggregate these flexibilities and participate in the market on behalf of the end-users. An aggregator can be defined as an intermediary agent that offers the “service of pooling of flexibilities from different distinct agents (consumers, prosumers) and acts as a single entity when engaging in power system markets” [43].

The role of the aggregator is not clearly defined and varies across Europe and the USA [43,44,45,46]. This role may be provided by an independent player (third party) or can be an additional role for an already existing player (TSO, DSO, retailer, supplier). An independent aggregator may provide a single service (aggregation) or multiple services (aggregation, balancing, electricity supply). The power system may have a single centralized aggregator or multiple aggregators. An aggregator can also act as a facilitator in Local Energy Markets (LEM) or Micro-Grids (MG) and can sell flexibility to system operators through power markets [47,48,49]. Aggregation of flexibility has been extensively studied to integrate variable RES into the grid [50, 51]. The volatility of RES might cause system imbalances and aggregation can maintain the balance by providing its services in the ancillary market [52].

Aggregated flexibility can provide ancillary, capacity, and inertia maintenance as well as black start services to transmission operators. Distribution system operators can request flexibility for congestion management, voltage/reactive power control, controlled islanding, etc. Balance responsible parties can use flexibility to fulfil commitments, optimize portfolio, and avoid imbalance charges. Aggregation also improves failure mitigation during flexibility provision as it is provided by pooling of multiple small resources and failure of a single resource will only have a small effect on the power system and can be easily replaced by another resource in the portfolio [53].

Delivering Aggregated Flexibility

Aggregated flexibility can be delivered as either upward regulation (decreased consumption) or downward regulation (increased consumption) depending upon the request [54]. Aggregators optimize their operation and coordination of flexibility assets or resources which otherwise, when left to the end-user, will be uncoordinated and might reduce the value of flexibility [53, 55].

Monitoring, managing, and controlling thousands of flexibility assets is an extremely complex task. In order to accomplish this, the aggregator needs to have a precise understanding of its customers’ load profiles, flexibility assets and behavioural patterns. The aggregator does this by analysing customers’ historical load profiles to estimate flexibility potential and clusters customers and assets based on their location, consumption value, behaviour, etc. Clustering helps the aggregator to better manage its portfolio, aid decision-making process, design strategies and formulate pricing. Clustering-based flexibility aggregation has been studied in detail in [49, 56,57,58,59] and also implemented in European projects such as FLEXCoop [60], EDREAM [61], and DELTA [62]. Cluster analysis is challenging as it requires processing huge amounts of data from heterogeneous users from multiple years or due to the requirement of a faster response tool for aggregation [61]. In order to address this issue, generic algorithms (K-means, DB SCAN) have been explored [62, 63] and in particular, deep learning (autoencoder) based technique has been used for better performance [61].

Based on the forecasted flexibility, demand, and price, the aggregator needs to optimally select and group the assets that satisfy each market product requirements, develop bidding strategies, plan the operation of the assets considering short-term and long-term effects if the bids are accepted and select backup assets for failure management. Decision-making is a highly complex optimization process under uncertainty and must be repeated for every bidding horizon as new information and decisions are revealed. To address this issue, stochastic optimization methods that support sequential decision-making under uncertainty have been studied in [64, 65]. Most works do not consider the iterative process or simplify the stages (multistage stochastic programming) or even assume some variables to be deterministic [66]. Additionally, other optimization techniques such as robust optimization [67], Fuzzy optimization [68], model predictive control [69], and metaheuristic-based techniques [70] have also been explored for decision-making purposes.

Rewarding Flexibility Aggregation

Once the requested flexibility is activated and delivered, end-users are remunerated for their participation and discomfort. Despite a lot of debate around fairness in flexibility pricing and remuneration, very little attention has been given to end-user remunerations for explicit demand response. Rewarding demand-side flexibility is largely related to the scheduling of flexibility resources [71, 72] and the markets in which different flexibility products are traded [73]. The flexibility market structure and aggregator business model should reward and maximize demand-side flexibility in a manner that provides financial stability and incentives to all stakeholders involved [74]. Incentives should compensate for the aggregator’s ICT investments and encourage consumers to participate in demand response events.

Various business models for aggregators have been proposed in [44, 46, 75,76,77,78,79]. Business models for aggregators with emphasis on financial and operational aspects have been reviewed in [80]. It is found that most business models consider only one financial aspect (either aggregator’s profit or consumer’s cost) which leads to a limited assessment of models. Fair remuneration of end-users using shapely values is explored in [81], but in general, there are very few papers that study the flexibility prices offered by aggregators to end-users. New research efforts should emphasize the aggregator payments to end-users and pricing of flexibility product [82] in future markets.

Currently, the involvement of aggregators is very limited in EU electricity markets due to the lack of commercially viable business models and various regulatory barriers [83,84,85,86]. Business strategies and revenue streams for flexibility aggregators to overcome early stage technological issues and regulatory barriers is addressed in [76]. One might also argue that there is no need for an aggregator in future markets where the power system is expected to be heavily decentralized and equipped with advanced sensors, automation, ICT technologies and self-enforcing smart contracts [87] resulting in a transactive system [88] with complete information, perfect coordination and rational behaviour. However, the aggregator can still provide fundamental value additions and other benefits to stay relevant in the future [43, 83]. Studies indicate that the evolution and success of aggregators in the future is mainly dependent on three factors — Business models, Regulation, and Market design.

Market Designs for Flexibility

Trends in Power Markets

Authors in [18] discuss incentivizing flexibility in the short-term operation of the system and how it could be done in existing and new market designs, mostly with a focus on power markets in the USA. The study argues that the delivery of flexibility in a short-term perspective is already incentivized by today’s market design using the price for power delivery. However, it is also concluded, that currently there is not an incentive for baseload units to become more flexible in the long-term. In order to provide sufficient incentives to ensure an adequate level of system flexibility, given increasing level of RES, it is argued that new market mechanisms are necessary. One of these mechanisms is the so-called flexible ramping constraint, included in the dispatching algorithm of California Independent System Operator (CAISO), which ensures that ramping capacity is rewarded specifically.

In the context of the European Power System, authors in [89] argue that energy-only markets should be sufficient to remunerate flexibility due to variability on their price signals. However, new products and market design will be necessary to handle uncertainty under a high RES scenario. Villar et al. [89] conclude that flexibility markets using conventional generation are more mature and appear as natural extensions of already existing wholesale power markets, designed to guarantee the system ramping capability.

The review in [90] discusses that an impact of a larger RES deployment is the expected increase in trading of the intra-day market, and an increase in balancing services because of uncertainty. To increase the available flexibility within the power market several points for re-designing the existing power markets are raised, the central ones are:

-

implement intra-day auctions to increase liquidity,

-

have a higher temporal resolution in markets and in the scheduling plans,

-

increase or remove price caps and floors.

It is also suggested to align or co-optimize the reserve markets with the spot- and intra-day markets to better reveal the actual availability of flexibility. In this regard, to reward generators via capacity mechanisms, Höschle et al. [91] argue that a centralized capacity market has a lower distortion on available flexibility and reserves than strategic reserves, while also being more economic efficient. From a system security perspective, authors in [92] argue that a sufficient volume of firm generation capacity can no longer be relied upon to deliver system reliability. Instead system reliability will increasingly depend on resources that have a range of extra capabilities including the ability to rapidly and frequently change output or demand [93]. Hence, it is concluded that traditional “capacity-only” markets are not fitted to meet this requirement.

Integration of Demand-Side Flexibility

As noted in the preceding chapter, aggregators have been at the forefront in enabling demand-side flexibility. However, established market mechanism or marketplaces to exploit them are a matter of research as there is limited demonstrated implementations in place. Also, estimating the available flexibility potential in buildings, transport or industry is a research area where more empirical studies are needed. For example, Gils [94] assesses the theoretical demand response potential in Europe. Paulus and Borggrefe [95] look at the potential for DR in energy intensive industries. Stadler [96] discuss the role of DR in power grid balancing. Saele and Grande [97] study DR with household customers in a small case study in Norway to estimate their DR potential.

Here, a central area of research is to understand the value to the power system on integrating demand-side flexibility. Zepter et al. [98] propose a market-sequencing (wholesale day-ahead and connection to intra-day) framework to integrate flexibility from a local market by studying the role of batteries. Crespo Del Granado et al. [2] integrate flexibility from a large end-user to the day-ahead market. Authors argue that the end-user perspective on deciding the flexibility schedule is difficult to align with the current time-structures of the wholesale market. Backe et al. [99] studies the integration of neighborhood flexibility to the long-term decarbonization roadmap of the power system. As some of the flexibility services might be in sync with the distribution grids, a coordination of TSO-DSO within a market framework has been noted as a valuable mechanism to integrate demand-side flexibility [100]. For example, the review in [101] states that congestion and imbalance relief by integrating demand flexibility can achieve a 60% reduction for distribution grids.

Conclusions

Widening the view from individual products to a market perspective, the main question is whether flexibility products are priced correctly and efficiently allocated in existing markets. Arguing that they are not, the follow up question is how future markets dedicated to such products should be designed and if there will be an interaction with other markets for example through overlapping products or assets. Further, the market design will affect the specification and value of flexibility products. This can be different in decentralized markets or when aggregators are present.

Based on the reviewed papers and the related identified research gaps, the following summarizes some reflections and conclusions on market designs for flexibility:

-

Time: The time dimension and market time window are key to the market design: Bidding and selling flexibility may be continuous processes that happen around the clock or it may happen within predefined time windows depending upon the market. Some assets will have advantages in some time windows based on activation time, ramping speed and duration. For optimal resource allocation this needs to be reflected in market design.

-

Aggregators: The main tasks of the aggregator involve but are not limited to estimating flexibility, optimally bidding in the market, scheduling, and monitoring the assets, optimizing the operation of assets, delivering the flexibility, and validating the deliverance. Aggregators may be able to provide firm services or products where individual assets may not. The aggregator needs to enter into an agreement with the end-user about the activation time, the maximum number of activations, and other aspects related to control of an asset. To defend the role of an aggregator, the market design needs to recognize (a) the added value of firm service provision, possibly based on multiple assets and/or (b) Have advantages of scale or technological complexities that prevents individual assets from participating in the market.

-

DSO/TSO integration: Some of the flexibility assets will have geographical relevance both in the distribution grid and in the transmission grid. That means that market design would need to support simultaneous participation of both multiple DSOs and TSOs in the same market place in order to ensure optimal resource allocation (e.g. [102]).

-

Multi-market, multi-period: The market design should recognize that some of the assets have relevance in multiple market sand in multiple time periods and incentivize the optimal allocation of resources over these.

-

Investments: In addition to support short-term optimal resource allocation of flexible assets, the market design needs to incentivize the right amount of investment. That is, in addition to cover the short run marginal cost of flexible operation, capital cost of the flexibility needs to be covered over the lifetime of operation, either by the market clearing price or by side payments.

References

Graabak I, Korpås M, Belsnes M. Balancing needs and measures in the future west central european power system with large shares of wind and solar resources. 2017 14th international conference on the european energy market (EEM). IEEE; 2017. p. 1–6.

Crespo Del Granado P, Wallace SW, Pang Z. The impact of wind uncertainty on the strategic valuation of distributed electricity storage. CMS 2016;13(1):5–27.

Hirth L. The benefits of flexibility: The value of wind energy with hydropower. Appl Energy 2016; 181:210–223.

Huber M, Dimkova D, Hamacher T. Integration of wind and solar power in europe: Assessment of flexibility requirements. Energy 2014;69:236–246.

Crspo Del Granado P, Wallace SW, Pang Z. The value of electricity storage in domestic homes: a smart grid perspective. Energy Systems 2014;5(2):211–232.

Kara G, Tomasgard A, Farahmand H. 2021. Characterization of flexible electricity in power and energy markets. arXiv:2109.03000. [Online; Accessed 08 Sept 2021].

Measures to increase demand side flexibility in the swedish electricity system, 2016.

Hummon M, Palchak D, Denholm P, Jorgenson J, Olsen DJ, Kiliccote S, Matson N, Sohn M, Rose C, Dudley J, et al. 2013. Grid integration of aggregated demand response, part 2: modeling demand response in a production cost model, tech. rep., National Renewable Energy Lab.(NREL), Golden CO (United States).

The economics of demand flexibility, 2015.

Innovation landscape brief : Aggregators, 2019.

Gissey GC, Subkhankulova D, Dodds PE, Barrett M. Value of energy storage aggregation to the electricity system. Energy Policy 2019;128:685–696.

Biegel B, Hansen LH, Stoustrup J, Andersen P, Harbo S. Value of flexible consumption in the electricity markets. Energy 2014;66:354–362.

Okur Ö, Brouwer R, Bots P, Troost F. Aggregated flexibility to support congestion management. IEEE PES innovative smart grid technologies conference Europe (ISGT-Europe). IEEE; 2018. p. 2018.

H P. 2017. Low-carbon cars in germany: A summary of socio-economic assessment.

Mandatova P, Mikhailova O. 2014. Flexibility and aggregation. Requirements for their interaction in the market, tech. rep. EURELECTRIC.

de Vries LJ, Verzijlbergh R. Organizing flexibility: How to adapt market design to the growing demand for flexibility? European Energy Market (EEM), 2015 12th international conference on the. IEEE; 2015. p. 1–5.

Eid C, Codani P, Perez Y, Reneses J, Hakvoort R. Managing electric flexibility from distributed energy resources: A review of incentives for market design. Renew Sust Energ Rev 2016;64:237–247.

Ela E, Milligan M, Bloom A, Botterud A, Townsend A, Levin T, Frew BA. Wholesale electricity market design with increasing levels of renewable generation: Incentivizing flexibility in system operations. Electr J 2016;29(4):51–60.

Kara G, Pisciella P, Tomasgard A, Farahmand H. The impact of uncertainty and time structure on optimal flexibility scheduling in active distribution networks. IEEE Access 2021;9:82966–82978.

Hillberg E, Zegers A, Herndler B, Wong S, Pompee J, Bourmaud J-Y, Lehnhoff S, Migliavacca G, Uhlen K, Oleinikova I, et al. 2019. Flexibility needs in the future power system, tech. rep. ISGAN.

Kouzelis K, Bak-Jensen B, Pillai JR. The geographical aspect of flexibility in distribution grids. Innovative smart grid technologies conference (ISGT) IEEE power & energy society. IEEE; 2015. p. 2015.

U. D. of Energy Quadrennial Technology Review 2015 Chapter 3. 2015. Enabling modernization of the electric power system technology assessments flexible and distributed energy resources.

Xiong B, Predel J, Crespo del Granado P, Egging-Bratseth R. Spatial flexibility in redispatch: Supporting low carbon energy systems with power-to-gas. Appl Energy 2021;283:116201.

Bayer B. Current practice and thinking with integrating demand response for power system flexibility in the electricity markets in the usa and germany. Current Sustainable/Renewable Energy Reports 2015;2(2): 55–62.

Madaeni SH, Sioshansi R. Using demand response to improve the emission benefits of wind. IEEE Trans Power Syst 2012;28(2):1385–1394.

Madaeni SH, Sioshansi R. The impacts of stochastic programming and demand response on wind integration. Energy Systems 2013;4(2):109–124.

Zöphel C, Schreiber S, Müller T, Möst D. Which flexibility options facilitate the integration of intermittent renewable energy sources in electricity systems? Current Sustainable/Renewable Energy Reports 2018;5(1):37–44.

Papaefthymiou G, Grave K, Dragoon K. 2014. Flexibility options in electricity systems, Project number: POWDE14426 Ecofys.

Fernandez LP, San Román TG, Cossent R, Domingo CM, Frias P. Assessment of the impact of plug-in electric vehicles on distribution networks. IEEE Trans Power Syst 2010;26(1):206–213.

Mwasilu F, Justo JJ, Kim E-K, Do TD, Jung J-W. Electric vehicles and smart grid interaction: A review on vehicle to grid and renewable energy sources integration. Renewable And Sustainable Energy Reviews 2014;34:501–516.

Wang Q, Liu X, Du J, Kong F. Smart charging for electric vehicles: A survey from the algorithmic perspective. IEEE Communications Surveys & Tutorials 2016;18(2):1500– 1517.

Weiller C, Shang AT, Mullen P. 2020. Market design for electric vehicles. Current Sustainable/Renewable Energy Reports 1–9.

Xi X, Sioshansi R. Using price-based signals to control plug-in electric vehicle fleet charging. IEEE Trans Smart Grid 2014;5(3):1451–1464.

Bordin C, Tomasgard A. Behavioural change in green transportation: Micro-economics perspectives and optimization strategies. Energies 2021;14:13.

Ødegaard Ottesen S., Tomasgard A., Fleten S.-E. Multi market bidding strategies for demand side flexibility aggregators in electricity markets. Energy 2018;149:120–134.

Lannoye E, Flynn D, O’Malley M. Evaluation of power system flexibility. IEEE Trans Power Syst 2012;27(2):922– 931.

Navid N, Rosenwald G. 2013. Ramp capability product design for MISO markets, White paper July.

Abdul-Rahman KH, Alarian H, Rothleder M, Ristanovic P, Vesovic B, Lu B. Enhanced system reliability using flexible ramp constraint in CAISO market. Power and Energy Society General Meeting, 2012 IEEE. IEEE; 2012. p. 1–6.

Wang Q, Hodge B-M. 2017. Enhancing power system operational flexibility with flexible ramping products: A review. IEEE Transactions on Industrial Informatics, vol. 13, no NREL/JA-5D00-67471.

Berkhout PH, Muskens JC, Velthuijsen JW. Defining the rebound effect. Energy Policy 2000;28(6-7):425–432.

Esmat A, Usaola J, Moreno M. Á. Congestion management in smart grids with flexible demand considering the payback effect. 2016 IEEE PES innovative smart grid technologies conference Europe (ISGT-Europe). IEEE; 2016. p. 1–6.

Eid C, Codani P, Chen Y, Perez Y, Hakvoort R. Aggregation of demand side flexibility in a smart grid: A review for european market design. 2015 12th International Conference on the European Energy Market (EEM); 2015. p. 1–5.

Burger S, Chaves-Ávila JP, Batlle C, Pérez-Arriaga IJ. A review of the value of aggregators in electricity systems. Renew Sust Energ Rev 2017;77:395–405.

Lu X, Li K, Xu H, Wang F, Zhou Z, Zhang Y. Fundamentals and business model for resource aggregator of demand response in electricity markets. Energy 2020;204:117885.

Schittekatte T, Deschamps V, Meeus L. The regulatory framework for independent aggregators. Electr J 2021;34(6):106971.

Verhaegen R, Dierckxsens C. Existing business models for renewable energy aggregators, linea]. Disponible en: http://bestres.eu/wp-content/uploads/2016/08/BestRESExisting-business-models-for-RE-aggregators.pdf, vol. 246, Vol. 2016.

Olivella-Rosell P, Lloret-Gallego P, Munné-Collado N, Villafafila-Robles R, Sumper A, Ottessen SD, Rajasekharan J, Bremdal BA. 2018. Local flexibility market design for aggregators providing multiple flexibility services at distribution network level. Energies 11(4).

Innovation landscape brief : Peer-to-peer electricity trading, 2020.

Hashemipour N, Crespo del Granado P, Aghaei J. Dynamic allocation of peer-to-peer clusters in virtual local electricity markets: A marketplace for ev flexibility. Energy 2021;236 :121428.

Winkler J, Gaio A, Pfluger B, Ragwitz M. Impact of renewables on electricity markets–do support schemes matter?. Energy Policy 2016;93:157–167.

Kyritsis E, Andersson J, Serletis A. Electricity prices, large-scale renewable integration, and policy implications. Energy Policy 2017;101:550–560.

Damsgaard N, Papaefthymiou G, Grave K, Helbrink J, Giordano V, Gentili P. 2015. Study on the effective integration of distributed energy resources for providing flexibility to the electricity system: Final report to the european commission, Final Rep. to, Eur. Comm. 179.

Ponds KT, Arefi A, Sayigh A, Ledwich G. Aggregator of demand response for renewable integration and customer engagement: Strengths, weaknesses, opportunities, and threats. Energies 2018;11(9):2391.

Zhang L, Good N, Mancarella P. Building-to-grid flexibility: Modelling and assessment metrics for residential demand response from heat pump aggregations. Appl Energy 2019;233:709–723.

Gissey GC, Subkhankulova D, Dodds PE, Barrett M. Value of energy storage aggregation to the electricity system. Energy Policy 2019;128:685–696.

Bhattarai B, de Cerio Mendaza ID, Myers KS, Bak-Jensen B, Paudyal S. Optimum aggregation and control of spatially distributed flexible resources in smart grid. IEEE Transactions on Smart Grid 2018; 9:5311–5322.

Minniti S, Nguyen P, Vo T, Haque A. Development of grid-flexibility services from aggregators a clustering algorithm for deploying flexible ders. 2018 IEEE international conference on environment and electrical engineering and 2018 IEEE Industrial and Commercial Power Systems Europe (EEEIC / I&CPS Europe); 2018. p. 1–7.

Iria J, Soares F. A cluster-based optimization approach to support the participation of an aggregator of a larger number of prosumers in the day-ahead energy market. Electr Power Syst Res 2019;168:324–335.

Cruz C, Palomar E, Bravo I, Aleixandre M. Behavioural patterns in aggregated demand response developments for communities targeting renewables. Sustain Cities Soc 2021;72:103001.

Katerina V, Stefanos M, Christoforos V. 2020. Flexcoop flexibility forecasting, segmentation and aggregation module.

Gallego L, Stecchi U, Gómez J. 2020. Deliverable: D4.6 load profiles and customer clusters v2.

Energy asset segmentation, 2020.

Faria P, Spínola J, Vale Z. Methods for aggregation and remuneration of distributed energy resources. Appl Sci 2018;8:1283.

Ottesen SØ, Tomasgard A, Fleten S-E. Prosumer bidding and scheduling in electricity markets. Energy 2016;94:828– 843.

Ottesen SØ, Tomasgard A, Fleten S-E. Multi market bidding strategies for demand side flexibility aggregators in electricity markets. Energy 2018;149:120–134.

Ottesen SØ, Haug M, Nygård H. A framework for offering short-term demand-side flexibility to a flexibility marketplace. Energies 2020;13:3612.

Correa-Florez CA, Michiorri A, Kariniotakis G. Optimal participation of residential aggregators in energy and local flexibility markets. IEEE Transactions on Smart Grid 2020;11:1644– 1656.

Ansari M, Al-Awami A, Sortomme E, Abidoeric MA. Coordinated bidding of ancillary services for vehicle-to-grid using fuzzy optimization. IEEE Transactions on Smart Grid 2015;6:261–270.

Cai S, Matsuhashi R. Model predictive control for ev aggregators participating in system frequency regulation market. IEEE Access 2021;9:80763–80771.

Sousa T, Morais H, Castro R, Vale Z. Evaluation of different initial solution algorithms to be used in the heuristics optimization to solve the energy resource scheduling in smart grids. Appl Soft Comput 2016;48:491–506.

Ribeiro C, Pinto T, Vale Z, Baptista J. Data mining for remuneration of consumers demand response participation. PAAMS; 2020.

Silva C, Faria P, Vale Z. Multi-period observation clustering for tariff definition in a weekly basis remuneration of demand response. Energies 2019;12:1248.

Mamounakis I, Efthymiopoulos N, Vergados D, Tsaousoglou G, Makris P, Varvarigos E. 2019. A pricing scheme for electric utility’s participation in day-ahead and real-time flexibility energy markets. Journal of Modern Power Systems and Clean Energy 1–13.

Explicit demand response in europe, 2017.

Boscán L, Poudineh R. 2016. Business models for power system flexibility: New actors, new roles new rules.

Kubli M, Canzi P. Business strategies for flexibility aggregators to steer clear of being ”too small to bid”. Renewable & Sustainable Energy Reviews 2021;143:110908.

Beus M, Pavić I, Pandžić H, Capuder T, Štritof I, Androcec I. Evaluating flexibility of business models for distributed energy resource aggregators. 2018 15th international conference on the european energy market (EEM); 2018. p. 1–5.

Lampropoulos I, Broek M, Sark WV, Van der Hoofd E, Hommes K. 2017. Enabling flexibility from demand-side resources through aggregator companies.

Ma Z, Billanes JD, Jørgensen BN. Aggregation potentials for buildings—business models of demand response and virtual power plants. Energies 2017;10:1646.

Okur Ö, Heijnen P, Lukszo Z. Aggregator’s business models in residential and service sectors: A review of operational and financial aspects. Renewable & Sustainable Energy Reviews 2021;139:110702.

Faia R, Pinto T, Vale Z. Fair remuneration of energy consumption flexibility using shapley value. EPIA; 2019.

Nicholson E. Procuring flexibility in wholesale electricity markets. Current Sustainable/Renewable Energy Reports 2019;6:100–106.

Poplavskaya K, Vries LD. 2020. Aggregators today and tomorrow: from intermediaries to local orchestrators?

Lampropoulos I, Broek M, van der Hoofd E, Hommes K, Sark WV. A system perspective to the deployment of flexibility through aggregator companies in the netherlands. Energy Policy 2016;118: 534–551.

Bray R, Woodman B. 2019. Barriers to independent aggregators in europe.

Schittekatte T, Reif, Meeus L. 2021. Welcoming new entrants into european electricity markets.

Silvestre MLD, Gallo P, Sanseverino ER, Sciumè G, Zizzo G. Aggregation and remuneration in demand response with a blockchain-based framework. IEEE Trans Ind Appl 2020;56:4248–4257.

Boursier G, Vukasović I, Brguljan PM, Lohmander M, Ghita I, Andreu FBB, Barrett E, Brugnoni D, Kroupis C, Šprongl L, Thelen M, Vanstapel F, Vodnik T, Huisman W, Vaubourdolle M. Accreditation process in european countries – an eflm survey. Clinical Chemistry and Laboratory Medicine (CCLM) 2016;54:545–551.

Villar J, Bessa R, Matos M. Flexibility products and markets:Literature review. Electr Power Syst Res 2018;154:329–340.

Lund PD, Lindgren J, Mikkola J, Salpakari J. Review of energy system flexibility measures to enable high levels of variable renewable electricity. Renew Sust Energ Rev 2015;45:785– 807.

Höschle H, De Jonghe C, Le Cadre H, Belmans R. Electricity markets for energy, flexibility and availability-Impact of capacity mechanisms on the remuneration of generation technologies. Energy Economics 2017;66:372–383.

Gottstein M, Skillings S. Beyond capacity markets—delivering capability resources to europe’s decarbonised power system. 2012 9th international conference on the European energy market. IEEE; 2012. p. 1–8.

Antenucci A, Crespo del Granado P, Gjorgiev B, Sansavini G. Can models for long-term decarbonization policies guarantee security of power supply? a perspective from gas and power sector coupling; 2019. p. 100410.

Gils HC. Assessment of the theoretical demand response potential in europe. Energy 2014;67: 1–18.

Paulus M, Borggrefe F. The potential of demand-side management in energy-intensive industries for electricity markets in germany. Appl Energy 2011;88(2):432–441.

Stadler I. Power grid balancing of energy systems with high renewable energy penetration by demand response. Utilities Policy 2008;16(2):90–98. Sustainable Energy and Transportation Systems.

Saele H, Grande OS. Demand response from household customers: Experiences from a pilot study in norway. IEEE Transactions on Smart Grid 2011;2(1):102–109.

Zepter JM, Lüth A, Crespo del Granado P, Egging R. Prosumer integration in wholesale electricity markets: Synergies of peer-to-peer trade and residential storage. Energy and Buildings 2019;184:163–176.

Backe S, Crespo del Granado P, Tomasgard A, Pinel D, Korpast M, Lindberg KB. Towards zero emission neighbourhoods: Implications for the power system. 2018 15th International Conference on the European Energy Market (EEM). IEEE; 2018. p. 1–6.

Grøttum HH, Bjerland SF, Crespo del Granado P, Egging R. Modelling tso-dso coordination: The value of distributed flexible resources to the power system. 2019 16th international conference on the european energy market (EEM). IEEE; 2019. p. 1–6.

Kohlhepp P, Harb H, Wolisz H, Waczowicz S, Müller D., Hagenmeyer V. Large-scale grid integration of residential thermal energy storages as demand-side flexibility resource: A review of international field studies. Renew Sust Energ Rev 2019;101:527–547.

Pearson S, Wellnitz S, Crespo del Granado P, Hashemipour N. The value of tso-dso coordination in re-dispatch with flexible decentralized energy sources: Insights for Germany in 2030. Appl Energy 2022; 326:119905.

Acknowledgements

This paper was prepared as a part of the PowerDig project (Digitalization of short-term resource allocation in power markets), funded by the Research Council of Norway through the ENERGIX program (p-nr: 320789). We are also grateful to industrial partners Statnett and Statkraft supporting the PowerDig project.

Funding

Open access funding provided by NTNU Norwegian University of Science and Technology (incl St. Olavs Hospital - Trondheim University Hospital). This work received funding from FME NTRANS (Grant 296205, Research Council of Norway).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no competing interests.

Additional information

Human and Animal Rights and Informed Consent

This article does not contain any studies with human or animal subjects performed by any of the authors.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the Topical Collection on Zero-Marginal-Cost Market Design

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Granado, P.C.d., Rajasekharan, J., Pandiyan, S.V. et al. Flexibility Characterization, Aggregation, and Market Design Trends with a High Share of Renewables: a Review. Curr Sustainable Renewable Energy Rep 10, 12–21 (2023). https://doi.org/10.1007/s40518-022-00205-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40518-022-00205-y