Abstract

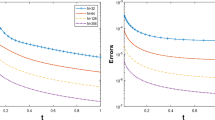

The operator splitting method has been effectively applied to jump-diffusion models, and it is also easy to implement because the differential and complementarity restrictions are decoupled and solved separately. Despite their ubiquity, these operator-splitting approaches for jump-diffusion models have no stability and error analysis. In this direction, we performed a priori stability analysis for the implicit–explicit backward difference operator splitting techniques (IMEX-BDF-OS). After the stability analysis, we established the error estimates for IMEX-BDF1-OS and IMEX-BDF2-OS techniques. To validate the theoretical results, numerical evidence of the pricing of American options under Kou’s and Merton’s jump-diffusion models has been shown.

Similar content being viewed by others

Data availability

Not Applicable.

References

Akbari R, Mokhtari R, Jahandideh MT (2019) A combined compact difference scheme for option pricing in the exponential jump-diffusion models. Adv Differ Equ 1:1–3

Bastani AF, Ahmadi Z, Damircheli D (2013) A radial basis collocation method for pricing American options under regime-switching jump-diffusion models. Appl Numer Math 65:79–90

Boen L, In’t Hout KJ (2020) Operator splitting schemes for American options under the two-asset Merton jump-diffusion model. Appl Numer Math 153:114–31

Chen F, Shen J (2020) Stability and error analysis of operator splitting methods for American options under the Black–Scholes model. J Sci Comput 82(2):1–17

Chen F, Shen J, Haijun Y (2012) A new spectral element method for pricing European options under the Black–Scholes and Merton jump diffusion models. J Sci Comput 52(3):499–518

Chen C, Wang Z, Yang Y (2019) A new operator splitting method for American options under fractional Black–Scholes models. Comput Math Appl 77(8):2130–2144

Chen Y, Xiao A, Wang W (2019) An IMEX-BDF2 compact scheme for pricing options under regime-switching jump-diffusion models. Math Methods Appl Sci 42(8):2646–2663

Cho J, Kim Y, Lee S (2022) An accurate and stable numerical method for option hedge parameters. Appl Math Comput 430:127276

Company R, Egorova VN, Jódar L (2021) A front-fixing ETD numerical method for solving jump-diffusion American option pricing problems. Math Comput Simul 189:69–84

Cont R, Voltchkova E (2005) A finite difference scheme for option pricing in jump diffusion and exponential Lévy models. SIAM J Numer Anal 43(4):1596–1626

Dehghan M, Bastani AF et al (2018) On a new family of radial basis functions: mathematical analysis and applications to option pricing. J Comput Appl Math 328:75–100

del Carmen Calvo-Garrido M, Vázquez C (2015) Effects of jump-diffusion models for the house price dynamics in the pricing of fixed-rate mortgages, insurance and coinsurance. Appl Math Comput 271:730–742

Düring B, Pitkin A (2019) High-order compact finite difference scheme for option pricing in stochastic volatility jump models. J Comput Appl Math 355:201–217

Garroni MG, Menaldi JL et al (1992) Green functions for second order parabolic integro-differential problems, vol 275. Chapman and Hall/CRC

Haghi M, Mollapourasl R, Vanmaele M (2018) An RBF-FD method for pricing American options under jump-diffusion models. Comput Math Appl 76(10):2434–2459

Huang Y, Forsyth PA, Labahn G (2011) Methods for pricing American options under regime switching. SIAM J Sci Comput 33(5):2144–2168

Huang J, Cen Z, Le A (2013) A finite difference scheme for pricing American put options under Kou’s jump-diffusion model. J Funct Spaces Appl

Ikonen S, Toivanen J (2004) Operator splitting methods for American option pricing. Appl Math Lett 17(7):809–814

Ikonen S, Toivanen J (2009) Operator splitting methods for pricing American options under stochastic volatility. Numer Math 113(2):299–324

Kadalbajoo MK, Kumar A, Tripathi LP (2015) Application of the local radial basis function-based finite difference method for pricing American options. Int J Comput Math 92(8):1608–1624

Kadalbajoo MK, Tripathi LP, Kumar A (2015) Second order accurate IMEX methods for option pricing under Merton and Kou jump-diffusion models. J Sci Comput 65(3):979–1024

Kadalbajoo MK, Kumar A, Tripathi LP (2016) A radial basis function based implicit-explicit method for option pricing under jump-diffusion models. Appl Numer Math 110:159–173

Kazmi K (2019) An IMEX predictor-corrector method for pricing options under regime-switching jump-diffusion models. Int J Comput Math 96(6):1137–1157

Kou SG (2002) A jump-diffusion model for option pricing. Manage Sci 48(8):1086–1101

Kumar D, Deswal K (2021) Haar-wavelet based approximation for pricing American options under linear complementarity formulations. Numer Methods Partial Differ Equ 37(2):1091–1111

Kwon Y, Lee Y (2011) A second-order tridiagonal method for American options under jump-diffusion models. SIAM J Sci Comput 33(4):1860–1872

Li H, Mollapourasl R, Haghi M (2019) A local radial basis function method for pricing options under the regime switching model. J Sci Comput 79(1):517–541

Matache A-M, Von Petersdorff T, Schwab C (2004) Fast deterministic pricing of options on Lévy driven assets. ESAIM Math Model Numer Anal 38(1):37–71

Merton RC (1976) Option pricing when underlying stock returns are discontinuous. J Financ Econ 3(1–2):125–144

Mollapourasl R, Haghi M, Liu R (2018) Localized kernel-based approximation for pricing financial options under regime switching jump diffusion model. Appl Numer Math 134:81–104

Patel KS, Mehra M (2017) Fourth-order compact finite difference scheme for American option pricing under regime-switching jump-diffusion models. Int J Appl Comput Math 3(1):547–567

Patel KS, Mehra M (2018) Fourth-order compact scheme for option pricing under the Merton’s and Kou’s jump-diffusion models. Int J Theor Appl Finance 21(04):1850027

Pindza E, Patidar KC, Ngounda E (2014) Robust spectral method for numerical valuation of European options under Merton’s jump-diffusion model. Numer Methods Partial Differ Equ 30(4):1169–1188

Quarteroni A, Valli A (2008) Numerical approximation of partial differential equations, vol 23. Springer, Berlin

Rad JA, Parand K (2017) Numerical pricing of American options under two stochastic factor models with jumps using a meshless local Petrov-Galerkin method. Appl Numer Math 115:252–274

Saib AAE-F, Tangman DY, Bhuruth M (2012) A new radial basis functions method for pricing American options under Merton’s jump-diffusion model. Int J Comput Math 89(9):1164–1185

Salmi S, Toivanen J (2011) An iterative method for pricing American options under jump-diffusion models. Appl Numer Math 61(7):821–831

Salmi S, Toivanen J (2014) IMEX schemes for pricing options under jump-diffusion models. Appl Numer Math 84:33–45

Shirzadi M, Dehghan M, Bastani AF (2020) On the pricing of multi-asset options under jump-diffusion processes using meshfree moving least-squares approximation. Commun Nonlinear Sci Numer Simul 84:105160

Thakoor N, Tangman DY, Bhuruth M (2013) A new fourth-order numerical scheme for option pricing under the CEV model. Appl Math Lett 26(1):160–164

Thakoor N, Tangman DY, Bhuruth M (2018) RBF-FD schemes for option valuation under models with price-dependent and stochastic volatility. Eng Anal Boundary Elem 92:207–217

Tour G, Thakoor N, Ma J, Tangman DY (2020) A spectral element method for option pricing under regime-switching with jumps. J Sci Comput 83(3):1–31

Wang W, Chen Y, Fang H (2019) On the variable two-step IMEX BDF method for parabolic integro-differential equations with nonsmooth initial data arising in finance. SIAM J Numer Anal 57(3):1289–1317

Wang W, Mao M, Wang Z (2021) An efficient variable step-size method for options pricing under jump-diffusion models with nonsmooth payoff function. ESAIM Math Model Numer Anal 55(3):913–938

Xu C, Su B, Liu C (2022) A quick operator splitting method for option pricing. J Comput Appl Math 406:113949

Yousuf Muhammad, Khaliq AQM, Alrabeei Salah (2018) Solving complex PIDE systems for pricing American option under multi-state regime switching jump-diffusion model. Comput Math Appl 75(8):2989–3001

Acknowledgements

We would like to show our gratitude to the Dr. Lok Pati Tripathi, Department of Mathematics, Indian Institute of Technology Goa, India for sharing his valuable thoughts with us throughout this research. The work of author [Deepak Kumar Yadav] is supported by the University Grants Commission(UGC), India (Student ID-DEC18-416341).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Communicated by Dan Goreac.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yadav, D.K., Bhardwaj, A. & Kumar, A. Errors in the IMEX-BDF-OS methods for pricing American style options under the jump-diffusion model. Comp. Appl. Math. 43, 6 (2024). https://doi.org/10.1007/s40314-023-02510-8

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40314-023-02510-8

Keywords

- Operator splitting

- Jump-diffusion

- American options

- Linear complementarity problems

- Stability analysis

- Error analysis