Abstract

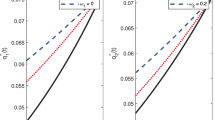

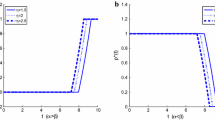

In this paper, we consider an optimal investment and proportional reinsurance problem with delay, in which the insurer’s surplus process is described by a jump-diffusion model. The insurer can buy proportional reinsurance to transfer part of the insurance claims risk. In addition to reinsurance, she also can invests her surplus in a financial market, which is consisted of a risk-free asset and a risky asset described by Heston’s stochastic volatility (SV) model. Considering the performance-related capital flow, the insurer’s wealth process is modeled by a stochastic differential delay equation. The insurer’s target is to find the optimal investment and proportional reinsurance strategy to maximize the expected exponential utility of combined terminal wealth. We explicitly derive the optimal strategy and the value function. Finally, we provide some numerical examples to illustrate our results.

Similar content being viewed by others

References

Browne, S.: Optimal investment policies for a firm with a random risk process: exponential utility and minimizing the probability of ruin. Math. Oper. Res. 20, 937–957 (1995)

Højgaard, B., Taksar, M.: Optimal proportional reinsurance policies for diffusion models. Scand. Actuar. J. 2, 166–180 (1998)

Yang, H.L., Zhang, L.H.: Optimal investment for insurer with jump-diffusion risk process. Insur. Math. Econ 37, 615–634 (2005)

Wang, N.: Optimal investment for an insurer with exponential utility preferences. Insur. Math. Econ 40, 77–84 (2007)

Bai, L.H., Guo, J.Y.: Optimal proportional reinsurance and investment with multiple risky assets and no-shorting constraint. Insur. Math. Econ. 42, 968–975 (2008)

Xu, L., Wang, R.M., Yao, D.J.: On maximizing the expected terminal utility by investment and reinsurance. J. Ind. Manag. Optim. 4, 801–815 (2008)

Bäuerle, N., Blatter, A.: Optimal control and dependence modeling of insurance portfolios with Lévy dynamics. Insur. Math. Econ. 48, 398–405 (2011)

Zeng, Y., Li, Z.F.: Optimal time-consistent investment and reinsurance policies for mean-variance insurers. Insur. Math. Econ. 49, 145–154 (2011)

Zeng, Y., Li, Z.F., Lai, Y.Z.: Time-consistent investment and reinsurance strategies for mean-variance insurers with jumps. Insur. Math. Econ. 52, 498–507 (2013)

Li, Z.F., Zeng, Y., Lai, Y.Z.: Optimal time-consistent investment and reinsurance strategies for insurers under Heston’ s SV model. Insur. Math. Econ. 51, 191–203 (2012)

Shen, Y., Zeng, Y.: Optimal investment-reinsurance strategy for mean-variance insurers with square-root factor process. Insur. Math. Econ. 62, 118–137 (2015)

Zeng, Y., Li, Z.F.: Optimal reinsurance-investment strategies for insurers under mean-CaR criteria. J. Ind. Manag. Optim. 8(3), 673–690 (2012)

Chen, S.M., Li, Z.F.: Optimal investment-reinsurance strategy for an insurance company with VaR contraint. Insur. Math. Econ. 47, 144–153 (2010)

Schmidli, H.: On minimizing the ruin probability by investment and reinsurance. Ann. Appl. Probab. 12, 890–907 (2002)

Promislow, D.S., Young, V.R.: Minimizing the probability of ruin when claims follow Brownian motion with drift. N. Am. Actuar. J. 9, 109–128 (2005)

Zhang, X., Siu, T.K.: On optimal proportional reinsurance and investment in a Markovian regime-switching economy. Acta Math. Sin. (English Ser.) 28, 67–82 (2012)

Liu, J., Yiu, K.F.C., Siu, T.K.: Optimal investment of an insurer with regime-switching and risk constraint. Scand. Actuar. J. 2014, 583–601 (2013)

Elliott, R.J., Siu, T.K.: A stochastic differential game for optimal investment of an insurer with regime switching. Quant. Finance 11, 365–380 (2011)

Zhang, X., Siu, T.K.: Optimal investment and reinsurance of an insurer with model uncertainty. Insur. Math. Econ. 45, 81–88 (2009)

Lin, X., Zhang, C., Siu, T.K.: Stochastic differential portfolio games for an insurer in jump diffusion risk process. Math. Oper. Res. 75, 83–100 (2012)

Yi, B., Li, Z., Viens, F., Zeng, Y.: Robust optimal control for an insurer with reinsurance and investment under Hestons stochastic volatility model. Insur. Math. Econ. 53, 601–614 (2013)

Beckers, S.: The constant elasticity of variance model and its implications for option pricing. J. Finance 35, 661–673 (1980)

Hobson, D.G., Rogers, L.C.G.: Complete models with stochastic volatility. Math. Finance 8, 27–48 (1998)

Engle, R.: Autoregressive conditional heteroskedasticity with estimates of the variance of U.K. inflation. Econometrica 50, 987–1008 (1982)

Taylor, S.J.: Financial returns modeled by the product of two stochastic processes, a study of daily sugar prices. 1961–75. In: Anderson, O.D. (ed.) Time Series Analysis: Theory and Practice, vol. 1, pp. 203–226. North-Holland, Amsterdam (1982)

Cox, J.C., Ross, S.A.: The valuation of options for alternative stochastic processes. J. Financ. Econ. 4, 145–166 (1976)

Hull, J., White, A.: The pricing of options on assets with stochastic volatilities. J. Finance 42, 281–300 (1987)

Stein, E.M., Stein, J.C.: Stock price distribution with stochastic volatility: an analytic approach. Rev. Financ. Stud. 4, 727–752 (1991)

Heston, S.L.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6, 327–343 (1993)

Gu, M.D., Yang, Y.P., Li, S.D., Zhang, J.Y.: Constant elasticity of variance model for proportional reinsurance and investment strategies. Insur. Math. Econ. 46, 580–587 (2010)

Gu, A.L., Guo, X.P., Li, Z.F., Zeng, Y.: Optimal control of excess-of-loss reinsurance and investment for insurers under a CEV model. Insur. Math. Econ. 51, 674–684 (2012)

Zhao, H., Rong, X.M., Zhao, Y.G.: Optimal excess-of-loss reinsurance and investment problem for an insurer with jump-diffusion risk process under the Heston model. Insur. Math. Econ. 53, 504–514 (2013)

Øksendal, B., Sulem, A.: A maximum principle for optimal control of stochastic systems with delay, with applications to finance. In: Menaldi, J.M., Rofman, E., Sulem, A. (eds.) Optimal Control and Partial Differential Equations-Innovations and Applications. IOS Press, Amsterdam (2000)

Elsanousi, I., Øksendal, B., Sulem, A.: Some solvable stochastic control problems with delay. Stoch. Stoch. Rep. 71(1), 69–89 (2000)

Larssen, B.: Dynamic programming in stochastic control of systems with delay. Int. J. Probab. Stoch. Process. 74(3–4), 651–673 (2002)

Elsanousi, L., Larssen, B.: Optimal Consumption Under Partial Observations for a Stochastic System with Delay. University of Oslo, Oslo, Norway (2001). http://urn.nb.no/URN:NBN:no-24279

Chang, M.-H., Pang, T., Yang, Y.P.: A stochastic portfolio optimization model with bounded memory. Math. Oper. Res. 36(4), 604–619 (2011)

Federico, S.: A stochastic control problem with delay arising in a pension fund model. Finance Stoch. 15, 421–459 (2011)

Shen, Y., Zeng, Y.: Optimal investment-reinsurance with delay for mean-variance insurers: a maximum principle approach. Insur. Math. Econ. 57, 1–12 (2014)

A, C., Li, Z.: Optimal investment and excess-of-loss reinsurance problem with delay for an insurer under Heston’s SV model. Insur. Math. Econ. 61, 181–196 (2015)

A, C., Lai, Y., Shao, Y.: Optimal excess-of-loss reinsurance and investment problem with delay and jump-diffusion risk process under the CEV model. J. Comput. Appl. Math. 342, 317–336 (2018)

Pang, T., Hussain, A.: An infinite time horizon portfolio optimization model with delays. Math. Control Relat. Fields 6(4), 629–651 (2016)

Pang, T., Hussain, A.: A stochastic portfolio optimization model with complete memory. Stoch. Anal. Appl. 35(4), 742–766 (2017)

Yang, X.X., Liang, Z.B., Zhang, C.B.: Optimal mean-variance reinsurance with delay and multiple classes of dependent risks. Sci. China Math. 47(6), 723–756 (2017). (in Chinese)

Li, K., Liu, J.: Portfolio selection under time delays: a piecewise dynamic programming approach (2018). https://doi.org/10.2139/ssrn.2916481

Deng, C., Bian, W.L., Wu, B.Y.: Optimal reinsurance and investment problem with default risk and bounded memory. Int. J. Control (2019). https://doi.org/10.1080/00207179.2019.1573320

Lin, X., Li, Y.F.: Optimal reinsurance and investment for a jump diffusion risk process under the CEV model. N. Am. Actuar. J. 15(3), 417–431 (2012)

Cox, J.C., Ingersoll, J.E., Ross, S.A.: A theorey of term structure of interest rates. Econometrica 53, 385–407 (1985)

Kraft, H.: Optimal portfolios and Heston stochastic volatility model: an explicit solution for power utility. Quant. Finance 5, 303–313 (2005)

Fleming, W.H., Hernández-Hernández, D.: An optimal consumption model with stochastic volatility. Finance Stoch. 7, 245–262 (2003)

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China (No. 71801186), the Science Foundation of Ministry of Education of China (No. 18YJC630001), and the Natural Science Foundation of Guangdong Province of China (No. 2017A030310660).

Appendix

Appendix

Lemma 1

Equation

has a unique positive solution \({\hat{u}}\). If \(c_{0}\leqslant \lambda \int _{0}^{\infty }c\mathrm{e}^{cu\gamma \mathrm{e}^{(\mu _{1}+\beta )(T-t)}}F(\mathrm{d}c)=0\), then the solution of Eq. (A1) satisfies \(0<{\hat{u}}\leqslant 1\); if \(c_{0}>\lambda \int _{0}^{\infty }ce^{cu\gamma \mathrm{e}^{(\mu _{1}+\beta )(T-t)}}F(dc)=0\), then the solution of Eq. (A1) satisfies \({\hat{u}}> 1\).

The proof of Lemma 1 is similar to Lemma 3.1 in Lin and Li [47], so we omit it.

The proof of Theorem 1

Assume that the HJB equation (16) has a classical solution J, which satisfies \(J_{x}>0\) and \(J_{xx}<0\). For maximizing the quantity in the HJB equation, by the first-order condition, we can derive the optimal investment strategy \(\alpha ^{*}(t)\) as follows:

Plugging (A2) into (16) yields

with terminal condition

Based on the form of the exponential utility function, we try the following form of value function J(t, x, y, v) as follows:

with \(a(T)=1\), \(b(T)=0\), \(g(T,v)=0\). Then

here \(a'(t),b'(t),g_{t}(t,v),g_{v}(t,v)\) denote the derivatives of a(t), b(t), g(t, v), and \(g_{vv}(t,v)\) denotes the second-order derivatives of g(t, v) w.r.t. v. Introducing the above derivatives into (A3), we derive

By the first-order condition, we have

According to Lemma 1, Eq. (A6) has a unique positive solution, we denote it by \({\hat{u}}\). Then plugging \({\hat{u}}\) into (A5) and simplifying, we have

With the assumption of (18) and (19), we can get

By the equation above, a(t), b(t) and g(t, v) meet the following differential equations:

Using the boundary condition \(a(T)=0\), it follows from (5.7) that

Plugging (A10) into (5.8), we have

with \(b(T)=0.\) If the distribution of C is known, then the expression form of b(t) can be derive explicitly.

To solve (5.9), we guess

with the boundary condition \(A(T)=B(T)=0\). Thus,

Inserting (A13) into (5.9), we obtain

Matching coefficients yields

Firstly, we solve equation (5.14).

-

(i)

If \(\rho =1\), (5.14) reduces to

$$\begin{aligned} B^{\prime }(t)-(\kappa +\eta \sigma )B(t) +\frac{1}{2} \frac{\eta ^{2}}{\gamma }=0. \end{aligned}$$Considering \(B(T)=0\), we can obtain

$$\begin{aligned} B(t)=\frac{\eta ^{2}}{2\gamma (\kappa +\eta \sigma )} \bigg (1-\mathrm{e}^{-(\kappa +\eta \sigma )(T-t)}\bigg ). \end{aligned}$$(A16) -

(ii)

If \(\rho =-1\) and \(\kappa \ne \eta \sigma \) (or \(\kappa +\eta \sigma \rho \ne 0\)), Eq. (5.14) reduces to (5.15) and has the same solution with (i); If \(\rho =-1\) and \(\kappa =\eta \sigma \) (or \(\kappa +\eta \sigma \rho =0\)), (5.14) reduces to

$$\begin{aligned} B^{\prime }(t)+\frac{1}{2} \frac{\eta ^{2}}{\gamma }=0. \end{aligned}$$(A17)Using \(B(T)=0\), we get the solution for (A17)

$$\begin{aligned} B(t)=\frac{\eta ^{2}}{2\gamma }(T-t). \end{aligned}$$(A18) -

(iii)

If \(\rho \ne \pm 1\), let \({\bar{B}}(t)=-\frac{1}{2}\sigma ^{2}\gamma (1-\rho ^{2})B(t)\). Then, it follows from (5.14) that

$$\begin{aligned} {\bar{B}}^{\prime }(t)+{\bar{B}}^{2}(t)-(\kappa +\eta \sigma \rho ) {\bar{B}}(t)-\frac{1}{2}\eta ^{2}\sigma ^{2}(1-\rho ^{2})=0. \end{aligned}$$(A19)Letting \({\bar{B}}(t)=\frac{\phi ^{\prime }(t)}{\phi (t)}\) (where \(\phi (t)\ne 0\)) and inserting it into (A19) yields

$$\begin{aligned} \phi ^{\prime \prime }(t)-(\kappa +\eta \sigma \rho )\phi ^{\prime }(t) -\frac{1}{4}\eta ^{2}\sigma ^{2}(1-\rho ^{2})\phi (t)=0 \end{aligned}$$(A20)with \(\phi (T)=1\) and \(\phi ^{\prime }(T)=0\). We easily derive the solution of (A20)

$$\begin{aligned} \phi (t)=\frac{\phi _{2}}{\phi _{2}-\phi _{1}}\mathrm{e}^{\phi _{1}t} +\frac{\phi _{1}}{\phi _{1}-\phi _{2}}\mathrm{e}^{\phi _{2}t}, \end{aligned}$$(A21)where

$$\begin{aligned} \phi _{1,2}=\frac{\kappa +\eta \sigma \rho \pm \sqrt{(\kappa +\eta \sigma \rho )^{2} +\eta ^{2}\sigma ^{2}(1-\rho ^{2})}}{2}. \end{aligned}$$(A22)Furthermore,

$$\begin{aligned} {\bar{B}}(t)=\frac{\phi ^{\prime }(t)}{\phi (t)} =\frac{\phi _{1}\phi _{2}-\phi _{1}\phi _{2}e^{-(\phi _{1}-\phi _{2})(T-t)}}{\phi _{2}-\phi _{1}\mathrm{e}^{-(\phi _{1}-\phi _{2})(T-t)}} \end{aligned}$$and

$$\begin{aligned} B(t)=-\frac{2}{\sigma ^{2}\gamma (1-\rho ^{2})}{\bar{B}}(t) =-\frac{2}{\sigma ^{2}\gamma (1-\rho ^{2})} \frac{\phi _{1}\phi _{2}-\phi _{1}\phi _{2}\mathrm{e}^{-(\phi _{1}-\phi _{2})(T-t)}}{\phi _{2}-\phi _{1}\mathrm{e}^{-(\phi _{1}-\phi _{2})(T-t)}}. \end{aligned}$$In summary, the solution of (5.14) is

$$\begin{aligned} {B(t)=}\left\{ \begin{array}{ll} -\frac{2}{\eta ^{2}\gamma (1-\rho ^{2})} \frac{\phi _{1}\phi _{2}-\phi _{1}\phi _{2}\mathrm{e}^{-(\phi _{1}-\phi _{2})(T-t)}}{\phi _{2}-\phi _{1}\mathrm{e}^{-(\phi _{1}-\phi _{2})(T-t)}}, \,\,\,\,\, \rho \ne \pm 1, \\ \frac{\delta ^{2}}{2\gamma (\kappa +\eta \sigma )} \bigg [1-\mathrm{e}^{-(\kappa +\eta \sigma )(T-t)}\bigg ], \,\,\,\, \qquad \rho =1, \\ \frac{\eta ^{2}}{2\gamma (\kappa -\eta \sigma )} \bigg [1-\mathrm{e}^{-(\kappa -\eta \sigma )(T-t)}\bigg ], \,\,\,\, \qquad \rho =-1 \,\, \text{ and } \,\, \kappa \ne \eta \sigma , \\ \frac{\eta ^{2}}{2\gamma }(T-t), \qquad \qquad \qquad \qquad \qquad \qquad \quad \rho =-1 \,\,\mathrm{and} \,\,\kappa =\eta \sigma . \\ \end{array}\right. \end{aligned}$$(A23)Further, we can get the solution of (5.14)

$$\begin{aligned} \!\!\! {A(t)=}\left\{ \begin{array}{ll} \frac{2}{\sigma ^{2}\kappa \zeta \gamma (1-\rho ^{2})} \bigg (\phi _{1}(T-t)-\frac{\phi _{1}+\phi _{2}}{\phi _{1}-\phi _{2}} \ln \bigg |\frac{\phi _{2}-\phi _{1}}{\phi _{2}-\phi _{1}\mathrm{e}^{-(\kappa +\eta \sigma )(T-t)}}\bigg |\bigg ) , \,\,\,\, \rho \ne \pm 1, \\ -\frac{\eta ^{2}}{2\gamma \kappa \zeta (\kappa +\eta \sigma )} \bigg [(T-t)-\frac{1}{\kappa +\eta \sigma } \mathrm{e}^{-(\kappa +\eta \sigma )(T-t)} +\frac{1}{\kappa +\eta \sigma }\bigg ], \quad \rho =1, \\ -\frac{\delta ^{2}}{2\gamma \kappa \zeta (\kappa -\eta \sigma )} \bigg [(T-t)-\frac{1}{\kappa -\eta \sigma } \mathrm{e}^{-(\kappa -\eta \sigma )(T-t)} +\frac{1}{\kappa -\eta \sigma }\bigg ], \, \rho =-1 \,\, \mathrm{and} \,\, \kappa \ne \eta \sigma , \\ \frac{\delta ^{2}}{4\gamma \kappa \zeta }(T-t)^{2}, \qquad \qquad \qquad \qquad \qquad \qquad \qquad \quad \qquad \qquad \, \rho =-1 \,\,\,\mathrm{and} \,\,\kappa =\eta \sigma . \\ \end{array}\right. \end{aligned}$$(A24)

Therefore, we have derived the expressions of g(t, v) in (5.9) and value function J(t, x, y, v) in (A4). Combining (A2), (A4), (A10) and (A12), we obtain the optimal investment strategy

where B(t) is given by (A23). Combining with Lemma 1, the theorem is proved.

The following is the proof of Theorem 2.

Proof

Let \(Q=[0,\infty )\times [0,\infty )\times [0,\infty )\). Take a sequence of bounded open sets \(Q_{1},Q_{2},Q_{3},\cdots \), with \(Q_{i}\subset Q_{i+1}\subset Q, i=1,2, \cdots \), and \(Q=\bigcup Q_{i}\). Denote the exit time of (X(t), Y(t), V(t)) from \(Q_{i}\) by \(\tau _{i}\). Thus, \(\tau _{i}\wedge T \rightarrow T\) when \(i\rightarrow \infty \).

For the wealth process \(X^{\pi }(t)\), we can obtain

Using Itô’s formula on \(\varPhi (t,X(t),Y(t),V(t))\) yields

Because \(\pi \in \Pi \), the terms \(\int _{t}^{\tau _{i}\wedge T}\varPhi _{x} \sigma _{0}\mathrm{d}W_{0}(s),\, \int _{t}^{\tau _{i}\wedge T}\varPhi _{x}\alpha (t)\sqrt{V(t)}\mathrm{d}W_{1}(s), \int _{t}^{\tau _{i}\wedge T} \varPhi _{v}\sigma \sqrt{V(s)}\mathrm{d}W_{2}(s)\) on the right hand are square-integrable martingales with zero expectation. And with (4), we have

In terms of Lemma in Larssen [35], the uniform integrability of \(\varPhi (\tau _{i}\wedge T,X(\tau _{i}\wedge T),Y(\tau _{i}\wedge T),V(\tau _{i}\wedge T)), i=1,2,\cdots \) yields

Similarly, we have

and then

Thus, for X(t), we have

For \(\pi ^{*}=(u^{*}(t),\alpha ^{*}(t))\) and \(X^{*}(t)\), all inequalities become equalities, i.e., \(J(t,x,y,v)=\varPhi (t,x,y,v)\) and \(\sup _{\pi \in \Pi }E[U(X^{*}(T),Y(T))]=\varPhi (0,x_{0},y_{0},v_{0})\). The proof is completed.

Rights and permissions

About this article

Cite this article

A, CX., Gu, AL. & Shao, Y. Optimal Reinsurance and Investment Strategy with Delay in Heston’s SV Model. J. Oper. Res. Soc. China 9, 245–271 (2021). https://doi.org/10.1007/s40305-020-00331-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40305-020-00331-8

Keywords

- Proportional reinsurance

- Stochastic differential delay equation (SDDE)

- Heston's stochastic volatility (SV) model

- Hamilton–Jacobi–Bellman (HJB) equation