Abstract

Background

Although pharmaceutical expenditures have been rising for decades, the question of their drivers remains unclear, and long-term projections of pharmaceutical spending are still scarce. We use a Markov approach considering different cost-risk groups to show the possible range of future drug spending in Germany and illustrate the influence of various determinants on pharmaceutical expenditure.

Methods

We compute different medium and long-term projections of pharmaceutical expenditure in Germany up to 2060 and compare extrapolations with constant shares, time-to-death scenarios, and Markov modeling based on transition probabilities. Our modeling is based on data from a large statutory sickness fund covering around four million insureds. We divide the population into six risk groups according to their share of total pharmaceutical expenditures, determine their cost growth rates, survival and transition probabilities, and compute different scenarios related to changes in life expectancy or spending trends in different cost-risk groups.

Results

If the spending trends in the high-cost groups continue, per-capita expenditure will increase by over 40% until 2040. By 2060, pharmaceutical expenditures could more than double, even if these groups would not benefit from rising life expectancy. By contrast, the isolated effect of demographic change would "only" lead to a long-term increase of around 15%.

Conclusion

The long-term development of pharmaceutical spending in Germany will depend mainly on future expenditure and life expectancy trends of particularly high-cost patients. Thus, appropriate pricing of new expensive pharmaceuticals is essential for the sustainability of the German healthcare system.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

High-risk patients have a decisive impact on the future development of pharmaceutical expenditure. |

Germany must prepare for a strong increase in drug spending if the current trends continue. |

Policymakers can respond to these challenges with appropriate pricing policies. |

1 Introduction

Healthcare spending in Germany has been rising for years, with pharmaceutical spending being one of the most dynamic cost drivers. With an increase of 5.5% in 2022, pharmaceutical per capita expenditures in statutory health insurance show by far the highest growth rate, followed by per capita spending for inpatient care (3.2%), dental care (2.9%), and outpatient care (1.9%) [1]. However, e.g., the widespread use of expensive biologics and the ongoing increase in launch prices makes it difficult to predict the future development of expenditures for pharmaceuticals [2, 3]. Furthermore, in light of the aging of societies, the sustainable financing of drug spending becomes a challenge [2,3,4]. The Organisation for Economic Co-operation and Development (OECD) provides an overview of forecasting activities for pharmaceutical expenditures of its member states [2]. In contrast to short-term forecasts (1–5 years), the OECD identifies only a few studies with a medium- and long-term perspective. Focusing solely on age and gender, previous studies neglect the influence of different patient groups with specific profiles of drug consumption. But the share of specific groups in spending growth is of particular interest to policymakers, e.g., in terms of reform options, especially regarding the increasing spending concentration on a small group of high-risk patients [5].

The pharmaceutical market can be divided into the market segment of off-patent drugs, characterized by high price competition and/or a high degree of price regulation, and the market segment of patent-protected drugs with, for the most part, stand-alone products [6]. For Germany, most top-selling drugs are patent-protected blockbusters like oncologics, immunotherapeutics, or pharmaceuticals for cardiovascular diseases [7]. However, in the last few years, most of the increase in pharmaceutical spending in Germany and many other countries is attributable to pharmaceuticals for rare diseases (so-called orphan drugs) [8, 9]. The presumable reason for this is a less stringent legal framework for drug evaluation and reimbursement for new launches of orphan drugs compared to new launches of blockbusters [10, 11]. Overall, in 2019 half of all newly launched pharmaceuticals in Germany were orphan drugs, most of them for cancers [7]. Consequently, this trend is leading to an increasing concentration of spending on high-risk patients [5].

In this paper, we compute different medium- and long-term projections of outpatient pharmaceutical expenditure in Germany from 2019 to 2060 using a Markov approach. In our model, we distinguish between different risk groups defined by cost, i.e., we measure the previous year's drug costs for risk group classification. Our model operates with affiliation probabilities to the risk groups, transition probabilities between the groups, and group-specific mortality rates, each by age and sex, for linking the model to population projections. Even though discrete-time Markov models are widely used in pharmacoeconomics, their application tends to focus on cost-benefit, cost-effectiveness, or cost-utility analyses [12, 13] rather than on population-based expenditure projections. Our model is based on a large statutory sickness funds dataset covering approximately 4 million insureds. All our modeling is done within a population projection in which we simulate the distribution and development of risk groups for the German population. This allows us to distinguish projections with constant shares (status quo), projections with the time-to-death assumption, and projections via the Markov modeling mentioned above. With this comprehensive approach, we can extend the literature both in terms of medium- and long-term drug expenditure projections and on the impact of the increasing high-cost cases on future pharmaceutical spending. By making different assumptions about gains in life expectancy and risk group-specific future growth trends of pharmaceutical costs, we can show the possible future range of pharmaceutical spending for the healthcare system. As many scholars support the assumption that healthcare spending is determined less by age itself than by proximity to death [14,15,16], we also account for the costs of dying in one projection model.

The paper is organized as follows: First, we describe the projection model, the underlying data set, and the different projection scenarios for the future development of pharmaceutical spending in Germany. We then present our projection results, followed by a discussion of the results considering current literature and limitations. At the end, we draw the respective conclusions and provide policy implications.

2 Methods

2.1 Model

We project future pharmaceutical expenditures for Germany until 2060. As usual for this long time horizon, we focus on the demand side [2] and, particularly, on the impact of high-cost patients. We follow the work of Thiébaut et al. [17] and use a Markov model approach based on transition probabilities to simulate future pharmaceutical expenditure in various scenarios. Our model operates with different risk groups based on their share of total pharmaceutical spending, risk group one representing the most expensive 1%, risk group two the second most expensive 4%, and the other risk groups the following: 5%, 10%, 30%, and 50%. The risk group members can transition to other risk groups and also transition to death with group-specific mortality (see Pritchard [18], Sherris and Wei [19] or Rickayzen and Walsh [20]). Since we focus on the influence of patients with very high drug spending, the risk in our model is determined by prior year pharmaceutical expenditure, as this has proven to be a good predictor of high spending in the future [21, 22]. In the field of health economics, there is an ongoing debate about reasons for disproportionate healthcare spending growth [23]. First, to account for the costs of dying as a widely discussed determinant of high healthcare spending [24], we distinguish the costs of survivors and deceased, following Kildemoes et al. [25] and Morgan and Cunningham [26]. Furthermore, medical progress is under discussion as an expenditure driver [27], leading to the inclusion of cost growth rates in forecast models (see, e.g., the Intergenerational Report of the Commonwealth of Australia [28]). Since previous studies found different disproportionate cost growth rates for survivors and decedents of various patient groups [29] and particularly high pharmaceutical spending growth for patients with the highest drug expenditures [30], we include risk group- and survival status-specific cost growth rates in our projection model.

The data in our model are calibrated to the pharmaceutical expenditures in 2019 of the German Social Health Insurance (SHI), covering about 90% of the German population. The population in our model is split into six (different-in-size) risk groups, as mentioned above. This approach should address the highly skewed distribution of healthcare spending in Germany since the most expensive 1% of insureds in the SHI are responsible for about 20% of healthcare expenditures, and the most expensive 10% account for over 50% [31, 32]. Focusing only on pharmaceutical expenditures, this distortion is particularly strong and continuously increasing [32]. For each risk group, we calculate age- and sex-related affiliation probabilities.

We use a deterministic Markov approach to determine how the different risk groups transition over time, as illustrated in Fig. 1.Footnote 1 For each cohort by age \(a\) and sex \(s\), we calculate transition probabilities and mortality rates. The initial risk groups \({\mathrm{rg}}_{t}\) (R1–R6) are shown in Fig. 1 on the left. Every cohort of a risk group has a certain transition probability \({\mathrm{tp}}_{{\mathrm{rg}}_{t},{\mathrm{rg}}_{t+1}}^{a,s}\) to move to another risk group \({\mathrm{rg}}_{t+1}\) or to die with a certain mortality rate \({\mathrm{mr}}_{{\mathrm{rg}}_{t},{\mathrm{rg}}_{t+1}}^{a,s}\) in year \(t+1\). The rates \({\mathrm{tp}}_{{\mathrm{rg}}_{t},{\mathrm{rg}}_{t+1}}^{a,s}\) and \({\mathrm{mr}}_{{\mathrm{rg}}_{t},{\mathrm{rg}}_{t+1}}^{a,s}\) are calibrated to the life tables [33] associated with the projection of the German population up to 2060 [34]. For each risk group, we calculate average daily per-capita pharmaceutical costs differentiated by deceased and survivors. In the Markov model, the origin risk group in year \(t\) determines the amount of expenditure in year \(t+1.\) Thus, in year \(t=2018\), we use age- and sex-related (affiliation) probabilities to distribute the population among the six risk groups to begin modeling from year \(t+1=2019\) using the transition probabilities and mortality rates. In allocating expenditure to survivors and decedents, we calibrate the model to the total outpatient drug expenditure of the German SHI in 2019 [35]. Therefore, we assume a daily spending of 360 days for survivors and 180 days for decedents.

2.2 Data

As input data for the population projection, we use official population statistics and life tables from Destatis [36] and mortality.org [37] to derive (future) cohort sizes and survival rates. In line with the fertility assumption G2 and mortality assumption L2 of the official forecast [34], we assume a constant total fertility rate of 1.55 children per woman of childbearing age and an increase in the life expectancy at birth from 83.4 (78.6) in the year 2019 to 88.1 (84.4) in the year 2060 for women (men). Further, we abstract from future migration movements, as we do not know the extent to which age-, sex-, and risk-specific characteristics with respect to drug use are transferable to (future) migrants. Nevertheless, we also present scenarios that include future migration as part of our sensitivity analyses.

The risk group-specific data are based on a dataset from the AOK Baden-Württemberg (AOK BW), a large German sickness fund with around 4 million insureds, spanning the years 2010–2019. We divide the insured population into the six (different-sized) risk groups, considering only individuals with at least 360 insurance days. Since we need both a pre-observation year with a full insurance period and a post-observation year to distinguish between deceased and survivors, the data used stem from the period 2011–2018. Table 1a provides an overview of the study population. For every cost group, it offers for the year 2018 the number of insureds, the share of total pharmaceutical costs, the distribution of women and men, and the average age. Given the overall size of the dataset, the sex distribution, and the total population’s mortality rate compared to official population statistics, it can be assumed that the data are representative [38, 39].

Table 1b shows the average daily per-capita costs per risk group differentiated by survivors and deceased, calibrated to the total outpatient pharmaceutical expenditures of the SHI in 2019 [35]Footnote 2. Since we only consider outpatient pharmaceutical expenditures, drugs used within a hospital treatment as well as pharmaceuticals not reimbursed by the SHI are not includedFootnote 3. To account for spending trends, we calculate the expenditure growth rates per risk group from 2010 to 2018, additionally differentiated by survivors and deceased.

The age- and sex-related (affiliation) probabilities for every risk group obtained from the AOK BW dataset are illustrated in Fig. 2. We can see that the probability of incurring high costs is clearly dependent on age, especially evident in risk groups 2–4. In risk group 1, the curve is less steep, with exceptionally high costs compared to the other groups. The observed swings in the cohorts of 14- to 21-year-old women in groups 4 and 5 are attributable to contraceptives that are reimbursed by SHI in Germany for these age groups.

The data set allows us to follow each insured over the complete years 2010–2018. Thus, we can also track how frequently risk classes are changed (or individuals die). The transition probabilities for the survivors (as a weighted average over sex and age) as well as the share of decedents per initial risk group and their average age are illustrated in Table 1c. As the probability of changing the risk class is constant across years, we use the average of the age-, sex-, and risk group-specific 1-year transition probabilities \({\mathrm{tp}}_{{\mathrm{rg}}_{t},{\mathrm{rg}}_{t+1}}^{a,s}\) and mortality rates \({\mathrm{mr}}_{{\mathrm{rg}}_{t},{\mathrm{rg}}_{t+1}}^{a,s}\) from 2011 to 2018 in the simulation. The transition probabilities of 0-year-olds are estimated based on the risk group affiliations of 1-year-olds. In the next step, all values are calibrated to the corresponding years' life tables associated with the German populationFootnote 4.

2.3 Scenarios

We use different scenarios, all presented in Table 2, to simulate the range of future drug spending in the German SHI. The benchmark is a Status quo simulation, as often done in the literature. In this scenario, the cost distribution per age and sex of the projection's base year ("status quo") is linked to the future demographic development of the population. This implies that all rates by age and sex remain constant, so the cross-sectional data are interpreted as longitudinal data. In the second scenario (scenario Cost of dying), we additionally distinguish between the sex- and age-specific costs of survivors and decedents. As our population projection comes along with an increase in life expectancy, this approach mimics the cost-of-dying theory (for the costs occurring in the last half-year before dying).

In scenarios 3–5, we use the Markov model described above to simulate future pharmaceutical expenditure. Scenario 3 serves as our Baseline scenario, where we use the transition probabilities \({\text{tp}}_{{{\text{rg}}_{t} ,{\text{rg}}_{t + 1} }}^{a,s}\) and the risk group-specific mortality rates \({\text{mr}}_{{{\text{rg}}_{t} ,{\text{rg}}_{t + 1} }}^{a,s}\) to model future pharmaceutical spending. Since the mortality rates are calibrated to the moderately increasing life expectancy assumed for the underlying population, this results in a continuous gain in life expectancy for all cost groups. In scenarios 4 and 5, we also show the impact of an uneven gain in life expectancy for different risk groups. In scenario 4, Expensive ageing, the high-cost groups 1–4 benefit from the increasing survival rate. In contrast to this, in scenario 5, Inexpensive ageing, the very low-cost groups 5 and 6 drive the increase in life expectancy.

In all scenarios, we initially apply constant pharmaceutical costs over time (no pharma growth surplus). In a further step, we consider uniform and finally risk group-specific growth rates of per-capita pharmaceutical costs (pharma growth surplus). For this purpose, we use the observed average cost growth rates of our dataset from 2010 to 2018 (see Table 1b) less an alternative economic nominal growth rate of 3% per year. The latter amount follows the annual real gross domestic product (GDP) growth projected by the European Commission [40] (1% per year) plus the European Central Bank's inflation target [41] of 2% per year.

In addition to these five scenarios with three different assumptions about future spending growth, we show in sensitivity analyses how variations in transition probabilities (which are not constant over time), the consideration of future migration, and other assumptions about future alternative growth in the economy affect the results.

3 Results

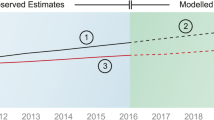

We first consider the results of a simplified projection of the change of annual per-capita drug spending for the five scenarios in which we neglect the case of future cost growth due to pharma growth surplus (Fig. 3). The two dashed lines in Fig. 3 show the extrapolations of the scenarios Status quo and Costs of dying. Both scenarios lead to more or less the same increase in pharmaceutical per-capita spending (€562 in 2019 [42]) of around 15% until 2060. The reason for this increase is the upcoming aging of the German population.

The Baseline scenario of the Markov simulation, where we take the risk group-specific mortality rates and transition probabilities into account, shows a moderately higher increase in drug spending of around 25%. In all scenarios so far, every risk group benefits equally from the assumed increase in life expectancy. However, the question arises whether new and high-cost therapies also lead to an increase in life expectancy specifically for the group of high-cost cases and, if so, what effect this would have on future drug expenditures. We want to investigate this question more closely regarding scenarios 4 and 5: in scenario 4, Expensive ageing, only the high-risk groups 1–4 benefit from a gain in life expectancy, which leads to a significantly stronger increase in per-capita spending of almost 40%. The opposite result can be seen in scenario 5, Inexpensive ageing, where only the less cost-intensive groups 5–6 benefit from the gain in life expectancy, resulting in a spending increase of only about 17%.

In general, one can notice that the Markov modeling predicts higher expenditure increases than the status quo projection, even without any increase in life expectancy of the high-risk groups. This illustrates the crucial difference between the two forecasting methods. In our Markov modeling, we first define the six risk groups, followed by calculating age-related transition probabilities. Resultantly, the high-cost groups 1–4 have a significantly higher age with a mean of 63.6 years, compared to the risk groups 5 and 6 with 38.8 years. Thus, the further increase in high expenditures in the high-cost groups due to their increasing age has a decisive impact on total spending, especially in the medium term. Only in the long run (after 2080) is this effect compensated by higher mortality in these groups. A status quo projection with a mere extrapolation of average values cannot account for such determining socioeconomic characteristics and may underestimate future spending especially in the medium term.

So far, the results are based on the assumption of no pharma growth surplus (compared to GDP per capita) in the future. However, the cost growth rates presented in the data section (Table 1) for the years 2010–2018 differ significantly from zero. The consequence of a continuing trend of cost increase is shown in Table 3 for all scenarios. It depicts the projection results as a percentage change from 2019 to 2040 and 2060. The results using a uniform growth rate for all cost-risk groups of 3.2% for survivors and 3.5% for decedents are compared to the results using risk group-specific growth rates. All scenarios are additionally based on an assumed alternative nominal economic growth of 3% per year.

We can see that even at a uniform growth rate, annual per-capita spending on pharmaceuticals in Germany would increase by 40% up to 2060 in our Baseline scenario. However, the gap between the extrapolations of per-capita spending by age and sex (1–2) and the Markov scenarios (3–5) is even more prominent when applying risk group-specific growth rates in our model. The Baseline scenario of the Markov model projects an increase of more than 40% already by 2040. By 2060, pharmaceutical per-capita spending would more than double, compared with an increase of only about 27% in scenarios 1 and 2. The combination of increasing life expectancy to the benefit of high-cost risk groups 1–4 and a continued trend in risk group-specific growth leads to a pharmaceutical per-capita expenditure increase by more than 150% in scenario 4, Expensive ageing.

To prove the robustness of our results, we provide additional sensitivity analyses in the electronic supplementary material. First, we test the variance for a change in transition probabilities over time and assume that the probability of remaining in the same risk group increases or decreases by 9% until 2060Footnote 5. The probability of transitioning to one of the other risk groups increases or decreases accordingly. With a maximum deviation of 12.8 percentage points, the results remain quite stable under these assumptions (see Table 4 in the electronic supplementary material).

Our second sensitivity analysis concerns the effects of migration movements on the projection results. For this item, we use the medium-level migration scenario W2 of the official population projection [34] and postulate that the 221,000 assumed migrants per year have the same age- and sex-specific characteristics as our study population. However, our results show only minor deviations of 10.1 percentage points at most (see Table 5 in the electronic supplementary material).

Our third sensitivity analysis deals with different assumptions on the alternative economic growth rate. In addition to our scenarios with a 3.0% alternative economic growth, we calculate scenarios with 2.5% and 3.5%. An assumption of 3.5% economic growth implies that pharmaceutical per capita spending, on average, grows slower than the rest of the economy. The effects are correspondingly strong, although they are nevertheless overcompensated by demographic development: even the assumption of 3.5% growth in conjunction with the status quo scenario results in a positive growth of pharmaceutical expenditures. On the other hand, the scenario with economic growth of 2.5% shows that the impact of the growth differential in pharmaceutical spending is substantial, and in the most extreme case (scenario Expensive ageing combined with risk group-specific growth rates), pharmaceutical expenditures would triple compared to 2019 (see Table 6 in the electronic supplementary material).

4 Discussion

To our knowledge, this study is the first to project pharmaceutical expenditures for Germany, considering different cost-risk groups and their development on the medium- and long-term horizon. We can show that although the probability of incurring high drug spending depends significantly on age, the key determinant of future expenditure growth is the cost trend within the different risk groups, together with an increasing life expectancy for high-risk groups. In contrast, other demographic trends play a minor role in influencing pharmaceutical expenditure growth. Especially the influence of mortality costs seems to have a smaller impact on future pharmaceutical spending in comparison to other kinds of healthcare expenditure (e.g., hospital services), as also indicated by other studies (Kildemoes et al. [25] or Moore et al. [43]). If the observed spending trend in the high-risk groups continues, the German SHI must prepare for a significant increase in pharmaceutical expenditure already in the medium term.

There are only a few studies that can be compared with our results. Boecking et al. [44] project the pharmaceutical spending for Germany and France up to 2050, solely considering the demographic development in an extrapolation of per-capita expenditures. For Germany, they calculate a demographically driven increase in pharmaceutical spending of 26% from 2004 to 2050, which is comparable with our results for the Status quo scenario. Our slightly lower projected rate of increase is probably attributable to the underlying population projection assuming a smaller proportion of older people. Thiébaut et al. [17] use a similar Markov simulation model to predict future drug spending in France until 2029. Using an aggregate indicator of morbidity–mortality, they model different scenarios of chronic morbidity and forecast growth in pharmaceutical spending for France between 33% (scenario healthy aging) and 55% (scenario medical progress) by 2029. Kildemoes et al. [25] project the Danish pharmaceutical expenditures from 2003 to 2030, also focusing on the effect of population aging. In line with our findings, they arrive at nearly the same results with and without accounting for the costs of dying, projecting an increase of 17.9% and 16.9%, respectively. They also conclude that the predicted demographically driven increase is small compared to recently observed increases in pharmaceutical expenditures. Morgan and Cunningham [26] reach the same conclusion in their analysis and forecast of prescription drug spending for British Columbia. Many studies show that, instead, most of the past increases in drug spending stemmed from changes in therapies and in the amount of prescriptions, as well as new pharmaceuticals [45]. Thus, not only future demographic development needs to be considered for medium- and long-term forecasts, but also the influence of medical-technological progress and spending trends.

At the same time, there are certain limitations to our results. Firstly, Markov models have a key limitation: their lack of memory. That means that with each cycle, individuals' possible transitions depend only on their current state, not on how they got to it [13, 46]. In our case, we assume that the identified transition probabilities are age-dependent and remain constant in the future. With regard to the cost of dying, these model specifications imply a risk group-specific probability of dying. It is possible, however, that there is reverse causality, namely that high costs of dying lead to higher risk classification.

Furthermore, the assumption of an ongoing pharma growth surplus must be explored more in detail, as our results show that spending trends in the area of high-cost therapies have the greatest leverage effect regarding future drug spending. Indeed, Newhouse [27] identified medical-technological progress as the main cause of past increases in healthcare spending, and many studies confirm that health spending in OECD countries is higher than GDP growth [47, 48]. An overview of possible reasons for this phenomenon can be found in Chernew and Newhouse [49]. Meijer et al. [50] find the same phenomenon for pharmaceutical spending in the Netherlands. And in line with our findings, they show that the high-cost cases treated with high-priced innovative medicines are the main drivers of the disproportionate increase in drug spending. Schlander et al. [51] find evidence of rising research and development costs for new pharmaceuticals and particularly high development costs for oncology drugs, which could contribute to this development. Other studies also show that the amount of cost-increasing innovations strongly varies between different diseases [29, 52]. In turn, these are expected to develop very differently within demographic change [53, 54]. Thus, future pharmaceutical spending will be influenced by several factors whose interaction should be explored in more detail.

Despite the abovementioned limitations, we can derive the following implications from our results. First, our analysis shows that the choice of projection model significantly impacts the forecast results. Even if the widely discussed mortality costs are considered, status quo projections may not adequately reflect the clear socioeconomic differences of certain population groups. This leads to the second key point: Future drug expenditures depend significantly on the life expectancy and expenditure development of a specific population group, namely the high-cost cases. Therefore, additional research is needed on which population groups are really driving the current increase in life expectancy to better forecast future drug spending. Especially since a benefit in longevity in the high-risk groups is associated with enormous financial costs.

Whether the high level of spending on high-risk patients, especially in the field of oncology [29, 51], leads to the intended goals should be monitored more closely. In particular, the average gain in life expectancy determined in clinical trials should continue to be assessed after approval under real-life conditions. Especially because the high-cost groups drive the identified excessive growth in drug spending, which, if continued, would have an even greater impact on future spending than rising life expectancy. These observed over-proportional drug spending growth rates, also identified in other studies [55], are influenced not only by the upcoming amount of innovations and new therapies but also by the pricing policies of the German SHI. Thus, policymakers should question the current less restrictive requirements for the evaluation and reimbursement of orphan drugs in Germany to ensure the sustainability of the German healthcare system.Footnote 6 However, this is not a specific German problem as the main driver of prices for orphan drugs are European prices derived from healthcare systems, which have not introduced specific incentives for orphan drugs like Germany [11].

5 Conclusion

When forecasting pharmaceutical spending in the medium and long term, particular focus should be placed on the small group of high-cost patients responsible for a large share of drug expenditures. If the current spending growth on high-cost therapies continues, the German SHI must prepare itself for a significant increase in pharmaceutical spending. Policymakers should address this with adequate pricing policies in the orphan drug segment, also at the European level, and increased monitoring under real-life conditions regarding the impact of these therapies on life expectancy and quality of life.

Notes

In addition, the transition matrix underlying the model can be found in the electronic supplementary material (Fig. 4).

For the cohort of 0-year-olds, we use only total costs without dividing them into cost groups.

Furthermore, the pharmaceutical expenditures in our dataset do not include co-payments.

The aggregate claim data are determined in the pseudonymized database environment of the AOK Baden-Württemberg via SQL scripts, resulting in only anonymized data being used for the model calculations. Further calculations are executed using Microsoft Excel and Matlab.

In particular, some surviving cohorts in risk group 6 have a partial probability of remaining in their risk group of over 91%. Consequently, only a maximum 9.0% increase in the probability of remaining in the same risk group seems reasonable.

A new law passed in November 2022 ("GKV-Finanzstabilisierungsgesetz") includes an item concerning this point [56].

References

GKV Spitzenverband. Kennzahlen der Gesetzlichen Krankenversicherung. Berlin; Dezember 2022. https://www.gkv-spitzenverband.de/media/grafiken/gkv_kennzahlen/kennzahlen_gkv_2022_q3/20221220_GKV_Kennzahlen_Booklet_Q3-2022_300dpi_barrierefrei.pdf. Accessed 23 Dec 2022.

OECD. Improving forecasting of pharmaceutical spending—insights from 23 OECD and EU countries; 2019.

WHO. Access to new medicines in Europe: technical review of policy initiatives and opportunities for collaboration and research; 2015.

Mills M, Kanavos P. Do pharmaceutical budgets deliver financial sustainability in healthcare? Evidence from Europe. Health Policy. 2020;124:239–51. https://doi.org/10.1016/j.healthpol.2019.12.002.

Mestre-Ferrandiz J, Palaska C, Kelly T, Hutchings A, Parnaby A. An analysis of orphan medicine expenditure in Europe: is it sustainable? Orphanet J Rare Dis. 2019;14:287. https://doi.org/10.1186/s13023-019-1246-7.

Danzon PM, Chao L-W. Does regulation drive out competition in pharmaceutical markets? J Law Econ. 2000;43:311–58. https://doi.org/10.1086/467458.

Lohmüller J, Bauckmann J, Schröder M, Niepraschk-von Dollen K, Telschow C, Sollmann S, et al. Der GKV-Arzneimittelmarkt. https://doi.org/10.4126/FRL01-006423607.

Morgan SG, Bathula HS, Moon S. Pricing of pharmaceuticals is becoming a major challenge for health systems. BMJ. 2020;368:l4627. https://doi.org/10.1136/bmj.l4627.

Danzon PM. Affordability challenges to value-based pricing: mass diseases, orphan diseases, and cures. Value Health. 2018;21:252–7. https://doi.org/10.1016/j.jval.2017.12.018.

Czech M, Baran-Kooiker A, Atikeler K, Demirtshyan M, Gaitova K, Holownia-Voloskova M, et al. A review of rare disease policies and orphan drug reimbursement systems in 12 Eurasian countries. Front Public Health. 2019;7:416. https://doi.org/10.3389/fpubh.2019.00416.

Worm F, Dintsios C-M. Determinants of orphan drug prices in Germany. Pharmacoeconomics. 2020;38:397–411. https://doi.org/10.1007/s40273-019-00872-8.

Carta A, Conversano C. On the use of Markov models in pharmacoeconomics: pros and cons and implications for policy makers. Front Public Health. 2020;8:569500. https://doi.org/10.3389/fpubh.2020.569500.

Stahl JE. Modelling methods for pharmacoeconomics and health technology assessment: an overview and guide. Pharmacoeconomics. 2008;26:131–48. https://doi.org/10.2165/00019053-200826020-00004.

Zweifel P, Felder S, Meiers M. Ageing of population and health care expenditure: a red herring? Health Econ. 1999;8:485–96. https://doi.org/10.1002/(sici)1099-1050(199909)8:6%3c485::aid-hec461%3e3.0.co;2-4.

Zweifel P, Felder S, Werblow A. Population ageing and health care expenditure: new evidence on the “Red Herring.” Geneva Pap Risk Insur Issues Pract. 2004;29:652–66. https://doi.org/10.1111/j.1468-0440.2004.00308.x.

Felder S, Werblow A, Zweifel P. Do red herrings swim in circles? Controlling for the endogeneity of time to death. J Health Econ. 2010;29:205–12. https://doi.org/10.1016/j.jhealeco.2009.11.014.

Thiébaut SP, Barnay T, Ventelou B. Ageing, chronic conditions and the evolution of future drugs expenditure: a five-year micro-simulation from 2004 to 2029. Appl Econ. 2013;45:1663–72. https://doi.org/10.1080/00036846.2011.633895.

Pritchard DJ. Modeling disability in long-term care insurance. N Am Actuar J. 2006;10:48–75. https://doi.org/10.1080/10920277.2006.10597413.

Sherris M, Wei P. A multi-state model of functional disability and health status in the presence of systematic trend and uncertainty. N Am Actuar J. 2021;25:17–39. https://doi.org/10.1080/10920277.2019.1708755.

Rickayzen BD, Walsh DEP. A multi-state model of disability for the United Kingdom: implications for future need for long-term care for the elderly. Br Actuar J. 2002;8:341–93. https://doi.org/10.1017/S1357321700003755.

Xu Y, Joyce G. Persistence and concentration of prescription drug expenditure among medicare beneficiaries 2006–2013. Value Health. 2017;20:A664. https://doi.org/10.1016/j.jval.2017.08.1604.

Hanley GE, Morgan S. Chronic catastrophes: exploring the concentration and sustained nature of ambulatory prescription drug expenditures in the population of British Columbia, Canada. Soc Sci Med. 2009;68:919–24. https://doi.org/10.1016/j.socscimed.2008.12.008.

Bodenheimer T. High and rising health care costs. Part 1: seeking an explanation. Ann Intern Med. 2005;142:847–54. https://doi.org/10.7326/0003-4819-142-10-200505170-00010.

Breyer F, Lorenz N. The, “red herring” after 20 years: ageing and health care expenditures. Eur J Health Econ. 2021;22:661–7. https://doi.org/10.1007/s10198-020-01203-x.

Kildemoes HW, Christiansen T, Gyrd-Hansen D, Kristiansen IS, Andersen M. The impact of population ageing on future Danish drug expenditure. Health Policy. 2006;75:298–311. https://doi.org/10.1016/j.healthpol.2005.03.013.

Morgan S, Cunningham C. Population aging and the determinants of healthcare expenditures: the case of hospital, medical and pharmaceutical care in British Columbia, 1996 to 2006. Healthc Policy. 2011;7:68–79.

Newhouse JP. Medical care costs: how much welfare loss? J Econ Perspect. 1992;6:3–21. https://doi.org/10.1257/jep.6.3.3.

Commonwealth of Australia. 2021 Intergenerational Report; 2021.

Breyer F, Lorenz N, Pruckner GJ, Schober T. Looking into the black box of “medical progress”: Rising health expenditures by illness type and age. 2021. http://hdl.handle.net/10419/231468. Accessed 29 Dec 2022.

de Meijer C, Wouterse B, Polder J, Koopmanschap M. The effect of population aging on health expenditure growth: a critical review. Eur J Ageing. 2013;10:353–61. https://doi.org/10.1007/s10433-013-0280-x.

Karlsson M, Klein TJ, Ziebarth NR. Skewed, persistent and high before death: medical spending in Germany. Fisc Stud. 2016;37:527–59. https://doi.org/10.1111/J.1475-5890.2016.12108.

Wende D, Schmitt N. Hochkostenpatienten und Auswirkung des Risikopools in der GKV. In: Repschläger et al. (Hg.) 2021 - Gesundheitswesen aktuell 2021. pp. 126–47. https://doi.org/10.30433/GWA2021-126.

Destatis. Population: death, life expectancy. 2022. https://www.destatis.de/EN/Themes/Society-Environment/Population/Deaths-Life-Expectancy/_node.html#268862. Accessed 23 Dec 2022.

Destatis. Bevölkerung Deutschlands bis 2060: Ergebnisse der 14. koordinierten Bevölkerungsvorausberechnung. Wiesbaden; 2019.

Federal Office for Social Security. GKV-Ausgabenprofile nach Alter, Geschlecht und Hauptleistungsbereich, 1996–2020. 2021. https://www.bundesamtsozialesicherung.de/de/themen/risikostrukturausgleich/datenzusammenstellungen-und-auswertungen/. Accessed 23 Dec 2022.

Destatis. Population. 2022. https://www.destatis.de/EN/Themes/Society-Environment/Population/_node.html;jsessionid=5EDEE3AF26A891247D7E9DB1DD47E158.live712. Accessed 23.23.2022.

The Human Mortality Database. Germany, total population. https://mortality.org/cgi-bin/hmd/country.php?cntr=DEU&level=2. Accessed 8 May 2022.

Destatis. Sterbefälle: Fallzahlen nach Tagen, Wochen, Monaten, Altersgruppen, Geschlecht und Bundesländern für Deutschland 2016 - 2022. 2022. https://www.destatis.de/DE/Themen/Gesellschaft-Umwelt/Bevoelkerung/Sterbefaelle-Lebenserwartung/Tabellen/sonderauswertung-sterbefaelle.html. Accessed 23 Dec 2022.

Destatis. Bevölkerung nach Nationalität und Geschlecht. 2022. https://www.destatis.de/DE/Themen/Gesellschaft-Umwelt/Bevoelkerung/Bevoelkerungsstand/Tabellen/deutsche-nichtdeutsche-bevoelkerung-nach-geschlecht-deutschland.html. Accessed 23 Dec 2022.

European Commission. The 2021 ageing report. Luxembourg: Publication Office of the European Union; 2020.

European Central Bank. An overview of the ECB’s monetary policy strategy. 2022. https://www.ecb.europa.eu/home/search/review/html/ecb.strategyreview_monpol_strategy_overview.en.html#toc3. Accessed 27 May 2022.

Bundesgesundheitsministerium. Gesetzliche Krankenversicherung Vorläufige Rechnungsergebnisse 1. bis 4. Quartal 2019. 2019. https://www.bundesgesundheitsministerium.de/fileadmin/Dateien/3_Downloads/Statistiken/GKV/Finanzergebnisse/KV45_1-4_Quartal_2019_Internet.pdf. Accessed 15 July 2022.

Moore PV, Bennett K, Normand C. The importance of proximity to death in modelling community medication expenditures for older people: evidence from New Zealand. Appl Health Econ Health Policy. 2014;12:623–33. https://doi.org/10.1007/s40258-014-0121-x.

Boecking W, Klamar A, Kitzmann F, Kirch W. Pharmaco-economic impact of demographic change on pharmaceutical expenses in Germany and France. BMC Public Health. 2012;12:894. https://doi.org/10.1186/1471-2458-12-894.

Mousnad MA, Shafie AA, Ibrahim MI. Systematic review of factors affecting pharmaceutical expenditures. Health Policy. 2014;116:137–46. https://doi.org/10.1016/j.healthpol.2014.03.010.

Ademi Z, Kim H, Zomer E, Reid CM, Hollingsworth B, Liew D. Overview of pharmacoeconomic modelling methods. Br J Clin Pharmacol. 2013;75:944–50. https://doi.org/10.1111/j.1365-2125.2012.04421.x.

OECD. Health at a glance 2019: OECD indicators. Paris; 2019.

Hagist C, Kotlikoff LJ. Who's going broke? Comparing growth in healthcare costs in ten OECD countries. Cambridge, MA, USA; 2005.

Chernew ME, Newhouse JP. Health care spending growth. In: Pauly MV, McGuire TG, Barros PP, editors. Handbook of health economics. Amsterdam: Elsevier; 2011. p. 1–43. https://doi.org/10.1016/B978-0-444-53592-4.00001-3.

de Meijer C, O’Donnell O, Koopmanschap M, van Doorslaer E. Health expenditure growth: looking beyond the average through decomposition of the full distribution. J Health Econ. 2013;32:88–105. https://doi.org/10.1016/j.jhealeco.2012.10.009.

Schlander M, Hernandez-Villafuerte K, Cheng C-Y, Mestre-Ferrandiz J, Baumann M. How much does it cost to research and develop a new drug? A systematic review and assessment. Pharmacoeconomics. 2021;39:1243–69. https://doi.org/10.1007/s40273-021-01065-y.

Starr M, Dominiak L, Aizcorbe A. Decomposing growth in spending finds annual cost of treatment contributed most to spending growth, 1980–2006. Health Aff (Millwood). 2014;33:823–31. https://doi.org/10.1377/hlthaff.2013.0656.

Milan V, Fetzer S, Hagist C. Healing, surviving, or dying? Projecting the German future disease burden using a Markov illness-death model. BMC Public Health. 2021;21:123. https://doi.org/10.1186/s12889-020-09941-6.

Fetzer S, Moog S. Indicators for measuring intergenerational fairness of social security systems—the case of the German social health insurance. Sustainability. 2021;13:5743. https://doi.org/10.3390/su13105743.

Wasem J, Hüer T, Abels C. Gesellschaftliche und volkswirtschaftliche Sicht auf die (zukünftige) Finanzierbarkeit von Arzneimitteln. In: Schröder H, Thürmann P, Telschow C, Schröder M, Busse R, editors. Arzneimittel-Kompass 2021. Berlin: Springer; 2021. p. 19–34. https://doi.org/10.1007/978-3-662-63929-0_2.

German Bundestag. Gesetz zur finanziellen Stabilisierung der gesetzlichen rankenversicherung: GKV-Finanzstabilisierungsgesetz; 07.11.2022.

Acknowledgements

The authors want to thank the anonymous reviewers and Holger Neye for their valuable comments to improve the quality of our manuscript.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

Open Access funding enabled and organized by Projekt DEAL.

Conflict of interest

Valeska Hofbauer-Milan is an employee of the AOK Baden-Württemberg, the donor of the data set. The theses and opinions shared do not represent those of the AOK Baden-Württemberg, but solely those of the authors.

Ethics approval

Not applicable.

Consent to participate and consent to publish

Not applicable.

Availability of data and material

Population data are available at Destatis, Germany's official statistical office. The aggregate claim data from the German sickness fund are available upon request depending on the permission of the data donor.

Code availability

Not applicable.

Author contributions

VHM was responsible for selecting and calculating the aggregate claim data; CH and SF supervised the calculations. SF provided the population projection data and the programming expertise. All authors were involved in developing the model and drafting the manuscript. The final version is read and approved by all authors.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Hofbauer-Milan, V., Fetzer, S. & Hagist, C. How to Predict Drug Expenditure: A Markov Model Approach with Risk Classes. PharmacoEconomics 41, 561–572 (2023). https://doi.org/10.1007/s40273-023-01240-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40273-023-01240-3