Abstract

Background

Biological drugs are generally expensive and produce a continuously growing share of drug costs. Yet they are essential in the treatment of many chronic diseases. Biosimilars, clinically equivalent to biological originator products, are expected to restrain drug costs in the biological market.

Objective

This study aimed to examine the impact of the biosimilar market entry on the prices of the reference products in outpatient care in Finland, investigate the impact of biosimilar market entries on price competition among biological medicinal products, and examine how the prices and market shares of outpatient biosimilars have developed in Finland during 2009–2020.

Methods

This retrospective register study applied data from IQVIA covering national community pharmacy wholesale data between 1 January, 2009, and 31 August, 2020, for somatropin, epoetin, filgrastim, follitropin, insulin glargine, insulin lispro, etanercept, pegfilgrastim, adalimumab, teriparatide, and enoxaparin biosimilars and their reference products, in addition to two relevant insulin products. We determined the monthly wholesale amounts in defined daily doses and wholesale weighted average prices (excluding value-added tax) per defined daily dose for each product. We analyzed the evolution of the price and market shares. We performed a linear segmented regression analysis to examine the impact of the market entry of biosimilars on the prices of reference products.

Results

The prices of the reference products mainly decreased after the biosimilar entered the market. If the reference product price was not reduced, it was no longer reimbursable after evaluation under the Health Insurance Act, leading to marginal market shares. The changes in the prices of biosimilars were not as remarkable as the changes in the prices of reference products after the biosimilar market entry. For most active substances, biosimilar prices were stable or decreased. The utilization of biosimilars varied widely between different active substances at the end of the observation period.

Conclusions

Changes in pricing policy and the public reimbursement scheme related to the market entry of biosimilars were the main reasons for the decrease in the prices of reference products. Therefore, biosimilars did not generate genuine price competition between biological products. In many of the drug groups examined, the market shares of biosimilars have growth potential in the future.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

The price of the reference product decreases after the biosimilar market entry, but current initiatives do not support genuine price competition between biosimilars and reference products. |

Biosimilars still have a minor market share among some of the biologics, and they have significant growth potential in the market in the future. |

Biosimilar prices remained stable or decreased after the market entry. |

1 Introduction

Global pharmaceutical costs continue to rise, and spending on medicines is expected to increase at an annual rate of 3–6% [1]. A significant part of pharmaceutical costs is caused by the sale of biological medicinal products (biologics): for example, over 30% of drug spending is driven by biologics in Europe [2]. Biologics are essential in treating many chronic diseases such as diabetes mellitus, autoimmune diseases, and cancers [3].

A biosimilar is a biological medicinal product highly similar to another biological medicinal product (‘reference medicine’) already having a market approval in the European Union [3]. Biosimilars are expected to lead to significant cost savings in the biologics market [1]. Because of more affordable development costs, a biosimilar may enter the market at a lower price than its reference product once the patent and marketing protection of the reference product has expired [3]. The introduction of biosimilars may also lower the prices of reference products [4].

In Finland, biologics are dispensed by two routes with separate funding mechanisms. In hospitals, most administered biologics are intravenous and/or monoclonal antibodies for anti-cancer treatments [5]. The majority of the self-injectable biologics are reimbursable and dispensed from the community pharmacies for outpatient care. The prices of reimbursable biologics are highly regulated. Under the Ministry of Social Affairs and Health, the Pharmaceuticals Pricing Board sets the maximum wholesale prices for reimbursable medicinal products in outpatient care [6]. The retail prices of the reimbursable prescription medicines are based on maximum wholesale prices, whereas pharmaceutical companies can freely set the price of non-reimbursable medicines. The prices of prescription medicines are the same in all Finnish community pharmacies. Two supply-side changes in pharmaceutical legislation in 2013 and 2017 have had a significant impact on the maximum wholesale prices of biologics in Finland. First, in 2013, the wholesale prices of all medicines outside the reference price system were reduced by 5% [7]. Second, in 2017, two amendments regarding biosimilars were added to the Health Insurance Act (2004/1224) [6]. According to the amendments, the first biosimilar entering the market must be priced at least 30% lower than the reference product to gain reimbursable status. Further, when a biosimilar product containing the same active substance enters the reimbursement system, the Pharmaceuticals Pricing Board is required to re-evaluate the reasonable wholesale price for the reference product [6]. In the only demand-side regulation, which came into force in 2017, the prescriber must choose the most affordable comparable product if a biosimilar is available for biological medicine [8]. To date, biologics are not substituted in community pharmacies in Finland [9].

Despite policy and legislative changes, the increase in costs has continued in the Finnish prescription pharmaceutical market in outpatient care [10]. In 2020, sales of outpatient prescription drugs, measured at retail prices including value-added tax, increased 2.1% compared with the previous year, EUR 2.33 billion of the total drug sales of EUR 3.52 billion. A significant part of the growth is caused by the sale of biologics [11]. The objective of this study was to find out what impact the market entry of biosimilars has on the prices of the reference products in outpatient care in Finland and to investigate whether biosimilars trigger price competition for biologics. In addition, the study examined how the prices and market shares of outpatient biosimilars have developed in Finland from 2009 to 2020.

2 Methods

2.1 Selection of Included Biological Medicinal Products and Data

The study included all the biological medicinal products with biosimilars on the market sold between 1 January, 2009 and 31 August, 2020, in community pharmacies in Finland (Table 1) limiting the data to the outpatient care prescription drug market. Additionally, two relevant insulin products (Toujeo® and Liprolog®) containing the same active substances as included reference products and biosimilars were included. These products were included to test whether competitors with the same active substance would impact the market development of the insulin biosimilars. Toujeo® is an improved version of the insulin glargine reference product containing three times more insulin glargine than the reference product [12], and Liprolog® is an insulin lispro product with the same marketing authorization holder as the insulin lispro reference product [13].

In Finland, the prices of outpatient prescription drugs are publicly available, but product-specific wholesale data are not. The data for the study were obtained from IQVIA (formerly IMS Health and Quintiles), which has collected data on pharmacy wholesale sales of medicines in Finland since 2009. The data were collected based on Anatomical Therapeutic Chemical codes from Finnish pharmacy wholesale data at the product level. The observation period began on 1 January, 2009, for the products for which the first biosimilar entered the market before 1 January, 2012. For the other products, the observation period started 3 years before the first biosimilar of the active substance entered the market. The observation period continued for all included products until 31 August, 2020. The monthly updated data of Anatomical Therapeutic Chemical code, Nordic product number, trade name, package description (package size, strength, dosage form), number of packages sold, and wholesale value (excluding value-added tax) for the included medicinal products (Table 1) were received.

2.2 Data Analysis

2.2.1 Data Processing

We performed data processing and analysis of the market share and price evolution with Microsoft Office Excel. Parallel import products were included with the same trade name, as parallel imported products comprise only a small share of wholesale sales in Finland [11]. We determined the amount of the active substance in each package by the package description or by using a Nordic product number from FimeaWeb, a pharmaceutical product database provided by the Finnish Medicines Agency Fimea [16]. The consumption of active substances was measured as defined daily doses (DDDs), which refers to the presumed average adult maintenance dose per day when a drug is used for its primary indication [18]. We used the year 2020 DDD values [19]. The total monthly consumption of the products (in DDDs) comprised all products with the same trade name. In addition, we combined the monthly consumption of the reference product and its biosimilars for each active substance.

We used the monthly wholesale weighted average price per DDD to describe drug prices. It was calculated for each included product. A common weighted average price for biosimilars was calculated for those active substances with more than one biosimilar. All prices were converted to 2018 Euros.

2.2.2 Analysis of Market and Price Evolution

The evolution of market shares and the wholesale prices of the included products were presented graphically with subsequent analysis of their utilization and price evolution. The results were synthesized with reimbursement information and the reimbursement expiry dates for the products obtained from the databases of Finnish authorities or official notifications/notices [20,21,22,23]. For the active substances, for which the first biosimilar entered the market after 1 January 2012, the reference product price evolutions were summarized in a graph. The price of the reference product was presented in relation to its price at the moment of its first biosimilar market entry.

2.2.3 Statistical Analysis

The effect of the biosimilar market entry on the price of the reference product was estimated by an interrupted time series analysis, which is a strong quasi-experimental design to study the long-term effects of interventions over time [24]. We used a segmented linear regression analysis, which can be used to model an interrupted time series analysis and to estimate the effects of interventions on the variable under study. This method allows the changes in trends and levels to be analyzed by comparing the values of the variables before and after the intervention. The interrupted time series analysis has previously been used together with a segmented linear regression analysis (see, e.g., Koskinen et al. [25, 26]).

The time series can be divided into two or more segments at the change points in the series [24]. In the current study, we divided the time series for each active substance into two parts. The time series was interrupted from the moment the decrease in the price of the reference product was seen graphically. If no change in the price was observed, the time series was interrupted when the biosimilar entered the market. This approach was chosen assuming that the price change of the reference product was because of the biosimilar market entry (considered as an intervention). However, we were unable to foresee when this change would occur. Regression analysis was performed for reference products for which the first biosimilar was introduced after 1 January, 2012. The statistical analysis was carried out with the R program (version 1.3.1093).

Two regression models were used in this study. The best-fitting model for each active substance was determined by an analysis of variance and comparison of the Akaike Information Criterion and Bayesian Information Criterion values (described, for example, by Kuha [27]). If the Akaike Information Criterion and Bayesian Information Criterion values were inconsistent, the model was selected based on the Akaike Information Criterion value and the analysis of variance. In the first model, the explanatory factors were time and the market entry of the biosimilar. Model 1 takes the form of Equation 1:

where Yt is the average wholesale price per DDD of the reference product in month t, β0 estimates the baseline level of the average wholesale price per DDD of the reference product per month at time zero, β1 estimates the monthly baseline trend of the average wholesale price per DDD of the reference product before interruption, time is a continuous variable indicating time in months from the start of the observation period starting from zero, β2 estimates the level change in the average wholesale price per DDD of the reference product immediately after the time series interruption, interventiont indicates time t and gets a value of 0 before and a value of 1 after the interruption, and εt is the error term.

The second model explained the price by time, biosimilar market entry, and a parameter describing the change in trend. Model 2 takes the form of Equation 2:

where the parameters are otherwise the same as in Model 1, but β3 and time after intervention are added. β3 estimates the monthly change in the trend of the average wholesale price per DDD of the reference product after the interruption, compared with the monthly trend before the interruption and time after intervention is a continuous variable expressing the time in months after the interruption and receives the value 0 before the interruption.

We used the Durbin–Watson test [28] and the Newey–West method [29] because of the possible autocorrelation of the time series analysis. In addition to the autocorrelation, the Newey–West method takes heteroskedasticity into account. The results are autoregressively corrected results and presented with a significance level of 0.01.

3 Results

3.1 Market Share Evolution of Biosimilars

The biosimilar uptake varied between different active substances (Table 2, Electronic Supplementary Material [ESM]). At the end of the observation period in 2020, the market shares of filgrastim and epoetin biosimilars were 100%, while the market shares of insulin glargine (6%), teriparatide (0%), and enoxaparin (6%) biosimilars were low. The biosimilar market shares for the other seven active substances were in-between.

The combined utilization of the reference product and its biosimilars, measured by DDDs, was the highest for insulin glargine, followed by enoxaparin, adalimumab, insulin lispro, and etanercept at the end of the observation period. The sales of the first biosimilars of these five active substances started in the first month when entering the market (Table 2). Biosimilars for other active substances that entered the market during the observation period were not sold during the first month. Six active substances had multiple biosimilars on the market during the observation period. The first biosimilar of the active substance had the largest market share by the end of the observation period, except filgrastim, whose second biosimilar had the largest market share.

Non-biosimilar competitors Toujeo® and Liprolog® had gained remarkable market shares (32% and 49%, respectively) at the end of the observation period (Table 2, ESM). After their introduction to the market, competitors’ uptakes were the same or more efficient than biosimilar uptake of the same active ingredient.

3.2 Price Evolution of Biosimilars

Seven of the first biosimilars were 26–31% lower priced than the reference product when the biosimilar was first sold (Table 2, ESM). The first biosimilar of the insulin glargine had the smallest price difference to the reference product (15%), and the first biosimilar of enoxaparin had the largest (42%). For all active substances, apart from enoxaparin, biosimilar prices either remained steady or decreased over the observation period from 1 January, 2009 (somatropin and epoetin) or the first biosimilar market entry (other active substances) to 31 August, 2020. The combined wholesale weighted average price of enoxaparin biosimilars increased by 22%.

Somatropin, insulin glargine, insulin lispro, etanercept, and teriparatide had only one biosimilar on the market during the observation period (Table 2). The prices of these biosimilars had only small changes, except the somatropin biosimilar, whose price decreased by 27% in September 2010 (ESM). Only small changes were observed in the prices of the two biosimilars of follitropin during the observation period. However, the first of two epoetin biosimilars had more price variation (ESM). The price of the epoetin first biosimilar slowly increased but began to decrease in October 2012. After that, the price has slightly decreased or stayed stable. Filgrastim, pegfilgrastim, adalimumab, and enoxaparin had more than two biosimilars on the market. The prices of the filgrastim biosimilars began to differ in 2017 when the prices of the biosimilars either stayed stable or decreased (maximum price decrease 63%). The price of the pegfilgrastim first biosimilar decreased by 14%, and the third biosimilar by 7% over the observation period. The price development of the pegfilgrastim second and fourth biosimilars is unknown because these products were not sold over the observation period, and we could not calculate the wholesale weighted average price. The prices of the first three adalimumab biosimilars decreased by 19–23%, and the fourth biosimilar price stayed stable.

For all active substances for which prices of biosimilars and reference products were known at the end of the observation period, biosimilars were more affordable than reference products. However, the insulin lispro competitor Liprolog® was sold at a lower price than the insulin lispro biosimilar.

3.3 Effect of the Biosimilar Market Entry on the Price of the Reference Product

There were only small changes in the price of the somatropin reference product after the biosimilar market entry, except at the beginning of the year 2013 (62 months after the biosimilar market entry) when the price decreased approximately 30% (ESM). The largest price decrease for the epoetin reference product was 12% in October 2009, and after that, the price has slightly increased or stayed stable. The price of the filgrastim reference product seemed to decrease 43 months after the biosimilar market entry in January and February 2013. However, after 2 years, the price increased even to a higher level than before the price decreased. At the end of the observation period, epoetin and filgrastim reference products were no longer reimbursed (Table 2).

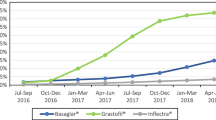

The relative changes in the wholesale weighted average prices of the reference products were further analyzed for the eight other active substances (Fig. 1). For enoxaparin, teriparatide, insulin lispro, adalimumab, and etanercept, the price of the reference product remained fairly stable before the biosimilar entered the market. For insulin glargine, pegfilgrastim, and follitropin, the price of the reference product was higher 3 years before the biosimilar market entry compared to the price at the time of the biosimilar market entry.

Development of relative prices of reference products for eight active substances. The observation period began 3 years (36 months) before the first biosimilar entered the market and continued for 3 years (36 months) thereafter. The relative prices of the reference products are standardized to be 1 when the first biosimilar entered the market (at 0 months). The price decreases for insulin glargine (− 33 months) and follitropin (− 19 months) reference products occurred in 2013

Compared to the time before biosimilars entered the market, larger changes in prices of the reference products were observed after the biosimilar market entry (Fig. 1). For all active substances, except enoxaparin and insulin lispro, the price of the reference product decreased permanently after the biosimilar entered the market. With enoxaparin, whose observation period was 8 months after biosimilar introduction, no changes in the price of the reference product were observed. The price of the insulin lispro reference product decreased at first, but after 18 months, it increased higher than at the time of biosimilar introduction. At the end of the observation period, the insulin lispro reference product was no longer in the reimbursement scheme (Table 2).

For those active substances whose biosimilars entered the market after 2017, the prices of the reference products fell shortly after the biosimilars entered the market compared with the price decreases for insulin glargine and follitropin (Fig. 1). The insulin glargine reference product price decreased in December 2016 and again in April 2017. The follitropin reference product price decreased between March and June 2017.

Model 2 was a better fit for seven reference products in the statistical analysis. Model 1 was only used for the teriparatide reference product. The changes in the price level of the reference products after the interruption (the price decrease of the reference product or biosimilar market entry) were statistically significant for six reference products (follitropin, insulin glargine, pegfilgrastim, adalimumab, teriparatide and enoxaparin) and statistically insignificant for two reference products (insulin lispro and etanercept) (Table 3). The change in the price level of the etanercept reference product after the interruption was not statistically significant, although the price drop can be seen in Fig. 1. However, without the Newey–West method [29], the change in the price level was a significant result (p < 0.001), and similarly, Model 1 yielded a statistically significant result (p < 0.001) using the Newey–West method. There were statistically significant price trends of the reference products before the interruption of the time series and statistically significant changes in the price trends of the reference products after the interruption of the time series (Table 3).

4 Discussion

In light of the global need to increase price competition among interchangeable biologics, our study provides several findings on the price and market share evolution of the original biologics and their biosimilars on a national level. Our study shows that the biosimilar market entry reduces the prices of reference products in outpatient care in Finland. However, the price reduction of the reference products can be seen as a consequence of the pricing policy and public reimbursement scheme concerning the market entry of the first biosimilars. Biosimilar prices usually remained stable or decreased during the observation period depending on the number of competing biosimilars. The market shares of biosimilars were relatively minor compared with the market shares of the reference products, with significant variations between different active substances.

The changes in pharmaceutical pricing and reimbursement legislation in 2013 [7] and 2017 [6] impacted the prices of the included products in this study. These two changes seem to explain almost all reference product price changes being more than the annual variation in the price indexes. For all products (reference products and biosimilars) whose observation periods were started before 2013, a single decrease in prices was observed in 2013. Otherwise, the reference product prices mainly stayed stable before the biosimilar introduction to the market. Price trends were generally marginal and comparable to the annual variation in the price index. Before 2017, the market entries of biosimilars were not found to cause immediate price reductions for the reference products. Following the mandatory price regulation in 2017, the decline in the prices of reference products occurred relatively soon after the first biosimilar entered the market, and the price generally decreased only once. After that, the changes in the price trends of the reference products were mainly minor. Similar results from the price decrease of the reference product after the biosimilar market entry have also been reported previously in Finland and other European countries [30, 31]. However, this study did not observe permanent price decreases for insulin lispro, filgrastim, epoetin, and enoxaparin reference products. As a result, the first three of these reference products were no longer covered by the public reimbursement scheme at the end of the observation period [23]. Subsequently, the latter reference product was re-evaluated and not reimbursed after the end of November 2020 [22].

Although the reference product price reduction is mainly because of price regulation, the biosimilar market entry enables the treatment of patients with more affordable biologics. However, the savings may not be gained if the patient’s medication is switched to another competitor, such as an improved version or a follow-on drug (a compound with a very similar mechanism of action, which usually does not add therapeutic value to medicines already on the market [32]). We observed that the improved competitor of the insulin glargine gained a significant market share after entering the market. A recent study on the Finnish pharmaceutical market showed that some patients treated earlier with a reference product were switched to improved versions after the biosimilar market entry [11].

In this study, the biosimilar prices mainly remained steady or decreased over a long observation period, starting from the market entry of the first biosimilar for each active substance until 31 August, 2020. The price regulation of reimbursable biologics was seen from 2017. After that, the first biosimilar to be reimbursed must be at least 30% lower priced than the reference product [6]. In addition, the prices of subsequent biosimilars entering the market must be at least as low as the price of the first biosimilar. We found that if there were more than two biosimilars on the market, introducing new biosimilars triggered a slight price reduction among the previous biosimilars. This finding may indicate that one or two biosimilars on the market do not yet lead to price competition between interchangeable products. However, further research is needed to confirm this finding.

The mandatory price reduction of the reference product may curb incentives to switch to biosimilars and lead to meager use of biosimilars in the future. This situation may not be a problem, but mandatory price reductions for reference products may hinder long-term competition by limiting price differences between products and affecting incentives to enter the market for biosimilar products [30, 33]. Incentives for pharmaceutical companies to bring biosimilars to the market may weaken if biosimilars do not achieve reasonable market shares. The most significant market shares were for epoetin, filgrastim, and insulin lispro biosimilars at the end of the observation period in 2020, considering the overall market for the reference product and its biosimilars. However, the utilization of biosimilars varies greatly between different biological agents, and the uptake is still scarce among some active substances. The lowest biosimilar market shares were for enoxaparin and teriparatide with the shortest observation periods and insulin glargine. Similar variation in biosimilar use has been observed between active substances elsewhere in Europe [2]. Several studies have explored initiatives and policies that may influence biosimilar uptake [34,35,36,37]. In Finland, the biosimilar uptake has been promoted by legislative changes in public reimbursement schemes and prescribing rules and information guidance targeted mainly at physicians [38]. However, our study confirms that although Finnish prescribers have positive views on biosimilars [39], these initiatives have not been effective enough in promoting biosimilar uptake as the reference product had the highest market share at the end of the observation period in several active substances. Therefore, Finland should consider new, more effective methods to incite biosimilar uptake and trigger price competition [39, 40].

The strengths of this study were the use of comprehensive nationwide data and the application of a robust scientific method suitable to analyze the impact of the interventions on the biologics market in outpatient care. In addition, we had a long observation period that covered almost the entire time biosimilars have been on the Finnish market. To the best of our knowledge, no previous comprehensive nationwide analysis on this topic has been published from the Western markets. However, our study has some limitations. First, we excluded the competitors of biosimilars, such as improved versions and follow-on products from the study, except for two insulin products. Competitors with the same or a similar mechanism of action may impact the biosimilar market development. This perspective should be considered in pharmacoeconomic studies focusing on one or a few indications treated by a biological medicine or its competitors. For the complete nationwide data used in the present study, extended inclusion criteria were not applicable. Further, the effect of competitors should be noted as a potential bias in the statistical analysis. A reference product’s price change could have been due to the market entry of any competitor and not specifically due to a biosimilar, as assumed in our approach. However, the graphs of the market shares and price evolutions in the ESM support our assumptions. Second, we made some extrapolations using wholesale data and wholesale weighted average prices instead of retail sales in community pharmacies. However, as the prices of biologics are relatively high, it can be assumed that community pharmacies are hesitant to store many expensive medicines and the use of wholesale data is representative. In addition, the sales prices of prescription medicines are the same in all Finnish community pharmacies based on wholesale prices. The use of the wholesale weighted average price may skew the prices if the monthly wholesale is minor and targeted to small package sizes. We also used DDDs in the study, which describe the presumed average adult maintenance dose per day when a drug is used for its primary indication [18]. These are not necessarily equal to the prescribed doses of the drug for patients. However, DDDs can be used to compare drug utilization regardless of different strengths or package sizes between products and active ingredients. Additionally, the use of DDDs and Anatomical Therapeutic Chemical codes enables the international comparison of the results [41] increasing the generalizability of our findings. However, the national context should be noted as the policies for biosimilar uptake vary across Europe [35].

5 Conclusions

The market entry of biosimilars induced a reduction in the prices of the reference products in outpatient care in Finland. However, the prices of the reference products decreased mainly because of the public reimbursement legislation. Therefore, biosimilars did not create genuine price competition between the biosimilar and the reference product. The market shares of biosimilars have further growth potential in the Finnish pharmaceutical market.

References

Aitken M, Kleinrock M, Muñoz E. Global medicine spending and usage trends: outlook to 2025. IQVIA. 2021. https://www.iqvia.com/insights/the-iqvia-institute/reports/global-medicine-spending-and-usage-trends-outlook-to-2025. Accessed 7 Jan 2022.

Troein P, Newton M, Scott K, Mulligan C. The impact of biosimilar competition in Europe. IQVIA, White paper. 2021. https://www.iqvia.com/library/white-papers/the-impact-of-biosimilar-competition-in-europe-2021. Accessed 23 May 2022.

European Medicines Agency and European Commission. Biosimilars in the EU: information guide for healthcare professionals. 2019. https://www.ema.europa.eu/en/documents/leaflet/biosimilars-eu-information-guide-healthcare-professionals_en.pdf. Accessed 24 Nov 2021.

Blackstone EA, Fuhr JP Jr. The economics of biosimilars. Am Health Drug Benefits. 2013;6:469–77.

Finnish Medicines Agency Fimea. Drug consumption in 2018–2021 [in Finnish]. 2022. http://raportit.nam.fi/raportit/kulutus/laakekulutus.pdf. Accessed 21 May 2022.

Ministry of Social Affairs and Health. Health Insurance Act 1224/2004. Chapter 6, translation from Finnish. 2019. https://www.hila.fi/content/uploads/2020/01/Sairausvakuutuslain-6-luku-englanti-29.1.2019.pdf. Accessed 24 Nov 2021.

Ministry of Social Affairs and Health. Development of the Pharmaceutical Reimbursement System. Final report of the Development Working Group on Pharmaceutical Reimbursement System [in Finnish]. Reports and memorandums of the Ministry of Social Affairs and Health 2012:33. http://urn.fi/URN:ISBN:978-952-00-3272-2. Accessed 21 May 2022.

Ministry of Social Affairs and Health. Decree of the Ministry of Social Affairs and Health on prescribing medicines [in Finnish]. 2016. https://www.finlex.fi/fi/laki/alkup/2016/20161459?search%5Btype%5D=pika&search%5Bpika%5D=lääkkeidenmäärääminen. Accessed 21 May 2022.

Finnish Medicines Agency Fimea. Interchangeability of biosimilars: position of Finnish Medicines Agency Fimea. 2015. https://www.fimea.fi/documents/542809/838272/29197_Biosimilaarien_vaihtokelpoisuus_EN.pdf. Accessed 9 Jan 2022.

Finnish Medicines Agency Fimea, Social Insurance Institution. Finnish statistics on medicines 2020. 2021. https://urn.fi/URN:NBN:fi-fe2021122162437. Accessed 7 Jan 2022.

Kinnunen M, Laukkonen M-L, Linnosmaa I, Mäklin S, Nokso-Koivisto O, Saxell T, et al. What costs in medicines? A study on regulation and control of pharmaceutical prices [in Finnish]. Publications of the Government’s analysis, assessment and research activities 2021:19. https://urn.fi/URN:ISBN:978-952-383-194-0. Accessed 1 Nov 2021.

European Medicines Agency. European public assessment report (EPAR), Toujeo. https://www.ema.europa.eu/en/medicines/human/EPAR/toujeo-previously-optisulin. Accessed 8 Dec 2021.

European Medicines Agency. European public assessment report (EPAR), Liprolog. https://www.ema.europa.eu/en/medicines/human/EPAR/liprolog-0. Accessed 8 Dec 2021.

Finnish Medicines Agency Fimea. List of available biosimilars in Finland. https://www.fimea.fi/documents/542809/838272/List+of+available+biosimilars+in+Finland.pdf/de0e643f-40c0-1f70-3272-8ee0ddc94219?t=1636472164498. Accessed 1 Mar 2021.

Finnish Medicines Agency Fimea. Basic register. https://www.fimea.fi/web/en/databases_and_registers/basic-register. Accessed 16 Nov 2021.

Finnish Medicines Agency Fimea. FimeaWeb. https://www.fimea.fi/web/en/databases_and_registers/fimeaweb. Accessed 26 Feb 2021.

European Medicines Agency. European public assessment reports (EPAR). https://www.ema.europa.eu/en/medicines. Accessed 26 Feb 2021.

WHO Collaborating Centre for Drug Statistics Methodology. DDD: definition and general considerations. https://www.whocc.no/ddd/definition_and_general_considera/. Accessed 4 Mar 2021.

WHO Collaborating Centre for Drug Statistics Methodology. ATC/DDD index 2020. https://www.whocc.no/atc_ddd_index/. Accessed 30 Nov 2020.

The Social Insurance Institution of Finland. Medicinal products database. https://www.kela.fi/web/en/medicinal-products-database. Accessed 21 Mar 2021.

Pharmaceuticals Pricing Board. The reimbursement of Humalog expires on 31 May 2019 [in Finnish]. https://www.hila.fi/humalog-valmisteen-korvattavuus-paattyy-31-5-2019/. Accessed 17 Apr 2021.

Pharmaceuticals Pricing Board. The reimbursement of Klexane expires on 30 November 2020 [in Finnish]. https://www.hila.fi/klexane-valmisteen-korvattavuus-paattyy-30-11-2020/. Accessed 17 Apr 2021.

Pharmaceuticals Pricing Board. Reimbursable authorized medicinal products and their prices. 2021. https://www.hila.fi/en/notices/reimbursable-authorized-medicinal-products-and-their-prices/. Accessed 17 Apr 2021.

Wagner AK, Soumerai SB, Zhang F, Ross-Degnan D. Segmented regression analysis of interrupted time series studies in medication use research. J Clin Pharm Ther. 2002;27:299–309.

Koskinen H, Ahola E, Saastamoinen LK, Mikkola H, Martikainen JE. The impact of reference pricing and extension of generic substitution on the daily cost of antipsychotic medication in Finland. Health Econ Rev. 2014;4:9.

Koskinen H, Mikkola H, Saastamoinen LK, Ahola E, Martikainen JE. Time series analysis on the impact of generic substitution and reference pricing on antipsychotic costs in Finland. Value Health. 2015;18:1105–12.

Kuha J. AIC and BIC: comparisons of assumptions and performance. Sociol Methods Res. 2004;33:188–229.

Durbin J, Watson GS. Testing for serial correlation in least squares regression. I. Biometrika. 1950;37:409–28.

Newey WK, West KD. A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica. 1987;55:703–8.

Moorkens E, Godman B, Huys I, Hoxha I, Malaj A, Keuerleber S, et al. The expiry of Humira® market exclusivity and the entry of adalimumab biosimilars in Europe: an overview of pricing and national policy measures. Front Pharmacol. 2021;11: 591134.

Saastamoinen L, Airaksinen M, Dimitrow M, Heino P, Hämeen-Anttila K, Jauhonen H-M, et al. Creating price competition in the pharmaceutical market and the public’s expectations of pharmacies [in Finnish]. Publications of the Government’s analysis, assessment and research activities 2021:32. http://urn.fi/URN:ISBN:978-952-383-409-5. Accessed 24 Nov 2021.

Aronson JK, Green AR. Me-too pharmaceutical products: history, definitions, examples, and relevance to drug shortages and essential medicines lists. Br J Clin Pharm. 2020;86:2114–22.

Mestre-Ferrandiz J, Towse A, Berdud M. Biosimilars: how can payers get long-term savings? Pharmacoeconomics. 2016;34:609–16.

Moorkens E, Jonker-Exler C, Huys I, Declerck P, Simoens S, Vulto AG. Overcoming barriers to the market access of biosimilars in the European Union: the case of biosimilar monoclonal antibodies. Front Pharmacol. 2016;7:193.

Moorkens E, Vulto AG, Huys I, Dylst P, Godman B, Keuerleber S, et al. Policies for biosimilar uptake in Europe: an overview. PLoS ONE. 2017;12: e0190147.

Rémuzat C, Dorey J, Cristeau O, Ionescu D, Radière G, Toumi M. Key drivers for market penetration of biosimilars in Europe. J Mark Access Health Policy. 2017;5:1272308.

Rémuzat C, Kapusniak A, Caban A, Ionescu D, Radiere G, Mendoza C, et al. Supply-side and demand-side policies for biosimilars: an overview in 10 European member states. J Mark Access Health Policy. 2017;5:1307315.

Rannanheimo P, Kiviniemi V. The biosimilar uptake can be promoted in various ways [in Finnish]. Sic! 2017:3–4. https://urn.fi/URN:NBN:fi-fe201801081142. Accessed 21 May 2022.

Sarnola K, Merikoski M, Jyrkkä J, Kastarinen H, Kurki P, Ruokoniemi P, et al. Uptake of biosimilars in Finland: physicians’ views [in Finnish] extended English summary. Serial publication Fimea develops, assesses and informs 4/2019. https://urn.fi/URN:ISBN:978-952-7299-02-9. Accessed 11 Nov 2021.

Tolonen HM, Airaksinen MSA, Ruokoniemi P, Hämeen-Anttila K, Shermock KM, Kurki P. Medication safety risks to be managed in national implementation of automatic substitution of biological medicines: a qualitative study. BMJ Open. 2019;9: e032892.

WHO Collaborating Centre for Drug Statistics Methodology. International language for drug utilization research. https://www.whocc.no/. Accessed 24 Nov 2021.

Acknowledgements

We thank the IQVIA for providing the datasets for this study. We also thank Dr. Hanna Koskinen, Head of Research Team from the Social Insurance Institution of Finland, for her valuable comments on the manuscript.

Funding

Open Access funding provided by University of Helsinki including Helsinki University Central Hospital.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

No funding was received to conduct this research.

Conflicts of interest/competing interests

Saana V. Luukkanen, Hanna M. Tolonen, Marja Airaksinen, and Laura S. M. Saarukka have no conflicts of interest to declare.

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Availability of data and material

The data that support the findings of this study are available from IQVIA, but restrictions apply to the availability of these data as they are not publicly available. However, data are available from the authors upon reasonable request and with the permission of IQVIA.

Code availability

The code is available from the authors upon reasonable request.

Authors’ contributions

All authors contributed to the study conception and the design of the data evaluation, analysis, and interpretation. Data analysis was performed by SVL. The first draft of the manuscript was written by SVL and HMT, and all authors critically revised the previous versions of the manuscript. All authors read and approved the final manuscript.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Luukkanen, S.V., Tolonen, H.M., Airaksinen, M. et al. The Price and Market Share Evolution of the Original Biologics and Their Biosimilars in Finland. BioDrugs 36, 537–547 (2022). https://doi.org/10.1007/s40259-022-00540-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40259-022-00540-y