Abstract

Background

Increasing pharmaceutical expenditure challenges the sustainability and accessibility of healthcare systems across Europe. Confidentiality restraints hinder assessment of actual prices of Orphan Medicinal Products (OMPs). Hence, we assessed the real prices of brand-name OMPs around market exclusivity expiry (MEE).

Objective

We aimed to explore developments in published list prices (LPs) and confidential hospital purchase prices (PPs) of brand-name OMPs relative to their market exclusivity status in Western European countries with similar GDPs.

Methods

We analyzed LPs and PPs of 13 selected OMPs purchased by university hospitals in Western European countries between 2000 and 2020. For confidentially reasons, proportions were used, with the Dutch LPs of the selected OMPs at the year of MEE serving as reference values. PPs included pre-purchase discounts. Rebates were not considered.

Results

Data were analyzed from hospitals in Denmark (DK) (n = 1), France (FR) (n = 1), Germany (DE) (n = 2), and the Netherlands (NL) (n = 1). Average LPs and PPs of included OMPs dropped gradually but limited over time, with no explicit price drop after MEE. LP levels differed more per country than PP levels: LP range before MEE was 164% (DE)–101% (FR) and after MEE was 135% (DE)–82% (FR); PP range before MEE was 150% (DE)–102% (FR) and after MEE was 107% (DE)–80% (FR). Overall differences between LPs and PPs were < 3% in all countries, except for Denmark.

Conclusion

No evident price drops of included brand-name OMPs were observed around MEE and differences in purchase prices are modest in the selected Western European countries. Results were not subject to significance testing. More robust data are needed to strengthen negotiations with suppliers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Brand-name OMP prices drop gradually but limited over time and purchase prices are homogenous in our sample, despite extensive procurement and negotiation processes. |

More robust data are needed on purchase prices and pricing mechanisms for OMPs, both during and after expiry of market exclusivity. |

Stakeholders involved in OMP pricing should consider strengthening international collaboration to increase knowledge on prices and strengthen negotiations with suppliers. |

1 Introduction

High drug prices have been subject to debate at policy tables across Europe since the 1990s and have raised concerns about the ethics and sustainability of pharmaceutical pricing [1,2,3,4]. Simultaneously, innovation for rare diseases was lacking compared with non-rare disease areas until 2000. In the 1980s, the awareness concerning unmet medical needs for patients with rare diseases started to increase in the European Union (EU) [5, 6]. Against this background, Regulation (EC) No 141/2000—the Orphan Regulation—was adopted in the EU on 22 January 2000 [7, 8]. The Orphan Regulation provides a framework to incentivize the development and market entry of Orphan Medicinal Products (OMPs), presuming that OMPs’ research and development (R&D) costs would not be covered by market revenues under ‘normal’ market conditions due to small patient populations. The Regulation states that granting market exclusivity forms the strongest incentive for the pharmaceutical industry to invest in development and marketing of drugs [7,8,9]. Article 8 of the Regulation displays the principle of market exclusivity for OMPs that priorly obtained orphan designation. After a pharmaceutical firm has been granted market authorization for a particular orphan-designated drug, competitors are withheld from market entry for a period of ten years [8].

In the Joint Evaluation of Regulation (EC) No 141/2000 by the European Commission (2020), it was concluded that the Orphan Regulation fostered the development and availability of medicines for patients with rare diseases, although substantial differences in (timely) access exist between countries [10,11,12,13,14,15].

However, in this evaluation it is suggested that the Orphan Regulation has contributed to increased financial burden for healthcare systems in Europe. Furthermore, high drug prices may result in displacement of other types of care because of limited healthcare budgets and may lead to diminished patient access [16, 17].

The question is raised whether a 10-year market exclusivity period to incentivize the research and development of OMPs is always justified [10]. Furthermore, the rationale of the Orphan Regulation suggests that after an OMPs’ market exclusivity period, manufacturers should have recouped their investment costs and, hence, might lower their prices. The goal of policy in this area should be to ensure that market exclusivity provides for a fair return on investment but does not indefinitely block availability of low-cost generics [18].

A study by the National Health Care Institute in the Netherlands demonstrated that prices of brand-name OMPs often remain high after their initial market exclusivity period [19]. This may be due to a combination of, inter alia, evergreening (lengthening patent life through various strategies by pharmaceutical firms), patents running beyond the initial market exclusivity period, and a lack of competition in the market [19]. This makes identifying the exact mechanisms that hinder price drops a challenging endeavor. Therefore, it is difficult to adequately assess to what extent market exclusivity under the Orphan Regulation is justified based on returns on investments, reinforced by a lack of transparency on costs [20, 21]. The National Health Care Institute underlined, furthermore, that lack of OMP price drops after market exclusivity is a bottleneck in need of assessment [19]. Nevertheless, the lack of reliable and coherent estimates across literature distorts the debate on OMP prices and, subsequently, on the right incentives to stimulate their development and marketing.

In Western European countries, a price is published for each OMP by the respective responsible health authority. This published price is referred to as the ‘list price’ [22]. In general, list prices can be considered to serve as a starting point for negotiations between manufacturers and purchasers. A discount level is agreed on by the manufacturer and the purchaser at hand. However, because of confidentiality clauses in contracts between purchasers and manufacturers, the actual purchase price after discounts and rebates is not disclosed publicly. This has resulted in erroneous estimates of OMP spending and price trends [23, 24]. Because of confidentiality constraints, only one study was found that collected purchase prices instead of list prices on a selection of drugs. Van Harten et al. surveyed the actual prices of a selection of cancer drugs in 15 European countries. The authors concluded that discounts differ widely across countries, indicating that list prices were no accurate reflection of actual prices [25].

To the best of our knowledge, no literature is available that reports on purchase prices for OMPs specifically. Hence, no conclusions can be drawn on the actual price development of OMPs after their formal market exclusivity expiry or on differences between list and purchase prices. Moreover, existing analyses that only include list prices do not reflect actual prices and may fail to reflect actual price developments, considering the potentially substantial differences between list and purchase prices. Regarding the particular challenge on OMP prices, it would be highly valuable to analyze how actual prices of brand-name OMPs, purchased by hospitals, develop over time, both during and after expiry of market exclusivity. This would be instrumental in making informed judgements about price levels and the justifiability of market exclusivity of OMPs.

Therefore, the aim of our study was to explore developments in published list prices and hospital purchase prices of brand-name orphan drugs relative to their market exclusivity status, price reductions, and accompanying cross-country differences in selected Western European countries.

2 Methods

Our study included list prices (LPs) and purchase prices (PPs) over time between 2000 and 2020 of OMPs for which market exclusivity had expired for at least one year. This period was chosen because the Orphan Regulation became effective in 2000 and 2020 was the most recent year for which annual prices were available. Price data were collected from Western European countries with similar standards of living since a country’s GDP may influence drug pricing outcomes [5, 26]. Hence, no purchasing power parities were used. Danish Krones were converted to Euros using retrospective, annual simple exchange rates obtained via the European Central Bank’s Euro foreign exchange reference rates [27].

As OMPs are most likely to be prescribed to patients at hospitals and more specifically, at university or academic hospitals, price data were collected from university hospitals. It should be noted that the list price in one country may not entail the exact same price build-up as in another country. For example, in some countries the list price constitutes the ex-factory price whereas in other countries the list price is subject to prior government negotiation or legislation. Considering the delicate context of the confidentiality issues surrounding drug purchase prices, the research team contacted its existing professional network of heads of hospital pharmacy departments of university hospitals across Europe. First, heads of hospital pharmacy departments were contacted via Email or LinkedIn and were invited to take notice of the research proposal (Online Resource 1, see electronic supplementary material [ESM]). Subsequently, a video meeting with potential participants and the research team was arranged to elaborate on the study and to provide additional information. A Data Transfer Agreement was signed with each participating hospital to manage data confidentiality.

A retrospective, quantitative study design was selected in order to analyze OMP price data [28]. From an initial database containing price data of 175 OMPs at Erasmus MC, the Netherlands, we selected 14 OMPs (Fig. 1). The first selection for inclusion was based on the following predefined criteria: (i) pharmaceutical was an OMP according to EC Community Register of Orphan Medicinal Products; (ii) availability of OMPs and corresponding list prices and purchase prices in the Netherlands, and (iii) market exclusivity expiry of OMP no later than December 31, 2019. Subsequently, these OMPs were categorized according to (i) prevalence; (ii) therapeutic modality, and (iii) route of administration. Finally, for each category, OMPs were included which represented one of the following market mechanisms: (i) OMP is considered generic itself; (ii) OMP is in competition with one or more OMP generics; (iii) OMP is in competition with other patented drugs (me-too); or (iv) no competition (Online Resource 2, see ESM). Preceding data collection, we described the selection process for OMPs as well as the process of data collection [29].

Indexed prices were obtained for 13 of the 14 selected brand-name OMPs (Table 1). One OMP was excluded as no Dutch list price was obtained for the year of market exclusivity expiry (MEE); therefore, a reference value was missing. Notably, only one biologic drug ended up in our sample. The therapeutic modalities of the other 12 OMPs are small-molecule drugs. More information on competition regarding the selected OMPs can be found in Online Resource 3 (see ESM).

A data management plan and corresponding digital infrastructure were created to ensure secure data transfer and storage. Castor EDC (Electronic Data Capture) was selected as the data capture system, in which a survey was placed for participants to upload their data securely. A data collection template was created and sent to the participants with concise instructions for price calculations and data upload (Online Resource 4, see ESM). Participating hospitals were assigned a two-digit hospital code. This code was a means of pseudonymizing the hospital names when using the data collection template. The pseudonymization table containing the links between hospital codes and corresponding hospital names was saved on a secured internal server at Erasmus MC to which only AD and AKG had access. Once data from participating hospitals were collected, the pseudonymized data collection templates were exported from Castor EDC into Microsoft Excel 2016 and saved on the secured server. All data collected were then merged and analyzed in IBM SPSS Statistics 25 for Windows.

We used descriptive statistics to analyze (i) LPs of brand-name OPMs during and after market exclusivity; (ii) PPs of brand-name OMPs during and after market exclusivity; (iii) differences between LPs and PPs of brand-name OMPs; and (iv) differences in price levels and developments between countries (Online Resource 4, see ESM).

Average annual list prices were calculated by using formula 1.

When a list price LP for a specific OMP r changed multiple times n throughout one calendar year y, the unweighted average was taken as average annual LP. A similar formula (2) was used to calculate average purchase prices.

To analyze developments in LPs and PPs of brand-name OMPs relative to their market exclusivity status, the prices for each selected brand-name OMP were analyzed from the start of its market exclusivity period up to and including a maximum of ten years after market exclusivity expiry. When an OMP was not available at a particular hospital in the studied period, it was excluded from the analysis. To cover confidentiality issues, all LPs and PPs were transformed into proportions for which the Dutch list price of each selected OMP at the year of market exclusivity (MEE = 0) was used as reference value (p = 100%), formulas 3 and 4, respectively.

For each OMP presentation, index numbers were created. To illustrate with an example, for product r in the year MEE+3, the indexed list price (LP_index) was calculated using formula 5.

To calculate differences between the indexed PPs and the indexed LPs for a particular OMP, we used formula 6.

In cases where the purchase price was re-determined to a lower price during the calendar year but most purchases by a hospital took place at the beginning of the year at a relatively higher purchase price, estimated annual average purchase prices could be calculated to be higher than list prices, which is not possible in practice. This has been corrected for through setting the index numbers for both the list price and purchase price as equal for a particular product at a particular hospital in the corresponding year when the purchase price estimate was indeed slightly higher than the list price.

3 Results

We invited 21 hospital pharmacy departments in 11 Western European countries to participate, of which five departments in four countries provided us with the required information. One department had to withdraw after confirmation of participation because of lack of time. Four departments had the intention to participate, but could not overcome the confidentiality issues. One department had no intention to participate and, finally, we received no responses from 10 departments, despite reminders. The number of included OMP brands per participating hospital and country is reported in Table 2.

Since our research aim was mainly focused on overall price developments and cross-country differences, results were not split by OMP. Instead, all OMPs were considered as one group for analysis. All results were split by country to assess cross-country differences in the data set. List price data were retrieved from country-specific sources (Table 3).

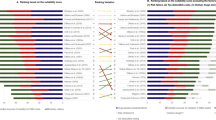

Compared with the reference price, LP at MEE = 0 (p = 100%) for the Netherlands, the average list prices of OMPs before MEE (10 years to 1 year before expiry of market exclusivity; MEE-10 to MEE-1) compared with after MEE (1 year to a maximum of 10 years after expiry of market exclusivity; MEE+1 to MEE+10) differs per country, but data presented a modest decrease in price over time. For the Dutch hospital, the proportion of the indexed overall average LPs after MEE was 96% compared with 104% before MEE. For the Danish, French and German hospitals, these percentages were 136% versus 147% (DK), 82% versus 102% (FR), and 114% versus 164% (DE), respectively (Table 3). Regarding average overall PPs before (MEE-10 to MEE-1) and after (MEE+1 to MEE+10) MEE and compared with the same reference price mentioned above, the results were similar to the LPs. For Germany, the average PP over the two participating hospitals was calculated and plotted. For the Dutch hospital, the proportion of the indexed overall average PPs after MEE was 93% compared with 102% before MEE. For the Danish, French and German hospitals, these percentages were 98% versus 116% (DK), 81% versus 106% (FR), and 107% versus 150% (DE), respectively (Table 4).

When plotting the indexed LPs and PPs relative to their year of market exclusivity expiry (MEE = 0), we obtained Figs 2 and 3. Regarding the German and French outlier data, the German outlier at MEE-1 for both average LP and PP was caused by one OMP which was extremely highly priced 1 year before market exclusivity expiry. The French outlier at LP MEE+8 was caused by one OMP for which no LP was available and one other OMP for which the LP dropped substantially.

To analyze actual price drops at MEE = 0 by country, the percentage difference between the average PPs after MEE = 0 compared with before MEE = 0 were calculated. It was found that the average PPs in the 2 years after MEE = 0 compared with the two years before (average over MEE+1 and MEE+2 compared with average over MEE-1 and MEE-2), dropped 4% for the Dutch hospital, 9% for the Danish hospital, 14% for the French hospital, and 11% for the German hospitals. The average PPs in the 3 years after MEE = 0 compared with the 3 years before (average over MEE+1, MEE+2, MEE+3 compared with average over MEE-1, MEE-2, MEE-3), dropped 4% for the Dutch hospital, 9% for the Danish hospital, 15% for the French hospital, and 11% for the German hospitals. Lastly, this analysis was performed for 4 years after versus before MEE = 0. The average PPs in the 4 years after MEE = 0 compared with the 4 years before (average over MEE+1, MEE+2, MEE+3, MEE+4 compared with average over MEE-1, MEE-2, MEE-3, MEE-4), had dropped 5% for the Dutch hospital, 9% for the Danish hospital, 16% for the French hospital, and 11% for the German hospitals (Table 5).

The percentage difference between the PP and the LP per OMP per year were calculated and revealed overall average price reductions of −2% for the Dutch hospital, −32% for the Danish hospital, −0.0004% for the French hospital, and −2% for the German hospitals. In Fig. 4, accompanying price reductions per year were plotted relative to MEE = 0.

4 Discussion

Our aim was to explore developments in published list prices and hospital purchase prices of brand-name orphan drugs relative to their market exclusivity status, which resulted in three key findings.

First, starting at the year of market access (MEE-10), overall average list prices and purchase prices of included OMPs dropped gradually but limited over time, although the drop differed per country. Generally, there were no signs of price drops immediately after or prior to market exclusivity expiry. Second, in our data set, list price levels differed per country while purchase price levels were more homogeneous. Third, the difference between list prices and purchase prices was < 3% in all countries, except for Denmark which had a price reduction of over 30%.

Regarding our first key finding, in our data set, both list prices and purchase prices of OMPs dropped gradually over time during the 10-year period of market exclusivity and after market exclusivity expiry. By adopting the Orphan Regulation the European Commission presumed that companies would recoup their costs in this 10-year period of market exclusivity [10]. The Commission thereby implied that prices of OMPs would drop in analogy with patent legislation and the so-called patent cliff, when prices of medicines drop steeply after patent expiry as a result of loss of exclusivity [33]. However, in our data set the year of expiry did not mark a considerable price drop, neither in comparison to 2 years before and after market exclusivity expiry, nor in comparison to 3 or even 4 years before and after. We were unable to look beyond 4 years, because most of the selected OMPs did not have a market exclusivity expiry date beyond that. Compared with drugs that go off-patent where a considerable price drop in the months following loss of exclusivity can be observed [34], sometimes up to 90%, an average and gradual price drop of 20% after market exclusivity is modest. According to Sabatini and Silva, the largest determinant for the behavior of a prescription drug after loss of exclusivity is the degree of generic competition [34].

Regarding our second key finding, when comparing price developments of list prices and purchase prices in our data set specifically, we observed that in all participating countries purchase prices converge to a similar level, despite their country-specific list prices. This suggests that, despite extensive procurement and negotiation processes, Western European countries eventually pay rather similar prices for brand-name OMPs. This seems to contradict, together with evidence from previous literature, arguments of stakeholders from the pharmaceutical industry claiming that the confidentiality of discounts would contribute to getting ‘fair price deals’ for individual countries in line with available resources [35,36,37]. As with the former key finding, due to lack of data points, results after MEE+4 were non-conclusive.

Lastly, when comparing the hospitals in the four countries, the Danish hospital obtained the largest average annual price reduction (difference between list price and purchase price), but still retained the highest purchase price at MEE = 0. One explanation for the Danish results might be the national procurement of OMPs by Amgros, a public organization owned by the five Danish regions, which negotiates OMP prices on a national level instead of hospitals themselves. Prices in all hospitals in Denmark are, therefore, exactly the same [38]. In our data set, OMP purchase prices in the two German hospitals were the highest compared with the other countries. In Germany, it is not mandatory to submit a benefit dossier to the German Federal Joint Committee for OMPs not exceeding annual costs of EUR 50 million. However, price negotiations on OMPs do occur between pharmaceutical companies and health insurers which sometimes results in published price reductions and sometimes in undisclosed rebates paid directly to the insurance company [39].

Considering our key findings, this study may help to improve decision making for multiple stakeholders involved in negotiation and purchasing processes on the European OMP market. By enhancing the understanding of cross-country pricing patterns in practice, policy makers and purchasers of brand-name OMPs may anticipate their practices. Nevertheless, more robust data are needed on real-world pricing and negotiation practices for OMPs, both during and after market exclusivity expiry as well as on- and off-patent protection. The ongoing shift from ‘blockbuster’ to ‘niche buster’ drugs, including an expected increase in market entry of brand-name OMPs, highlights the relevance and urgency of patterns explored in this study [40]. Substantial additional research is needed that focuses on biosimilars and generics besides brand-name orphan drugs to inform policy and decision makers in finding solutions for the future in terms of policy and practice regarding OMP pricing.

This study has some limitations. First, our study depended on hospital data solely and we did not consider any possible rebates afterwards or other price negotiating effects beyond the included hospitals, which might have caused a decrease in purchase price. Secondly, this study was restricted to the analysis of prices of brand-name OMPs, as opposed to expenditure or total budget impact; we therefore omitted volume. Moreover, we did not include procurement of any of the selected OMPs’ competitors, e.g., generics, biosimilars, or me-toos. This might have caused a decrease in average expenditure more reflective of reality than that suggested in this study. Nevertheless, this strategy allowed us to interpret the prices included in this study as ‘the price of a drug as paid by purchasing hospitals at moment of transaction’. Third, the composition of ‘list prices’ differed between included countries. The Danish list prices comprise the prices set by pharmaceutical firms in Denmark. The Dutch maximum list prices are determined through external reference pricing by the Dutch Ministry of Health. German list prices refer to the pharmacy purchasing price (‘Apothekeneinkaufpreis’) which entails the ex-factory price plus 0.70 cents plus 3.15% of the ex-factory price up to a price cap of 37.80 euros. In France, published list prices are the prices negotiated in confidentiality by the Economic Committee for Health Products (CEPS), which may additionally include a confidential rebate for the national health insurer (NHI). Since this study aimed, inter alia, to assess the gap between published list prices stated in reports and publications and actual prices paid, cross-country differences in the composition of list prices are not corrected for. Nevertheless, list price levels should be interpret with caution. Fourth, our data set included a limited number of brand-name OMPs, hence, results had limited generalizability for all brand-name OMPs. To construct causal inference and to draw conclusions about causation rather than correlation of brand-name OMP prices relative to their market exclusivity expiry, a larger body of data should be analyzed. The same applied to the number of countries and hospitals analyzed, limiting external validity and transferability of the results. It should be noticed that, of the 21 invited hospital pharmacy departments in this study, only five departments decided to participate. Selection bias may have occurred as a result of university hospitals which had negotiated favorable deals not participating.

Further, we calculated only the annual unweighted average of both list prices and purchase prices. This implied that for cases in which a list price was re-determined more than once in one calendar year, the length of time for which this list price was in place was not accounted for. The unweighted annual average purchase prices implied that the volumes purchased were not accounted for although they might influence the level of negotiated prices and/or rebates. Hence, it is likely that the purchase price levels and corresponding differences between purchase and list prices reflect discounts rather than rebates particularly. Finally, against the background of a lack of transparency on drug purchase prices and consequent challenges to collect large volumes of data on OMPs’ actual hospital purchase prices, this study did not include enough data points to conduct statistical tests including significance testing. Nonetheless, this study serves as a first exploration of brand-name OMPs’ actual paid prices in four Western European countries and descriptive statistics were applied to interpret and describe data.

Nevertheless, considering the limitations mentioned above, the results from this study offer insights in brand-name OMPs’ confidential prices which were previously concealed due to a persisting lack of transparency. Moreover, the value of this research lies in a) the description of price developments relative to market exclusivity expiry; and b) the observation that purchase prices of OMPs both during and after market exclusivity expiry tend to converge to a similar level in the studied countries and hospitals.To enable increased leverage in purchasing and corresponding negotiation processes, cross-country collaboration between stakeholders involved in OMP procurement is needed.

5 Conclusions

This study is, to our knowledge, the first to compare published list prices with actual hospital purchase prices of OMPs in Western European countries specifically and to address price differences in purchase prices during and particularly after EU market exclusivity expiry. Our study provides evidence of a lack of discounts in orphan drug procurement by university hospitals, indicating limited leverage for price drops. We conclude that market exclusivity expiry may be only weakly correlated with prices of respective brand-name drugs and that differences in purchase prices across Western European countries with similar GDPs are modest. Potentially, this knowledge can be helpful to governments and university hospitals as well as other stakeholders involved in OMP procurement when considering strategies to optimize procurement and strengthen negotiations with suppliers.

References

Mestre-Ferrandiz J, Palaska C, Kelly T, Hutchings A, Parnaby A. An analysis of orphan medicine expenditure in Europe: is it sustainable? Orphanet J Rare Dis. 2019;14(article number 287).

Simoens S. Pricing and reimbursement of orphan drugs: The need for more transparency. Orphanet J Rare Dis. 2011;6(article number 42).

Michel M, Toumi M. Access to orphan drugs in Europe: current and future issues. Expert Rev Pharmacoecon Outcomes Res. 2012;12(1):23–9.

Garattini L, Padula A. HTA for pharmaceuticals in Europe: will the mountain deliver a mouse? The European journal of health economics: HEPAC: health economics in prevention and care, 2020. p. 1–5.

OECD/European Union. Health at a Glance: Europe 2020: State of Health in the EU Cycle. Chapter 5: Health Expenditure and Financing 2020. Report No.: 9789264183902.

OECD. Pharmaceutical Innovation and Access to Medicines, OECD Health Policy Studies. Chapter 3. Policy Options to Address Current Challenges. OECD Publishing. Paris, 2018.

European Medicines A. Legal framework: orphan designation | European Medicines Agency. https://www.ema.europa.eu/en/human-regulatory/overview/orphan-designation/legal-framework-orphan-designation. Accessed 9 Sep 2022.

The European Parliament, the Council of the European Union. Regulation (EC) No 141/2000 of the European Parliament and of the Council of 16 December 1999 on orphan medicinal products. Off J Eur Union. 1999; L 18:1–5.

Tambuyzer E. Rare diseases, orphan drugs and their regulation: questions and misconceptions. Nat Rev Drug Discov. 2010;9(12):921–9.

European Commission. Joint evaluation of Regulation (EC) No 1901/2006 of the European Parliament and of the Council of 12 December 2006 on medicinal products for paediatric use and Regulation (EC) No 141/2000 of the European Parliament and of the Council of 16 December 1999 on 2020. Report No.: 9788578110796.

Detiček A, Locatelli I, Kos M. Patient access to medicines for rare diseases in European countries. Value Health. 2018;21(5):553–60.

Zamora B, Maignen F, O’Neill P, Mestre-Ferrandiz J, Garau M. Comparing access to orphan medicinal products in Europe. Orphanet J Rare Dis. 2019;14(1):95.

Kanters TA, Redekop WK, Hakkaart L. International differences in patient access to ultra-orphan drugs. Health Policy Technol. 2018;7(1):57–64.

Zamora B, Maignen F, Neill PO, Mestre-ferrandiz J, Garau M. Comparing Access to Orphan Medicinal Products (OMPs) in the United Kingdom and other European countries. OHE Consulting Report. 2017:1–37.

European Medicines Agency. Orphan Medicines Figures: 2000–2020. European Medicines Agency; 2020.

Vogler S, Paris V, Ferrario A, Wirtz VJ. How can pricing and reimbursement policies improve affordable access to medicines? Lessons learned from European countries. Appl Health Econ Health Policy. 2017;15(2):307–21.

Neumann PJ, Cohen JT, Ollendorf DA. The right price: a value-based prescription for drug costs. Oxford Scholarship online. Oxford: Oxford Press; 2021.

Kesselheim AS, Sinha MS, Avorn J. Determinants of market exclusivity for prescription drugs in the United States. JAMA Intern Med. 2017;177(11):1658–64.

Zorginstituut Nederland. Monitor Weesgeneesmiddelen in de Praktijk 2020. Diemen; 2020. https://www.zorginstituutnederland.nl/publicaties/rapport/2020/12/10/monitor-weesgeneesmiddelen-2020. Accessed 9 Sep 2022.

Moorkens E, Godman B, Huys I, Hoxha I, Malaj A, Keuerleber S, et al. The expiry of Humira(®) market exclusivity and the entry of adalimumab biosimilars in Europe: an overview of pricing and national policy measures. Front Pharmacol. 2020;11: 591134.

Padula WV, Parasrampuria S, Socal MP, Conti RM, Anderson GF. Market exclusivity for drugs with multiple orphan approvals (1983–2017) and associated budget impact in the US. Pharmacoeconomics. 2020;38(10):1115–21.

Leopold C, Vogler S, Mantel-Teeuwisse AK. Differences in external price referencing in Europe—a descriptive overview. Oxford: Elsevier; 2012.

Espin J, Schlander M, Godman B, Anderson P, Mestre-Ferrandiz J, Borget I, et al. Projecting pharmaceutical expenditure in EU5 to 2021: adjusting for the impact of discounts and rebates. Appl Health Econ Health Policy. 2018;16(6):803–17.

Vogler S, Zimmermann N, Babar ZUD. Price comparison of high-cost originator medicines in European countries. Expert Rev Pharmacoecon Outcomes Res. 2017;17(2):221–30.

van Harten WH, Wind A, de Paoli P, Saghatchian M, Oberst S. Actual costs of cancer drugs in 15 European countries. Lancet Oncol. 2016;17(1):18–20.

Janssen Daalen JM, Den Ambtman A, Van Houdenhoven M, Van Den Bemt BJF. Determinants of drug prices: a systematic review of comparison studies. BMJ Open. 2021;11(7).

European Central Bank. Euro references exchange rate. 2023 [cited 2021 March]; https://www.ecb.europa.eu/stats/policy_and_exchange_rates/euro_reference_exchange_rates/html/index.en.html. Accessed 9 Sep 2022.

Salkind N. Encyclopedia of research design. 2010 2022/01/30;1-0.

Dane A, Klein Gebbink A-S, van der Kuy PHM. The importance of publishing research protocols for pharmacoeconomic studies. Eur J Hosp Pharm. 2021 2021/9//:ejhpharm-002987.

Danish Medicines Agency. Medicinpriser.dk. [cited 2021 March]; https://www.medicinpriser.dk/default.aspx. Accessed 9 Sep 2022.

Ameli. list prices. 2023 [cited 2021; http://www.codage.ext.cnamts.fr/codif/bdm_it/index_tele_ucd.php?p_site=AMELI. Accessed 9 Sep 2022.

CGM Compugroup Medical. Lauer-Taxe [cited 2021; https://www.cgm.com/deu_de/produkte/apotheke/lauer-taxe-en.html. Accessed 9 Sep 2022.

Harrison C. The patent cliff steepens. Nat Rev Drug Discov. 2011;10(1):12–3.

Sabatini MT, Silva M. Patent cliffs in the era of complex therapies and biologics. Pharm Med. 2020;34(4):271–8.

Vogler S, Paterson KR. Can price transparency contribute to more affordable patient access to medicines? PharmacoEcon Open. 2017;1(3):145–7.

Danzon PM. Differential pricing of pharmaceuticals: theory, evidence and emerging issues. Pharmacoeconomics. 2018;36(12):1395–405.

Morgan SG, Vogler S, Wagner AK. Payers’ experiences with confidential pharmaceutical price discounts: a survey of public and statutory health systems in North America, Europe, and Australasia. Health Policy. 2017;121(4):354–62.

Amgros. amgros.dk. 2022 [cited 2022 April 28]; https://amgros.dk/en/about-amgros/organisation/. Accessed 9 Sep 2022.

Ruof J, Schwartz FW, Schulenburg JM, Dintsios CM. Early benefit assessment (EBA) in Germany: Analysing decisions 18 months after introducing the new AMNOG legislation. Eur J Health Econ. 2014;15(6):577–89.

Marselis D, Hordijk L. From blockbuster to “nichebuster”: how a flawed legislation helped create a new profit model for the drug industry. BMJ. 2020;370: m2983.

Acknowledgements

The authors wish to thank the following people for contributing to this study by retrieving, collecting and/or analyzing data: Inge Snijders, Erasmus MC, The Netherlands. Sahar Barjesteh van Waalwijk van Doorn-Khosrovani, CZ, The Netherlands. Daniëlle Baenen, CZ, The Netherlands. Heidi Bakmand Letvinka, Region Hovedstadens Apotek, Denmark. Anissa Aharaz, The Capital Region Pharmacy, Herlev, Denmark. Dorte Kromann Krysfeldt, The Capital Region Pharmacy, Herlev, Denmark. Lorenz van der Linden, University Hospital Leuven, Belgium. Franziska Behrend, Charité, University Hospital Berlin, Germany. Frederike Peters, Charité, University Hospital Berlin, Germany. Cornelia Eberhardt, Charité, University Hospital Berlin, Germany.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

No funding was received to conduct this study.

Conflicts of interest

There are no conflicts of interests for specific or individual authors.

Availability of data and material

Data supporting the results are subject to confidentiality restraints. Supplementary materials provide information on the research methods used and provide transparency in the way data were handled.

Ethics approval

Not applicable.

Consent to participate

Participants consented to participate by means of a signed data transfer agreement.

Consent for publication

Participants consented for publication by means of a signed data transfer agreement.

Code availability

Not applicable.

Author contributions

Concept and design: Brugma, Dane, Klein Gebbink, van der Kuy, Uyl-de Groot; acquisition of data: Dane, Klein Gebbink, van der Kuy; retrieving data: Brugma, Degrassat-Theas, Houlind, Hug, Paubel; analysis and interpretation of data: Brugma, Dane, Klein Gebbink; drafting of the manuscript: Dane, Klein Gebbink; critical revision of the manuscript: Brugma, Degrassat-Theas, Houlind, Hug, van der Kuy, Paubel, Uyl-de Groot; supervision: Dane, Uyl-de Groot. All authors take responsibility for the integrity of the work and have given their approval for this version to be submitted.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Dane, A., Klein Gebbink, AS., Brugma, JD. et al. Prices of Orphan Drugs in Four Western European Countries Before and After Market Exclusivity Expiry: A Cross-Country Comparison of List Prices and Purchase Prices. Appl Health Econ Health Policy 21, 905–914 (2023). https://doi.org/10.1007/s40258-023-00832-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40258-023-00832-6