Abstract

Production efficiency is a key determinant of economic growth and demonstrates how a country uses its resources by relating the quantity of its inputs to its outputs. When a natural hazard-induced disaster strikes, it has a devastating impact on capital and labor, but at the same time provides an opportunity to upgrade capital and increase labor demand and training opportunities, thereby potentially boosting production efficiency. We studied the impact of natural hazard-induced disasters on countries’ production efficiency, using the case study of hurricanes in the Caribbean. To this end we built a country-specific, time-varying data set of hurricane damage and national output and input indicators for 17 Caribbean countries for the period 1940–2014. Our results, using a stochastic frontier approach, show that there is a short-lived production efficiency boost, and that this can be large for very damaging storms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Natural hazard-induced disasters bring about widespread destruction and disruption to economic production and even considerable loss of life. Disaster-stricken countries dedicate a lot of resources to addressing the impacts of these hazardous events in order to design and implement policies to combat and mitigate their damaging effects. While these disasters by definition bring about severe losses, some studies have actually found that economic growth increases in their aftermath (Albala-Bertrand 1993; Skidmore and Toya 2002), while other studies have concluded that growth decreases (Noy and Nualsri 2007; Raddatz 2007; Noy 2009). Notwithstanding the destruction of physical and human capital involved, the increase in growth may not be unexpected. The destruction following a natural catastrophe may stimulate a more accelerated adoption of capital, which could yield positive growth in productivity through embodied technological change, the adoption of new technology, and the replacement of old and outdated infrastructure. Studies on natural hazard-induced disasters nevertheless tend to quantify their impact on production output and input (Bluedorn 2005; Belasen and Polachek 2008; Spencer and Polachek 2015; Mohan 2016) and have suggested that disasters may temporarily disrupt production (Strobl 2011). Few studies have looked at the production efficiency effects of natural hazard-induced disasters, which may be of even more importance because production efficiency demonstrates how a country uses its resources by relating the quantity of its inputs to its outputs and is a key determinant of economic growth.

When a natural hazard-induced disaster strikes, it damages physical capital including factories, power plants, bridges, roads, and buildings. The devastated capital may not only be replaced, but upgraded using the most up-to-date technologies. Older infrastructure and buildings are more prone to damage from disasters, and the reinvestment and replacement of such facilities will have a positive effect on productivity and economic growth in the long run. But there is also the risk that capital would immediately be replaced by older, out-of-date technology, especially where it is more easily available. The benefits of investing in more technologically advanced capital may be offset by the short-run productivity losses following a disaster occurrence as time is needed to incorporate new technology and equipment and to train workers. Disaster strikes also affect a country’s human capital. The demand for labor in disaster-affected areas could increase as workers are needed for clean-up and recovery and reconstruction operations. Alternatively, the labor supply in affected areas may decrease as loss of life occurs, and persons may migrate to seek better living conditions. The loss of capital and labor following a disaster may be compensated by increased production efficiency and increased opportunities for new industries and workers.

The few empirical studies that have investigated the production efficiency effects of natural hazard-induced disasters provide ambiguous results on the matter. Albala-Bertand (1993) looked at 28 natural hazard-induced disasters in 26 countries for the period 1960–1979 and concluded that destroyed capital was replaced by more efficient capital after a disaster, causing Gross Domestic Product (GDP) growth to increase. Skidmore and Toya (2002) studied 89 countries and found that disasters provide the impetus to update the capital stock and adopt new, more productive technologies for post-disaster reconstruction, leading to improvements in total factor productivity, thereby promoting economic growth. They also found that disaster risk reduces the expected rate of return to physical capital as investment in physical capital falls, but increases the relative return to human capital as there is a substitution toward human capital investment, thereby promoting growth.

In a study of Oklahoma City after the 3 May 1999 tornado, Ewing et al. (2009) found that the reconstruction of housing and infrastructure stimulated the labor market and increased the average employment rate. Banerjee (2007) also provided evidence that flooding in Bangladesh can have a positive effect on long-term agricultural wages because it increased crop yield in the dry season. Leiter et al. (2009), in a study of European firms, concluded that in the short run companies in regions hit by a flood showed on average higher growth of total assets and employment than firms in regions unaffected by flooding. Belasen and Polachek (2008) studied the impact of hurricanes in Florida and found a decrease in the labor supply and a simultaneous increase in post-hurricane labor demand, particularly in construction in directly versus indirectly affected counties, causing income to rise by 4.35%. Neighboring counties suffered from the inflow of labor and experienced a decrease in earnings of 4.51%.

Benson and Clay (2004) attributed GDP increases following a natural hazard-induced disaster event to a catch-up effect and reconstruction activities rather than productivity increases. They also highlighted the challenge of implementing new technologies after a natural catastrophe because of time and financial constraints that make productivity increases difficult to achieve. Hallegatte and Dumas (2009) similarly stated that long-run productivity remains unchanged compared with pre-disaster levels in the aftermath of disasters. This is especially the case in low-income countries that suffer from frequent disasters and are at risk of becoming stuck in a poverty trap. These countries continually replace damaged capital with capital similar to what existed before the disaster in order to resume prior levels of productivity as quickly as possible, and this limits the possibility of future productivity growth. According to Horwich (2000) there is no established relationship between the 1995 Kobe Earthquake in Japan and its capital stock. Sarmiento (2007) showed that on average, aggregate local employment in the United States fell by 3.4% following floods as workers left the affected area.

The literature also provides evidence that improvements in productivity are only possible when disaster events are relatively small as the recovery process is more easily managed, compared to when large areas are affected, since there might be less time for efficient decision making. Halkos et al. (2015) in a study of 137 countries for the period 1980–2011 analyzed the effect of man-made and natural hazard-induced disaster occurrences on countries’ technological change and technological catch-up. The study uncovered a “U” shaped relationship between countries’ technological change and technological catch-up with disaster events, suggesting that the effect on countries’ production efficiency is positive for a smaller number of disaster events; however, after a specific threshold value, the effect becomes negative. There is the possibility that for a small number of disaster occurrences and small disaster impacts, productivity might decrease since there will be no change in industrial composition. The results also reveal that low-income countries are negatively affected much quicker, compared to high-income countries. The study suggests that the negative effects of disaster occurrences impact countries’ technological catch-up first and then their technological change.

In this article we add to the limited literature on natural hazard-induced disaster impacts on production efficiency by explicitly modeling the technical efficiency effect of disasters using a stochastic frontier analysis approach on hurricanes in Caribbean Small Island Developing States (SIDS). To undertake our investigation, we used a panel data set that included 17 Caribbean countriesFootnote 1 for the period 1940–2014. Caribbean SIDS are an especially apt case study since the islands are located in the Atlantic Hurricane belt, and are particularly vulnerable to hurricane strikes. Hurricane damage equivalent to more than 2% of GDP can be expected every two and a half years, and as such it is argued that the region is the most disaster-prone globally on account of the large number of hurricane events experienced (Rasmussen 2004). The economic and geographic characteristics of Caribbean island economies, including their small size and location, and their highly specialized economic structures and openness to external shocks also make them especially vulnerable to natural hazard-induced disasters (Pelling and Uitto 2001; Rasmussen 2004).

To our knowledge the only other study that provides empirical evidence on the technical efficiency effect of natural hazard-induced disasters is Halkos et al. (2015). In contrast to Halkos et al. (2015), we examine the specific case of hurricanes in the Caribbean and thereby advance the literature in a number of ways. It is well established that different disasters have different production effects (Loayza et al. 2012), and that country-specific characteristics can affect the impacts of disasters (Noy 2009). Halko et al. (2015) used the Emergency Events Database (EMDAT) to measure and identify natural hazard-induced disasters, which has been shown to be affected by measurement error bias due to its ex post nature (Felbermayr and Gröschl 2014). In contrast, the hurricane destruction index employed in our study is built on the physical features of storms and the ex ante population exposure, thereby minimizing measurement errors. Finally, Halkos et al. (2015) used data envelopment analysis that, while nonparametric, cannot, in contrast to stochastic frontier analysis, identify the difference between technical inefficiency and random errors, and does not allow random shocks to affect output.

In the following, Sect. 2 introduces the data sources and summary statistics, Sect. 3 outlines the econometric methodology, and Sects. 4 and 5 provide the results and their discussion.

2 Data and Summary Statistics

To investigate the impact of hurricanes on production efficiency we require data on hurricane strikes to create a measure of potential hurricane destruction and climate data as well as data on production output, and inputs into the production function namely labor and capital.

2.1 The Production Function Data

We took information on output, capital, and labor data for the Caribbean nations from the World Penn (Version 9.0) database.Footnote 2 Overall, this gives an unbalanced panel of production function data for the 17 Caribbean countries for the period 1940–2014.

2.2 The Hurricane Destruction Index

Hurricane destruction depends mainly on three related aspects: destruction from wind speed, flooding/excess rainfall, and storm surge. A simplifying assumption, commonly adopted in the literature, is that the latter two effects, which would be much more difficult to model, are highly correlated with wind speed, and that wind speed can be used as a proxy for the potential damage due to a hurricane strike.Footnote 3 To capture the potential destruction due to hurricanes we thus used an index adapted from Strobl (2012) that measures wind speed experienced at points within countries and then uses exposure weights to arrive at a country-specific proxy. More specifically, for a set of hurricanes, k = 1,…, K, and a set of locations, i = 1,…I, in island j we define tropical cyclone destruction during month t as:

where Wmax is the maximum measured wind speed at point i during a storm k, and w are exposure weights in the previous month t − 1 of locations, i = 1,…I, which aggregate to 1 at the island j level.Footnote 4 We set the minimum speed at which hurricane wind speeds are damaging at 119 km/hr, at the threshold above which hurricanes generate damage. In order to calculate the wind speed experienced due to a tropical cyclone, W, in Eq. 1 we employed Boose et al.’s (2004) version of the well-known Holland (1980) wind field model and the tropical storm track data from the National Hurricane Center HURDAT Best Track Data.Footnote 5 To derive local exposure weights, wi, we used the decadal Latin American and Caribbean Population databaseFootnote 6 and linearly interpolated the cell level values to obtain annual values of population shares. These cells, i, also determine the set of spatial units at which we estimated local hurricane wind speed measures.

2.3 Other Climate Control Data

In order to ensure that our estimation does not capture other climatic phenomena that may be correlated with hurricanesFootnote 7 and affect technical efficiency, we also calculated average annual population weighted rainfall and temperature per island using the gridded CRU TS v. 4.01 database.Footnote 8 More specifically, we used aggregated population values given in the Latin American and Caribbean Population database to the 0.5 degree level of the CRU data. We then created yearly interpolated population shares at this spatial level and calculated population weighted countrywide annual measures of precipitation and temperature.

2.4 Summary Statistics

Table 1 shows the statistics for all the variables used in our estimation process, including the number of observations, and the mean and standard deviations for each variable. Since employment has the lowest number of observations, our regression analysis is restricted to 538 observations despite a higher number for the other variables. Data for employment is not available consistently for all countries over the time period of study. Output as measured by real GDP in millions of 2011 US dollars averages 10,385, while the average real capital stock measured in millions of 2011 US dollars amounts to around 47,784. The mean number of employed persons in millions is 0.62. Out of our total 538 observations our hurricane index takes on 37.36% non-zero values, with a large standard deviation of the index when this is the case. Annual rainfall averages 153 mm, while the average annual temperature is around 26 °C.

3 Econometric Methodology

This section describes the two-stage methodological approach taken in estimating the relationship between hurricanes and efficiency. First, we detail the stochastic frontier approach, which is the first stage of the estimation. Second, we set up and discuss the hurricane-inefficiency model.

3.1 The Stochastic Frontier Approach

There are two commonly used frontier techniques for estimating the production efficiency frontier and technical efficiency: the stochastic frontier approach (SFA) and the data envelopment analysis (DEA), a nonparametric approach that does not require a priori assumptions and involves the use of linear programming to construct the production efficiency frontier to measure technical inefficiency (Coelli 1996; Coelli et al. 2005; Lee and Lee 2014). The shortcoming of the latter model is that it does not identify the difference between technical inefficiency and random errors, and does not allow for random shocks (Admassie and Matambalya 2002; Coelli et al. 2005; Arunsawadiwong 2007; Lee and Lee 2014). In contrast, the SFA model is a parametric approach where the form of the production function is assumed to be known and allows other parameters of the production technology to be estimated. The technique allows for the measurement of inefficiency and random shocks outside the control of economic actors to affect output level (Coelli 1996; Wadud 2003; Coelli et al. 2005). The error term can be decomposed into two components. The first error component is assumed to follow a symmetric distribution and is the standard error, and the other component captures inefficiency. The SFA model obtains technical efficiency scores free from distortion and statistical noise inherent in the deterministic DEA model. The disadvantage of the SFA model, however, is that because it is a parametric approach it is necessary to impose an a priori functional form and to specify distributional assumptions in order to separate the two components of the error term.

To study the impact of hurricanes on technical efficiency this study followed a two-stage approach. Technical inefficiency scores were estimated using the SFA model, where a Cobb–Douglas production function (the most commonly used functional specification) is applied. This step provides the estimated production function together with the technical efficiency scores. The estimation of the frontier rests on the idea that a maximum achievable output exists, which is constrained by available inputs. Inefficiency occurs if output lies within the frontier, while efficiency is achieved if output lies on the frontier. The distance to the frontier can then be calculated via technical inefficiency scores. The stochastic frontier model is represented by the following log-linearized equation:

and

where y is output, x is the vector of the log of inputs, \(c\) and \(\delta\) are country and time fixed dummies, respectively, ε is an error term consisting of the usual error term \(\omega\) and \(\upsilon\), the one-sided error term capturing inefficiency. The standard assumptions apply to Eqs. 2 and 3, that is, \(\omega\) and \(\upsilon\) are independent, where the former is also presumed to be independent of the vector on inputs. To estimate Eq. 2, we also included a time trend and its value squared to capture systematic technological changes in countries over time. We also included non-linear values of the inputs, namely capital (K) and labor (L), to allow for a flexible functional form of the production function.

3.2 The Hurricane-Inefficiency Model

To estimate the impact of hurricanes on production efficiency, we utilized the inefficiency scores obtained from the stochastic analysis and ran the following benchmark regression equation:

where \({\text{IE}}\) are the time-varying, country-specific inefficiency scores for each country i and year t, \(H _{it}\) is the country-specific indicator of hurricane damage that is calculated from Eq. 1, and \(X\) is a vector of other controls, specifically rainfall and temperature; l captures our lag inclusion for hurricanes, rainfall and temperature variables that go up to 3 years; and c and \(\gamma\) represent country and year dummies. We utilized a panel fixed effects estimator to account for country fixed effects ci. Finally, we employed Driscoll and Kraay’s (1998) hetereoskedastic consistent standard errors to take account of the possibility of cross-sectional and serial dependence among the error terms \(\varepsilon\). It is noteworthy to point out that arguably our estimates of β will be unbiased, given the inclusion of country fixed effects and time dummies and the fact that our index H is built on the physical features of the storms as well as pre-event population exposure.

4 Results

This section discusses our results in three parts. First, we discuss the stochastic frontier results. These results show how key inputs, capital and employment, affect output. Second, we use the inefficiency scores generated from the stochastic frontier stage to establish the hurricane-inefficiency link. The results show how our variable of interest, hurricane, and other weather variables affect inefficiency. Third, we estimate and discuss how inefficiency varied across the Caribbean countries.

4.1 Stochastic Frontier

We first investigated the stationarity of our variables using the Augmented Dickey Fuller unit root test and could not reject the existence of a unit root for output, labor, and capital. However, the Kao (1999) test of cointegration shows that these variables are cointegrated and we thus proceeded to estimate Eq. 2 as is. We estimated Eq. 2 using the stochastic frontier approach that allows for variation over time in inefficiency and elasticities of capital and employment. Such variation is important to identify changes in the structure of production (Puig-Junoy 2002). The results from our stochastic frontier production function model are shown in Table 2. Before estimating a more flexible model, we first estimated a more restrictive form of Eq. 2 by disregarding the non-linearity of production inputs. Table 2 shows the elasticities of output with respect to labor and capital, where unit changes are measured in millions. We estimated the percent change output for a percent change in labor and capital. As would be expected, labor and capital significantly increase output in the Caribbean as can be seen for both models. More specifically, for Model 2, our preferred specification that allows for non-linear effects, the estimates show that a 1% increase in labor and capital, on average, increases output by 3.1% and 0.8%, respectively. The time trend, which captures the rate of technical change, is negative and significant, implying that a 1% increase in technology generates a reduction in output by 0.02%. This may be due to the growth in the tourism and service industries in many islands since 1950.

As Table 2 shows, the squared value of employment is negative and significant, indicating that as the number of workers increases, their impact on production decreases—a 1% increase in the number of workers results in a 1.1% decline in output. Thus, the marginal product of labor increases at first, but declines as the labor input increases. This is not the case for capital as our squared value for capital is not significant. Our results therefore suggest that Caribbean countries are more highly labor rather than capital dependent in their production. The low elasticity of capital reveals that capital has a low share in Caribbean countries’ production.

4.2 The Hurricane-Inefficiency Link

After estimating Eq. 2 we obtained the efficiency scores from the production frontier, which we converted into inefficiency scores by taking their negative log. These are represented by the distance between the frontier and the production point. Inefficiency is determined by deviations from full production. The stochastic frontier approach decomposes variations from the best practice production frontier into a random error and a deterministic error, which is assumed to represent production inefficiency. Table 3 provides the average inefficiency scores for the Caribbean and each country in our study. The inefficiency score varies across the region—Barbados, with an inefficiency score of 0.061, is the least inefficient, whereas countries like Jamaica and Haiti, with inefficiency scores of 2.147 and 2.278, respectively, are the most inefficient. In general, the smaller service-based Caribbean economies such as Barbados, the Bahamas, and Dominica appear more efficient than the larger commodity-based economies such as Trinidad and Tobago and Jamaica.

Our main objective was to estimate the impact of hurricanes on the technical inefficiency score just described. To do so, we estimated Eq. 4 using a country fixed effects estimator with the inefficiency scores as our dependent variable and our hurricane destruction index as our independent variable of interest, and temperature and rainfall variables as controls. When interpreting the inefficiency effects model, negative coefficients indicate lower country inefficiency and, thus, increase efficiency. The estimated results for four models are shown in Table 4. Model 1 gives the results with the basic controls, rainfall and temperature at time t. Accordingly, we see that hurricanes negatively impact inefficiency—that is, hurricanes have a positive impact on production efficiency, which we attribute to the activities that take place after a storm, such as reconstruction activities.Footnote 9 Average rainfall and temperature, in contrast, have no effect on inefficiency.

We next progressively increased our lag structure of H by one for each additional model, using a similar lag structure also for the climatic controls. From Models 2 through 4 one can see that the estimates again show that hurricane events in the Caribbean have increased efficiency through the measures that are taken after events to reconstruct the economy. However, this efficiency boost is only short-lived, with no impact beyond the year of the strike, as is demonstrated by the insignificance of our lagged hurricane variables. One may want to also note that most of the weather controls are insignificant with the exception of temperature, which increases efficiency in the current time period and two periods after.

To get an indication of the economic impact we used the coefficient on our hurricane damage variable from Eq. 2 and multiplied this by the non-zero average and maximum hurricane wind speed strike over our sample period. The results for all four models for the average (maximum) storm effect are more or less the same (Table 5). For example, for Model 4, we observe that hurricanes increase efficiency by roughly 0.4% for the average storm and 8.5% for the strongest observed storm over our sample period. Thus, the impact is on average not very large, but can be substantial for very damaging storms—although only short-lived as the economy adjusts back to its equilibrium.Footnote 10 We can conclude that hurricanes play a role in creative destruction in the Caribbean in the year of a strike by boosting efficiency, though by a negligible amount, with no positive long-term effect.

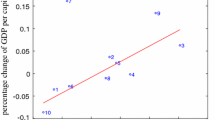

The preceding discussion assumed a linear relationship between inefficiency and hurricanes. So, we explored the relationship without any restrictions using a semiparametric fixed effects regression estimator where the hurricane variable enters the model nonparametrically. We thus were able to estimate the net nonparametric relationship (Libois and Verardi 2013) between the dependent variable, inefficiency, and the hurricane variable. The estimated relationship is shown in Fig. 1. As the figure shows, we obtained a more or less downward sloping line except for the large values of the hurricane index where we notice a somewhat linear outcome. This leads us to conclude that at lower levels of wind damage there appears to be a negative impact on production inefficiency.

4.3 Heterogeneities

Our results above constitute the average effect across the countries in our sample. We next investigated whether there are heterogeneities across countries. More specifically, Eq. 4 above is used to determine the different effects by allowing the coefficients to vary by country as follows:

where \(\propto_{c}\), \(\beta_{c }\), and \(\pi_{c}\) are vectors of coefficients, one for each country c. Table 6 presents the average and maximum effects for only the countries whose inefficiencies are significantly impacted by hurricanes. Panel A shows the country estimates, which reveal that hurricanes can negatively impact inefficiency differently across countries. Panel B presents the economic impact of hurricanes. The results reveal that the greatest average impact is felt in Anguilla with a 14.5% increase in efficiency, followed by the Dominican Republic with a 11.8% boost. Lower efficiency boosts are seen in Aruba (1.1%), the Bahamas (1.3%), and the Cayman Islands (0.6%). The impact in each country is significantly greater for stronger storms, where the impact is 23 times more than the average.

The question as to why the impact is greater in some countries than in others, or the existence of such general variation, is important. Perhaps this difference may be attributed to the income differences across countries, though this may not always hold for every country (Spencer and Urquhart 2018). Aruba, the Bahamas, and the Cayman Islands, for example, are high-income earning economies (with high GDP per capita) and their efficiency may be less vulnerable to hurricane strikes. These countries’ inefficiency scores (see Table 3) demonstrate that they are already more efficient; thus, there might not be a significant observed effect on their level of efficiency. In contrast, Anguilla and the Dominican Republic have lower GDP per capita, compared to the former three, and may be less resilient to the effects of hurricanes. The inefficiency scores for the latter two countries are higher than for the former; so, there is an opening for a hurricane boost in productivity to take place in their economies.

We next investigated whether income per capita may play a role in differences in productive efficiency responses to hurricanes. More specifically, using the World Bank’s 2017 data on GDP per capitaFootnote 11 for Caribbean countries, we categorized high-income earners as those with a GDP per capita above USD 10,000, and low-income earners as those with a GDP per capita below USD 10,000. High-income earners include Aruba, the Bahamas, and the Cayman Islands, while low-income earners include Anguilla, the Dominican Republic, Haiti, and Jamaica. We re-ran Eq. 4, but interacted a per capita income dummy variable—takes on a value of 1 if a country is a high-income earner and 0 if a country is a low-income earner—with the hurricane wind damage variable. Table 7 shows the result of this estimation. Consistent with the Table 4 results, there are no lagged hurricane effects, only a negative contemporaneous impact is observed on inefficiency, which implies an increase in productive efficiency after a storm. Although we observe a positive coefficient on the interaction between hurricane and income per capita, the total hurricane effect is a lowering of inefficiency as shown by the calculated values in Panel B. For a high-income earning economy, productive efficiency is increased by 0.02% for the average hurricane and by 0.52% for a stronger storm. Panel C demonstrates that lower income economies’ productive efficiency is boosted by 1.53% for an average storm and over 35% for a stronger one. These are outstanding increases compared to higher-income economies. Creative destruction is more apparent in economies that are low-income earners.

Our hurricane destruction index only captures the impact of winds, which we assume is correlated with other destructive features. One such feature is storm surge, which is more likely to occur in low-elevation areas. To very roughly take account of possible differences in this regard, we separated the countries into two categories, high elevation and low elevation. Those countries whose highest point is recorded at 1000 m and above are placed in the high elevation category, and those whose highest point is recorded at below 1000 m are placed in the low elevation category. We re-ran Eq. 4, but interacted an elevation dummy variable with the hurricane wind damage index. The dummy variable takes on a value of 1 if a country is highly elevated and 0 if the country is elevated at a low level. Table 8 shows the result of this estimation. The only significant variable is the interaction between our contemporaneous hurricane variable and the elevation dummy. So, elevation does play a role in reducing the inefficiency of countries that are highly elevated, thereby boosting their productive efficiency. Our estimated coefficient suggests a 1.65% increase in productive efficiency due to an average hurricane for those countries with geographical points elevated at 1000 m and above.

5 Discussion

In seeking possible explanations for the positive impact of hurricanes on efficiency in the Caribbean, potential reasons include increased government spending and insurance payments. Mohan et al. (2018) found that immediately following a hurricane, spending by Caribbean governments increased by 1.4% in the year of a strike for clean-up activities, with no further significant impact, leading to short-term improvements of productive efficiency with no long-term effect. Other studies contend that Caribbean government spending is highly volatile and, even in the event of a disaster, governments may not be able to increase spending for relief and clean-up (Crowards 2000; Rasmussen 2004), while others state that government spending actually decreases (Auffret 2003). Mohan et al. (2018) also posit that investment in the year of a hurricane event in the Caribbean is first positive and increases by 4.6% but subsequently becomes negative and declines by 0.3%. According to the study, the magnitude of the reconstruction effort in the year of a hurricane strike may be sufficient to cause an initial increase in investment by drawing on savings, followed by a subsequent decrease to replenish savings. Rasmussen (2004) similarly found an increase in investment in the year of a disaster strike for Eastern Caribbean countries, while Auffret (2003) showed that natural hazard-induced disasters resulted in a substantial decline in investment in the year of a strike for the region.

Foreign aid injections, which are used for disaster relief and clean-up activities, reconstruction, and the replacement of capital after hurricanes, could also temporarily boost production in the short term (Horwich 2000; Skidmore and Toya 2002; Raddatz 2007; Noy 2009; Strobl 2012; McDermott et al. 2014). Caribbean SIDS generally receive considerable external assistance for managing disaster risk and assisting with disaster relief. In 2009 the Caribbean Development Bank (CDB) developed the “Disaster Management Strategy and Operational Guidelines,” which seek to adopt a multi-hazard approach to disaster and climate risk management, with a focus on risk reduction, and provide loan financing, grants, and a combination of loan and grant funds (Kirton 2013). A range of international organizations also support disaster risk management in the region (Kirton 2013). The Caribbean has also established several agencies to cope with and manage disaster risk. The Caribbean Disaster Emergency Management Agency (CDEMA) is a regional intergovernmental agency for comprehensive disaster management that seeks to reduce the risk and loss associated with hazards. The Caribbean Community Climate Change Centre (CCCCC) stores information on climate-related threats, which is then used to help governments, the private sector, financial institutions, and nongovernmental organizations develop and implement various disaster adaptation strategies. The Caribbean Institute for Meteorology and Hydrology (CIMH) is a training and research organization that provides meteorological and hydrological services. The Caribbean Disaster Information Network (CARDIN) provides linkages with Caribbean disaster organizations. The study by Kirton (2013) looked at the Caribbean’s regional disaster response and management and showed some evidence that these institutions are better able to cope with the short-term impact of disasters and the provision of emergency assistance, rather than engaging in longer-term commitments.

The evidence of a short-term positive boost to efficiency provided by hurricane shocks to developing Caribbean countries presents important policy implications. The results suggest that disaster strikes provide governments with an opportunity to increase production efficiency and technological development, at least in the short term, thereby stimulating growth and development, through government expenditure, insurance payouts, and foreign aid. Consequently, the way governments distribute spending after a disaster has implications for production efficiency and economic growth. Moreover, a government’s management of natural hazard-induced disasters is multi-staged and involves mitigation, preparation, responding to, and recovering from disaster strikes. However, governments are often driven by political motivations and current budget allocations and spend disproportionately more on ex post disaster response, relief, and recovery that provide a short-term increase in productivity, compared to ex ante mitigation and preparedness. It is crucial that a strategy for government ex post disaster spending be articulated and implemented to achieve maximum benefit.

6 Conclusion

Our study adds to the scarce literature on the production efficiency effects of disasters. Unlike Halkos et al. (2015), we examined the specific case of hurricanes in the Caribbean, since different disasters have different production effects (Loayza et al. 2012) and country-specific characteristics can affect their impact (Noy 2009). Halkos et al. (2015) used the Emergency Events Database and a count measure of disaster damage that can result in measurement errors, while our hurricane destruction index provides an arguably better measure (Strobl 2011). Halkos et al. (2015) also used data envelopment analysis that, unlike the SFA, does not identify the difference between technical inefficiency and random errors, and does not allow random shocks to affect output. Nevertheless, our result of a short-lived efficiency boost, particularly due to stronger storms, is similar to Halkos et al. (2015).

Possible explanations for the short-term positive impact of hurricanes on production efficiency in the developing Caribbean include increased government spending, insurance payments, and foreign aid injection that are used for disaster relief and clean-up activities, reconstruction, and the replacement of capital after hurricanes, which could temporarily boost production in the short term. Government spending through government expenditure, insurance payouts, and aid following a disaster should therefore not only focus on clean-up and reconstruction expenditure, but also on restructuring and reinvestment expenditure, which may be of even greater importance. This is particularly important given that governments allocate a disproportionately larger share of expenditure to ex post disaster recovery, compared to ex ante mitigation strategies.

Notes

Anguilla, Antigua and Barbuda, Aruba, Bahamas, Barbados, British Virgin Islands, Cayman Islands, Dominica, Dominican Republic, Grenada, Haiti, Jamaica, Montserrat, Saint Lucia, St. Vincent and the Grenadines, Trinidad and Tobago, and Turks and Caicos Islands.

See Emanuel (2011) for a more detailed discussion on the relationship between wind speed and flooding/storm surge.

Note that local destruction is allowed to vary with wind speed in a cubic manner, since, as noted by Emanuel (2011), kinetic energy from a storm dissipates roughly to the cubic power with respect to wind speed, and this energy release scales with the wind pressure that acts on a structure.

See Auffhammer et al. (2013) for the importance of doing so.

An increase in efficiency due to hurricanes is facilitated through various channels. These channels might include any relief activities such as reconstruction and financial aid.

Examining the impact of hurricanes on Caribbean GDP growth rates, Strobl (2012) also found only a short-lived impact.

For information see: https://data.worldbank.org/indicator/ny.gdp.pcap.cd.

References

Admassie, A., and F.A.S.T. Matambalya. 2002. Technical efficiency of small- and medium-scale enterprises: Evidence from a survey of enterprises in Tanzania. Eastern Africa Social Science Research Review 1(2): 1–29.

Albala-Bertrand, J.M. 1993. Natural disaster situations and growth: A macroeconomic model for sudden disaster impacts. World Development 21(9): 1414–1434.

Arunsawadiwong, S. 2007. Productivity trends in the Thai manufacturing sector: The pre- and post-crisis evidence relating to the 1997 economic crisis. Ph.D dissertation. St. Andrews, Scotland: University of St. Andrews.

Auffhammer, M., S.M. Hsiang, W. Schlenker, and A. Sobel. 2013. Using weather data and climate model output in economic analyses of climate change. Review of Environmental Economics and Policy 7(2): 181–198.

Auffret, P. 2003. High consumption volatility: The impact of natural disasters? Policy Research Working Paper No. 2962. Washington, DC: The World Bank.

Banerjee, L. 2007. Effect of flood on agricultural wages in Bangladesh: An empirical analysis. World Development 35(11): 1989–2009.

Belasen, A.R., and S.W. Polachek. 2008. How hurricanes affect wages and employment in local labor markets. American Economic Review 98(2): 49–53.

Benson, C., and E.J. Clay. 2004. Understanding the economic and financial impacts of natural disasters. Disaster Risk Management Series No. 4. Washington, DC: The World Bank.

Bluedorn, J.C. 2005. Hurricanes: Intertemporal trade and capital shocks. Economics Papers No. 2005-W22. Oxford: Economics Group.

Boose, E., M.I. Serrano, and D.R. Foster. 2004. Landscape and regional impacts of hurricanes in Puerto Rico. Ecological Monograph 74(2): 335–352.

Coelli, T. 1996. A guide to DEAP version 2.1: A data envelopment analysis (computer) program. CEPA Working Paper 96/08. Armidale, NSW, Australia: Centre for Efficiency and Productivity Analysis, University of New England.

Coelli, T.J., D.S.P. Rao, C.J. O’Donnell, and G.E. Battese. 2005. An introduction to efficiency and productivity analysis, 2nd edn. New York: Springer.

Crowards, T. 2000. An index of inherent economic vulnerability for developing countries. Barbados: Caribbean Development Bank.

Driscoll, J.C., and A.C. Kraay. 1998. Consistent covariance matrix estimation with spatially dependent panel data. Review of Economic Statistics 80(4):–549–560.

Emanuel, K. 2011. Global warming effects on U.S. hurricane damage. Weather, Climate, and Society 3: 261–268.

Ewing, B.T., J.B. Kruse, and M.A. Thompson. 2009. Twister! Employment responses to the 3 May 1999 Oklahoma City Tornado. Applied Economics 41(6): 691–702.

Felbermayr, G., and J. Gröschl. 2014. Naturally negative: The growth effects of natural disasters. Journal of Development Economics 111(C): 92–106.

Halkos, G., S. Managi, and N.G. Tzeremes. 2015. The effect of natural and man-made disasters on countries’ production efficiency. Journal of Economic Structures 4(1): Article 10.

Hallegatte, S., and P. Dumas. 2009. Can natural disasters have positive consequences? Investigating the role of embodied technical change. Ecological Economics 68(3): 777–786.

Holland, G.J. 1980. An analytical model of the wind and pressure profiles in hurricanes. Monthly Weather Review 108(8): 1212–1218.

Horwich, G. 2000. Economic lessons of the Kobe Earthquake. Economic Development and Cultural Change 48(3): 521–542.

Kao, C. 1999. Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics 90(1): 1–44.

Kirton, M. 2013. Caribbean regional disaster response and management mechanisms: Prospects and challenges. The Brookings London School of Economics, Project on Internal Displacement.

Lee, S., and Y. Lee. 2014. Stochastic frontier models with threshold efficiency. Journal of Productivity Analysis 42(1): 45–54.

Leiter, A.M., H. Oberhofer, and P.A. Raschky. 2009. Creative disasters? Flooding effects on capital, labour and productivity within European firms. Environmental and Resource Economics 43(3): 333–350.

Libois, F., and V. Verardi. 2013. Semiparametric fixed-effects estimator. The Stata Journal 13(2): 329–336.

Loayza, N., E. Olaberría, J. Rigolini, and L. Christiansen. 2012. Natural disasters and growth-going beyond the averages. World Development 40(7): 1317–1336.

McDermott, T.K.J., F. Barry, and R.S.J. Tol. 2014. Disasters and development: Natural disasters, credit constraints, and economic growth. Oxford Economic Papers 66(3): 750–773.

Mohan, P. 2016. Diversification and development in small island developing states. The World Economy 39(9): 1434–1453.

Mohan, P., B. Ouattara, and E. Strobl. 2018. Decomposing the macroeconomic effects of natural disasters: A national income accounting perspective. Ecological Economics 146: 1–9.

Noy, I. 2009. The macroeconomic consequences of disasters. Journal of Development Economics 88(2): 221–231.

Noy, I., and A. Nualsri. 2007. What do exogenous shocks tell us about growth theories? Working Paper, No. 07-16. https://www.econstor.eu/bitstream/10419/64100/1/60462350X.pdf. Accessed 3 May 2019.

Pelling, M., and J.I. Uitto. 2001. Small island developing states: Natural disaster vulnerability and global change. Environmental Hazards 3(2): 49–62.

Puig-Junoy, J. 2002. Technical inefficiency and public capital in U.S. States: A stochastic frontier approach. Journal of Regional Science 41(1): 75–96.

Raddatz, C. 2007. Are external shocks responsible for the instability of output in low income countries? Journal of Development Economics 84(1): 155–187.

Rasmussen, T.N. 2004. Macroeconomic implications of natural disasters in the Caribbean. Washington, DC: The International Monetary Fund.

Sarmiento, C. 2007. The impact of flood hazards on local employment. Applied Economics Letters 14(15): 1123–1126.

Skidmore, M., and H. Toya. 2002. Do natural disasters promote long-run growth? Economic Inquiry 40(4): 664–687.

Spencer, N., and S. Polachek. 2015. Hurricane watch: Battening down the effects of the storm on local crop production. Ecological Economics 120: 234–240.

Spencer, N., and M. Urquhart. 2018. Hurricane strikes and migration: Evidence from storms in central America and the Caribbean. Weather, Climate, and Society 10: 569–577.

Strobl, E. 2011. The economic growth impact of hurricanes: Evidence from US coastal counties. Review of Economics and Statistics 93(2): 575–589.

Strobl, E. 2012. The economic growth impact of natural disasters in developing countries: Evidence from hurricane strikes in the central American and Caribbean regions. Journal of Development Economics 97(1): 130–141.

Wadud, M.A. 2003. Technical, allocative, and economic efficiency of farms in Bangladesh: A stochastic frontier and DEA approach. Journal of Developing Areas 37(1): 109–126.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Mohan, P.S., Spencer, N. & Strobl, E. Natural Hazard-Induced Disasters and Production Efficiency: Moving Closer to or Further from the Frontier?. Int J Disaster Risk Sci 10, 166–178 (2019). https://doi.org/10.1007/s13753-019-0218-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13753-019-0218-9