Abstract

This article summarizes a joint research project undertaken under the Risk Management Solutions, Inc. (RMS) banner to investigate some of the possible approaches for agricultural risk modeling in China. Two modeling approaches were investigated—the simulated weather crop index and the burn yield analysis approach. The study was limited to Hunan Province and a single crop—rice. Both modeling approaches were dealt with probabilistically and were able to produce probabilistic risk metrics. Illustrative model outputs are also presented. The article discusses the robustness of the modeling approaches and their dependence on the availability, access to, and quality of weather and yield data. We offer our perspective on the requirements for models and platforms for agricultural risk quantification in China in order to respond to the needs of all stakeholders in agricultural risk transfer.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

China is one of the world’s largest producers of many crops, as well as one of the biggest consumers of staple food crops such as rice and wheat. Government policies related to food production and food security have focused on increasing the efficiency of agricultural production, securing stable food supplies, and improving farmers’ quality of life. After the introduction of heavy subsidies for agricultural insurance in 2007, the Chinese agricultural insurance market, measured by the Gross Written Premium (GWP), became the second largest in the world following the U.S. agricultural risk market, and has steadily grown to over USD 3 billion in 2012. Such a high exposure requires solutions for risk quantification and risk transfer for all stakeholders. The list of stakeholders includes domestic insurance companies and international insurers entering the Chinese market, Chinese and global reinsurers, brokers, and government (state, provincial, and city governments). The foundation of such solutions is robust risk quantification that enables all stakeholders to have informed and solid views of the risks retained or transferred through insurance/reinsurance contracts.

In response to this practical as well as academic challenge, we examined two approaches for agricultural risk modeling and further explored the associated challenges of agricultural risk quantification in China, including availability, access to, and quality of weather and yield data, underlying uncertainties, and the use of yield based type of insurance products that are still dominant in China. The goal of the project was to identify and quantify the challenges of possible modeling approaches, and to evaluate the requirements for modeling agricultural risk in China, with the understanding that the progress of agricultural risk modeling is a process and maturity, complexity, and robustness of property catastrophe risk modeling takes time to achieve. It is also recognized that reliable models are immediately needed to respond to the needs of all stakeholders in agricultural risk transfer.

This article summarizes our investigation, the challenges and the two modeling approaches, and outlines our conclusions from the Hunan Province case study, as well as our views on the challenges and their resolution with respect to agricultural risk quantification in China in general.

We carried out the investigation between 2009 and 2011 at the county level using a hypothetical insurance structure that is similar to the Chinese agricultural insurance policies:

-

Premium of 6 %, in general set by the government, but subject to negotiation with local governments, and subsidized by the central, provincial, and local governments.

-

Coverage limit of RMB 280 Yuan/mu.Footnote 1

-

Full payment of RMB 280 Yuan/mu if yield reduction relative to expected yield is greater or equal to 70 %.

-

Reduced payment of RMB 140 Yuan/mu (50 % of limits) if yield reduction is greater than 30 % and less than 70 %.

Yield reduction is typically determined by a joint inspection of insurance company representatives, government representatives, and village representatives relative to the historically expected yield. No yield sampling—such as the crop cutting experiments in India—is conducted in China. The insurance structure used did not include government protection programs or other instruments (such as riders) intended to limit the risk for the primary insurance companies because these programs change annually before the start of the growing season.

In the literature, crop insurance pricing heavily relies on the use of historical crop yield data. The mainstream methodology follows the detrending-distribution fitting-pricing template (Coble et al. 2010). Generally, a time series of historical yields are fitted using a trend model and the residuals (detrended yield) are examined to derive a probability distribution. Yield loss risk is then measured by left-truncating the distribution at its mean or the guaranteed yield. By taking its expectation, the average yield loss rate as well as the pure premium rate can be derived (Deng et al. 2007). A variety of such trend models as well as distribution functions (Goodwin and Ker 1998; Atwood et al. 2002; Ker and Coble 2003) have been employed in empirical works, which also introduce large model uncertainty in practice (Sherrick et al. 2004; Ye et al. 2015). The procedure is also known as “burn yield analysis.” In simplest terms it could be articulated with fitting a distribution of the yield based on the observed (recorded) yields, probabilistic yield sampling from the distribution, and determination of the reduction of the yield (burn) to derive the risk metrics. For competent statistical inferences from recorded yield data, yield data series should be ideally 30 years or longer. In practice this is not achievable and inferences may be based on much shorter series lengths. Obviously, in such cases the procedure cannot adequately characterize the population of yield data, thus the large uncertainty.

The use and accuracy of the methodology can be heavily restrained in cases when data on agricultural yields (by crop areas sown and crop production), agricultural losses, and agricultural insurance statistics (including losses) are not systematically collected and archived, and/or are not publicly accessible. This is the case in many developing and low income countries. Similar data-related issues have also been reported in China (Du 2008). For extremely small sample sizes (for example, less than five years of yield records), this approach is simply not applicable because the data series length falls outside of the bounds of applicability, and as commented earlier, would render very large uncertainties in the statistical inference.

With the more recent development of weather-index insurance (Ibarra and Skees 2007), a weather index is increasingly employed in crop insurance pricing models. These models try to establish empirical relationships between crop yield reduction and a specific weather index, and analyze crop yield loss risk by measuring the statistical distribution of the associated index. This approach appears to be superior in some aspects to burn yield analysis. The weather index approach associates yield reduction with weather factors, which can be regarded as the “vulnerability” relationship. Burn yield analysis does not account explicitly for any specific factor, but instead treats all yields below the estimated mean as a “reduction.” Weather data also generally have longer observation series than crop yields. Even if the yield series satisfies the minimum requirement of statistical inference (for example, more than 30 years of observation), a weather index can help to better reveal extreme unfavorable weather conditions affecting the yields than is the case by solely using a yield series.

The weather index approach also has its own challenges. For example, since 2007 India has been implementing a pilot Weather Based Crop Insurance Scheme (WBCIS) across the country (Agricultural Finance Corporation 2011). The big challenge to this approach is estimating the basis riskFootnote 2 at high spatial resolution (for example, village or group of villages). Two primary factors driving the basis risk have been identified: (1) the density of the weather stations measuring the weather parameters and proximity of the weather stations to the covered area under WBCIS. The goal has been to reduce it to 5 km; and (2) the design of the WBCIS insurance product (insurance policy) that should correlate well the yield with the weather parameters in the index causing stress to the plants (for example, inadequate rainfall, abnormal temperature, and so on). Solving the issues related to the basis risk at higher spatial resolutions is critical for the success of the weather index approach in practice.

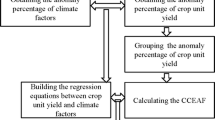

We investigated the two modeling approaches at the county level for their effectiveness, applicability, and reliability for crop risk modeling as a basis for risk transfer across the chain of stakeholders (farmers, Chinese and international insurance companies, Chinese and international reinsurers, and government). The procedures applied to the two modeling approaches can be summarized as follows:

-

(1)

Simulated Weather Crop Index (WCI)

Long-term simulation (1000 years) of weather over China, development of a weather crop index (WCI) that should correlate well with observed recorded yields, simulation of the WCI, development of correlations between the observed WCI and the historical yields, simulation of crop yield reduction, derivation of risk metrics (AEP—aggregate exceeding probability; AAL—average annual loss; St. Dev.—standard deviation of the annual loss). In China most of the crop losses are attributed to drought or floods, and the focus of the simulation was on drought (or insufficient rainfall).

-

(2)

Burn Yield Analysis

Yield simulations based on the available time series of recorded yields at the county level (minimum 10 years), modeling of yield volatility within the county, simulation of yield reduction, and derivation of insurance risk metrics.

2 Availability of Weather and Rice Yield Data

Weather data are an important input for agricultural risk quantification for weather based risk transfer solutions, as well as for application of WCI based approaches. We used daily precipitation data from 1951 to 2006 from 742 stations across China. China has more than 2000 counties and Hunan Province has 122 counties, which were covered with only 20 weather stations. This was a significant challenge to the project. We addressed it by assimilating the reanalyzed gridded data (ERA 40, and Climate Research Unit (CRU) of the University of East Anglia with the aforementioned observed station data). This resulted in a 43-year gridded daily precipitation data series.

Rice yield data should include yield data for the rice varieties cultivated in Hunan Province. Hunan and other provinces along the Yangtze River cultivate three types of rice:

-

Early rice—planted in February to April and harvested in June to July.

-

Intermediate (single-crop) late rice—planted in March to June and harvested in September to October.

-

Late rice (double-crop)—planted after the early crop has been harvested and harvested in October to November.

For high-resolution physical modeling these broad rice crop types need to be further refined with the rice production phases—start of land preparation, sowing, plant emergence, transplanting, maturity, and harvest.

We obtained county level rice yield data for the 122 counties in Hunan (including major cities) from the Hunan Agricultural Statistical Yearbook 2000–2009 (Statistical Bureau of Hunan Province 2010). This statistical yearbook provides data for the planted area, yield, and production of the three types of rice. Only available in hard copy, we extracted and compiled the data into an electronic version. For 2002, for example, rice cultivation statistics were only reported for 118 counties in the 2010 statistical yearbook—data for the remaining four counties were approximated with their average yield across the available years. The three top rice producing counties were identified as Ningxiang (with 3.2 % of Hunan’s total rice production), Xiangtan (3.1 %), and Hengyang (2.7 %). There are large variations in rice yield across the counties in Hunan Province. In 2008, for example, rice yield varied between 4860 kg/ha and 7665 kg/ha.

We also made efforts to utilize Hunan Province Statistical Yearbook 1986–2008 (Agricultural section) (Statistical Bureau of Hunan Province 2009) in order to cross-reference the yield and planted area data, as well as to enhance the data quality in general. However, we could not use this source due to large gaps in data, including frequently missing planted area data and sparse yield data; and inconsistent reporting of the total production.

3 The Modelling Approaches

In order to rationally quantify (introduce a measure of) the variability of the yield within a county (farm to farm variability), as well as to reduce uncertainties in mapping the yield to insured loss, in 2011 a limited size survey was conducted in the village of Kuangjiaqiao in Xiejiapu Town, Changde City. This survey captured the insured loss experience over 4 years (2007–2010). The survey covered early rice (92 surveyed farmers), intermediate rice (77 farmers), and late rice (96 farmers). Based on the survey data, we fitted a lognormal distribution to capture the volatility of the insured mean loss ratio, resulting in a standard deviation of 20 %. For further investigations we used the same rice yield volatility for both of the modeling approaches, and for all counties in Hunan.

3.1 The Simulated Weather Crop Index (WCI)

We simulated 1000 years of precipitation over China, while accounting for spatial and temporal correlation at the 50 km grid resolution. The simulated rainfall events are statistically equivalent in frequency and intensity to and correlate with observed precipitation at the rainfall stations. The continental-scale rainfall events evolve over time as they move across land. The resulting simulated rainfall footprints are realistically irregular, and the volume of rain is not uniform throughout the footprint. This work was based on accepted principles (Lorenz 1956). Our Monte Carlo simulation methodology can be summarized as follows:

-

(1)

Blend and cleanFootnote 3 the weather data, based on the 43 years of observed and reanalyzed grid data.

-

(2)

Calculate and normalize monthly rainfall anomalies. Anomaly P is defined as the difference between the monthly observed rainfall and the long-term monthly average rainfall. Normalized anomaly P′ is obtained through a power transformation P′ = P **0.4. Anomalies were grouped in seasons—Winter (November, December, January, February); Spring/Autumn (March, April, September, October); and Summer (May, June, July, August). Transformed anomalies are independent and Gaussian distributed, which was verified with the K-S test at 90 % significance level. Figure 1 shows pixels that failed the test (50 km grids) for the Spring/Autumn anomalies. The fraction of pixels that was rejected was 0.11.

-

(3)

Perform a principal component analysis (PCA) of monthly rainfall anomalies using the empirical orthogonal function (EOF) approach (Lorenz 1956)—a standard approach in meteorology, adapted for this project. EOF analysis of the seasonal data consists of linear recombination of typical anomaly patterns (EOFs) to capture large-scale features, and adding spatially correlated noise for features of small scales (Fig. 2).

Final monthly rainfall simulation is conducted by adding the scaled climatology (long term average of a climate variable) on top of the simulated monthly anomalies and performing an inverse power transformation.

Several principal components (patterns) are needed to represent the weather signal. In this simulation, the number of patterns for each season was determined so that they can account for 70 % of the variance. By applying a Monte Carlo sampling to the principal components loadings that are Gaussian distributed, it is straightforward to simulate a 1000-year time series of principal components (PCs). New anomalies can be obtained by recombining the EOFs and PCs. They are statistically similar to those observed historically in the 43 years of clean data. Adding the residual noise is necessary to capture the remaining 30 % of the variance. Using the covariance matrix of the residual noise, it is possible to generate random fields with the same covariance matrix. As an example, spring/autumn EOFs are shown in Fig. 3.

The crop weather index we used in this study did not require daily precipitation data. However for future work and indices associated with phenological crop phases, we also simulated daily precipitation patterns by downscaling the monthly precipitation to daily precipitation while maintaining simulated rainfall footprints being realistically irregular with non-uniform volume throughout the footprint. This has been achieved by using monthly simulated patterns, and for each simulated month finding in the observed (recorded) data the same month for which the differences between the observed and simulated principal components (PC’s) are minimal (that is, finding the most similar observed monthly precipitation). Downscaling the simulated monthly precipitation to daily precipitation has been completed using the observed daily pattern.

Simulation results were validated across China. Some of the validations are shown in Figs. 4, 5 and 6.

Validations of the 1000 year simulated rainfall show that simulated rainfall follows the distribution patterns of the observed rainfall and captures the observed correlation in space and time. These data can be used in statistical forecasting and/or correlation analysis between rainfall and rice yield for this study at any of the simulated temporal resolutions—daily, monthly, seasonal, and annual.

The WCI approach requires a relationship between a weather parameter, or weather parameters, and rice yields at the county level. In Hunan Province rice is produced from February to November, with the three rice types being cultivated almost continuously over the year. For this study, we used annual rainfall data at the county level, and developed a relationship between the average county rice yield (across all three types of rice) and the difference between the annual county rainfall and the annual expected county rainfall (annual rainfall anomaly). Each of the 122 counties was linked to one of the 20 available weather stations. Using the 10-year yield data from the Hunan Agricultural Statistical Yearbook 2000–2009 and the 2000–2009 rainfall data from the weather stations linked to the Hunan counties the relationship between the rice yield and the annual rainfall anomaly was derived. Example for Dingcheng County of such a relationship is shown in Fig. 7.

In a number of counties the correlation between the rice yield and the rainfall was not very clear. Factors contributing to this include a combination of the very low density of weather stations, appropriateness of the weather parameter, lack of information on trends in changes of rice varieties, and elements of farming practices including irrigation. Addressing these issues was beyond the scope of this investigation. But the result of an expanded investigation would still be constrained by the availability, access to, and quality of the data required to address these issues. For a number of counties we used the yield-weather index relationship of the nearest (neighboring) county where this relationship was better defined.

Gross loss which is defined as insurer’s loss net of deductible before reinsurance was modeled for each simulated year and county by first determining the “attachment points” for the full and partial payouts (that is, 70 and 30 % reduction relative to the expected rice yield). Following that, we fitted a lognormal distribution of the yield for a given year and county, using the expected yield, and the standard deviation identified from the survey data. Mean gross loss and its standard deviation (for a given county and year) were determined from this distribution.

For loss aggregation across counties to the provincial level or group of counties, we assumed that the county gross loss follows a Beta distribution (frequently used in catastrophe risk modeling). Parameters of the distribution were determined from the county exposure,Footnote 4 and the loss mean and standard deviation of the county loss. The probability density function (pdf) of the county gross loss was sampled at a large number of predefined points. This discrete pdf was weighted by 1/1000 (for simulation length = 1000). Summation across all 1000 years of simulated rainfall of the weighted pdfs for a given county results in a discrete distribution of the county gross loss.

The mean gross loss for the province was obtained as the sum of the mean county gross losses. Yield variations across the counties could be assumed to be independent, on the basis of which the standard deviation of the province gross loss was defined as a square root of the sum of the squares of the county standard deviations of the gross loss.

Figures 8, 9, 10, and 11 show gross loss aggregate exceeding probability function (AEP) for Hunan Province and Dingcheng County, and county level average annual loss (AAL) and premium distribution in Hunan Province.

3.2 Burn Yield Analysis

Burn yield analysis is based on a probabilistic yield distribution from which expected yield and probabilities of different yield levels could be determined. Our analysis was based on transformation of the physical domain (yield) into insurer’s loss domain (gross loss—net of deductibles and reinsurance). As mentioned in Sect. 2, we relied on the 10 years of county level rice yield data for the 122 counties in Hunan from the Hunan Agricultural Statistical Yearbook 2000–2009 (Statistical Bureau of Hunan Province 2010). For each recorded year and for each county, we fitted a lognormal distribution with mean equal to the recorded yield and 20 % standard deviation (based on the results of the survey). By applying the details of the assumed insurance policy (please refer to Sect. 1 for details) and using this log normal distribution we derived the standard deviation and the expected value of the insurer’s county gross loss for each recorded year. Province level gross lossFootnote 5 for each recorded year was defined with its mean (sum of the means of county gross losses) and standard deviation (under the independence assumption, as square root of the sum of the squares of the county standard deviations of the gross loss). We used the expected province level gross losses and their standard deviations to fit a Beta distribution of the province (portfolio) level gross loss. The Beta distribution was sampled in 2000 discrete points for construction of the AEP and other risk metrics.

Figures 12, 13 and 14 show the gross loss AEP function for Hunan Province and Dingcheng County, and the county level AAL using the burn yield analysis approach.

3.3 AEP Comparisons Between the Two Agricultural Risk Modeling Approaches

We compare the AEP curves and gross RMB losses in the two agricultural risk modeling approaches for short 5-year and long 30-year return periods (RP) at the Hunan provincial level and at the Dingcheng county level (Figs. 15, 16). Comparisons, as expected, are better at the provincial than the county level.

At the provincial level the two AEP curves are smooth and similar in shape, with a clearly defined long tail. The burn analysis losses consistently exceed the simulated losses by about 30 %. The five-year return period burn analysis loss is 46 % higher, and the 30-year return period loss (further in the tail) is 36 % higher. The differences in losses could be attributed to the fact that both modeling approaches are statistical without an underlying physical model as a foundation. They heavily depend on the quality and length of the time series used for the related statistical inferences.

At the Dingcheng county level the AEP curves cross at a return period of about 4 years and losses for return periods of up to 10 years are quite similar. For the five-year return period, the burn analysis loss exceeds the simulated loss by 18 %. However, the comparisons break down further in the tail—at the 30-year return period the difference grows to more than 500 %. This shows that at this level of resolution, risk metrics exceeding the length of the key data series (we used 10 years of rice yield data) are highly unreliable.

4 Discussion

The intent of our investigation was not to find the best modeling approach to respond to the needs of agricultural risk insurance in China. Rather, we wanted to identify the key challenges and obstacles to the two crop risk modeling approaches (which are used for agricultural insurance pricing), their dependency on data, and ways to overcome these challenges in the environment under which agricultural insurance operates in China.

4.1 Agricultural Risk Insurance from a Broader Perspective

Although subsidies from the public sector in China are substantial, agricultural insurance transfers only part of the agricultural production risk. With premiums pre-set, insurance companies need tools to assess the crop risk and ensure that they can underwrite the risk for such premiums. Application of insurance pricing models requires risk metrics (that is, AEP—aggregate exceeding probability function; AAL—average annual loss; St. Dev.—standard deviation of the annual loss). Risk metrics are produced by crop risk models like the ones discussed in this article. Premium that the insurance company collects should cover the AAL plus its expenses and profit margins. It should also account for the volatility of the loss and occurrence of large widespread losses due to possible occurrence of large spread extreme events (catastrophe—Cat events). Standard deviation risk metric is also used in pricing models since it captures loss volatility due to Cat events. Typically some percent of the standard deviation is added on the top of the premium as Cat loading. Additionally, AEP curve is used to determine losses at selected return periods while evaluating the need for the insurance company to purchase reinsurance to transfer part of the risk and to protect itself from catastrophic loss. The principal challenge for crop risk models, similar to the models discussed in this article, is that their foundation is statistical in absence of robust data. They are not physical event based, and do not model agricultural risk in the structured risk modeling framework, which has become a standard way of modeling Cat risk for property insurance. Structured risk modeling framework consists of event definition/occurrence, hazards created by the event, exposure to the hazards, vulnerability of the exposure units to the hazards, quantification of the damage, and monetization (converting the damage into monetary effects) of the loss. Despite this deficiency of the crop risk models, they appear to satisfy the needs from the perspective of insurers, reinsurers, and brokers.

Public sector agricultural enterprise comprises not only farm production, but also human development, rural development, improvement of quality of life of the agrarian populations, and so on. Therefore use of statistical crop risk models is not sufficient to quantify the agricultural risk of the public sector. Stojanovski and Muir-Wood (2015) argue for the creation and use of comprehensive disaster risk modeling for agriculture (AgriCat models) capable of quantifying the risk across the entire agricultural enterprise. The goal of such an effort is geared towards enabling governments to promote comprehensive and holistic agricultural risk management programs, involving improved resilience of the agricultural sector as well as risk transfer through insurance/reinsurance mechanisms. This is justified when there is significant exposure to disasters, with significant proportions of economic activity, rural development, poverty eradication, human development, and livelihoods are associated with and dependent on agriculture. The AgriCat risk modeling framework is based on the principles of structured physical risk modeling for property Cat risk, employing the probabilistic event based approach. Such models do not exist today, but in principle there is no significant conceptual or modeling hurdle to be overcome in order to create and use them (Stojanovski and Muir-Wood 2015). With the use of AgriCat models, crop risk and insurance pricing models could be related to the public agricultural risk in such a way that standard crop insurance pricing models (which still need improvements) could remain as basis for a “frequency cover” for short loss return periods of the agricultural incomes and insurance losses, combined and supplemented with catastrophic loss insurance arrangements (catastrophe cover, Cat cover) by the governments for long loss return periods to protect the livelihood of the farmers against direct and indirect effects of a disaster. The AgriCat modeling framework covers the entire range of return periods, and provides stochastic event based tail catastrophe losses from extreme events associated with significant damage and disruption to the entire agricultural enterprise including insurance.

In addition to weather index based and yield based insurance instruments, multi-peril crop insurance (MPCI) could also be considered to provide broader coverage for agricultural production. MPCI offers combined coverage for several perils, some combination of excessive rainfall, floods, drought, pests, diseases, and so on. It is more sensitive to the occurrence of catastrophic, extreme events for the farmers, insurers, reinsurers, and government rural development, human development and agricultural programs.

Development and application of AgriCat models would significantly enhance the comprehensive and holistic view of risk to the entire agricultural enterprise, particularly from the public sector perspective. This area could be on the agenda of future research work to better understand and quantify agricultural risk so that a comprehensive and balanced approach for its management could be developed and implemented, including risk mitigation, risk retention, and risk transfer to insurance/reinsurance.

4.2 Differences Between the Results of the Two Modeling Approaches

Regarding the differences between the two modeling approaches and the causes for the divergence of their results, the core of both approaches is statistical, though some components (for example, rainfall) include physical modeling. Without a physical foundation it is not really possible to judge which model represents reality better. The choice of the modeling approach is often driven by the available data at highest resolution. Also, a competent roadmap of the models is needed to show the progression and improvements in the model over time in order to address its deficiencies and gain credibility with its users. Our investigation demonstrated that both approaches—“simulated weather crop index” (WCI) and “burn yield analysis”—could be implemented at the county level in ways that produce the necessary probabilistic risk metrics required for risk underwriting, risk transfer, and risk management. It is clear that both approaches are only as robust as the data they rely on, and heavily depend on loss data (physical loss and insured loss) for validation and calibration. It was beyond the scope of this investigation to further calibrate the models. Loss data remain one of the key ingredients and challenges for building robust models for agricultural risk assessment in China and elsewhere.

The simulated weather crop index approach achieves excellent correlation between simulated and observed rainfall (necessary, for example, for modeling drought conditions) at the macroscale. However, the low density of weather station coverage makes large-scale applicability problematic. Correlating yield losses with weather parameters proves to be very challenging because of the low density of station coverage and the limited crop specific yield data. In general, the correlation between the weather parameter rainfall and yield was not strong and in some cases it was weak.

In the Chinese agricultural insurance market, this relationship needs to be developed for large numbers of crops (Beijing Municipality, for example, insures close to 20 food and cash crops), which is a significant challenge to model development. The limited number of ground weather stations also impacts the implementation of weather based parametric crop insurance solutions (which have been widely used in India) to complement yield based approaches.

Burn yield analysis relies on competent crop specific yield time series (including areas planted, production, and crop variety) at the county level (preferably 10 years or more, and ideally 30 years or longer). This type of modeling cannot be very robust if the data is of insufficient time series length and quality. Getting these data proved to be difficult in Hunan, and such data for other crops and provinces may not be available or accessible. If data of the necessary resolution and quality are available, a robust burn yield analysis could be used to derive the risk metrics.

Ultimately, the choice of the modeling approach critically depends on the availability, resolution, accessibility to, and quality of the weather and yield data. Any modeling approach to address the needs for agricultural risk quantification needs to choose the method on the basis of available data at the highest spatial resolution possible.

4.3 Improving the Models to Satisfy the Needs

Chinese agricultural insurance in the contemporary sense has a short history—aggressive promotion and implementation started in 2007 and the insurance volume has steadily grown every year since. Models based only on yield and weather data without solid insurance loss validations, no matter how sophisticated internally, cannot produce results for effective use in risk transfer transactions in the market. Since 2007, insured loss experience has been growing in China for both insurers and reinsurers, and it is paramount that this data can be accessed and used for validation of the risk models.

A look at the context of how agricultural insurance/reinsurance is implemented in China is instructive. Once a year, the government releases the underlying policy terms and conditions and the level of government protection for the year for all provinces where agricultural insurance is implemented. These conditions apply to all insurers operating in China and are subject to changes every year. In 2012, Hunan Province policies, for example, covered five crops (paddy rice, cotton, rape, corn, and sugar cane—more crops insured than in the previous year). Insured perils (multi-peril coverage) as well as premium rates and the sums insured were crop specific. Government subsidies (between central, provincial, and county governments), type and level of deductibles, and provincial government protection plans (such as provincial catastrophe funds) are also announced by the government. Reinsurers write part of the agricultural risk as quota share or stop loss reinsurance programs. This environment could be described as dynamic with many government instituted constraints in a quasi-market environment. The size of the total gross premiums written has attracted and is still attracting many international insurers and reinsurers to enter the agricultural insurance market in China. Agricultural insurance in China also includes livestock and forestry in combination with crops, and likely these exposures are “packaged” for transfer to reinsurers. Players in this changing complex environment need tools to integrate this information into their view of risk and workflows. However, these types of tools need to be complemented and replaced over time with physical robust models to quantify the risk (preferably to cover crops, forestry, and livestock). A feasible avenue for this could be to start with improvements to the statistical models based on years of reported losses through official robust Chinese statistics. Undoubtedly this would be useful, but this kind of modeling cannot be termed “catastrophe” modeling and cannot provide holistic quantification of the agricultural risk for the public sector and for insurance (as discussed at the beginning of this section). Models capable to achieve this (for example, the AgriCat modeling concept) need to be developed and implemented in practice.

5 Growth Path of Agricultural Risk Models

Finally, we want to offer our perspective on the requirements and the growth path of models and platforms for agricultural risk quantification in China.

-

Models should effectively respond to the immediate and critical needs of the stakeholders (farmers, insurers, reinsurers, and governments). Modeling platforms should support the workflows and details of how agricultural insurance operates in China. Original terms and conditions, government protection programs, and other embedded risk transfer mechanisms should be part of the modeling platform workflows to facilitate an informed risk view from the perspectives of all stakeholders.

-

Modeling platforms should cover all lines of business—crops, livestock, and forestry at the level of resolution required in the markets.

-

Models should grow to incorporate new loss, research, and other data leading to robust high resolution physical risk models that competently capture and quantify the correlations across geographies and lines of business. Models should be particularly robust in the quantification of the tail risk. In this context, users should be very cautious when using agricultural risk pricing tools developed on the basis of extremely short time series using low resolution coarsely aggregated loss estimates.

-

Models should be nonprescriptive in the sense of being nimble to accept, support, and integrate different modeling approaches across China that are most appropriate given the data. Use of satellite based measurements (inclusion of virtual weather stations, development of synthetic yield data and yield forecasting, and so on) could greatly help in overcoming some of the data challenges.

-

Models need to incorporate the yield variations across a county (reflecting the impacts of topography, farming practices, irrigation, crop varieties, and so forth).

-

Models have to be regularly and extensively benchmarked and updated against the historical loss experience—both physical and insured loss, using actual claims data.

Notes

1 ha = 15 mu. As of 2012 the premium was 5 %, coverage limits were RMB 320 Yuan/mu.

Note that weather index approach is premised on a correlation of a weather index (single or multiple weather parameters) with the yield. Weather parameters chosen for the index affect crop development through its life cycle (phenological phases) and reflect crop requirements for achieving full maturity and yield. Rather than assessing the actual losses, insurance payments are based on specific index values. Basis risk refers to situations when the index indicates loss (yield reduction) while in reality this may not occur, or when the index indicates no loss contrary to the observed loss. Basis risk cannot be avoided, and increases as the spatial resolution of the area modeled increases (requiring good index correlation with the loss at such resolution).

Cleaned data refers to the historical data after corrections for missing or erroneous (e.g. minimum values bigger than the maximum values) records. Corrections are based on estimated values based on comparisons with records of the neighboring stations and analysis of the local micro-climate biases. Clean data contains a continuous and complete historical time series of daily values.

Exposure was defined as the product of the total county sown area and the maximum payout of RMB 280 Yuan/mu.

Province level loss could also be referred to as the insurer’s portfolio loss.

References

Agricultural Finance Corporation. 2011. Report on impact evaluation of pilot weather based crop insurance study (WBCIS). Mumbai: Agricultural Finance Corporation Ltd. Head Office. http://agricoop.nic.in/imagedefault/credit/WBCIS-FINAL%20REPORT-060211.pdf. Accessed 6 Dec 2015.

Atwood, J., S. Shaik, and M. Watts. 2002. Can normality of yields be assumed for crop insurance? Canadian Journal of Agricultural Economics/Revue Canadienne D’agroeconomie 50(2): 171–184.

Coble, K.H., T.O. Knight, B.K. Goodwin, M.F. Miller, and R.M. Rejesus. 2010. A comprehensive review of the RMA APH and COMBO rating methodology. RMA contract report. Washington, DC. http://www.rma.usd-a.gov/pubs/2009/comprehensivereview.pdf. Accessed 6 Dec 2015.

Deng, X.H., B.J. Barnett, and D.V. Vedenov. 2007. Is there a viable market for area-based crop insurance? American Journal of Agricultural Economics 89(2): 508–519.

Du, L. 2008. On the reform and development of agricultural insurance statistical scheme. Insurance Studies 3: 45–48 (in Chinese).

Goodwin, B.K., and A.P. Ker. 1998. Nonparametric estimation of crop yield distributions: Implications for rating group risk crop insurance contracts. American Journal of Agricultural Economics 80(1): 139–153.

Ibarra, H., and J. Skees. 2007. Innovation in risk transfer for natural hazards impacting agriculture. Environmental Hazards 7(1): 62–69.

Ker, A.P., and K. Coble. 2003. Modeling conditional yield densities. American Journal of Agricultural Economics 85(2): 291–304.

Lorenz, E.N. 1956. Empirical orthogonal functions and statistical weather prediction. Massachusetts Institute of Technology, Cambridge, MA, USA. http://www.o3d.org/abracco/Atlantic/Lorenz1956.pdf. Accessed 6 Dec 2015.

Sherrick, B.J., F.C. Zanini, G.D. Schnitkey, and S.H. Irwain. 2004. Crop insurance valuation under alternative yield distributions. American Journal of Agricultural Economics 86(2): 406–419.

Statistical Bureau of Hunan Province. 2009. Hunan Province statistical yearbook 1986–2008 (Agricultural section). Changsha: Statistical Bureau of Hunan Province.

Statistical Bureau of Hunan Province. 2010. Hunan agricultural statistical yearbook 2000–2009. Changsha: Statistical Bureau of Hunan Province (in Chinese).

Stojanovski, P., and R. Muir-Wood. 2015. Comprehensive disaster risk modeling for agriculture. Planet@Risk 3(1): 158–167.

Ye, T., J.L. Nie, J. Wang, P.J. Shi, and Z. Wang. 2015. Performance of detrending models for crop yield risk assessment: Evaluation with real and hypothetical yield data. Stochastic Environmental Research and Risk Assessment 29(1): 109–117.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Stojanovski, P., Dong, W., Wang, M. et al. Agricultural Risk Modeling Challenges in China: Probabilistic Modeling of Rice Losses in Hunan Province. Int J Disaster Risk Sci 6, 335–346 (2015). https://doi.org/10.1007/s13753-015-0071-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13753-015-0071-4