Abstract

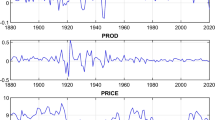

The dynamics of metal prices are highly significant for worldwide economic activity due to metals being key intermediate inputs to industrial production and construction and treated as investment assets. In that sense, this study investigates the efficient market hypothesis, i.e., predictability of price patterns, for several non-renewable resources, namely copper, lead, tin, nickel, zinc, aluminum, gold, platinum, and silver. Our period covers 1980Q1–2019Q4, during which metal markets witnessed many extraordinary times due to market-specific and global factors. Accounting for the importance of the potential breaks in the analysis of stochastic properties of non-renewable resource prices, we utilize two different stationarity tests; one is designed to capture smooth breaks, and the other one is designed to detect abrupt changes in the prices. Our empirical results reveal that none of the prices, except silver, can be characterized by the efficient market hypothesis. They follow stationary and predictable patterns with structural changes related to market-specific and global economic events, though concerns on economic uncertainties appeared to be more effective on precious metals.

Similar content being viewed by others

Data availability

The data used in this study are available from the corresponding author upon request.

Code availability

The GAUSS code used for the analysis is available from the corresponding author upon request.

Notes

The Malthusian approach states that natural resources are fixed in supply, and their demand grows with population, which puts upward pressure on resource prices. However, due to technological advances, which enable the exploration of new reserves, the supply is not considered entirely fixed. Technological progress further leads to cost reductions, increases in labor productivity, efficiency gains, and improvements in workers’ safety through automated, remote-controlled, and autonomous types of equipment. Hence, innovation plays an essential role in the mining industry by loosening the supply constraint and leading to price declines even in the face of volatile commodity markets.

The reason behind selecting this set of non-renewable resources is that although different groups of resources are analyzed in the literature, copper, lead, tin, nickel, zinc, and aluminum are the ones investigated in almost all studies. For precious metals, gold, silver, and platinum are selected, while palladium, one of the metals commonly used in the literature, is excluded due to data constraints.

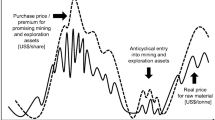

Regarding cyclicality, it is worth mentioning that a common characteristic of metal prices is that periods of rising prices (expansions) are generally followed by falling prices (contractions). There are many studies, including Davutyan and Roberts (1994), Cashin and McDermott (2002), Roberts (2009), and Rossen (2015), examining whether these fluctuations are sufficiently regular to be characterized as cycles or they occur randomly. Despite some differences, those studies agree on the finding that some of the fluctuations are not purely random and show some degree of cyclicality. Rather than being confined to a single filtering procedure, a comprehensive analysis covering various different filters designed for specific data characteristics is required to analyze the cyclicality in the metal price. In our study, in line with all existing empirical studies in the literature, we limit our scope to propose a reliable testing procedure for the market efficiency hypothesis without accounting for metal price cycles. We agree that the cyclicality of the metal prices is an issue that requires great attention and leave it for future research. We are grateful to an anonymous referee for bringing this valuable extension to our attention.

In their papers, Carrion-i Silvestre and Sanso (2007) have proposed seven different specificants for the deterministic terms that are represented by \(f\left( {t,T_{b1} ,T_{b2} } \right)\). Among them, we select the most general form that allows for two structural changes in the intercept and trend terms. For other deterministic specifications, see Carrion-i Silvestre and Sanso (2007).

When we extend the grid search procedure for each integer value of \(k \in \left[ {1,5} \right]\), we observe no substantial change in the reported results.

Russia was the second largest primary aluminum producer after the USA in years 1992 and 1993 (Bureau of Mines 1993:107).

The first exchange-traded fund backed by gold is established in 2003.

Given the historical correlation between gold and silver, the nonstationarity finding for silver prices can sound surprising while gold prices follow a stationary path. To clarify this point, we can recall that there are numerous studies on the co-movements of gold and silver (e.g., Ciner (2001); Escribano and Granger (1998); Lucey and Tully (2006); Soytas et al. (2009), Rossen (2015)). Overall, results indicate that the connection between gold and silver prices depends on the time period under consideration, and they have become more separated over time. The reason behind such a divergence, which is more apparent in the short run, is that these precious metals do not belong to one great pool due to their characteristics and economic uses. Although both gold and silver are used in the jewelry industry and treated as investment assets, the industrial use of silver is quite remarkable so that almost half of the silver consumption is for industrial applications (electronic and electrical industries (mobile phones, computer hardware) and photography to a smaller extent).

References

Ahrens WA, Sharma RS (1997) Trends in natural resource commodity prices: deterministic or stochastic? J Environm Econ Manag 33:59–74

Andrews DWK (1991) Heteroskedasticity and autocorrelation consistent covariance matrix estimation. Econometrica 59:817–858

Bai J (1994) Least squares estimation of a shift in linear processes. J Time Series Anal 15:453–472

Becker R, Enders W, Lee J (2006) A stationary test in the presence of an unknown number of smooth breaks. J Time Series Anal 27:381–409

Berck P, Roberts M (1996) Natural resource prices: will they ever turn up? J Environm Econ Manag 31:65–78

Bureau of Mines (1993) Minerals Yearbook Metals and Minerals 1993 Aluminum http://digital.library.wisc.edu/1711.dl/EcoNatRes.MinYB1993v1

Bureau of Mines (2011) Minerals Yearbook Metals and Minerals 2011 Gold. https://s3-us-west-2.amazonaws.com/prd-wret/assets/palladium/production/mineral-pubs/gold/myb1-2011-gold.pdf.

Bureau of Mines (2013) Minerals Yearbook Metals and Minerals 2013 Gold. https://s3-us-west-2.amazonaws.com/prd-wret/assets/palladium/production/mineral-pubs/gold/myb1-2013-gold.pdf.

Cagli EF, Taskin D, Mandaci PE (2019) The short- and long-run efficiency of energy, precious metals, and base metals markets: evidence from the exponential smooth transition autoregressive models. Energy Econ 84:104540

Carrion-i-Silvestre JL, Sanso A (2006) A guide to computation of stationarity tests. Empir Econ 31:433–448

Carrion-i-Silvestre JL, Sanso A (2007) The KPSS test with two structural breaks. Spanish Econ Rev 9:105–127

Cashin P, McDermott C (2002) The long-run behavior of commodity prices: small trends and big variability. IMF Working Paper WP/01/68, 1–27

Chan WH, Young D (2006) Jumping hedges: an examination of movements in copper spot and futures markets. J Futures Markets 26:169–188

Charles A, Darné O (2009) The efficiency of the crude oil markets: evidence from variance ratio tests. Energy Pol 37:4267–4272

Choi I (1994) Residual based tests for the null of stationarity with applications to US macroeconomic time series. Economet Theor 10:720–746

Choi I, Ahn BC (1995) Testing for cointegration in a system of equations. Economet Theor 11:952–983

Choi I, Ahn BC (1999) Testing the null of stationarity for multiple time series. J Econometrics 62:1383–1414

Chowdhury AR (1991) Futures market efficiency: evidence from cointegration tests. J Futures Market 11:577–589

Ciner C (2001) On the long run relationship between gold and silver prices. A Note Global Finance J 12(2):299–303

Davutyan N, Roberts MC (1994) Cyclicality in metal prices. Resour Policy 20(1):49–57

Escribano A, Granger C (1998) Investigating the relationship between gold and silver prices. J Forecast 17(2):81–107

Fama E (1970) Efficient capital markets: a review of theory and empirical work. J Finance 25:383–423

Georgiev G (2001) Benefits of commodity investment. J Altern Invest 4:61–68

Ghoshray A (2021) A reexamination of trends in primary commodity prices. J Dev Econ 95:242–251

Ghoshray A, Johnson B (2010) Trend in world energy prices. Energy Econ 32:1147–1156

Gil-Alana LA, Chang S, Balcilar M, Aye GA (2015) Persistence of precious metal prices: a fractional integration approach with structural breaks. Resour Pol 44:57–64

Harvey DI, Mills TC (2004) Tests for stationarity in series with endogenously determined structural change. Oxf Bull Econ Stat 66:863–894

Hobijn B, Franses PH, Ooms M (2004) Generalizations of the KPSS-test for stationarity. Stat Neerl 58:483–502

Jones PM, Enders W (2014) On the use of the flexible Fourier form in unit root tests, endogenous breaks, and parameter instability. In: Ma J, Wohar M (eds) Recent advances in estimating nonlinear models. Springer, New York, pp 59–83

Kellard N, Wohar M (2006) On the prevalence of trends in primary commodity prices. J Dev Econ 79:146–167

Kuck PH (1999) Nickel, in metals prices in the United States through 1998. US Geological Surv, pp 91–98

Kurozumi E (2002) Testing for stationarity with a break. J Econ 108:63–99

Kwiatkowski D, Philips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationary against the alternative of a unit root. J Econ 54:159–178

Lee J (1996) On the power of stationarity tests using optimal bandwidth estimates. Econ Lett 51:131–137

Lee C, Lee J (2009) Energy prices, multiple structural breaks, and efficient market hypothesis. Appl Energy 86:466–479

Lee J, Strazicich MC (2003) Minimum Lagrange multiplier unit root test with two structural breaks. Rev Econ Stat 85:1082–1089

Lee J, List JA, Strazicich MC (2006) Non-renewable resource prices: deterministic or stochastic trends. J Environm Econ Manag 51:354–370

Lo AW (2004) The adaptive markets hypothesis: market efficiency from an evolutionary perspective. J Portf Manag 30:15–29

Lucey BM, Tully E (2006) The evolving relationship between gold and silver 1978–2002: evidence from a dynamic cointegration analysis: a note. Appl Finan Econ Lett 2(1):47–53

Lumsdaine RL, Papell DH (1997) Multiple trend breaks and the unit root hypothesis. Rev Econ Stat 79:212–218

Macdonald R, Taylor M (1988) Metals prices, efficiency and cointegration: some evidence from the London metal exchange. Bull Econ Res 40:235–240

Maslyuk S, Symth R (2008) Unit root properties of crude oil spot and future prices. Energy Pol 36:2591–2600

Moore MJ, Cullen U (1995) Speculative efficiency on the London metal exchange. Manch Sch 63:235–236

Narayan PK, Liu R (2011) Are shocks to commodity prices persistent? Appl. Energy 88:409–416

Newey WK, West KD (1994) Lag selection in covariance matrix estimation. The Rev Econ Stud 61:631–653

Ozdemir ZA, Gokmenoglu K, Ekinci C (2013) Persistence in crude oil spot and futures prices. Energy 59:29–37

Pathak R, Gupta RD, Taufemback CG, Tiwari AK (2020) Testing the efficiency of metal’s market: new evidence from a generalized spectral test. Stud Econ Finace 37:311–321

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57:1361–1401

Presno MJ, Landajo M, Fernandez P (2014) Non-renewable resource prices: a robust evaluation from the stationary perspective. Resour Energy Econ 36:394–416

Rehman MU, Vo XV (2021) Energy commodities, precious metals and industrial metal markets: a nexus across different investment horizons and market conditions. Resour Pol 70:101843

Roberts MC (2009) Duration and characteristics of metal price cycles. Resour Polic 34(3):87–102

Rossen A (2015) What are metal prices like? Co-movement, price cycles and long-run. Resour Policy 45:255–276

Soytas U, Sari R, Hammoudeh S, Hacihasanoglu E (2009) World oil prices, precious metal prices and macroeconomy in Turkey. Energy Policy 37(12):5557–5566

Stevens J, de Lamirande P (2014) Testing the efficiency of the futures market for crude oil in the presence of a structural break. Appl Econ 46:4053–4059

Sul D, Phillips PCB, Choi C (2005) Prewhitening bias in HAC estimation. Oxf Bull Econ Stat 67:517–546

USGS (2012) Metal prices in the United States through 2010. https://pubs.usgs.gov/sir/2012/5188/sir2012-5188.pdf.

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus EconStat 10:251–270

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Supplementary file1

(XLSX 31 KB)

Supplementary file2

(DOCX 191 KB)

Rights and permissions

About this article

Cite this article

Kara, A., Yildirim, D. & Tunc, G.I. Market efficiency in non-renewable resource markets: evidence from stationarity tests with structural changes. Miner Econ 36, 279–290 (2023). https://doi.org/10.1007/s13563-022-00312-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-022-00312-8

Keywords

- Long-run variance estimation

- Market efficiency

- Non-renewable resource price

- Stationarity test

- Structural change