Abstract

Using unique linked data, we examine income inequality and mobility across racial and ethnic groups in the United States. Our data encompass the universe of income tax filers in the United States for the period 2000–2014, matched with individual-level race and ethnicity information from multiple censuses and American Community Survey data. We document both income inequality and mobility trends over the period. We find significant stratification in terms of average incomes by racial/ethnic group and distinct differences in within-group income inequality. The groups with the highest incomes—whites and Asians—also have the highest levels of within-group inequality and the lowest levels of within-group mobility. The reverse is true for the lowest-income groups: blacks, American Indians, and Hispanics have lower within-group inequality and immobility. On the other hand, low-income groups are also highly immobile in terms of overall, rather than within-group, mobility. These same groups also have a higher probability of experiencing downward mobility compared with whites and Asians. We also find that within-group income inequality increased for all groups between 2000 and 2014, and the increase was especially large for whites. The picture that emerges from our analysis is of a rigid income structure, with mainly whites and Asians positioned at the top and blacks, American Indians, and Hispanics confined to the bottom.

Similar content being viewed by others

Notes

In the relatively few cases when differences are explained, the explanatory variables—such as employment opportunities, educational opportunities, or household characteristics—are often highly correlated with race and ethnicity. In these cases, pre-market conditions suggest disparities in access to or quality of educational institutions; these disparities are highly correlated with race and ethnicity and may simply imply an explanation for disparities, predating entry into the labor market, that are still race-/ethnicity-based.

Measures of income inequality are meaningful on their own and may determine other economic outcomes. For example, inequality may drive racial residential segregation (Reardon and Bischoff 2011) and may reduce the incentive to invest in higher education (Kearney and Levine 2016). Some evidence indicates that inequality may reduce the societal support for public assistance programs (Ashok et al. 2015). Violent crimes may also be causally related to high levels of income inequality (Fajnzylber et al. 2002; Kennedy et al. 1998). Income inequality may also affect adult health outcomes with a lag (Subramanian and Kawachi 2004). In tight housing markets, increased income inequality may disproportionately affect the poor, who have to pay more for housing (Matlack and Vigdor 2008). Kawachi et al. (1997) found that increasing income inequality reduces investment in social capital, which then increases adult mortality. Related to this, Hout (2016) found that higher levels of inequality reduce happiness.

The U.S. Census Bureau adheres to the Office of Management and Budget’s 1997 race and ethnicity standards, which specify five major race groups—white, black or African American (“black” here), American Indian or Alaska Native (“American Indian” or “AIAN” here), Asian, and Native Hawaiian or Other Pacific Islander (“Pacific Islander” or “NHPI” here)—and two ethnic groups (Hispanic and non-Hispanic). For our study, we define each racial group as that race alone and non-Hispanic, except for Other, which includes non-Hispanic multiple-race respondents as well as people who reported Some Other Race. Hispanic is defined as Hispanic of any race.

For more information on the linking process, see Wagner and Layne (2014).

In the online appendix, we examine those with W-2 (wages) data and all working-age men from the decennial censuses to assess how much bias may be induced by examining only tax filers.

The number of household members are equal to (A + 0.7K)0.7, where A = number of adults in the household, and K = the number of children (National Research Council 1995). We examine how our results change when we use a different equivalency scale as suggested by the National Research Council, and we find that the results are qualitatively very similar. Those results are available upon request.

Estimates of Americans living and working abroad range from 2.2 to 6.8 million people (Costanzo and von Koppenfels 2013). When we subtract 2.2 and 6.8 million people from the SOI estimates, our universe coverage rates of the SOI estimates increase to between 95 % and 100 %, compared with 94 % and 96 %.

Comparing 1040s and W-2s from 2010 matched to the 2010 census also helps us assess the representativeness of our universe. W-2s cover the distribution of wage earners with the exception of the self-employed. We find that 1040s cover more people ages 25–65 in the 2010 census compared with W-2s. Each racial group has a higher number of people in the 2010 census–1040 matched universe relative to the 2010 census–W-2 matched universe. Although race distributions are generally similar between both universes, the proportion of blacks in the matched 2010 census–1040 universe is lower relative to W-2s, and the proportion of Asians and Hispanics is slightly higher in the 2010 census–1040 universe. This further supports the suitability of our data for this analysis. Our universe contains a higher proportion of women relative to men, whereas the W-2 universe covers slightly more men. This higher coverage of females in our universe is likely in part because we are capturing women who are out of the labor force but married to a spouse who is earning income and filing income tax. Our W-2 analysis is available upon request. In the online appendix, we perform an analysis in which we add W-2 nonfilers to our analytic data from 2005 to 2014.

A number of studies have used administrative data to measure income inequality in the United States, especially the growth of the top percentiles. Piketty and Saez (2003) identified the increasing share of total income that has gone to the top income deciles in the last few decades. Feenberg and Poterba (2000) found an increase in the fraction of income accruing to the top 0.5 % using IRS tax data over the period 1960–1995. In the latter analysis, the authors examined adjusted gross income (AGI) measured in three ways (including and excluding capital gains and statutory gains). All recent research confirms an increase in income inequality since the 1970s.

Table A1 in the online appendix shows the population distribution and top and bottom shares for every year of our data. Patterns of change roughly hold true when looking at every year rather than the first and last year, but interesting patterns can be observed before, during, and after the Great Recession. We intend to follow up on these differences in future research.

The results indicate that the filing of tax returns differed by group because the results are all relative to non-Hispanic white. The bump disappears in the subsequent figures after the 40th percentile as the upper-income points are less sensitive to changes associated with the bottom of the income distribution.

The inequality symbol is due to the convexity of the Gini function and the fact that the function is also homogeneous of degree 0.

We restrict our analysis in Figs. A1–A7 (online appendix) to the years 2005–2014 and add individuals who had W2 earnings but did not file a 1040 form. This robustness check allows us to evaluate whether a significant difference is obtained when these individuals are included in the analysis. We find no strong qualitative (or quantitative) differences across the transition matrices with and without the additional individuals who were identified from using the W2 forms.

In Figs. A10 and A11 (online appendix), we provide additional analysis where we separate the transition matrices by race and ethnicity into two broad educational categories. As expected, education has a mitigating effect on mobility, where low-education individuals are more likely to remain entrenched or to experience downward mobility (especially for blacks and Hispanics), while high-education individuals are more likely to transition upward in the distribution. In Figs. A12 and A13 (online appendix), we separate the observations into two broad categories compared with the full sample. People at the start of their careers in our data (aged 25–34) appear to have slightly more downward mobility than those later in life, which may indicate an increasing return in the labor market as experience is gained, or it may reflect the impact of the erosion of the value of wages over time.

References

Altonji, J. G., & Blank, R. M. (1999). Race and gender in the labor market. In O. Ashenfelter & D. Card (Eds.), Handbook of Labor Economics (Vol. 3, pp. 3143–3259). Amsterdam, the Netherlands: Elsevier.

Ashok, V., Kuziemko, I., & Washington, E. (2015). Support for redistribution in an age of rising inequality: New stylized facts and some tentative explanations. Brookings Papers on Economic Activity, 2015(1), 367–405.

Bayer, P., & Charles, K. K. (2016). Divergent paths: Structural change, economic rank, and the evolution of black-white earnings differences, 1940–2014 (NBER Working Paper No. 22797). Cambridge, MA: National Bureau of Economic Research.

Black, D., Haviland, A., Sanders, S., & Taylor, L. (2006). Why do minority men earn less? A study of wage differentials among the highly educated. Review of Economics and Statistics, 88, 300–313.

Bloome, D. (2014). Racial inequality trends and the intergenerational persistence of income and family structure. American Sociological Review, 79, 1196–1225.

Bloome, D., & Western, B. (2011). Cohort change and racial differences in educational and income mobility. Social Forces, 90, 375–395.

Bollinger, C. R., Hirsch, B. T., Hokayem, C., & Ziliak, J. P. (2015). Measuring levels and trends in earnings inequality with nonresponse, imputations, and topcoding (Working paper). Retrieved from http://gattonweb.uky.edu/Faculty/Ziliak/BHHZ_Inequality.pdf

Bollinger, C. R., Hirsch, B. T., Hokayem, C. M., & Ziliak, J. P. (2018). Trouble in the tails? What we know about earnings nonresponse thirty years after Lillard, Smith, and Welch (IZA Discussion Paper No. 11710). Bonn, Germany: Institute of Labor Economics.

Bond, B., Brown, J. D., Luque, A., & O’Hara, A. (2014). The nature of the bias when studying only linkable person records: Evidence from the American Community Survey (CARRA Working Paper No. 2014-08). Washington, DC: Center for Administrative Records Research and Applications.

Bound, J., & Freeman, R. B. (1992). What went wrong? The erosion of relative earnings and employment among young black men in the 1980s. Quarterly Journal of Economics, 107, 201–232.

Boustan, L. P., & Margo, R. A. (2016). Racial differences in health in the United States: A long-run perspective. In J. Komlos & I. R. Kelly (Eds.), The Oxford handbook of economics and human biology (pp. 730–750). New York, NY: Oxford University Press.

Carruthers, C. K., & Wanamaker, M. H. (2017). Returns to school resources in the Jim Crow South. Explorations in Economic History, 64, 104–110.

Chetty, R., Hendren, N., Kline, P., & Saez, E. (2014). Where is the land of opportunity? The geography of intergenerational mobility in the United States. Quarterly Journal of Economics, 129, 1553–1623.

Collins, W. J., & Margo, R. A. (2011). Race and home ownership from the end of the Civil War to the present. American Economic Review: Papers and Proceedings, 101, 355–359.

Costanzo, J., & von Koppenfels, A. K. (2013, May 17). Counting the uncountable: Overseas Americans. Migration Information Source. Retrieved from https://www.migrationpolicy.org/article/counting-uncountable-overseas-americans

Darity, W. A., & Mason, P. L. (1998). Evidence on discrimination in employment: Codes of color, codes of gender. Journal of Economic Perspectives, 12(2), 63–90.

DeBacker, J., Heim, B., Panousi, V., Ramnath, S., & Vidangos, I. (2013). Rising inequality: Transitory or persistent? New evidence from a panel of U.S. tax returns. Brookings Papers on Economic Activity, 2013(1), 67–142.

Fajnzylber, P., Lederman, D., & Loayza, N. (2002). Inequality and violent crime. Journal of Law and Economics, 45, 1–39.

Feenberg, D. R., & Poterba, J. M. (2000). The income and tax share of very high-income households, 1960–1995. American Economic Review: Papers and Proceedings, 90, 264–270.

Fryer, R., Jr. (2011). Racial inequality in the 21st century: The declining significance of discrimination. Handbook of Labor Economics, 4, 855–971.

Goldin, C., & Margo, R. A. (1992). The great compression: The wage structure in the United States at mid-century. Quarterly Journal of Economics, 107, 1–34.

Hout, M. (2016). Money and morale: Growing inequality affects how Americans view themselves and others. Annals of the American Academy of Political and Social Science, 663, 204–228.

Internal Revenue Service (IRS). (2016). Statistics of income—2016 individual income tax returns (Report). Washington, DC: IRS. https://www.irs.gov/uac/soi-tax-stats-individual-income-tax-returns-publication-1304-complete-report

Juhn, C., Murphy, K. M., & Pierce, B. (1991). Accounting for the slowdown in black-white wage convergence. In M. H. Kosters (Ed.), Workers and their wages (pp. 107–143). Washington, DC: AEI Press.

Juhn, C., Murphy, K. M., & Pierce, B. (1993). Wage inequality and the rise in returns to skill. Journal of Political Economy, 101, 410–442.

Kawachi, I., Kennedy, B. P., Lochner, K., & Prothrow-Stith, D. (1997). Social capital, income inequality, and mortality. American Journal of Public Health, 87, 1491–1498.

Kearney, M. S., & Levine, P. B. (2016). Income inequality, social mobility, and the decision to drop out of high school. Brookings Papers on Economic Activity, 2016(1), 333–380.

Keister, L. A. (2000). Race and wealth inequality: The impact of racial differences in asset ownership on the distribution of household wealth. Social Science Research, 29, 477–502.

Kennedy, B. P., Kawachi, I., Prothrow-Stith, D., Lochner, K., & Gupta, V. (1998). Social capital, income inequality, and firearm violent crime. Social Science & Medicine, 47, 7–17.

Kochhar, R., & Fry, R. (2014, December 12). Wealth inequality has widened along racial, ethnic lines since end of great recession (FactTank: News in the Numbers report). Washington, DC: Pew Research Center. Retrieved from http://www.pewresearch.org/fact-tank/2014/12/12/racial-wealth-gaps-great-recession/

Kopczuk, W., Saez, E., & Song, J. (2010). Earnings inequality and mobility in the United States: Evidence from Social Security data since 1937. Quarterly Journal of Economics, 125, 91–128.

LaFree, G., Baumer, E. P., & O’Brien, R. (2010). Still separate and unequal? A city-level analysis of the black-white gap in homicide arrests since 1960. American Sociological Review, 75, 75–100.

Lang, K., Lehmann, J., & Yeon, K. (2012). Racial discrimination in the labor market: Theory and empirics. Journal of Economic Literature, 50, 959–1006.

Matlack, J. L., & Vigdor, J. L. (2008). Do rising tides lift all prices? Income inequality and housing affordability. Journal of Housing Economics, 17, 212–224.

McKernan, S.-M., Ratcliffe, C., Steuerle, C. E., Kalish, E., Quakenbush, C., Lei, S.,... Chartoff, B. (2015). Nine charts about wealth inequality in America. Washington, DC: Urban Institute. Retrieved from http://datatools.urban.org/Features/wealth-inequality-charts/

Meyer, B. D., & Mittag, N. (2015). Using linked survey and administrative data to better measure income: Implications for poverty, program effectiveness and holes in the safety net (NBER Working Paper No. 21676). Cambridge, MA: National Bureau of Economic Research.

Mitnik, P. A., Cumberworth, E., & Grusky, D. B. (2016). Social mobility in a high-inequality regime. Annals of the American Academy of Political and Social Science, 663, 140–184.

National Research Council. (1995). Measuring poverty: A new approach. Washington, DC: National Academies Press.

Neal, D. A., & Johnson, W. R. (1996). The role of premarket factors in black-white wage differences. Journal of Political Economy, 104, 869–895.

Pedace, R., & Bates, N. (2000). Using administrative records to assess earnings reporting error in the Survey of Income and Program Participation. Journal of Economic and Social Measurement, 26, 173–192.

Piketty, T., & Saez, E. (2003). Income inequality in the United States, 1913–1998. Quarterly Journal of Economics, 118, 1–41.

Ramakrishnan, K., & Ahmad, F. Z. (2014). State of Asian Americans and Pacific Islander series: A multifaceted portrait of a growing population (Technical report). Washington, DC: Center for American Progress.

Ramraj, C., Shahidi, F. V., Darity, W., Kawachi, I., Zuberi, D., & Siddiqi, A. (2016). Equally inequitable? A cross-national comparative study of racial health inequalities in the United States and Canada. Social Science & Medicine, 161, 19–26.

Reardon, S. F., & Bischoff, K. (2011). Income inequality and income segregation. American Journal of Sociology, 116, 1092–1153.

Ritter, J. A., & Taylor, L. J. (2011). Racial disparity in unemployment. Review of Economics and Statistics, 93, 30–42.

Snipp, C. M., & Cheung, S. Y. (2016). Changes in racial and gender inequality since 1970. Annals of the American Academy of Political and Social Science, 663, 80–98.

Snyder, T. D., & Dillow, S. A. (2013). Digest of education statistics, 2012 (NCES Report 2014-015). Washington, DC: National Center for Education Statistics. Retrieved from https://nces.ed.gov/pubsearch/pubsinfo.asp?pubid=2014015

Subramanian, S. V., & Kawachi, I. (2004). Income inequality and health: What have we learned so far? Epidemiologic Reviews, 26, 78–91.

Wagner, D., & Layne, M. (2014). The Person Identification Validation System (PVS): Applying the Center for Administrative Records Research and Applications’ (CARRA) record linkage software (CARRA Working Paper No. 2014-01). Washington, DC: U.S. Census Bureau, Center for Administrative Records Research and Applications.

Acknowledgments

This article is released to inform interested parties of research and to encourage discussion. The views expressed are those of the authors and not necessarily those of the U.S. Census Bureau. We would like to thank participants at the UCLA Center for Population Research seminar and seminars at Dartmouth University and the University of Kentucky, as well as Moshe Buchinsky, David Card, Raj Chetty, Sandy Darity, Rajeev Dehejia, Nicole Fortin, John Friedman, Tim Halliday, Darrick Hamilton, Nathan Hendren, Chinhui Juhn, Adriana Kugler, Adriana Lleras-Muney, Paul Ong, Sarah Reber, Mark Rosenzweig, Matthias Schuendeln, Steven Stillman, and Till von Wachter for helpful comments and feedback; any errors are ours alone.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

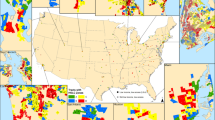

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

ESM 1

(PDF 3671 kb)

Rights and permissions

About this article

Cite this article

Akee, R., Jones, M.R. & Porter, S.R. Race Matters: Income Shares, Income Inequality, and Income Mobility for All U.S. Races. Demography 56, 999–1021 (2019). https://doi.org/10.1007/s13524-019-00773-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-019-00773-7