Abstract

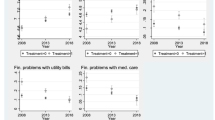

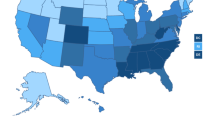

Refundable tax credits and food assistance are the largest transfer programs available to able-bodied working poor and near-poor families in the United States, and simultaneous participation in these programs has more than doubled since the early 2000s. To understand this growth, we construct a series of two-year panels from the 1981–2013 waves of the Current Population Survey Annual Social and Economic Supplement to estimate the effect of state labor-market conditions, federal and state transfer program policy choices, and household demographics governing joint participation in food and refundable tax credit programs. Overall, changing policy drives much of the increase in the simultaneous, biennial use of food assistance and refundable tax credits. This stands in stark contrast from the factors accounting for the growth in food assistance alone, where cyclical and structural labor market factors account for at least one-half of the growth, and demographics play a more prominent role. Moreover, since 2000, the business cycle factors as the leading determinant in biennial participation decisions in food programs and refundable tax credits, suggesting a recent strengthening in the relationship between economic conditions and transfer programs.

Similar content being viewed by others

Notes

A recent study by Heflin et al. (2015) highlighted that although 35 states in 2014 had reportedly removed liquid asset tests, 28 of them still listed the test in their prescreening web-based tools for potential SNAP eligibility, which could have the effect of deterring some from applying.

Online Resource 1 details sample construction and characteristics of our CPS data set, including matching procedures. It also contains numerous specification checks on the baseline estimates presented in the main text.

The focus on federal EITC is informative for understanding state EITC participation and eligibility as well given that, by construction, almost all state EITC programs allocate refunds using federal rules and as a fixed proportion of federal EITC received (Johnson and Williams 2011).

With the 1994 survey, the CPS also asked about country of birth. Because the variable is available for only two-thirds of the sample period, we do not include it in our main analyses. We do, however, report the counterfactual simulations for 2000–2012 inclusive of nativity status in Tables S9 and S10 (Online Resource 1), with no substantive change in results reported in this article.

Because most research has found little evidence that marriage or fertility responds endogenously to the generosity of welfare benefits (Bitler et al. 2004; Hoynes 1997; Lopoo and Raissan 2014; Moffitt et al. 1998), the family size–specific EITC and SNAP parameters are treated as exogenous in the model.

The data on the state economic and policy environment are obtained from the University of Kentucky Center for Poverty Research, and the SNAP policy variables come from the Economic Research Service in the U.S. Department of Agriculture (http://www.ers.usda.gov/data-products/snap-policy-database.aspx#.UhQQ-ZLVC3I). All income and spending data are deflated by the 2010 Personal Consumption Expenditure Deflator (http://www.whitehouse.gov/sites/default/files/docs/erp2013/ERP2013_Appendix_B.pdf).

See http://www.bls.gov/lau/lauov.htm for details on construction of state unemployment rates.

For the minimum wage, we use the maximum of the state and federal minimum in each state and year; for the median wage, we compute the average annual hourly wage across the two years for each matched individual in the CPS and then compute the median in each state and year. We use the personal consumption expenditure deflator with 2010 base year to adjust for inflation.

A Wald test of the null hypothesis that the three unemployment rate coefficients are jointly zero is rejected at the p < .001 level.

Extending the notation in Eq. (1), for any given continuous regressor z k , the elasticity of participation in program y k (SNAP, EITC, and ACTC) equals \( {\delta}_k\left(\frac{\overline{z_k}}{\overline{y_k}}\right) \), where \( \overline{z_k} \) and \( \overline{y_k} \) reflect mean values of the policy variable and dependent variable, respectively.

Outreach spending has an unexpected negative sign. Ziliak (2015b) found a similar result in the study of cross-sectional SNAP participation, attributing this to the federal response to SNAP during the Great Recession as the coefficient is the expected positive sign if the sample period stops in 2006.

Wald tests of the joint hypothesis that the three unemployment rate coefficients are 0 (zero) is rejected at the 0.07, 0.10, 0.002, and 0.08 level for all, low-income, low-skilled, and single-mother families, respectively.

In an independent analysis conducted concurrent to this initial draft of this paper, Bitler et al. (2014) used annual cross-sections of IRS Statistics of Income data and found that single-year EITC participation was acyclical for single-mother families and countercyclical among married-couple families.

The Wald test of the three coefficients on unemployment being jointly 0 is rejected at p < .001 level for all families, low-income, and low skilled; and at p < .034 for single mothers.

A limitation of the counterfactual simulation is that the observable and unobservable characteristics of the examined subgroups could, themselves, change over time.

Our baseline models require that the head of household remain the same across the two survey waves, which could depress the influence of demographic factors in our simulations. As a robustness check, we reestimated the models in Tables 1 and 3 that relaxed the constant headship requirement. We report the counterfactual simulations in Tables S7 and S8 (Online Resource 1). As shown in those tables, the results are little changed from the baseline models.

The forecasted spending on the EITC and ACTC was before the ARRA expansions of the ACTC, which were set to expire in 2017, were extended indefinitely as part of the federal budget agreement reached in December 2015 (Rachidi 2015).

References

Akee, R., Simeonova, E., Costello, E. J., & Copeland, W. (2015). How does household income affect child personality and behaviors? (NBER Working Paper No. 21562). Cambridge, MA: National Bureau of Economic Research.

Almond, D., Hoynes, H. W., & Schanzenbach, D. W. (2011). Inside the war on poverty: The impact of food stamps on birth outcomes. Review of Economics and Statistics, 93, 387–403.

Autor, D. H. (2014). Skills, education, and the rise of earnings inequality among the “other 99 percent.” Science, 344, 843–851.

Autor, D. H., & Duggan, M. G. (2007). Distinguishing income from substitution effects in disability insurance. American Economic Review, 97, 119–124.

Autor, D. H., Katz, L. F., & Kearney, M. S. (2008). Trends in U.S. wage inequality: Revising the revisionists. Review of Economics and Statistics, 90, 300–323.

Ben-Shalom, Y., Moffitt, R., & Scholz, J. K. (2012). An assessment of the effectiveness of antipoverty programs in the United States. In P. N. Jefferson (Ed.), Oxford handbook of the economics of poverty (pp. 709–749). New York, NY: Oxford University Press.

Bitler, M. P., & Hoynes, H. W. (2010). The state of the social safety net in the post-welfare reform era. Brookings Papers on Economic Activity, 2010(2), 71–127.

Bitler, M., & Hoynes, H. (2016). The more things change the more they stay the same? The safety net and poverty in the Great Recession. Journal of Labor Economics, 34, S403–S444.

Bitler, M., Hoynes, H., & Kuka, E. (2014). Do in-work tax credits serve as a safety net? (NBER Working Paper No. 19785). Cambridge, MA: National Bureau of Economic Research.

Bitler, M. P., Gelbach, J. B., Hoynes, H. W., & Zavodny, M. (2004). The impact of welfare reform on marriage and divorce. Demography, 41, 213–236.

Blank, R. M. (2009). What we know, what we don’t know, and what we need to know about welfare reform. In J. Ziliak (Ed.), Welfare reform and its long-term consequences for America’s poor (pp. 22–58). New York, NY: Cambridge University Press.

Bloome, D., & Western, B. (2011). Cohort change and racial differences in educational and income mobility. Social Forces, 90, 375–395.

Cancian, M., Han, E., & Noyes, J. L. (2014). From multiple program participation to disconnection: Changing trajectories of TANF and SNAP beneficiaries in Wisconsin. Children and Youth Services Review, 42, 91–102.

Cancian, M., & Reed, D. (2009). Family structure, childbearing, and parental employment: Implications for the level and trend in poverty. In M. Cancian & S. Danziger (Eds.), Changing poverty, changing policies (pp. 92–121). New York, NY: Russell Sage Foundation.

Chetty, R., Friedman, J. N., & Saez, E. (2013). Using differences in knowledge across neighborhoods to uncover the impacts of the EITC on earnings. American Economic Review, 103, 2683–2721.

Congressional Budget Office (CBO). (2013a). Growth in means-tested programs and tax credits for low-income households (CBO Publication No. 4504). Washington, DC: CBO.

Congressional Budget Office (CBO). (2013b). Refundable tax credits (CBO Publication No. 4152). Washington, DC: CBO.

Congressional Budget Office (CBO). (2015). Supplemental Nutrition Assistance Program: CBO baseline, January 2015. Retrieved from https://www.cbo.gov/sites/default/files/recurringdata/51312-2015-01-snap.pdf

Cooper, K., & Stewart, K. (2013). Does money affect children’s outcomes? A systematic review (Report). York, UK: Joseph Rowntree Foundation. Retrieved from http://sticerd.lse.ac.uk/dps/case/cr/casereport80.pdf

Corcoran, M. (2001). Mobility, persistence, and the consequences of poverty for children: Child and adult outcomes. In S. H. Danziger & R. H. Haveman (Eds.), Understanding poverty (pp. 127–161). Cambridge, MA: Russell Sage Foundation.

Currie, J. M. (2006). Welfare vs. “making work pay.” In J. M. Currie, The invisible safety net: Protecting the nation’s poor children and families (pp. 11–31). Princeton, NJ: Princeton University Press.

Currie, J. M. (2012). Programs to address child poverty and their effects. In P. N. Jefferson (Ed.), Oxford handbook of the economics of poverty (pp. 277–315). New York, NY: Oxford University Press.

Dahl, G. B., & Lochner, L. (2012). The impact of family income on child achievement: Evidence from the earned income tax credit. American Economic Review, 102, 1927–1956.

Duncan, G. J., Magnuson, K., & Votruba-Drzal, E. (2014). Boosting family income to promote child development. Future of Children, 24(1), 99–120.

Duncan, G. J., Morris, P., & Rodrigues, C. (2011). Does money really matter? Estimating impacts of family income on young children’s achievement with data from random-assignment experiments. Developmental Psychology, 47, 1263–1279.

Eissa, N., & Hoynes, H. (2004). Taxes and the labor market participation of married couples: The earned income tax credit. Journal of Public Economics, 88, 1931–1958.

Evans, W. N., & Garthwaite, C. L. (2014). Giving mom a break: The impact of higher EITC payments on maternal health. American Economic Journal: Economic Policy, 6(2), 258–290.

Feng, S. (2008). Longitudinal matching of recent current population surveys: Methods, non-matches and mismatches. Journal of Economic and Social Measurement, 33, 241–252.

Fox, L., Wimer, C., Garfinkel, I., Kaushal, N., & Waldfogel, J. (2015). Waging war on poverty: Poverty trends using a historical supplemental poverty measure. Journal of Policy Analysis and Management, 34, 567–592.

Ganong, P., & Liebman, J. B. (2013). The decline, rebound, and further rise in SNAP enrollment: Disentangling business cycle fluctuations and policy changes (NBER Working Paper No. 19363). Cambridge, MA: National Bureau of Economic Research.

Garfinkel, I., Harris, D., Waldfogel, J., & Wimer, C. (2016). Doing more for our children: Modeling a universal child allowance or more generous child tax credit (Report). New York, NY: The Century Foundation. Retrieved from http://tcf.org/content/report/doing-more-for-our-children

Gundersen, C., & Ziliak, J. P. (2004). Poverty and macroeconomic performance across space, race, and family structure. Demography, 41, 61–86.

Hardy, B. L. (2014). Childhood income volatility and adult outcomes. Demography, 51, 1641–1665.

Hardy, B. L. (2016). Income instability and the response of the safety net. Contemporary Economic Policy, 35, 312–330.

Hardy, B. L., Muhammad, D., & Samudra, R. (2015). The effect of the earned income tax credit in the District of Columbia on poverty and income dynamics (Upjohn Institute Working Paper No. 15–230). Kalamazoo, MI: W.E. Upjohn Institute for Employment Research.

Heflin, C. M., Mueser, P., & Cronin, J. M. (2015). The Supplemental Nutrition Assistance Program asset limit: Reports of its death may be exaggerated (Working Paper No. 15–06). Columbia: University of Missouri.

Hotz, V. J., & Scholz, J. K. (2003). The earned income tax credit. In R. Moffitt (Ed.), Means-tested transfer programs in the United States (pp. 141–198). Chicago, IL: University of Chicago Press.

Hoynes, H. W. (1997). Work, welfare, and family structure: What have we learned? In A. Auerbach (Ed.), Fiscal policy: Lessons from economic research (pp. 101–146). Cambridge, MA: MIT Press.

Hoynes, H., & Schanzenbach, D. W. (2016). U.S. food and nutrition programs. In R. A. Moffitt (Ed.), Economics of means-tested transfer programs in the United States (Vol. 1, 219–302). Chicago, IL: University of Chicago Press.

Hoynes, H. W., Page, M. E., & Huff Stevens, A. (2006). Poverty in America: Trends and explanations. Journal of Economic Perspectives, 20(1), 47–68.

Hoynes, H. W., & Schanzenbach, D. W. (2009). Consumption responses to in-kind transfers: Evidence from the introduction of the Food Stamp Program. American Economic Journal: Applied Economics, 1(4), 109–139.

Hoynes, H., Schanzenbach, D. W., & Almond, D. (2016). Long-run impacts of childhood access to the safety net. American Economic Review, 106, 903–934.

Johnson, N., & Williams, E. (2011). A hand up: How state earned income tax credits help working families escape poverty in 2011 (Report). Washington, DC: Center on Budget and Policy Priorities.

Jones, M. R. (2014). Changes in EITC eligibility and participation, 2005–2009 (CARRA Working Paper No. 2014–04). Washington, DC: Center for Administrative Records Research and Applications, U.S. Census Bureau.

Jones, M. R. (2015). The EITC over the Great Recession: Who benefited? (Report). Washington, DC: U.S. Census Bureau.

Kreider, B., Pepper, J. V., Gundersen, C., & Jolliffe, D. (2012). Identifying the effects of SNAP (food stamps) on child health outcomes when participation is endogenous and misreported. Journal of the American Statistical Association, 107, 958–975.

Larrimore, J., Burkhauser, R. V., & Armour, P. (2013). Accounting for income changes over the Great Recession (2007–2010) relative to previous recessions: The importance of taxes and transfers (NBER Working Paper No. 19699). Cambridge, MA: National Bureau of Economic Research.

Leftin, J., Eslami, E., & Strayer, M. (2011). Trends in Supplemental Nutrition Assistance Program participation rates: Fiscal year 2002 to fiscal year 2009 (Mathematica Policy Research Report). Washington, DC: U.S. Department of Agriculture, Food and Nutrition Service.

Lopoo, L. M., & Raissan, K. M. (2014). U.S. social policy and family complexity. Annals of the American Academy of Political and Social Science, 654, 213–230.

Madrian, B. C., & Lefgren, L. J. (1999). A note on longitudinally matching Current Population Survey (CPS) respondents (NBER Working Paper No. 247). Cambridge, MA: National Bureau of Economic Research.

Meyer, B. D., Goerge, R. M., & Mittag, N. (2014). Errors in survey reporting and imputation and their effects on estimates of Food Stamp Program participation (CES Report No. 11-14). Washington, DC: Center for Economic Studies, U.S. Census Bureau.

Meyer, B. D., Mok, W. K. C., & Sullivan, J. X. (2015). Household surveys in crisis (NBER Working Paper No. 21399). Cambridge, MA: National Bureau of Economic Research.

Meyer, B. D., & Rosenbaum, D. T. (2001). Welfare, the earned income tax credit, and the labor supply of single mothers. Quarterly Journal of Economics, 116, 1063–1114.

Milligan, K., & Stabile, M. (2009). Child benefits, maternal employment, and children’s health: Evidence from Canadian child benefit expansions. American Economic Review, 99(2), 128–132.

Moffitt, R. A. (2013). The Great Recession and the social safety net. Annals of the American Academy of Political and Social Science, 650, 143–166.

Moffitt, R. A. (2015a). Multiple program participation and the SNAP program. In J. Bartfeld, C. Gundersen, T. M. Smeeding, & J. P. Ziliak (Eds.), SNAP matters: How food stamps affect health and well being (pp. 213–242). Stanford, CA: Stanford University Press.

Moffitt, R. A. (2015b). The deserving poor, the family, and the U.S. welfare system. Demography, 52, 729–749.

Moffitt, R. A., Reville, R., & Winkler, A. E. (1998). Beyond single mothers: Cohabitation and marriage in the AFDC program. Demography, 35, 259–278.

Mollborn, S., Lawrence, E., James-Hawkins, L., & Fomby, P. (2014). How resource dynamics explain accumulating developmental and health disparities for teen parents’ children. Demography, 51, 1199–1224.

Nichols, A., & Rothstein, J. (2016). The Earned Income Tax Credit. In R. Moffitt (Ed.), Economics of means-tested transfer programs in the United States (Vol. 1, pp. 137–218). Chicago, IL: The University of Chicago Press.

Piketty, T., & Saez, E. (2003). Income inequality in the United States, 1913–1998. Quarterly Journal of Economics, 118, 1–39.

Rachidi, A. (2015, December 16). Budget deal is good for low-income working families [Blog post]. Washington, DC: American Enterprise Institute. Retrieved from http://www.aei.org/publication/budget-deal-is-good-for-low-income-working-families/

Ratcliffe, C., McKernan, S.-M., & Finegold, K. (2008). Effects of food stamp and TANF policies on food stamp receipt. Social Service Review, 82, 291–334.

Sawhill, I. V., & Karpilow, Q. (2014a). Raising the minimum wage and redesigning the EITC (Center on Children and Families report). Washington, DC: Brookings Institution. Retrieved from http://www.brookings.edu/research/papers/2014/01/30-raising-minimum-wage-redesigning-eitc-sawhill

Sawhill, I.V., & Karpilow, Q. (2014b, June 10). Building a better EITC [Commentary post]. Retrieved from http://spotlightonpoverty.org/spotlight-exclusives/building-a-better-eitc/

Slack, K. S., Kim, B., Yang, M.-Y., & Berger, L. M. (2014). The economic safety net for low-income families with children. Children and Youth Services Review, 46, 213–219.

Steuerle, E. (2015, June 25). Marginal tax rates and 21st century social welfare reform (Statement before the Joint Hearing of the Subcommittee on Human Resources, Committee on Ways and Means, and Subcommittee on Nutrition, Committee on Agriculture). Washington, DC: Urban Institute.

Tach, L. M., & Eads, A. (2015). Trends in the economic consequences of marital and cohabitation dissolution in the United States. Demography, 52, 401–432.

Tiehen, L., Jolliffe, D., & Smeeding, T. M. (2015). The effect of SNAP on poverty. In J. Bartfeld, C. Gundersen, T. M. Smeeding, & J. P. Ziliak (Eds.), SNAP matters: How food stamps affect health and well being (pp. 49–73). Stanford, CA: Stanford University Press.

U.S. Bureau of Labor Statistics. (2014). Employment situation—May 2014 [News release No. USDL–14–0987]. Retrieved from http://www.bls.gov/news.release/archives/empsit_06062014.pdf

Wheaton, L. (2007). Underreporting of means-tested transfer programs in the CPS and SIPP. In Proceedings of the American Statistical Association, Social Statistics Section [CD-ROM]. Alexandria, VA: American Statistical Association.

Wooldridge, J. (2007). Inverse probability weighted estimation for general missing data problems. Journal of Econometrics, 141, 1281–1301.

Ziliak, J. P. (2014). Supporting low-income workers through refundable child-care credits. In M. Kearney & B. Harris (Eds.), Policies to address poverty in America (pp. 109–118). Washington, DC: Brookings Institution Press.

Ziliak, J. P. (2015a). Recent developments in antipoverty policies in the United States. In J. K. Scholz, H. Moon, & S.-H. Lee (Eds.), Social policies in an age of austerity: A comparative analysis of the US and Korea (pp. 235–262). Cheltenham, UK: Edward Elgar Publishing.

Ziliak, J. P. (2015b). Why are so many Americans on food stamps? The role of the economy, policy, and demographics. In J. Bartfeld, C. Gundersen, T. M. Smeeding, & J. P. Ziliak (Eds.), SNAP matters: How food stamps affect health and well being (pp. 18–48). Stanford, CA: Stanford University Press.

Ziliak, J. P., Hardy, B., & Bollinger, C. (2011). Earnings volatility in America: Evidence from matched CPS. Labour Economics, 18, 742–754.

Acknowledgments

We thank the Smith Richardson Foundation for providing financial support. We also thank Susan Mayer, Dan Puskin, Darrick Hamilton, and Robin Lumsdaine, as well as participants at the 2013 APPAM conference, 2014 ASSA meetings, the 2014 Building Human Capital Conference, and seminar participants at Washington and Lee University for helpful feedback on earlier versions. We thank Robert Hartley for timely and valuable research assistance. Finally, this project was completed while Hardy served as the 2017–2018 Okun-Model fellow in Economic Studies at The Brookings Institution, and we acknowledge their support.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

ESM 1

(PDF 1859 kb)

Rights and permissions

About this article

Cite this article

Hardy, B., Smeeding, T. & Ziliak, J.P. The Changing Safety Net for Low-Income Parents and Their Children: Structural or Cyclical Changes in Income Support Policy?. Demography 55, 189–221 (2018). https://doi.org/10.1007/s13524-017-0642-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-017-0642-7